China Longyuan Power Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Longyuan Power Bundle

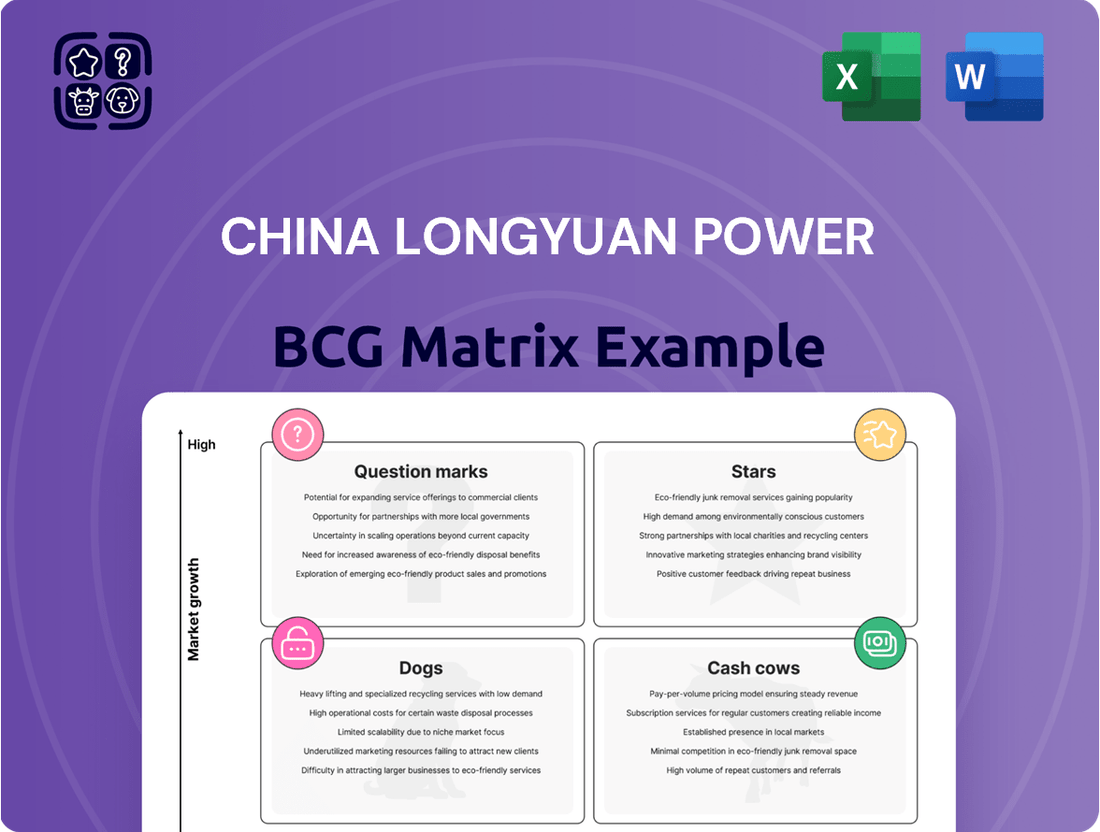

China Longyuan Power's strategic positioning is laid bare in its BCG Matrix. Understand which of their ventures are driving growth and which require careful management to unlock their full potential.

Don't miss out on the complete picture! Purchase the full BCG Matrix to gain a detailed quadrant breakdown, revealing their Stars, Cash Cows, Dogs, and Question Marks, and equip yourself with actionable insights for informed decision-making.

Stars

Wind Power Generation (Onshore) represents a significant strength for China Longyuan Power. As the world's largest wind power operator, the company's installed wind power capacity reached an impressive 30,408.77 MW by the close of 2024. This substantial capacity is largely driven by its extensive onshore wind power portfolio, strategically deployed across numerous Chinese provinces.

The robust growth of China's domestic wind market in 2024 further bolsters this segment. China accounted for over 60% of global annual connected wind capacity, highlighting a favorable operating environment and strong market demand that China Longyuan Power is well-positioned to capitalize on.

China Longyuan Power is a clear leader in offshore wind power development, having launched China's first large-scale offshore wind farm connected to the grid back in 2010. This early mover advantage has positioned them strongly in a rapidly expanding market.

The company's commitment to innovation is evident in projects like their floating wind-fishery integrated technology. In 2024, Longyuan Power accounted for a substantial portion of China's offshore wind capacity additions, underscoring their ongoing dominance in this high-growth sector.

China Longyuan Power is aggressively developing large-scale renewable energy bases, particularly in desert and Gobi regions. A prime example is the Tengger Desert New Energy Base in Ningxia, which stands as China's largest of its kind.

These ambitious projects underscore the company's focus on high-growth renewable energy deployment, often incorporating ecological restoration efforts. For instance, by the end of 2023, Longyuan Power had a significant installed capacity in wind power, with a substantial portion of this coming from these large-scale bases.

Technological Innovation in Renewables

Technological innovation is a cornerstone of China Longyuan Power's strategy, driving advancements across its renewable energy portfolio. The company has demonstrated significant progress, notably with the development of the world's first floating wind-fishery integrated technology. This pioneering effort showcases an innovative approach to maximizing land and sea utilization while generating clean energy.

Further solidifying its leadership, Longyuan Power established China's first fully domestically developed offshore wind testing platform. This critical infrastructure supports the testing and validation of new offshore wind technologies, accelerating their deployment and improving efficiency. These innovations are crucial for reducing costs and enhancing the competitiveness of renewable energy sources.

Longyuan Power's commitment to technological advancement is reflected in its operational achievements. By the end of 2023, the company had achieved a cumulative installed capacity of 30.34 GW in wind power, with offshore wind capacity reaching 10.79 GW. This expansion is underpinned by continuous investment in research and development, ensuring they remain at the cutting edge of the industry.

- World's first floating wind-fishery integrated technology

- China's first fully domestically developed offshore wind testing platform

- Cumulative installed capacity of 30.34 GW in wind power (end of 2023)

- Offshore wind capacity reached 10.79 GW (end of 2023)

Strategic Acquisitions for Market Share

In 2024, China Longyuan Power made significant moves to bolster its market position. The company strategically acquired eight new energy assets from its parent company, China Energy Investment Group. This expansion effort added nearly 1,447 MW of installed capacity to its portfolio.

These acquisitions are a clear indicator of Longyuan Power's ambition to grow its business and capture a larger share of the burgeoning new energy market. By integrating these assets, the company aims to strengthen its overall competitiveness and solidify its standing in the industry.

- Acquisition of 8 new energy assets in 2024.

- Total installed capacity added: ~1,447 MW.

- Acquired from controlling shareholder, China Energy Investment Group.

- Objective: Expand business layout and increase market share.

China Longyuan Power's Stars segment, characterized by high growth and high market share, is primarily represented by its dominant position in both onshore and offshore wind power. The company's vast installed capacity, reaching 30,408.77 MW by the end of 2024, largely stems from its extensive onshore wind farms. Furthermore, its pioneering role in offshore wind, including China's first large-scale offshore wind farm and innovative floating technologies, solidifies its leadership in this rapidly expanding sector.

| Segment | Market Share | Growth Rate | Key Strengths |

|---|---|---|---|

| Onshore Wind Power | High | High | Largest operator globally, extensive capacity (30,408.77 MW by end of 2024), favorable domestic market growth. |

| Offshore Wind Power | High | High | Early mover advantage, first large-scale offshore farm (2010), innovative technologies (floating wind-fishery), significant capacity additions in 2024. |

What is included in the product

This BCG Matrix overview of China Longyuan Power highlights which business units are Stars, Cash Cows, Question Marks, and Dogs, guiding investment decisions.

The China Longyuan Power BCG Matrix provides a clear, actionable overview of its business units, relieving the pain point of strategic uncertainty.

Cash Cows

China Longyuan Power's established wind power fleet represents a classic Cash Cow. As China's pioneering wind power developer, the company boasts a mature and expansive operational base.

These long-standing wind farms benefit from a dominant market share and a well-developed market landscape, which significantly reduces the need for aggressive promotional spending. This allows them to generate substantial and consistent cash flow for the company.

In 2023, Longyuan Power reported a total installed capacity of 27.47 GW, with its wind power segment being a primary contributor. The company’s operational efficiency and scale in this segment underscore its Cash Cow status.

China Longyuan Power's substantial installed capacity in wind and photovoltaic power, exceeding 41 GW by the close of 2024, forms the bedrock of its stable power generation revenue. This vast renewable energy portfolio guarantees a consistent and significant income stream from electricity sales to national grid companies, underscoring its position as a cash cow.

China Longyuan Power's focus on operational efficiency and cost management is key to its Cash Cow strategy. By enhancing the performance of its existing wind farms, the company ensures these mature assets continue to generate substantial profits and strong cash flow. This dedication to maximizing output from established projects is a hallmark of a successful Cash Cow, providing the financial fuel for other business segments.

Green Power Transactions and Certificates

Green Power Transactions and Certificates within China Longyuan Power's BCG Matrix are clearly positioned as Cash Cows. In 2024, the company demonstrated robust performance in this segment.

- Green Power Transactions: Longyuan Power completed 6.701 billion kWh of green power transactions, marking a substantial year-on-year increase of 288.84%.

- Green Certificates Traded: The company traded 10.2354 million green certificates, reflecting a significant growth of 140.83%.

- Revenue Generation: These figures highlight a strong and growing revenue stream derived from Longyuan Power's established renewable energy generation capacity.

- Market Demand: The increasing volume of transactions underscores the company's ability to capitalize on the escalating demand for clean energy attributes in the market.

Robust Financial Profile and Low-Cost Funding

China Longyuan Power's robust financial profile, characterized by high credit ratings from S&P Global Ratings and Moody's Investors Service, underpins its status as a Cash Cow. This strong creditworthiness allows the company to access low-cost financing, a crucial advantage in the capital-intensive power generation sector.

This financial strength translates into significant operational benefits. Longyuan Power can efficiently refinance its existing debt obligations, reducing interest expenses and improving profitability. Furthermore, it ensures a stable and cost-effective capital supply for its ongoing operations, minimizing the need to draw heavily on internal cash reserves.

- Strong Credit Ratings: S&P Global Ratings and Moody's Investors Service consistently assign high ratings to China Longyuan Power, reflecting its financial stability and low risk profile.

- Low-Cost Financing Advantage: The company's credit standing enables it to secure debt at competitive interest rates, significantly lowering its cost of capital compared to less creditworthy peers.

- Efficient Debt Management: Longyuan Power leverages its financial strength to proactively refinance existing debt, optimizing its debt structure and reducing overall interest payments.

- Stable Capital for Operations: Reliable access to low-cost funding ensures that the company's day-to-day operations and necessary capital expenditures are well-supported without straining its cash flow.

China Longyuan Power's Green Power Transactions and Certificates are firmly established as Cash Cows within its BCG Matrix. The company's 2024 performance in these areas highlights their maturity and consistent revenue generation capabilities. These segments benefit from China's increasing demand for renewable energy attributes.

| Segment | 2024 Performance Metric | Value | Year-on-Year Change |

|---|---|---|---|

| Green Power Transactions | Volume Traded (kWh) | 6.701 billion | +288.84% |

| Green Certificates Traded | Volume Traded | 10.2354 million | +140.83% |

| Overall Impact | Revenue Stream | Strong and Growing | N/A |

Full Transparency, Always

China Longyuan Power BCG Matrix

The China Longyuan Power BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase, ensuring no surprises and immediate usability for strategic analysis.

This preview accurately represents the complete China Longyuan Power BCG Matrix report that will be delivered to you after completing your purchase, offering a ready-to-use tool for evaluating their business portfolio.

Rest assured, the China Longyuan Power BCG Matrix you see here is the final, professional version you'll download after purchase, providing a comprehensive and actionable strategic framework.

What you are previewing is the exact China Longyuan Power BCG Matrix file that will be yours immediately after purchase, enabling you to delve into strategic insights without delay.

Dogs

China Longyuan Power's historical involvement with conventional coal power plants represented a significant portion of its past operations. However, the company has been actively divesting from this sector, recognizing its limited growth potential and declining market relevance.

By October 2024, China Longyuan Power officially ceased to own any consolidated installed capacity from conventional coal power plants. This strategic pivot underscores the company's commitment to shifting its portfolio towards more sustainable and higher-growth energy sources, effectively moving these assets out of its core business.

Legacy small-scale, inefficient assets within China Longyuan Power's portfolio could be classified as 'dogs' in the BCG Matrix. These might include older wind farms with lower capacity factors or solar installations in areas with less consistent sunlight. For instance, if a wind farm built in the early 2010s is operating at a significantly lower efficiency compared to newer models, its contribution to Longyuan's overall profitability might be minimal.

Such assets would likely possess a low market share within the rapidly expanding renewable energy sector and operate in a mature, non-growth segment of the market. Their operational costs, including maintenance and potential upgrades to meet newer environmental standards, could easily exceed their revenue generation, especially if electricity prices have not kept pace with inflation or if their power purchase agreements are less favorable.

By the end of 2023, China's total installed renewable energy capacity surpassed 1.4 billion kilowatts, with wind and solar making up the bulk. Assets that haven't been upgraded or are inherently less efficient would struggle to compete. These underperforming units might be prime candidates for divestiture, allowing Longyuan to reallocate capital to more promising, high-growth areas, or for decommissioning if their continued operation is no longer economically viable.

Non-core, underperforming ancillary businesses, such as the manufacturing of wind turbine blades or related equipment that lacks a competitive edge or faces declining market demand, would be classified as Dogs in China Longyuan Power's BCG Matrix. These operations, characterized by low market share within a slow-growing manufacturing segment, represent potential cash traps that require meticulous assessment. For instance, if a specific blade manufacturing line saw its market share dip to below 5% in a segment growing at only 2% annually, it would clearly fit this 'Dog' profile, necessitating a strategic review to prevent further resource drain.

Projects Facing Significant Curtailment Issues

In areas where the electricity grid struggles to absorb the surge in renewable energy, certain Longyuan Power wind and solar projects may face substantial curtailment. This means their generated power is deliberately reduced or stopped because the grid cannot handle it. For instance, in some provinces in China, grid congestion has led to significant curtailment for renewable projects.

When these projects are frequently unable to transmit their full output due to grid limitations, they operate with a low effective market share relative to their installed capacity. This leads to reduced revenue generation and profitability, potentially categorizing them as 'dogs' in the BCG matrix. By the end of 2023, China's wind power curtailment rate was reported to be around 2.5% nationally, but localized issues in certain regions could be much higher, impacting specific projects.

- Grid Infrastructure Lag: Projects in regions with underdeveloped grid infrastructure are most susceptible to curtailment.

- Reduced Operational Efficiency: Consistent curtailment significantly lowers the actual energy output and financial returns of these projects.

- Potential 'Dog' Classification: Projects with low market share and low growth prospects due to these operational constraints may be classified as dogs.

Exploration into Non-Viable Renewable Technologies

While China Longyuan Power Group is known for its innovation, certain renewable technologies might fall into the 'dog' category of the BCG matrix. These are typically new ventures or niche applications that, despite initial investment, fail to gain significant market traction or demonstrate commercial viability. For instance, early-stage investments in experimental tidal power or advanced geothermal technologies that prove too costly or inefficient could become dogs.

These 'dogs' are characterized by a low market share within the broader renewable energy sector and a failure to capitalize on any potential growth. For example, if a specific type of biomass energy conversion technology, despite R&D efforts, only captures less than 1% of the relevant energy market by 2024 and shows no signs of increasing that share, it would likely be classified as a dog.

The consequence of such a classification is the need for tough strategic decisions. Companies must evaluate whether to continue pouring resources into these underperforming ventures or to divest from them entirely. Consider a scenario where a pilot project for concentrated solar power with thermal storage, which was initiated with significant capital, fails to achieve its projected energy output targets and faces intense competition from more established solar PV technologies, leading to a decision to cease further development by the end of 2024.

- Low Market Share: Technologies failing to capture even a small percentage of their target market by 2024.

- Commercial Non-Viability: High operational costs or low energy output making them unprofitable.

- Stagnant Growth Prospects: Lack of market adoption or technological advancements hindering future expansion.

- Divestment Consideration: The need to reallocate capital from underperforming assets to more promising areas.

Certain legacy wind farms or solar installations within China Longyuan Power's portfolio might be classified as 'dogs' if they exhibit low operational efficiency and minimal market share in the rapidly expanding renewable sector. These aging assets, potentially built in the early 2010s, may struggle to compete with newer, more efficient technologies, leading to reduced profitability and making them candidates for divestiture.

Non-core ancillary businesses, such as specific wind turbine blade manufacturing lines that lack a competitive edge or face declining demand, could also be categorized as dogs. If such a line holds less than 5% market share in a segment growing at only 2% annually, it represents a potential drain on resources requiring a strategic review.

Projects experiencing significant curtailment due to grid congestion, especially in regions with underdeveloped infrastructure, can also become dogs. If a project's generated power is frequently reduced, its effective market share and financial returns diminish, potentially leading to its classification as an underperforming asset. By the end of 2023, while the national wind power curtailment rate was around 2.5%, localized issues could be considerably higher, impacting specific projects.

Question Marks

China Longyuan Power is strategically investing in new overseas renewable energy projects, particularly in Southeast Asia. The company is progressing with preliminary work on significant ventures like fishery-solar complementary projects in Brunei and photovoltaic (PV) projects in Indonesia.

These new overseas endeavors position Longyuan Power in burgeoning renewable energy markets, though they also represent a relatively nascent stage for the company's international footprint. The market share and long-term viability of these specific projects remain subjects of ongoing assessment, reflecting their potential as question marks within the BCG framework.

China Longyuan Power Group Corporation also operates biomass power plants, contributing to its diverse renewable energy portfolio. While biomass is a recognized renewable source, its market expansion and Longyuan's specific footprint within this sector are less pronounced compared to its wind and solar operations. This relative positioning places biomass in the question mark category, necessitating careful consideration for future investment and strategic development to assess its growth potential.

Emerging energy storage solutions represent a key area for Longyuan Power, fitting the profile of a question mark in the BCG matrix. While the clean energy sector's demand for storage is rapidly expanding, Longyuan's current market share in these nascent technologies is likely minimal. For instance, by the end of 2023, China's installed energy storage capacity reached 16.6 GW, a significant increase but one where Longyuan's specific contribution to emerging solutions is still developing.

These initiatives demand substantial capital investment for research, development, and scaling. The long-term profitability of these emerging storage technologies remains uncertain, reflecting the high risk and potential reward associated with question mark assets. For example, the global energy storage market was projected to grow substantially, with significant investments pouring into battery technologies and other innovative solutions throughout 2024.

Advanced Offshore Wind Technologies (e.g., Floating Platforms)

China Longyuan Power's ventures into advanced offshore wind technologies, such as floating platforms, position them in the 'Question Marks' category of the BCG matrix. While Longyuan has demonstrated innovation with integrated platforms, like their floating wind-fishery concept, these technologies are nascent and carry significant upfront costs relative to established fixed-bottom offshore wind farms.

These emerging technologies represent a high-potential growth area in the offshore wind sector. However, they currently hold a minimal market share and necessitate considerable capital investment for scaling up and achieving profitability. As of early 2024, floating offshore wind projects globally are still in demonstration or early commercial phases, with significant R&D and infrastructure development needed.

- High Growth Potential: Floating wind technology is projected to unlock vast deep-water wind resources, a market segment inaccessible to fixed-bottom turbines.

- Low Market Share: Despite its potential, floating offshore wind's installed capacity remains a small fraction of the total offshore wind market. For instance, by the end of 2023, global floating offshore wind capacity was only a few hundred megawatts, compared to tens of gigawatts for fixed-bottom.

- High Investment Requirements: Developing and deploying floating platforms involves complex engineering, specialized vessels, and new port infrastructure, demanding substantial financial commitment.

- Uncertain Profitability: The high costs associated with floating wind mean that profitability is not yet guaranteed, making them a strategic investment with inherent risks.

Integration of AI and Digital Technologies in Operations

China Longyuan Power is actively integrating digital technologies, including artificial intelligence, to enhance its operational efficiency. This focus on innovation positions them to capitalize on the growing AI in energy sector, a market projected for substantial growth. However, their current market share or established competitive edge in AI-driven energy management is likely still developing.

This makes AI integration a question mark within their BCG matrix. It represents a high-potential area requiring significant investment to mature into a future growth driver. For instance, in 2024, companies investing heavily in AI for grid optimization and predictive maintenance saw improved asset utilization.

- AI Integration Focus: Longyuan's commitment to digital transformation underscores a strategic move towards AI for operational enhancements.

- Nascent Market Position: While the AI in energy market is expanding, Longyuan's specific competitive standing in AI-driven solutions is likely in its early stages.

- Investment Requirement: Significant capital and research and development are needed for Longyuan to fully leverage AI for future growth and market leadership.

- Industry Trend Alignment: The company's efforts align with broader industry trends where AI adoption is crucial for efficiency and competitive advantage in the energy sector.

China Longyuan Power's investment in emerging overseas renewable energy markets, such as those in Southeast Asia, places them in the question mark category. While these ventures, like the Brunei fishery-solar and Indonesian PV projects, offer high growth potential, their current market share and long-term profitability are still being established. These initiatives require significant capital and carry inherent risks, reflecting their nascent stage.

Similarly, the company's biomass power operations, though a recognized renewable source, represent a question mark due to less pronounced market expansion compared to their wind and solar segments. Longyuan's strategic focus on energy storage solutions and advanced offshore wind technologies, like floating platforms, also falls into this category. These areas demand substantial investment for development and scaling, with uncertain immediate profitability but high future growth prospects.

The integration of digital technologies, particularly AI for operational efficiency, is another key question mark. While aligning with industry trends and offering significant potential, Longyuan's current market share and competitive edge in AI-driven energy management are still developing, necessitating further investment to mature.

| Initiative | Market Growth Potential | Current Market Share | Investment Needs | Profitability Outlook |

| Overseas Renewables (SEA) | High | Low/Developing | High | Uncertain |

| Biomass Power | Moderate | Moderate | Moderate | Moderate |

| Energy Storage | Very High | Low/Developing | Very High | Uncertain |

| Floating Offshore Wind | Very High | Very Low | Very High | Uncertain |

| AI Integration | High | Low/Developing | High | Uncertain |

BCG Matrix Data Sources

Our China Longyuan Power BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.