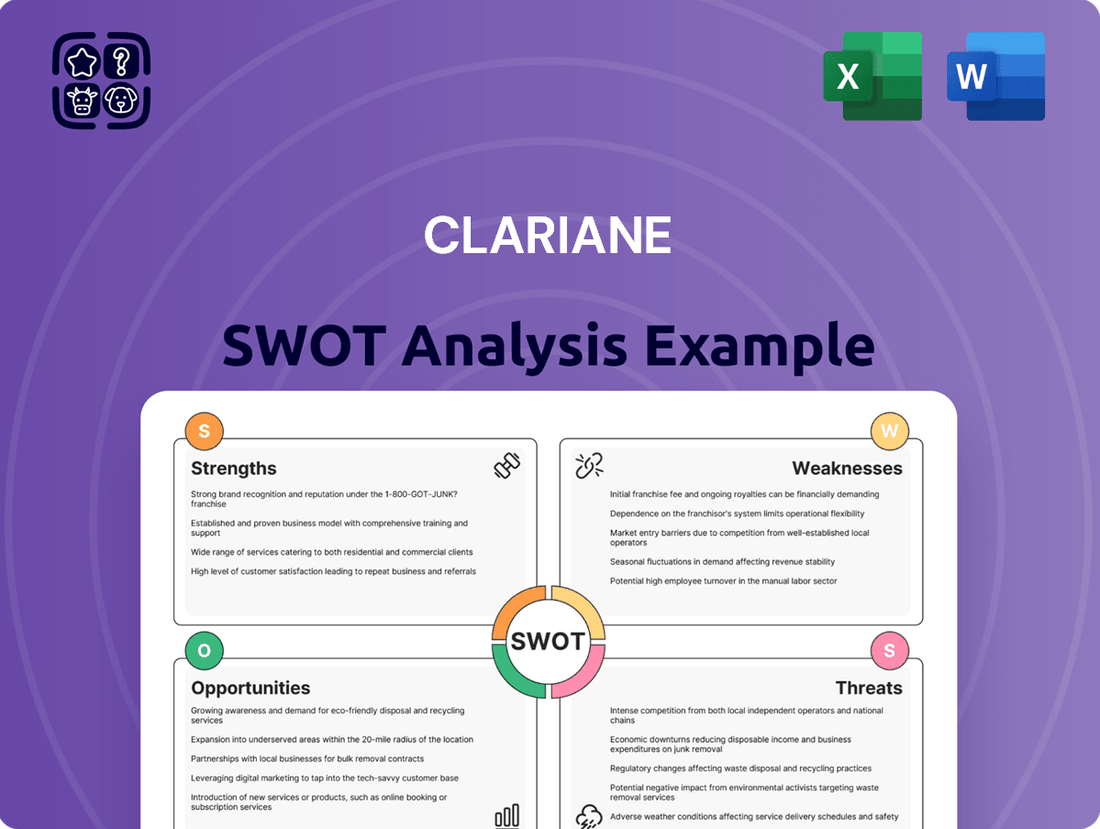

Clariane SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clariane Bundle

Clariane's strategic positioning reveals significant market opportunities, yet also highlights potential challenges in operational efficiency. Understanding these dynamics is crucial for navigating the evolving healthcare landscape.

Want the full story behind Clariane's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Clariane boasts an extensive European network, operating a substantial number of nursing homes, specialized clinics, and assisted living facilities. This widespread presence across multiple countries, including France, Germany, Belgium, and Spain, solidifies its position as a market leader in the long-term care sector. For instance, by the end of 2023, Clariane managed over 100,000 places across Europe, highlighting its significant scale and reach.

This broad geographical footprint not only diversifies Clariane's revenue streams, mitigating risks associated with single-market downturns, but also enhances its market leadership. The economies of scale achieved through this extensive network contribute to cost efficiencies and strengthen its brand recognition across key European markets. This established leadership provides a robust competitive advantage, enabling greater market penetration and influence.

Clariane boasts a remarkably diversified service portfolio, covering everything from short-term rehabilitation and long-term residential care to essential medical, paramedical, hospitality, and well-being services. This broad offering significantly reduces the company's vulnerability to fluctuations in any single service sector. For instance, in 2023, Clariane operated over 1,000 facilities across Europe, demonstrating its substantial reach and capacity to serve a wide array of senior care needs.

Clariane's core strength lies in its unwavering focus on delivering high-quality, personalized care. This approach integrates medical and paramedical support with a strong emphasis on hospitality and resident well-being.

This dedication to patient-centric service excellence directly translates into enhanced resident satisfaction and better health outcomes. For instance, in 2023, Clariane reported a resident satisfaction rate of 85%, a testament to their personalized care model.

This commitment not only builds a strong reputation but also proves crucial for attracting and retaining residents, thereby supporting high occupancy rates across Clariane's network of facilities, which stood at an average of 92% in the first half of 2024.

Addressing Growing Demographic Needs

Europe's aging population is a powerful demographic trend, creating a consistent and increasing need for Clariane's long-term care services. This demographic shift ensures a stable and growing market for the company, underpinning its long-term business strategy. For instance, in 2023, the number of people aged 65 and over in the EU reached approximately 96.5 million, a figure projected to rise significantly in the coming years.

Clariane is well-positioned to meet this demand, with its established network of care facilities and services. This strategic alignment with demographic needs provides a strong competitive advantage and a solid foundation for continued expansion. The company's focus on this growing segment of the population directly addresses a fundamental societal requirement.

- Sustained Market Demand: The increasing number of elderly individuals across Europe guarantees a continuous and expanding customer base for Clariane's core offerings.

- Demographic Tailwinds: Clariane benefits from a favorable demographic environment, with projections indicating a further rise in the elderly population in the coming decade.

- Strategic Alignment: The company's business model is inherently aligned with addressing the growing needs of an aging society, a key strength in the current market landscape.

Integrated Care Model

Clariane's integrated care model is a significant strength, combining medical, paramedical, hospitality, and well-being services under one roof. This holistic approach addresses residents' health and lifestyle needs, setting it apart from competitors. For example, in 2024, Clariane continued to emphasize this model across its European network, aiming to enhance resident satisfaction and well-being.

This comprehensive offering fosters a more attractive living environment and potentially leads to improved overall resident health outcomes. By managing both care and daily living aspects, Clariane can offer a more seamless and personalized experience for its residents.

- Holistic Resident Experience: Blends medical, paramedical, hospitality, and well-being services.

- Competitive Differentiation: Addresses both health and lifestyle needs, a key differentiator in the care sector.

- Enhanced Well-being: Aims for better overall health and a more appealing living environment for residents.

Clariane's extensive European network is a significant strength, comprising over 1,000 facilities as of 2023, including nursing homes and specialized clinics. This vast geographical reach across countries like France, Germany, and Spain, managing over 100,000 places by year-end 2023, diversifies revenue and solidifies its market leadership in long-term care.

The company's diversified service portfolio, encompassing medical, paramedical, and hospitality services, reduces vulnerability to single-sector downturns. This integrated care model, focusing on personalized resident well-being, contributed to a reported resident satisfaction rate of 85% in 2023 and high occupancy rates averaging 92% in the first half of 2024.

Clariane is strategically aligned with Europe's aging population, a demographic trend ensuring sustained market demand. With approximately 96.5 million individuals aged 65+ in the EU in 2023, the company is well-positioned to address this growing societal need.

| Metric | 2023 Data | H1 2024 Data |

|---|---|---|

| Number of Facilities | Over 1,000 | - |

| Places Managed | Over 100,000 | - |

| Resident Satisfaction Rate | 85% | - |

| Average Occupancy Rate | - | 92% |

What is included in the product

Delivers a strategic overview of Clariane’s internal and external business factors, highlighting its strengths and weaknesses against market opportunities and threats.

Offers a clear, actionable SWOT framework to identify and address Clariane's core challenges.

Weaknesses

Clariane faces significant operating costs due to the inherently labor-intensive nature of the long-term care sector. This requires a substantial workforce of skilled medical and caregiving professionals, driving up expenses related to wages, benefits, and ongoing training. For instance, the average registered nurse salary in France, a key market for Clariane, saw an increase in 2024, contributing to these pressures.

Rising inflation further exacerbates these cost challenges, placing continuous pressure on Clariane's profit margins. Beyond labor, substantial expenditures are also allocated to facility maintenance and ensuring strict adherence to evolving regulatory compliance standards within the healthcare industry.

Clariane faces a significant weakness in the substantial regulatory and compliance burden inherent in its multi-country European operations. Navigating the diverse and frequently changing healthcare regulations, licensing stipulations, and quality standards across different nations demands considerable financial and human resources, thereby increasing administrative overhead.

This intricate regulatory landscape poses a constant risk of penalties or legal repercussions for any non-compliance. For instance, in 2023, the healthcare sector in general saw increased scrutiny, with fines for data privacy breaches alone reaching substantial figures in many EU member states, a trend likely to continue into 2024 and 2025.

Clariane, like many in the long-term care sector, faces significant reputational risk. Incidents involving the quality of care, such as alleged neglect or inadequate staffing, can quickly damage public perception. For example, in early 2024, Clariane faced scrutiny over its operations in France, with reports highlighting concerns about working conditions and patient care, which could impact future resident admissions.

Negative publicity and public complaints can directly affect occupancy rates, a key driver of revenue. If a facility gains a reputation for poor care, potential residents and their families may choose alternatives, directly impacting the company's financial performance. This scrutiny extends to regulatory bodies, where investigations into operational failures can lead to fines and further damage to brand value.

Sensitivity to Reimbursement Policies

Clariane's reliance on reimbursement policies presents a significant weakness. A considerable part of its income often comes from government funding, social security, or private insurance. This makes the company vulnerable to shifts in political and economic landscapes.

Adverse policy changes, like reduced reimbursement rates or tighter eligibility rules, can directly harm Clariane's financial health. For instance, if a major payer system in a key market like France or Germany were to implement a 5% reduction in care service reimbursement rates, it could directly impact revenue streams. In 2023, Clariane reported that approximately 70% of its revenue was linked to public funding and insurance, highlighting this sensitivity.

- Dependence on Public Funding: A large percentage of Clariane's revenue is tied to government and insurance reimbursements, making it susceptible to policy shifts.

- Risk of Rate Cuts: Potential reductions in reimbursement rates by payers can directly decrease profitability.

- Eligibility Criteria Changes: Stricter rules for accessing services could limit patient volume and revenue.

- Payment Delays: Delays in receiving reimbursements can strain cash flow and operational liquidity.

Capital-Intensive Nature of Expansion

Clariane's strategy of expanding its network of nursing homes, clinics, and assisted living facilities is inherently capital-intensive. This involves significant upfront costs for acquiring land, building new facilities, renovating existing ones, and equipping them. For instance, the construction of a modern nursing home can easily run into tens of millions of euros, depending on size and location.

This reliance on substantial capital investment can lead to increased debt levels on Clariane's balance sheet. High debt can constrain the company's financial flexibility, making it harder to pursue other strategic opportunities or weather economic downturns when revenue streams might be pressured.

- High Capital Outlay: Significant investments are needed for property acquisition, construction, and modernization of healthcare facilities.

- Debt Accumulation Risk: The capital-intensive growth model can result in substantial debt, potentially impacting financial flexibility.

- Limited Financial Agility: Increased debt may restrict Clariane's ability to invest in other strategic areas or respond to economic volatility.

Clariane's extensive European footprint, while a strength, also presents a significant weakness due to the complex and varied regulatory environments across different countries. Navigating these diverse legal frameworks, licensing requirements, and quality standards demands substantial resources and increases administrative overhead, potentially leading to compliance risks and penalties.

The company's reliance on reimbursement from public funding and insurance sources, which accounted for approximately 70% of its revenue in 2023, makes it highly vulnerable to changes in government policies and payer decisions. A reduction in reimbursement rates, as seen in potential shifts in healthcare funding in key markets like France or Germany, could directly impact profitability and financial stability.

Clariane faces considerable reputational risk, as negative incidents related to care quality or staffing can severely damage public perception and occupancy rates. For example, reports in early 2024 highlighting concerns about working conditions in its French operations underscore the potential impact on future resident admissions and brand value.

The capital-intensive nature of expanding and maintaining its network of facilities necessitates significant investment, potentially leading to increased debt. This financial leverage can limit the company's agility in pursuing new opportunities or responding to economic downturns, with new facility constructions easily costing tens of millions of euros.

Preview Before You Purchase

Clariane SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Clariane's Strengths, Weaknesses, Opportunities, and Threats, meticulously researched and presented.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights to inform your strategic decisions regarding Clariane.

Opportunities

The aging European population is a significant tailwind for Clariane. With life expectancies continuing to climb across the continent, the demand for senior living, home care, and specialized medical services is set to expand considerably. This demographic shift ensures a robust and growing market for Clariane's core business.

In 2024, the proportion of individuals aged 65 and over in the European Union was approximately 22%. Projections indicate this figure will reach around 27% by 2030, highlighting a sustained increase in the target demographic for Clariane's services. This trend directly translates into greater demand for the company's specialized care and living solutions.

Clariane can capitalize on technological integration in healthcare by implementing telemedicine, AI-driven predictive analytics, and remote monitoring. These advancements can significantly boost care quality and personalize resident experiences. For instance, the global telemedicine market was projected to reach over $200 billion by 2027, indicating substantial growth potential.

Adopting smart living solutions and AI can streamline operations, leading to cost reductions and improved resident outcomes. This technological edge can attract families seeking advanced, tech-enabled care solutions. In 2024, AI adoption in healthcare was rapidly increasing, with many providers reporting improved diagnostic accuracy and operational efficiency.

The long-term care sector in Europe remains quite fragmented, especially in certain countries, presenting a significant opportunity for Clariane. This fragmentation means there are many smaller, independent care providers that could be acquired. For instance, in 2023, the European long-term care market was valued at approximately €250 billion, with a substantial portion still held by smaller, regional players, offering Clariane a chance to consolidate its position.

By strategically acquiring these smaller entities or forging partnerships with local healthcare groups, Clariane can effectively expand its footprint into new or currently underserved European territories. This approach not only bolsters market share but also allows for the introduction of Clariane's established service models and standards into these new markets, potentially reaching a wider patient base.

Furthermore, these strategic moves can significantly diversify Clariane's service offerings. Acquiring providers with specialized services, such as advanced dementia care or rehabilitation, can enrich Clariane's portfolio. This diversification is crucial for meeting the evolving needs of an aging population and can lead to stronger revenue streams and a more resilient business model, especially as healthcare demands become more specialized.

Development of New Care Models

Clariane has a significant opportunity to develop and implement innovative care models that extend beyond its traditional residential facilities. This includes expanding into home-based care services, which saw a notable increase in demand, with the global home healthcare market projected to reach over $500 billion by 2027. Additionally, focusing on specialized dementia care programs and establishing day care centers can cater to evolving consumer preferences for more flexible and personalized care solutions.

These new care models offer a pathway to tap into a broader demographic and create diversified revenue streams, thereby mitigating business risk. For instance, the market for home care services alone is expected to grow substantially, with some estimates suggesting a compound annual growth rate of around 8% in the coming years. By embracing these innovative approaches, Clariane can enhance its market position and adapt to changing healthcare needs.

- Expansion into Home-Based Care: Capitalizing on the growing demand for in-home support services.

- Specialized Dementia Care: Developing tailored programs to address the increasing prevalence of dementia.

- Day Care Centers: Offering flexible daytime care options for seniors and individuals needing support.

- Diversification of Revenue: Creating new income streams by offering a wider range of care services.

Focus on Wellness and Preventative Care

Clariane can capitalize on the growing demand for wellness and preventative care by expanding its service offerings. This includes developing comprehensive wellness programs, offering preventative health screenings, and enhancing rehabilitation services. For instance, the global wellness market was valued at over $4.5 trillion in 2022, with preventative care being a significant driver.

By focusing on proactive health management and improving quality of life, Clariane can appeal to a broader customer base. This includes individuals who wish to maintain their independence for longer periods. This aligns with a significant shift in healthcare towards a more holistic approach to well-being, moving beyond just treating illness.

- Expanding preventative health services

- Developing comprehensive wellness programs

- Enhancing rehabilitation and post-acute care

- Attracting clients seeking long-term independence

Clariane is well-positioned to benefit from Europe's aging demographics, with the 65+ population in the EU expected to grow from approximately 22% in 2024 to around 27% by 2030. This demographic shift fuels demand for senior living and home care. The company can also leverage technological advancements like telemedicine and AI to enhance care quality and operational efficiency, mirroring the rapid adoption of AI in healthcare reported by providers in 2024.

The fragmented nature of the European long-term care market, valued at roughly €250 billion in 2023, presents a prime opportunity for Clariane to expand through strategic acquisitions and partnerships. This consolidation strategy can broaden its geographical reach and introduce its established service models into new territories. Furthermore, diversifying into home-based care, a market projected to exceed $500 billion by 2027, and specialized dementia care programs can create new revenue streams and cater to evolving consumer preferences for flexible, personalized solutions.

Clariane can also tap into the expanding wellness market, valued at over $4.5 trillion in 2022, by enhancing preventative health services, wellness programs, and rehabilitation offerings. This focus on proactive health management appeals to individuals seeking to maintain independence longer, aligning with a broader healthcare trend towards holistic well-being.

| Opportunity | Description | Market Data/Projection |

| Demographic Tailwinds | Growing elderly population in Europe | EU 65+ population: ~22% (2024) to ~27% (2030) |

| Technological Integration | Adoption of telemedicine, AI for enhanced care | Global telemedicine market projected >$200B by 2027; AI adoption in healthcare increasing |

| Market Consolidation | Acquiring fragmented smaller providers | European long-term care market: ~€250B (2023), significant portion held by smaller players |

| Service Diversification | Expansion into home care, dementia care, day centers | Global home healthcare market projected >$500B by 2027 |

| Wellness & Prevention | Developing wellness programs and preventative health services | Global wellness market: >$4.5T (2022), preventative care a key driver |

Threats

The European long-term care sector is a crowded space. Clariane faces intense rivalry from a multitude of private companies, public entities, and smaller, local care homes all competing for residents and staff.

This fierce competition is a significant threat. Competitors are actively expanding their operations, new players are entering the market, and innovative service offerings are emerging. For instance, in 2023, the European long-term care market was valued at approximately €200 billion, highlighting the scale of the opportunity but also the intensity of the battle for market share.

These dynamics directly challenge Clariane's ability to maintain its market position, influence pricing, and secure both residents and qualified personnel.

Governments in key European markets like France and Germany are increasingly scrutinizing the elderly care sector. For instance, in late 2023, France proposed new regulations aimed at enhancing staffing levels in nursing homes, a move that could add an estimated €500 million annually to the sector's costs. Such changes could directly increase Clariane's operational expenses and compliance requirements.

Economic headwinds and shifting political priorities could lead to reduced public funding for social care services. In Germany, for example, ongoing debates about healthcare reform in 2024 have included discussions on potential adjustments to reimbursement rates for long-term care, which might negatively affect Clariane's revenue streams if implemented.

Clariane faces a significant threat from ongoing labor shortages in the healthcare sector, especially within long-term care. This scarcity of qualified nurses, doctors, and caregivers is a persistent challenge that directly impacts operational costs and service quality.

The demand for healthcare professionals continues to outstrip supply, forcing companies like Clariane to contend with escalating labor expenses. These costs stem from increased wages, competitive recruitment incentives, and the necessity of employing costly temporary or agency staff to fill critical roles.

For instance, in 2024, the average hourly wage for registered nurses in skilled nursing facilities saw an increase, reflecting the tight labor market. This rise in personnel expenses directly pressures Clariane's profit margins and potentially compromises its ability to maintain consistent, high-quality patient care.

Economic Downturns and Reduced Disposable Income

Economic downturns, characterized by recessions or high inflation, directly impact consumer spending power. For instance, if inflation in key European markets where Clariane operates, like France, were to persist at elevated levels throughout 2024 and into 2025, families would likely experience a significant reduction in their disposable income. This squeeze on household budgets makes discretionary spending on private long-term care services a less viable option for many.

This reduced affordability poses a direct threat to Clariane's business model. Lower disposable income could translate into decreased demand for their services, leading to lower occupancy rates in their facilities. Furthermore, it might increase the appeal of more budget-friendly, publicly funded care options, diverting potential clients. Companies like Clariane could also face pressure to lower their prices, impacting revenue and profitability.

- Reduced Disposable Income: Persistent inflation in 2024-2025 could erode household purchasing power, making private long-term care less accessible.

- Lower Occupancy Rates: Economic hardship may lead to fewer families opting for or being able to afford Clariane's services.

- Increased Competition from Public Services: Budget constraints could drive demand towards more affordable, government-subsidized care alternatives.

- Pricing Pressure: To maintain occupancy, Clariane might be forced to reduce service prices, negatively affecting margins.

Public Scrutiny and Negative Perception

The long-term care sector, including companies like Clariane, is under constant public and media watch. Issues like care quality, resident safety, and financial dealings are frequently scrutinized. This intense focus means any negative incident, even if isolated, can quickly damage reputation and erode trust.

Such reputational harm can directly impact business by reducing new resident admissions and potentially leading to increased government regulation or legal challenges. For instance, in 2023, reports highlighted ongoing concerns regarding staffing levels and care standards in some parts of the European elderly care market, a trend that could affect all operators.

- Reputational Risk: Negative press or social media attention can significantly harm public perception.

- Admissions Impact: Loss of trust can lead to lower occupancy rates.

- Regulatory Scrutiny: Incidents can trigger investigations and stricter operational requirements.

- Financial Repercussions: Damage to reputation can manifest as decreased revenue and increased legal costs.

Clariane faces significant threats from increasing regulatory burdens and potential shifts in government funding. New regulations, such as those proposed in France in late 2023 to enhance staffing, could add substantial costs. Furthermore, economic pressures in 2024 and 2025 might lead to reduced public funding for social care, impacting revenue streams, as seen in ongoing healthcare reform discussions in Germany.

Labor shortages remain a critical threat, driving up operational costs through higher wages and recruitment incentives. For instance, the average hourly wage for registered nurses in skilled nursing facilities saw an increase in 2024. This scarcity of qualified staff directly pressures Clariane's profit margins and service quality.

Economic headwinds, particularly persistent inflation in 2024-2025, threaten to reduce consumer spending power. This could lead to lower occupancy rates as families find private care less affordable, potentially increasing demand for cheaper public services and forcing Clariane to lower prices, impacting profitability.

Intense competition from a crowded European long-term care market, valued at approximately €200 billion in 2023, poses a constant challenge. New entrants and expanding existing players intensify the battle for residents and staff, affecting market position and pricing power.

Reputational risks are also a major concern. Negative publicity or isolated incidents can quickly damage public trust, leading to reduced admissions and increased regulatory scrutiny. Reports in 2023 highlighted ongoing concerns about care standards, a trend that could affect all operators in the sector.

| Threat Category | Specific Threat | Impact on Clariane | 2023-2025 Data/Context |

| Regulatory & Political | Increased regulation and potential funding cuts | Higher operational costs, reduced revenue | France proposed new regulations late 2023; German healthcare reform discussions in 2024 |

| Labor Market | Shortage of qualified healthcare professionals | Escalating labor costs, service quality risk | Increased RN wages in skilled nursing facilities in 2024 |

| Economic Conditions | Reduced consumer spending power due to inflation | Lower occupancy, pricing pressure, shift to public services | Persistent inflation in 2024-2025 impacting disposable income |

| Market Competition | Intense rivalry in the long-term care sector | Difficulty maintaining market share and pricing power | European long-term care market valued at ~€200 billion in 2023 |

| Reputation | Negative publicity and reputational damage | Decreased admissions, increased scrutiny | Ongoing concerns about care standards highlighted in 2023 reports |

SWOT Analysis Data Sources

This SWOT analysis draws from a comprehensive blend of internal financial reports, detailed market research, and expert industry commentary. We also incorporate publicly available data and verified reports to ensure a robust and insightful assessment.