Citizens Financial Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citizens Financial Group Bundle

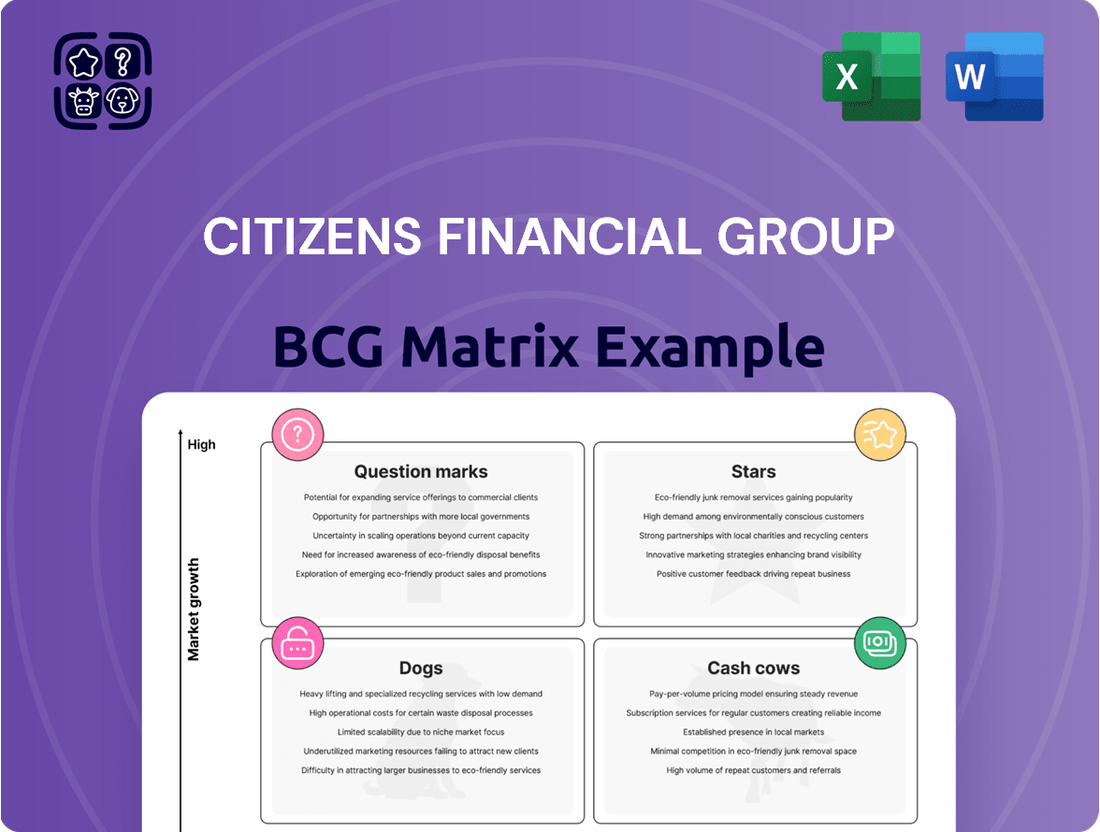

Curious about Citizens Financial Group's market performance? Our BCG Matrix preview highlights key product positions, but the full report unlocks the complete picture. Discover which segments are driving growth and which require strategic attention.

Don't just guess where Citizens Financial Group's future lies; know it. Purchase the full BCG Matrix for a comprehensive breakdown of Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights to optimize your investment strategy.

This isn't just a chart; it's your strategic roadmap. Get the full Citizens Financial Group BCG Matrix to gain a competitive edge and make informed decisions about resource allocation and future product development.

Stars

Citizens Financial Group is significantly bolstering its Private Banking and Wealth Management offerings, aiming to attract high-net-worth and ultra-high-net-worth clients. This expansion is a clear indicator of the company's strategic intent to capitalize on a lucrative and expanding market segment.

The opening of new private banking offices in major financial hubs like New York and Boston underscores this commitment. By establishing a stronger physical presence in key markets, Citizens is positioning itself to better serve its target demographic and gain market share.

The recent onboarding of experienced advisor teams, managing substantial client assets, highlights the perceived high growth potential and strategic importance of this business line. For instance, in 2024, the company has been actively recruiting seasoned professionals to bolster its advisory capabilities.

Citizens' Commercial Banking division, especially its capital markets arm, is a star performer. In 2024, this segment achieved record fee income, a testament to its robust client engagement and service offerings. Projections for 2025 indicate continued strong growth, solidifying its position as a key revenue driver for the group.

The focus on mid-corporate and middle-market clients allows Citizens to deliver a full suite of financial solutions. This includes essential services like lending, sophisticated treasury management, and crucial M&A advisory, catering to the complex needs of these businesses. This strategic focus is paying off handsomely.

Synergies with the Private Bank and Private Wealth segments are a significant advantage. By collaborating effectively, Citizens can better serve private equity communities, unlocking new opportunities and driving further expansion within this lucrative market. This integrated approach is a key differentiator.

Citizens Financial Group is heavily investing in digital banking and mobile capabilities, aiming for a seamless customer experience. Recent enhancements, like improved payment and direct deposit features developed with partners such as Mastercard, highlight this commitment to digital innovation.

Strategic Acquisitions and Geographic Expansion

Citizens Financial Group has actively pursued strategic acquisitions to bolster its market position. A prime example is the acquisition of HSBC's East Coast branches, which significantly boosted its deposit base and customer reach. This move, along with the integration of Investors Bank, has injected substantial household and deposit growth, particularly within the competitive Tri-State metropolitan area.

The bank's expansion strategy isn't limited to branch acquisitions; it also focuses on enhancing its product suite and market share through targeted talent acquisition, especially within its wealth management segment. This dual approach of strategic buying and organic talent development positions Citizens for continued growth in key financial services.

- Acquisition of Investors Bank: This deal, valued at approximately $3.5 billion, significantly expanded Citizens' footprint in the attractive Tri-State region, adding around $24 billion in deposits and $12 billion in loans as of early 2023.

- HSBC East Coast Branches: The acquisition of 80 HSBC branches in the Eastern U.S. for $7.7 billion, completed in early 2023, brought in approximately $9 billion in deposits and $2 billion in loans, further strengthening Citizens' retail presence.

- Talent Focus in Wealth Management: Citizens has been actively recruiting experienced professionals in wealth management, aiming to deepen client relationships and expand its advisory services, a key area for future revenue growth.

Sustainable Finance Initiatives

Citizens Financial Group is actively pursuing ambitious sustainable finance goals. By 2030, the company aims to provide $50 billion in sustainable finance, with a significant portion dedicated to green financing. This includes a commitment to achieve carbon neutrality for its oil and gas clients by 2035, demonstrating a forward-thinking approach to environmental stewardship.

The bank's dedication extends to various environmental and social initiatives. Projects supporting affordable housing and community development are key components of their strategy, positioning Citizens as a frontrunner in responsible banking practices. These efforts resonate with increasing public demand for sustainability and unlock new opportunities in the expanding green economy.

- Sustainable Finance Target: $50 billion by 2030.

- Green Financing Focus: A substantial portion of the $50 billion target is allocated to green initiatives.

- Oil & Gas Client Carbon Neutrality: Aiming for carbon neutrality for these clients by 2035.

- Community Impact: Investment in affordable housing and community development projects.

Citizens Financial Group's Commercial Banking, particularly its capital markets division, stands out as a star performer within the company's BCG Matrix. This segment has demonstrated exceptional growth and profitability, driven by strong client relationships and a comprehensive suite of financial solutions tailored for mid-corporate and middle-market businesses. Its success is a significant contributor to the group's overall financial strength.

The capital markets arm has achieved notable financial milestones, including record fee income in 2024, underscoring its robust performance. Projections for 2025 indicate a continuation of this upward trend, solidifying its position as a key revenue generator. The strategic focus on providing lending, treasury management, and M&A advisory services to this client base has proven highly effective.

Furthermore, the synergies created between Commercial Banking, Private Banking, and Private Wealth management enhance the overall value proposition. This integrated approach allows Citizens to effectively serve diverse client needs, including those within the private equity sector, further solidifying the star status of its commercial operations.

| Business Segment | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| Commercial Banking (Capital Markets) | High | High | Star |

| Private Banking & Wealth Management | High | Medium | Question Mark / Star |

| Digital Banking & Mobile Capabilities | High | Medium | Question Mark / Star |

| Retail Banking (Post-Acquisitions) | Medium | High | Cash Cow |

What is included in the product

This BCG Matrix overview provides strategic insights for Citizens Financial Group's business units, highlighting which to invest in or divest.

Citizens Financial Group's BCG Matrix offers a clear, one-page overview, relieving the pain of strategic uncertainty by placing each business unit in a quadrant.

Cash Cows

Citizens Financial Group's core retail banking services, encompassing checking, savings, and a range of loan products like mortgages and credit cards, are firmly positioned as Cash Cows. This segment boasts a high market share within a mature industry, providing a stable and foundational deposit base crucial for the bank's operations.

These established offerings consistently generate substantial cash flow with minimal need for extensive marketing or expansion initiatives. For instance, in the first quarter of 2024, Citizens reported a net interest margin of 3.15%, reflecting the profitability of its lending and deposit activities, even as the overall loan growth moderated.

Citizens Financial Group's extensive network of roughly 1,000 branches and 3,100 ATMs across 14 states and the District of Columbia represents a significant Cash Cow. This robust physical footprint ensures broad customer reach and convenient access, fostering a stable deposit base and consistent cash flow.

The established branch and ATM infrastructure, a key component of Citizens' Cash Cow strategy, provides a reliable channel for customer interaction and transactions, even as digital banking expands. This physical presence underpins sustained revenue generation and market stability.

Citizens Financial Group's mortgage lending and servicing rights (MSR) represent a significant cash cow. This business line generates substantial fee income for the bank, leveraging a mature market to provide a consistent and reliable revenue stream. The ability to realize gains from MSRs, even amidst interest rate volatility, solidifies its position as a profit-driver.

Treasury Management Services

Citizens Financial Group's Treasury Management Services (TMS) are a prime example of a cash cow within their business portfolio. These services are designed for commercial clients, offering a steady stream of fee-based income and fostering deep, lasting relationships.

The core of TMS involves helping businesses efficiently manage their cash flow and overall financial operations. This makes the services indispensable for corporate clients, leading to the characteristic long-term and sticky client engagements that are vital for stable revenue generation.

In 2024, Citizens Financial Group reported significant growth in its commercial banking segment, which heavily relies on treasury management solutions. For instance, their net interest income in this segment showed resilience, and fee income from treasury management services contributed substantially to the overall profitability. This segment's consistent performance provides a reliable revenue base, demonstrating a lower sensitivity to market volatility when contrasted with more interest-rate sensitive banking products.

- Stable Fee Income: Treasury management services generate predictable, recurring fees, reducing reliance on volatile interest rate spreads.

- Client Retention: The essential nature of these services fosters strong, long-term relationships, leading to high client retention rates.

- Low Market Sensitivity: Unlike loan portfolios, fee income from treasury management is less impacted by fluctuations in interest rates or economic downturns.

- Revenue Diversification: TMS offers a crucial diversification of revenue streams for Citizens Financial Group, balancing risk across different business lines.

Long-standing Customer Relationships

Citizens Financial Group, with its deep roots as one of America's oldest financial institutions, leverages a significant advantage through its long-standing customer relationships. These established connections, spanning both retail and commercial banking, translate into a stable and predictable revenue stream. For instance, in 2023, Citizens reported a net interest margin of 3.16%, reflecting the consistent profitability derived from these enduring client ties.

This legacy fosters a loyal customer base, a critical asset in the competitive banking landscape. The bank's commitment to offering personalized advice and bespoke financial solutions is key to nurturing and strengthening these valuable relationships. This customer-centric approach helps ensure retention and encourages deeper engagement, contributing to the predictable deposit and loan volumes that characterize a cash cow.

- Loyal Customer Base: Citizens benefits from decades of customer trust.

- Predictable Revenue: Long-term relationships ensure consistent income.

- Tailored Solutions: Personalized service strengthens client bonds.

- Deposit Stability: Established relationships support a strong deposit base.

Citizens Financial Group's established retail banking operations, including checking and savings accounts, are a prime example of a cash cow. These services maintain a high market share in a mature sector, providing a consistent and substantial revenue stream with minimal investment. In Q1 2024, Citizens reported a net interest margin of 3.15%, underscoring the profitability of these core deposit and lending activities.

| Business Segment | BCG Matrix Category | Key Characteristics | 2024 Performance Insight |

|---|---|---|---|

| Core Retail Banking (Deposits & Loans) | Cash Cow | High market share, mature industry, stable cash flow. | Net interest margin of 3.15% in Q1 2024. |

| Branch & ATM Network | Cash Cow | Extensive physical presence, broad customer reach, stable revenue. | Approximately 1,000 branches and 3,100 ATMs across 14 states. |

| Mortgage Lending & MSRs | Cash Cow | Generates substantial fee income, mature market, reliable revenue. | Consistent fee income contribution, even with interest rate shifts. |

| Treasury Management Services (TMS) | Cash Cow | Steady fee-based income, high client retention, low market sensitivity. | Significant contribution to commercial banking segment profitability in 2024. |

What You’re Viewing Is Included

Citizens Financial Group BCG Matrix

The Citizens Financial Group BCG Matrix you are previewing is the definitive, final document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted, will be delivered without any watermarks or demo content, ensuring you get a fully formatted and professionally prepared strategic tool.

Rest assured, the BCG Matrix report you see now is precisely the same high-quality document that will be sent to you upon completion of your purchase. It represents the final, analysis-ready version, offering immediate utility for your strategic planning and decision-making processes.

Dogs

Citizens Financial Group's legacy loan portfolios, especially within certain Commercial Real Estate (CRE) segments, are showing signs of weakness. These areas are experiencing a rise in criticized loan balances and non-performing assets, indicating potential trouble spots.

These specific CRE segments are likely categorized as 'dogs' in the BCG matrix. They face limited growth opportunities and carry a higher risk of loans moving to non-accrual status and subsequent net charge-offs, impacting profitability.

For instance, as of the first quarter of 2024, Citizens Financial Group reported that its non-performing loans increased to $571 million, up from $480 million in the prior year. While the bank is actively working to manage these legacy assets, their performance continues to present a drag on the overall financial health of the institution.

While Citizens Financial Group boasts a robust branch network, certain locations might be classified as dogs within its BCG Matrix. These are branches situated in areas experiencing reduced customer visits or demographic shifts, leading to lower revenue generation. For instance, in 2024, Citizens continued its strategic review of its physical footprint, a common practice for large banks to align with evolving customer behaviors.

These underperforming branches represent an inefficient use of capital, incurring substantial operational expenses without commensurate returns. As Citizens invests heavily in its digital transformation, aiming to enhance online and mobile banking services, the need to re-evaluate and potentially optimize or close these legacy locations becomes critical. This strategic pruning allows for reallocation of resources to more profitable ventures or digital initiatives.

Citizens Financial Group might classify certain traditional banking products with low digital adoption and high operational costs as 'dogs' in its BCG Matrix. These could include services that still heavily rely on in-branch transactions or manual paperwork, leading to significant overhead. For instance, if a specific type of loan processing or a niche account management service sees minimal online engagement and requires extensive manual intervention, it would fit this category.

In 2024, the banking sector continued to push for digital transformation, meaning products with lagging digital uptake become increasingly costly to maintain. For example, if a product's digital channel usage remains below 30% while its operational cost per transaction is significantly higher than digitally processed ones, it represents a drain on resources. This inefficiency contrasts with the industry trend, where banks like Citizens are investing heavily in automation to reduce costs and improve customer experience, making 'dog' products a clear target for divestment or restructuring.

Non-strategic or Divested Business Units

Non-strategic or divested business units within Citizens Financial Group, if any exist, would be classified as Dogs in the BCG Matrix. These are typically operations that generate low returns and have minimal growth prospects, not aligning with the company's forward-looking strategy. Such units might be considered for divestment to reallocate capital to more promising ventures.

While Citizens Financial Group actively manages its portfolio, specific public disclosures classifying current business units as 'Dogs' are not readily available. However, the financial industry often sees portfolio optimization through divestitures. For instance, in 2023, Citizens continued to refine its offerings, a common practice for banks aiming to focus on core, high-growth areas.

- Potential 'Dog' Characteristics: Low market share in a slow-growing segment, consistently negative or very low profitability, and requiring significant investment without clear return potential.

- Strategic Implications: Divesting such units allows for capital redeployment to support Stars or Question Marks, enhancing overall portfolio performance.

- Industry Context: Banks frequently review and divest non-core or underperforming assets to streamline operations and improve efficiency.

Certain Rate-Sensitive Deposit Products

Certain rate-sensitive deposit products can be categorized as Dogs within Citizens Financial Group's BCG Matrix. These are products where interest rate changes significantly impact customer behavior, potentially leading to substantial deposit outflows or requiring Citizens to offer very high rates to retain funds. For instance, during periods of rising interest rates, customers might rapidly move funds from lower-yielding accounts to higher-yield alternatives, straining the bank's cost of funds.

While deposits are fundamental to a bank's operations, those that primarily serve to increase funding costs without fostering a deep, loyal customer relationship are less strategic. These products may attract customers solely based on yield, making them prone to churn when better offers emerge elsewhere. Citizens' stated goal of building a granular and stable deposit base underscores their strategy to mitigate the impact of such volatile, rate-driven deposit flows.

- High Volatility: Rate-sensitive deposits often exhibit high volatility in response to market interest rate shifts.

- Cost Pressure: Aggressive pricing to retain these deposits can significantly increase the bank's funding costs.

- Customer Stickiness: These products may lack the deep customer relationships that encourage long-term loyalty.

- Strategic Focus: Citizens aims for a stable deposit base, suggesting a strategic effort to manage or reduce reliance on these sensitive products.

Certain legacy loan portfolios, particularly within specific Commercial Real Estate segments, are identified as Dogs for Citizens Financial Group. These segments exhibit low growth and increasing non-performing assets, as seen in the first quarter of 2024 when non-performing loans rose to $571 million.

Underperforming physical branches in areas with declining customer traffic also fall into the Dog category. Citizens' ongoing review of its physical footprint in 2024 reflects an effort to address these inefficient locations.

Products with low digital adoption and high operational costs, such as certain traditional banking services requiring manual processing, are also considered Dogs. The industry-wide push for digital transformation in 2024 makes these products increasingly costly to maintain.

Rate-sensitive deposit products that lack customer stickiness and increase funding costs without fostering loyalty can be classified as Dogs. Citizens' strategy to build a stable deposit base aims to mitigate reliance on these volatile products.

| BCG Category | Citizens Financial Group Examples | Key Characteristics | 2024 Data/Context |

|---|---|---|---|

| Dogs | Legacy CRE Loans | Low growth, high risk, rising non-performing assets | Non-performing loans at $571M (Q1 2024), up from $480M YoY |

| Dogs | Underperforming Branches | Low revenue generation, high operational costs | Strategic review of physical footprint ongoing |

| Dogs | Low Digital Adoption Products | High operational costs, low online engagement | Industry trend: digital transformation increases cost of low-usage products |

| Dogs | Rate-Sensitive Deposits | High volatility, cost pressure, low customer loyalty | Citizens aims for stable deposit base, reducing reliance on volatile products |

Question Marks

Citizens Financial Group is strategically partnering with fintech innovators to bolster its digital capabilities and explore cutting-edge technologies like AI and Agentic AI. These collaborations, exemplified by the integration of Wisetack for Buy Now, Pay Later (BNPL) solutions and InvestiFi for embedded investing, are currently categorized as 'question marks' within the BCG framework. Their ultimate market penetration and profitability remain uncertain as they are still in the early stages of development and customer adoption.

These ventures, while demanding significant investment in integration and ongoing development, hold substantial promise for high future growth. For instance, the BNPL market, which saw significant expansion in 2023 and is projected to continue growing, presents a key area for Citizens to capture new customer segments. The success of these fintech partnerships hinges on their ability to resonate with a broad customer base and deliver tangible value, thereby transforming them from question marks into stars.

Citizens Financial Group's 'Reimagining the Bank' initiative represents a significant, multi-year effort to overhaul customer service and operational efficiency. This ambitious program is leveraging cutting-edge technologies like Generative AI and Agentic AI to achieve these goals. The substantial investment and inherent uncertainties of such large-scale technological transformations place this squarely in the question mark category of a BCG Matrix analysis, as its future benefits are promising but not yet guaranteed.

Citizens Financial Group's expansion into new geographic markets within wealth management presents a classic BCG Matrix question mark. While the broader wealth management sector is a star for Citizens, specific new markets, like the Tri-State Metro area for private banking, are still developing their market share and profitability.

Significant capital is being deployed to build a strong presence and attract elite talent in these competitive regions. For instance, in 2024, Citizens continued its strategic hiring initiatives, bringing on experienced private bankers and wealth advisors to bolster its offerings in key urban centers.

The success of these ventures hinges on capturing substantial market share in areas with established competitors. The ultimate return on these investments remains uncertain, necessitating close monitoring of customer acquisition costs and revenue generation against ambitious growth targets.

Certain Specialized Commercial Lending Verticals

Citizens Financial Group's strategy in certain specialized commercial lending verticals can be viewed through the lens of the BCG Matrix as potential question marks. These are markets where the bank is investing for future growth but where its current market share and growth rate are not yet established.

These specialized areas might include sectors like renewable energy project finance, specialized healthcare real estate, or technology equipment leasing. For instance, Citizens announced in 2024 a significant expansion of its renewable energy lending portfolio, aiming to double its capacity by 2025. This requires substantial upfront investment in sector-specific expertise and building new client relationships.

The success of these question mark segments hinges on Citizens' ability to effectively deploy its industry knowledge and integrated financial solutions.

- Renewable Energy Finance: Targeting growth in a sector projected to see continued expansion, requiring specialized risk assessment and structuring capabilities.

- Healthcare Real Estate: Focusing on niche segments within healthcare property lending, demanding deep understanding of regulatory and operational nuances.

- Technology Equipment Leasing: Building out capabilities to finance specialized and rapidly evolving technology assets, necessitating expertise in asset valuation and residual risk.

New Credit Card Products and Offerings

Citizens Financial Group's recent introduction of a new suite of Mastercard credit cards positions these offerings as potential question marks within the BCG Matrix. These products aim to address evolving customer demands in a crowded marketplace.

The success of these new credit cards hinges on several factors. Citizens must achieve strong market adoption and effective marketing campaigns to gain traction.

- Market Acceptance: The ability of these new cards to resonate with consumers and gain significant adoption is crucial.

- Competitive Landscape: Citizens faces intense competition from established players, making market share acquisition a challenge.

- Revenue Potential: While initial investment may be high, successful penetration could lead to substantial future revenue streams.

- Strategic Importance: These launches reflect Citizens' strategy to innovate and expand its credit card portfolio.

Citizens Financial Group's fintech partnerships, new market expansions, specialized lending, and new credit card offerings are all currently classified as question marks. These initiatives require substantial investment and their future success and market dominance are not yet assured, presenting both risks and significant growth potential.

BCG Matrix Data Sources

Our BCG Matrix leverages Citizens Financial Group's financial disclosures, market research reports, and industry growth forecasts to accurately position each business unit.