Citizens Financial Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citizens Financial Group Bundle

Citizens Financial Group operates within a dynamic banking landscape shaped by intense competition and evolving customer expectations. Understanding the subtle interplay of buyer power, supplier influence, and the threat of new entrants is crucial for navigating this environment.

The complete report reveals the real forces shaping Citizens Financial Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

For Citizens Financial Group, the primary 'suppliers' are its depositors. If a large chunk of these deposits comes from just a few big institutional clients or a segment that's very sensitive to interest rates, these depositors gain more power to ask for higher rates. This directly affects the bank's net interest margin, which is a key measure of profitability.

Citizens Financial Group actively works to keep its deposit base stable and diverse. A significant portion of their total deposits comes from retail customers, which is a more stable source compared to large, potentially volatile institutional deposits. This strategy helps to lessen the bargaining power of any single large depositor group.

As Citizens Financial Group (CFG) pushes further into digital banking, the power of its technology and software suppliers grows. Companies providing specialized AI and embedded finance APIs are crucial for CFG's online and mobile services, wealth management, and risk analysis. For instance, in 2024, the global financial technology market was valued at over $1.1 trillion, highlighting the significant demand for these services.

This reliance means these specialized vendors, especially those with unique AI capabilities or robust API integrations, can negotiate from a stronger position. The complexity and integration costs associated with switching these critical systems can make it difficult for CFG to change providers, potentially leading to higher prices or less favorable contract terms from these suppliers.

The financial services sector, including institutions like Citizens Financial Group, heavily relies on specialized expertise. Fields such as wealth management, commercial lending, and cutting-edge digital innovation demand professionals with deep knowledge and experience. This need for highly skilled individuals is a significant factor in the bargaining power of suppliers in this industry.

The scarcity of top-tier talent in these niche areas translates directly into increased leverage for employees. They can command higher salaries and more attractive benefits packages, which naturally drives up recruitment and retention costs for companies. For Citizens Financial Group, especially as they invest in growth areas like their Private Bank, managing these human capital costs is a key consideration.

Interbank Lending Market

The interbank lending market acts as a crucial, albeit non-traditional, supplier of liquidity for Citizens Financial Group. When conditions in this market tighten or rates rise, it directly increases the bank's cost of funds, impacting its bottom line and lending capacity.

Citizens Financial Group, like other banks, actively manages its funding mix to control these costs. For instance, in Q1 2024, the bank reported a net interest margin of 3.22%, demonstrating the ongoing effort to balance funding costs with asset yields.

- Interbank Lending Rates: Volatility in these rates can significantly alter Citizens Financial Group's funding expenses.

- Liquidity Conditions: A contraction in available liquidity in the wholesale market forces banks to seek more expensive funding alternatives.

- Cost of Funds Management: Citizens Financial Group's strategy to optimize deposit costs is a direct response to managing the bargaining power of these funding sources.

Data and Information Providers

In today's financial world, data is king, and those who provide it wield considerable influence. For Citizens Financial Group, access to accurate and timely financial data, market intelligence, and credit scoring models is crucial for everything from managing risk to understanding customers and making smart strategic moves. The reliance on these providers means they have a strong hand in negotiations.

The bargaining power of data and information providers for Citizens Financial Group is amplified by the specialized and often proprietary nature of the information they offer. Services like Bloomberg Terminal, Refinitiv Eikon, or specialized credit bureaus provide data that is not readily available elsewhere. For instance, in 2024, the global financial data market was valued at over $30 billion, with a significant portion attributed to specialized data providers that banks like Citizens depend on for competitive insights and regulatory compliance.

- Data Dependency: Citizens Financial Group's operational efficiency and strategic planning are heavily reliant on the quality and availability of data from external providers.

- Proprietary Information: Unique datasets and advanced analytical models offered by these suppliers create a barrier to switching and give them pricing leverage.

- Market Value: The significant investment in data services, estimated to be a substantial portion of operational budgets for large financial institutions, underscores the critical role and power of these information providers.

The bargaining power of suppliers for Citizens Financial Group is multifaceted, encompassing depositors, technology providers, skilled labor, and data services. For instance, in Q1 2024, Citizens Financial Group reported a net interest margin of 3.22%, directly influenced by the cost of its funding sources, including deposits and interbank borrowing.

The bank's reliance on specialized technology, such as AI and APIs, means vendors in the over $1.1 trillion global fintech market in 2024 can command leverage due to integration complexities. Similarly, the scarcity of top-tier talent in areas like wealth management increases the bargaining power of skilled employees, impacting recruitment costs.

Furthermore, data providers, operating within a market valued at over $30 billion in 2024 for specialized financial data, hold significant sway due to the proprietary nature of their offerings, which are critical for CFG's risk management and strategic decisions.

| Supplier Type | Key Considerations for CFG | Impact on CFG | 2024 Data Point/Context |

| Depositors | Concentration of large institutional deposits; interest rate sensitivity | Affects net interest margin; cost of funds | Q1 2024 Net Interest Margin: 3.22% |

| Technology Providers | Specialized AI, APIs for digital services | Higher costs for critical systems; switching difficulties | Global Fintech Market Value (2024): >$1.1 trillion |

| Skilled Labor | Demand for expertise in wealth management, digital innovation | Increased recruitment and retention costs | N/A (Qualitative assessment of talent scarcity) |

| Data & Information Providers | Proprietary data, credit scoring models | Leverage in negotiations; reliance for insights | Global Financial Data Market Value (2024): >$30 billion (specialized segment) |

What is included in the product

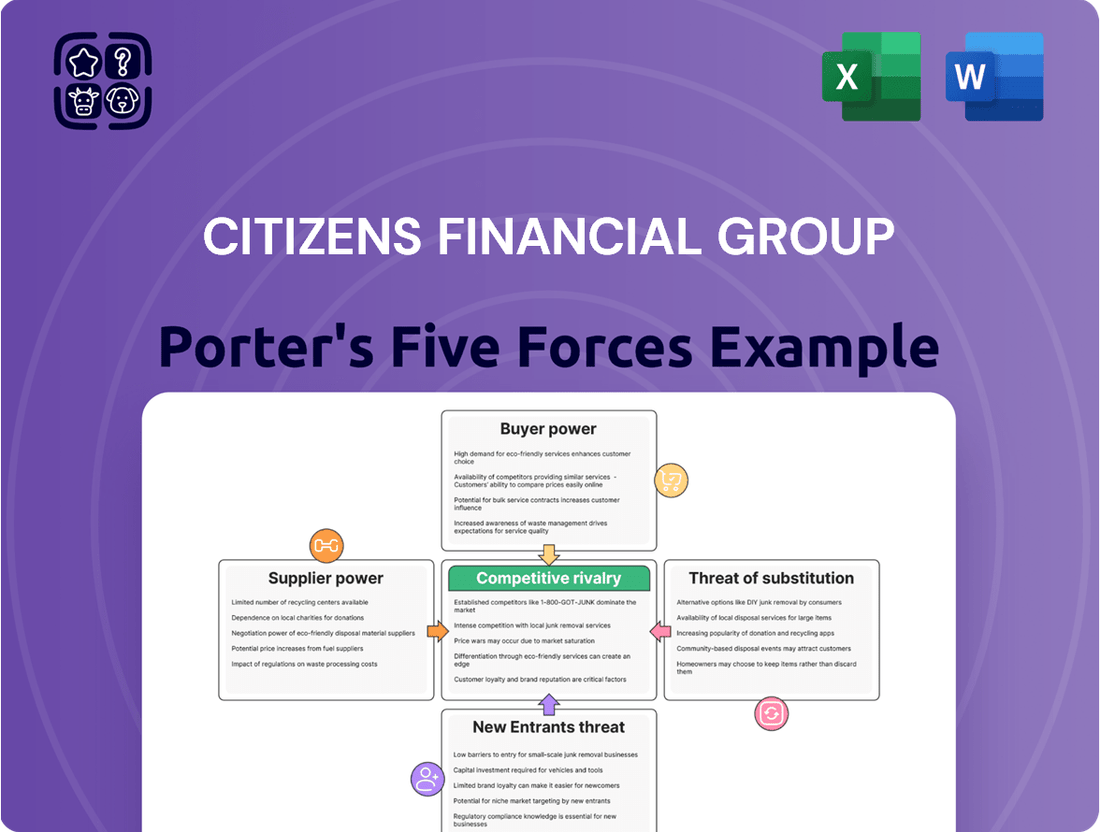

This analysis dissects the competitive forces impacting Citizens Financial Group, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Effortlessly gauge competitive intensity across all five forces to proactively address potential threats and capitalize on opportunities.

Customers Bargaining Power

While switching banks might appear straightforward, for many, particularly small and large businesses, the operational hurdles of changing accounts, payment systems, and lending relationships create substantial switching costs. These complexities can diminish customer bargaining power, as the inconvenience and potential disruption often outweigh minor rate advantages. Citizens Financial Group leverages its integrated services and deep-seated client relationships to reinforce these switching barriers.

Customers today have unprecedented access to information, thanks to digital banking platforms and comparison tools. This means they can easily see interest rates, fees, and what different banks offer. For instance, in 2024, many fintech apps provide real-time comparisons of savings account yields and loan rates, directly impacting how customers view financial institutions.

This transparency directly boosts customer bargaining power. If they find better deals elsewhere, switching providers becomes much simpler. Citizens Financial Group, recognizing this shift, has invested heavily in its digital offerings to ensure it remains competitive and meets these heightened customer expectations for easy comparison and switching.

Citizens Financial Group provides a wide array of retail and commercial banking products, from basic accounts to complex commercial loans and wealth management. This extensive portfolio allows them to offer integrated solutions.

By customizing product bundles or offering tailored services, Citizens can diminish customer bargaining power. Customers often prefer a one-stop shop for their financial needs, making it less appealing to piece together services from different providers.

Segment-Specific Power Dynamics

The bargaining power of customers for Citizens Financial Group (CFG) is not uniform; it shifts considerably depending on the specific market segment. Large institutional clients and affluent individuals, for instance, wield more influence. This is particularly evident in areas like commercial lending and wealth management, where the sheer volume of business and the potential for significant revenue allow these customers to negotiate more favorable terms and pricing. For example, in 2024, the expansion of CFG's Private Bank aims directly at this high-net-worth demographic, recognizing their greater ability to demand customized services and competitive rates.

In contrast, the average retail customer generally possesses less individual bargaining power. Their leverage increases primarily when they can easily compare offerings across multiple financial institutions, often facilitated by digital platforms and comparison websites. This accessibility to information empowers even smaller customers to seek better deals on products like mortgages, auto loans, or deposit accounts. CFG's digital strategy, therefore, plays a crucial role in managing customer expectations and maintaining competitiveness across its broader retail base.

Key aspects of customer bargaining power within CFG's operations include:

- Volume and Relationship Value: Larger clients, such as major corporations or significant wealth management accounts, often negotiate based on the substantial volume of assets or transactions they bring to the bank.

- Information Asymmetry Reduction: Digital tools and readily available market data empower retail customers to understand prevailing interest rates and fees, reducing the information gap and increasing their ability to negotiate.

- Segmented Service Models: CFG's strategic focus on segments like the Private Bank acknowledges that high-net-worth individuals expect and can demand more personalized service and preferential terms, reflecting their higher bargaining power.

- Price Sensitivity: While all customers are sensitive to price, the degree varies. Retail customers might switch for minor differences, while large corporate clients might negotiate more complex fee structures and service level agreements.

Interest Rate Environment

In a rising interest rate environment, customers, especially those with substantial deposits or loan needs, tend to gain more bargaining power. Banks often compete more aggressively for this business by offering more favorable rates. For instance, during periods of rate hikes, a customer with a large certificate of deposit might find themselves able to negotiate a higher yield. This dynamic directly impacts a financial institution like Citizens Financial Group.

Conversely, when interest rates are low, the bargaining power often shifts back towards the banks. In such scenarios, customers have fewer alternatives for higher returns on their deposits, making them more inclined to accept prevailing rates. This can lead to a compression of net interest margins for banks if they are unable to offset lower lending rates with increased loan volumes.

Citizens Financial Group's performance reflects these shifts. For example, in the first quarter of 2024, the company reported a net interest margin that was influenced by the prevailing interest rate landscape. As rates began to stabilize or slightly decrease in certain periods of 2024, the bank's ability to attract deposits at competitive rates and lend at profitable spreads became a key focus.

- Customer Leverage: Higher rates empower deposit-rich customers and borrowers to seek better terms.

- Bank Competition: Financial institutions must offer competitive rates to attract and retain customers in a rising rate environment.

- Net Interest Margin Impact: Fluctuations in interest rates directly affect the difference between interest income and interest expense for banks like Citizens Financial Group.

- 2024 Trends: Early 2024 data for Citizens Financial Group showed how interest rate movements influenced their net interest margin, highlighting the sensitivity to customer deposit and lending behavior.

The bargaining power of customers for Citizens Financial Group (CFG) is influenced by their ability to switch and the availability of information. While operational complexities can deter some, the rise of digital comparison tools in 2024 empowers customers to easily assess rates and fees across institutions. This transparency, coupled with CFG's broad product offerings and segmented service models, means customer leverage varies significantly by segment, with larger clients typically holding more sway.

| Customer Segment | Bargaining Power Factors | CFG Strategy Example |

|---|---|---|

| Retail Customers | Information access via digital platforms, price sensitivity | Competitive digital offerings, streamlined account opening |

| High-Net-Worth Individuals | Relationship value, demand for customization | Private Bank expansion, tailored wealth management |

| Commercial Clients | Transaction volume, complex financial needs | Integrated banking solutions, dedicated relationship managers |

Preview Before You Purchase

Citizens Financial Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Citizens Financial Group, detailing the competitive landscape and strategic positioning. The document you see here is the exact, fully formatted report you will receive immediately after purchase, offering actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and substitute products. You can trust that what you are previewing is precisely the professionally written analysis that will be available to you instantly upon completing your transaction.

Rivalry Among Competitors

The U.S. banking sector's fragmentation fuels intense competition, with hundreds of regional and community banks vying against national giants like Citizens Financial Group. This crowded field means many institutions offer similar deposit, lending, and wealth management services, making differentiation a constant challenge.

Citizens Financial Group faces intense competition from rivals employing aggressive pricing on loans and deposits. This constant pressure necessitates a strategic focus on differentiation through product innovation.

To stay ahead, Citizens has been actively expanding its product suite and investing in technological advancements. For instance, their recent launch of a new range of Mastercard credit cards and enhanced cash management platforms demonstrates this commitment to innovation.

The banking sector is experiencing a significant surge in competitive rivalry fueled by rapid technological advancements and widespread digital transformation. Banks are pouring resources into developing advanced digital platforms and mobile banking solutions to improve customer engagement and streamline operations. For instance, by the end of 2023, Citizens Financial Group reported a 15% increase in digital sales, highlighting the industry's shift towards digital channels.

Geographic and Segment Overlap

Citizens Financial Group (CFG) faces robust competitive rivalry due to significant geographic and segment overlap with numerous regional and national banks. This intense competition is particularly evident in core areas like deposit gathering and loan origination, where banks vie for the same customer base. CFG's strategic expansion into markets such as the New York City Metro area and California directly places it in head-to-head competition with established players in these lucrative regions.

The overlap isn't just about location; it extends to the customer segments CFG serves, including individuals, small businesses, and larger corporations. This broad reach means CFG is often competing with institutions that have similar product offerings and target demographics. For instance, in 2024, the banking sector continued to see consolidation and aggressive market share pursuits, making differentiation and customer retention paramount.

- Geographic Overlap: CFG's presence in states like Pennsylvania, New Jersey, and Massachusetts means it directly competes with other banks operating in these same areas, such as PNC Financial Services and M&T Bank.

- Segment Overlap: Serving both retail and commercial clients means CFG competes with a wide array of institutions, from community banks focusing on local businesses to large national banks with extensive corporate banking divisions.

- Market Expansion: CFG's move into the New York City Metro area, a highly competitive financial hub, intensifies rivalry with giants like JPMorgan Chase and Bank of America, as well as numerous regional banks.

- Deposit and Loan Competition: In 2024, the pursuit of deposits remained a key battleground, with banks offering competitive rates. Similarly, loan markets, especially for small businesses and mortgages, saw intense competition, impacting net interest margins.

Mergers and Acquisitions Activity

Mergers and acquisitions (M&A) are a constant feature in the banking industry, significantly altering the competitive environment. When banks combine, they often become larger and more powerful, potentially increasing pressure on rivals like Citizens Financial Group. This activity can also lead to the acquisition of niche technologies or expanded customer bases, further intensifying competition.

Citizens Financial Group has actively participated in M&A, demonstrating its strategic approach to navigating this dynamic landscape. For instance, in 2021, Citizens completed its acquisition of 80 branches and related deposits from HSBC, a move aimed at expanding its retail footprint in attractive markets.

- Increased Scale and Market Share: M&A can consolidate market share, creating larger entities with greater pricing power and broader reach.

- Acquisition of Capabilities: Banks may acquire competitors to gain specialized technologies, talent, or access to new customer segments.

- Strategic Repositioning: M&A allows banks to divest non-core assets or enter new geographic or product markets, reshaping their competitive positioning.

- Impact on Rivalry Intensity: Successful M&A can lead to fewer, but stronger, competitors, potentially increasing rivalry among the remaining players for market dominance.

Citizens Financial Group operates in a highly competitive U.S. banking landscape, characterized by significant overlap in geographic presence and customer segments with numerous regional and national institutions. This intense rivalry is further amplified by the industry's ongoing digital transformation, pushing banks to innovate in areas like mobile banking and digital sales, where Citizens saw a 15% increase by the end of 2023.

| Competitor | Key Overlap Areas | Competitive Actions |

|---|---|---|

| PNC Financial Services | Pennsylvania, New Jersey, Massachusetts (Geographic); Retail & Commercial (Segment) | Aggressive pricing on loans, digital platform enhancements |

| M&T Bank | Northeastern U.S. (Geographic); Small Business (Segment) | Focus on community banking relationships, strategic acquisitions |

| JPMorgan Chase | New York City Metro, National Presence (Geographic); All Segments | Extensive digital services, broad product offerings, significant marketing investment |

| Bank of America | National Presence (Geographic); All Segments | Digital banking leadership, personalized financial advice, strong brand recognition |

SSubstitutes Threaten

Fintech companies and digital-only banks present a significant threat of substitutes by offering niche financial services, like streamlined payment processing and accessible lending platforms, often at a lower cost due to their lean digital operations. These agile competitors can attract customers seeking convenience and specialized solutions, directly challenging traditional banks like Citizens Financial Group.

For instance, the digital banking sector has seen substantial growth, with neobanks attracting millions of users globally. In 2024, many fintechs reported strong user acquisition numbers, demonstrating their appeal to consumers who prioritize digital-first experiences. This trend forces established institutions to innovate rapidly.

Citizens Financial Group has acknowledged this competitive landscape by actively pursuing partnerships with fintech firms. These collaborations aim to integrate innovative technologies and expand service offerings, thereby mitigating the threat of substitutes and retaining customers by providing modern, efficient digital banking solutions.

Alternative lending platforms, including online lenders and peer-to-peer networks, present a significant threat by offering faster and often more flexible financing. These platforms are increasingly capturing market share, particularly in consumer and small business segments, directly competing with Citizens Financial Group's traditional loan products.

Citizens Financial Group's wealth management and investment services face a significant threat from specialized investment management firms and the burgeoning robo-advisor sector. These alternatives provide focused expertise and often more competitive fee structures, directly challenging traditional banking models. For instance, the global robo-advisor market was projected to reach $2.7 trillion in assets under management by 2024, a testament to their growing appeal.

The appeal of these substitutes lies in their ability to offer a wide array of investment products and increasingly sophisticated automated financial advice. This forces established players like Citizens Financial Group to continuously innovate and enhance their own private banking and wealth management divisions to retain and attract clients. The convenience and perceived cost-effectiveness of digital platforms are key drivers of this competitive pressure.

Credit Unions and Community Banks

Credit unions and community banks present a notable threat of substitutes for Citizens Financial Group. These institutions often attract customers by offering more personalized service, potentially lower fees, and a strong local presence, which can be highly appealing to specific customer segments. For instance, as of early 2024, the credit union sector in the U.S. continued to grow, with total assets reaching over $2.2 trillion, demonstrating their significant market presence and ability to draw deposits and loans away from traditional banks.

Their cooperative or community-focused business models differentiate them from larger, publicly traded banks. This differentiation allows them to cater to niche markets or customers who prioritize community investment and member benefits over the broader reach of a national institution. The appeal of these substitutes is amplified when customers feel underserved by larger banks or seek a more intimate banking relationship.

- Personalized Service: Credit unions and community banks often excel in providing tailored customer experiences.

- Lower Fees and Rates: Their non-profit or community-centric structures can enable them to offer more competitive pricing.

- Local Focus: A strong emphasis on community development resonates with customers who want their banking to support local economies.

Direct Capital Markets and Corporate Treasury Management

Large corporations increasingly bypass traditional commercial banks by directly accessing capital markets for funding through bond or equity issuances. This direct access, coupled with sophisticated internal treasury management systems, can substitute for services like traditional corporate lending and basic cash management offered by banks. For instance, in 2023, U.S. non-financial corporate debt issuance reached approximately $1.7 trillion, showcasing a significant alternative to bank loans.

Citizens Financial Group actively addresses this threat by integrating capital markets expertise and advanced treasury solutions within its commercial banking offerings. This strategy aims to retain clients by providing comprehensive financial management tools that compete with direct market access. The bank's treasury management services, for example, focus on optimizing cash flow, liquidity, and payment processing, thereby offering value beyond simple lending.

- Direct Capital Markets Access: Corporations can raise capital directly through bond and equity markets, reducing reliance on bank loans.

- Internal Treasury Management: Sophisticated in-house systems for cash, liquidity, and risk management can substitute for certain bank services.

- Citizens' Mitigation Strategy: Citizens Financial Group offers integrated capital markets and treasury management services to provide a competitive alternative.

- Market Trend: U.S. non-financial corporate debt issuance highlights the significant scale of direct capital market financing as a substitute for traditional banking.

The threat of substitutes for Citizens Financial Group is multifaceted, encompassing fintech innovations, alternative lending, specialized investment services, credit unions, and direct access to capital markets by corporations. These substitutes often offer greater convenience, lower costs, or more specialized services, compelling traditional banks to adapt.

Fintechs and neobanks continue to gain traction by providing digital-first experiences and niche services, while alternative lenders expedite loan processes. Robo-advisors are increasingly managing wealth, and credit unions offer personalized community banking. Corporations are also bypassing banks for direct capital raising.

Citizens Financial Group is actively countering these threats through strategic partnerships with fintechs, enhancing its digital offerings, and bolstering its capital markets and treasury management services. This proactive approach aims to retain clients by offering competitive, modern financial solutions that meet evolving customer demands.

| Substitute Category | Key Characteristics | Impact on Citizens Financial Group | Mitigation Strategies | Relevant 2024 Data/Trends |

|---|---|---|---|---|

| Fintech & Digital Banks | Niche services, lower costs, convenience | Customer attrition, reduced fee income | Partnerships, digital innovation, improved user experience | Neobanks attracting millions of users; strong user acquisition reported by fintechs. |

| Alternative Lending | Faster, flexible financing | Loss of loan market share (consumer/SME) | Streamlining loan processes, competitive rates | Continued growth in online lending platforms. |

| Investment Management & Robo-Advisors | Specialized expertise, lower fees, automation | Reduced wealth management AUM and fees | Enhancing wealth management services, hybrid models | Projected $2.7 trillion in robo-advisor AUM globally by 2024. |

| Credit Unions & Community Banks | Personalized service, lower fees, local focus | Deposit and loan competition, customer loyalty | Leveraging community ties, competitive pricing | U.S. credit union sector assets exceeding $2.2 trillion in early 2024. |

| Direct Capital Markets Access | Bypassing banks for funding | Reduced corporate lending and treasury services revenue | Integrated capital markets and treasury solutions | U.S. non-financial corporate debt issuance around $1.7 trillion in 2023. |

Entrants Threaten

The banking sector, including institutions like Citizens Financial Group, faces substantial regulatory barriers that deter new entrants. Navigating complex licensing, significant capital requirements, and ongoing compliance obligations demands considerable resources and expertise. This stringent oversight, exemplified by the Federal Reserve's rigorous stress tests applied to major banks, effectively limits the number of new traditional players entering the market.

Establishing a bank, particularly one offering comprehensive retail and commercial services like Citizens Financial Group, demands immense capital. This includes significant investments in physical infrastructure, cutting-edge technology, and stringent regulatory compliance. For instance, in 2023, the average capital required to charter a new national bank in the US could easily run into tens of millions of dollars, a figure that can escalate dramatically for larger operations.

This substantial financial barrier effectively deters numerous potential new entrants. The sheer scale of the initial investment, coupled with the prolonged period required to achieve a return, presents a formidable challenge for any aspiring competitor looking to enter the banking sector.

Citizens Financial Group, with its decades of operation and extensive branch presence, already enjoys significant brand recognition and deeply ingrained customer trust. This makes it difficult for newcomers to gain traction.

New entrants must invest heavily in marketing and building a reputation from scratch, a process that can take years and substantial capital to overcome the loyalty Citizens has cultivated.

Economies of Scale and Scope

Large, established financial institutions like Citizens Financial Group leverage significant economies of scale. This means they can spread their operational, technological, and marketing costs over a much larger customer base, leading to lower per-unit costs. For instance, in 2024, Citizens Financial Group reported total assets exceeding $220 billion, enabling substantial investments in advanced digital platforms and nationwide marketing campaigns that new entrants simply cannot match from the outset.

New entrants face a considerable hurdle in achieving comparable efficiencies. Without the established infrastructure and customer volume, they struggle to compete on price or offer the same breadth of products and services as incumbents. This disparity makes it challenging for them to attract customers away from trusted, large-scale providers.

- Economies of Scale: Citizens Financial Group's large asset base allows for cost efficiencies in technology and operations.

- Competitive Pricing: Scale enables lower pricing, a barrier for smaller, newer competitors.

- Service Breadth: Established players offer a wider range of services, difficult for new entrants to replicate quickly.

- Marketing Reach: Significant marketing budgets enhance brand recognition and customer acquisition for large banks.

Technological Disruption by FinTechs

Technological disruption by FinTechs presents a significant threat to established players like Citizens Financial Group. While traditional banks face high regulatory and capital hurdles, FinTech firms can bypass much of this by focusing on niche services and leveraging agile technology. This allows them to enter the market more easily and quickly gain traction.

These agile competitors often offer specialized services, such as payments, lending, or wealth management, with a superior user experience and lower costs. For instance, the digital payments market continues to see rapid growth, with companies like PayPal and Square processing billions in transactions. In 2023, global FinTech investment reached over $100 billion, indicating a strong influx of capital into these innovative companies.

- FinTechs bypass traditional banking infrastructure, reducing entry barriers.

- They focus on specific, high-demand financial services, often with better user experience.

- Rapid market share gains in niche areas can disrupt established business models.

- Citizens Financial Group, like other incumbents, must innovate or acquire to remain competitive.

The threat of new entrants for Citizens Financial Group is moderate, primarily due to high capital requirements and stringent regulations that act as significant deterrents. However, the rise of FinTech companies, which can operate with lower overhead and focus on specific services, presents a more accessible entry point into certain segments of the financial market. These agile competitors often leverage technology to offer specialized services with a streamlined user experience, challenging incumbents. For example, in 2023, FinTech investment globally exceeded $100 billion, demonstrating substantial capital flowing into these disruptive players.

| Barrier Type | Impact on New Entrants | Citizens Financial Group's Advantage |

| Capital Requirements | Very High | Established, large asset base ($220+ billion in 2024) |

| Regulatory Hurdles | Very High | Extensive experience in compliance and licensing |

| Brand Recognition & Trust | High | Decades of operation and established customer loyalty |

| Economies of Scale | High | Lower per-unit costs in technology, operations, and marketing |

| FinTech Agility | Moderate | Potential for disruption in niche services and digital offerings |

Porter's Five Forces Analysis Data Sources

Our Citizens Financial Group Porter's Five Forces analysis is built upon a foundation of reliable data, including Citizens' annual reports and SEC filings, alongside industry-specific reports from research firms like IBISWorld and financial data providers such as S&P Capital IQ.