Clean Harbors SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clean Harbors Bundle

Clean Harbors' robust operational capabilities and extensive service network present significant strengths in the environmental services sector. However, understanding the full scope of their market position, including potential regulatory headwinds and competitive pressures, is crucial for informed decision-making.

Want the full story behind Clean Harbors' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Clean Harbors is the undisputed leader in North America for environmental and industrial services, a position solidified by its extensive infrastructure. This vast network, encompassing landfills, incinerators, and treatment centers, grants them unparalleled capacity to manage a wide array of waste streams across the continent, giving them a significant edge over competitors.

The company's market leadership is further bolstered by its robust infrastructure, which is continuously being expanded. For instance, the recent commercial launch and ramp-up of the Kimball incinerator in 2024 are key examples of how Clean Harbors is actively enhancing its disposal capacity and operational capabilities, reinforcing its dominant market position.

Clean Harbors boasts a highly diversified service portfolio, covering everything from hazardous waste management and emergency response to industrial cleaning, environmental consulting, and used oil re-refining. This extensive range of offerings means they can cater to a broad spectrum of client requirements, which is a significant advantage as it lessens their dependence on any single revenue stream.

The company's strategic acquisitions further bolster this strength. For example, the integration of HEPACO significantly expanded their emergency response services, a critical area for environmental remediation. Similarly, the acquisition of Noble Oil bolstered their capabilities in used oil collection and recycling, demonstrating a commitment to a circular economy model.

Clean Harbors consistently showcases impressive financial health. For instance, in the first quarter of 2024, the company reported a 10% increase in revenue, reaching $1.05 billion, and its Environmental Services segment saw adjusted EBITDA grow by 15%.

This operational efficiency translates into tangible results, with the Environmental Services segment achieving a multi-year trend of profitable growth and record financial performance. The company's adjusted EBITDA margins have also seen significant expansion, reflecting effective cost management and strong pricing power.

Furthermore, Clean Harbors maintains a robust balance sheet, bolstered by a healthy cash position. As of the end of Q1 2024, the company held approximately $450 million in cash and cash equivalents, providing ample flexibility for strategic investments and capital allocation.

Resilient and Diverse Client Base

Clean Harbors boasts a robust and varied client portfolio, encompassing sectors like chemical, energy, manufacturing, automotive, and government. This broad industry reach is a significant strength, as it insulates the company from the volatility that might affect a single sector. For instance, in 2023, revenue from their Industrial and Field Services segment, which serves a wide array of these industries, remained strong, demonstrating the benefit of this diversification.

The essential nature of Clean Harbors' services, particularly their role in environmental compliance and hazardous waste management, underpins their resilience. Even during economic slowdowns, businesses and government entities must adhere to stringent environmental regulations, ensuring a consistent demand for their offerings. This regulatory necessity creates a stable revenue stream, making the company less susceptible to economic downturns.

Key strengths derived from their diverse client base include:

- Reduced Sector-Specific Risk: Exposure to multiple industries buffers against downturns in any single market.

- Consistent Demand for Essential Services: Environmental compliance needs ensure a steady client requirement for their waste management solutions.

- Cross-Selling Opportunities: A diverse client base allows for the expansion of service offerings across different industries.

- Market Stability: Serving critical infrastructure and regulated industries provides a degree of economic insulation.

Commitment to Safety and Sustainability

Clean Harbors' dedication to safety is a significant strength, reflected in its consistently low Total Recordable Incident Rate (TRIR), which reached a record low in recent quarters. This operational discipline is crucial for managing hazardous materials effectively.

The company's commitment to sustainability is also a key advantage, as detailed in its 2024 Sustainability Report. This report highlights substantial progress in areas like greenhouse gas avoidance and the expansion of its used oil re-refining capabilities.

- Record Low TRIR: Demonstrates operational excellence in high-risk environments.

- 2024 Sustainability Report: Outlines robust initiatives in GHG avoidance and waste solutions.

- Used Oil Re-refining: Expands capacity, contributing to circular economy principles.

Clean Harbors' market leadership is anchored by its extensive infrastructure, a critical asset in the environmental services sector. This network of landfills, incinerators, and treatment facilities provides unparalleled capacity for waste management across North America, giving them a significant competitive advantage. The ongoing expansion of this infrastructure, exemplified by the 2024 commercial launch of the Kimball incinerator, further solidifies their dominant position.

The company's diversified service portfolio, ranging from hazardous waste management to emergency response and environmental consulting, reduces reliance on any single revenue stream. Strategic acquisitions, such as HEPACO for emergency response and Noble Oil for used oil recycling, have effectively broadened their service offerings and strengthened their market presence, aligning with circular economy principles.

Financially, Clean Harbors demonstrates robust health. In Q1 2024, revenue increased by 10% to $1.05 billion, with the Environmental Services segment experiencing a 15% rise in adjusted EBITDA. This consistent profitable growth is supported by a strong balance sheet, including approximately $450 million in cash and cash equivalents as of Q1 2024, allowing for strategic investments and operational flexibility.

Their broad client base, spanning chemical, energy, manufacturing, and government sectors, provides resilience against sector-specific downturns. The essential nature of their services, particularly hazardous waste management, ensures consistent demand driven by regulatory compliance, creating a stable revenue foundation. This diversity also unlocks cross-selling opportunities, further enhancing their market stability.

| Strength Category | Key Aspect | Supporting Data/Example |

|---|---|---|

| Market Leadership & Infrastructure | North American Leader | Extensive network of landfills, incinerators, treatment centers. |

| Infrastructure Expansion | Increased Capacity | Kimball incinerator commercial launch and ramp-up (2024). |

| Service Diversification | Broad Offerings | Hazardous waste, emergency response, industrial cleaning, consulting, used oil re-refining. |

| Strategic Acquisitions | Service Enhancement | HEPACO (emergency response), Noble Oil (used oil recycling). |

| Financial Health | Revenue Growth | Q1 2024 revenue: $1.05 billion (+10%). |

| Financial Health | Profitability | Environmental Services adjusted EBITDA growth: +15% (Q1 2024). |

| Financial Health | Liquidity | Cash & Equivalents: ~$450 million (Q1 2024). |

| Client Diversification | Industry Reach | Chemical, energy, manufacturing, automotive, government sectors. |

| Service Resilience | Essential Nature | Regulatory compliance drives consistent demand for waste management. |

| Operational Excellence | Safety Focus | Record low Total Recordable Incident Rate (TRIR). |

| Sustainability Commitment | Environmental Initiatives | GHG avoidance, expanded used oil re-refining (2024 Sustainability Report). |

What is included in the product

Explores the strategic advantages and threats impacting Clean Harbors’s success by examining its robust service network and market leadership against regulatory pressures and competitive landscape.

Offers a clear, actionable framework for identifying and mitigating potential risks in environmental services.

Weaknesses

The Safety-Kleen Sustainability Solutions (SKSS) segment, particularly its used oil re-refining operations, faces a significant hurdle due to its exposure to volatile commodity prices, specifically those of base oil and lubricants. This inherent susceptibility can directly translate into reduced revenues and diminished profitability for this crucial business unit.

For instance, fluctuations in the global base oil market, which can be influenced by crude oil prices and refining capacity, directly impact the value of the re-refined products. While Clean Harbors employs strategies like charge-for-oil pricing to buffer these swings, the underlying market volatility remains a persistent financial risk for a notable portion of their operations.

Clean Harbors' reliance on industrial sectors like refining and manufacturing presents a significant vulnerability. For instance, a slowdown in refinery maintenance schedules, which are often a key driver of their services, directly impacts revenue. Economic downturns can exacerbate this, leading companies to postpone non-essential environmental services, as seen when industrial production indexes dip.

Clean Harbors faces a significant hurdle with its high capital expenditure requirements. Building and keeping up a broad network of waste management sites, such as incinerators and treatment centers, demands a massive upfront investment. This can put a strain on the company's available cash, especially during periods when major projects are underway.

For instance, while the Kimball incinerator project is now contributing to revenue, the initial outlay was substantial. Looking ahead, the company anticipates capital expenditures to ease once these large-scale projects are operational, which should improve free cash flow in the coming years.

Challenges in Overall Revenue Growth

While Clean Harbors' Environmental Services segment often shines, the company has faced headwinds in achieving consistent overall revenue growth. There have been instances of flat top-line performance and missed revenue targets by analysts, suggesting difficulties in expanding revenue across all its business lines. This makes sustained, broad-based revenue expansion a significant challenge.

- Revenue Growth Concerns: Clean Harbors has seen periods of flat overall revenue, impacting its ability to consistently impress investors.

- Missed Expectations: The company has occasionally fallen short of Wall Street's revenue forecasts, highlighting underlying growth challenges.

- Segmental Performance Disparity: Strong results in one segment, like Environmental Services, can mask broader difficulties in driving top-line growth company-wide.

Operational Risks and Regulatory Scrutiny

Operating in the hazardous waste management sector inherently carries significant operational and safety risks due to the nature of the materials handled. Clean Harbors, like its peers, must maintain rigorous safety protocols to mitigate these dangers.

Environmental incidents or instances of non-compliance can result in substantial financial liabilities, severe reputational damage, and heightened regulatory scrutiny. For example, in 2023, the EPA continued to enforce strict penalties for environmental violations across various industries, underscoring the importance of adherence.

The hazardous waste industry is under constant pressure to adapt to evolving and increasingly stringent environmental regulations. This necessitates continuous investment in compliance measures and updated operational procedures to meet new standards.

- Operational Risks: Handling hazardous materials poses inherent safety and environmental risks.

- Regulatory Scrutiny: Non-compliance can lead to significant financial penalties and reputational harm.

- Evolving Regulations: The need to adapt to stricter environmental laws requires ongoing investment and vigilance.

Clean Harbors' reliance on a few key industrial sectors, particularly refining and manufacturing, makes it vulnerable to economic downturns. A slowdown in these sectors, as indicated by a dip in industrial production indexes, can directly reduce demand for their services, impacting revenue streams. For instance, a significant contraction in manufacturing output in 2024 would naturally lead to fewer waste management needs.

The company's Safety-Kleen Sustainability Solutions (SKSS) segment is exposed to volatile commodity prices, especially for base oil and lubricants. This volatility can directly affect profitability, as seen when lubricant prices fluctuate. While Clean Harbors uses pricing strategies to mitigate these swings, the underlying market instability remains a persistent risk for this segment.

Clean Harbors faces challenges in achieving consistent, broad-based revenue growth across all its business lines. There have been instances of flat top-line performance and missed revenue forecasts, indicating difficulties in expanding revenue company-wide. For example, analyst expectations for revenue growth in 2024 might be tempered by these historical trends.

Preview the Actual Deliverable

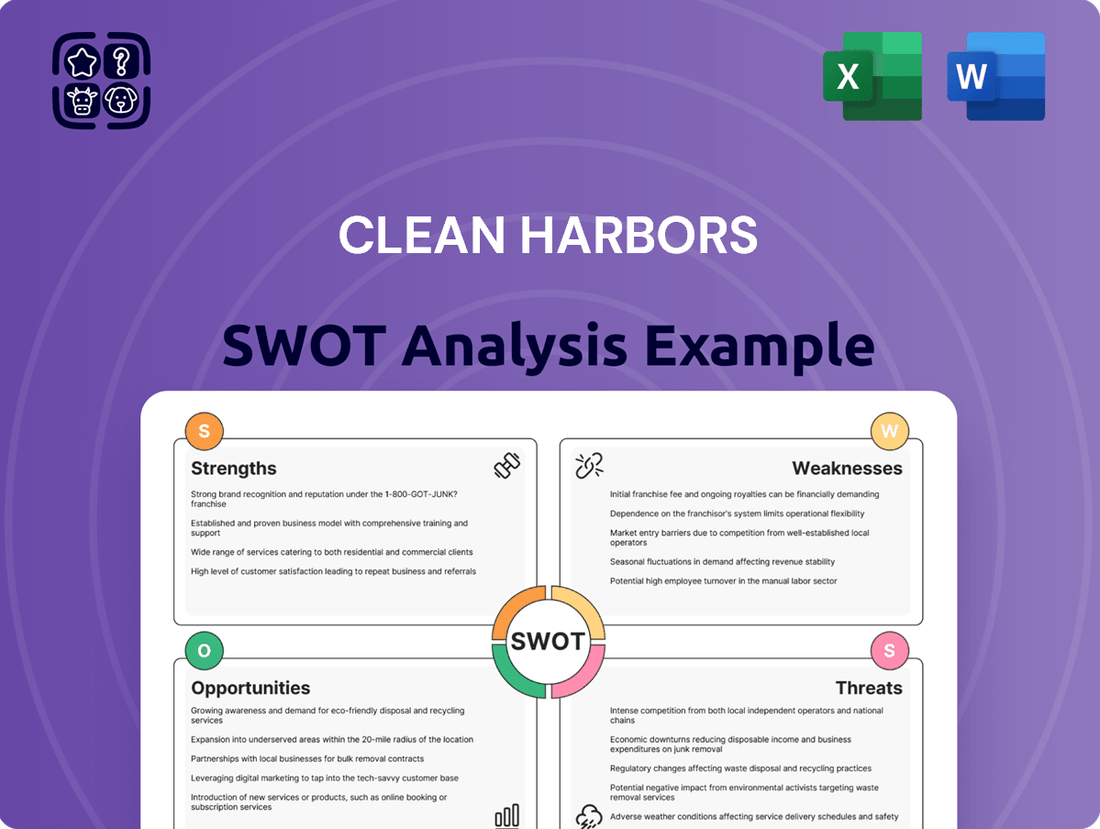

Clean Harbors SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Clean Harbors' Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The global environmental consulting services market is expected to reach $52.6 billion by 2027, growing at a compound annual growth rate of 4.5%. Similarly, the hazardous waste management market is projected to grow substantially, driven by stricter regulations and increased industrial output.

These trends are fueled by rising environmental awareness and the need for sustainable industrial practices. As nations focus on reducing pollution and managing waste effectively, the demand for specialized environmental services continues to climb.

Clean Harbors, with its comprehensive suite of environmental, energy, and industrial services, is strategically positioned to benefit from this expanding market. Their expertise in hazardous waste disposal, emergency response, and industrial cleaning aligns perfectly with the growing needs of various sectors.

The increasing global focus on environmental stewardship, evidenced by evolving regulations in waste management and emissions control, directly benefits Clean Harbors. For instance, in 2024, many regions saw proposed or enacted legislation aimed at increasing landfill diversion rates and hazardous waste accountability, creating a greater need for specialized handling and disposal services.

As governments worldwide, including key markets for Clean Harbors, implement stricter rules on pollution and mandate sustainable practices, industries are compelled to invest in compliant solutions. This regulatory push, particularly in areas like chemical waste and electronic scrap, translates into a growing demand for the comprehensive environmental services Clean Harbors provides, driving revenue growth.

The growing concern over emerging contaminants like PFAS, often called ‘forever chemicals,’ is a significant growth area for Clean Harbors. These substances are increasingly being scrutinized by regulators and the public alike, driving a strong demand for effective cleanup and disposal methods.

The potential for litigation and the pressing need for action at all government levels are creating a robust market for specialized environmental services. This situation directly benefits companies like Clean Harbors that possess the expertise and infrastructure to handle these complex challenges.

Clean Harbors is proactively addressing this market by offering its comprehensive 'Total PFAS Solution,' which includes advanced treatment and disposal technologies. This strategic offering positions the company to capitalize on the expanding need for PFAS remediation, a market projected to grow substantially in the coming years.

Strategic Acquisitions and Market Consolidation

Clean Harbors has a history of successfully integrating acquisitions, which has consistently broadened its service offerings and geographic footprint. For instance, its acquisition of Safety-Kleen in 2012 significantly boosted its position in the environmental services sector. The company actively seeks further M&A opportunities to bolster its capabilities and expand its market leadership.

This inorganic growth strategy offers a swift path to scaling operations and achieving cost synergies. In 2023, Clean Harbors continued to explore such avenues, aiming to enhance its hazardous waste management and industrial services segments. The company’s focus remains on targets that align with its core competencies and offer opportunities for market consolidation.

- Acquisition Integration: Proven ability to integrate acquired businesses, as demonstrated by the Safety-Kleen deal.

- Market Expansion: M&A provides a rapid route to increasing market share and geographic reach.

- Synergy Realization: Strategic acquisitions allow for the capture of operational and financial synergies.

- Capability Enhancement: Continuously looking to acquire businesses that add new services or strengthen existing ones.

Technological Advancements and Innovation

Clean Harbors is well-positioned to capitalize on the rapid integration of advanced technologies within the hazardous waste sector. The company can leverage innovations like AI-driven route optimization and IoT-enabled sensor networks to streamline operations and reduce costs. For instance, by adopting predictive analytics for equipment maintenance, Clean Harbors could potentially decrease downtime by an estimated 15-20% in the coming years, as seen in similar industrial applications.

The company's commitment to adopting new technologies presents significant opportunities for growth and market leadership. This includes the implementation of advanced waste treatment processes that not only improve environmental outcomes but also create new revenue streams. By investing in R&D for these solutions, Clean Harbors can differentiate itself and capture a larger share of the evolving hazardous waste market, which is projected to grow at a compound annual growth rate of over 5% through 2027.

- Enhanced Efficiency: AI and IoT can optimize collection routes, reducing fuel consumption by an estimated 10-15%.

- Improved Compliance: Real-time tracking and automated reporting through advanced systems minimize regulatory risks.

- New Service Offerings: Development of novel, sustainable treatment technologies can open up new markets.

- Operational Optimization: Predictive maintenance powered by sensors can reduce equipment downtime significantly.

Clean Harbors is poised to benefit from the increasing global demand for specialized environmental services, driven by stricter regulations and a growing emphasis on sustainability. The company's expertise in hazardous waste management and emerging contaminants like PFAS presents significant growth avenues. Furthermore, Clean Harbors' proven track record of successful acquisitions and its embrace of technological advancements offer pathways to expand market share and operational efficiency.

The company's strategic focus on emerging contaminants, particularly PFAS, aligns with a market segment experiencing rapid regulatory scrutiny and public attention. This creates a substantial opportunity for Clean Harbors to deploy its specialized treatment and disposal solutions. By continuing to integrate acquisitions and adopt innovative technologies, Clean Harbors can solidify its leadership position in the evolving environmental services landscape.

| Opportunity Area | Market Driver | Clean Harbors' Advantage |

|---|---|---|

| Emerging Contaminants (e.g., PFAS) | Increased regulatory focus and public demand for remediation. | Development of comprehensive 'Total PFAS Solution' with advanced technologies. |

| Technological Integration | Need for operational efficiency and cost reduction in waste management. | Leveraging AI for route optimization and IoT for predictive maintenance, potentially reducing downtime by 15-20%. |

| Acquisitions & Market Expansion | Consolidation opportunities and rapid market share growth. | Proven integration capabilities (e.g., Safety-Kleen) and ongoing pursuit of strategic M&A. |

| Stricter Environmental Regulations | Global push for pollution reduction and sustainable industrial practices. | Comprehensive service suite for hazardous waste disposal, emergency response, and industrial cleaning. |

Threats

A significant economic downturn, particularly a recession in North America, poses a substantial threat to Clean Harbors. Such a slowdown directly correlates with reduced industrial activity, which is a key driver for the company's environmental and industrial services. For instance, a contraction in manufacturing or energy sectors could mean less waste generation and a deferral of essential maintenance services, impacting Clean Harbors' revenue streams.

In 2023, the industrial services segment of Clean Harbors experienced revenue of $1.4 billion. A sustained economic slowdown could see this figure decline as customers cut back on spending. Historically, during economic contractions, companies tend to reduce waste output and postpone non-critical industrial cleaning and maintenance, directly affecting demand for Clean Harbors' core offerings.

The environmental services sector is quite competitive, featuring a mix of large global companies and many smaller, local businesses all trying to win customers. This crowded landscape means Clean Harbors faces constant pressure on its pricing, which can squeeze profit margins and potentially hinder its ability to grow revenue as quickly as it might like.

For instance, in 2023, the waste management and remediation services industry saw significant competition, with companies like Waste Management and Republic Services also reporting strong performance, indicating a robust market but also heightened rivalry. This intense competition could force Clean Harbors to adjust its pricing strategies, impacting its financial results.

Furthermore, rivals are quick to adopt successful business models, such as the charge-for-oil concept that Clean Harbors has utilized. When competitors replicate profitable strategies, it can dilute the unique advantage those strategies provide, forcing Clean Harbors to innovate continuously to maintain its market position and profitability.

Unforeseen or excessively strict environmental regulations pose a significant threat to Clean Harbors. For instance, a hypothetical new rule mandating a 20% reduction in hazardous waste incineration emissions by 2026 could necessitate substantial capital expenditures for technology upgrades across multiple facilities, potentially impacting profitability.

Shifts in how waste is categorized or the standards for its disposal could disrupt Clean Harbors' current operational footprint and service delivery. If, for example, a specific type of industrial byproduct previously classified as non-hazardous were reclassified, it could require entirely new handling and disposal protocols, adding complexity and cost to their operations.

Public Perception and Environmental Activism

Negative public perception and intensified environmental activism pose a significant threat to waste management companies like Clean Harbors. Opposition to practices such as incineration or landfilling can result in community resistance, more rigorous permitting, and potential legal battles, impacting operational expansion and efficiency. For instance, in 2024, several proposed waste-to-energy projects faced significant local opposition, leading to delays and increased compliance costs.

Heightened public scrutiny, even stemming from incidents involving other industry players, can cast a shadow over the entire sector. This increased attention can lead to stricter regulatory oversight and a greater demand for transparency in waste handling processes. In 2025, the Environmental Protection Agency (EPA) proposed new reporting requirements for hazardous waste facilities, partly in response to public concern over industrial emissions.

- Community Opposition: Local groups may actively campaign against new facilities or existing operations, demanding stricter environmental controls.

- Regulatory Hurdles: Increased activism can translate into more stringent permitting processes and tougher compliance standards for waste disposal methods.

- Reputational Risk: Negative press or high-profile environmental incidents, even if unrelated to Clean Harbors, can damage public trust in the industry.

- Legal Challenges: Activist groups may pursue legal action to block operations or seek damages, leading to costly litigation and operational disruptions.

Fluctuations in Energy and Operating Costs

Clean Harbors' business, heavily reliant on energy for transportation, waste treatment, and facility upkeep, faces a significant threat from volatile energy and operating costs. For instance, spikes in diesel fuel prices, a critical component for their extensive logistics network, can directly inflate operational expenditures. In 2024, crude oil prices have seen considerable fluctuation, impacting fuel costs for many industries, including environmental services.

These cost surges can erode profit margins if not effectively passed on to customers or offset by internal efficiencies. While Clean Harbors actively pursues cost-saving measures, external price shocks, such as those seen in natural gas markets impacting incineration processes, remain a persistent risk to their financial performance and competitive pricing strategies.

- Energy-Intensive Operations: Transportation, waste processing, and facility management are core to Clean Harbors' model and consume substantial energy.

- Impact of Fuel Price Volatility: Increases in diesel and other fuel costs directly raise operating expenses, potentially reducing profitability.

- Raw Material Cost Sensitivity: Fluctuations in the cost of chemicals and other materials used in waste treatment also pose a threat.

- External Price Shocks: Unforeseen surges in energy or commodity prices can significantly impact financial performance despite internal cost-control efforts.

The competitive landscape presents a significant threat, with rivals like Waste Management and Republic Services actively vying for market share. This intense rivalry can lead to pricing pressures, potentially impacting Clean Harbors' profit margins and growth trajectory. For example, in 2023, the waste management industry saw strong performance across major players, highlighting both market opportunity and the need for continuous competitive advantage.

SWOT Analysis Data Sources

This SWOT analysis is built on a robust foundation of data, drawing from Clean Harbor's official financial filings, comprehensive market research reports, and expert industry analyses to ensure a thorough and insightful assessment.