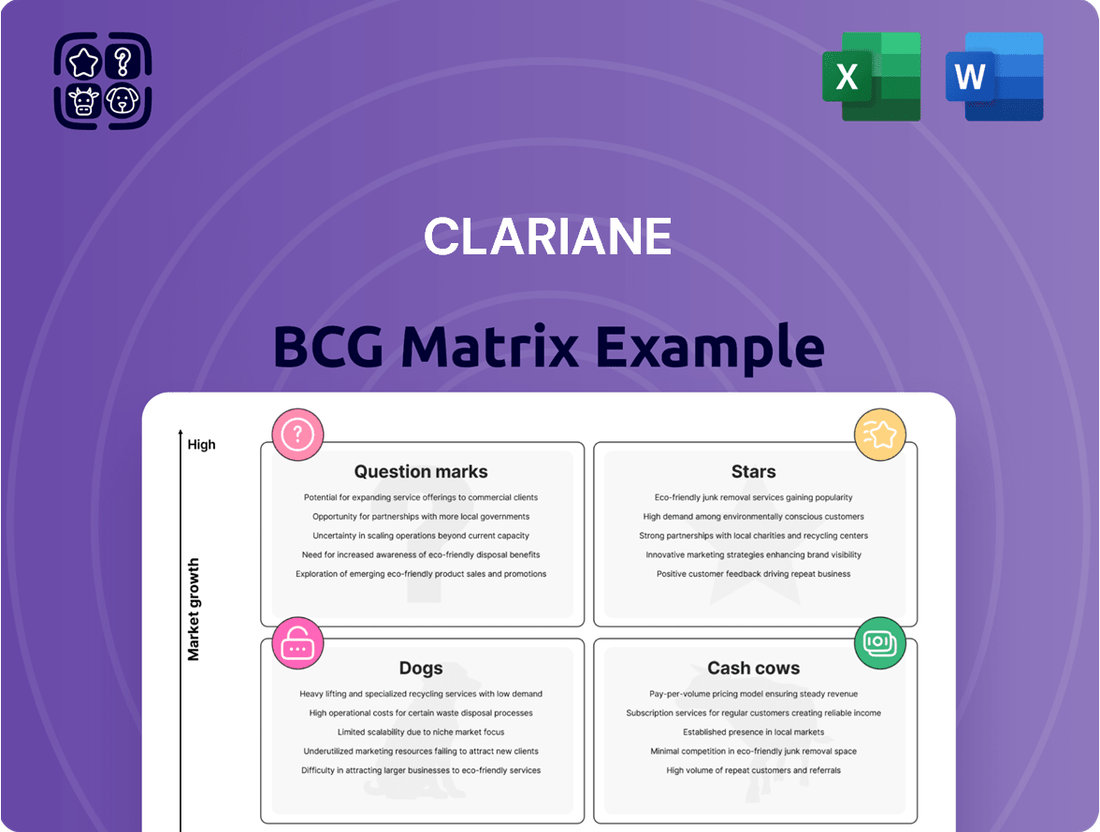

Clariane Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clariane Bundle

Uncover the strategic brilliance behind Clariane's product portfolio with this insightful BCG Matrix preview. See how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and prepare for informed decision-making.

Don't settle for a glimpse; invest in the complete Clariane BCG Matrix to unlock detailed quadrant analysis, actionable strategies, and a clear roadmap for optimizing resource allocation and driving future growth. Purchase the full report today for unparalleled strategic clarity.

Stars

Clariane's German operations are a star performer within the company's portfolio, exhibiting robust organic growth of 8.0% in the first quarter of 2025. This impressive figure highlights a strong market presence and effective strategy in one of Europe's largest economies.

Similarly, the Benelux region is a key growth driver for Clariane, reporting an organic growth rate of 7.8% in Q1 2025. This consistent high performance in neighboring markets underscores Clariane's strategic advantage and operational excellence in these territories.

The combined strength of German and Benelux operations significantly surpasses the group's overall average growth, positioning these regions as stars in Clariane's BCG matrix. This success is likely a result of targeted investments and a deep understanding of local market dynamics.

Clariane is strategically focusing on health innovation within specialized rehabilitation and mental health services, areas experiencing significant demand growth across Europe. This focus on niche, high-growth segments like psychiatry and addiction care is a key part of their market leadership expansion strategy.

By investing in these specialized clinics, Clariane is positioning them as crucial growth drivers for the company's future. For instance, the European mental health services market alone was valued at approximately €150 billion in 2023 and is projected to grow substantially, with specialized care being a key component.

Clariane is making significant investments in AI-driven innovations, telemedicine, and digital health solutions. These technologies are poised to revolutionize patient diagnosis, streamline care pathways, and boost operational efficiency across the healthcare landscape. This sector is experiencing rapid evolution and substantial growth, making it a key area for future development.

The company's strategic emphasis on integrating advanced technologies like artificial intelligence and digital platforms positions these initiatives as potential stars in the Clariane BCG matrix. By focusing on these high-growth areas, Clariane aims to capture a substantial share of the evolving healthcare market. For instance, the global digital health market was valued at approximately USD 211 billion in 2023 and is projected to grow significantly in the coming years.

Expansion of Outpatient Care Services

Clariane's medium-term strategy places significant focus on boosting activity in Specialized Care, especially through outpatient services. This move is well-positioned to capitalize on the growing trend of de-institutionalization and community-based healthcare, a segment experiencing rapid expansion.

The company's expansion initiatives are designed to capture a greater market share in this dynamic sector. For instance, in 2024, Clariane reported a notable increase in its outpatient care offerings, aiming to meet the rising demand for accessible and specialized medical services outside traditional hospital settings.

- Growth Driver: Outpatient care is identified as a key growth area within Clariane's portfolio.

- Market Trend Alignment: Expansion aligns with the shift towards community-based and less institutionalized healthcare models.

- Strategic Objective: Clariane aims to increase its market presence in the high-growth outpatient segment.

- 2024 Focus: The company actively invested in expanding its outpatient service capacity during 2024.

New High-Value Service Offerings

Clariane is actively developing new, high-value service offerings within its innovation strategy, focusing on personalized, high-quality medical and paramedical support. This includes expanding into new activity areas such as sleep and pain management, aiming to capture premium market segments with differentiated care.

The company's strategic pivot towards specialized services allows it to address growing market needs more effectively. For example, in 2024, Clariane reported a significant increase in demand for its home healthcare services, particularly those catering to chronic conditions and post-operative recovery, indicating a strong market appetite for these specialized offerings.

- Personalized Medical Support: Clariane's commitment to tailored care plans enhances patient outcomes and satisfaction.

- Expansion into New Segments: Targeting areas like sleep disorders and pain management diversifies revenue streams.

- Innovation Framework: Integrating new activities demonstrates a proactive approach to evolving healthcare demands.

- Premium Market Capture: Differentiated, high-quality services position Clariane for leadership in specialized healthcare niches.

Clariane's German and Benelux operations are clear stars, demonstrating exceptional growth rates of 8.0% and 7.8% respectively in Q1 2025. These regions significantly outperform the group average, positioning them as key revenue generators. Their success is attributed to strong market penetration and effective localized strategies.

The company's strategic focus on specialized care, particularly in mental health and rehabilitation, is also a star performer. The European mental health market, valued at €150 billion in 2023, offers substantial growth potential, with Clariane actively investing in specialized clinics to capture this demand. AI and digital health solutions further bolster this star status, leveraging a global digital health market valued at USD 211 billion in 2023.

Clariane's expansion into outpatient services and new high-value offerings like sleep and pain management are emerging stars. The company reported a notable increase in outpatient care capacity in 2024, aligning with the trend towards community-based healthcare. These specialized, personalized services cater to premium market segments, driving future growth.

| Clariane Business Segment | BCG Category | Key Performance Indicator (2025 Q1 unless noted) | Market Context |

|---|---|---|---|

| German Operations | Star | Organic Growth: 8.0% | Strong market presence in a major European economy. |

| Benelux Operations | Star | Organic Growth: 7.8% | Consistent high performance in neighboring markets. |

| Specialized Care (Mental Health, Rehabilitation) | Star | High demand growth, strategic investment focus | European mental health market valued at €150 billion (2023). |

| Digital Health & AI Innovations | Star | Investment in AI, telemedicine, digital platforms | Global digital health market valued at USD 211 billion (2023). |

| Outpatient Services | Emerging Star | Increased capacity in 2024, alignment with de-institutionalization trend | Growing demand for accessible, community-based care. |

| New High-Value Services (Sleep, Pain Management) | Emerging Star | Expansion into premium, differentiated care segments | Catering to growing demand for personalized medical support. |

What is included in the product

The Clariane BCG Matrix analyzes business units based on market share and growth, guiding investment decisions.

A clear BCG Matrix visualizes portfolio strengths, easing the pain of resource allocation decisions.

Cash Cows

Clariane's core long-term care nursing home network is the bedrock of its operations, making up a substantial 63% of the company's overall business. This segment represents a mature market where Clariane holds a significant market share, evidenced by a robust average occupancy rate of 90.4% in the first quarter of 2025.

This high and consistent occupancy demonstrates the network's stability and its role as a dependable generator of revenue and cash flow for Clariane. It's a classic example of a cash cow within the BCG matrix, providing the financial fuel for other ventures.

France represents Clariane's most established market, a cornerstone of its long-term care services. Despite some revenue shifts from divestitures, this mature European market continues to be a significant revenue contributor, underpinning the group's financial stability.

Clariane's deep roots and substantial market share in France translate into consistent cash flow generation. This reliable performance from its French operations provides a solid financial base for the company's broader strategic initiatives.

Clariane's extensive real estate portfolio, valued at €2.6 billion as of June 2025, serves as a foundational asset for its operational needs. Despite ongoing divestments, the remaining prime properties are key income generators.

These high-value assets contribute stable cash flows, primarily through rental income and potential capital gains. This consistent, albeit low-growth, revenue stream firmly places the real estate segment within the cash cow category of the BCG matrix.

Basic Hospitality and Well-being Services

Basic Hospitality and Well-being Services represent a significant Cash Cow for Clariane. These services are fundamental to the daily lives of residents in Clariane's care homes and facilities, leading to consistent demand and high utilization rates. They are a stable revenue generator that doesn't necessitate substantial new investments to maintain its performance.

This segment reliably produces substantial cash flow for Clariane, supporting other areas of the business. For instance, in 2024, Clariane reported a revenue of €2.3 billion, with a significant portion stemming from these essential resident services. The operational efficiency of these offerings allows them to contribute positively to the company's bottom line without the need for aggressive expansion plans.

- Consistent Demand: High occupancy rates in Clariane's facilities ensure steady income from core hospitality and well-being services.

- Profitability: These services are a stable profit driver, contributing to overall financial health.

- Low Investment Needs: Unlike growth-oriented Stars or Question Marks, Cash Cows require minimal new capital expenditure to maintain their market position.

- Cash Generation: They are the primary source of readily available cash for Clariane, funding other strategic initiatives.

Mature Assisted Living Facilities

Clariane's mature assisted living facilities are classic cash cows within the BCG matrix. These facilities serve a well-established customer base, leading to predictable and stable occupancy rates.

Operating in a mature segment of the elder care market, these facilities are designed to generate consistent revenue and robust cash flow. Their established nature means they require very little in terms of new investment for marketing or market penetration, making them highly efficient generators of cash for the company.

In 2024, the assisted living sector continued to show resilience. For instance, occupancy rates in many established facilities remained strong, often exceeding 85%, reflecting the ongoing demand for such services.

- Mature Market Presence: Clariane's assisted living facilities are situated in markets where demand is stable and well-understood.

- Stable Revenue Streams: These facilities benefit from consistent occupancy and predictable fee structures, ensuring reliable income.

- Low Investment Needs: Significant capital expenditure is not typically required for growth, allowing for efficient cash conversion.

- High Cash Generation: The combination of stable revenue and low investment needs positions them as key cash cows for Clariane.

Clariane's core long-term care nursing homes and its French operations are prime examples of cash cows. These segments benefit from high, stable occupancy rates, such as the 90.4% seen in Q1 2025 for the nursing home network. They generate consistent cash flow with minimal need for new investment, effectively funding other business areas.

The company's extensive real estate portfolio, valued at €2.6 billion as of June 2025, also acts as a cash cow. Rental income from these assets provides a predictable and low-growth revenue stream, contributing to Clariane's overall financial stability.

Basic hospitality and well-being services, which brought in a significant portion of Clariane's €2.3 billion revenue in 2024, are also classified as cash cows. Their consistent demand and operational efficiency ensure they are stable profit drivers with low investment requirements.

Clariane's mature assisted living facilities, with occupancy rates often exceeding 85% in 2024, are another strong cash cow. Operating in a stable market segment, these facilities generate reliable income and require limited new capital for growth.

| Segment | BCG Category | Key Characteristic | Supporting Data (as of mid-2025 or 2024) |

| Long-Term Care Nursing Homes | Cash Cow | Mature market, high occupancy | 63% of business, 90.4% occupancy (Q1 2025) |

| French Operations | Cash Cow | Established market, consistent cash flow | Significant revenue contributor, stable financial base |

| Real Estate Portfolio | Cash Cow | Valuable assets, rental income | €2.6 billion valuation (June 2025), prime income generators |

| Basic Hospitality & Well-being Services | Cash Cow | Consistent demand, operational efficiency | Significant portion of €2.3 billion revenue (2024) |

| Assisted Living Facilities | Cash Cow | Stable customer base, predictable revenue | Occupancy often >85% (2024), reliable income |

Delivered as Shown

Clariane BCG Matrix

The Clariane BCG Matrix preview you see is precisely the final, unwatermarked document you will receive upon purchase, offering a complete strategic overview. This comprehensive report is meticulously designed to provide actionable insights into your business portfolio, enabling informed decision-making. You'll gain access to the fully formatted analysis, ready for immediate integration into your strategic planning processes. No demo content or hidden surprises, just a professional-grade tool to clarify your market position and guide future investments.

Dogs

Clariane completed the sale of its UK operations in April 2024, a move designed to bolster its financial standing. This divestiture suggests these UK assets were either not performing as well as desired or didn't align with the company's future direction, likely holding a modest market share or facing limited growth opportunities.

Clariane's decision to sell its French home hospitalization business in 2024 likely positions this segment as a 'Dog' in the BCG matrix. This divestment indicates the business may have experienced limited growth or held a minor market share within the broader healthcare sector.

This strategic move to offload the French home hospitalization unit was part of Clariane's broader portfolio optimization efforts. By divesting assets deemed less profitable or non-core, the company aimed to reallocate resources and capital towards more promising areas of its business.

Clariane's divestment of smaller operational assets across France, Italy, and Germany, part of a broader €1 billion asset disposal program, highlights the strategic pruning of underperforming or non-core units. These sales, amounting to roughly €100 million in Q1 2025, exemplify the 'dogs' category in the BCG matrix, representing assets with low growth prospects and market share.

'Petits-fils' Home Care Business (Divested)

Clariane completed the disposal of its 'Petits-fils' home care business in June 2025, ahead of schedule. This move suggests that, from Clariane's viewpoint, the home care segment was either experiencing slow growth, possessed a modest market share, or was considered peripheral to its main strategic objectives. The divestiture was likely undertaken to bolster the company's financial standing.

Within the BCG Matrix framework, a divested business like 'Petits-fils' would typically be categorized as a Dog. Dogs are characterized by low market share in slow-growing industries. Their divestiture often frees up capital and resources that can be redirected towards more promising ventures.

- Divestment Rationale: The sale of 'Petits-fils' aligns with a strategic decision to exit a business unit that was not contributing significantly to overall growth or market leadership.

- Financial Impact: While specific financial figures for the divestment are not publicly detailed, such sales are generally aimed at improving cash flow and reducing operational complexity.

- Strategic Realignment: Clariane's focus likely shifts to its core businesses, such as its European network of elderly care facilities, which represent its primary growth drivers.

- BCG Classification: 'Petits-fils' would be classified as a Dog due to its presumed low market share and low growth rate within the broader home care sector, making it a candidate for divestment.

Underperforming or Restructured Facilities

Clariane's strategic restructuring efforts in 2024 and early 2025 included the closure and reorganization of several facilities across Germany, Spain, and Belgium. These moves directly address underperforming units, often identified by consistently low occupancy and elevated operational expenses. Such facilities, akin to ‘dogs’ in the BCG matrix, drain resources without generating adequate returns.

For instance, the Q1 2025 reports highlighted specific actions taken in these regions. These closures are designed to reallocate capital and management focus towards more promising segments of the business, improving overall portfolio efficiency.

- Facility Closures: Targeted underperforming sites in Germany, Spain, and Belgium.

- Performance Metrics: Actions driven by persistently low occupancy rates and high operational costs.

- Strategic Rationale: Reallocation of resources from 'dog' units to more profitable ventures.

- Financial Impact: Aims to improve overall portfolio efficiency and profitability.

Clariane's divestment of various business units, such as its UK operations and the French home hospitalization segment in 2024, strongly suggests these were classified as 'Dogs' in the BCG matrix. These actions indicate segments with low growth and market share, prompting their sale to improve financial health and focus on core strengths.

The company's broader €1 billion asset disposal program, including sales around €100 million in Q1 2025, further exemplifies the pruning of 'Dog' assets. These divestitures, like the 'Petits-fils' home care business in June 2025, are strategic moves to exit underperforming or non-core units, freeing up capital for more profitable ventures.

Facility closures in Germany, Spain, and Belgium in 2024 and early 2025, driven by low occupancy and high costs, also represent the management of 'Dog' assets. This approach aims to enhance overall portfolio efficiency by reallocating resources away from these resource-draining units.

The classification of these divested or closed units as 'Dogs' underscores Clariane's strategy to optimize its business portfolio by shedding low-performing assets and concentrating on areas with higher growth potential.

| Clariane Business Unit | BCG Classification (Implied) | Rationale for Classification | Divestment/Closure Year | Strategic Impact |

| UK Operations | Dog | Likely low market share/growth | 2024 | Improved financial standing |

| French Home Hospitalization | Dog | Limited growth/minor market share | 2024 | Portfolio optimization |

| Petits-fils Home Care | Dog | Slow growth/peripheral to core | June 2025 | Bolstered financial standing |

| Underperforming Facilities (DE, ES, BE) | Dog | Low occupancy, high costs | 2024-2025 | Resource reallocation |

Question Marks

Clariane is investing in early-stage digital health solutions, such as AI diagnostics and telemedicine. These innovative ventures are positioned as question marks in the BCG matrix, reflecting their high growth potential but currently low market share for Clariane. For instance, the global digital health market was valued at approximately $211 billion in 2023 and is projected to reach over $680 billion by 2030, indicating substantial future opportunity.

Clariane's investment in new niche therapeutic programs, such as advanced brain stimulation techniques, falls into the question marks category of the BCG Matrix. These innovative, specialized treatments are designed for emerging, high-growth markets, reflecting a strategic push into less established areas.

These programs require significant research and development expenditure, alongside substantial investment in market education to build awareness and adoption. For instance, Clariane's focus on non-drug treatments signifies a commitment to cutting-edge medical advancements, which inherently carry a higher risk profile.

The long-term success of these niche therapies is not guaranteed and hinges on continued, heavy investment to overcome market uncertainties and achieve scalability. This strategic positioning aims to capture future market leadership in specialized healthcare segments.

Strategic partnerships with emerging health tech startups align with the Stars category in the BCG matrix. Clariane actively cultivates an open innovation environment, engaging with promising startups in the rapidly evolving health technology sector. These collaborations represent significant future growth potential, even if their current market share is minimal.

Investments in these health tech innovators, particularly those in high-growth, nascent markets, are classic Star plays. For example, by mid-2024, venture capital funding for health tech startups saw a notable uptick, with areas like AI-driven diagnostics and personalized medicine attracting substantial interest. While these ventures may not yet have a dominant market share, their innovative solutions position them for substantial future success and market leadership.

Targeted Specialized Care Facility Renovations for New Concepts

Clariane's strategic network upgrades, while necessary, can cast a spotlight on certain renovation projects as question marks within the BCG matrix. These are initiatives focused on transforming existing facilities into entirely new, high-growth specialized care concepts. Such ventures demand significant capital outlay with the aim of entering nascent market segments where Clariane's footprint is currently minimal.

The success of these specialized care facility renovations hinges on effective market penetration and the ability to establish a strong initial presence. For example, if Clariane were to invest heavily in a new concept like advanced pediatric neurology centers, the initial returns and market acceptance would be uncertain, placing these projects in the question mark category.

- Investment Uncertainty: Renovations for novel care concepts represent substantial capital expenditures with uncertain market reception.

- New Market Entry: These projects aim to tap into new, high-growth segments, increasing the risk profile due to limited initial market presence.

- Dependence on Penetration: Success is heavily reliant on Clariane's ability to effectively penetrate these new markets and gain traction.

- Potential for Growth: Despite the risks, these question marks hold the potential to become stars if market penetration strategies are successful and demand materializes.

Potential Expansion into Untapped European Micro-Markets

Clariane's potential expansion into untapped European micro-markets fits the 'question mark' category within the BCG matrix. These markets, while offering high-growth potential, would necessitate substantial initial investment for infrastructure development and market penetration. For instance, entering a new, smaller European country with a burgeoning elderly population, like Slovenia or Estonia, would mean starting with a very low market share. This requires careful strategic planning to nurture these nascent operations into stronger market positions.

The financial commitment for such ventures is significant. Clariane would need to allocate capital for building new facilities, establishing local distribution networks, and implementing tailored marketing campaigns to resonate with specific cultural nuances.

- Low Initial Market Share: Entering niche European micro-markets, such as specialized home care services in emerging economies like Poland or the Baltics, would see Clariane begin with a minimal presence.

- High Investment Requirement: Significant capital expenditure would be needed for infrastructure, local staffing, and brand building to establish a foothold. For example, setting up a new care home in a country like Portugal, where the over-65 population is projected to grow by over 20% by 2030, would require substantial upfront investment.

- Uncertain Future Returns: The success of these ventures is not guaranteed, requiring ongoing evaluation and potential adjustments to strategy to convert potential into stable revenue streams.

- Strategic Importance: These question marks, if successful, could become future stars, diversifying Clariane's geographic footprint and tapping into new customer segments.

Question marks represent Clariane's investments in areas with high growth potential but low current market share. These ventures require substantial investment and carry a degree of uncertainty regarding future success and market position. Successfully nurturing these question marks can lead to future stars, contributing significantly to Clariane's overall portfolio growth.

Clariane's foray into advanced AI-powered patient monitoring systems exemplifies a question mark. While the global AI in healthcare market is projected to grow from $15.4 billion in 2023 to $187.9 billion by 2030, Clariane's current share in this specific niche is minimal, necessitating significant R&D and market development.

| Initiative | BCG Category | Market Growth | Current Market Share | Investment Needs | Potential Outcome |

|---|---|---|---|---|---|

| AI Patient Monitoring | Question Mark | High (AI in Healthcare: $15.4B in 2023 to $187.9B by 2030) | Low | High (R&D, Market Penetration) | Future Star |

| Niche Therapeutic Programs (e.g., Brain Stimulation) | Question Mark | High (Specialized medical markets) | Low | High (R&D, Market Education) | Future Star |

| European Micro-Market Expansion (e.g., Baltics) | Question Mark | High (Emerging economies, aging populations) | Low | High (Infrastructure, Local Operations) | Future Star |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, encompassing sales figures, industry growth rates, competitor analysis, and consumer behavior trends for robust strategic insights.