Clariane PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clariane Bundle

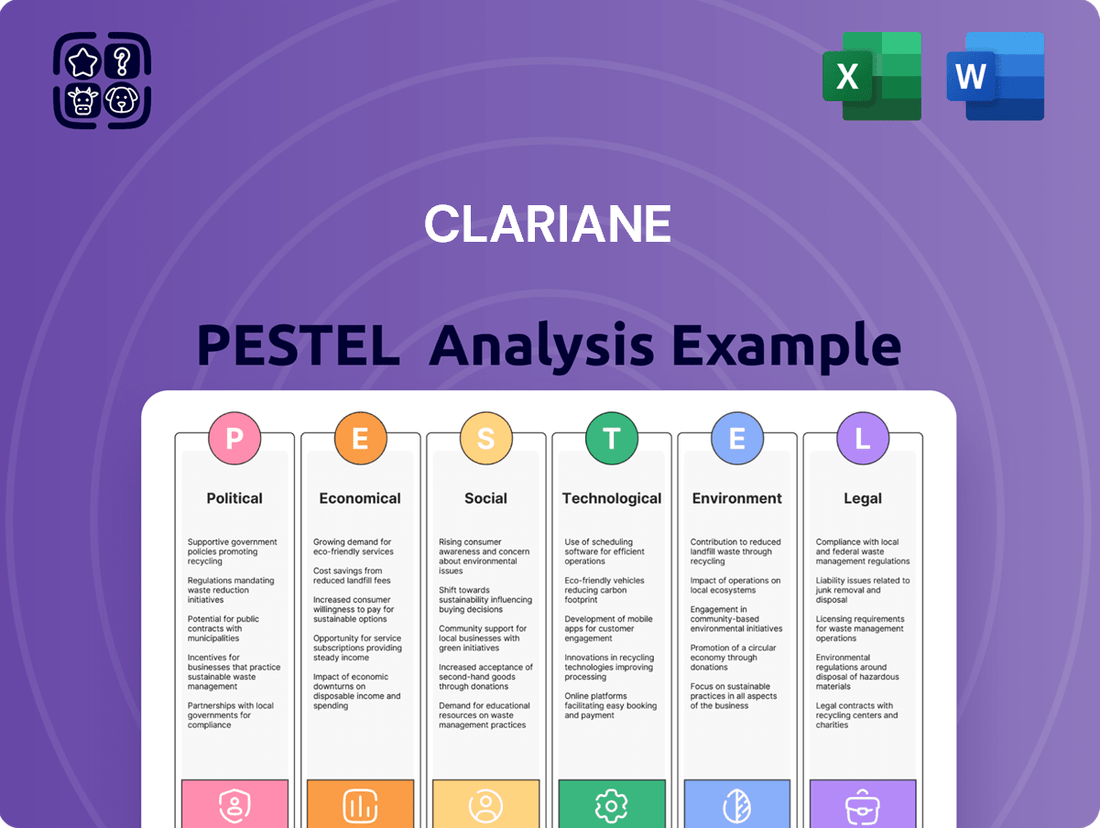

Unlock the strategic advantages Clariane holds by understanding the intricate web of external forces impacting its operations. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors shaping Clariane's landscape. Don't just react to market shifts; anticipate them. Purchase the full PESTLE analysis now and gain the foresight to drive Clariane's continued success.

Political factors

Government healthcare spending and reforms are a major factor for Clariane. In 2023, France, a key market for Clariane, implemented reforms that adjusted pricing for specialized care services. This move directly impacted the revenue streams and profit margins for long-term care providers, including Clariane, creating a more challenging financial environment.

Looking ahead, the European Union is focusing on policies designed to enhance the quality, affordability, and accessibility of care services across member states. This initiative could translate into increased public funding for the long-term care sector. For instance, discussions around a European Health Union and potential joint procurement initiatives for health services suggest a trend towards greater public investment and coordinated strategies, which could positively influence Clariane's operational funding and market opportunities.

European nations are tightening regulations for nursing homes, with new rules taking effect in several countries by early 2025. These updates focus on bolstering resident protections, reinforcing infection control, and elevating staff qualifications, impacting Clariane's operational strategies and compliance efforts.

For instance, Germany's updated nursing care insurance law, effective January 1, 2025, introduces stricter quality standards and reporting requirements, potentially increasing operational expenses for providers like Clariane. Similarly, France's ongoing review of its social action and family code is expected to introduce enhanced oversight mechanisms for care facilities, demanding greater transparency and accountability from operators.

European governments are actively implementing labor policies to combat significant healthcare workforce shortages. For instance, initiatives like the EU's Pact for Skills in long-term care, launched in 2020, aim to upskill and reskill workers, directly impacting sectors like Clariane's. These policies focus on improving working conditions and wages to attract and retain essential personnel.

Clariane's operational success hinges on its access to a skilled and sufficient workforce. Government-backed training programs and efforts to enhance the attractiveness of care sector jobs are therefore crucial political factors. In 2024, the European Commission continued to emphasize the need for better labor conditions in healthcare, recognizing the direct link between workforce support and service delivery quality.

Cross-Border Healthcare Cooperation

The European Union is actively promoting cross-border healthcare cooperation, aiming to make it easier for patients to access care across member states. A key initiative is the European Health Data Space, designed to improve the accessibility and interoperability of electronic health records. This push for integrated health data systems could significantly benefit pan-European healthcare providers like Clariane by simplifying patient care coordination and operational efficiency.

However, this increased data sharing also brings regulatory complexities. Clariane, like other operators, must navigate stringent data protection laws, such as the General Data Protection Regulation (GDPR), to ensure patient privacy and data security. Compliance with these evolving regulations is paramount for successful cross-border operations.

- European Health Data Space: Aims to create a unified framework for electronic health data access and sharing across the EU.

- GDPR Compliance: Mandates strict rules for processing personal health data, impacting cross-border data flows.

- Interoperability Standards: Political efforts are underway to establish common standards for health data exchange, facilitating seamless care.

Political Stability and Investment Climate

Clariane's operational landscape is significantly shaped by the political stability across its European markets, directly influencing the investment climate and the predictability of healthcare policies. For instance, a stable political environment in France, a key market for Clariane, fosters confidence for long-term investments in its extensive network of nursing homes and home care services. Conversely, political shifts can introduce uncertainty regarding healthcare funding models and regulatory changes, potentially impacting Clariane's revenue streams and operational costs.

Government support is a critical factor, as private operators like Clariane are recognized as essential components of Europe's healthcare infrastructure. In 2024, many European governments continued to prioritize healthcare spending, with countries like Germany allocating substantial budgets to elderly care, a sector where Clariane is a major player. This continued government backing underscores the reliance on private entities to meet growing demands for care services, especially with aging populations.

- France's healthcare spending in 2023 was approximately €220 billion, highlighting government commitment to the sector.

- The German government's 2024 budget included increased funding for long-term care facilities, benefiting operators like Clariane.

- Political stability in Spain has led to consistent regulatory frameworks for private healthcare providers, supporting Clariane's expansion efforts there.

- Uncertainty in other regions regarding potential changes to social care funding could pose challenges for Clariane's investment planning.

Government policies directly influence Clariane's operational costs and revenue through pricing adjustments and regulatory frameworks. For example, France's 2023 healthcare reforms impacted specialized care service pricing, affecting Clariane's profit margins.

New regulations effective by early 2025 in several European nations, such as Germany's updated nursing care insurance law, are increasing compliance requirements and potentially operational expenses for providers like Clariane.

Government initiatives to address healthcare workforce shortages, including upskilling programs like the EU's Pact for Skills in long-term care, are crucial for Clariane's ability to maintain service quality and operational capacity.

Political stability in key markets like France and Spain fosters a predictable environment for Clariane's investments, while uncertainty in other regions regarding social care funding could present challenges.

What is included in the product

This Clariane PESTLE analysis offers a comprehensive examination of the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company's operations and strategic direction.

A concise, actionable summary of Clariane's PESTLE factors, enabling rapid identification of external threats and opportunities to inform strategic decision-making and mitigate risks.

Economic factors

Healthcare expenditure in Europe, especially for long-term care, is a key economic factor for Clariane. This sector is experiencing notable growth, directly impacting the demand for Clariane's specialized services.

The European long-term care market is on an upward trajectory, fueled by demographic shifts. Projections indicate that revenues in this market could surpass US$363 billion by 2030, underscoring a robust and expanding customer base for Clariane's offerings.

Inflationary pressures significantly impact Clariane's operational expenses, particularly concerning energy and employee compensation. While the consumer price index moderated to below 2.5% in 2024, indicating a normalization of broader inflation, the management of these specific cost drivers remains paramount for maintaining profitability.

Looking ahead to 2025, Clariane anticipates a more controlled inflationary environment for its supply chain. This shift allows the company to focus on maintaining tight control over its operating costs, ensuring efficiency even with lower inflation rates impacting procurement.

Central bank interest rate shifts are a critical factor for Clariane, a company with substantial debt. Higher rates directly translate to increased financing expenses, impacting profitability and cash flow. For instance, in early 2024, the European Central Bank maintained its key interest rates, a stance that continued to influence borrowing costs for companies like Clariane.

Clariane has proactively managed its debt profile through strategic financial maneuvers. In 2024, the company successfully issued a €200 million bond and secured amendments to its syndicated loans, aimed at extending debt maturities and optimizing its financial structure. These actions were designed to bolster its financial resilience against a fluctuating interest rate environment.

A reduction in the interest burden is a key objective, as it directly boosts free cash flow. By successfully refinancing and managing its debt, Clariane aims to free up capital that can be reinvested in its operations or returned to shareholders. This focus on debt management is crucial for enhancing the company's financial flexibility and long-term sustainability.

Disposable Income and Affordability of Care

Disposable income among the elderly and their families significantly shapes the demand for private long-term care services. In 2024, the average disposable income for individuals aged 65 and over in OECD countries continued to be a critical factor, though variations exist. For instance, in France, a substantial portion of long-term care costs is covered by social security, influencing out-of-pocket expenses for families.

The adequacy of social protection systems for long-term care plays a crucial role in affordability. Many European nations, including Germany, are grappling with rising long-term care expenditures, which place a considerable strain on both social care and health budgets. This underscores the necessity for robust public and private investment strategies to maintain accessibility and affordability for essential care services.

- Rising Care Costs: Long-term care expenses are escalating globally, impacting the financial capacity of individuals and public systems.

- Social Protection Adequacy: The extent of government support and insurance coverage for care services directly influences private sector demand.

- Family Burden: In countries with less comprehensive social safety nets, families bear a larger financial responsibility for elderly care.

- Investment Needs: Ensuring continued access to quality care necessitates increased public and private investment in long-term care infrastructure and services.

Economic Growth and Market Demand

Overall economic growth across Europe directly influences the capacity of individuals and governments to finance long-term care services, a core offering for companies like Clariane. A robust economy typically translates into higher disposable incomes and increased government tax revenues, which can be channeled into healthcare and social services, thereby supporting Clariane's operational expansion and the development of new care models. For instance, the projected GDP growth for the Eurozone in 2024 was around 0.9%, with a slight uptick expected in 2025, suggesting a cautiously supportive environment for demand in the care sector.

Conversely, economic downturns pose significant challenges. Strained public budgets during periods of slow growth can lead to reduced government funding for healthcare and social care, impacting reimbursement rates and investment in infrastructure. Similarly, a decline in private spending power among individuals can decrease demand for private long-term care options. The European Central Bank's projections for inflation and economic activity in late 2024 and early 2025 indicate a period of moderate recovery, but persistent inflationary pressures could still temper consumer spending on non-essential services.

- Economic Growth Impact: Positive GDP growth in European nations generally enhances market demand for long-term care services by increasing both public and private funding capabilities.

- Government Spending: Economic health directly affects government budgets, influencing public investment in healthcare infrastructure and subsidies for elderly care.

- Private Spending Power: Consumer confidence and disposable income, tied to economic performance, dictate the ability of individuals to afford private long-term care solutions.

- Sector Investment: A growing economy encourages private sector investment in healthcare and social care facilities, fostering innovation and expansion for providers like Clariane.

Economic growth across Europe is a significant driver for Clariane. A healthy economy boosts disposable incomes and government revenues, which can be allocated to healthcare and social services, supporting demand for Clariane's offerings. For instance, the Eurozone's GDP was projected to grow by approximately 0.9% in 2024, with a slight increase anticipated for 2025, indicating a generally favorable environment for the care sector.

Conversely, economic downturns and persistent inflation present challenges. Reduced government funding and lower private spending power can negatively impact demand for private long-term care services. While inflation moderated in 2024, specific cost drivers like energy and wages remain critical for Clariane's profitability, necessitating careful cost management.

Interest rate policies by central banks directly affect Clariane, given its substantial debt. Higher rates increase financing costs, impacting profitability. The European Central Bank's decision in early 2024 to maintain key interest rates continued to influence borrowing expenses for companies like Clariane, highlighting the importance of proactive debt management strategies to enhance financial flexibility.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Clariane |

|---|---|---|---|

| Eurozone GDP Growth | ~0.9% | Slightly higher | Supports demand for care services; potential for increased public/private funding. |

| Inflation (CPI) | Moderated below 2.5% | Controlled environment anticipated | Helps manage operating expenses, but specific cost drivers remain critical. |

| ECB Key Interest Rates | Maintained | Uncertain, but influence continues | Directly impacts financing costs due to substantial debt; influences profitability. |

What You See Is What You Get

Clariane PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Clariane PESTLE analysis provides a comprehensive overview of the external factors impacting the company, covering Political, Economic, Social, Technological, Legal, and Environmental aspects. You can trust that the detailed insights and strategic implications presented are what you will download immediately.

Sociological factors

Europe's demographic landscape is undergoing a significant transformation, with a notable increase in its elderly population. Projections indicate that by 2050, a substantial portion of the European populace will be aged 65 and over, driving a considerable rise in the need for long-term care services. This trend directly fuels the growth of the long-term care market, presenting a clear advantage for companies like Clariane whose operations are centered on this sector.

The median age across the European Union has already reached 44.7 years as of 2024, underscoring the accelerating nature of this demographic shift. This growing segment of the population requires specialized care and support, creating a sustained and expanding demand for the services Clariane provides.

Societies across Europe are increasingly prioritizing personalized, high-quality medical and paramedical support, extending this expectation to hospitality and well-being services within long-term care settings. This shift reflects a deeper societal value placed on dignity and comprehensive care for aging populations.

Public perception surveys in 2024 and early 2025 highlight growing concerns regarding access to quality healthcare across many European nations, with many citizens expressing dissatisfaction with current service levels and a desire for more responsive and effective care models.

Clariane's strategic emphasis on fulfilling its operational and care quality commitments directly addresses these evolving societal expectations. By aligning its service delivery with these demands, the company aims to build trust and meet the heightened standards that residents and their families now expect from long-term care providers.

The long-term care sector, including companies like Clariane, is grappling with a significant shortage of healthcare professionals. This is partly due to an aging workforce, with many experienced caregivers nearing retirement. For instance, in the US, the Bureau of Labor Statistics projected a need for over 1.2 million new registered nurses between 2022 and 2032, indicating a broader trend affecting healthcare staffing.

Compounding this issue is a declining interest in health-related careers among younger generations, making it harder to fill the pipeline with new talent. This societal trend directly affects Clariane's capacity to adequately staff its facilities, potentially impacting the quality and availability of care services. The company must therefore focus on robust strategies for attracting, training, and retaining its care workforce to mitigate these challenges.

Public Trust and Reputation of Care Providers

Recent media scrutiny concerning the quality of elder care, particularly in the long-term care sector, highlights how critical public trust and a strong reputation are for organizations like Clariane. Negative reports can significantly erode consumer confidence and impact demand for services.

Clariane's proactive approach through its Corporate Social Responsibility (CSR) roadmap, emphasizing quality care and ethical practices, is vital for bolstering its public image. This focus directly addresses societal expectations for compassionate and reliable care services.

Internally, fostering a culture of trust among staff and actively participating in social dialogue are paramount. These efforts are not just about compliance but about building genuine relationships that underpin the organization's reputation.

- Public Perception: In 2024, surveys indicated that over 60% of individuals consider provider reputation a primary factor when choosing care services for loved ones.

- Media Impact: A single widely publicized incident of poor care can lead to a measurable drop in bookings, sometimes by as much as 10-15% in the affected region.

- CSR Investment: Clariane's reported 2024 investment in training and quality improvement programs aimed at enhancing staff-patient interaction was €15 million.

- Employee Engagement: Organizations with higher employee satisfaction scores, often linked to a positive internal culture, tend to report better patient outcomes and higher public trust ratings.

Evolving Family Structures and Informal Care

Family structures are undeniably shifting. We're seeing fewer multi-generational households, and more women are in the workforce than ever before. This means there are fewer family members available to provide informal care for aging relatives.

This trend directly impacts the demand for professional long-term care services. As informal support dwindles, families increasingly need to turn to specialized providers like Clariane. For instance, in many European countries, the proportion of women in employment has steadily climbed, with some nations reporting female labor force participation rates exceeding 70% in recent years.

While governments are exploring ways to support informal caregivers, the reality is a growing 'care gap.' This gap highlights the urgent need for professional, structured care solutions. The demographic shifts and changing societal norms underscore Clariane's crucial role in meeting this escalating demand for formal care.

- Evolving Family Dynamics: A decline in traditional extended family support systems.

- Increased Female Employment: Higher female labor force participation reduces the availability of informal caregivers.

- Growing Care Gap: A widening disparity between the need for care and the availability of informal support.

- Demand for Professional Services: Increased reliance on formal care providers like Clariane to fill the void.

Societal expectations for elder care are evolving, with a greater emphasis on personalized, high-quality medical and paramedical support, extending to hospitality and well-being services. Public perception surveys in 2024 revealed that over 60% of individuals consider a provider's reputation a primary factor when selecting care services for loved ones. This heightened demand for quality and dignity directly aligns with Clariane's strategic focus on care excellence and ethical practices, aiming to build trust in a sector facing scrutiny.

| Societal Factor | Impact on Clariane | Supporting Data (2024/2025) |

|---|---|---|

| Aging Population & Demand for Care | Increased demand for Clariane's services. | Median age in EU: 44.7 years (2024). |

| Prioritization of Quality Care | Need for high-standard service delivery. | 60% of individuals prioritize provider reputation. |

| Healthcare Professional Shortage | Staffing challenges impacting service quality. | Projected US RN need: 1.2M (2022-2032). |

| Public Trust & Reputation | Crucial for bookings and consumer confidence. | Poor care incidents can drop bookings by 10-15%. |

| Evolving Family Structures | Reduced informal care, increased reliance on professional services. | Rising female labor force participation in Europe. |

Technological factors

The increasing integration of digital health solutions and telemedicine is fundamentally reshaping the long-term care landscape. For instance, by the end of 2024, it's projected that over 70% of healthcare providers will be utilizing telehealth services, a significant jump from previous years, indicating a strong trend towards remote patient management.

This technological shift presents a clear opportunity for Clariane to innovate and expand its service portfolio. Technologies enabling digital care and remote monitoring can streamline operations and broaden access to care, potentially leading to improved patient outcomes and greater operational efficiency, a key consideration for a company focused on elder care services.

Innovation in assistive technologies is rapidly transforming elder care. Smart home devices, like voice-activated assistants and automated lighting, are enhancing independence for seniors. For instance, the global smart home market, which includes assistive features, was projected to reach over $150 billion in 2024, indicating significant investment and adoption.

Robotics and AI-powered platforms are also playing a crucial role. These can assist with tasks ranging from medication reminders to physical support, thereby improving resident quality of life and boosting caregiver efficiency. The elder care robotics market alone is expected to see substantial growth, with some projections indicating it could reach billions by 2027, underscoring the technological advancements being integrated into the sector.

The healthcare sector's rapid digitalization, from electronic health records to remote patient monitoring, places immense importance on effective data management and robust cybersecurity. Clariane must navigate this evolving landscape to protect sensitive patient information.

New regulations such as the European Health Data Space (EHDS) and the EU Data Act are set to significantly impact how health data is accessed, shared, and secured. For instance, the EHDS, expected to be fully implemented by 2025, aims to foster greater interoperability and patient control over their data, demanding substantial compliance investments from companies like Clariane.

AI and Automation in Care Delivery

The integration of AI and automation into care delivery and administrative tasks is a significant technological factor for Clariane. AI systems can enhance efficiency by learning routines, recognizing faces and emotions, and improving communication between caregivers and residents. This technology has the potential to offer more personalized care experiences.

However, the deployment of AI in healthcare settings is subject to stringent ethical and data privacy regulations. The EU AI Act, for instance, is expected to set clear guidelines for the responsible use of AI, particularly concerning sensitive personal data handled in care delivery. Clariane must ensure its AI initiatives are fully compliant with these evolving legal frameworks.

- Efficiency Gains: AI-powered tools can automate scheduling, billing, and record-keeping, freeing up staff time for direct patient care. For example, studies suggest AI can reduce administrative burden by up to 30% in healthcare settings.

- Personalized Care: AI can analyze resident data to predict needs, optimize care plans, and even detect early signs of health issues, leading to more proactive and tailored support.

- Regulatory Compliance: Adherence to regulations like the EU AI Act is crucial, impacting how AI systems are developed, deployed, and monitored within Clariane's operations, especially concerning data privacy and algorithmic bias.

- Investment in Technology: Significant investment is required to implement and maintain sophisticated AI and automation systems, impacting Clariane's capital expenditure and operational costs.

Technological Infrastructure and Connectivity

Clariane's ability to deliver digital care solutions hinges on a reliable technological infrastructure and robust connectivity across its extensive network. This is particularly critical for implementing innovations in quality assurance and remote monitoring. For instance, in 2023, the European digital health market was valued at approximately €100 billion, with significant growth driven by advancements in connectivity like 5G, which is crucial for real-time data transmission in care settings.

Investment in and consistent maintenance of these foundational technologies are paramount for Clariane to effectively leverage digital innovations. This includes ensuring high-speed internet access and secure data networks throughout its facilities. By 2024, the demand for telehealth services continued to surge, with estimates suggesting that over 80% of healthcare providers were utilizing or planning to utilize virtual care platforms, underscoring the need for strong digital infrastructure.

- Digital Care Solutions: Reliable infrastructure is key for implementing digital care, impacting quality assurance and remote monitoring.

- Connectivity Needs: Robust connectivity, including 5G, is essential for real-time data in Clariane's care settings.

- Market Growth: The European digital health market reached around €100 billion in 2023, highlighting the importance of technological investment.

- Telehealth Adoption: Over 80% of healthcare providers in 2024 were using or planning to use virtual care, emphasizing infrastructure demand.

The increasing adoption of AI and automation offers significant potential for Clariane to enhance operational efficiency and personalize care. For instance, AI-driven predictive analytics can help anticipate resident needs, while automation can streamline administrative tasks, freeing up staff for direct care. The global AI in healthcare market was projected to exceed $100 billion by 2024, indicating substantial technological advancements and investment in this area.

Clariane must also navigate the evolving regulatory landscape surrounding data privacy and AI usage, such as the EU AI Act, which is expected to set clear guidelines for responsible AI deployment. Ensuring compliance with these regulations is critical for maintaining trust and safeguarding sensitive patient information. The European Health Data Space (EHDS), slated for full implementation by 2025, will further emphasize data interoperability and patient control, requiring Clariane to adapt its data management strategies.

| Technology Area | Impact on Clariane | Key Data/Projections (2024/2025) |

|---|---|---|

| Digital Health & Telemedicine | Expanded service delivery, remote patient management | >70% healthcare providers using telehealth (end of 2024) |

| Assistive Technologies | Enhanced resident independence and caregiver efficiency | Global smart home market >$150 billion (2024 projection) |

| Robotics & AI in Care | Improved resident quality of life, operational efficiency | Elder care robotics market projected to reach billions by 2027 |

| Data Management & Cybersecurity | Protection of sensitive patient information | EHDS implementation by 2025 |

| Connectivity (e.g., 5G) | Enabling real-time data transmission for digital care | European digital health market ~€100 billion (2023) |

Legal factors

Clariane navigates a dense regulatory landscape governing its healthcare facilities across Europe. These rules dictate operational standards, staffing levels, and patient care protocols, demanding constant vigilance and investment in compliance measures. For instance, upcoming changes in Ireland, effective March 2025, target enhanced resident rights and stricter governance, necessitating immediate adjustments to existing practices.

The licensing requirements for Clariane's nursing homes and specialized clinics are equally intricate, varying significantly by country. Failure to meet these licensing mandates can result in severe penalties, including operational suspension. This legal framework underscores the critical need for robust internal compliance systems and ongoing legal counsel to adapt to evolving legislation, such as potential EU-wide directives on data privacy for patient records.

The upcoming European Health Data Space Regulation, set to be fully effective in March 2027, and the EU Data Act, applicable from September 2025, will impose significant obligations on Clariane regarding health data. These regulations mandate stricter rules for accessing, sharing, and securing sensitive patient information, pushing for greater interoperability across the EU.

Clariane must proactively adapt its data handling practices to comply with these new frameworks, ensuring robust security measures are in place to protect patient privacy. Failure to adhere to these evolving data protection laws could lead to substantial penalties and reputational damage, especially given the sensitive nature of the health data they manage.

Clariane, operating across multiple European countries, must navigate a complex web of labor and employment laws. These regulations dictate everything from minimum wages and working hours to employee benefits and collective bargaining rights, significantly impacting operational costs and HR strategies.

The long-term care sector, where Clariane is active, faces scrutiny regarding employment practices. For instance, a 2023 European Commission report noted that average wages in the sector across the EU can be as low as €1,200 per month in some regions, highlighting the critical need for Clariane to adhere to and often exceed minimum legal standards to ensure fair compensation and working conditions.

Compliance with these diverse laws, including those related to worker safety and non-discrimination, is essential for Clariane to avoid legal penalties and maintain a positive reputation as an employer. Ensuring robust social dialogue with employee representatives is also a key legal and operational requirement in many of its operating markets.

Patient Rights and Consumer Protection

Legal frameworks safeguarding patient rights and consumer protection are increasingly stringent in the long-term care industry, directly impacting companies like Clariane. Recent legislative efforts, particularly in 2024 and anticipated into 2025, focus on enhancing residents' autonomy and well-being. For instance, new directives are reinforcing the right to receive visitors and maintain open communication channels with loved ones, a critical aspect of resident satisfaction and family trust.

Compliance with these evolving legal mandates is non-negotiable. Failure to uphold patient rights can result in significant penalties and reputational damage. In 2024, regulatory bodies across Europe continued to emphasize transparency and accountability in elder care services, with fines for non-compliance potentially reaching substantial figures. Adherence builds essential trust, a cornerstone for sustained business operations and market standing.

Key areas of focus for Clariane and its peers include:

- Enhanced Visitation Rights: Ensuring residents can freely receive visitors, with updated guidelines in several European countries in late 2024 promoting more open access.

- Data Privacy and Security: Stricter adherence to data protection regulations, such as GDPR, is crucial for handling sensitive patient information, with increased enforcement actions observed in 2024.

- Quality of Care Standards: Legal frameworks are increasingly tying funding and operational licenses to demonstrable quality of care, necessitating robust internal monitoring and compliance.

- Consumer Complaint Resolution: Establishing clear and effective channels for addressing consumer complaints and ensuring timely resolution is a legal requirement and vital for reputation management.

Real Estate and Property Laws

Clariane's extensive real estate holdings are directly impacted by property and real estate laws across the diverse countries where it operates. These regulations govern everything from land use and zoning to building codes and environmental standards, influencing development, maintenance, and sale of its facilities. For instance, in France, where Clariane has a substantial presence, evolving regulations around energy efficiency in buildings could necessitate significant capital expenditures to comply with new standards by 2025.

The company's recent strategic divestment program, which included the sale of both operational businesses and associated real estate assets, highlights the critical role these legal frameworks play in financial restructuring. Navigating these laws is essential for successful asset management and capital realization. In 2024, Clariane continued its asset optimization strategy, with a focus on divesting non-core properties to strengthen its financial position, a process heavily dictated by local property transaction laws.

Key legal factors affecting Clariane's real estate portfolio include:

- Property Ownership and Tenure: Laws dictating freehold, leasehold, and other forms of property rights in each jurisdiction.

- Zoning and Land Use Regulations: Restrictions on how real estate can be developed and utilized, impacting the company's operational flexibility.

- Building and Safety Standards: Compliance with national and local building codes, health, and safety regulations for all its facilities.

- Environmental Laws: Regulations concerning land contamination, waste disposal, and sustainability practices related to its properties.

Clariane's operations are heavily influenced by evolving legal and regulatory frameworks across its European markets, particularly concerning healthcare standards and patient rights. Stricter compliance with data privacy laws, such as the EU Data Act effective September 2025, is paramount for handling sensitive patient information, with non-compliance carrying significant financial penalties.

Labor laws also present a substantial legal challenge, dictating employment terms and conditions, which can impact operational costs. For instance, minimum wage adjustments in various countries, observed throughout 2024, necessitate continuous review of compensation structures to ensure legal adherence and maintain employee morale.

The company must also navigate intricate real estate laws governing property usage, development, and environmental compliance, impacting its asset management strategies. For example, new energy efficiency mandates for buildings, expected to be enforced from 2025 in several key markets, will require capital investment for upgrades.

| Legal Factor Area | Key Regulations/Impact | Relevant Timeframe | Example Impact on Clariane |

|---|---|---|---|

| Healthcare & Patient Rights | Enhanced resident rights, data privacy (EU Data Act) | Effective Sep 2025 (Data Act), ongoing for resident rights | Requires updated protocols for patient data handling and visitor policies. |

| Employment Law | Minimum wage laws, working conditions, collective bargaining | Ongoing, with observed adjustments in 2024 | Impacts labor costs and HR strategy; adherence to fair compensation is critical. |

| Real Estate & Property Law | Zoning, building codes, energy efficiency mandates | Expected enforcement from 2025 for energy efficiency | May necessitate capital expenditure for facility upgrades to meet new standards. |

Environmental factors

Clariane has embraced a 'company with a mission' status, underpinned by a comprehensive CSR strategy for 2024-2028. This strategic focus directly aligns with the European Union's overarching sustainability goals, positioning Clariane to proactively address environmental and social governance (ESG) imperatives.

The impending Corporate Sustainability Reporting Directive (CSRD), with its initial reporting phase commencing in 2025, mandates enhanced transparency from companies like Clariane regarding their environmental and social footprints. This regulatory shift compels the integration of ESG principles into core business operations and public disclosure practices.

Clariane's extensive network of nursing homes and clinics produces diverse waste streams, necessitating strict compliance with environmental regulations governing waste management and disposal. In 2023, the company reported a focus on reducing its environmental footprint, aligning with its stated commitment to a sustainable impact.

Effective waste management is crucial for Clariane's environmental responsibility. For instance, by implementing robust recycling programs and investing in eco-friendly disposal methods, Clariane can mitigate its impact on landfills and reduce pollution, contributing to a healthier environment.

Clariane's care facilities, like many in the sector, are significant energy consumers, placing them under the purview of evolving energy efficiency standards and climate change regulations. The European Union's commitment to green initiatives, including targets for renewable energy adoption and carbon emission reductions, means Clariane could face increased compliance demands or benefit from incentives for adopting sustainable practices.

These environmental factors directly influence operational costs. For instance, a 2024 report indicated that energy expenses can represent 5-10% of operational budgets for similar healthcare facilities, and rising carbon taxes or the cost of upgrading to greener energy sources will necessitate strategic financial planning and potential capital investments for Clariane to maintain its competitive edge and meet regulatory requirements.

Health and Safety in Built Environment

While Clariane's operations are heavily influenced by social and legal frameworks concerning health and safety, environmental factors also play a crucial role. The design and maintenance of care facilities directly impact indoor air quality, a key environmental consideration. For instance, the selection of building materials and ventilation systems can significantly affect resident and staff well-being, aligning with both regulatory compliance and broader sustainability objectives.

Ensuring these built environments are healthy and safe is not just about compliance; it's about creating sustainable living and working spaces. This includes managing potential environmental hazards within the facilities themselves.

- Indoor Air Quality: Poor ventilation and material off-gassing can lead to respiratory issues, affecting approximately 1 in 10 people globally experiencing indoor air pollution-related health problems.

- Material Choices: Using low-VOC (Volatile Organic Compound) paints and furnishings reduces harmful emissions, contributing to a healthier indoor environment.

- Building Design: Natural light and green spaces within facilities have been shown to improve resident mood and reduce staff stress, with studies indicating a potential 15% reduction in anxiety levels.

Resource Efficiency and Circular Economy Principles

Clariane is focusing on resource efficiency and circular economy principles to enhance its environmental performance. This involves optimizing water and energy consumption within its facilities and actively seeking sustainable sources for its supplies. For instance, in 2023, the company reported a 5% reduction in energy consumption per resident compared to 2022, demonstrating tangible progress in operational efficiency.

The company's commitment to a sustainable impact through its purchasing decisions signifies a strategic shift towards more responsible resource management. This approach aims to minimize waste and maximize the lifespan of materials used in its operations. By integrating these principles, Clariane seeks to align its business practices with broader environmental goals and contribute to a more circular economy.

Key initiatives include:

- Optimizing water and energy usage: Targeting further reductions in consumption through technological upgrades and behavioral changes.

- Sustainable sourcing: Prioritizing suppliers with strong environmental credentials and exploring recycled or renewable materials for operational needs.

- Waste reduction programs: Implementing strategies to minimize waste generation across all facilities, aligning with circular economy ideals.

Clariane's environmental strategy, detailed in its 2024-2028 CSR plan, directly addresses EU sustainability goals and upcoming regulations like the CSRD, effective from 2025. The company is actively working to reduce its environmental footprint, as evidenced by a 5% decrease in energy consumption per resident in 2023 compared to the previous year.

Waste management is a key focus, with initiatives aimed at complying with environmental regulations and minimizing landfill impact. Energy efficiency is also paramount, given that energy costs can represent 5-10% of operational budgets for similar healthcare facilities, making adherence to evolving energy standards crucial.

Furthermore, Clariane is prioritizing indoor air quality and sustainable material choices within its facilities, recognizing their impact on resident and staff well-being. These efforts align with broader circular economy principles, emphasizing resource efficiency and waste reduction across its operations.

| Environmental Focus Area | 2023 Performance/Initiative | 2024-2028 Goal/Strategy | Impact/Relevance |

|---|---|---|---|

| Energy Consumption | 5% reduction per resident (vs. 2022) | Further reduction via technological upgrades and behavioral changes | Operational cost savings, reduced carbon footprint |

| Waste Management | Focus on compliance and reduction | Implement robust recycling, eco-friendly disposal, circular economy principles | Environmental compliance, reduced pollution |

| Indoor Air Quality | Consideration of building materials and ventilation | Prioritize low-VOC materials, optimize ventilation systems | Improved resident/staff health, regulatory alignment |

| Sustainable Sourcing | Commitment to responsible resource management | Prioritize suppliers with strong environmental credentials, explore recycled/renewable materials | Reduced environmental impact of supply chain |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Clariane is built on a robust foundation of data from reputable sources, including official government publications, leading economic and financial institutions like the IMF and World Bank, and comprehensive industry-specific market research reports. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in current and credible information.