Clean Harbors Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clean Harbors Bundle

Clean Harbors operates in a complex waste management landscape, where bargaining power of buyers and suppliers can significantly impact profitability. Understanding the intensity of rivalry and the threat of substitutes is crucial for navigating this competitive environment.

The complete report reveals the real forces shaping Clean Harbors’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Clean Harbors sources a wide array of inputs, from fuel to specialized treatment chemicals. For common resources like fuel, a broad supplier base means competition keeps supplier power in check, which is beneficial for Clean Harbors. For example, in 2024, the diesel fuel market remains highly competitive with numerous providers.

However, when it comes to highly specific waste treatment technologies or unique chemical compounds, the supplier pool shrinks considerably. This limited availability can significantly amplify the bargaining power of those few specialized suppliers, potentially leading to higher costs for Clean Harbors.

Clean Harbors' position as North America's largest environmental and industrial services provider makes it a substantial customer for its suppliers. This scale means Clean Harbors can wield considerable purchasing power, enabling it to negotiate advantageous terms and pricing. For instance, in 2023, Clean Harbors reported total revenues of $4.5 billion, indicating the significant volume of business it represents to its supply chain partners.

Clean Harbors' extensive ownership and operation of waste management facilities, encompassing landfills, incinerators, and treatment centers, significantly reduces its dependence on external disposal providers. This vertical integration directly curtails the bargaining power of potential suppliers, as Clean Harbors controls a substantial portion of its required infrastructure.

By investing in and operating its own advanced facilities, such as the Kimball incinerator, Clean Harbors solidifies its control over the waste disposal process. This strategic move limits the leverage that third-party disposal sites could otherwise exert, ensuring more stable and predictable operational costs.

Availability of Alternative Suppliers

While Clean Harbors deals with specialized waste streams, many of its operational needs, such as fuel, transportation equipment, and general maintenance services, have a healthy number of alternative suppliers. This readily available competition for common inputs significantly reduces the bargaining power any single supplier can wield. For instance, the diverse market for commercial trucking services means Clean Harbors can often negotiate favorable rates and terms by having multiple providers to choose from.

The presence of numerous suppliers for non-specialized goods and services acts as a natural check on supplier power. This competitive landscape ensures that Clean Harbors can secure necessary components and services at market-driven prices, preventing any one supplier from dictating terms. In 2024, the robust logistics sector, with thousands of independent carriers and equipment providers, exemplifies this broad availability.

- Multiple Supplier Options: Clean Harbors benefits from a wide array of suppliers for common operational needs like fuel, parts, and transportation.

- Competitive Pricing: The availability of alternatives allows for negotiation of better pricing and terms, keeping input costs in check.

- Reduced Supplier Leverage: A broad supplier base limits the ability of any single supplier to exert significant price or condition control.

- Operational Flexibility: The ability to switch suppliers for non-specialized inputs provides greater operational agility and cost management.

Regulatory Requirements as a Factor

Regulatory requirements can significantly influence the bargaining power of suppliers for companies like Clean Harbors. Suppliers offering services or materials crucial for environmental compliance, such as specialized waste treatment technologies or hazardous material disposal expertise, may wield considerable influence. This is because failure to meet stringent regulations can result in substantial fines and operational disruptions.

However, Clean Harbors' robust internal regulatory compliance capabilities often mitigate this supplier power. The company's deep understanding of environmental laws and its established processes allow it to define the specifications for necessary services and materials. This internal expertise means Clean Harbors is less likely to be at the mercy of supplier demands, often dictating terms rather than being dictated to.

For instance, in 2024, the environmental services sector continued to see evolving regulations around PFAS (per- and polyfluoroalkyl substances) disposal. Companies with proven, compliant PFAS treatment solutions would naturally have stronger bargaining power. Yet, Clean Harbors' own investments in developing and implementing such technologies position them to negotiate more effectively.

Key considerations regarding regulatory requirements and supplier power include:

- Criticality of Compliance: Suppliers providing essential services for regulatory adherence, like hazardous waste management, gain leverage due to the non-negotiable nature of these requirements.

- Internal Expertise: Clean Harbors' in-house regulatory knowledge allows it to set performance standards and specifications, reducing reliance on supplier-defined terms.

- Specialized Technologies: Suppliers offering unique or patented solutions for complex environmental challenges, such as advanced incineration or chemical treatment, may command higher prices.

- Supplier Concentration: The number of qualified suppliers for specific regulatory-driven services impacts their bargaining power; fewer options typically mean greater supplier leverage.

The bargaining power of suppliers for Clean Harbors is generally moderate, influenced by the type of input. For common resources like fuel, the market is competitive, limiting supplier leverage. However, for specialized waste treatment technologies or unique chemicals, fewer suppliers exist, granting them more power and potentially increasing costs for Clean Harbors.

Clean Harbors' significant scale, evidenced by its $4.5 billion in revenues in 2023, allows it to negotiate favorable terms. Furthermore, its extensive network of owned facilities reduces reliance on external disposal providers, thereby curtailing supplier influence.

| Factor | Impact on Clean Harbors | 2024 Data/Trend |

| Supplier Concentration (Specialized Inputs) | High power for niche suppliers | Evolving regulations for PFAS disposal create demand for specialized solutions, strengthening supplier positions. |

| Availability of Substitutes (Commodity Inputs) | Low power for general suppliers | The diesel fuel market remained competitive in 2024, offering Clean Harbors multiple sourcing options. |

| Customer's Purchasing Power | Lowers supplier power | Clean Harbors' substantial revenue ($4.5 billion in 2023) provides significant negotiation leverage. |

| Vertical Integration | Reduces reliance on external suppliers | Clean Harbors' ownership of landfills and treatment centers limits the bargaining power of third-party disposal sites. |

What is included in the product

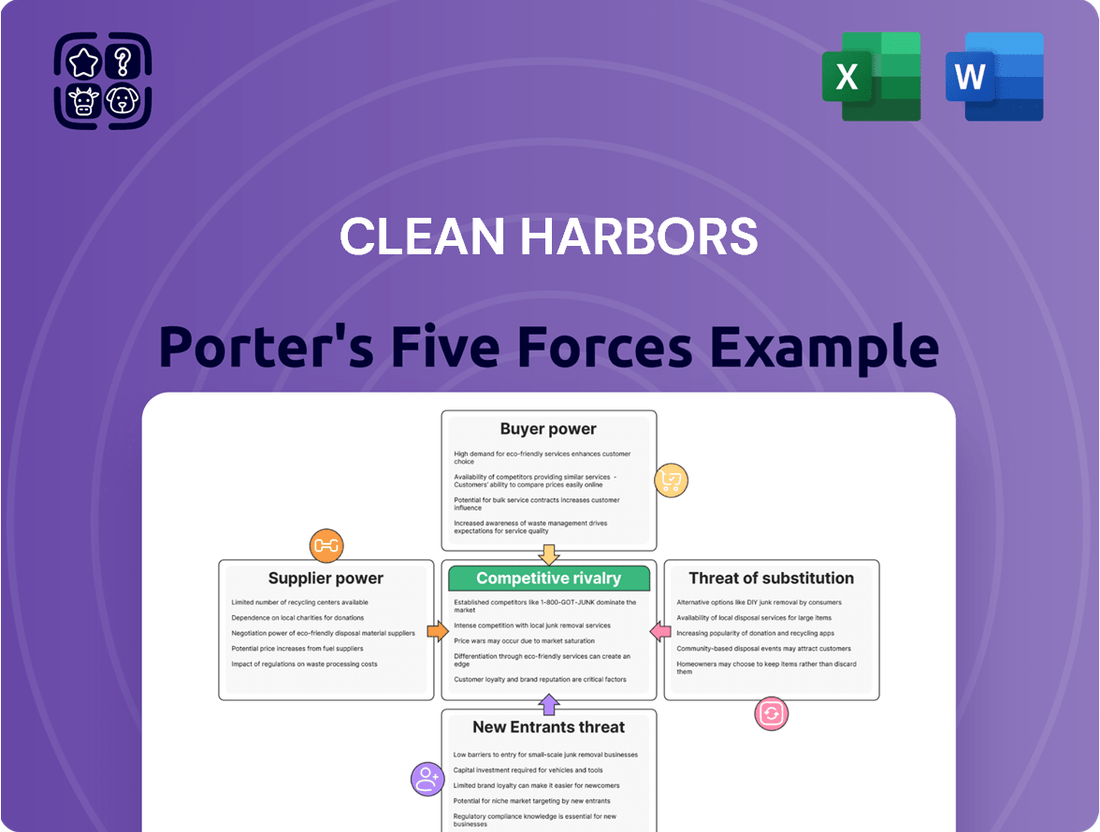

This analysis tailors Porter's Five Forces to Clean Harbors, examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes in the environmental, energy, and industrial services sectors.

Instantly assess competitive pressures within the hazardous waste management industry, allowing for proactive strategic adjustments and risk mitigation.

Customers Bargaining Power

Clean Harbors serves a very diverse customer base, spanning industries like chemical, manufacturing, automotive, energy, and government. This wide reach, including a significant portion of Fortune 500 companies, means no single customer or industry segment holds excessive sway. This broad client portfolio helps to spread risk and reduces the company's reliance on any few major buyers.

For customers deeply integrated with Clean Harbors' suite of services, like comprehensive hazardous waste management and complex environmental solutions, the cost and effort to switch are substantial. These integrated services often involve specialized equipment, established site-specific protocols, and regulatory compliance frameworks that are difficult and expensive to replicate with a new vendor. This inherent complexity significantly reduces the bargaining power of these customers.

Clients are frequently obligated by law to manage hazardous waste and adhere to stringent environmental regulations. This regulatory imperative transforms Clean Harbors' services from optional to essential, significantly curtailing customers' power to reduce or eliminate demand. For instance, the Resource Conservation and Recovery Act (RCRA) in the United States mandates proper disposal of hazardous materials, making compliance a critical operational necessity for businesses across various sectors.

Criticality of Services

The criticality of services, particularly emergency spill response, significantly diminishes customer bargaining power. These situations demand immediate, reliable, and expert intervention, where price becomes a secondary consideration. Clean Harbors' established reputation for dependability in these high-stakes scenarios reinforces this advantage.

Customers facing critical, time-sensitive needs are less likely to negotiate on price when specialized expertise and rapid deployment are essential. For instance, in 2023, Clean Harbors reported that its Environmental Services segment, which includes emergency response, accounted for a substantial portion of its revenue, underscoring the demand for these vital, non-discretionary services.

- Criticality Reduces Price Sensitivity: For emergency spill response, the need for immediate and expert handling outweighs cost concerns, limiting customer negotiation leverage.

- Reliability is Paramount: Customers prioritize proven expertise and a track record of success in critical situations over finding the lowest price.

- Clean Harbors' Competitive Edge: The company's long-standing reputation for dependable and effective emergency services acts as a strong deterrent against price-based competition.

- Revenue Contribution: In 2023, Clean Harbors' Environmental Services segment demonstrated the market's reliance on these critical offerings, contributing significantly to overall financial performance.

Large Customer Leverage

While Clean Harbors serves a broad range of customers, its largest industrial clients and government contracts can still wield significant bargaining power. These major accounts, due to their substantial volume, can negotiate for better pricing and tailored service agreements, impacting profitability on a per-contract basis.

For instance, in 2023, Clean Harbors reported that its largest customer accounted for approximately 3% of its total revenue. This suggests that while no single customer dominates, a concentration of very large clients could collectively exert pressure. The company's diverse service portfolio, however, often mitigates this by embedding Clean Harbors deeply into the operational needs of these large clients, making it harder for them to switch providers for all their requirements.

- Large clients can demand preferential pricing due to volume.

- Government contracts often involve extensive negotiation processes.

- Clean Harbors' integrated service offerings can reduce customer leverage by creating dependency.

- The company's diversified customer base dilutes the impact of any single large client's bargaining power.

The bargaining power of customers for Clean Harbors is generally moderate, influenced by the criticality of its services and the integration of its offerings. While a diverse customer base limits the sway of any single client, large industrial and government accounts can negotiate for better terms due to volume. The essential nature of hazardous waste management and emergency response, often mandated by regulations like RCRA, reduces price sensitivity and limits customers' ability to dictate terms.

| Factor | Impact on Bargaining Power | Supporting Data/Observation (2023/2024) |

|---|---|---|

| Customer Diversification | Lowers individual customer power | Largest customer accounted for ~3% of total revenue in 2023. |

| Service Integration & Switching Costs | Reduces customer power | Customers with comprehensive hazardous waste management and environmental solutions face substantial costs and complexity to switch. |

| Regulatory Mandates | Significantly reduces customer power | Laws like RCRA make hazardous waste management a necessity, not an option. |

| Criticality of Services (e.g., Emergency Response) | Lowers customer power | Price is secondary to immediate, reliable expertise in spill response scenarios. Environmental Services segment is a significant revenue contributor. |

| Large Client Volume | Increases customer power (on a per-contract basis) | Major accounts can negotiate for better pricing and tailored agreements. |

What You See Is What You Get

Clean Harbors Porter's Five Forces Analysis

This preview showcases the comprehensive Clean Harbors Porter's Five Forces Analysis, detailing threats from new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitute products. The document you see here is exactly what you’ll be able to download after payment, offering a thorough strategic overview of the environmental services industry.

Rivalry Among Competitors

The environmental and industrial services sector in North America is a crowded space with significant competition. Major players like Waste Management, Republic Services, Veolia Environmental Services, and GFL Environmental vie for market share, creating a highly competitive landscape. Clean Harbors actively competes with these established companies across its diverse service offerings.

Clean Harbors stands out by offering a broad range of specialized services, including hazardous waste management, emergency response, and industrial cleaning, supported by an extensive network of landfills, incinerators, and treatment centers. This deep specialization clearly separates them from less specialized waste management providers.

The recent addition of the Kimball incinerator significantly bolsters Clean Harbors' capacity and technological edge in waste treatment, further solidifying its differentiated service offerings in the market.

The hazardous waste management market is experiencing robust growth, with projections indicating an annual expansion. This upward trend is fueled by escalating industrial output and increasingly stringent environmental regulations across various sectors. For instance, the global hazardous waste management market was valued at approximately $39.7 billion in 2023 and is anticipated to reach $57.8 billion by 2030, growing at a CAGR of 5.5% during this period.

This overall market expansion offers a degree of relief from intense price-based competition, as it creates ample growth opportunities for numerous participants. As the industry expands, companies can focus on capturing new market share rather than solely engaging in aggressive price wars. Furthermore, evolving regulatory landscapes, which often mandate higher operational and disposal standards, tend to favor specialized providers like Clean Harbors who possess the necessary expertise and infrastructure.

High Capital Intensity and Exit Barriers

The environmental services sector, especially hazardous waste management, demands massive upfront investment in specialized facilities and advanced technologies. This high capital intensity means new entrants face significant financial hurdles.

These substantial fixed costs and the unique, often non-transferable nature of assets create considerable exit barriers. Companies are essentially locked into the industry, fostering intense competition as they strive to maintain operations and profitability.

For instance, Clean Harbors operates numerous highly specialized incineration and treatment facilities, representing billions in capital expenditure. In 2023, the company reported capital expenditures of $528.4 million, highlighting the ongoing investment required to maintain and expand its infrastructure.

- High Capital Intensity: Significant investment needed for specialized infrastructure and technology.

- Substantial Exit Barriers: Specialized assets and high fixed costs make leaving the industry difficult.

- Industry Competitiveness: These factors encourage existing players to remain and compete aggressively.

Acquisitions and Strategic Expansions

Clean Harbors actively pursues acquisitions to bolster its market position and service offerings. Notable examples include the acquisition of HEPACO, strengthening its emergency response capabilities, and Noble Oil, enhancing its oil collection services. These strategic moves are not unique to Clean Harbors; competitors also engage in similar consolidation efforts.

This trend of mergers and acquisitions among environmental and industrial services providers intensifies rivalry. As companies like Clean Harbors integrate acquired businesses, the remaining large players often find themselves competing against more robust, expanded entities. For instance, in 2023, the environmental services sector saw significant M&A activity, with companies aiming to achieve economies of scale and broader geographic reach, directly impacting competitive dynamics.

- Acquisitions Drive Market Consolidation: Clean Harbors' strategic purchases, like HEPACO and Noble Oil, expand its service portfolio and geographic footprint.

- Competitor Response Intensifies Rivalry: Other major players in the environmental services sector also pursue acquisitions, leading to a more concentrated market.

- Increased Competition for Market Share: This consolidation means fewer, larger competitors are vying for contracts, raising the stakes for all participants.

- Impact on Service Pricing and Innovation: The intensified rivalry can influence pricing strategies and the pace of innovation as companies seek to differentiate themselves.

Competitive rivalry within the environmental services sector is fierce, with major players like Waste Management and Veolia Environmental Services constantly vying for market share. Clean Harbors differentiates itself through specialized services, such as hazardous waste management and emergency response, supported by extensive infrastructure. The market's high capital intensity and significant exit barriers mean existing companies must compete aggressively to maintain profitability.

Mergers and acquisitions further intensify this rivalry, as companies like Clean Harbors, which acquired HEPACO and Noble Oil, consolidate their positions. This trend leads to fewer, larger competitors, increasing the pressure on all participants to innovate and optimize pricing strategies to capture market share.

The hazardous waste management market is projected to grow, with the global segment valued at approximately $39.7 billion in 2023 and expected to reach $57.8 billion by 2030. This growth, driven by industrial output and stricter regulations, allows for expansion without solely relying on price wars.

Clean Harbors' capital expenditures reflect the ongoing investment required in this competitive landscape. In 2023, the company invested $528.4 million in capital expenditures, underscoring the commitment needed to maintain and upgrade specialized facilities and technologies essential for competing effectively.

| Competitor | Key Service Areas | 2023 Revenue (Approx. Billions USD) |

| Waste Management | Waste Collection, Landfilling, Recycling | $20.0 |

| Republic Services | Waste Collection, Transfer Stations, Recycling | $12.0 |

| Veolia Environmental Services | Water Management, Waste Management, Energy Services | $33.0 (Global) |

| GFL Environmental | Waste, Water, Soil Services | $7.0 |

| Clean Harbors | Hazardous Waste, Industrial Services, Emergency Response | $4.0 |

SSubstitutes Threaten

The threat of substitutes for hazardous waste management services, especially for complex and highly regulated waste streams, is quite low. Clean Harbors offers specialized solutions that are difficult to replicate. For instance, in 2023, the company managed over 4.7 million tons of hazardous waste, highlighting the scale and specialized nature of its operations.

The rigorous regulatory landscape, including EPA mandates and state-specific rules, necessitates significant investment in infrastructure, permits, and trained personnel. This creates high barriers to entry for potential substitute providers, making it challenging for them to offer a comparable level of service and compliance across the board.

Large industrial clients may explore developing in-house waste management for non-hazardous or simpler waste streams, potentially lessening their need for external services. This trend, while present, is often constrained by the significant capital outlay and stringent regulatory compliance required for hazardous waste, making it a less viable substitute for specialized providers like Clean Harbors.

Customers are increasingly prioritizing waste minimization and source reduction, driven by sustainability mandates and a desire to cut expenses. This trend, while potentially lowering the total volume of waste needing disposal, actually fuels demand for specialized consulting and recycling services, areas where Clean Harbors excels. For instance, in 2023, the U.S. generated an estimated 292.4 million tons of municipal solid waste, with recycling and composting diverting 94 million tons, highlighting the growing importance of these services.

Emerging Technologies and Circular Economy

New technologies are emerging that could offer alternatives to traditional waste disposal. For instance, advanced recycling, waste-to-energy processes, and chemical recycling present potential substitutes for landfilling and incineration. These innovations aim to recover more value from waste streams, potentially reducing the need for conventional disposal services.

The growing emphasis on a circular economy further intensifies the threat of substitutes. This economic model prioritizes reusing materials and recovering resources, which could shift demand away from linear disposal services that simply manage waste. Companies that can adapt to circular principles by offering resource recovery solutions may gain an advantage.

Clean Harbors is actively engaged in these evolving areas. For example, the company's oil re-refining operations demonstrate a commitment to resource recovery and a more circular approach to waste management. This strategic positioning helps mitigate the threat of substitutes by offering services that align with the principles of a circular economy.

- Advanced Recycling: Technologies that break down waste materials into their original components for reuse.

- Waste-to-Energy: Processes that convert waste into usable energy, such as electricity or heat.

- Chemical Recycling: Advanced methods that use chemical processes to convert plastic waste into new materials or fuels.

- Circular Economy Model: An economic system aimed at eliminating waste and the continual use of resources.

Regulatory Incentives for Alternatives

Government regulations and initiatives, such as Extended Producer Responsibility (EPR) programs, are increasingly pushing manufacturers toward greater accountability for product end-of-life management. For instance, the EU's Circular Economy Action Plan, with its focus on sustainable product design and waste reduction, directly impacts how products are manufactured and managed post-use. This trend encourages redesign for enhanced recyclability and material recovery, potentially shrinking the demand for traditional waste treatment and disposal services.

These regulatory shifts can be seen as a growing threat of substitutes because they promote alternative waste management strategies. Instead of relying on conventional disposal, companies are incentivized to invest in closed-loop systems and material reuse. For example, as of early 2024, several US states have introduced or expanded EPR legislation for packaging, requiring producers to fund and manage collection and recycling programs. This diversion of materials from traditional waste streams directly impacts the volume of business available for companies like Clean Harbors.

- Regulatory Push for Circularity: EPR programs and similar mandates encourage product redesign for recyclability and material recovery.

- Shift in Waste Management: Incentives favor closed-loop systems and reuse over conventional treatment and disposal.

- Impact on Volume: Diversion of materials from traditional waste streams can reduce the overall volume requiring conventional services.

- Example: US states implementing EPR for packaging in 2024 illustrate this trend, impacting waste management providers.

The threat of substitutes for hazardous waste management remains relatively low due to the specialized nature of services and high regulatory barriers. While alternative technologies like advanced recycling and waste-to-energy are emerging, they often complement rather than replace the core services offered by companies like Clean Harbors, particularly for complex waste streams.

The push towards a circular economy and government regulations, such as Extended Producer Responsibility (EPR) programs, are encouraging waste reduction and material reuse. For instance, in 2023, the U.S. generated approximately 292.4 million tons of municipal solid waste, with about 32% diverted through recycling and composting, demonstrating a growing trend away from traditional disposal.

| Factor | Description | Impact on Clean Harbors |

| Specialized Services | Complex hazardous waste requires specific expertise and infrastructure. | Low threat; difficult for substitutes to match capabilities. |

| Regulatory Hurdles | Strict environmental regulations create high entry barriers. | Low threat; compliance is costly and time-consuming for new entrants. |

| Emerging Technologies | Advanced recycling, waste-to-energy offer alternatives for certain waste streams. | Moderate threat; potential to reduce volume for some services, but also opportunities for Clean Harbors to adopt. |

| Circular Economy/EPR | Focus on reuse and producer responsibility shifts waste management practices. | Moderate threat; incentivizes waste reduction and diversion, impacting traditional disposal volumes. |

Entrants Threaten

Entering the environmental and industrial services sector, particularly hazardous waste management, demands significant capital outlay. This includes specialized infrastructure such as permitted landfills, advanced incinerators, and sophisticated treatment facilities, alongside a dedicated fleet of hazardous material transport vehicles and processing equipment. For instance, establishing a new hazardous waste landfill can cost hundreds of millions of dollars, encompassing land acquisition, permitting, construction, and ongoing operational compliance.

The environmental services sector, particularly for hazardous waste management, faces formidable barriers to entry due to stringent regulatory frameworks. Companies like Clean Harbors must navigate a labyrinth of federal, state, and local regulations governing the handling, transportation, treatment, and disposal of hazardous materials. For instance, the Resource Conservation and Recovery Act (RCRA) in the United States imposes rigorous standards on waste generators, transporters, and treatment, storage, and disposal facilities (TSDFs). Obtaining the necessary permits can be an arduous and time-consuming process, often taking years and demanding substantial investment in legal counsel and compliance infrastructure.

Established players like Clean Harbors benefit from significant economies of scale due to their vast operational network, integrated services, and high volume of waste processing. This allows them to achieve lower per-unit costs and offer competitive pricing, making it challenging for smaller new entrants to compete effectively.

For instance, Clean Harbors' extensive network of treatment, storage, and disposal facilities (TSDFs) across North America enables them to optimize logistics and processing, driving down operational expenses. In 2023, the company reported total revenue of $4.5 billion, underscoring the scale of its operations and its ability to leverage these efficiencies.

Established Customer Relationships and Brand Loyalty

Clean Harbors benefits significantly from deeply entrenched customer relationships, particularly with its extensive base of Fortune 500 clients. These long-standing partnerships are built on a foundation of trust, reliability, and a proven history of service delivery, making it challenging for new competitors to gain traction. For instance, in 2023, Clean Harbors continued to secure multi-year contracts with major industrial players, underscoring the stickiness of its customer base.

The difficulty for new entrants is amplified by the integrated nature of services often required by these large clients. Newcomers must not only offer competitive pricing but also demonstrate the capacity to meet complex operational needs and stringent compliance standards, which takes considerable time and investment to prove. This creates a substantial barrier, as replicating the established trust and operational synergy Clean Harbors enjoys with its clientele is a lengthy and resource-intensive endeavor.

- Established Client Base: Clean Harbors serves a majority of Fortune 500 companies, indicating a high degree of customer loyalty and reliance.

- Trust and Reputation: Years of reliable service have cultivated a strong reputation, a critical factor in securing and retaining large industrial clients.

- Integrated Service Needs: Many clients require comprehensive waste management solutions, making it difficult for new entrants to offer a comparable, fully integrated service package.

- High Switching Costs: The operational and contractual complexities involved in switching providers deter existing customers from moving to new, unproven entities.

Access to Specialized Expertise and Talent

The hazardous waste management sector demands a highly specialized workforce, including engineers, chemists, and certified technicians. New entrants face considerable hurdles in recruiting and retaining individuals with this niche expertise, especially in critical areas like hazardous materials handling and advanced disposal techniques. For example, in 2024, the demand for environmental engineers with specific hazardous waste certifications saw an estimated 15% increase year-over-year, making talent acquisition a competitive landscape.

Building a robust safety culture, paramount in this industry, also requires significant investment in training and development. New companies may struggle to match the established safety protocols and experienced personnel that incumbent firms like Clean Harbors possess. This talent gap can translate into higher operational risks and slower market penetration for emerging competitors.

- Specialized Skills: Expertise in chemical analysis, waste treatment technologies, and regulatory compliance is essential.

- Safety Culture: New entrants must invest heavily in training to replicate the safety records of established players.

- Talent Acquisition: Competition for skilled professionals in hazardous waste management is intense, driving up recruitment costs.

The threat of new entrants into hazardous waste management is generally low due to substantial capital requirements and regulatory complexities. Significant investments are needed for specialized facilities and equipment, alongside navigating a dense web of environmental laws. These factors, combined with the need for a skilled workforce and established customer trust, create formidable barriers for newcomers seeking to compete with established players like Clean Harbors.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Clean Harbors is built upon a foundation of comprehensive data, including publicly available financial statements, investor relations materials, and industry-specific market research reports.