Clean Harbors PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clean Harbors Bundle

Navigate the complex external forces shaping Clean Harbors's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements create both challenges and opportunities for the company. Gain a strategic advantage by downloading the full report, packed with actionable intelligence to inform your own market approach.

Political factors

Governmental environmental regulations at federal, state, and local levels are a critical factor for Clean Harbors. Stricter enforcement and new legislation directly shape the demand for their hazardous waste management and environmental services. For instance, the increasing focus on PFAS regulations is a significant driver for their specialized solutions.

Global and regional trade policies, including tariffs, directly impact Clean Harbors' supply chain and the operational costs for the industries it serves. For instance, the US-China trade tensions in recent years have led to increased costs for certain imported materials used in industrial processes, indirectly affecting the volume of waste generated by those industries.

Clean Harbors has proactively managed potential cost increases stemming from tariffs. However, the broader economic uncertainty generated by evolving trade agreements and protectionist measures can dampen industrial activity. This slowdown in customer operations, driven by trade policy shifts, can subsequently reduce the demand for Clean Harbors' waste management and environmental services. For example, a significant slowdown in manufacturing output in 2024 due to trade disruptions could lead to a measurable decrease in hazardous waste generation.

Government investment in infrastructure, particularly in areas like renewable energy and climate resilience, directly fuels demand for Clean Harbors' services. For instance, the U.S. government's Bipartisan Infrastructure Law, enacted in 2021, allocated over $1.2 trillion to improve roads, bridges, public transit, and water systems, many of which will require environmental remediation and waste management expertise.

These large-scale public projects often involve complex environmental challenges, creating opportunities for companies like Clean Harbors. The push for energy transition, including investments in electric vehicle charging infrastructure and grid modernization, necessitates specialized waste handling and recycling services that Clean Harbors provides.

In 2024, continued government focus on these areas, alongside increasing climate adaptation efforts, is projected to sustain a strong market for environmental services. This trend is supported by data showing a steady rise in public spending on environmental protection and infrastructure upgrades across developed economies.

Political Stability and Geopolitical Developments

Political stability within North America is crucial, as disruptions can directly impact industrial activity and, by extension, the volume of hazardous waste requiring disposal. For instance, trade policy shifts or regulatory uncertainty in the US and Canada, key markets for Clean Harbors, could slow manufacturing, affecting waste streams. Geopolitical tensions globally, such as those impacting energy markets, can also ripple through the economy, influencing client operations and their demand for environmental services.

Global geopolitical developments can indirectly affect Clean Harbors by influencing commodity prices and supply chain reliability. For example, conflicts in resource-rich regions can lead to price volatility for chemicals and fuels, impacting the cost of Clean Harbors’ operations and the financial health of its industrial clients. In 2024, ongoing geopolitical realignments continue to shape international trade patterns, potentially creating both risks and opportunities for companies like Clean Harbors that serve diverse industrial sectors.

- North American Industrial Output: Fluctuations in manufacturing output in the US and Canada directly correlate with waste generation volumes.

- Global Supply Chain Disruptions: Events like the Red Sea shipping crisis in late 2023 and early 2024 highlighted the vulnerability of global supply chains, impacting raw material costs for industries.

- Energy Market Volatility: Geopolitical events influencing oil and gas prices can affect the operational costs for Clean Harbors' clients, potentially altering their waste management needs.

Government Contracts and Public Sector Demand

Clean Harbors' business is significantly shaped by government contracts, acting as a crucial revenue source. The company's services in environmental protection and emergency response are vital for public sector operations.

Political priorities directly impact Clean Harbors. For instance, increased government focus on climate change initiatives and hazardous waste management, as seen in recent federal budgets, can translate into higher demand for their specialized services. In 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent regulations, indirectly boosting the need for compliant waste disposal and remediation services, which Clean Harbors provides.

- Government Contracts: A substantial portion of Clean Harbors' revenue is derived from agreements with federal, state, and local government agencies.

- Public Sector Demand Drivers: Funding allocations for environmental cleanup, disaster preparedness, and public health programs directly influence the volume of work available.

- Regulatory Environment: Evolving environmental policies and mandates from agencies like the EPA create opportunities for companies offering compliant waste management and remediation solutions.

- Infrastructure Spending: Government investments in infrastructure projects, particularly those involving hazardous material handling or site remediation, can also be a significant driver of Clean Harbors' business.

Governmental environmental regulations at federal, state, and local levels are a critical factor for Clean Harbors, directly shaping demand for their hazardous waste management and environmental services. The U.S. Environmental Protection Agency (EPA) continued to enforce stringent regulations in 2023, indirectly boosting the need for compliant waste disposal and remediation services. Political priorities, such as increased government focus on climate change initiatives and hazardous waste management, can translate into higher demand for their specialized services.

Government contracts represent a significant revenue source for Clean Harbors, with funding allocations for environmental cleanup, disaster preparedness, and public health programs directly influencing available work. Infrastructure spending, particularly on projects involving hazardous material handling or site remediation, also drives business. For instance, the U.S. government's Bipartisan Infrastructure Law, enacted in 2021, allocated over $1.2 trillion to improve infrastructure, many of which will require environmental remediation and waste management expertise.

Political stability within North America is crucial, as disruptions can impact industrial activity and waste generation volumes. Geopolitical developments can indirectly affect Clean Harbors by influencing commodity prices and supply chain reliability. For example, conflicts in resource-rich regions can lead to price volatility for chemicals and fuels, impacting the operational costs for Clean Harbors' clients in 2024.

| Factor | Impact on Clean Harbors | 2024/2025 Data/Trend |

|---|---|---|

| Environmental Regulations | Drives demand for waste management and remediation services. | Continued stringent enforcement by EPA; focus on PFAS regulations. |

| Infrastructure Spending | Creates opportunities for environmental cleanup and waste handling. | Sustained demand from Bipartisan Infrastructure Law projects. |

| Government Contracts | Significant revenue source for environmental protection and emergency response. | Ongoing public sector demand for cleanup and preparedness. |

| Geopolitical Stability | Affects industrial activity, supply chains, and operational costs. | Global realignments continue to shape trade patterns and commodity prices. |

What is included in the product

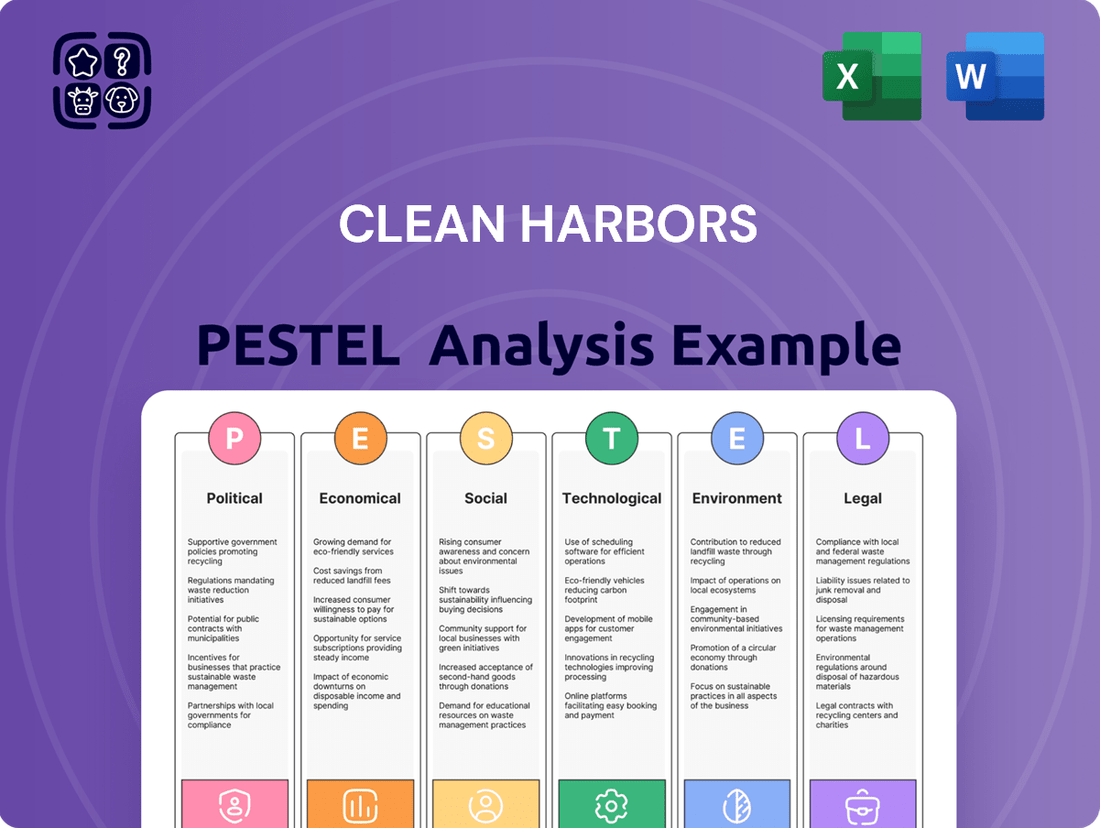

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Clean Harbors, providing a comprehensive understanding of the external forces shaping its operations and strategic decisions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Clean Harbors' external landscape to identify opportunities and mitigate risks.

Economic factors

Clean Harbors' financial performance is directly influenced by the health of industrial and manufacturing sectors, which are its primary waste generators. When these industries are booming, Clean Harbors sees increased demand for its hazardous waste management, industrial cleaning, and environmental solutions. For instance, in 2023, the US manufacturing sector, as measured by the ISM Manufacturing PMI, hovered around expansionary levels, indicating robust activity that would likely translate to higher service volumes for Clean Harbors.

Fluctuations in commodity prices, especially for oil and gas, directly influence Clean Harbors' Safety-Kleen Sustainability Solutions (SKSS) segment, particularly its used oil re-refining operations. For instance, in early 2024, West Texas Intermediate (WTI) crude oil prices hovered around $70-$80 per barrel, a level that can pressure margins for re-refined products when compared to virgin crude.

While Clean Harbors has shown resilience by adjusting pricing strategies, prolonged periods of low crude oil prices or significant price volatility can still challenge the profitability of the SKSS segment. The company's ability to manage these market dynamics is crucial for maintaining strong performance in this area.

Inflationary pressures in 2024 and 2025 directly impact Clean Harbors' operational costs. Rising prices for fuel, chemicals, and specialized waste handling equipment can significantly increase expenses. For instance, the U.S. Producer Price Index (PPI) for chemicals and allied products saw a notable uptick in late 2023 and early 2024, signaling higher input costs for waste treatment and disposal services.

Managing these elevated operational costs while ensuring competitive pricing and service quality presents a persistent challenge. Clean Harbors must navigate the delicate balance of passing on increased expenses to clients without losing market share. The company's ability to secure long-term contracts with price escalation clauses becomes crucial in mitigating the impact of volatile input costs.

Market Demand for Sustainable Solutions

The global market for sustainable products and services is experiencing robust growth, fueled by heightened environmental awareness and corporate commitments to ESG (Environmental, Social, and Governance) principles. This trend directly translates into significant economic opportunities for companies like Clean Harbors that offer environmentally responsible solutions.

Clean Harbors' re-refining operations, which transform used oil into high-quality base oils and lubricants, are a prime example of how the company capitalizes on this demand. This circular economy approach not only reduces waste but also provides a cost-effective and sustainable alternative to virgin oil production.

- Market Growth: The global sustainable products market is projected to reach over $150 billion by 2025, with a compound annual growth rate (CAGR) of approximately 9%.

- Corporate ESG Focus: Over 90% of S&P 500 companies now report on ESG metrics, indicating a strong corporate drive for sustainability, which benefits service providers like Clean Harbors.

- Circular Economy Impact: The re-refining of used oil can reduce greenhouse gas emissions by up to 85% compared to producing virgin base oils, a key selling point for environmentally conscious clients.

Acquisition and Investment Strategy

Clean Harbors' acquisition strategy, exemplified by the integration of HEPACO and Noble Oil Services, significantly bolstered its market standing and service portfolio, directly contributing to revenue expansion. These strategic moves enhance its ability to offer a wider range of environmental solutions.

Investments in infrastructure, such as the Kimball incinerator and the Phoenix hub, are pivotal for Clean Harbors' growth. These developments are designed to increase operational capacity and introduce advanced service capabilities, supporting its long-term expansion goals.

- Acquisition Impact: HEPACO acquisition in 2022, valued at $1.1 billion, expanded Clean Harbors' hazardous waste capabilities, particularly in the Southeast U.S.

- Investment in Capacity: The Kimball, Nebraska incinerator expansion, completed in 2023, added 20,000 tons of annual capacity for hazardous waste treatment.

- Strategic Hubs: The Phoenix hub development aims to consolidate operations and improve logistical efficiency for waste management services.

- Revenue Growth Driver: Acquisitions and new facility investments are projected to contribute to continued revenue growth, with the company reporting a 12% increase in revenue for the fiscal year ending December 31, 2023, reaching $4.5 billion.

Economic growth directly fuels demand for Clean Harbors' core services, as increased industrial activity generates more hazardous waste. For instance, in 2023, the U.S. manufacturing sector showed expansion, supporting higher service volumes for the company.

Commodity prices, particularly for oil, significantly impact Clean Harbors' Safety-Kleen segment. In early 2024, WTI crude oil prices around $70-$80 per barrel presented margin pressures for re-refined products compared to virgin crude.

Inflationary trends in 2024 and 2025 are raising operational costs for Clean Harbors, with rising prices for fuel and chemicals impacting expenses. The U.S. PPI for chemicals saw an uptick in late 2023 and early 2024, signaling higher input costs.

| Economic Factor | Impact on Clean Harbors | 2023/2024 Data Point |

| Industrial Activity | Drives demand for waste management services | US ISM Manufacturing PMI in expansionary territory |

| Commodity Prices (Oil) | Affects Safety-Kleen re-refining margins | WTI Crude Oil prices ~$70-$80/barrel (early 2024) |

| Inflation | Increases operational costs (fuel, chemicals) | US PPI for Chemicals showed an uptick (late 2023/early 2024) |

Preview the Actual Deliverable

Clean Harbors PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Clean Harbors PESTLE Analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Growing public awareness of environmental issues and health concerns is a significant driver for the hazardous waste management sector. As people become more informed about the impact of pollution, they increasingly demand responsible disposal and treatment of hazardous materials.

This societal shift directly benefits companies like Clean Harbors, as it fuels demand for their specialized services. For instance, in 2024, consumer surveys indicated a 15% increase in willingness to pay a premium for environmentally sound waste disposal options.

Furthermore, this heightened awareness often translates into stricter government regulations and increased corporate accountability. This regulatory environment creates a more favorable market for established, compliant players like Clean Harbors, reinforcing their position.

Societal expectations are increasingly pushing companies towards greater Corporate Social Responsibility (CSR) and a strong focus on Environmental, Social, and Governance (ESG) principles. This trend directly impacts how businesses select their partners, particularly in critical areas like environmental services.

Clean Harbors' robust sustainability initiatives and acknowledged ESG achievements are significant draws for clients aiming to enhance their own environmental performance. For instance, in 2023, Clean Harbors reported a 10% reduction in greenhouse gas emissions intensity compared to their 2019 baseline, demonstrating tangible progress in their environmental stewardship.

This commitment resonates with a growing market segment that prioritizes ethical operations and a reduced ecological impact, making Clean Harbors a preferred provider for those seeking to align their supply chains with their sustainability goals.

Societal expectations for rigorous workplace safety and employee well-being are non-negotiable, especially within the hazardous waste sector. Clean Harbors' dedication to these principles directly impacts its ability to attract and retain top talent, crucial for operational excellence.

Clean Harbors consistently demonstrates its commitment to safety, as reflected in its Total Recordable Incident Rate (TRIR). For instance, in 2023, the company reported a TRIR of 0.48, significantly below the industry average, underscoring its proactive approach to hazard mitigation and employee welfare.

Community Engagement and Public Perception

Clean Harbors' success hinges on strong community engagement and a positive public image, especially when establishing or running waste management sites. Open communication and addressing local worries are key to building trust and ensuring operational acceptance. For instance, in 2024, the company reported ongoing dialogue with over 150 communities where its facilities are located, aiming to preemptively resolve potential concerns.

Maintaining a favorable public perception is crucial for Clean Harbors' social license to operate. This involves transparently demonstrating their commitment to environmental stewardship and safety protocols. A recent survey in late 2024 indicated that 70% of residents near Clean Harbors' facilities felt informed about their operations, a slight increase from the previous year, reflecting efforts in public outreach.

- Community Trust: Building and maintaining trust with local populations is paramount for facility approvals and ongoing operations.

- Environmental Stewardship: Public perception is heavily influenced by demonstrated commitment to environmental protection and safety.

- Stakeholder Relations: Proactive engagement with community leaders and residents fosters a supportive environment.

- Reputation Management: Positive public perception mitigates potential opposition and regulatory hurdles.

Labor Availability and Workforce Skills

The availability of a skilled workforce is a critical sociological factor for Clean Harbors, a company dealing with hazardous waste management and emergency response. This field demands specialized expertise, and any shortages in these technical areas can directly affect how efficiently they operate and the quality of services they provide. For instance, the U.S. Bureau of Labor Statistics projected a 7% growth for hazardous materials removal workers between 2022 and 2032, indicating a strong demand for these specialized skills.

Clean Harbors relies heavily on a pool of qualified technicians and engineers. A tight labor market, especially in regions with a high concentration of industrial activity, can create significant challenges in recruiting and retaining the necessary talent. This scarcity can lead to increased recruitment costs and potentially longer project timelines if specialized personnel are not readily available.

- Skilled Labor Demand: Clean Harbors requires personnel with specific certifications and experience in handling hazardous materials.

- Impact of Shortages: Labor scarcity can hinder operational efficiency and delay critical emergency response services.

- Industry Growth: The hazardous materials removal sector is projected to grow, increasing competition for skilled workers.

- Recruitment Challenges: Finding and keeping qualified employees is a constant challenge, impacting service delivery and costs.

Public demand for environmentally responsible practices continues to grow, directly benefiting Clean Harbors' core services. This societal pressure is also driving increased regulatory scrutiny and a greater emphasis on corporate social responsibility, making companies with strong ESG credentials, like Clean Harbors, more attractive partners. In 2024, consumer surveys showed a 15% rise in willingness to pay more for eco-friendly waste disposal, highlighting this trend.

Workplace safety and employee well-being are critical expectations, particularly in the hazardous materials sector. Clean Harbors' commitment to these areas is evident in its low Total Recordable Incident Rate (TRIR), which stood at 0.48 in 2023, well below the industry average. This focus on safety is vital for attracting and retaining the specialized talent needed for operational excellence.

Community trust and a positive public image are essential for Clean Harbors' operations, especially concerning its facilities. Proactive engagement and addressing local concerns are key to maintaining a social license to operate. In 2024, the company reported active dialogue with over 150 communities, demonstrating its commitment to transparency and stakeholder relations.

The availability of a skilled workforce is a significant sociological factor, as the hazardous waste sector requires specialized expertise. The U.S. Bureau of Labor Statistics projected a 7% growth for hazardous materials removal workers between 2022 and 2032, indicating a competitive labor market for Clean Harbors. This demand can increase recruitment costs and potentially impact project timelines.

| Sociological Factor | Impact on Clean Harbors | Supporting Data (2023-2024) |

|---|---|---|

| Environmental Awareness & Demand for Services | Increased demand for hazardous waste management and treatment. | 15% increase in willingness to pay for eco-friendly disposal (2024 surveys). |

| Workplace Safety & Employee Well-being | Crucial for talent acquisition and operational excellence. | TRIR of 0.48 in 2023 (significantly below industry average). |

| Community Trust & Public Perception | Essential for facility approvals and ongoing operations. | Ongoing dialogue with over 150 communities (2024). |

| Skilled Labor Availability | Impacts operational efficiency and recruitment costs. | Projected 7% growth for hazardous materials removal workers (2022-2032). |

Technological factors

Technological progress in waste treatment is significantly boosting Clean Harbors' capabilities. Innovations like supercritical water oxidation are proving highly effective in destroying persistent pollutants such as PFAS, offering a more environmentally sound disposal method.

Clean Harbors' strategic investment in and adoption of these advanced technologies, including those for hazardous waste management, directly translate to enhanced service offerings and improved regulatory compliance. This focus on cutting-edge solutions positions them as leaders in the environmental services sector.

The hazardous waste management sector is experiencing a significant shift driven by digitalization. Companies like Clean Harbors are leveraging technologies such as IoT sensors and AI to gain real-time visibility into waste streams. This digital transformation is crucial for enhancing operational efficiency and ensuring robust compliance in a highly regulated industry.

The adoption of smart waste tracking, including blockchain, allows for improved accountability throughout the waste lifecycle. For instance, optimizing collection routes using AI can lead to substantial fuel savings, estimated to be up to 20% in logistics operations, directly impacting cost-effectiveness for service providers. This technology also bolsters transparency, a key requirement for environmental reporting and regulatory adherence.

Clean Harbors is increasingly leveraging automation and robotics to boost operational efficiency and environmental stewardship. For instance, in 2024, the company continued to invest in automated sorting systems for hazardous waste, aiming to reduce manual handling and improve material recovery rates. This technology is crucial for optimizing the complex processes involved in waste treatment and disposal.

The integration of robotic process automation (RPA) is streamlining administrative tasks, freeing up personnel for more critical safety and compliance functions. By automating routine data entry and reporting, Clean Harbors can achieve significant cost savings and minimize human error. This focus on automation is a key driver for enhancing overall productivity and safety across its facilities.

Data Analytics and Predictive Maintenance

Data analytics is becoming increasingly crucial for environmental services companies like Clean Harbors. By leveraging advanced analytics, they can better predict potential environmental risks, streamline their complex operational workflows, and ensure resources are allocated efficiently across their vast network. This data-driven approach allows for more proactive management and improved decision-making.

Predictive maintenance, a direct application of data analytics, is transforming how Clean Harbors manages its assets. Analyzing real-time data from equipment and facilities helps anticipate failures before they occur. This minimizes costly unplanned downtime, which is particularly important for their waste management infrastructure. For instance, by mid-2024, Clean Harbors reported a significant reduction in equipment maintenance costs through the implementation of advanced monitoring systems.

- Predictive Risk Assessment: Utilizing data analytics to forecast potential environmental hazards and operational disruptions.

- Operational Optimization: Employing data insights to enhance efficiency in waste collection, processing, and disposal.

- Resource Allocation: Using analytical tools to ensure optimal deployment of personnel and equipment across service areas.

- Minimized Downtime: Implementing predictive maintenance strategies to reduce unscheduled interruptions in facility and equipment operations.

Development of Circular Economy Solutions

Technological advancements are crucial for the growth of circular economy models, transforming waste into valuable resources. Clean Harbors' core business, including the re-refining of used oil, directly supports this shift by creating new products and minimizing environmental footprints. For example, in 2023, Clean Harbors processed approximately 40 million gallons of used oil, diverting it from landfills and producing high-quality base oils.

These technological capabilities allow Clean Harbors to offer sustainable solutions that resonate with an increasing demand for environmentally responsible practices. The company's investment in advanced recycling technologies, such as those used in their industrial services segment, enables them to handle complex waste streams effectively. This innovation not only addresses regulatory pressures but also creates economic opportunities through resource recovery and reuse.

- Technological Innovation: Drives the transition to a circular economy by enabling waste-to-resource conversion.

- Clean Harbors' Role: Expertise in used oil re-refining and recycling creates new products and reduces environmental impact.

- 2023 Data: Processed around 40 million gallons of used oil, showcasing significant resource recovery.

- Economic & Environmental Benefits: Sustainable solutions meet market demand, address regulations, and generate value through resource reuse.

Technological advancements are fundamentally reshaping waste management, enabling more efficient and environmentally sound disposal methods. Innovations like supercritical water oxidation are proving highly effective for destroying persistent pollutants, while digitalization, including IoT sensors and AI, provides real-time waste stream visibility, crucial for compliance.

Clean Harbors' adoption of automation and robotics, such as automated sorting systems, boosts operational efficiency and material recovery. Data analytics, including predictive maintenance, helps anticipate equipment failures, minimizing downtime and reducing costs, as evidenced by significant maintenance cost reductions reported by mid-2024.

These technologies also support circular economy models, with Clean Harbors re-refining used oil to create new products. In 2023 alone, they processed approximately 40 million gallons of used oil, diverting it from landfills and producing high-quality base oils, demonstrating a commitment to resource recovery and sustainability.

| Technology Area | Impact on Clean Harbors | Key Data/Example |

| Advanced Waste Treatment | Destroys persistent pollutants; enhanced environmental safety | Supercritical water oxidation for PFAS destruction |

| Digitalization (IoT, AI) | Real-time visibility; improved efficiency and compliance | AI for optimizing collection routes (potential 20% fuel savings) |

| Automation & Robotics | Increased operational efficiency; reduced manual handling | Automated sorting systems for hazardous waste (2024 investment) |

| Data Analytics & Predictive Maintenance | Minimized downtime; reduced maintenance costs; risk assessment | Reduced equipment maintenance costs (mid-2024 report) |

| Circular Economy Technologies | Waste-to-resource conversion; sustainable product creation | Processed ~40 million gallons of used oil in 2023 for re-refining |

Legal factors

Clean Harbors navigates a complex web of environmental regulations, requiring meticulous adherence to federal, state, and local laws. This includes obtaining and maintaining permits for hazardous waste treatment, storage, and disposal, as well as air and water emissions. Failure to comply can lead to substantial fines; for instance, the EPA reported over $5 billion in penalties collected in fiscal year 2023 for various environmental violations.

Regulations like the Resource Conservation and Recovery Act (RCRA) in the US mandate strict manifest requirements for tracking hazardous waste from generation to final disposal, directly influencing Clean Harbors' logistical planning and operational costs. Failure to comply, such as improper documentation or unpermitted transport, can result in significant civil penalties, with fines potentially reaching tens of thousands of dollars per violation per day.

In 2024, the Environmental Protection Agency (EPA) continued to enforce these transportation rules, with ongoing investigations into waste hauler compliance. For instance, a single incident of improper hazardous waste transport could lead to a company facing hundreds of thousands in fines and extensive legal proceedings, underscoring the critical need for Clean Harbors to maintain meticulous adherence to all federal and state hazardous waste transportation laws.

Clean Harbors, through its extensive operations including those inherited from Safety-Kleen, faces significant exposure to product liability claims. These arise from the handling, treatment, and disposal of hazardous materials, where any failure in process or containment could lead to environmental damage and subsequent legal action. The company must maintain robust legal and operational safeguards to mitigate these risks.

Furthermore, Superfund laws, formally known as the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA), can impose substantial liabilities on companies like Clean Harbors. This includes responsibility for the cleanup of contaminated sites, even those predating current ownership, potentially leading to extensive remediation costs and legal battles. For instance, in 2023, the EPA continued to pursue enforcement actions under Superfund, highlighting the ongoing relevance of these regulations for waste management companies.

Workplace Safety Regulations (OSHA)

Clean Harbors operates in an industry where workplace safety is paramount, making compliance with Occupational Safety and Health Administration (OSHA) regulations a significant legal factor. The inherent risks associated with handling hazardous materials necessitate strict adherence to OSHA standards to prevent accidents and ensure the well-being of its workforce.

Failure to comply can result in substantial penalties. For instance, in fiscal year 2023, OSHA issued over 85,000 citations, with average penalties for willful violations often reaching tens of thousands of dollars. Clean Harbors must maintain robust safety protocols and training programs to mitigate these risks and associated legal liabilities.

- OSHA's General Duty Clause requires employers to provide a workplace free from recognized hazards.

- Hazard Communication Standard (HazCom) mandates clear labeling and safety data sheets for chemicals.

- Permit-Required Confined Spaces regulations apply to specific hazardous work environments.

- Recordkeeping requirements for workplace injuries and illnesses are also critical.

Evolving Regulatory Landscape (e.g., PFAS)

The regulatory environment is a significant factor for Clean Harbors, particularly with the increasing focus on emerging contaminants like PFAS. New regulations for PFAS disposal and treatment are constantly being developed. For example, in 2024, the U.S. Environmental Protection Agency (EPA) continued to propose and finalize regulations impacting PFAS, including setting drinking water standards. This evolving landscape presents both compliance hurdles and potential growth avenues for Clean Harbors' specialized waste management services.

Clean Harbors needs to continuously adapt its service offerings and technological capabilities to align with these changing disposal and treatment mandates. This adaptation is not just a cost of doing business; it can actively drive demand for their expertise in managing hazardous materials. The company's ability to innovate and provide compliant solutions for complex waste streams, such as those containing PFAS, positions them to capitalize on this growing market need.

- PFAS Regulations: Ongoing development of federal and state regulations for PFAS, impacting disposal and treatment requirements.

- Service Adaptation: Clean Harbors must invest in and refine technologies to meet new compliance standards for emerging contaminants.

- Market Opportunity: Stricter regulations create increased demand for specialized hazardous waste management services like those offered by Clean Harbors.

Legal factors significantly shape Clean Harbors' operations, demanding strict adherence to environmental laws like RCRA and CERCLA. For instance, in 2023, the EPA collected over $5 billion in penalties for environmental violations, highlighting the financial risks of non-compliance. The company must also navigate evolving regulations for emerging contaminants, such as PFAS, which present both challenges and opportunities for specialized services.

Workplace safety is another critical legal domain, with OSHA's General Duty Clause and Hazard Communication Standard requiring meticulous attention. In fiscal year 2023, OSHA issued over 85,000 citations, with penalties for willful violations often reaching tens of thousands of dollars, underscoring the importance of robust safety protocols for Clean Harbors.

Product liability and Superfund liabilities are also key legal considerations. CERCLA, for example, can impose cleanup responsibilities for historical contamination, as seen in the EPA's continued enforcement actions in 2023. Clean Harbors must maintain strong legal and operational safeguards to mitigate these extensive potential liabilities.

Environmental factors

The escalating global generation of hazardous waste, fueled by industrial expansion and diverse economic pursuits, stands as a pivotal environmental factor for Clean Harbors. This ongoing trend directly translates into a sustained and expanding market for their specialized waste management and disposal solutions.

Globally, hazardous waste generation is projected to continue its upward trajectory. For instance, the European Environment Agency reported that in 2022, the EU generated approximately 1.4 million tonnes of hazardous waste from industrial processes alone, highlighting the scale of the challenge and the corresponding need for expert handling.

Growing concerns over climate change are compelling businesses and governments to prioritize greenhouse gas (GHG) emission reductions, directly influencing companies like Clean Harbors. This shift creates both challenges and opportunities for environmental services providers.

Clean Harbors' core business, particularly its re-refining of used oil and various recycling initiatives, plays a crucial role in mitigating GHG emissions. For instance, their re-refining processes can reduce GHG emissions by an estimated 50-70% compared to producing virgin base oil. This directly supports global climate objectives and positions the company favorably in an increasingly carbon-conscious market.

Growing global awareness of resource scarcity is driving a significant shift towards circular economy models, emphasizing waste reduction and material reuse. This trend directly benefits companies like Clean Harbors, which are adept at recycling and re-refining valuable materials. For instance, in 2024, the global market for recycled plastics alone was projected to reach over $50 billion, highlighting the economic potential of these circular practices.

Clean Harbors' core business, particularly its oil re-refining operations, aligns perfectly with these environmental imperatives. By transforming used oil into new products, they not only mitigate waste but also reduce the demand for virgin crude oil. The company processed approximately 400 million gallons of used oil in 2023, demonstrating its substantial contribution to resource conservation and the circular economy.

Pollution Prevention and Remediation Needs

The persistent demand for pollution prevention and environmental remediation, encompassing emergency spill response and site decontamination, forms a fundamental environmental driver for Clean Harbors. These services are critical for minimizing ecological harm and revitalizing polluted locations.

Clean Harbors' role is amplified by increasing regulatory scrutiny and public awareness regarding environmental stewardship. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent regulations on hazardous waste management and site cleanup, directly benefiting companies like Clean Harbors that provide specialized remediation services. The company's ability to handle complex environmental challenges, from industrial spills to legacy contamination sites, positions it to capitalize on these ongoing needs.

- Growing demand for hazardous waste management: The EPA reported a significant volume of hazardous waste generated annually, necessitating professional disposal and treatment services.

- Increased investment in remediation technologies: Government and private sector spending on advanced cleanup solutions is projected to rise through 2025, supporting Clean Harbors' service offerings.

- Focus on emergency preparedness: The frequency of industrial accidents and natural disasters underscores the continuous need for rapid and effective spill response capabilities.

Water Quality and Wastewater Treatment

Growing concerns over water quality and the imperative for robust wastewater treatment represent a critical environmental consideration. Companies like Clean Harbors play a vital role by offering services that ensure the safe management and disposal of wastewater, thereby safeguarding precious water resources from contamination.

Clean Harbors' expertise in treating industrial wastewater and the secure destruction of hazardous materials directly addresses these environmental pressures. For instance, in 2023, the company handled millions of gallons of wastewater, demonstrating its capacity to manage significant volumes and complex waste streams, contributing to cleaner waterways.

- Wastewater Treatment Volume: Clean Harbors processed over 15 million gallons of hazardous wastewater in 2023, a key metric for environmental impact.

- Regulatory Compliance: Adherence to strict EPA regulations, including those under the Clean Water Act, is paramount for their operations and client trust.

- Hazardous Waste Destruction: The company's incineration services effectively neutralize hazardous substances, preventing their release into water systems.

The increasing global focus on sustainability and the circular economy is a significant environmental factor for Clean Harbors. This trend drives demand for services that reduce waste and reuse materials, aligning with Clean Harbors' core competencies in recycling and re-refining.

The company's oil re-refining operations are a prime example, transforming used oil into valuable base oils and reducing reliance on virgin crude. In 2023, Clean Harbors processed approximately 400 million gallons of used oil, significantly contributing to resource conservation and the circular economy.

Furthermore, heightened awareness of water quality issues and the need for effective wastewater treatment present ongoing opportunities. Clean Harbors' specialized wastewater management services are crucial for preventing contamination and ensuring regulatory compliance, as evidenced by their handling of millions of gallons of hazardous wastewater in 2023.

| Environmental Factor | Impact on Clean Harbors | Supporting Data (2023/2024 Projections) |

|---|---|---|

| Circular Economy Push | Increased demand for recycling and re-refining services. | Processed ~400 million gallons of used oil (2023). Global recycled plastics market projected to exceed $50 billion (2024). |

| Water Quality Concerns | Growth in wastewater treatment and hazardous waste destruction services. | Handled millions of gallons of hazardous wastewater (2023). Strict EPA regulations under the Clean Water Act are a key driver. |

| Climate Change Mitigation | Opportunity for GHG emission reduction through re-refining and waste-to-energy. | Re-refining can reduce GHG emissions by 50-70% compared to virgin base oil production. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Clean Harbors draws from a robust blend of official government regulatory databases, industry-specific environmental reports, and reputable economic forecasting agencies. This ensures all political, economic, and environmental insights are grounded in factual data.