Clean Harbors Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clean Harbors Bundle

Curious about Clean Harbors' market position? Our preview offers a glimpse into their BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Unlock the full strategic advantage by purchasing the complete report for a detailed quadrant breakdown and actionable insights that will shape your investment decisions.

Stars

Clean Harbors' PFAS management services are a standout performer, demonstrating robust expansion with an estimated 20% pipeline growth per quarter. This surge is fueled by the company's comprehensive 'total PFAS solution' and heightened regulatory scrutiny, including new EPA guidelines.

The significant demand in this emerging market, coupled with Clean Harbors' integrated service offering, firmly places PFAS remediation as a Star in their business portfolio.

The Kimball, Nebraska incinerator, which began commercial operations in December 2024, is poised to become a significant contributor to Clean Harbors' margins. Over the next 12 to 18 months, as operations ramp up, this facility is expected to enhance profitability.

Its specialized capability to process more complex waste streams directly addresses escalating market demands. This includes waste generated from reshoring initiatives and the increasing need for PFAS (per- and polyfluoroalkyl substances) remediation, signaling robust future revenue potential and reinforcing Clean Harbors' market leadership.

Clean Harbors' Field Services & Emergency Response segment is a strong performer within its business portfolio. In Q1 2025, this division experienced a robust 32% year-over-year revenue increase, significantly boosted by the strategic acquisition of HEPACO. This growth underscores the segment's vital role in the company's overall strategy.

The company is actively investing in expanding its Field Services capabilities, evidenced by the opening of new service branches. This expansion is a direct response to sustained high demand for emergency response services, reinforcing Clean Harbors' leadership in this critical market. The consistent volume of emergency response events highlights the ongoing need for these specialized services.

Technical Services (Incineration)

Technical Services, encompassing incineration, demonstrated robust performance in early 2025. Revenue saw a healthy 5% increase in Q1 2025. This growth was supported by a significant uptick in incineration utilization, reaching 88% excluding the new Kimball facility, a notable jump from 79% in the same period last year.

The company's ability to command higher prices further underscored the strength of this segment. Incineration prices climbed by over 5% in Q1 2025. This price appreciation reflects strong market demand and Clean Harbors' pricing power, especially given the constrained availability of incineration capacity.

- Revenue Growth: Technical Services revenue increased by 5% in Q1 2025.

- Utilization Rate: Incineration utilization (excluding Kimball) rose to 88% in Q1 2025, up from 79% year-over-year.

- Pricing Power: Incineration prices increased by more than 5% in Q1 2025.

- Market Conditions: Tight incineration capacity is driving strong demand and favorable pricing.

Environmental Services Segment Overall Growth

The Environmental Services (ES) segment of Clean Harbors is a powerhouse, showing remarkable and steady growth. It's been on an upward trajectory for a significant period, with Q2 2025 marking the 13th consecutive quarter of year-over-year margin expansion. This sustained performance highlights the segment's resilience and its crucial role in the company's financial health.

This segment, encompassing critical services like hazardous waste management and disposal, is a primary engine for Clean Harbors' revenue and overall profitability. The consistent demand for these essential services, coupled with robust waste collection volumes and advantageous pricing strategies, underpins this impressive growth.

- Consistent Profitability: The ES segment has achieved 13 consecutive quarters of year-over-year margin expansion as of Q2 2025.

- Key Revenue Driver: Hazardous waste management and disposal services are central to the company's top-line performance.

- Demand Factors: Growth is supported by steady demand, strong waste collection volumes, and favorable pricing dynamics.

Clean Harbors' PFAS management services are a clear Star, experiencing rapid growth driven by new regulations and a comprehensive service offering. Similarly, the Field Services & Emergency Response segment shines, with Q1 2025 revenue up 32% year-over-year, bolstered by the HEPACO acquisition and ongoing service expansion. The Technical Services segment, particularly incineration, also performs strongly, with Q1 2025 revenue up 5% and utilization hitting 88% (excluding Kimball), supported by a 5% price increase due to tight capacity.

| Business Segment | BCG Category | Key Performance Indicators (as of Q1/Q2 2025) |

|---|---|---|

| PFAS Management | Star | ~20% pipeline growth per quarter; High demand driven by EPA guidelines. |

| Field Services & Emergency Response | Star | 32% YoY revenue growth (Q1 2025); Expansion through HEPACO acquisition and new branches. |

| Technical Services (Incineration) | Star | 5% YoY revenue growth (Q1 2025); 88% utilization (excl. Kimball); >5% price increase. |

| Environmental Services (ES) | Star | 13 consecutive quarters of YoY margin expansion (as of Q2 2025); Strong waste volumes and pricing. |

What is included in the product

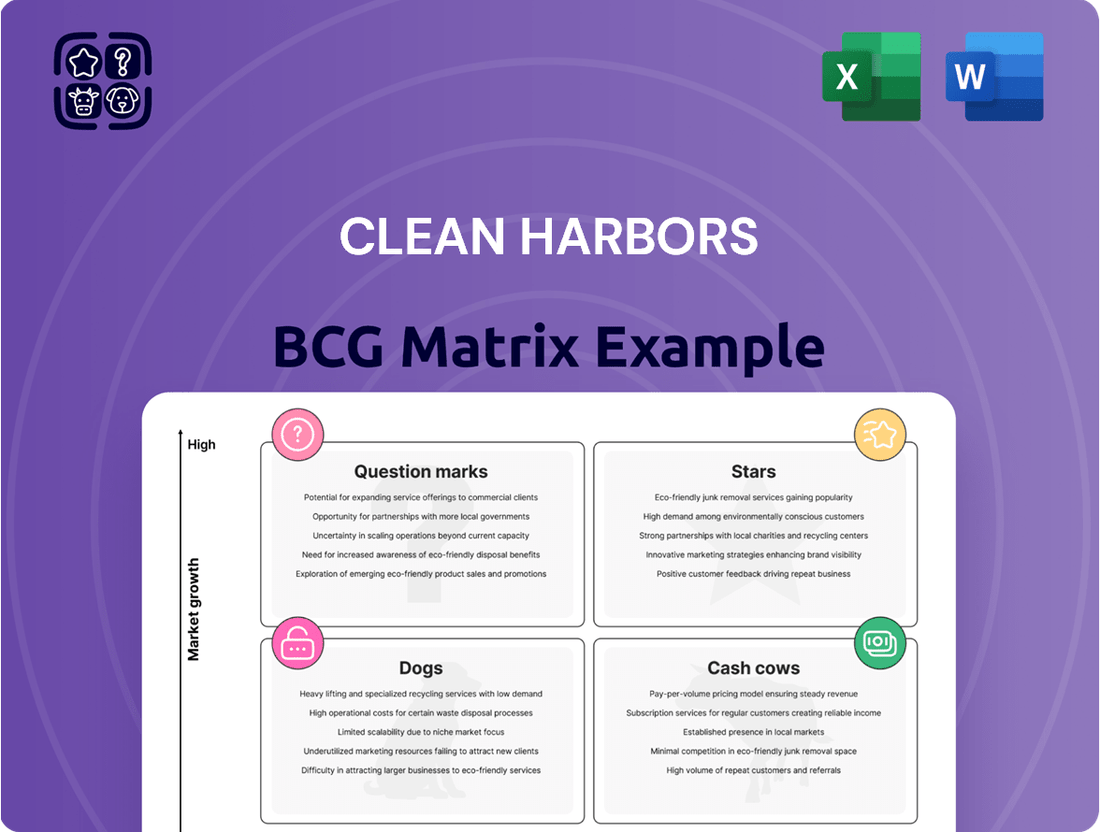

The Clean Harbors BCG Matrix categorizes its services into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

It highlights which services offer strong growth and market leadership, which generate consistent cash, which require investment to grow, and which should be divested.

A clear BCG Matrix visualizes Clean Harbors' portfolio, easing strategic decision-making and resource allocation.

Cash Cows

Clean Harbors' hazardous waste management and disposal network functions as a classic Cash Cow. Its vast infrastructure, comprising the largest network of landfills, incinerators, and treatment centers in North America, solidifies its dominant, high-market-share position in a mature yet indispensable industry.

This established dominance translates into a reliable and substantial generation of cash flow. The company benefits from a stable demand for its services, even with modest market growth, allowing for consistent returns on investment with minimal need for aggressive expansion capital.

For instance, in 2024, Clean Harbors reported robust performance in its Safety-Kleen and Environmental Services segments, which heavily rely on this disposal network, contributing significantly to its overall profitability and cash generation capabilities.

Safety-Kleen Sustainability Solutions (SKSS) is a powerhouse within Clean Harbors, functioning as a prime Cash Cow. As North America's leading re-refiner and recycler of used oil, SKSS transforms waste into valuable base oils and lubricants, consistently delivering robust revenue streams. This segment's market dominance and highly efficient re-refining operations ensure its status as a significant cash generator, even amidst certain market fluctuations.

Clean Harbors' industrial cleaning and maintenance services are a prime example of a Cash Cow within its BCG Matrix. These offerings generate consistent, reliable revenue by catering to the ongoing needs of a wide array of industrial clients. The company's established expertise and deep-rooted customer loyalty in this mature market segment ensure a steady cash flow.

Environmental Consulting Services

Clean Harbors' environmental consulting services function as a Cash Cow within its BCG Matrix. This segment offers specialized expertise to clients navigating complex regulatory landscapes and managing waste streams effectively.

While the growth rate for these services is modest, reflecting a mature market, they generate consistent and reliable revenue for Clean Harbors. This stability is driven by the company's established reputation, extensive client base, and deep knowledge within the environmental sector.

- Revenue Generation: Steady income stream from regulatory compliance and waste management advice.

- Market Position: Leverages deep expertise and strong client relationships in a mature industry.

- Profitability: Contributes significantly to overall company profits due to lower investment needs and established operations.

- Strategic Role: Provides stable cash flow that can be reinvested in other business units or used for strategic initiatives.

Established Client Base and Contracts

Clean Harbors' established client base, which includes a majority of Fortune 500 companies and numerous government agencies, solidifies its position in the Cash Cows quadrant. This extensive network translates into consistent demand for its environmental, energy, and industrial services.

The company's reliance on long-term contracts and a high rate of repeat business from these major clients ensures a stable and predictable revenue stream. This is particularly advantageous in the mature waste management industry, where operational efficiency and established relationships are key differentiators.

- Fortune 500 Penetration: Clean Harbors serves a significant portion of Fortune 500 companies, indicating strong market trust and recurring revenue.

- Government Contracts: Secure government contracts provide a baseline of consistent business, contributing to financial stability.

- Repeat Business: A high percentage of repeat business from its established clientele underscores customer loyalty and the essential nature of its services.

- Predictable Cash Flow: These factors combine to generate a strong and predictable cash flow, characteristic of a Cash Cow.

Clean Harbors' Safety-Kleen segment, a leader in used oil re-refining and recycling, exemplifies a Cash Cow. Its dominant market share and efficient operations generate consistent, substantial cash flow, even with modest industry growth.

The company's industrial cleaning and maintenance services also operate as Cash Cows. These services leverage established expertise and client loyalty in a mature market, ensuring a steady revenue stream with minimal capital reinvestment.

Environmental consulting services, while in a mature market with modest growth, function as Cash Cows due to their consistent revenue generation, driven by deep industry knowledge and a strong client base.

Clean Harbors' extensive network of hazardous waste management facilities, including landfills and treatment centers, is a core Cash Cow. This infrastructure supports its high market share in a stable, essential industry, leading to predictable cash generation.

| Segment | BCG Category | Key Characteristics | 2024 Financial Highlight (Illustrative) |

| Safety-Kleen | Cash Cow | Leading re-refiner, stable demand, efficient operations | Contributed significantly to overall profitability. |

| Industrial Cleaning & Maintenance | Cash Cow | Mature market, established expertise, high customer retention | Generated reliable, consistent revenue streams. |

| Environmental Consulting | Cash Cow | Mature market, deep regulatory knowledge, strong client relationships | Provided steady cash flow with low investment needs. |

| Hazardous Waste Network | Cash Cow | Largest North American infrastructure, essential services, stable demand | Underpinned consistent cash generation from core operations. |

Full Transparency, Always

Clean Harbors BCG Matrix

The Clean Harbors BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no altered content, and no surprises – just the comprehensive strategic analysis ready for your immediate use. You can confidently assess this document knowing it represents the exact, professional-grade BCG Matrix you'll download and integrate into your business planning.

Dogs

Clean Harbors' Industrial Services segment, characterized as a potential 'Dog' in the BCG Matrix, faced headwinds in 2024. Revenue for this division saw a notable 10% decrease year-over-year in the first quarter of 2025. This downturn was primarily attributed to the prevailing low crude oil prices and a noticeable deferral of essential maintenance projects within the refinery industry, directly impacting service demand.

Despite the company's outlook for eventual growth, the Industrial Services business has been a focus for cost-reduction initiatives. The segment's performance in 2024 and early 2025 underscores its position as a lower-growth, lower-market-share area within Clean Harbors' broader portfolio, necessitating careful management and strategic evaluation.

The Safety-Kleen Sustainability Solutions (SKSS) segment, specifically its waste oil collection operations, has been impacted by a downturn in the U.S. base oil and lubricants market. This has led to increased collection costs and pricing pressures, making it a segment that requires careful management.

Clean Harbors has implemented strategies like transitioning to a charge-for-oil model to mitigate these rising costs. This move highlights the segment's sensitivity to market fluctuations and the ongoing efforts to ensure its profitability amidst these challenges.

Niche services with low market share and slow growth, often characterized by highly specialized offerings or a limited geographic focus, represent a potential area for re-evaluation within Clean Harbors' portfolio. These segments, while potentially catering to specific customer needs, typically contribute minimally to the company's overall revenue and profitability. For instance, if Clean Harbors offers a highly technical waste treatment for a very specific industrial byproduct with limited demand, and faces numerous smaller, regional competitors, this would fit the description.

Non-Strategic or Divested Assets

Non-strategic or divested assets in Clean Harbors' portfolio are those businesses or segments that no longer align with the company's core strategy or are underperforming. These might include operations with low profitability, minimal competitive advantage, or those that have been identified for divestiture to streamline operations and focus on core growth areas. For instance, Clean Harbors periodically assesses its service offerings and geographical presence to identify such assets.

The company's strategic reviews often lead to the divestiture of non-core assets. This allows Clean Harbors to reallocate capital and management attention to higher-growth, more profitable segments. For example, in 2023, Clean Harbors continued to evaluate its asset base, aiming to enhance overall portfolio performance and shareholder value through targeted divestments if deemed necessary.

- Portfolio Optimization: Clean Harbors actively manages its business units to ensure they contribute effectively to the company's strategic goals.

- Divestiture Rationale: Assets are considered for divestiture if they exhibit low profitability, a weak market position, or a lack of strategic alignment.

- Focus on Core Competencies: Divesting non-strategic assets allows the company to concentrate resources on its core environmental and industrial services.

- Financial Impact: Such actions are typically undertaken to improve financial performance, reduce operational complexity, and enhance overall return on investment.

Services Highly Susceptible to Economic Downturns

Certain discretionary environmental services, particularly those tied to new construction or expansion projects, could exhibit 'Dog' characteristics during an economic downturn. Clients facing reduced capital budgets might postpone or cancel these types of services, impacting revenue streams.

For instance, if Clean Harbors offers specialized industrial cleaning or decontamination services that are not immediately critical for regulatory compliance or ongoing operations, these could be deferred. This is especially true if the services are project-based rather than recurring. In 2024, many industrial sectors experienced cautious spending, leading to a slowdown in non-essential capital expenditures.

- Project-Based Deferral: Services like large-scale site remediation or specialized waste disposal for non-critical industrial processes are susceptible to client budget cuts.

- Discretionary Spending Impact: Non-essential upgrades or preventative maintenance contracts that don't directly impact immediate production or compliance could be postponed.

- Economic Sensitivity: Sectors heavily reliant on capital investment, such as manufacturing and construction, often scale back on auxiliary services during economic slowdowns.

The Industrial Services segment, identified as a potential 'Dog', experienced a 10% revenue decline in Q1 2025 due to low oil prices and deferred refinery maintenance, impacting demand. Clean Harbors is implementing cost-reduction measures in this lower-growth, lower-market-share division, reflecting a need for careful strategic management.

Similarly, Safety-Kleen's waste oil operations face challenges from a weak lubricants market, leading to higher collection costs and pricing pressures. The company's shift to a charge-for-oil model highlights the segment's vulnerability to market shifts and ongoing efforts to maintain profitability.

Niche services with limited demand and specialized offerings, alongside non-strategic assets identified for divestiture, also fit the 'Dog' profile. These segments, like discretionary environmental services tied to capital projects, often see reduced demand during economic downturns, as observed with cautious spending in industrial sectors throughout 2024.

Question Marks

Clean Harbors is actively investigating cutting-edge waste treatment technologies like artificial intelligence (AI) and robotic process automation (RPA). These innovations aim to significantly boost operational efficiency and improve environmental outcomes across their facilities.

While these emerging technologies represent high-growth potential areas, their current market share within the waste treatment sector is minimal. Clean Harbors’ strategic investments in these nascent fields necessitate substantial upfront capital expenditure, with the expectation of considerable returns only materializing over a longer horizon.

Clean Harbors is strategically expanding into new geographic markets, viewing these as potential Stars in its BCG matrix. A prime example is its investment in a new hub location in Phoenix, Arizona, a move directly fueled by the burgeoning semiconductor industry in that region. This expansion represents a commitment to high-growth areas where the company is establishing its foothold.

While these new regional expansions are characterized by significant growth potential, Clean Harbors currently holds a limited market share in these specific nascent markets. For instance, the Phoenix expansion aims to capitalize on the projected substantial growth in semiconductor manufacturing, a sector expected to see significant investment and activity in the coming years. This positions these new ventures as high-potential, albeit early-stage, growth opportunities.

The ever-changing landscape of environmental rules consistently births new service demands. Clean Harbors is strategically positioned to capitalize on these shifts, particularly in areas where regulations are still solidifying, allowing them to establish early market leadership.

For instance, the increasing scrutiny on emerging contaminants, beyond the well-established per- and polyfluoroalkyl substances (PFAS), presents a significant growth avenue. Services focused on the identification, remediation, and disposal of novel pollutants, driven by evolving scientific understanding and legislative action, represent a key area for expansion.

In 2024, the global environmental services market reached an estimated $1.5 trillion, with a notable portion attributed to compliance-driven solutions. Clean Harbors' proactive development of services addressing anticipated regulatory needs, such as advanced waste stream characterization and specialized treatment technologies for newly regulated substances, positions them to capture a growing share of this market.

Pilot Programs for Circular Economy Initiatives

Clean Harbors is actively exploring pilot programs to bolster its involvement in the circular economy, focusing on novel recycling and resource recovery projects. These ventures represent high-growth opportunities, though they currently hold a small market share and necessitate substantial investment and widespread market acceptance to achieve success.

- Innovation Focus: Pilot programs might include advanced material recovery from waste streams or novel chemical recycling processes, aiming to capture value from materials previously destined for disposal.

- Investment Needs: Significant capital expenditure is anticipated for these pilots, covering research and development, specialized equipment, and infrastructure upgrades. For instance, advanced recycling technologies often require millions in upfront investment.

- Market Adoption Challenges: Success hinges on building customer demand for recycled materials and demonstrating the economic viability and environmental benefits of these circular solutions to gain market traction.

- BCG Matrix Placement: These initiatives would typically be categorized as 'Stars' or 'Question Marks' within the BCG framework, reflecting their high growth potential but uncertain market position and significant resource requirements.

Strategic Partnerships for New Product Development

Clean Harbors' strategic partnerships, such as the one with Castrol for its MoreCircular offering, represent a focus on developing new, sustainable products. These collaborations are designed to tap into emerging markets and build a foundation for future growth, aligning with the company's broader environmental, social, and governance (ESG) objectives.

These new product development initiatives, including efforts in Group III production, are currently in their nascent stages. While they hold significant promise, their market share remains unproven, necessitating substantial investment to achieve scalability and widespread adoption. This positions them as potential question marks within a BCG matrix framework.

- Partnership with Castrol: Focuses on circular economy solutions, aiming to develop new product streams from waste materials.

- Group III Production Initiatives: Represents investment in advanced refining capabilities to produce higher-value lubricant base oils.

- Market Uncertainty: Both ventures face the challenge of establishing market traction and proving their commercial viability.

- Investment Requirements: Significant capital outlay is anticipated to support research, development, and scaling of these new offerings.

Clean Harbors' exploration into novel waste treatment technologies, like AI and RPA, and its strategic geographic expansion, particularly in Phoenix, Arizona, represent significant growth potential. However, these ventures currently have minimal market share and require substantial upfront investment, positioning them as Question Marks in the BCG matrix.

The company's focus on emerging contaminants and pilot programs in the circular economy also falls into this category. These areas offer high growth prospects but face challenges in market adoption and require considerable capital to prove their commercial viability.

New product development, such as the partnership with Castrol for its MoreCircular offering and Group III production initiatives, are also nascent. Their success is contingent on market acceptance and scalability, making them prime examples of Question Marks needing careful strategic evaluation and investment.

| BCG Category | Clean Harbors Initiatives | Market Growth | Market Share | Investment Needs |

|---|---|---|---|---|

| Question Marks | AI & RPA in Waste Treatment | High | Low | High |

| Question Marks | Phoenix Expansion (Semiconductor Focus) | High | Low | High |

| Question Marks | Emerging Contaminant Services | High | Low | Moderate to High |

| Question Marks | Circular Economy Pilots | High | Low | High |

| Question Marks | Castrol Partnership (MoreCircular) | High | Low | High |

| Question Marks | Group III Production | High | Low | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.