Clariane Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clariane Bundle

Clariane's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the ever-present threat of new entrants. Understanding these dynamics is crucial for navigating the industry effectively.

The complete report reveals the real forces shaping Clariane’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The European long-term care sector, including providers like Clariane, is grappling with substantial labor shortages, especially for skilled nursing staff and healthcare assistants. This scarcity directly translates into increased bargaining power for employees, forcing companies to offer more competitive wages and better working conditions to attract and retain talent.

These persistent labor challenges are expected to continue well past 2025, directly impacting Clariane's operational expenses. For instance, in 2024, the average hourly wage for a registered nurse in Germany, a key market for Clariane, saw an increase of approximately 5% compared to the previous year, reflecting the heightened demand for qualified professionals.

Clariane's extensive network of facilities means real estate is a significant cost. In 2024, rising interest rates continued to influence the senior housing market, with prime yields for nursing home assets in Europe seeing an uptick. This trend directly impacts Clariane by potentially increasing the cost of acquiring or leasing new locations and influencing the valuation of its existing property portfolio.

Suppliers of specialized medical equipment, pharmaceuticals, and general consumables for nursing homes and clinics generally hold moderate bargaining power. This is because while many items have multiple vendors, the presence of unique or highly specialized medical technologies and pharmaceuticals can significantly shift leverage towards certain suppliers. For instance, a breakthrough in diagnostic imaging equipment could give its manufacturer considerable power over healthcare providers.

Clariane's substantial operational scale likely provides some advantage through bulk purchasing, which can mitigate supplier power. However, the rapid pace of innovation in medical devices means that suppliers introducing cutting-edge technology often retain significant influence. In 2024, the global medical devices market was valued at over $500 billion, highlighting the substantial economic forces at play.

Technology and Digital Solutions Providers

As the elderly care sector embraces digital transformation, technology and digital solutions providers are becoming increasingly influential. Suppliers offering telecare services, AI-driven monitoring, and digital health platforms are crucial for enhancing care quality, enabling remote patient oversight, and streamlining administrative tasks for companies like Clariane. This reliance grants these specialized tech firms a degree of bargaining power.

The market for digital health solutions in elderly care is experiencing significant growth. For instance, the global digital health market was valued at approximately $365.7 billion in 2023 and is projected to reach $1,024.2 billion by 2030, growing at a compound annual growth rate of 15.9% according to some market analyses. This expansion underscores the increasing dependence of care providers on these technological advancements.

- Increasing Demand for Digital Health: The growing adoption of telecare and AI monitoring systems in elderly care elevates the importance of specialized technology suppliers.

- Supplier Concentration: In niche areas of digital health for elder care, a limited number of highly specialized providers can concentrate market influence.

- Switching Costs: Integrating new digital platforms can involve significant costs and operational disruptions, potentially increasing the bargaining power of incumbent technology providers.

Specialized Services and Professional Expertise

Clariane's reliance on specialized services like facility maintenance, catering, and paramedical support grants these providers significant leverage. The scarcity of highly skilled professionals in these niche areas, particularly those offering specialized therapeutic services, can amplify their bargaining power. For instance, a shortage of qualified occupational therapists or specialized dementia care consultants directly impacts Clariane's operational flexibility and cost structure.

The demand for high-quality, personalized care, a cornerstone of Clariane's offering, inherently increases the value and bargaining power of expert service providers. These specialists are not easily replaceable, and their unique skills are crucial for maintaining the company's reputation and service standards. This dependence means Clariane must often negotiate terms that reflect the expertise and specialized nature of these essential external resources.

- Specialized Staffing: Clariane's need for niche healthcare professionals, such as physiotherapists or speech therapists, can be a significant cost driver.

- Facility Management Costs: The outsourcing of maintenance and catering services, especially in specialized eldercare facilities, can lead to substantial expenditure, with providers often dictating terms.

- Quality Assurance: Ensuring the high quality of external services directly impacts patient outcomes and satisfaction, giving providers with proven track records greater negotiation strength.

Suppliers of essential goods and services to Clariane, particularly those with specialized offerings or facing their own labor constraints, can exert considerable bargaining power. This is particularly evident with providers of specialized medical equipment and digital health solutions, where innovation and integration costs can shift leverage. For instance, the increasing reliance on advanced monitoring systems means technology providers hold significant sway.

The bargaining power of suppliers is influenced by factors such as the uniqueness of their offerings and the concentration of providers in specific niches. For Clariane, this means that while bulk purchasing can offer some leverage, the need for specialized, high-quality inputs in areas like advanced medical technology or skilled care staffing can lead to higher costs. In 2024, the global medical devices market exceeding $500 billion underscores the economic weight of these suppliers.

The trend towards digital transformation in elderly care further empowers technology suppliers. Companies providing telecare, AI-driven monitoring, and digital health platforms are becoming indispensable, granting them increased negotiation strength due to the critical nature of their services and the potential switching costs for Clariane. The projected growth of the digital health market, estimated to reach over $1 trillion by 2030, highlights this trend.

| Supplier Category | Bargaining Power Factors | Impact on Clariane | 2024 Data/Trend |

|---|---|---|---|

| Specialized Medical Equipment | Technological innovation, R&D intensity | Potential for higher acquisition costs, dependence on specific vendors | Global medical devices market valued over $500 billion |

| Digital Health Solutions | Integration complexity, switching costs, data security | Increased reliance on tech providers, potential for recurring service fees | Digital health market projected to exceed $1 trillion by 2030 |

| Niche Healthcare Staffing | Scarcity of specialized skills (e.g., therapists) | Higher labor costs, operational challenges if services are unavailable | ~5% wage increase for registered nurses in Germany (2024) |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Clariane's operations in the elderly care sector.

Instantly identify key competitive pressures and opportunities with a visual, easy-to-understand breakdown of each force.

Customers Bargaining Power

Europe's rapidly aging population is a significant driver for Clariane, creating a large and growing customer base for its long-term care services. The demand for nursing homes, specialized clinics, and assisted living facilities is set to increase substantially. In fact, the number of individuals requiring long-term care in the EU is projected to grow from 30.8 million in 2019 to 38.1 million by 2050, underscoring the robust market expansion.

Government funding significantly influences the bargaining power of customers in the long-term care sector, including for companies like Clariane. A substantial portion of these services is often funded or subsidized by national healthcare systems and social security programs. For instance, in 2024, many European countries continue to grapple with increasing healthcare expenditures, with long-term care representing a growing segment of public spending. This reliance on public funding means that changes in government reimbursement rates, regulatory frameworks, or public investment directly impact Clariane's revenue streams and profitability.

Governments are often under pressure to increase public spending on long-term care to meet the needs of aging populations, yet they also face considerable challenges in securing adequate funding. This creates a dynamic where governments can exert considerable influence by adjusting reimbursement levels, which in turn affects the effective price customers pay and their overall willingness to pay. For example, if a government decides to cap reimbursement rates, it can effectively reduce the revenue Clariane can generate per patient, thereby increasing the customer's (or payer's) bargaining power.

The increasing demand for home-based care, driven by technological advancements like telehealth and remote monitoring, empowers customers. This shift offers alternatives to traditional institutional settings, giving individuals more leverage when choosing care providers. For instance, in 2023, the global home healthcare market was valued at approximately $370 billion and is projected to grow significantly, indicating a strong customer preference for these services.

Information Availability and Choice

The burgeoning availability of information through specialized care home marketplaces and digital comparison platforms significantly bolsters customer bargaining power. These resources empower individuals and their families to scrutinize services, compare quality ratings, and evaluate pricing with unprecedented ease. This heightened transparency allows customers to make more informed decisions regarding their long-term care needs, directly influencing their ability to negotiate terms.

For instance, platforms like CareChoices in the UK reported a 20% increase in user inquiries for care homes in the first half of 2024, indicating a growing reliance on digital tools for research. Startups are actively innovating in the elderly care sector, developing platforms designed to enhance access to information and improve the overall efficiency of the care selection process. This trend suggests a continued shift towards greater customer agency in the market.

- Enhanced Information Access: Digital platforms provide comprehensive data on care homes, including services, staff-to-resident ratios, and inspection reports.

- Price Transparency: Customers can easily compare pricing structures across different providers, leading to more competitive offers.

- Quality Benchmarking: User reviews and independent ratings allow for a clearer understanding of the quality of care offered by various facilities.

- Startup Innovation: New entrants are focused on simplifying the search and selection process, further empowering consumers.

Severity of Needs and Urgency

For individuals requiring specialized medical care, the severity of their needs often dictates their priorities. When conditions are complex or dependency levels are high, the immediate concern shifts from price to the availability and quality of essential services. This urgency can significantly diminish their immediate bargaining power, as finding appropriate and reliable care becomes paramount.

Clariane's strategic positioning addresses this dynamic. By concentrating on high-quality medical and paramedical support, the company caters directly to these critical needs. For instance, in 2024, the demand for specialized home healthcare services for chronic conditions, such as advanced dementia or post-operative recovery, saw a notable increase, highlighting the importance of expert care over cost considerations for many families.

- High Dependency Needs: Patients with severe chronic illnesses or disabilities often prioritize the expertise and reliability of care providers.

- Urgency of Care: The immediate need for medical attention or ongoing support reduces the customer's ability to negotiate terms.

- Quality Over Cost: For critical health situations, the perceived quality of service and the provider's reputation often outweigh price sensitivity.

- Clariane's Focus: The company's emphasis on medical and paramedical expertise aligns with the non-negotiable needs of vulnerable patient populations.

The bargaining power of customers in Clariane's sector is influenced by increasing information availability and the growing demand for home-based care, which offer alternatives to traditional facilities. Platforms providing detailed comparisons of services and pricing empower individuals to negotiate more effectively. For example, user inquiries on care home comparison sites saw a significant rise in early 2024.

However, the urgency and complexity of medical needs can reduce customer bargaining power, as the priority shifts to the quality and availability of specialized care. Clariane's focus on high-quality medical support caters to these critical needs, where expertise often outweighs cost considerations, especially for chronic conditions requiring advanced care.

| Factor | Impact on Bargaining Power | Example/Data (2023-2024) |

| Information Access | Increases power | 20% rise in user inquiries on care comparison platforms (early 2024) |

| Home Care Demand | Increases power | Global home healthcare market valued at ~$370 billion (2023) |

| Medical Urgency/Complexity | Decreases power | Increased demand for specialized chronic condition care (2024) |

| Government Funding | Influences power | Ongoing adjustments in reimbursement rates impact effective pricing |

Preview the Actual Deliverable

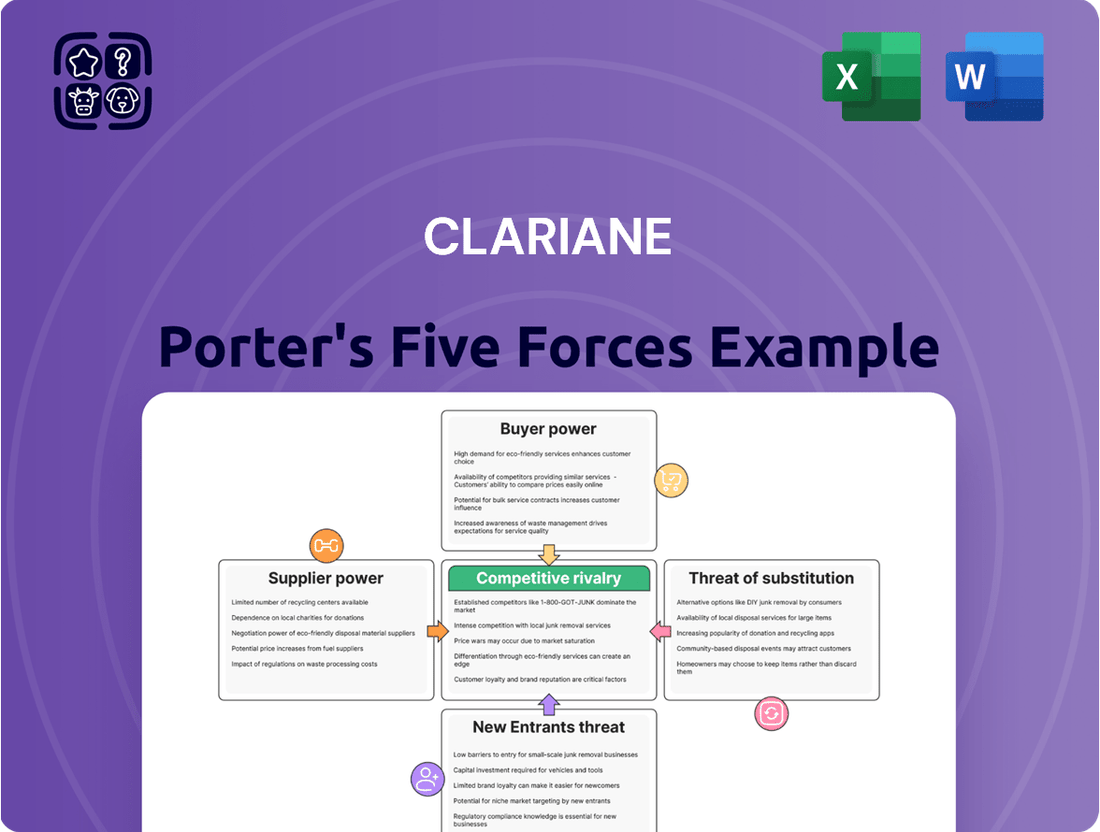

Clariane Porter's Five Forces Analysis

This preview showcases the complete Clariane Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of the company. The document you see here is the exact, professionally formatted report you will receive instantly upon purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

The European long-term care sector, where Clariane operates, presents a competitive rivalry characterized by its size and growth, yet it remains somewhat fragmented. This means Clariane, despite being a European leader, faces competition from a multitude of smaller, local providers, creating a dynamic environment for attracting residents and skilled caregivers.

This competitive intensity is further fueled by ongoing consolidation. For instance, in 2023, the care property market saw significant investment and merger activity across Europe, underscoring the trend of larger entities acquiring smaller ones. This consolidation suggests a market in transition, where scale and efficiency are becoming increasingly important competitive factors.

Competitive rivalry within the long-term care sector, including for companies like Clariane, is intensely shaped by the perceived quality of care and an organization's reputation. These factors directly influence patient outcomes and resident satisfaction.

Clariane, for instance, focuses on offering personalized, high-caliber medical and paramedical assistance, complemented by hospitality and well-being services, as key differentiators in a crowded market.

In 2024, the emphasis on quality care is paramount, as a strong reputation for excellence is vital for attracting and retaining both residents and patients, directly impacting occupancy rates and revenue streams.

Clariane's extensive geographic footprint across Europe, encompassing countries like France, Germany, and Belgium, coupled with its diverse service offerings—from traditional nursing homes to specialized clinics and assisted living—acts as a significant buffer against localized economic downturns or sector-specific pressures. This broad operational base means that while rivalry might be intense in certain regions or service lines, the company is not overly exposed to any single market. For instance, as of early 2024, Clariane managed over 100,000 beds across these varied markets, presenting a complex competitive landscape where rivals might specialize in a particular country or a niche service, such as dementia care, thereby intensifying competition within those specific segments.

Financial Strength and Investment Capacity

Clariane's ability to invest in its operations is a crucial element of its competitive standing. The company has been actively working to bolster its financial health, which directly impacts its capacity to invest in new facilities, upgrade existing ones, and integrate cutting-edge technologies. This financial strengthening is paramount for maintaining and enhancing its competitive edge in the market.

A significant part of Clariane's strategy involves financial restructuring. This includes measures like capital increases and the divestment of certain assets. The primary goals of these actions are to reduce the company's overall debt burden and improve its leverage ratios, thereby creating a more robust financial foundation for future growth and investment.

The success of Clariane's financial restructuring is directly linked to its long-term competitiveness. By improving its financial position, the company enhances its ability to fund strategic initiatives, such as expansion projects and technological advancements, which are vital for staying ahead of rivals.

- Financial Restructuring: Clariane has initiated capital increases and asset disposals to reduce debt and improve leverage.

- Investment Capacity: A stronger financial position enables investment in new facilities, modernization, and technology adoption.

- Long-Term Competitiveness: Financial health is directly tied to Clariane's ability to compete and expand effectively.

Staffing and Talent Acquisition

The healthcare sector in Europe, including France where Clariane operates, is experiencing significant labor shortages. This scarcity intensifies competition among companies for qualified staff, particularly nurses and caregivers. For instance, in 2023, the French Ministry of Health reported a deficit of tens of thousands of nurses.

Companies that excel in attracting and retaining talent through robust HR strategies, competitive compensation, and positive work environments hold a distinct advantage. This includes offering comprehensive training and development opportunities, which are crucial for upskilling existing staff and attracting new talent. Clariane's investment in employee well-being and continuous training programs directly addresses this intense rivalry for skilled professionals.

- Intensified Competition: Widespread labor shortages in European healthcare create a highly competitive environment for skilled professionals.

- Attraction Factors: Strong HR policies, appealing work conditions, and effective training programs are key differentiators.

- Clariane's Strategy: The company's focus on employee development and training is a direct response to this competitive pressure.

- Market Data: France, for example, faced a shortage of tens of thousands of nurses in 2023, highlighting the critical need for talent acquisition.

Competitive rivalry in the European long-term care sector is fierce, driven by a fragmented market and ongoing consolidation. Clariane, as a major player, contends with numerous local providers and larger entities acquiring smaller ones. The perceived quality of care and a strong reputation are paramount differentiators, directly influencing resident satisfaction and occupancy rates.

Clariane's extensive European presence, spanning over 100,000 beds across France, Germany, and Belgium as of early 2024, provides a degree of market resilience. However, this broad footprint also means facing specialized competitors in specific niches, such as dementia care, intensifying rivalry within those segments.

The company's financial restructuring, including capital increases and asset disposals, aims to bolster its investment capacity. This financial health is critical for upgrading facilities and adopting new technologies, essential for maintaining a competitive edge against rivals.

Labor shortages, particularly for nurses and caregivers, significantly fuel competition for talent across Europe. In 2023, France alone reported a deficit of tens of thousands of nurses. Companies like Clariane that invest in robust HR strategies, competitive compensation, and employee development gain a distinct advantage in attracting and retaining skilled staff.

| Key Competitive Factors | Clariane's Position/Strategy | Market Context (2023-2024) |

| Market Fragmentation & Consolidation | Operates as a European leader amidst numerous smaller, local competitors and increasing M&A activity. | Significant investment and merger activity in the care property market across Europe in 2023. |

| Quality of Care & Reputation | Focuses on personalized, high-caliber medical, paramedical, hospitality, and well-being services. | Reputation for excellence is vital for attracting/retaining residents, impacting occupancy and revenue. |

| Geographic Diversification & Specialization | Manages over 100,000 beds across France, Germany, Belgium, offering diverse services. | Rivals may specialize in specific countries or niches (e.g., dementia care), intensifying segment-specific competition. |

| Financial Health & Investment Capacity | Undergoing financial restructuring (capital increases, asset disposals) to reduce debt and improve leverage. | Improved financial position enables investment in facility upgrades and technology adoption. |

| Talent Acquisition & Retention | Invests in employee well-being and continuous training programs. | Labor shortages, especially for nurses (e.g., tens of thousands deficit in France in 2023), drive competition for skilled staff. |

SSubstitutes Threaten

Home healthcare services are increasingly becoming a potent substitute for traditional institutional long-term care. This shift is fueled by a strong consumer preference for aging in place, allowing individuals to remain in their familiar surroundings, and by rapid advancements in remote monitoring and telehealth technologies.

The European home healthcare market, for instance, is experiencing robust growth. In 2024, projections indicated a market value exceeding €100 billion, with significant investment flowing into telecare and digital health solutions designed to support at-home care. This expansion directly challenges the market share of conventional nursing homes and residential care facilities.

Informal caregiving, primarily by family members, represents a significant substitute for professional long-term care services. In 2024, it's estimated that millions of unpaid caregivers in the US alone provided care, a figure that continues to grow. This reliance on informal care can directly impact the demand for formal care providers like Clariane.

Government policies that offer support or tax breaks to informal caregivers can further strengthen this substitute. Conversely, increasing societal expectations for family involvement in elder care, coupled with persistent workforce shortages in the formal care sector, which saw a notable deficit in qualified personnel in many regions throughout 2024, pushes more individuals towards seeking or relying on informal solutions.

Technological advancements are increasingly offering robust alternatives to traditional senior living facilities. Innovations like smart home systems, wearable health monitors, and AI-driven personal assistants empower individuals to maintain independence in their own residences. For instance, the global smart home market was valued at approximately $84.5 billion in 2023 and is projected to grow significantly, indicating a substantial shift towards home-based solutions.

Assisted Living and Independent Living Facilities

The threat of substitutes for traditional nursing homes is significant, particularly from assisted living and independent living facilities. These alternatives provide seniors with varying levels of support, often at a lower cost or with a greater emphasis on independence, appealing to a segment that may not require the intensive medical care associated with nursing homes. For instance, in 2024, the U.S. assisted living market was valued at approximately $80 billion, showcasing substantial consumer preference for these less intensive care models.

Clariane, recognizing this trend, actively participates in these substitute markets by offering its own assisted living facilities. This diversification allows the company to capture a broader segment of the senior living market. The growth in this sector is further evidenced by projections indicating the U.S. senior living market could reach over $100 billion by 2027, with assisted living being a key driver.

- Assisted Living: Offers help with daily activities like bathing and medication management, fostering independence.

- Independent Living: Provides amenities and social opportunities for active seniors who need no daily assistance.

- Market Value: The U.S. assisted living market reached around $80 billion in 2024.

- Growth Potential: The overall senior living market is expected to exceed $100 billion by 2027.

Community-Based and Day Care Centers

Community-based and day care centers present a significant threat of substitutes for residential care facilities. These centers provide social interaction, supervision, and basic care services during the day, enabling seniors to continue living in their own homes. This can be a compelling alternative for individuals whose needs are not yet severe enough to require 24/7 residential care.

The demand for such services is growing, reflecting an aging population and a preference for aging in place. For instance, in the United States, the number of individuals aged 65 and over is projected to reach 80 million by 2040. Adult day care services, a key component of this substitute threat, offer a flexible and often more affordable option compared to full-time nursing home care.

- Market Growth: The U.S. adult day care market was valued at approximately $4.5 billion in 2023 and is expected to grow.

- Substitution Impact: These centers directly compete by offering daytime care, reducing the need for overnight residential facilities for many seniors.

- Cost-Effectiveness: Day care programs are typically less expensive than full-time residential care, making them an attractive substitute for budget-conscious families.

The threat of substitutes for traditional nursing homes is substantial, primarily from home healthcare and assisted living facilities. These alternatives cater to a growing preference for aging in place and offer more independence, often at a lower cost. For example, the European home healthcare market was projected to exceed €100 billion in 2024, highlighting a significant shift away from institutional care.

Informal caregiving by family members also represents a major substitute, with millions of unpaid caregivers in the US alone providing care in 2024. Government support for these caregivers and workforce shortages in the formal sector further bolster this trend, impacting demand for professional services like those offered by Clariane.

Technological advancements, such as smart home systems and wearable health monitors, empower individuals to remain independent at home, posing another strong substitute. The global smart home market, valued at approximately $84.5 billion in 2023, demonstrates the increasing adoption of these technologies.

Assisted living facilities, which offer support with daily activities, are also significant substitutes. The U.S. assisted living market was valued at approximately $80 billion in 2024, indicating strong consumer interest in these less intensive care models compared to traditional nursing homes.

| Substitute Type | 2024 Market Data/Projections | Impact on Traditional Nursing Homes |

|---|---|---|

| Home Healthcare (Europe) | Exceeded €100 billion | Directly competes by enabling aging in place. |

| Informal Caregiving (US) | Millions of unpaid caregivers | Reduces demand for paid, residential care. |

| Smart Home Technology | Global market ~$84.5 billion (2023) | Enhances independence, reducing need for facility-based care. |

| Assisted Living Facilities (US) | ~$80 billion | Offers a less intensive, often more affordable alternative. |

Entrants Threaten

The healthcare sector, particularly long-term care, presents a significant threat of new entrants due to high capital investment requirements. Establishing and operating nursing homes, specialized clinics, and assisted living facilities demands substantial upfront capital for real estate acquisition or development, state-of-the-art infrastructure, and specialized medical equipment. For instance, constructing a new, fully equipped nursing home in a major metropolitan area can easily cost tens of millions of dollars, a figure that acts as a formidable barrier.

The long-term care sector, where Clariane operates, is a minefield of regulations. New companies entering this space must contend with a patchwork of licensing requirements, quality standards, and funding models that differ significantly from one European country to another. For instance, Germany's Pflegestärkungsgesetz (Care Strengthening Act) introduced new assessment procedures and funding adjustments that new entrants must fully grasp.

Navigating these intricate and often country-specific regulatory frameworks is a formidable barrier. It demands substantial investment in legal and compliance expertise to ensure adherence to medical and care standards, which are often stringent and meticulously enforced. This complexity significantly deters potential new competitors who may lack the resources or specialized knowledge to manage such a landscape.

In the long-term care sector, brand reputation is a significant barrier to entry. Clariane, for instance, has cultivated trust over many years, a crucial element for attracting residents and their families. New competitors face the daunting task of building comparable credibility and recognition, which requires substantial time and financial commitment.

Workforce Recruitment and Retention Challenges

The significant shortage of skilled healthcare professionals across Europe presents a substantial hurdle for new entrants aiming to establish themselves in the sector. This scarcity makes it difficult for newcomers to recruit and retain the necessary talent to operate their facilities effectively.

Established companies often possess well-developed recruitment networks, robust training programs, and proven employee retention strategies. These existing advantages are not easily replicated by new market participants, creating a considerable barrier to entry.

For instance, in 2024, reports indicated a deficit of over 1 million healthcare professionals in Germany alone, underscoring the intensity of this labor market constraint. This situation directly impacts the ability of new companies to scale operations and compete.

- Skilled Workforce Shortage: A critical lack of qualified healthcare staff across Europe.

- Established Recruitment Channels: Incumbents benefit from existing, proven hiring pipelines.

- Retention Strategies: Existing players have developed loyalty programs and career paths that are hard for newcomers to match.

- Impact on New Entrants: Difficulty in staffing facilities adequately, hindering competitive entry.

Access to Funding and Real Estate

Newcomers to the senior housing market face significant hurdles in obtaining capital and prime real estate. While investor appetite for the sector grew, particularly in 2024, securing substantial financing for ambitious projects and acquiring desirable land remains a challenge.

Established companies often leverage existing lender relationships and extensive property holdings, creating a competitive advantage. For instance, in 2024, the average cost of land suitable for senior living development in major metropolitan areas continued to rise, making entry more expensive for new players.

- Financing Challenges: New entrants often struggle to secure the large-scale loans needed for development, as lenders may perceive them as higher risk compared to established operators.

- Real Estate Acquisition: Prime locations are scarce and expensive, with established entities often having pre-existing ownership or strong negotiation power for desirable sites.

- Investor Relations: Existing players have cultivated long-term relationships with investors, facilitating easier capital raises for expansion or new projects.

The threat of new entrants in Clariane's long-term care sector is moderate, primarily due to high capital requirements and stringent regulatory landscapes. While the sector's growth potential attracts new players, the substantial investment needed for facilities and navigating complex, country-specific rules acts as a significant deterrent.

The need for substantial capital investment, including real estate and specialized equipment, presents a considerable barrier. For instance, establishing a new, modern nursing facility can easily run into tens of millions of euros, a figure that new entrants must overcome. This financial hurdle is compounded by the difficulty in securing prime real estate, with established operators often holding advantageous land portfolios.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | High costs for real estate, infrastructure, and equipment. | Requires significant upfront funding, limiting the number of potential entrants. |

| Regulatory Complexity | Navigating diverse national licensing, quality, and funding standards. | Demands specialized legal and compliance expertise, increasing operational costs. |

| Skilled Workforce Shortage | Difficulty in recruiting and retaining qualified healthcare professionals. | Hinders operational capacity and service quality, impacting competitive positioning. |

| Brand Reputation | Building trust and recognition in a sensitive care sector. | Requires substantial time and investment to establish credibility comparable to incumbents. |

Porter's Five Forces Analysis Data Sources

Our Clariane Porter's Five Forces analysis is built upon a foundation of diverse data sources, including Clariane's official annual reports, investor presentations, and press releases. We supplement this with insights from reputable industry analysis firms and market research reports focused on the European healthcare and senior living sectors.