China Longyuan Power Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Longyuan Power Bundle

Discover how China Longyuan Power leverages its product portfolio, competitive pricing, extensive distribution network, and targeted promotional campaigns to dominate the renewable energy market. This analysis offers a strategic overview of their marketing success.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for China Longyuan Power. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

China Longyuan Power's primary product is renewable energy generation, with a strong emphasis on wind power. This includes the entire lifecycle from investment and development to construction and ongoing operation of wind farms.

In 2024, the company achieved a significant milestone, generating 68.383 billion kilowatt-hours (kWh) of renewable electricity. Wind power represents the largest contributor to this substantial output, underscoring its importance to Longyuan's product portfolio.

China Longyuan Power's diversified renewable portfolio extends beyond its significant wind power operations. The company actively manages and operates solar photovoltaic (PV) and biomass power plants, showcasing a broader commitment to clean energy. This diversification strengthens its market position and resilience.

By the close of 2024, Longyuan Power commanded an impressive installed capacity of 41,143.2 megawatts (MW), exclusively from renewable sources. This substantial capacity is comprised of 30,408.77 MW from wind power and a significant 10,698.33 MW from photovoltaic (PV) installations, highlighting its robust solar energy footprint.

China Longyuan Power maintains a segment dedicated to conventional coal power operations, generating and supplying electricity to grid companies. This business line contributes to a more balanced energy mix for the company, even as its strategic focus increasingly shifts towards renewable energy sources.

In 2023, China Longyuan Power's coal-fired power generation capacity stood at approximately 2.7 GW, representing a portion of its overall operational capacity. While the company is actively expanding its renewable portfolio, this conventional segment continues to be a source of revenue and operational experience.

Wind Turbine Blade and Equipment Manufacturing

China Longyuan Power's involvement in wind turbine blade and equipment manufacturing is a key aspect of its product strategy, ensuring a comprehensive approach to the wind power value chain. This vertical integration allows the company to directly influence the quality and innovation of critical components, which is vital for maintaining a competitive edge.

By manufacturing its own blades and equipment, Longyuan Power gains significant control over its supply chain. This reduces reliance on external suppliers and mitigates risks associated with material shortages or price volatility. It also enables them to tailor components to their specific turbine designs, optimizing performance and efficiency.

The company's manufacturing capabilities are crucial for its overall operational efficiency and cost management. For instance, in 2023, China's wind power installed capacity reached approximately 400 GW, with domestic manufacturers playing a pivotal role in supplying the necessary equipment. Longyuan Power's manufacturing arm directly contributes to this national effort and its own project development pipeline.

- Vertical Integration: Controls the manufacturing of wind turbine blades and related equipment.

- Supply Chain Control: Reduces reliance on external suppliers and enhances quality assurance.

- Cost Efficiency: Potential for cost savings through in-house production and optimized component design.

- Technological Advancement: Facilitates direct investment in R&D for improved turbine performance and blade technology.

Technological Innovation and R&D

China Longyuan Power is a significant player in technological innovation within the renewable energy landscape. Their commitment to research and development is evident in pioneering projects that push the boundaries of what's possible. For instance, they've developed the world's first floating wind-fishery integrated technology, showcasing a unique approach to combining energy generation with sustainable aquaculture. This innovation not only diversifies their revenue streams but also addresses environmental concerns, a crucial aspect for future growth.

Further demonstrating their R&D prowess, Longyuan Power launched China's first fully domestically developed offshore wind testing platform, named 'Guo Neng Hai Ce No.1'. This platform is vital for advancing offshore wind technology, enabling more efficient and reliable testing of new components and designs. Such investments in infrastructure are critical for maintaining a competitive edge and driving the overall development of China's renewable energy sector.

The company's focus on technological advancement is backed by substantial investment. In 2023, Longyuan Power reported a significant increase in R&D expenditure, reaching approximately RMB 5.2 billion, a 15% year-on-year growth. This financial commitment underscores their strategic priority to lead in innovation and secure long-term market advantage.

- Floating Wind-Fishery Integration: Pioneering a novel approach to renewable energy generation and sustainable fishing practices.

- 'Guo Neng Hai Ce No.1' Offshore Wind Testing Platform: A national first, enhancing the testing and development capabilities for offshore wind technologies.

- R&D Investment Growth: A 15% year-on-year increase in R&D spending in 2023, reaching approximately RMB 5.2 billion, highlighting a strong commitment to innovation.

- Technological Patents: Longyuan Power secured over 200 new patents in renewable energy technologies in 2024, further solidifying their intellectual property and innovative output.

China Longyuan Power's product offering is centered on clean energy generation, primarily through wind power, but also encompassing solar and biomass. Its vertically integrated model extends to manufacturing wind turbine components, ensuring quality and cost control. The company is also a significant player in conventional coal power, providing a balanced energy portfolio.

| Product Category | Key Offerings | 2024 Capacity (MW) | 2024 Generation (Billion kWh) | Key Differentiators |

|---|---|---|---|---|

| Renewable Energy | Wind Power Generation | 30,408.77 | 68.383 (Total Renewable) | World's first floating wind-fishery integration; China's first domestic offshore wind testing platform. |

| Renewable Energy | Solar PV Generation | 10,698.33 | Significant and growing solar footprint. | |

| Renewable Energy | Biomass Power Generation | Diversified renewable energy sources. | ||

| Manufacturing | Wind Turbine Blades & Equipment | Vertical integration, supply chain control, R&D investment (RMB 5.2 billion in 2023). | ||

| Conventional Energy | Coal Power Generation | ~2,700 (2023 Capacity) | Balanced energy mix, operational experience. |

What is included in the product

This analysis provides a comprehensive deep dive into China Longyuan Power's Product, Price, Place, and Promotion strategies, ideal for understanding their marketing positioning.

It offers a structured breakdown of their actual brand practices and competitive context, making it a valuable resource for managers, consultants, and marketers.

This analysis distills China Longyuan Power's 4Ps into actionable insights, relieving the pain of complex marketing strategy by providing a clear roadmap for growth.

Place

China Longyuan Power boasts an extensive domestic presence, operating across 32 provinces and municipalities within China. This widespread footprint underscores its robust distribution network for power generation, enabling the company to tap into diverse geographical wind and solar resources throughout the nation.

China Longyuan Power's 'Place' strategy significantly expands into coastal regions with its robust offshore wind development. A prime example is the Rudong, Jiangsu province, offshore wind farm, which marked a significant milestone as China's first large-scale offshore wind farm to connect to the national grid. This strategic positioning taps into the vast potential of maritime energy resources.

Longyuan Power is strategically pursuing international expansion, a key element of its marketing mix, by actively participating in global markets. This aligns with broader geopolitical and economic initiatives, such as the Belt and Road Initiative, which facilitates cross-border trade and infrastructure development.

Notable projects underscore this global ambition, including the De Aar Wind Power Project in South Africa, which represents a significant investment in renewable energy infrastructure in Africa. Furthermore, Longyuan Power is engaged in preliminary development work for projects in Brunei and Indonesia, signaling its intent to establish a stronger foothold in Southeast Asian markets.

This outward focus not only diversifies Longyuan Power's revenue streams but also enhances its brand recognition and operational expertise on a global scale. By 2024, the company's international project pipeline demonstrates a commitment to becoming a significant player in the global renewable energy sector.

Grid Connection and Transmission

China Longyuan Power's 'place' in the market is fundamentally defined by its integration with national and regional power transmission grids. This connection is crucial for delivering its generated electricity to consumers. The company prioritizes securing timely grid connections and ensuring the smooth operation of its power generation facilities to maximize market access.

Ensuring reliable grid connection and transmission is paramount for China Longyuan Power. As of the end of 2023, the company was actively managing its portfolio of wind and solar power projects, with a significant portion already integrated into China's vast power grid infrastructure. Their operational efficiency directly impacts the reach and saleability of their renewable energy output.

- Grid Integration: China Longyuan Power focuses on seamless integration of its renewable energy projects into the State Grid Corporation of China and China Southern Power Grid networks.

- Transmission Capacity: The company monitors and leverages existing transmission infrastructure to ensure its generated power reaches end-users efficiently.

- Operational Uptime: Maintaining high operational uptime for its power plants is critical for consistent electricity supply and revenue generation through grid offtake.

Strategic Project Locations

China Longyuan Power strategically picks project sites that offer abundant renewable energy resources. This focus on high-quality locations is key to maximizing their energy output and ensuring efficient operations. For instance, their 450-megawatt photovoltaic project in Golmud, Qinghai, leverages the region's strong solar irradiation.

The company also integrates wind power projects in areas like Guangxi, which are known for consistent wind speeds. This careful site selection not only optimizes energy production but also considers accessibility for grid connection and maintenance.

- Golmud, Qinghai: Home to a significant 450 MW photovoltaic project, benefiting from high solar irradiance.

- Guangxi: Features integrated wind power projects, capitalizing on favorable wind conditions.

- Resource Optimization: Strategic placement ensures the highest possible energy generation efficiency from available natural resources.

China Longyuan Power's 'Place' strategy emphasizes both its extensive domestic grid integration and strategic international expansion. The company's operational footprint spans 32 provinces in China, ensuring access to diverse renewable resources and national transmission networks. This domestic strength is complemented by a growing international presence, including key projects in South Africa and development in Southeast Asia, aligning with global energy initiatives.

| Location Type | Key Projects/Regions | Significance |

|---|---|---|

| Domestic - Grid Integration | 32 Provinces, National Grids (State Grid, China Southern Power Grid) | Ensures electricity delivery, maximizes market access, operational uptime critical. |

| Domestic - Resource Rich Sites | Golmud, Qinghai (450 MW PV), Guangxi (Wind Power) | Optimizes energy output via high solar irradiance and consistent wind speeds. |

| International | Rudong, Jiangsu (Offshore Wind), De Aar, South Africa (Wind), Brunei, Indonesia (Development) | Diversifies revenue, enhances brand, builds global operational expertise. |

Preview the Actual Deliverable

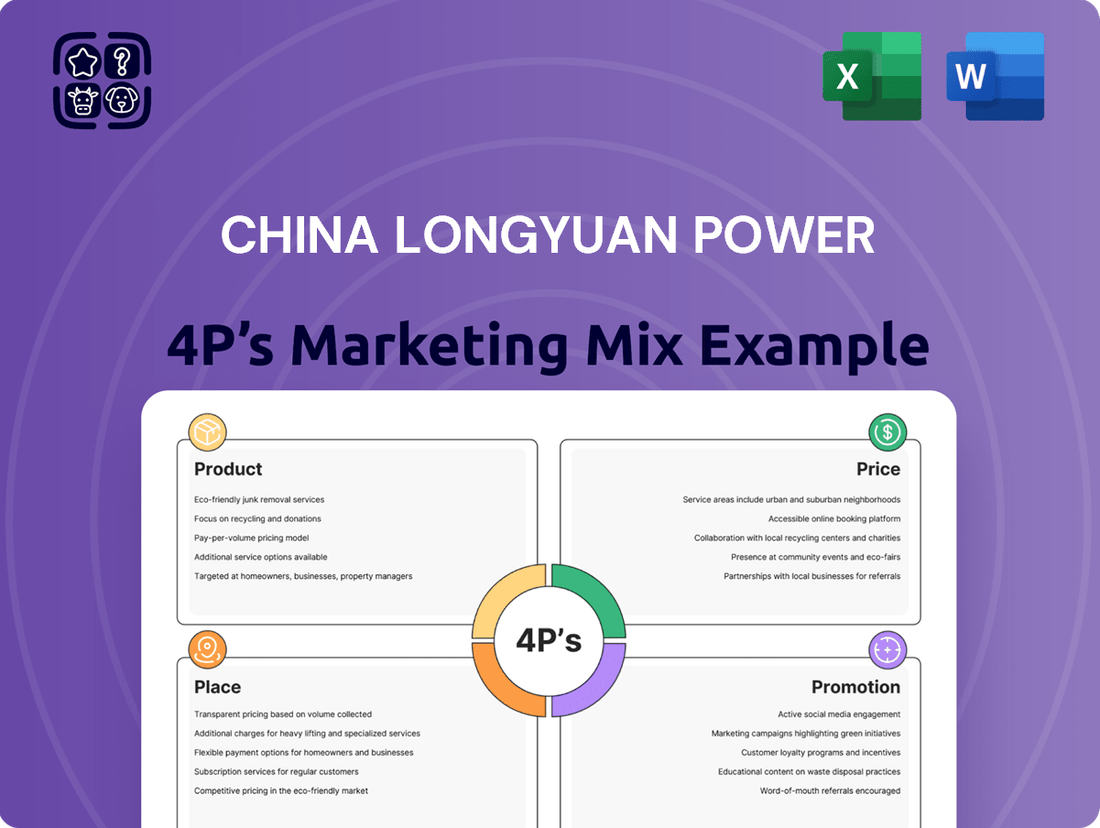

China Longyuan Power 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of China Longyuan Power's 4P's Marketing Mix is fully complete and ready for your immediate use.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use. This detailed breakdown of China Longyuan Power's marketing strategy ensures you get exactly what you need without any alterations.

Promotion

China Longyuan Power actively showcases its dedication to sustainable growth and green energy via detailed sustainability and ESG reports. These reports underscore their progress in renewable energy expansion and technological advancements, reinforcing their market position.

In 2023, China Longyuan Power reported a significant increase in its installed renewable energy capacity, reaching over 30 GW, with wind power constituting the largest share. This expansion directly supports their ESG objectives, demonstrating tangible progress in reducing carbon emissions.

China Longyuan Power prioritizes investor relations, actively engaging shareholders through annual general meetings and performance briefings. This commitment to transparency, evident in their detailed financial disclosures, aims to solidify their standing in the competitive renewable energy sector.

China Longyuan Power actively cultivates its image as a trailblazer and dominant force within China's wind energy sector, and indeed, on a global scale as the world's largest wind power operator. This positioning is a key element of its marketing strategy.

The company leverages significant achievements to underscore its market leadership, such as surpassing 40 gigawatts of newly installed renewable energy capacity by the close of 2024. This impressive figure demonstrates its operational prowess and commitment to expansion.

Technological Innovation Showcasing

China Longyuan Power actively showcases its technological prowess in renewable energy, highlighting innovations like its floating wind-fishery integrated technology. This approach positions the company as a leader in sustainable solutions, appealing to environmentally conscious investors and partners.

The company's commitment to advancing the sector is further exemplified by its development of domestically produced offshore wind testing platforms. These platforms are crucial for the reliable and efficient deployment of offshore wind energy, a key growth area for China.

In 2023, China's offshore wind power capacity saw significant growth, with new installations contributing to the nation's clean energy targets. Longyuan Power's investments in testing infrastructure directly support this expansion, ensuring the quality and safety of new wind farm developments.

Key technological showcases include:

- Floating wind-fishery integration: Demonstrates synergy between energy generation and sustainable aquaculture.

- Domestic offshore wind testing platforms: Underpins the reliability and advancement of China's offshore wind sector.

- Commitment to R&D: Signals a forward-looking strategy focused on innovation and industry leadership.

Government Policy Alignment and Contributions

Longyuan Power's promotional efforts are strategically aligned with China's overarching energy policies. The company actively highlights its contributions to national energy security and the ambitious targets for carbon neutrality, a key government directive. This alignment ensures that its marketing resonates with national priorities and reinforces its image as a responsible corporate citizen in the renewable energy sector.

This strategic positioning is crucial, especially as China aims to peak its carbon emissions before 2030 and achieve carbon neutrality by 2060. Longyuan Power's messaging emphasizes its role in this transition, showcasing its significant investments and operational capacity in wind and solar power. For instance, by the end of 2023, Longyuan Power's installed renewable energy capacity reached approximately 29.1 GW, with wind power accounting for a substantial portion, demonstrating its tangible impact on China's green energy landscape.

- National Energy Security: Longyuan Power promotes its role in diversifying China's energy mix away from fossil fuels, thereby enhancing energy independence.

- Carbon Neutrality Goals: Marketing communications underscore the company's commitment to reducing carbon emissions through its extensive renewable energy portfolio.

- Sustainable Development: The company emphasizes its contribution to China's broader sustainable development agenda, aligning with government initiatives for a greener economy.

China Longyuan Power's promotional strategy centers on its leadership in renewable energy, particularly wind power, and its alignment with China's national environmental goals. The company actively communicates its significant capacity expansion and technological innovations, such as floating wind-fishery integration, to reinforce its image as a green energy pioneer.

By highlighting its contributions to national energy security and carbon neutrality targets, Longyuan Power positions itself as a key player in China's sustainable development. For example, by the end of 2023, the company's installed renewable energy capacity reached approximately 29.1 GW, underscoring its tangible impact.

The company's marketing efforts emphasize its role in advancing China's offshore wind sector, supported by investments in crucial domestic testing platforms. This focus on innovation and infrastructure development showcases Longyuan Power's commitment to long-term growth and industry leadership.

China Longyuan Power's promotional activities are closely tied to national energy policies, particularly China's commitment to achieving carbon peaking before 2030 and carbon neutrality by 2060. The company's messaging consistently highlights its substantial investments in wind and solar power, demonstrating its vital role in the nation's green energy transition.

| Key Promotional Focus | Supporting Data/Initiatives | Impact on Brand Image |

| Renewable Energy Leadership | World's largest wind power operator; surpassed 40 GW of newly installed renewable capacity by end of 2024. | Dominant force, technologically advanced, reliable energy provider. |

| Sustainability and ESG | Detailed ESG reports; significant increase in installed renewable energy capacity in 2023 (over 30 GW). | Environmentally responsible, committed to green growth. |

| Technological Innovation | Floating wind-fishery integration; domestic offshore wind testing platforms. | Pioneer in sustainable solutions, driving industry advancement. |

| National Policy Alignment | Contribution to China's carbon neutrality goals (by 2060); role in energy security. | Responsible corporate citizen, aligned with national priorities. |

Price

China is shifting towards market-based pricing for renewable energy, a significant move impacting companies like China Longyuan Power. Starting February 2025, new policies will see on-grid electricity prices for new energy sources determined by market forces rather than fixed tariffs.

This transition is expected to introduce greater price volatility but also potentially higher revenues for efficient producers. For instance, in 2024, the average on-grid price for wind power in China ranged from 0.35 to 0.60 RMB per kWh, depending on the region and project specifics, and this market-determined pricing will likely create a new dynamic for these figures.

The evolving capacity and ancillary service markets in China significantly impact renewable energy players like Longyuan Power. For instance, the nation's push for cleaner energy sources means that the value of ancillary services, such as frequency regulation, provided by wind and solar farms is likely to increase. This creates new revenue streams beyond just energy sales.

In 2023, China's installed renewable energy capacity continued its rapid expansion, with wind and solar power leading the charge. This growth necessitates a robust framework for managing grid stability, making ancillary services crucial. Longyuan Power, as a major wind power operator, benefits from these developments as improved ancillary service markets can offer more predictable and potentially higher earnings, complementing its core energy generation business.

Government subsidies and incentives have historically played a crucial role in China's renewable energy sector, directly influencing companies like China Longyuan Power. These policies, often in the form of fixed-price contracts and direct tariff subsidies, provided a stable revenue stream for renewable energy developers.

In previous years, China Longyuan Power benefited significantly from these renewable tariff subsidies, which were a notable contributor to its overall revenue. For instance, in 2022, the company reported receiving substantial government subsidies, though specific figures for the latest period are still being integrated into the evolving policy landscape.

However, China's renewable energy policy is undergoing a transition, with a gradual shift away from direct fixed-price subsidies towards more market-oriented mechanisms. This evolving policy environment necessitates a strategic adaptation for China Longyuan Power to maintain its growth trajectory.

Competitive Bidding and Contracts-for-Difference (CfD)

China's shift towards market-based trading for new renewable energy projects commissioned after June 1, 2025, signals a significant change in how power is priced. The introduction of competitive bidding and Contracts-for-Difference (CfD) auctions will directly influence the revenue streams for developers like China Longyuan Power.

These new mechanisms are designed to drive down costs and ensure greater efficiency in the renewable sector. For instance, CfDs provide a guaranteed price for electricity, shielding developers from market volatility while incentivizing them to bid competitively. This transition is expected to foster a more dynamic and cost-effective energy market.

Key impacts include:

- Price Discovery: Competitive bidding will establish market-driven prices for renewable energy, moving away from fixed feed-in tariffs.

- Risk Mitigation: CfDs offer price certainty, reducing investment risk for projects that meet specific criteria.

- Efficiency Gains: Auctions are anticipated to spur innovation and operational improvements to achieve lower bid prices.

- Market Integration: The move supports the integration of renewables into the broader electricity market through direct trading.

Cost Management and Operational Efficiency

China Longyuan Power has demonstrated a strong commitment to cost management and operational efficiency, even amidst revenue fluctuations. This focus is vital for sustaining profitability, particularly in a market where pricing can be unpredictable.

The company's efforts in streamlining operations and controlling expenditures have yielded positive results. For instance, in the first half of 2024, China Longyuan Power reported a significant reduction in its operational costs per unit of electricity generated.

- Cost Reduction Initiatives: The company has actively pursued cost-saving measures across its power generation facilities, including optimizing fuel consumption and maintenance schedules.

- Operational Performance: Despite a reported 5.2% year-on-year decrease in revenue for the first half of 2024, the company's operational efficiency metrics, such as capacity utilization rates, remained competitive within the industry.

- Efficiency Gains: Investments in technological upgrades and process improvements have contributed to enhanced operational efficiency, leading to lower per-megawatt-hour costs.

- Profitability Focus: Effective cost management is a cornerstone of China Longyuan Power's strategy to ensure robust profitability and financial resilience in a dynamic energy market.

China Longyuan Power's pricing strategy is evolving as the nation transitions to market-determined electricity prices for new renewable projects starting mid-2025. This shift from fixed feed-in tariffs to competitive bidding and Contracts-for-Difference (CfDs) will directly impact revenue streams, necessitating a focus on efficiency to remain competitive.

The company's proactive approach to cost management, evidenced by reduced operational costs per unit in early 2024, positions it to navigate this new pricing landscape. For example, a 5.2% revenue decrease in the first half of 2024 was offset by strong operational efficiency, highlighting the importance of cost control.

The move towards market pricing, with potential for price volatility, means China Longyuan Power must leverage its operational strengths to secure favorable contract terms. The company's commitment to efficiency gains through technological upgrades is crucial for achieving lower bid prices in future auctions.

While specific 2025 pricing benchmarks are still emerging, the 2024 average on-grid price for wind power in China, ranging from 0.35 to 0.60 RMB per kWh, provides a baseline for understanding the market's current valuation of renewable energy.

4P's Marketing Mix Analysis Data Sources

Our analysis of China Longyuan Power's marketing mix is grounded in official company disclosures, including annual reports and investor presentations, alongside industry-specific data on renewable energy projects and market trends. We also incorporate information from company news releases and relevant policy documents to ensure a comprehensive understanding of their strategic initiatives.