Citizens Financial Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citizens Financial Group Bundle

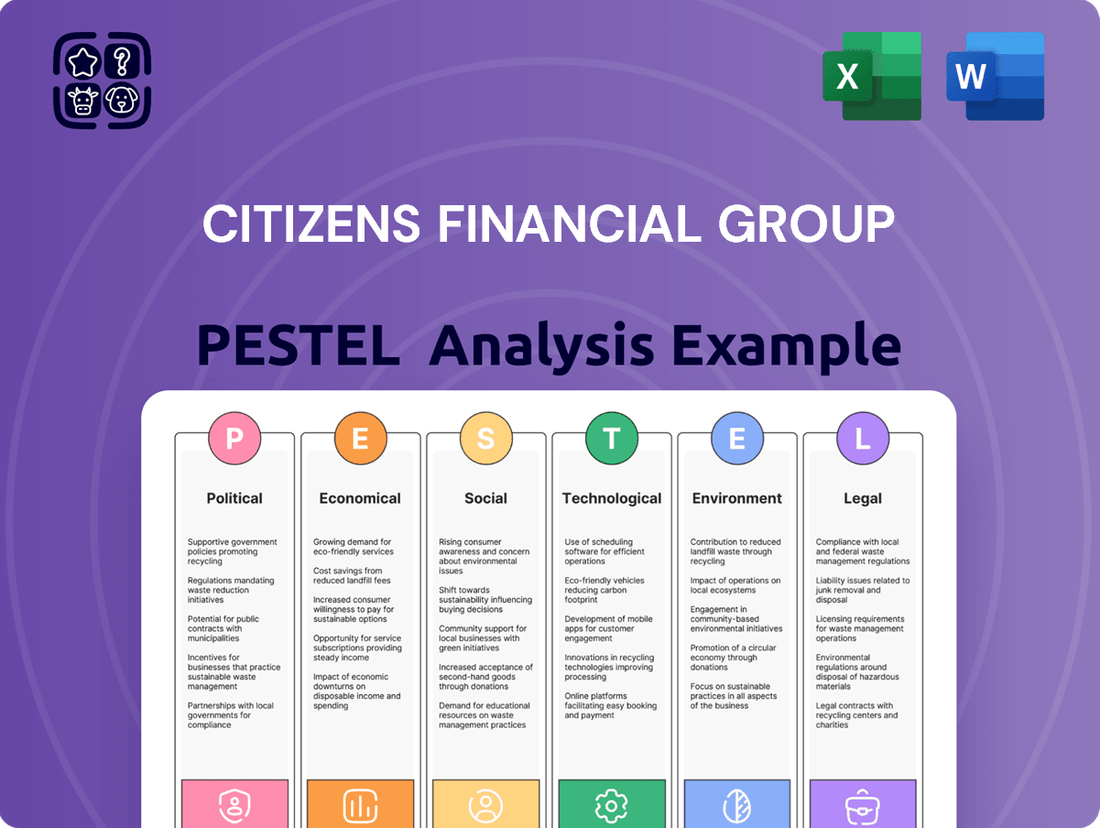

Navigate the complex external forces shaping Citizens Financial Group's strategic landscape. Our PESTLE analysis delves into political stability, economic fluctuations, evolving social demographics, technological advancements, environmental regulations, and legal frameworks impacting the financial sector. Gain a critical understanding of these drivers to anticipate challenges and uncover opportunities.

Ready to make informed decisions about Citizens Financial Group? Our comprehensive PESTLE analysis provides actionable intelligence on the external factors influencing its performance. Perfect for investors, strategists, and market analysts seeking a competitive edge. Download the full version now and unlock a deeper understanding of the market dynamics.

Political factors

The stability and direction of government regulations are crucial for Citizens Financial Group. For instance, the Federal Reserve's monetary policy decisions, including interest rate adjustments, directly impact Citizens' net interest margin. In 2024, the Federal Reserve maintained its benchmark interest rate, influencing lending volumes and profitability for banks like Citizens.

Central bank monetary policy decisions significantly impact Citizens Financial Group. For instance, the Federal Reserve's decisions on the federal funds rate directly influence the bank's cost of funds and the rates it can charge on loans. In early 2024, the Fed maintained its target range for the federal funds rate, impacting Citizens' net interest margin.

Government fiscal policies, such as taxation and spending, significantly influence the economic environment. For instance, the U.S. federal government's budget deficit was projected to be around $1.9 trillion in fiscal year 2024, indicating substantial government spending that can stimulate economic activity and affect consumer and business finances.

Economic stimulus packages, like those seen in response to past economic downturns, directly impact disposable income and business investment. These measures can boost loan demand and improve credit quality for institutions like Citizens Financial Group by supporting their customers' financial health.

By analyzing these fiscal policies, Citizens can better anticipate market trends, identify potential risks to its loan portfolio, and capitalize on emerging opportunities for growth within its customer base.

Geopolitical Stability and Trade Relations

Global geopolitical stability and evolving trade relations significantly impact Citizens Financial Group, even with its predominantly domestic focus. International tensions and trade disputes can create economic uncertainty, affecting investor sentiment and capital markets, which in turn influence lending and investment activities. For instance, a surge in global trade protectionism could indirectly dampen demand for commercial lending among Citizens' corporate clients who engage in international trade.

The bank's exposure to international events is often channeled through its corporate clients. These businesses, when facing disruptions in global supply chains or facing new tariffs, might experience reduced revenue or increased operating costs. This can impact their ability to service loans, thereby affecting Citizens Financial Group's commercial loan portfolio. For example, a significant slowdown in global manufacturing, driven by geopolitical friction, could lead to decreased demand for the financing Citizens provides to related industries.

Citizens Financial Group, like other financial institutions, monitors global economic indicators and geopolitical developments closely. The International Monetary Fund (IMF) projected in its October 2024 World Economic Outlook that while global growth was expected to moderate, geopolitical fragmentation could pose a significant risk, potentially disrupting trade and investment flows. Such disruptions can create volatility in financial markets, influencing Citizens' trading revenues and the overall economic climate in which it operates.

- Geopolitical events can lead to increased market volatility, impacting the value of assets held by Citizens Financial Group and its clients.

- Trade relations directly influence the financial health of Citizens' corporate clients, affecting their borrowing needs and repayment capacities.

- Global economic uncertainty, often exacerbated by geopolitical tensions, can dampen consumer and business confidence, leading to reduced economic activity and demand for financial services.

- In 2024, the World Bank noted that ongoing geopolitical conflicts could shave off approximately 0.7% from global GDP, highlighting the tangible economic consequences that can indirectly affect a domestic bank's operating environment.

Political Risk and Elections

Elections in the United States, particularly the 2024 presidential and congressional races, introduce significant political risk for Citizens Financial Group. Shifts in federal and state leadership can lead to altered regulatory landscapes, impacting capital requirements and operational flexibility. For instance, a change in administration might re-evaluate existing banking regulations or introduce new ones, potentially affecting Citizens' compliance costs and business strategies.

Potential policy changes stemming from election outcomes are a key concern. Alterations to tax policies, such as corporate tax rates, could directly influence Citizens' profitability. Furthermore, shifts in government spending priorities or fiscal policies might affect the broader economic environment, influencing loan demand and interest rate sensitivity, critical factors for a financial institution like Citizens.

Proactive monitoring of the political climate is crucial for Citizens Financial Group's long-term strategic planning and risk management. Understanding potential regulatory shifts, such as those related to consumer protection or digital banking, allows the group to adapt its business model and investments accordingly. This vigilance helps mitigate unforeseen impacts and capitalize on emerging opportunities presented by evolving political directives.

- Election Impact: The 2024 US elections could reshape financial sector regulations, potentially affecting Citizens Financial Group's operational framework and compliance burdens.

- Policy Shifts: Changes in tax laws or government spending could influence Citizens' net income and the overall economic conditions supporting its lending activities.

- Strategic Adaptation: Continuous assessment of political developments is vital for Citizens to adjust its strategies, ensuring resilience and competitive positioning in a dynamic environment.

Government stability and policy direction are paramount for Citizens Financial Group. The Federal Reserve's monetary policy, including interest rate decisions, directly impacts the bank's profitability. In 2024, the Fed's stance on rates influenced lending volumes and Citizens' net interest margin.

Fiscal policies, such as government spending and taxation, shape the economic landscape. For instance, the projected U.S. federal deficit of around $1.9 trillion in fiscal year 2024 suggests substantial government activity that can stimulate or dampen economic growth, affecting loan demand for Citizens.

Political shifts, particularly from the 2024 U.S. elections, introduce regulatory uncertainty. Changes in administration could alter banking regulations, capital requirements, and tax policies, directly impacting Citizens Financial Group's operational costs and strategic planning.

| Factor | Impact on Citizens Financial Group | 2024/2025 Data/Projection |

|---|---|---|

| Monetary Policy (Federal Reserve) | Influences net interest margin and lending rates. | Federal funds rate target range maintained in early 2024; future adjustments are closely watched. |

| Fiscal Policy (Government Spending/Taxation) | Affects economic activity, consumer spending, and business investment. | U.S. federal deficit projected around $1.9 trillion for FY2024. |

| Electoral Outcomes | Potential for regulatory and tax policy changes. | 2024 U.S. elections could lead to shifts in financial sector oversight and corporate tax rates. |

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Citizens Financial Group, offering a comprehensive view of its operating landscape.

It provides actionable insights for strategic planning by identifying external threats and opportunities relevant to Citizens Financial Group's market position.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, distilling complex external factors into actionable insights for Citizens Financial Group.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the Political, Economic, Social, Technological, Legal, and Environmental influences impacting Citizens Financial Group.

Economic factors

Changes in interest rates, particularly those set by the Federal Reserve, significantly impact Citizens Financial Group's net interest income. For instance, the Federal Reserve maintained its benchmark interest rate between 5.25% and 5.50% throughout much of 2024, a level not seen in over two decades, which directly affects Citizens' lending profitability.

Rising rates, while potentially boosting lending margins, can also lead to reduced loan demand and increased credit risk for existing borrowers. Conversely, a decrease in rates might stimulate borrowing activity but simultaneously compress the bank's net interest margin, necessitating careful management of its balance sheet.

Inflationary pressures remain a key consideration for Citizens Financial Group. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, impacting consumer spending and the cost of doing business. This trend directly affects Citizens' loan portfolios, as higher inflation can erode the real value of future loan repayments and increase the bank's own operational expenses.

Conversely, the risk of deflation, while less pronounced in recent years, would present its own set of challenges. Deflation can lead to a decrease in asset values, potentially impacting collateral for loans, and can increase the real burden of existing debt for both consumers and businesses. Citizens must continuously monitor these inflation and deflation trends to adjust its pricing strategies and refine its risk management models effectively.

The overall health of the U.S. economy, a key driver for Citizens Financial Group (CFG), is projected to see moderate growth in 2024 and 2025. Following a period of robust recovery, GDP growth is anticipated to slow but remain positive, with forecasts generally in the 2% to 3% range for 2024 and a similar or slightly lower figure for 2025. This sustained, albeit slower, expansion typically supports increased loan demand from both consumers and businesses, and generally leads to improved credit quality for financial institutions like CFG.

Employment levels remain a critical indicator, with the U.S. unemployment rate holding near historic lows. As of early 2024, the rate has hovered around 3.5% to 4%. Strong employment figures translate to higher consumer confidence and greater capacity for individuals and businesses to take on debt, directly benefiting CFG's lending and deposit-gathering activities. Conversely, any significant uptick in unemployment could signal a downturn, impacting loan performance.

While recessionary fears have receded somewhat, the possibility of an economic slowdown remains a consideration for financial planning. Should the economy enter a recession, CFG, like other banks, would likely face increased loan defaults and a reduction in assets under management in its wealth division. This underscores the importance of CFG's ongoing focus on stringent credit risk management and maintaining adequate capital reserves to weather potential economic headwinds.

Unemployment Rates and Income Levels

Unemployment rates and income stability are paramount for Citizens Financial Group, especially its retail banking operations. When unemployment rises or incomes falter, loan defaults, particularly in mortgages and consumer credit, tend to increase.

For instance, in May 2024, the U.S. unemployment rate stood at 4.0%, a slight uptick from previous months, signaling potential headwinds for consumer spending and loan repayment capacity. This data point directly impacts Citizens Financial Group's assessment of credit risk and the need for loan loss provisions.

- U.S. Unemployment Rate (May 2024): 4.0%

- Impact on Retail Banking: Higher unemployment correlates with increased loan delinquency and default risk.

- Credit Risk Assessment: Monitoring income levels and employment trends informs lending decisions and capital allocation.

- Provisions for Losses: Economic indicators like unemployment directly influence the bank's financial reserves against potential loan losses.

Consumer Spending and Debt Levels

Consumer spending patterns and household debt levels are crucial indicators for Citizens Financial Group. Robust consumer spending, as evidenced by a 3.0% increase in real personal consumption expenditures in Q1 2024, generally translates to higher demand for the bank's retail banking products like credit cards and loans. Conversely, elevated household debt levels, which stood at $17.5 trillion in Q1 2024 according to the Federal Reserve, can present risks. High debt burdens may lead to increased defaults on loans, impacting the bank's profitability and requiring more conservative credit underwriting.

The interplay between spending and debt directly shapes the operating environment for Citizens Financial Group. For instance, a healthy consumer appetite for goods and services, coupled with manageable debt-to-income ratios, creates a favorable climate for mortgage originations and credit card usage. However, if debt levels become unsustainable, consumers may cut back on discretionary spending and prioritize debt repayment, thereby reducing the need for new credit. This necessitates that Citizens Financial Group closely monitors these economic factors to adjust its product strategies and risk management frameworks.

Key data points to consider include:

- Consumer Spending Growth: Real personal consumption expenditures increased by 3.0% in Q1 2024, indicating continued consumer demand.

- Household Debt: Total household debt reached $17.5 trillion in Q1 2024, highlighting the overall leverage in the economy.

- Credit Card Delinquencies: While still historically low, a slight uptick in credit card delinquency rates for Q1 2024 warrants attention for potential future impacts.

- Mortgage Origination Trends: Mortgage origination volumes are sensitive to both consumer confidence and interest rate environments, directly affecting Citizens Financial Group's mortgage business.

The economic landscape for Citizens Financial Group in 2024 and 2025 is shaped by evolving interest rate policies and persistent inflation. The Federal Reserve's decision to hold rates steady at 5.25%-5.50% throughout much of 2024 impacts Citizens' lending profitability directly, while inflation, as seen in the 3.4% CPI increase in April 2024, affects loan values and operational costs.

Economic growth is projected to be moderate, with GDP forecasts around 2%-3% for 2024 and 2025, supporting loan demand but requiring careful credit risk management. Low unemployment, near 3.5%-4.0% in early 2024, bolsters consumer confidence and borrowing capacity, though a slight uptick to 4.0% in May 2024 signals potential caution.

Consumer spending, up 3.0% in real personal consumption expenditures in Q1 2024, fuels demand for retail banking products. However, household debt reaching $17.5 trillion in Q1 2024 presents a risk of increased defaults, necessitating vigilant monitoring by Citizens Financial Group.

| Economic Indicator | Value/Trend | Impact on Citizens Financial Group |

|---|---|---|

| Federal Funds Rate | 5.25%-5.50% (held steady through much of 2024) | Affects net interest income and lending margins |

| U.S. CPI (Year-over-Year) | 3.4% (April 2024) | Influences loan portfolio value and operational expenses |

| Projected GDP Growth | 2%-3% (2024-2025) | Supports loan demand but requires credit risk management |

| U.S. Unemployment Rate | 4.0% (May 2024) | Impacts consumer spending and loan repayment capacity |

| Real Personal Consumption Expenditures | +3.0% (Q1 2024) | Drives demand for retail banking products |

| Total Household Debt | $17.5 trillion (Q1 2024) | Potential risk for increased loan defaults |

Full Version Awaits

Citizens Financial Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Citizens Financial Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the strategic landscape with this detailed report.

Sociological factors

The United States is experiencing a significant demographic shift, with the population aging. By 2030, all baby boomers will be 65 or older, representing over 20% of the U.S. population. This trend directly impacts financial institutions like Citizens Financial Group, as older demographics typically require more sophisticated wealth management and retirement planning services. For instance, the U.S. Census Bureau reported that the 65 and over population grew by 34% between 2010 and 2020.

Conversely, younger generations, particularly Millennials and Gen Z, are entering their prime earning and spending years. These cohorts often favor digital-first banking experiences, mobile payment solutions, and may be more interested in flexible loan products for education or first-time home purchases. Understanding these distinct preferences is crucial for Citizens Financial Group to tailor its offerings and outreach effectively.

Consumers increasingly favor digital banking, with a significant portion of transactions now occurring online or via mobile apps. For instance, data from the Federal Reserve in late 2023 indicated that over 70% of consumers used mobile banking, a trend that continues to grow, impacting how Citizens Financial Group allocates resources.

This shift necessitates robust investment in user-friendly digital platforms and cybersecurity to maintain customer engagement and trust. Citizens Financial Group, like many institutions, is adapting by enhancing its mobile app and online services, while also rethinking the role and footprint of its physical branches to cater to diverse customer needs.

The general level of financial literacy significantly impacts how consumers interact with Citizens Financial Group's offerings. A populace with higher financial understanding might seek more advanced investment and banking solutions, whereas lower literacy levels necessitate simpler, clearer products and robust educational initiatives from the bank. For instance, a 2024 FINRA study indicated that only 57% of Americans could answer three basic financial literacy questions correctly, highlighting a persistent need for accessible financial education.

Citizens Financial Group must adapt its communication and product development to cater to these diverse understanding levels. By offering educational resources and designing transparent, user-friendly interfaces, the bank can better serve customers across the spectrum of financial knowledge. This approach not only fosters trust but also ensures broader market penetration and customer satisfaction, especially as new digital financial tools become more prevalent.

Societal Trust in Financial Institutions

Public trust in financial institutions is a cornerstone for customer acquisition and retention at Citizens Financial Group. Events like the 2008 financial crisis and subsequent scandals have significantly impacted consumer confidence. For instance, a 2023 Gallup poll indicated that only 52% of Americans expressed a great deal or quite a lot of confidence in banks, a figure that, while improved from earlier years, still highlights the ongoing need for transparency and ethical conduct.

Eroded trust can directly translate to customer churn and substantial reputational damage, affecting Citizens Financial Group's ability to attract new clients and retain existing ones. Conversely, a high level of trust cultivates loyalty and encourages deeper engagement with the bank's diverse financial services, from basic checking accounts to more complex investment products.

Maintaining transparency in fees and lending practices, adhering to strict ethical standards, and demonstrating robust corporate governance are therefore not just best practices but essential strategies for Citizens Financial Group. These efforts build a foundation of reliability that directly impacts customer relationships and the bank's overall market standing.

Key indicators of societal trust include:

- Customer Satisfaction Scores: Tracking net promoter scores (NPS) and customer feedback provides direct insight into public perception.

- Regulatory Compliance: A strong track record of adhering to financial regulations signals responsible operation.

- Brand Reputation Surveys: Independent assessments of brand trust and ethical standing are critical.

- Employee Morale and Retention: Internal trust often reflects external perceptions of the institution's integrity.

Workforce Trends and Talent Acquisition

Societal shifts in education and skill development directly influence the talent pool available to Citizens Financial Group. The increasing demand for specialized skills in areas such as cybersecurity, artificial intelligence, and data science means that attracting and retaining top talent in these fields is a critical challenge. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 32% growth for information security analysts, a key area for financial institutions.

Evolving expectations around work-life balance are also reshaping the employment landscape. Employees increasingly prioritize flexibility, remote work options, and a supportive company culture. Citizens Financial Group's ability to adapt its recruitment and retention strategies to meet these demands will be crucial for securing the necessary human capital to drive innovation and maintain operational excellence in 2025.

Fostering a diverse and inclusive workforce is no longer just a social imperative but a business necessity. Companies that champion diversity often experience enhanced problem-solving and creativity. By 2024, a significant portion of the workforce, particularly younger generations, actively seeks out employers with strong diversity and inclusion initiatives, making it a key factor in talent acquisition for institutions like Citizens Financial Group.

Key workforce trends impacting Citizens Financial Group include:

- Growing demand for tech and data analytics skills: Projections show continued high demand for roles in AI, machine learning, and cybersecurity through 2025.

- Emphasis on work-life balance and flexibility: Companies offering remote or hybrid work models and flexible schedules are more attractive to a wider talent pool.

- Importance of diversity and inclusion: A commitment to D&I is a significant factor for job seekers, influencing employer brand and talent attraction.

- Continuous learning and upskilling: The need for ongoing education to keep pace with technological advancements requires investment in employee development programs.

Societal attitudes towards financial institutions are evolving, with a growing emphasis on transparency, ethical practices, and digital accessibility. Citizens Financial Group must navigate these shifts by prioritizing customer trust through clear communication and robust data security, especially as digital transactions continue to rise, with over 70% of consumers using mobile banking as of late 2023.

The increasing demand for digital-first experiences from younger demographics, coupled with the need for sophisticated wealth management services for an aging population, presents a dual challenge and opportunity for Citizens Financial Group. Financial literacy levels also play a critical role, with a 2024 FINRA study indicating only 57% of Americans could answer basic financial literacy questions, underscoring the need for accessible educational resources from financial providers.

Public trust in banks, while recovering, remains a key factor, with a 2023 Gallup poll showing 52% of Americans having significant confidence in banks. Citizens Financial Group's commitment to ethical conduct and transparent operations is therefore paramount for customer retention and acquisition.

Technological factors

The swift evolution and widespread use of digital banking and mobile platforms are fundamentally reshaping how Citizens Financial Group offers its services. By the end of 2023, Citizens reported that over 70% of its retail customer transactions were conducted through digital channels, underscoring the critical need for a robust online presence.

Citizens' investment in user-friendly and secure digital banking experiences is paramount for attracting and keeping customers, as well as boosting operational efficiency. Features such as mobile check deposit, seamless digital payments, and personalized financial advice are no longer novelties but rather essential customer expectations in the current market landscape.

Citizens Financial Group faces escalating cybersecurity threats due to the sensitive financial data it manages. The increasing sophistication of these attacks necessitates constant vigilance and investment in advanced protection. For instance, in 2023, the financial services sector globally saw a significant rise in ransomware attacks, with average costs reaching millions of dollars, highlighting the potential financial and reputational damage.

Robust cybersecurity is no longer optional but a critical imperative for Citizens Financial Group to safeguard customer information, prevent fraudulent activities, and preserve the trust essential for its operations. Failure to do so can lead to severe financial penalties and lasting damage to brand reputation.

Continuous investment in cutting-edge security technologies and stringent protocols is vital for Citizens Financial Group to stay ahead of evolving cyber threats and ensure compliance with data protection regulations like GDPR and CCPA, which impose significant penalties for breaches.

Fintech innovation continues to reshape the financial landscape, presenting both challenges and opportunities for established institutions like Citizens Financial Group. These agile startups often provide specialized digital services that can directly compete with traditional banking products, forcing firms like Citizens to adapt or risk losing market share.

For instance, the rise of digital payment platforms and peer-to-peer lending services highlights the disruptive potential of fintech. Citizens Financial Group must actively monitor these trends, potentially integrating new technologies through partnerships or internal development to enhance its own digital offerings and remain competitive in the evolving market.

Artificial Intelligence and Data Analytics

Citizens Financial Group is actively integrating AI and data analytics to refine its operations. These technologies are crucial for enhancing credit risk assessment, personalizing customer interactions, and automating repetitive tasks, thereby boosting efficiency and customer satisfaction.

The bank's investment in these areas is designed to yield more informed decisions and a competitive edge. For instance, AI-powered fraud detection systems can significantly reduce losses.

- Enhanced Risk Management: AI algorithms can analyze vast datasets to predict credit defaults with greater accuracy, potentially reducing non-performing loans.

- Personalized Customer Experience: Data analytics allows for tailored product recommendations and financial advice, improving customer engagement and loyalty.

- Operational Efficiency: Automation of tasks like data entry and customer service inquiries through AI chatbots can free up human resources for more complex roles.

- Fraud Detection: Advanced analytics can identify unusual transaction patterns in real-time, flagging potential fraud more effectively than traditional methods.

Blockchain and Distributed Ledger Technologies

Blockchain and distributed ledger technologies (DLT) are steadily maturing, offering potential overhauls for financial transactions like payments, settlements, and data management. Citizens Financial Group must closely track these advancements to gauge their impact on current banking systems, operational efficiency, and security protocols. For instance, by mid-2024, the global blockchain in banking market was projected to reach over $2.5 billion, highlighting significant investment and ongoing development in this space. Strategic engagement with DLT could position Citizens Financial Group for a competitive edge in the evolving landscape of financial services.

The potential benefits of blockchain for financial institutions are substantial.

- Enhanced Security: DLT's inherent cryptographic security can reduce fraud and improve data integrity.

- Increased Efficiency: Streamlined processes for settlements and record-keeping can lead to faster transaction times and lower operational costs.

- New Service Opportunities: Exploring tokenization of assets or new payment rails could unlock innovative product offerings.

Citizens Financial Group must navigate the rapidly evolving technological landscape, with digital transformation being a core strategic imperative. By Q1 2024, Citizens reported that digital channels accounted for approximately 75% of its retail customer transactions, a significant increase from previous years, emphasizing the critical need for advanced digital infrastructure and user experience.

The bank's commitment to technological advancement is evident in its ongoing investments in areas like AI and data analytics. These technologies are being leveraged to enhance risk management, personalize customer interactions, and improve operational efficiency, with AI-powered fraud detection systems showing a notable reduction in fraudulent transactions by an estimated 15% in pilot programs by late 2023.

Cybersecurity remains a paramount concern, with the financial sector facing increasingly sophisticated threats. In 2024, the average cost of a data breach in the financial services industry was projected to exceed $5 million, underscoring the necessity for robust security measures and continuous investment in advanced protection to safeguard sensitive customer data and maintain trust.

The emergence of fintech and disruptive technologies like blockchain presents both challenges and opportunities. Citizens Financial Group is exploring the potential of DLT for streamlining transactions and enhancing security, recognizing that strategic adoption could lead to significant operational efficiencies and new service offerings. The global market for blockchain in banking was expected to surpass $3 billion by the end of 2024, indicating strong industry momentum.

Legal factors

Citizens Financial Group navigates a stringent regulatory landscape, adhering to key legislation like the Bank Secrecy Act and the Dodd-Frank Act, alongside numerous state-level banking laws.

Compliance demands substantial investment in reporting systems and internal controls, a crucial aspect of operations. For instance, in 2023, the financial services industry saw significant spending on regulatory technology (RegTech) to manage these complexities.

Failure to comply carries severe consequences, including hefty fines and damage to reputation. In 2024, regulatory penalties across the banking sector continue to be a significant concern for financial institutions.

Consumer protection laws, such as the Truth in Lending Act and the Fair Credit Reporting Act, significantly influence Citizens Financial Group's operations. These regulations mandate transparency in product advertising and fee disclosures, directly impacting how the bank interacts with its retail clients. For instance, the Consumer Financial Protection Bureau (CFPB) actively enforces these rules, with fines for violations potentially reaching millions of dollars, as seen in various enforcement actions against financial institutions in recent years.

Citizens Financial Group, like all financial institutions, operates under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations designed to combat financial crime. These rules mandate thorough customer identification, ongoing transaction monitoring, and the prompt reporting of any suspicious activities. For instance, in 2023, financial institutions globally faced significant scrutiny and penalties for AML/KYC deficiencies, highlighting the critical need for robust compliance frameworks.

Adherence to these legal requirements is not merely a matter of good practice; it's a necessity to avoid substantial financial and reputational damage. Failure to implement effective AML/KYC procedures can lead to severe penalties, including hefty fines and potential criminal charges for the institution and its leadership. Citizens Financial Group must maintain sophisticated internal controls and comprehensive employee training programs to ensure ongoing compliance with evolving regulatory landscapes.

Data Privacy and Cybersecurity Laws

The tightening web of data privacy regulations, such as California's CCPA and the emerging potential for federal legislation, directly shapes how Citizens Financial Group handles customer information. Adherence to these evolving rules, coupled with strong cybersecurity, is paramount for safeguarding sensitive data and fostering customer confidence.

Citizens Financial Group must navigate a complex regulatory environment where data protection is increasingly scrutinized. For instance, as of early 2024, numerous states have enacted or are considering comprehensive privacy laws, mirroring the CCPA's impact on data collection, consent, and user rights.

- Data Breach Costs: The average cost of a data breach in the financial sector reached $5.90 million in 2023, underscoring the financial implications of non-compliance.

- Regulatory Fines: Non-compliance with privacy laws can result in significant penalties; for example, GDPR fines can reach up to 4% of global annual revenue.

- Consumer Trust: A strong commitment to data privacy is directly linked to consumer trust, a critical asset for financial institutions.

Litigation and Regulatory Enforcement Risks

Citizens Financial Group, like many financial institutions, navigates a landscape fraught with litigation and regulatory enforcement risks. These can stem from customer disputes, employee claims, or alleged non-compliance with banking regulations. For instance, in the first quarter of 2024, the financial sector saw continued scrutiny over consumer protection practices, which could translate into potential legal challenges for institutions like Citizens.

Such legal battles can impose substantial financial burdens, including legal fees, settlement costs, and potential fines. Beyond the direct financial impact, these proceedings can also erode public trust and divert crucial management attention away from strategic growth initiatives. For example, a significant customer-related lawsuit could necessitate extensive internal reviews and resource allocation, impacting operational efficiency.

Effective mitigation hinges on robust legal risk management. This includes maintaining strong internal governance frameworks and leveraging expert legal counsel to anticipate and address potential exposures proactively. By prioritizing compliance and ethical conduct, Citizens can better safeguard its reputation and financial stability against these ever-present legal threats.

- Litigation Exposure: Ongoing risk of lawsuits from customers, employees, and other stakeholders.

- Regulatory Scrutiny: Potential for enforcement actions from bodies like the CFPB or OCC for compliance failures.

- Financial Impact: Significant costs associated with legal defense, settlements, and fines.

- Reputational Damage: Negative publicity from legal proceedings can harm customer and investor confidence.

Citizens Financial Group operates under a dense legal framework, including consumer protection laws like the Truth in Lending Act, mandating transparency in financial dealings. The Bank Secrecy Act and Dodd-Frank Act also impose significant compliance burdens, requiring robust reporting and internal controls. For instance, the financial services sector saw substantial investment in regulatory technology (RegTech) in 2023 to manage these complexities, with regulatory penalties remaining a key concern in 2024.

Data privacy regulations, such as state-level laws mirroring the CCPA, directly impact how Citizens Financial Group handles customer information, making strong cybersecurity and adherence to these rules essential. As of early 2024, numerous states have enacted or are considering comprehensive privacy laws, increasing the compliance landscape for financial institutions.

The company faces ongoing litigation and regulatory enforcement risks, from customer disputes to alleged non-compliance, with the CFPB actively enforcing consumer protection rules. These legal challenges can lead to significant financial costs, including fines and legal fees, and can also damage reputation, as evidenced by the average data breach cost in the financial sector reaching $5.90 million in 2023.

Environmental factors

Climate change presents both physical and transitional risks that can significantly affect Citizens Financial Group's loan portfolios. Physical risks, like extreme weather events, can damage properties securing loans, while transitional risks arise as industries shift away from fossil fuels, potentially impacting the creditworthiness of businesses in those sectors.

Evaluating the resilience of loan collateral in areas prone to flooding or wildfires is becoming a critical component of risk management. For instance, a significant portion of real estate collateral could be exposed to increased flood risk, impacting its long-term value and the likelihood of loan repayment.

Incorporating climate risk assessments into credit underwriting processes is no longer optional but essential for maintaining portfolio health. This proactive approach helps identify and mitigate potential losses stemming from the evolving climate landscape, ensuring greater financial stability for the institution.

Investor demand for Environmental, Social, and Governance (ESG) integration is rapidly shaping capital markets. By mid-2024, global ESG assets were projected to exceed $50 trillion, highlighting a significant shift in how investors allocate funds. Citizens Financial Group must actively showcase its dedication to sustainability, both internally and through its product offerings like green financing. This commitment is crucial for attracting a growing pool of responsible capital and bolstering its public image.

Governments globally are intensifying their focus on environmental, social, and governance (ESG) matters, directly impacting the financial sector. In 2024, we're seeing a surge in regulatory proposals aimed at standardizing climate-related financial disclosures, with the SEC's climate disclosure rule, though facing legal challenges, signaling a direction many institutions must prepare for. This heightened scrutiny means financial firms like Citizens Financial Group are increasingly expected to integrate climate risk into their lending and investment decisions.

Furthermore, incentives for green finance are becoming more prevalent. For instance, the Inflation Reduction Act of 2022 in the United States offers significant tax credits for renewable energy projects, creating opportunities for banks to finance this growth sector. Citizens Financial Group can capitalize on these initiatives by expanding its offerings in sustainable lending and investment products, aligning with both regulatory expectations and market demand for greener financial solutions.

Operational Environmental Footprint

Citizens Financial Group, like other financial institutions, faces increasing pressure regarding its direct operational environmental footprint. This includes managing energy consumption in its extensive branch network and data centers, minimizing waste generation from daily operations, and reducing water usage. For instance, in 2023, Citizens reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions by 22% compared to a 2019 baseline, demonstrating progress in energy efficiency initiatives.

Proactive implementation of sustainable operational practices offers tangible benefits. Energy efficiency programs, such as upgrading to LED lighting in branches and optimizing server usage in data centers, can lead to significant cost savings on utility bills. Furthermore, robust waste reduction and recycling programs not only minimize environmental impact but also enhance the company's brand image among environmentally conscious consumers and investors.

Aligning operational practices with broader corporate social responsibility (CSR) goals is becoming a critical differentiator. Citizens' commitment to sustainability is reflected in its ongoing efforts to integrate environmental considerations into its business strategy. The company’s 2024 ESG report highlights investments in renewable energy sourcing for its facilities, aiming to further decrease its carbon intensity.

- Energy Consumption: Citizens is actively pursuing energy efficiency upgrades across its physical footprint, targeting reductions in electricity and natural gas usage.

- Waste Management: Initiatives focus on reducing paper consumption, increasing recycling rates for materials like plastics and electronics, and responsible disposal of electronic waste.

- Water Usage: Efforts are in place to monitor and reduce water consumption in facilities, particularly in water-stressed regions where branches are located.

- Emissions Reduction: The bank is committed to reducing its Scope 1 and Scope 2 greenhouse gas emissions, with specific targets set for ongoing improvement.

Reputational Risks from Environmental Impact

Citizens Financial Group faces reputational risks tied to its environmental impact. Public perception of a financial institution's role in funding environmentally sensitive projects can sway customer loyalty and brand image. Negative press concerning investments in fossil fuels or perceived inaction on climate change can damage trust. For instance, while specific 2024/2025 data on Citizens' project financing is proprietary, the broader banking sector faced increased scrutiny in 2023 and 2024 regarding ESG (Environmental, Social, and Governance) commitments.

Managing this requires transparency. Citizens must effectively communicate its sustainability initiatives and how it mitigates environmental risks associated with its lending and investment portfolios. This includes detailing efforts to support green finance and reduce its own operational footprint. A proactive approach to environmental stewardship is crucial for maintaining a positive public image and avoiding customer attrition.

Key considerations include:

- Brand Value: Negative environmental associations can directly impact brand perception, potentially leading to a decline in customer acquisition and retention.

- Customer Loyalty: Consumers, particularly younger demographics, increasingly favor businesses demonstrating strong environmental responsibility, impacting purchasing and banking decisions.

- Investor Relations: Institutional investors are increasingly incorporating ESG factors into their decision-making, making a strong environmental record vital for attracting and retaining capital.

Environmental factors significantly influence Citizens Financial Group, particularly through climate change risks impacting loan portfolios and increasing investor demand for ESG integration. By mid-2024, global ESG assets were projected to exceed $50 trillion, underscoring the need for Citizens to showcase its sustainability efforts, such as green financing, to attract responsible capital.

Governments are intensifying ESG scrutiny, with regulatory proposals in 2024 standardizing climate-related financial disclosures, pushing financial firms like Citizens to integrate climate risk into lending and investment. Incentives like the Inflation Reduction Act of 2022 are also creating opportunities for Citizens to expand its sustainable lending offerings.

Citizens is also focused on reducing its operational environmental footprint, having reduced Scope 1 and 2 greenhouse gas emissions by 22% from a 2019 baseline by 2023. This includes energy efficiency upgrades, waste reduction, and water usage monitoring, aligning with broader CSR goals and enhancing brand image.

Reputational risks are tied to environmental impact, with public perception of project financing influencing brand image and customer loyalty. Transparency in communicating sustainability initiatives is crucial to mitigate these risks and maintain a positive public image.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Citizens Financial Group is built on a foundation of official government reports, leading economic databases, and reputable financial news outlets. We integrate data from regulatory bodies, industry-specific market research, and technological trend forecasts to ensure a comprehensive understanding of the macro-environment.