China Longyuan Power Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Longyuan Power Bundle

China Longyuan Power faces a dynamic competitive landscape, with significant pressure from powerful buyers and the constant threat of new entrants in the renewable energy sector. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping China Longyuan Power’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of key suppliers for critical components such as wind turbine blades and specialized equipment significantly impacts Longyuan Power. When only a few dominant suppliers exist, their bargaining power escalates, potentially driving up costs or dictating less favorable terms for Longyuan.

Chinese manufacturers currently hold a substantial share of the global wind turbine market. This dominance can translate into considerable influence over pricing and the availability of essential components for companies like Longyuan Power, affecting their operational expenses and project timelines.

Switching costs for Longyuan Power are a significant factor in supplier bargaining power. These costs can include the expense of retooling manufacturing processes, re-certifying critical equipment to work with new suppliers, or the administrative burden of renegotiating contracts. For instance, if Longyuan Power were to switch from its primary wind turbine manufacturer, the integration of new systems and potential compatibility issues could lead to substantial downtime and capital expenditure.

The company's strategic decision to manufacture its own wind turbine blades could, however, offer some leverage. By controlling a key component in-house, Longyuan Power may reduce its reliance on external suppliers for this specific part, thereby potentially lowering the overall switching costs associated with certain supply chain disruptions. This vertical integration could provide a degree of insulation from price increases or supply shortages from blade manufacturers.

Suppliers offering highly specialized or proprietary technology, like advanced wind turbine designs or unique blade materials, hold significant bargaining power. While China's wind turbine manufacturing is extensive, advancements in materials, such as the increasing use of carbon fiber composites, can still provide certain suppliers with a competitive edge and greater leverage.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers can significantly bolster their bargaining power against China Longyuan Power. If suppliers can credibly threaten to enter the power generation market themselves, Longyuan Power faces increased pressure to concede to supplier demands.

While component manufacturers are unlikely to integrate forward, large equipment suppliers, such as those providing wind turbines or solar panels, could theoretically venture into power project development. However, the substantial capital requirements and the heavily regulated nature of China's energy sector present considerable barriers to entry for such moves, potentially mitigating this specific threat.

- Supplier Integration Risk: Suppliers moving into power generation increases their leverage over Longyuan Power.

- Capital Intensity Barrier: The high cost of developing power projects in China acts as a deterrent for equipment manufacturers.

- Regulatory Environment: China's regulated energy market adds complexity and cost to potential supplier forward integration.

Importance of Supplier to Buyer

Longyuan Power, as the world's largest wind power operator, possesses considerable bargaining power with smaller, less dominant suppliers. This scale allows it to negotiate favorable terms and pricing for components and services. For instance, in 2023, Longyuan Power's significant capital expenditure plans, exceeding 10 billion yuan for new wind farm development, underscore its substantial purchasing volume.

However, the bargaining power dynamic shifts when dealing with large, dominant component manufacturers. These major suppliers, often possessing proprietary technology and significant market share, may view Longyuan Power as just one of many crucial clients. Companies like Goldwind, a leading wind turbine manufacturer, reported revenues of approximately 104.6 billion RMB in 2023, indicating their capacity to absorb the loss of a single large customer, thereby diminishing Longyuan's leverage.

- Supplier Dependence: Longyuan Power's reliance on specialized components, such as advanced turbine blades and control systems, can increase supplier leverage if few manufacturers can meet its technical specifications.

- Market Concentration: In segments where a few large suppliers dominate, Longyuan's purchasing power is diluted. For example, the nacelle market often features a limited number of key players.

- Switching Costs: The high cost and time involved in qualifying and integrating new suppliers for critical components can make it difficult for Longyuan to switch, giving existing suppliers more power.

- Input Cost Volatility: Fluctuations in raw material prices, like steel and rare earth metals, can be passed on by suppliers, impacting Longyuan's operational costs.

The bargaining power of suppliers to China Longyuan Power is significantly influenced by market concentration and the availability of specialized components. When few suppliers can provide critical parts like advanced wind turbine blades or proprietary control systems, their leverage increases, potentially leading to higher prices or less favorable contract terms for Longyuan. For instance, in 2023, the global wind turbine market saw continued dominance by a few key manufacturers, meaning Longyuan, despite its size, faces powerful suppliers for certain high-tech components.

The threat of suppliers integrating forward into power generation is a concern, but high capital costs and China's regulated energy market act as significant barriers. While theoretically possible for large equipment providers to develop projects, the substantial investment required and the complexities of the Chinese energy sector make this a less immediate threat. This situation means that while suppliers of specialized technology hold sway, their ability to disrupt Longyuan's core business through forward integration is limited.

| Factor | Impact on Longyuan Power | Supporting Data/Context |

| Supplier Market Concentration | Increases supplier bargaining power for critical components. | Dominance of a few key manufacturers in the global wind turbine market (2023 data). |

| Supplier Specialization/Proprietary Tech | Grants suppliers significant leverage. | Advancements in materials like carbon fiber composites create specialized suppliers. |

| Switching Costs | Limits Longyuan's ability to change suppliers easily. | Costs include retooling, re-certification, and contract renegotiation. |

| Supplier Forward Integration Threat | Potential for increased supplier leverage. | Mitigated by high capital requirements and regulatory barriers in China's energy sector. |

What is included in the product

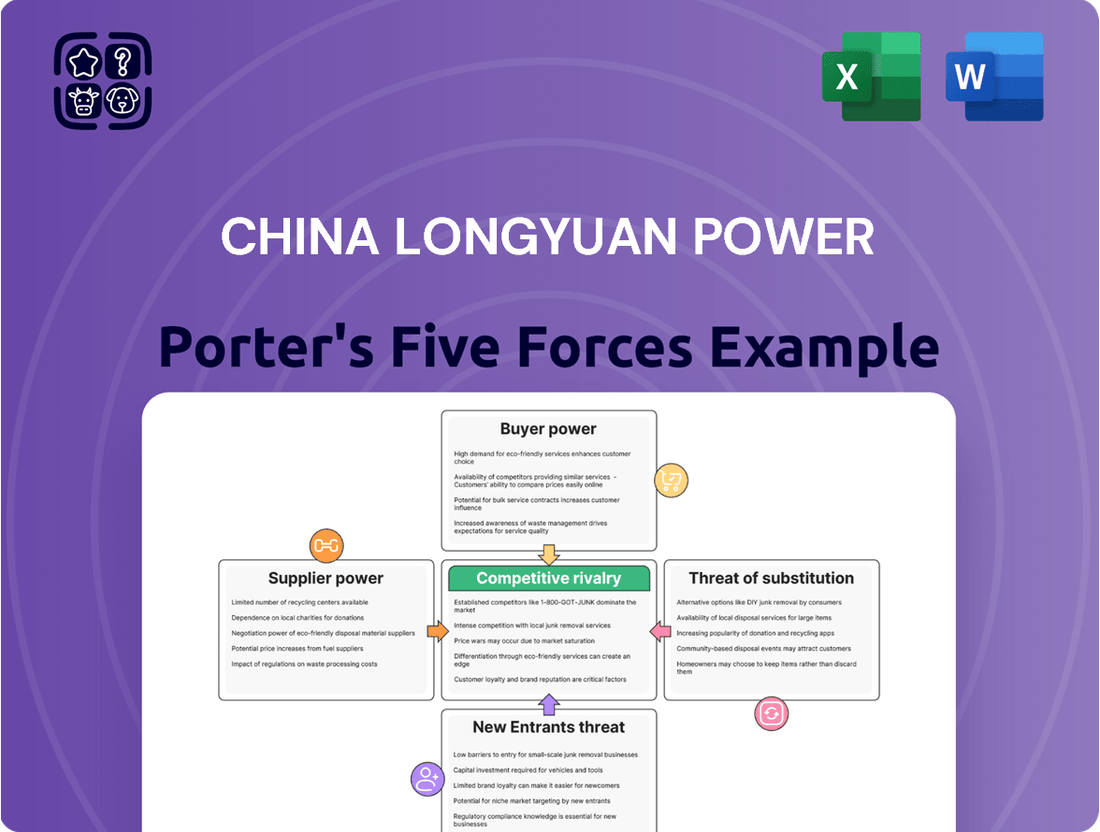

This analysis tailors Porter's Five Forces to China Longyuan Power, examining the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the renewable energy sector.

Understand the competitive landscape of China's renewable energy sector by quickly assessing the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry.

Customers Bargaining Power

Customer concentration is a significant factor for China Longyuan Power. The majority of electricity buyers in China are state-owned grid companies, a highly consolidated group. This means a few large entities hold considerable sway over power producers.

For instance, the State Grid Corporation of China is a dominant buyer. Its sheer size and market position allow it to dictate terms, including purchasing agreements, grid connection requirements, and the pricing of electricity. This concentration directly translates into substantial bargaining power for these customers.

In 2023, China's electricity consumption reached approximately 9.5 trillion kilowatt-hours. Longyuan Power, as a major renewable energy producer, sells its output primarily through these large state-owned grid operators, underscoring the impact of customer concentration on its revenue and operational flexibility.

Switching costs for China Longyuan Power's customers are generally low, especially for residential consumers. The ability to switch providers is often limited by regional monopolies in electricity distribution, meaning customers typically have few, if any, alternative suppliers to choose from.

For large industrial users, the decision to switch from grid power to self-generation or other energy sources can represent a substantial capital outlay. However, the ongoing costs associated with grid electricity can still make such investments attractive over the long term, impacting Longyuan's customer retention.

Customer price sensitivity is a key factor for China Longyuan Power. Electricity, especially for large industrial consumers, is largely viewed as a commodity, making them quite attuned to price changes. This means Longyuan Power must carefully consider its pricing strategies to remain competitive.

Government policies and regulations significantly influence the prices Longyuan Power can set for its electricity. For instance, in 2024, the Chinese government continued to focus on electricity market reforms aimed at increasing transparency and efficiency, which can impact pricing power.

Threat of Backward Integration by Customers

Large industrial consumers of electricity, such as manufacturing plants or data centers, possess the potential to mitigate their reliance on power producers like China Longyuan Power through backward integration. This often involves investing in on-site renewable energy generation, such as rooftop solar installations or small-scale wind turbines, to supplement or replace grid-supplied power. For instance, in 2024, China's distributed solar capacity saw significant growth, with new installations contributing to a more decentralized energy landscape, potentially impacting large-scale power providers.

While this threat isn't universal across all customer segments, it can exert considerable pressure on power generation companies. The ability of significant customers to generate their own power incentivizes Longyuan Power to maintain competitive pricing structures and ensure a consistently reliable supply to retain their business. This dynamic encourages efficiency and innovation within the power sector to meet evolving customer demands and market conditions.

- Threat of Backward Integration: Large industrial customers may generate their own power via rooftop solar or small wind projects.

- Customer Leverage: This capability pressures power producers to offer competitive pricing and reliable supply.

- Market Impact: In 2024, China's distributed solar capacity growth illustrated this trend towards decentralized energy, potentially affecting large-scale providers.

Availability of Substitutes for Customers

Customers have limited direct substitutes for electricity itself, but they can reduce their reliance on the grid. For instance, implementing energy efficiency measures can lower overall consumption. In certain scenarios, particularly during grid instability, businesses might resort to captive power generation, such as using diesel generators, although this comes with higher operating costs.

The landscape is shifting with the growing accessibility and affordability of distributed renewable energy solutions. Solar power, in particular, is becoming a viable alternative for many consumers and businesses, offering a degree of energy independence and potentially lower long-term costs compared to traditional utility providers.

- Limited Direct Substitutes: Consumers cannot easily replace the fundamental need for electricity.

- Indirect Substitution: Energy efficiency and conservation are key ways customers reduce demand.

- Captive Power: Businesses may use on-site generation (e.g., diesel generators) during outages, though this is costly.

- Rise of Renewables: Distributed solar power offers an increasingly competitive alternative for electricity supply.

China Longyuan Power faces strong customer bargaining power primarily due to the concentrated nature of its buyers, which are dominated by state-owned grid companies like the State Grid Corporation of China. These entities, by virtue of their size and market position, can significantly influence pricing and contract terms. In 2023, China's total electricity consumption was around 9.5 trillion kWh, with Longyuan Power supplying a substantial portion through these few key buyers, highlighting their leverage.

Preview Before You Purchase

China Longyuan Power Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for China Longyuan Power, detailing the competitive landscape and strategic implications within the renewable energy sector. The document you see here is the exact, fully formatted report you will receive immediately after purchase, offering an in-depth examination of industry rivalry, buyer and supplier power, threat of new entrants, and the threat of substitute products. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning and decision-making.

Rivalry Among Competitors

China Longyuan Power faces intense competition in the burgeoning Chinese renewable energy sector. The market is populated by a diverse array of players, including other large state-owned enterprises and increasingly agile private companies, all vying for market share in wind, solar, and other green energy segments.

While Longyuan Power holds a leading position, it operates in a landscape where numerous other substantial developers are actively expanding their portfolios. For instance, in 2023, China's installed renewable energy capacity continued its rapid ascent, with wind and solar power leading the charge, underscoring the sheer scale of market activity and the presence of formidable rivals.

The renewable energy sector in China, especially wind and solar, is booming. This rapid expansion offers significant growth opportunities for all companies involved, potentially softening intense rivalry by creating more market space. China's commitment to green energy is evident; in 2024 alone, the country installed more wind turbines and solar panels than all other nations globally combined, highlighting the sheer scale of this growth.

In the power generation sector, electricity itself is largely a commodity, making it challenging to stand out solely on the product. Longyuan Power, for instance, focuses on differentiating through its operational prowess and significant scale. By the end of 2023, Longyuan Power reported a total installed capacity of 26,510.7 MW, demonstrating its substantial market presence.

Technological advancements are another key differentiator for companies like Longyuan. This includes investments in areas such as offshore wind technology and the development of integrated energy projects. Their commitment to innovation is reflected in their ongoing expansion and upgrades, aiming to enhance efficiency and sustainability.

Exit Barriers

China Longyuan Power faces significant competitive rivalry due to high exit barriers. The immense capital investment required for power plants and transmission infrastructure, often running into billions of dollars, makes it extremely difficult and costly for companies to leave the market. For instance, the construction of a single large-scale wind farm can cost upwards of $200 million. This financial commitment means that even in less profitable times, firms are locked into operations, leading to sustained competition.

Furthermore, long-term power purchase agreements and complex regulatory frameworks create additional hurdles for exiting. These contracts, often spanning decades, obligate companies to continue supplying power, regardless of market conditions. Navigating the intricate web of environmental regulations and obtaining necessary permits for decommissioning or selling assets adds further complexity and expense, effectively trapping companies within the industry.

- High Capital Intensity: The power generation sector demands substantial upfront investment in fixed assets like power plants and transmission lines, creating a significant financial lock-in.

- Long-Term Contracts: Existing power purchase agreements commit companies to long-term operations, limiting flexibility to exit even when profitability declines.

- Regulatory Complexity: Stringent environmental regulations and the process of obtaining permits for asset disposal or market exit introduce considerable costs and time delays.

Strategic Stakes

China's ambitious renewable energy goals, including achieving carbon neutrality by 2060, create substantial strategic stakes for companies like Longyuan Power. This national focus fuels fierce competition for prime project locations and essential resources, as demonstrated by the rapid expansion in the sector. For instance, China's installed wind power capacity reached approximately 440 GW by the end of 2023, a significant increase that underscores the intense race for development opportunities.

The government's supportive policies, while beneficial, also intensify rivalry by encouraging numerous players to enter the renewable energy market. This dynamic means Longyuan Power must navigate a landscape where securing land, grid connections, and skilled labor is highly competitive. In 2024, the auction prices for offshore wind projects in China have shown a downward trend, reflecting this heightened competition as developers bid aggressively to win contracts.

- Strategic Imperative: China's commitment to renewable energy and carbon neutrality targets elevates the importance of companies like Longyuan Power expanding their clean energy assets.

- Intensified Competition: This national drive leads to significant competition for valuable project sites, necessary permits, and critical resources within the renewable energy sector.

- Market Dynamics: The push for renewables in 2024 has seen a surge in new project announcements and a growing number of developers vying for market share, impacting profitability and operational efficiency.

Competitive rivalry is a significant force for China Longyuan Power, driven by the sheer volume of players and the commodity nature of electricity. While Longyuan boasts substantial installed capacity, around 26,510.7 MW by the end of 2023, it competes with numerous other large state-owned enterprises and agile private firms. The rapid expansion of China's renewable energy sector, with a combined wind and solar capacity increase in 2023 alone, means more companies are vying for market share and resources.

| Metric | Value (End of 2023) | Year-on-Year Change (Approx.) |

|---|---|---|

| China Longyuan Power Installed Capacity | 26,510.7 MW | N/A (Specific 2022 data not provided) |

| China's Total Installed Renewable Capacity | Significant Growth | High double-digit percentage growth |

| China's Installed Wind Capacity | ~440 GW | Significant increase from 2022 |

SSubstitutes Threaten

The primary substitute for renewable energy sources like wind and solar in China remains conventional coal-fired power. Historically, coal offered a more attractive price-performance trade-off due to its lower initial costs and greater dispatchability, meaning it could be turned on and off more easily to meet demand.

However, this dynamic is rapidly evolving. The efficiency of renewable technologies is continuously improving, driving down their costs significantly. For instance, by the end of 2023, China's installed renewable energy capacity, including wind and solar, had surpassed 1,000 gigawatts, demonstrating a substantial shift. This increasing cost-competitiveness, coupled with China's strong commitment to environmental protection and decarbonization goals, is making renewables a more compelling alternative.

Despite the advancements in renewables, coal still plays a crucial role in China's energy mix, accounting for over 50% of the nation's electricity generation in 2023. This continued reliance on coal means that while the threat of substitution is growing, it has not yet fully displaced coal as the dominant energy source, presenting a nuanced competitive landscape for companies like China Longyuan Power.

The propensity for grid companies and industrial users to switch from Longyuan Power's offerings hinges on a delicate balance of reliability, cost-effectiveness, and government policy. While China's strong commitment to green energy, evidenced by significant investments in renewables throughout 2024, encourages a shift towards cleaner power sources, the fundamental need for grid stability and consistent baseload power means conventional sources remain crucial.

Switching costs for buyers, in this case, the grid operators and end-users of electricity, to alternative power generation sources are substantial. A complete transition away from established power sources like coal for China Longyuan Power would necessitate massive capital expenditure in grid modernization, including upgrades for smart grid capabilities and the integration of intermittent renewable sources. For example, China's commitment to renewable energy by 2030 aims for a significant increase in non-fossil fuel power generation, but the sheer scale of infrastructure required for a full substitution is a major barrier.

Availability of Alternative Energy Sources

While wind power is Longyuan Power's core business, the company also diversifies into solar and biomass energy. This internal diversification already presents a degree of substitution within its own portfolio. For example, in 2023, China's solar power generation capacity saw significant growth, adding to the competitive landscape.

Beyond Longyuan's own operations, China's energy market is rich with other alternative sources. Hydropower and nuclear power are substantial players, and even natural gas serves as a substitute in certain energy demand sectors. The sheer scale of expansion in solar and hydro capacity, in particular, directly challenges wind's dominance.

- Diversified Operations: Longyuan Power's presence in solar and biomass provides internal substitutes for its wind energy offerings.

- Hydropower and Nuclear Dominance: These established alternative sources represent significant competitive threats due to their scale and maturity in China.

- Rapid Solar Growth: The swift expansion of solar power generation capacity in China directly competes with wind energy, offering an increasingly viable alternative.

Technological Advancements in Substitutes

Technological advancements are significantly bolstering the threat of substitutes for traditional power sources. Improvements in energy storage, such as the development of more efficient and cost-effective large-scale battery systems, are making intermittent renewables like solar and wind more reliable. For instance, by mid-2024, global battery storage capacity is projected to reach over 100 GW, a substantial increase from previous years, directly enabling these renewables to offer more consistent baseload power.

Smart grid technologies also play a crucial role in this substitution. These advancements allow for better integration and management of distributed renewable energy sources, enhancing grid stability and reducing reliance on conventional power plants. The ongoing digital transformation of energy infrastructure, with significant investments pouring into smart grid development worldwide, further solidifies this trend.

Furthermore, innovations in other renewable energy sectors, beyond just solar and wind, present a long-term substitution threat. Advances in geothermal, tidal, and advanced biofuels continue to improve their efficiency and economic viability, offering diverse alternatives to fossil fuels and nuclear power. For example, the global renewable energy market, excluding hydropower, saw investments exceeding $500 billion in 2023, underscoring the rapid pace of innovation and adoption.

- Energy Storage Advancements: Large-scale battery technologies are improving reliability of intermittent renewables.

- Smart Grid Integration: Enhanced grid management makes distributed renewables more viable substitutes.

- Diversification of Renewables: Innovations in geothermal, tidal, and biofuels offer broader substitution options.

- Investment Trends: Significant global investment in renewables highlights the growing competitive landscape.

The primary substitute for renewable energy sources like wind and solar in China remains conventional coal-fired power, historically offering a more attractive price-performance trade-off. However, by the end of 2023, China's installed renewable energy capacity surpassed 1,000 gigawatts, demonstrating a substantial shift towards renewables due to improving efficiency and decreasing costs. Despite this, coal still accounted for over 50% of China's electricity generation in 2023, indicating that while the threat of substitution is growing, coal's dominance is not yet fully displaced.

| Energy Source | 2023 Generation Share (Approx.) | Key Substitution Factor |

|---|---|---|

| Coal | >50% | Dispatchability, historical cost advantage |

| Wind & Solar | Significant & Growing | Improving efficiency, falling costs, government policy |

| Hydropower | Substantial | Maturity, scale, established infrastructure |

| Nuclear | Substantial | Baseload power capabilities, energy security |

Entrants Threaten

The capital requirements for developing large-scale wind and solar projects in China are immense. For instance, a single 100 MW wind farm can cost upwards of $150 million to $200 million. This significant upfront investment creates a formidable barrier for new companies looking to enter the power generation sector, effectively limiting the threat of new entrants.

New entrants in China's power generation sector, particularly in renewables like wind and solar where Longyuan Power is prominent, face significant hurdles in accessing the national grid. State-owned grid companies, such as State Grid Corporation of China and China Southern Power Grid, hold a near-monopoly over transmission infrastructure. Securing grid connection is not merely a technical requirement but a bureaucratic and often lengthy process, acting as a substantial barrier to entry.

The Chinese government's extensive regulation of the power sector, particularly for renewables, significantly influences the threat of new entrants. Policies dictating renewable energy targets, subsidy structures, and pricing mechanisms create a complex landscape. For instance, China's 14th Five-Year Plan (2021-2025) aims for a significant increase in non-fossil fuel energy consumption, setting ambitious goals that can either encourage new players or be met by existing large-scale operators.

While these policies generally foster renewable energy development, their dynamic nature can act as a barrier. Sudden shifts in government support, such as adjustments to feed-in tariffs or the introduction of new environmental standards, can introduce uncertainty and increase the cost of entry for newcomers. This regulatory environment often favors established companies with the capacity to navigate and adapt to policy changes, thereby limiting the threat from new, less experienced entrants.

Economies of Scale

Established players like China Longyuan Power leverage significant economies of scale across project development, procurement, and operations. This allows them to spread fixed costs over a larger output, resulting in lower per-unit costs.

New entrants face a substantial hurdle in achieving comparable cost efficiencies. Without a large initial investment to build scale, they would find it difficult to compete on price with incumbents who benefit from established infrastructure and optimized supply chains.

- Economies of Scale: Longyuan Power's vast operational capacity, developed over years, allows for bulk purchasing of wind turbines and components, significantly reducing procurement costs per unit.

- Cost Advantage: In 2023, Longyuan Power reported a total installed capacity exceeding 27 GW, enabling them to achieve lower operational and maintenance expenses per megawatt compared to smaller, newer players.

- Barriers to Entry: The capital required to build a wind farm of comparable scale to Longyuan's existing portfolio is immense, creating a significant financial barrier for potential new entrants seeking to match their cost structure.

Proprietary Technology and Experience

Longyuan Power, a trailblazer in China's wind energy sector, benefits from significant proprietary technology and accumulated experience. This deep well of knowledge in site selection, construction, and operational efficiency creates a substantial barrier for newcomers aiming to enter the market.

Their expertise translates into tangible advantages. For instance, in 2023, Longyuan Power reported a significant portion of its operational capacity was in advanced stages of development or already online, showcasing its established project pipeline and execution capability. This hands-on experience allows for more efficient resource allocation and risk management, aspects that are difficult for new entrants to quickly match.

- Proprietary Technology: Longyuan Power's investment in research and development has likely led to unique technological solutions for wind farm development and operation, giving them a competitive edge.

- Experience Advantage: Years of navigating China's complex regulatory landscape and diverse geographical conditions have honed Longyuan Power's project execution skills.

- Operational Optimization: Their deep understanding of wind resource assessment and turbine performance tuning can lead to higher energy yields and lower operating costs, a difficult benchmark for new players to meet.

- Market Leadership: As a pioneer, Longyuan Power has secured prime locations and built strong relationships within the supply chain, further solidifying its position against potential new entrants.

The threat of new entrants for China Longyuan Power is significantly mitigated by the massive capital requirements for renewable energy projects. Building a single 100 MW wind farm can cost between $150 million and $200 million, creating a substantial financial barrier. Furthermore, securing grid connections is a complex and lengthy bureaucratic process, often controlled by state-owned monopolies like State Grid Corporation of China, further limiting new companies' ability to enter the market.

Established players like Longyuan Power benefit from considerable economies of scale, allowing for lower per-unit costs through bulk purchasing and optimized operations. In 2023, Longyuan Power's installed capacity exceeded 27 GW, enabling cost efficiencies that new entrants struggle to match. Their accumulated experience and proprietary technology in site selection and operations also create a high barrier, as demonstrated by their advanced project pipeline and execution capabilities in 2023.

| Factor | Impact on New Entrants | Longyuan Power's Advantage |

|---|---|---|

| Capital Requirements | Very High (e.g., $150M-$200M for 100 MW wind farm) | Established financial capacity and access to capital |

| Grid Access | Difficult bureaucratic and technical hurdles | Existing relationships and infrastructure access |

| Economies of Scale | Challenging to achieve cost competitiveness | Over 27 GW installed capacity (2023) leading to lower unit costs |

| Technology & Experience | Lack of proprietary tech and operational know-how | Pioneering status, advanced project execution |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Longyuan Power leverages data from annual reports, industry-specific research from organizations like IHS Markit, and official government statistics from the National Bureau of Statistics of China to provide a comprehensive view of the competitive landscape.