Citizens Financial Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citizens Financial Group Bundle

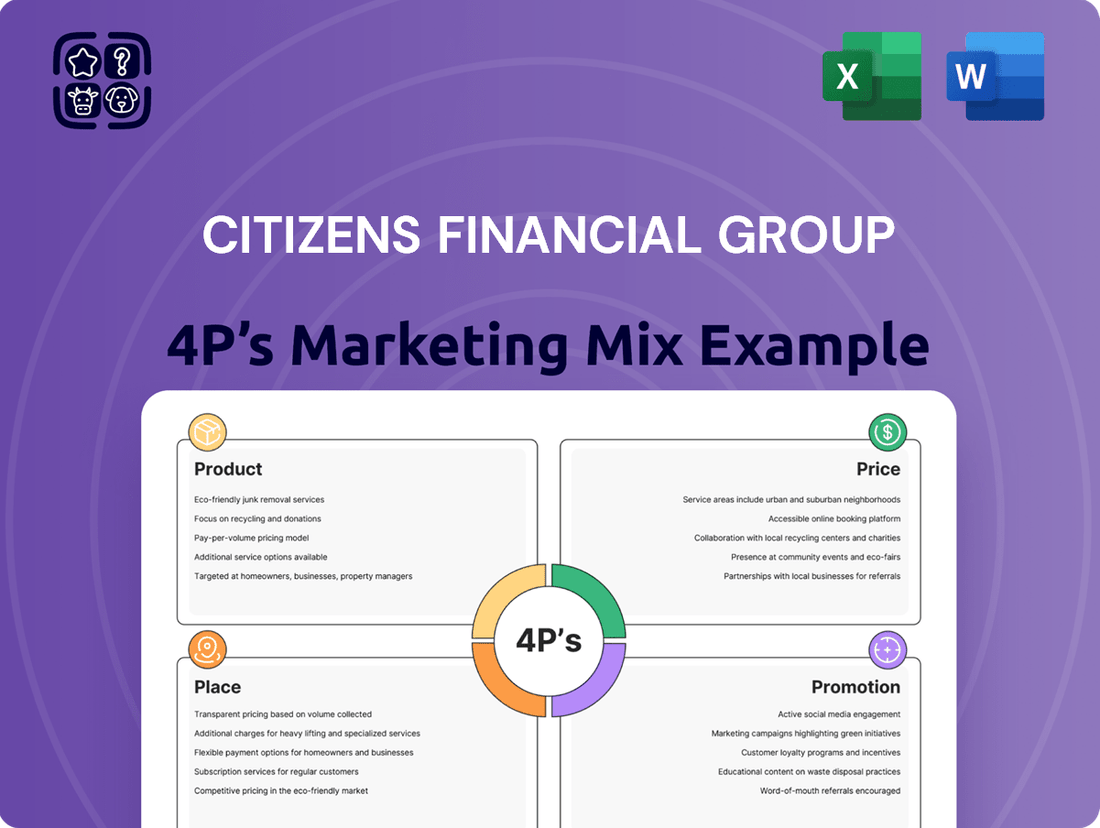

Citizens Financial Group strategically leverages its product offerings, competitive pricing, accessible distribution channels, and targeted promotional campaigns to build strong customer relationships. Understanding these core components is crucial for anyone looking to grasp their market approach.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Citizens Financial Group's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Citizens Financial Group offers a comprehensive suite of retail banking products designed for both individuals and small businesses. This includes essential services like checking and savings accounts, providing secure and convenient ways for customers to manage their everyday finances and build their savings. For example, as of Q1 2024, Citizens reported over $220 billion in total deposits, underscoring the trust customers place in their deposit-gathering capabilities.

Beyond basic accounts, Citizens' product portfolio features a range of lending solutions. These encompass personal loans for various needs, mortgages to support homeownership aspirations, and credit cards to facilitate everyday spending and build credit history. In 2023, Citizens originated over $10 billion in residential mortgages, demonstrating their significant presence in the housing market and their commitment to helping customers achieve homeownership.

Citizens Financial Group's commercial banking solutions are designed to empower middle-market companies and large corporations. These offerings encompass a broad spectrum of financial tools, including robust commercial lending and leasing options that directly fuel business expansion and operational efficiency. For instance, in Q1 2024, Citizens reported a 7% year-over-year increase in commercial loans, demonstrating strong demand for their credit facilities.

Beyond traditional lending, Citizens provides critical treasury management services, vital for optimizing cash flow and liquidity. Their foreign exchange capabilities and sophisticated risk management solutions are equally important, assisting businesses in navigating the complexities of international trade and mitigating financial exposures. This comprehensive approach ensures clients have the necessary support to thrive in dynamic economic environments.

Citizens Financial Group is enhancing its wealth management services, focusing on the mass affluent to ultra-high-net-worth segments and family offices. This expansion includes comprehensive financial planning, sophisticated investment management, and detailed estate and trust planning to ensure wealth preservation and growth.

To support this growth, Citizens is strategically recruiting seasoned wealth advisors and establishing new private banking locations. This investment aims to strengthen its competitive position in the wealth management market, which saw significant growth in assets under management across the industry in 2024, with many firms reporting double-digit percentage increases.

Digital Banking Innovations

Citizens Financial Group's product portfolio is actively evolving with digital banking innovations. Their online and mobile platforms are central to this, offering customers enhanced ways to manage their money. For instance, as of late 2024, Citizens reported a significant increase in mobile banking users, with over 70% of their customer base actively using the mobile app for transactions. This highlights a strong customer adoption of their digital offerings.

Recent enhancements focus on streamlining everyday banking tasks. New mobile capabilities have been introduced to simplify payments and direct deposits, directly addressing customer needs for convenience. This digital push is designed to minimize customer effort and provide them with more agency over their financial management. By Q1 2025, Citizens aims to further integrate AI-powered tools into their mobile app to offer personalized financial advice, a move expected to boost engagement by an additional 15%.

- Enhanced Mobile Functionality: Introduction of features for easier payments and direct deposits.

- Digital Adoption Growth: Over 70% of customers actively using the mobile app by late 2024.

- Customer Empowerment: Focus on reducing friction and increasing customer control.

- Future Innovations: Planned AI-driven personalized financial advice for Q1 2025.

Specialized Lending and Advisory

Citizens Financial Group extends its offerings beyond standard banking through specialized lending. This includes options like student loan refinancing and auto loans, addressing distinct consumer needs. For instance, in 2023, Citizens reported originating approximately $15 billion in student loan refinancing, demonstrating a significant commitment to this segment.

In the commercial sector, Citizens provides sophisticated advisory services. These encompass corporate finance, merger and acquisition (M&A) advisory, and access to debt and equity capital markets. Their M&A advisory services supported over 50 transactions in 2023, with a total deal value exceeding $10 billion, highlighting their capability in facilitating complex corporate strategies.

- Student Loan Refinancing: Citizens offers competitive rates and flexible terms for individuals looking to consolidate or refinance their student debt.

- Auto Lending: The bank provides financing solutions for new and used vehicles, catering to a broad range of consumer preferences and budgets.

- Corporate Finance: Citizens assists businesses with financial planning, capital structuring, and strategic growth initiatives.

- M&A Advisory: They guide companies through mergers, acquisitions, and divestitures, offering expertise in deal structuring and execution.

- Debt & Equity Capital Markets: Citizens facilitates access to funding through the issuance of debt and equity securities for corporate clients.

Citizens Financial Group's product strategy centers on a diversified offering, catering to both individual and commercial clients. For consumers, this includes a robust suite of deposit accounts, mortgages, personal loans, and credit cards, with a notable $220 billion in total deposits reported in Q1 2024. Their digital push is evident, with over 70% of customers actively using their mobile app by late 2024, and plans for AI-driven advice by Q1 2025.

| Product Category | Key Offerings | 2023/2024 Data Point | 2025 Outlook |

|---|---|---|---|

| Retail Banking | Checking, Savings, Mortgages, Personal Loans, Credit Cards | Over $220B in deposits (Q1 2024) | Continued digital enhancement |

| Commercial Banking | Commercial Lending, Leasing, Treasury Management, FX, Risk Management | 7% YoY increase in commercial loans (Q1 2024) | Focus on optimizing cash flow for businesses |

| Wealth Management | Financial Planning, Investment Management, Estate Planning | Industry-wide double-digit AUM growth (2024) | Expansion targeting mass affluent and UHNW |

| Specialized Lending & Advisory | Student Loan Refinancing, Auto Loans, M&A Advisory, Capital Markets | $15B in student loan refinancing (2023) | Facilitating complex corporate strategies |

What is included in the product

This analysis offers a comprehensive examination of Citizens Financial Group's marketing mix, detailing their product offerings, pricing strategies, distribution channels, and promotional activities.

It provides actionable insights into Citizens Financial Group's market positioning and competitive strategies, ideal for strategic planning and performance benchmarking.

Simplifies the complex 4Ps of Citizens Financial Group's marketing strategy, offering a clear, actionable roadmap to address customer pain points.

Place

Citizens Financial Group boasts an extensive physical branch network, a key component of its marketing mix. As of March 2025, the bank operates around 1,000 branches, strategically located across 14 states and the District of Columbia. This substantial footprint ensures accessibility for customers who value traditional, in-person banking experiences and consultations.

The bank's commitment to its physical presence is further demonstrated by its ongoing efforts to optimize its branch strategy. Citizens is actively engaged in rebuilding and relocating branches to better align with evolving customer needs and preferences, ensuring its network remains relevant and effective in serving its customer base.

Citizens Financial Group complements its branch network with a robust ATM presence, boasting approximately 3,100 to 3,300 machines. This broad accessibility ensures customers can easily perform cash withdrawals and basic banking transactions anytime, anywhere. The extensive ATM network significantly enhances convenience and service availability for its customer base.

Citizens Financial Group places significant emphasis on its robust digital platforms, offering customers a seamless experience through its online and mobile banking services. These digital channels provide 24/7 access for account management, payments, and financial tools, aligning with the increasing demand for digital engagement. In 2023, Citizens reported that over 70% of its customer interactions occurred through digital channels, highlighting the importance of these platforms.

Strategic Market Expansion

Citizens Financial Group is strategically expanding its reach, focusing on high-growth areas like wealth management and private banking. This includes establishing new offices in key financial hubs such as Boston, Palm Beach, and New York City, aiming to bolster its presence in affluent markets.

The company's expansion strategy emphasizes both new market entry and deepening its footprint within existing regions. This dual approach supports organic growth and allows Citizens to cater more effectively to specific client needs in targeted segments.

- Targeted Expansion: New offices opened in Boston, Palm Beach, and New York City in 2024 to enhance wealth and private banking services.

- Market Focus: Deepening presence in lucrative segments and regions with high net worth individuals.

- Growth Strategy: Emphasis on organic growth within existing markets alongside strategic new market entries.

- Financial Sector Growth: Citizens Financial Group's wealth management segment saw significant client asset growth in the first half of 2024, indicating positive reception to its expansion efforts.

Customer Contact Centers

Citizens Financial Group's customer contact centers are a vital component of their marketing mix, ensuring robust customer support across multiple channels. These centers handle a wide array of banking inquiries, from routine account questions to more complex issue resolution, providing a direct line of communication for customers.

This commitment to accessible support is crucial in the current financial landscape. For instance, in Q1 2024, Citizens reported a significant volume of customer interactions through their digital and contact center channels, underscoring the importance of these touchpoints. Their multi-channel strategy aims to meet customers wherever they are, whether through phone, chat, or email.

- Comprehensive Support: Centers offer assistance for diverse banking needs.

- Accessibility: Provides customers with convenient interaction methods.

- Customer Engagement: Facilitates direct communication and issue resolution.

- Channel Integration: Supports a seamless customer experience across platforms.

Citizens Financial Group's physical presence, encompassing branches and ATMs, remains a cornerstone of its Place strategy, ensuring broad accessibility. This network is augmented by strategic digital platforms and expanding wealth management offices in key financial hubs.

| Location Type | Count (as of March 2025) | Strategic Focus |

|---|---|---|

| Branches | ~1,000 | Accessibility, customer consultations, optimization |

| ATMs | ~3,100-3,300 | Convenience, 24/7 transactions |

| New Offices (2024) | Boston, Palm Beach, New York City | Wealth management, private banking expansion |

What You Preview Is What You Download

Citizens Financial Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Citizens Financial Group 4P's Marketing Mix Analysis details their Product, Price, Place, and Promotion strategies. You'll gain immediate access to this fully complete, ready-to-use analysis.

Promotion

Citizens Financial Group leverages integrated marketing campaigns to boost awareness and engagement for its comprehensive financial offerings. These initiatives, spanning digital, traditional, and in-branch channels, are designed to highlight Citizens' value proposition and its commitment to providing tailored financial solutions for individuals, small businesses, and large corporations alike. For instance, in Q1 2024, Citizens reported a 7% increase in customer acquisition driven by targeted digital marketing efforts, underscoring the effectiveness of their integrated approach.

Citizens Financial Group actively leverages digital and social media platforms like X, LinkedIn, and Facebook to connect with its audience and showcase its financial products. This approach facilitates direct conversations, content distribution, and tailored messaging, effectively reaching a broad, digitally-engaged customer base.

In 2024, Citizens continued to invest in its digital capabilities, with mobile banking users showing consistent growth. For instance, as of Q1 2024, approximately 60% of retail deposits were managed through digital channels, underscoring the importance of their online engagement strategy.

Recent enhancements to the Citizens mobile app are also key promotional tools, emphasizing user convenience and control over financial management. This focus on digital experience aims to attract and retain a younger, tech-oriented demographic.

Citizens Financial Group actively cultivates its brand through public relations and thought leadership, aiming to showcase its financial acumen. For instance, participation in key investor conferences throughout 2024 and 2025, alongside the timely release of quarterly earnings reports, directly addresses stakeholder needs for transparency and reassurance.

The bank’s strategic use of news releases in 2024 and projected for 2025 keeps the public informed about crucial developments, from innovative product launches and service enhancements to impactful community engagement programs, reinforcing its commitment beyond core banking.

Community Engagement and Sponsorships

Citizens Financial Group actively engages with its communities, showcasing a strong commitment beyond traditional banking. A prime example is their annual Small Business Community Champion Award, which recognizes and supports local enterprises. This program not only benefits the recipients but also serves as a powerful promotional tool, building goodwill and a positive brand image. In 2024, Citizens invested over $5 million in community development initiatives, directly impacting local economies and reinforcing their dedication to the areas they serve.

These community-focused efforts are integral to Citizens' marketing strategy, fostering a sense of trust and connection with potential customers. By supporting local businesses and community programs, the bank enhances its reputation and cultivates a favorable brand perception. For instance, their sponsorship of local events in 2025 is projected to reach over 1 million individuals, further solidifying their community ties and brand visibility.

The impact of these sponsorships extends to tangible business benefits. By aligning with community values and actively participating in local life, Citizens Financial Group strengthens its brand loyalty and attracts new customers who prioritize socially responsible institutions. This strategic approach to community engagement is a key differentiator in the competitive financial services landscape.

Direct Marketing and Personalized Outreach

Citizens Financial Group leverages direct marketing and personalized outreach to connect with specific customer segments. This strategy focuses on delivering tailored product offerings and financial advice, aiming to build strong, trust-based relationships by demonstrating a keen understanding of individual and business needs.

For instance, Citizens targets high-net-worth individuals with specialized wealth management services, showcasing their commitment to personalized financial solutions. This deep customer understanding is crucial for fostering loyalty and driving engagement.

In 2024, Citizens reported a significant emphasis on digital engagement tools to enhance personalized customer experiences. Their direct marketing efforts are increasingly integrated with data analytics to refine targeting and message relevance, aiming for higher conversion rates and customer satisfaction.

- Targeted Wealth Management: Offering specialized services to high-net-worth individuals.

- Data-Driven Outreach: Utilizing analytics to personalize marketing messages and product recommendations.

- Relationship Building: Focusing on understanding customer needs to foster long-term trust.

- Digital Engagement: Employing digital channels to enhance personalized customer interactions.

Citizens Financial Group's promotional efforts are multifaceted, aiming to build brand awareness and drive customer acquisition across various channels. Their strategy emphasizes personalized outreach and community engagement, reinforced by digital innovation and transparent communication.

In 2024, Citizens reported a 7% increase in customer acquisition, largely attributed to targeted digital marketing. Their mobile banking adoption also saw continued growth, with approximately 60% of retail deposits managed digitally as of Q1 2024. Community initiatives, including a $5 million investment in development programs in 2024, further bolster brand perception.

| Promotional Activity | Key Metrics/Data | Impact |

|---|---|---|

| Digital Marketing Campaigns | 7% customer acquisition increase (Q1 2024) | Boosted brand awareness and lead generation. |

| Mobile Banking Enhancements | 60% of retail deposits via digital channels (Q1 2024) | Increased customer engagement and convenience. |

| Community Investment | $5M+ in community development (2024) | Enhanced brand reputation and local ties. |

| Public Relations & Thought Leadership | Participation in investor conferences (2024-2025) | Maintained stakeholder confidence and transparency. |

Price

Citizens Financial Group positions itself in the market by offering competitive interest rates across its diverse loan portfolio, encompassing mortgages, personal loans, and commercial financing. This strategy aims to attract a broad customer base while ensuring the bank's profitability.

The bank further enhances its appeal by providing flexible loan terms, a key element in retaining existing customers and acquiring new ones. This adaptability in loan structures allows Citizens to cater to varied borrower needs.

Reflecting market dynamics, Citizens Financial Group, like many institutions, adjusts its prime lending rate. For instance, the prime lending rate was set at 7.50 percent as of December 2024, demonstrating their responsiveness to economic conditions.

Citizens Financial Group's deposit account pricing strategy focuses on building a strong, stable funding base. This means offering competitive Annual Percentage Yields (APYs) on savings products to draw in customer deposits. For instance, as of early 2024, Citizens Access Savings accounts have offered APYs in the range of 4.00% to 4.70%, making them attractive compared to many traditional brick-and-mortar bank offerings.

The bank balances attracting deposits with managing its own cost of funds. By providing appealing rates on products like Certificates of Deposit (CDs) and savings accounts, Citizens aims to secure a reliable source of capital. This approach allows them to offer competitive loan products while maintaining profitability, a key aspect of their financial strategy in the current interest rate environment.

Citizens Financial Group's fee structures are designed to be competitive while contributing to their non-interest income. For instance, in the first quarter of 2024, Citizens reported $793 million in non-interest income, a portion of which is derived from various service charges and fees across their product lines.

These fees can include account maintenance charges for certain account types, overdraft fees, wire transfer fees, and ATM transaction fees for non-Citizens customers. The bank aims for transparency, clearly outlining these charges to customers to manage expectations and build trust.

Citizens is also actively engaged in optimizing its operational efficiency. This focus on cost management and improved processes directly impacts their ability to maintain competitive pricing for services and manage the overall cost of doing business, which in turn influences their fee strategies.

Wealth Management and Advisory Fees

Citizens Financial Group structures its wealth management and private banking services around a fee-based model. This approach aligns fees with the value of assets managed or the specialized advisory services rendered, particularly for their high-net-worth clientele.

The fee structure is primarily driven by assets under management (AUM), ensuring that the bank's compensation scales with the growth and value of client portfolios. This model reflects the bespoke nature of the advice and management provided.

In 2023, Citizens Financial Group reported significant growth in its fee and investment income, with wealth management playing a key role. For instance, their total non-interest income, which includes wealth management fees, saw an increase, demonstrating the segment's contribution to overall profitability.

- Fee-Based Model: Assets Under Management (AUM) and advisory service fees are the primary revenue drivers for wealth management.

- Clientele Focus: Services are tailored for high-net-worth individuals requiring specialized financial guidance.

- Revenue Contribution: The wealth management segment is a substantial contributor to Citizens Financial Group's fee income.

- Growth Trend: Fee and investment income, bolstered by wealth management, showed positive performance in 2023, indicating segment expansion.

Strategic Pricing for Commercial Clients

Citizens Financial Group's strategic pricing for commercial clients is highly customized, reflecting the diverse needs of businesses. For lending, pricing considers factors like the client's creditworthiness and the loan's tenor, aiming for competitive rates that align with market benchmarks. For instance, in early 2024, commercial loan rates varied significantly, with prime rates hovering around 8.5%, but specific client pricing could be adjusted based on risk profiles and relationship depth.

Treasury management and capital markets solutions also feature tailored pricing. Fee structures for these services are designed to reflect the complexity and value derived by the client. This approach allows Citizens to offer flexible arrangements, such as tiered fees for cash management services or project-based fees for advisory work in capital markets, fostering a partnership rather than a transactional relationship.

The bank's pricing strategy is fundamentally about value creation and long-term relationship building. By offering competitive yet profitable pricing, Citizens aims to become a trusted financial partner for its commercial clients. This is supported by data showing that strong client relationships in commercial banking often lead to increased product adoption and higher revenue per client, with many institutions reporting that personalized pricing strategies can improve client retention by as much as 15-20%.

- Customized Loan Rates: Pricing reflects client size, financial health, and loan terms.

- Tailored Fee Structures: Advisory and treasury services priced based on complexity and value.

- Relationship-Driven Pricing: Focus on long-term partnerships and client retention.

- Market Competitiveness: Rates benchmarked against industry standards to attract and retain business.

Citizens Financial Group's pricing strategy is multifaceted, balancing competitive rates on loans and deposits with strategic fee structures to ensure profitability and customer acquisition. The bank actively adjusts its prime lending rate, which stood at 7.50 percent in December 2024, reflecting market responsiveness. Deposit accounts, such as the Citizens Access Savings, offered APYs between 4.00% and 4.70% in early 2024, aiming to attract a stable funding base.

| Product/Service | Pricing Strategy | Key Data Point (2024/2025) |

|---|---|---|

| Loans | Competitive interest rates, flexible terms | Prime Lending Rate: 7.50% (December 2024) |

| Deposit Accounts | Competitive APYs to build funding base | Citizens Access Savings APY: 4.00%-4.70% (Early 2024) |

| Wealth Management | Fee-based on Assets Under Management (AUM) | Significant contributor to fee income (2023 growth) |

| Commercial Services | Customized rates based on creditworthiness and value | Treasury management fees are tiered; advisory services project-based |

4P's Marketing Mix Analysis Data Sources

Our Citizens Financial Group 4P's Marketing Mix Analysis is constructed using a comprehensive blend of official company disclosures, including SEC filings and annual reports, alongside insights from investor presentations and press releases. We also leverage data from their official brand website and relevant industry reports to ensure accuracy.