Citi PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citi Bundle

Navigate the complex external forces shaping Citi's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting its operations and strategic direction. Gain critical insights to inform your own business decisions and identify potential opportunities or threats. Download the full analysis now for actionable intelligence.

Political factors

Citi's extensive global footprint, spanning over 160 countries, makes it inherently sensitive to shifts in government stability and evolving policy landscapes. For instance, a change in administration in a key market could lead to altered fiscal policies, impacting interest rates and regulatory frameworks that directly affect Citi's banking operations and profitability. The company must constantly monitor geopolitical risks and potential policy divergences to effectively manage its diverse portfolio.

The regulatory environment significantly shapes Citi's operations, with political shifts directly impacting financial services. For instance, the ongoing geopolitical tensions in Eastern Europe, coupled with broader trade disputes, have led to increased scrutiny and compliance burdens for global banks. Citi, like its peers, must navigate these complexities, which can affect cross-border transactions and market access, as seen in the heightened sanctions regimes implemented throughout 2023 and continuing into 2024.

Citi's global operations are significantly shaped by international relations and evolving trade policies. Favorable trade agreements, such as those fostering digital trade or reducing cross-border financial service barriers, can unlock new markets and drive revenue growth. For instance, the USMCA agreement, which came into effect in 2020 and continues to influence North American trade, impacts how Citi operates and serves clients across the region.

Conversely, rising protectionism or geopolitical tensions can create headwinds. Trade disputes can disrupt global supply chains, impacting corporate clients and, by extension, Citi's lending and transaction volumes. The ongoing shifts in global trade dynamics, including the focus on supply chain resilience, directly influence the demand for Citi's trade finance and treasury services, which are crucial for its international revenue.

Political Risk in Emerging Markets

Citi's extensive operations in emerging markets expose it to significant political risks, including the potential for civil unrest, coups, and abrupt policy changes. For instance, geopolitical tensions in regions where Citi operates could impact its revenue streams and asset valuations. In 2024, emerging markets accounted for a substantial portion of Citi's global revenue, making the management of these risks paramount.

These political events can trigger sharp declines in asset values, currency fluctuations, and disruptions to day-to-day business activities. The International Monetary Fund (IMF) has highlighted that political instability in several key emerging economies could slow down economic growth, directly affecting banking sector performance. This volatility poses a direct threat to the stability of Citi's Institutional Clients Group and Global Consumer Banking segments.

Effectively assessing and mitigating political risk in these dynamic environments is crucial for Citi's financial health. The bank's strategy for 2024-2025 likely includes enhanced due diligence and contingency planning for markets exhibiting heightened political uncertainty. For example, countries with upcoming elections in 2024 or 2025 are being closely monitored for potential policy shifts that could impact financial services.

- Emerging Market Exposure: Citi's significant footprint in emerging economies necessitates robust political risk management frameworks.

- Impact of Instability: Events like coups or sudden policy shifts can lead to asset devaluation, currency volatility, and operational disruptions for Citi.

- 2024/2025 Focus: Managing political risk is a key priority for Citi's Institutional Clients Group and Global Consumer Banking segments in the current economic climate.

- Data Points: Emerging markets represented approximately 30% of Citi's total revenue in Q1 2024, underscoring the importance of political stability in these regions.

Government Intervention in Financial Markets

Government intervention in financial markets remains a significant factor for institutions like Citi. During economic downturns, central banks often adjust monetary policy, influencing interest rates and liquidity. For instance, in response to inflation concerns in 2024, many central banks, including the Federal Reserve, maintained higher interest rates, impacting borrowing costs and investment returns globally. This directly affects Citi's core businesses, from consumer loans to corporate finance.

Bailouts and direct investments by governments, while less frequent in stable periods, can dramatically reshape market dynamics. In 2024, some governments continued to support strategic industries through targeted investments, potentially creating a landscape of state-backed competitors or partners. Citi must navigate these interventions, assessing how they might alter market competition and the availability of capital for its clients.

The potential for regulatory changes stemming from government actions is also crucial. For 2024 and into 2025, financial regulators worldwide have been focused on areas like digital asset oversight and cybersecurity. Citi's strategic planning must account for these evolving regulatory frameworks, which can influence operational costs, product development, and overall market access.

- Monetary Policy Impact: Central bank actions in 2024, such as the Federal Reserve's steady interest rates, influenced global borrowing costs, affecting Citi's loan portfolios.

- Government Support: In 2024, ongoing government support for key sectors could foster new competitive pressures or partnership opportunities for financial institutions.

- Regulatory Evolution: Anticipated regulatory shifts in 2025 concerning digital assets and cybersecurity will require Citi to adapt its compliance and operational strategies.

Government policies and political stability are paramount for Citi's global operations, influencing everything from interest rates to regulatory compliance. Political shifts can directly impact the economic climate in key markets, affecting consumer spending and corporate investment, which in turn influences Citi's revenue streams and loan portfolios. The ongoing focus on financial regulation in 2024 and anticipated changes in 2025 underscore the need for proactive adaptation.

Geopolitical tensions and trade policies continue to shape Citi's international business. For example, the ongoing trade dialogues and potential tariffs between major economies in 2024 create uncertainty for global trade finance and cross-border transactions, areas critical to Citi's Institutional Clients Group. Navigating these complex international relations is essential for maintaining market access and operational efficiency.

Citi's exposure to emerging markets means that political instability, such as civil unrest or sudden policy reversals, poses a significant risk. These events can lead to currency devaluation and asset price volatility, directly impacting Citi's profitability and the stability of its investments in these regions. Emerging markets represented approximately 30% of Citi's total revenue in Q1 2024, highlighting the critical nature of political risk management.

| Factor | Impact on Citi | 2024/2025 Relevance |

|---|---|---|

| Government Stability | Affects economic climate, consumer/corporate spending, and loan portfolios. | Key for revenue stability and risk management in over 160 countries. |

| Trade Policies | Influences global trade finance, cross-border transactions, and market access. | Ongoing trade dialogues in 2024 impact key revenue streams. |

| Political Instability (Emerging Markets) | Causes currency devaluation, asset volatility, and impacts profitability. | Emerging markets were ~30% of Q1 2024 revenue, making risk mitigation vital. |

What is included in the product

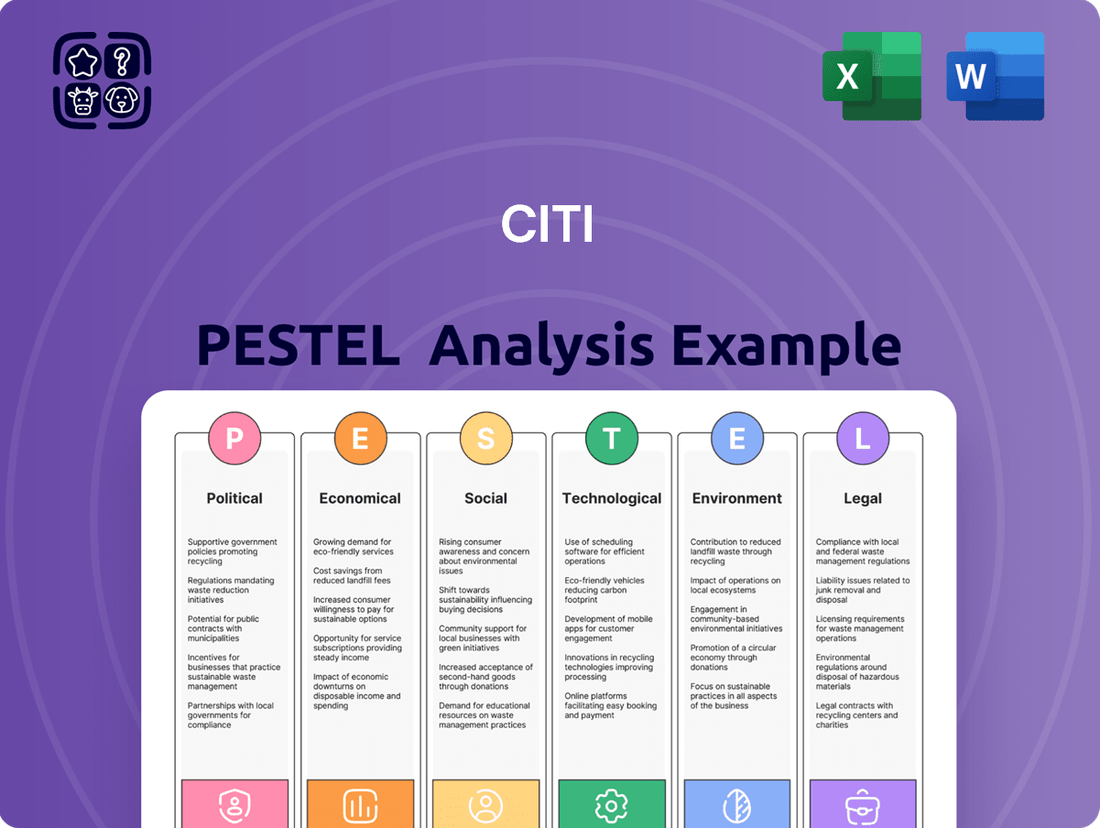

This PESTLE analysis examines the external macro-environmental factors impacting Citi across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of the landscape.

The Citi PESTLE Analysis offers a structured framework to identify and understand external factors impacting the business, thereby alleviating the pain of uncertainty and enabling more informed strategic decisions.

Economic factors

Interest rate fluctuations directly affect Citi's profitability. For instance, the U.S. Federal Reserve's aggressive rate hikes throughout 2022 and into 2023 boosted net interest income for banks like Citi, with their net interest margin widening. However, continued high rates in 2024 could pressure loan demand and increase the risk of defaults from borrowers facing higher repayment costs.

Inflation erodes the purchasing power of money, a significant concern for a global financial institution like Citi. For instance, persistent inflation in major economies throughout 2024 and into 2025 could increase Citi's operational costs and impact the real value of its earnings. This necessitates careful management of its balance sheet and investment strategies to safeguard its diverse financial product portfolio against price instability.

Conversely, deflationary pressures, though less common recently, pose their own risks. A sustained period of deflation, perhaps seen in specific sectors or regions in late 2024, could depress asset values and dampen demand for credit, directly affecting Citi's lending and investment banking activities. Monitoring global inflation trends, such as the projected average inflation rate of 3.5% across OECD countries for 2024, is crucial for Citi's forecasting and risk management.

Citi's financial performance is intrinsically linked to the health of the global economy. Strong economic growth fuels demand for banking, credit, and investment products, directly benefiting Citi's revenue streams. For instance, the International Monetary Fund (IMF) projected global growth to be 3.1% in 2024, a slight uptick from 3.0% in 2023, indicating a generally supportive environment.

However, the specter of recessionary pressures remains a significant risk. Economic slowdowns can curtail consumer spending and corporate investment, leading to higher loan defaults and reduced fee income for financial institutions like Citi. The US economy, for example, showed resilience in early 2024, but concerns about inflation and interest rate impacts persist, potentially slowing growth later in the year.

While Citi's diversified business model across various geographies and services offers some resilience, a widespread global downturn would inevitably impact its profitability. For example, a significant increase in non-performing loans due to a recession would directly hit Citi's balance sheet and earnings per share.

Currency Exchange Rate Volatility

Citi's extensive global footprint, operating in over 160 countries, inherently exposes the company to significant currency exchange rate volatility. These fluctuations directly impact the reported value of its international assets, liabilities, and ultimately, its earnings when converted back to its primary reporting currency, likely the US dollar.

For instance, in Q1 2024, Citi reported that foreign exchange headwinds negatively impacted its revenue by approximately $100 million, underscoring the tangible effect of currency swings on its financial performance. This highlights the critical need for robust currency hedging strategies and meticulous management of foreign currency exposures to safeguard its profitability.

Effective management of these risks is paramount for maintaining financial stability and predictable earnings growth. Citi's approach typically involves a combination of financial instruments and operational strategies to mitigate potential losses arising from adverse currency movements.

- Global Operations: Citi operates in over 160 countries, creating broad exposure to diverse currency markets.

- Impact on Financials: Fluctuations in exchange rates directly affect the translation of international assets, liabilities, and earnings.

- Revenue Impact: In Q1 2024, foreign exchange headwinds reduced Citi's revenue by an estimated $100 million.

- Mitigation Strategies: The company employs currency hedging and careful management of foreign currency exposures to protect financial performance.

Consumer Spending and Debt Levels

Citi's Global Consumer Banking performance is closely tied to how much consumers are spending and how much debt they carry. When people are confident and have disposable income, they tend to spend more, which is good for Citi's credit card and loan businesses. However, if debt levels rise too high or people start cutting back on spending, it can lead to more missed payments and defaults.

Consumer confidence and financial well-being are key indicators watched by Citi. For instance, data from the U.S. Bureau of Economic Analysis in late 2024 showed continued resilience in consumer spending, contributing to GDP growth. Yet, rising interest rates in 2024 and 2025 are putting pressure on household budgets, increasing the burden of existing debt for many.

- Consumer Spending Trends: Retail sales in the U.S. saw a 3.1% increase year-over-year through Q3 2024, indicating ongoing consumer demand.

- Household Debt: Total household debt in the U.S. reached approximately $17.5 trillion by the end of Q3 2024, with credit card debt showing a noticeable uptick.

- Delinquency Rates: While still historically low, credit card delinquency rates began to edge up in late 2024, reaching around 2.7% for major banks.

- Consumer Confidence: The Conference Board Consumer Confidence Index hovered around 102 in November 2024, reflecting cautious optimism amidst economic uncertainties.

Economic growth directly fuels Citi's revenue through increased demand for loans, investments, and transaction services. For example, the IMF projected global growth at 3.1% for 2024, a supportive backdrop for financial institutions. However, economic slowdowns or recessions, like potential impacts from persistent inflation and high interest rates in late 2024, could increase loan defaults and reduce fee income, directly affecting Citi's profitability.

Interest rate movements are critical. The Federal Reserve's rate hikes in 2022-2023 boosted net interest income, but sustained high rates in 2024 could dampen loan demand and increase default risks. Inflation also impacts Citi by raising operational costs and eroding real earnings, necessitating careful balance sheet management, with OECD countries projected to average 3.5% inflation in 2024.

Currency exchange rate volatility significantly affects Citi's global operations, impacting the reported value of international assets and earnings. In Q1 2024, foreign exchange headwinds reduced Citi's revenue by an estimated $100 million, highlighting the need for effective hedging strategies.

Consumer spending and debt levels are key to Citi's Global Consumer Banking. While U.S. retail sales grew 3.1% year-over-year through Q3 2024, rising interest rates in 2024-2025 are straining household budgets, with U.S. household debt around $17.5 trillion by Q3 2024 and credit card delinquencies beginning to rise.

| Economic Factor | Impact on Citi | 2024/2025 Data Point |

|---|---|---|

| Global Economic Growth | Drives revenue, but slowdowns increase default risk. | IMF projects 3.1% global growth for 2024. |

| Interest Rates | Affects net interest income and loan demand. | Fed rate hikes boosted NIM; sustained high rates pressure loan demand. |

| Inflation | Increases operational costs and erodes earnings value. | OECD average inflation projected at 3.5% for 2024. |

| Currency Exchange Rates | Impacts translation of international financials. | Q1 2024 revenue impacted by ~$100M from FX headwinds. |

| Consumer Spending & Debt | Key for Global Consumer Banking revenue and risk. | U.S. retail sales up 3.1% YoY (Q3 2024); household debt ~$17.5T (Q3 2024). |

Same Document Delivered

Citi PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Citi PESTLE Analysis provides a detailed examination of the external factors influencing the company's operations and strategy. You'll gain valuable insights into Political, Economic, Social, Technological, Legal, and Environmental aspects impacting Citi's business landscape.

Sociological factors

Global demographic shifts are profoundly reshaping markets. Developed economies, like Japan and much of Europe, are experiencing significant population aging; for instance, in 2024, over 20% of Japan's population is projected to be 65 or older. This trend directly impacts demand for retirement planning, wealth management, and healthcare-related financial services.

Conversely, emerging markets often feature youth bulges, with countries like Nigeria having a median age under 18 in 2024. Citi must tailor its product development to cater to these younger, often digitally native populations, focusing on accessible digital banking, microfinance solutions, and educational savings products to capture future growth.

Consumer preferences are shifting rapidly, with a significant portion of the global population now prioritizing digital-first banking experiences. In 2024, it's estimated that over 80% of banking transactions globally occur digitally, highlighting a clear demand for seamless online and mobile platforms. This digital evolution, coupled with a heightened focus on financial wellness, means institutions like Citi must adapt their service delivery to meet these evolving expectations.

There's a strong and growing demand for financial solutions that are not only personalized to individual needs but also transparent in their fee structures and easily accessible across multiple channels. For instance, by the end of 2024, over 75% of consumers surveyed indicated they prefer banks that offer clear, upfront information about all charges and fees. This signals a need for more intuitive product design and communication strategies.

Financial literacy levels vary considerably across different markets, presenting a challenge and an opportunity for financial institutions. In emerging markets, for example, a substantial percentage of the population may have limited exposure to formal financial education. Citi, therefore, needs to implement tailored educational programs and product designs that cater to these diverse literacy levels, ensuring accessibility and understanding for all customers.

Societal expectations are increasingly pushing financial institutions like Citi towards greater corporate social responsibility (CSR) and ethical banking. This translates into demands for sustainable finance options and responsible lending practices, directly influencing customer loyalty and brand perception. For instance, by 2024, many consumers are actively choosing banks that demonstrate transparent business conduct and a commitment to social good, impacting deposit growth and overall reputation.

Income Inequality and Wealth Distribution

Rising income inequality significantly impacts market segmentation for financial institutions like Citi. As wealth concentrates at the top, there's a growing demand for sophisticated wealth management and investment services, while a substantial portion of the population may require more accessible and affordable banking solutions. This societal trend necessitates a dual approach to product development, catering to both high-net-worth individuals and emerging middle-class or lower-income segments.

The widening gap in wealth distribution, with the top 1% often holding a disproportionate share of national income, directly shapes the demand for financial services. For instance, in the United States, the top 1% of earners captured 23% of pre-tax income in 2023, a figure that has trended upwards over the past two decades. This means Citi must strategically develop offerings that resonate with diverse economic strata, potentially leading to innovation in inclusive finance and digital banking solutions for broader accessibility.

- Wealth Concentration: The top 10% of households globally held approximately 76% of total wealth in 2023, highlighting a significant concentration that influences market targeting.

- Emerging Markets Growth: While inequality persists, the growth of the middle class in emerging economies presents opportunities for financial inclusion products.

- Product Diversification: Citi's strategy must encompass both premium services for the affluent and accessible, low-cost options for underserved populations to capture a wider market share.

Workforce Diversity and Inclusion

Societal expectations increasingly demand that companies like Citi prioritize diversity, equity, and inclusion (DEI) throughout their operations. This trend directly impacts how businesses are perceived and valued by employees, customers, and investors alike.

Citi's commitment to DEI is not just a social imperative but a strategic advantage. A diverse workforce fosters a wider range of perspectives, which is critical for driving innovation and understanding the needs of its global customer base. For instance, as of early 2024, financial institutions are increasingly reporting on their diversity metrics, with many aiming for at least 40% women in senior leadership roles by 2025. Citi's progress in this area directly influences its ability to attract top talent and maintain high employee morale.

A robust DEI strategy also significantly bolsters Citi's employer brand. In the competitive financial services landscape of 2024 and 2025, companies that demonstrate a genuine commitment to inclusion are more likely to attract and retain skilled professionals. This positive corporate culture, driven by DEI initiatives, can translate into improved financial performance and a stronger reputation.

- Talent Attraction: Companies with strong DEI programs often see a 12% increase in employee retention compared to those with weaker programs, according to recent industry surveys.

- Innovation: Research indicates that diverse teams are 17% more likely to be innovative.

- Customer Reflection: Citi's global presence requires a workforce that mirrors its diverse clientele, enhancing customer engagement and loyalty.

- Reputation: A positive employer brand, fueled by DEI, can improve a company's stock performance by up to 2.5% over a five-year period.

Societal attitudes towards financial institutions are evolving, with a growing emphasis on ethical practices and corporate social responsibility. Consumers in 2024 increasingly favor banks that demonstrate transparency, fair lending, and a commitment to community well-being, directly impacting brand loyalty and market share.

The demand for personalized financial advice and accessible digital platforms continues to rise, as evidenced by the over 80% of global banking transactions occurring digitally in 2024. Citi must adapt its service models to meet these expectations, offering tailored solutions and seamless online experiences.

Financial literacy remains a critical factor, with significant disparities across regions necessitating targeted educational initiatives. By the end of 2024, a substantial portion of the population in emerging markets still requires basic financial education, presenting an opportunity for institutions like Citi to bridge this gap through accessible resources.

Diversity, equity, and inclusion (DEI) are becoming paramount, influencing talent acquisition and customer engagement. Financial institutions with strong DEI programs, aiming for metrics like 40% women in senior leadership by 2025, are better positioned to attract top talent and reflect their diverse customer base.

Technological factors

The relentless march of digital transformation and the ubiquity of mobile devices are fundamentally altering customer engagement in financial services. Citi's strategic imperative involves substantial and ongoing investment in its mobile banking infrastructure, focusing on user-friendly interfaces and a smooth digital experience to stay ahead in a competitive landscape.

By 2024, it's estimated that over 1.5 billion people globally will use mobile banking, highlighting the critical need for Citi to enhance its digital offerings. This focus on digital convenience is paramount for both retaining existing customers and attracting new ones who increasingly expect seamless, on-the-go access to their finances.

As financial transactions increasingly move online, the threat of cyberattacks and data breaches intensifies for institutions like Citi. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the significant financial risks involved. Citi, handling vast amounts of sensitive customer data, must maintain state-of-the-art cybersecurity infrastructure and protocols to protect against fraud and maintain customer trust.

Robust data protection is not just a regulatory requirement but a fundamental business imperative for Citi. In 2023, financial services firms were among the most targeted industries for data breaches, with an average cost of $5.9 million per incident. Ensuring the integrity and confidentiality of customer information is paramount to safeguarding Citi's reputation and operational continuity.

Citi's adoption of artificial intelligence and machine learning is transforming its operations, significantly improving fraud detection and risk management capabilities. For instance, by mid-2024, advanced AI models are expected to reduce false positives in transaction monitoring by up to 30%, leading to more efficient resource allocation.

Leveraging AI/ML allows Citi to gain deeper customer insights, enabling hyper-personalized product offerings and enhanced customer service experiences. This strategic integration is projected to boost customer retention rates by an estimated 5-7% in the 2024-2025 period.

Furthermore, the implementation of AI in algorithmic trading strategies is providing Citi with a significant competitive edge in volatile markets. By Q1 2025, AI-driven trading platforms are anticipated to contribute an additional 10-15% to trading revenues through optimized execution and predictive analytics.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology (DLT) are poised to revolutionize financial services, from payments to asset management, by boosting security, transparency, and efficiency. Citi is actively investing in and exploring these innovations to optimize its operations and create novel financial products. This strategic focus could significantly reshape transaction settlement processes, potentially reducing friction and costs across global markets.

The adoption of DLT by major financial institutions like Citi is a significant indicator of its growing maturity. For instance, in 2023, the global blockchain market was valued at approximately $12.7 billion, with projections indicating substantial growth. Citi's involvement in initiatives like the development of central bank digital currencies (CBDCs) and tokenized assets underscores its commitment to leveraging these advancements.

- Enhanced Security: DLT's cryptographic nature makes transactions highly secure and tamper-proof, reducing fraud risks.

- Increased Transparency: Shared ledgers provide an immutable audit trail, improving regulatory compliance and trust.

- Operational Efficiency: Automation of processes like reconciliation and settlement can lead to significant cost savings and faster transaction speeds.

- New Financial Products: DLT enables the creation of innovative financial instruments, such as tokenized securities and smart contracts, opening new revenue streams.

Fintech Innovation and Competition

The fintech landscape is rapidly transforming financial services, presenting both challenges and opportunities for established institutions like Citi. Fintech startups, often characterized by their agility and focus on niche customer needs, are increasingly disrupting traditional banking models with innovative solutions. For instance, the global fintech market was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly, indicating the scale of this disruption.

Citi's strategy must address this evolving competitive environment. This involves a multi-pronged approach:

- Internal Innovation: Investing in and developing proprietary fintech solutions to match or exceed the offerings of startups.

- Acquisitions: Strategically acquiring promising fintech companies to integrate their technology and customer base. In 2024, major banks continued to invest heavily in fintech, with M&A activity remaining a key strategy.

- Partnerships: Collaborating with fintech firms to leverage their specialized capabilities and reach new customer segments. This allows Citi to tap into innovation without the full burden of in-house development.

By embracing these strategies, Citi can harness the power of fintech to enhance its services, improve customer experience, and maintain its competitive edge in a dynamic market where digital transformation is paramount.

Technological advancements are reshaping how Citi operates and interacts with customers, emphasizing digital channels and data-driven insights. The increasing reliance on mobile banking, projected to exceed 1.5 billion users globally by 2024, necessitates continuous investment in user-friendly digital platforms. Simultaneously, the escalating threat of cybercrime, with global costs anticipated to reach $10.5 trillion annually in 2024, demands robust cybersecurity measures to protect sensitive data and maintain customer trust.

Citi's strategic adoption of AI and machine learning is enhancing operational efficiency and customer engagement. AI models are expected to improve fraud detection accuracy by up to 30% by mid-2024, while personalized offerings driven by AI insights could boost customer retention by 5-7% between 2024 and 2025. Furthermore, AI-powered trading platforms are projected to increase trading revenues by 10-15% by Q1 2025.

Blockchain and distributed ledger technology (DLT) offer significant potential for security, transparency, and efficiency in financial transactions. Citi's exploration of DLT, within a market valued at approximately $12.7 billion in 2023, aims to optimize operations and develop new financial products, potentially transforming settlement processes and reducing transaction costs.

| Technology Area | Key Trend/Impact | 2024/2025 Data/Projection |

|---|---|---|

| Mobile Banking | Increased customer access and engagement | Over 1.5 billion global users by 2024 |

| Cybersecurity | Mitigation of digital threats and data breaches | Global cybercrime costs projected at $10.5 trillion annually in 2024 |

| AI/Machine Learning | Enhanced fraud detection, personalization, and trading | 30% reduction in false positives (fraud detection); 5-7% customer retention increase; 10-15% trading revenue boost |

| Blockchain/DLT | Improved security, transparency, and efficiency | Global blockchain market valued at $12.7 billion in 2023 |

Legal factors

Citi navigates a dense landscape of banking regulations, including capital adequacy rules like Basel III and the upcoming Basel IV, alongside stringent liquidity and risk management mandates. These frameworks, while crucial for financial stability, necessitate substantial investment in compliance infrastructure and can constrain lending activities.

For instance, as of Q1 2024, major banks like Citi are expected to maintain Common Equity Tier 1 (CET1) ratios well above regulatory minimums, often exceeding 11% to buffer against economic downturns. These requirements directly influence how much capital a bank can deploy for growth, impacting profitability and operational flexibility.

The constant evolution of these regulations, driven by global financial authorities, demands continuous adaptation and significant resources for Citi to remain compliant. Failure to adhere can result in hefty fines and reputational damage, underscoring the critical importance of proactive regulatory management.

Global efforts to combat money laundering and terrorist financing, including those enforced by the Financial Crimes Enforcement Network (FinCEN) in the US, impose stringent Anti-Money Laundering (AML) and sanctions compliance obligations on financial institutions like Citi. Failure to adhere can lead to significant penalties; for instance, in 2023, financial institutions globally faced billions in AML-related fines, with some individual cases reaching hundreds of millions.

Non-compliance carries severe consequences beyond financial penalties, including substantial reputational damage and the potential loss of operating licenses, which could cripple Citi's ability to conduct business in key markets. Citi's ongoing investments in sophisticated compliance systems and comprehensive employee training are therefore critical to meeting these rigorous legal requirements across its diverse international operations.

Citi must navigate a complex web of data privacy regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), which dictate how customer information is handled. Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of global annual revenue.

Consumer protection laws are also paramount, influencing everything from fair lending practices to transparent disclosure requirements. These regulations directly shape Citi's consumer banking offerings and necessitate robust complaint resolution mechanisms to maintain customer confidence and avoid regulatory scrutiny.

Antitrust and Competition Laws

Citi, as a significant global financial services provider, operates under stringent antitrust and competition laws. These regulations are in place to prevent market monopolization and foster healthy competition, directly impacting Citi's strategic decisions. For instance, in 2023, the US Department of Justice and the Federal Trade Commission continued to scrutinize large bank mergers, a trend likely to persist into 2024 and 2025, potentially affecting Citi's acquisition strategies.

The enforcement of these laws influences how Citi prices its products and services, as well as its overall market conduct. Regulatory bodies worldwide, including the European Commission and the UK's Competition and Markets Authority, actively monitor financial institutions for anti-competitive practices. This oversight ensures that smaller players and consumers are not disadvantaged, maintaining a fair marketplace.

Recent enforcement actions highlight the ongoing relevance of these laws. For example, in late 2023, several major banks faced investigations and fines related to alleged collusion in foreign exchange markets, underscoring the intense regulatory focus on market behavior. Citi, like its peers, must navigate these complex legal landscapes to ensure compliance and avoid penalties.

- Regulatory Scrutiny: Antitrust laws aim to prevent monopolies and ensure fair competition in the financial services sector, directly impacting Citi's operations and strategic growth plans.

- Merger and Acquisition Impact: These laws significantly influence Citi's ability to pursue mergers and acquisitions, with regulators closely examining deals for potential anti-competitive effects.

- Market Conduct and Pricing: Citi's pricing strategies and day-to-day market conduct are subject to review to ensure they do not stifle competition or harm consumers.

- Global Enforcement Trends: International regulatory bodies are actively enforcing competition laws, with significant fines levied against financial institutions for anti-competitive behavior, setting a precedent for future compliance.

International Tax Laws and Reporting Standards

Citi's global operations necessitate compliance with a complex web of international tax laws and reporting standards across dozens of countries. For instance, the OECD's Base Erosion and Profit Shifting (BEPS) project, including its Pillar Two global minimum tax initiative, directly impacts how multinational corporations like Citi structure their operations and calculate their tax liabilities. This initiative, which aims for a 15% minimum effective tax rate for large multinational enterprises, began its phased implementation in various jurisdictions throughout 2024 and will continue to be a significant factor in 2025. Navigating these evolving regulations, including intricate transfer pricing rules which govern intercompany transactions, presents a constant legal and operational challenge.

The sheer volume of differing financial reporting standards, such as IFRS and US GAAP, further complicates matters, requiring meticulous attention to detail to ensure accurate and compliant financial statements. Failure to adhere to these diverse legal frameworks can result in substantial penalties and reputational damage. Citi's commitment to robust tax compliance and the development of efficient, legally sound tax structures is therefore a critical and ongoing legal endeavor. For example, in 2023, financial institutions globally faced increased scrutiny on tax practices, leading to adjustments in reporting and tax planning strategies that will carry into 2024 and 2025.

- Global Minimum Tax: The OECD's Pillar Two initiative, targeting a 15% minimum effective tax rate for large multinationals, began implementation in 2024 and will continue to shape international tax strategies through 2025.

- Transfer Pricing Complexity: Citi must manage varying transfer pricing regulations across jurisdictions to ensure fair taxation of intercompany transactions, a critical element of international tax law.

- Reporting Standard Divergence: Adherence to multiple financial reporting frameworks like IFRS and US GAAP requires significant legal and accounting resources to maintain compliance and accuracy.

- Increased Regulatory Scrutiny: Financial institutions experienced heightened attention on tax practices in 2023, necessitating ongoing legal review and adaptation of tax structures for 2024 and beyond.

Citi's operations are heavily influenced by evolving labor laws and employment regulations globally. These include minimum wage adjustments, worker protection standards, and rules governing employee benefits and collective bargaining. For instance, in 2024, many countries continued to review and potentially increase minimum wages, impacting operational costs for Citi’s large workforce.

Compliance with these diverse legal frameworks is essential to avoid costly litigation and maintain positive employee relations. Citi must also adhere to anti-discrimination laws and regulations concerning workplace safety, ensuring fair treatment and a secure environment for all employees across its international branches.

The increasing focus on ESG (Environmental, Social, and Governance) factors also brings legal implications, particularly concerning labor practices and supply chain transparency. Citi's commitment to ethical employment and robust HR policies is therefore not just a matter of good practice but a legal imperative.

Environmental factors

Climate change presents tangible physical risks to Citi's operations and loan books, with extreme weather events like hurricanes and floods directly threatening real estate and agricultural assets. For instance, the increasing severity of storms in coastal regions, a trend observed throughout 2024, could lead to higher default rates on mortgages and commercial property loans in those areas.

Transition risks are also significant, as a global shift towards a low-carbon economy impacts industries Citi finances. Sectors heavily reliant on fossil fuels, such as energy and heavy manufacturing, face potential devaluation as regulations tighten and consumer preferences shift, potentially increasing credit risk for Citi's exposure to these industries.

The imperative for financial institutions like Citi to meticulously assess and transparently disclose climate-related financial risks is growing. Regulatory bodies worldwide, including those in the US and Europe, are increasingly mandating such disclosures, with new guidelines expected to be fully implemented by 2025, pushing for greater clarity on climate risk management.

Investor and regulatory demand for robust ESG reporting and sustainable finance is accelerating. Citi, like its peers, faces increasing pressure to embed environmental and social considerations into its core lending and investment strategies, impacting its market perception and investor relations.

The global sustainable finance market is projected to reach $50 trillion by 2025, highlighting a significant opportunity for financial institutions like Citi to offer green bonds, loans, and investment products. This trend directly influences how Citi's financial performance and strategic positioning are viewed by stakeholders.

Governments worldwide are intensifying their focus on the environmental impact of financial institutions. This translates into stricter regulations, such as mandatory climate risk stress testing, which major banks like Citi are now undergoing to assess their resilience to climate-related events. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) requires detailed reporting on environmental, social, and governance (ESG) factors for financial products.

Citi, like other global financial players, faces increasing pressure to align its operations and product offerings with evolving environmental legal frameworks. This includes adhering to carbon emission reporting standards and complying with green taxonomies, which define what constitutes an environmentally sustainable economic activity. Failure to adapt can lead to reputational damage and potential financial penalties, impacting the firm’s overall performance and market position.

Resource Scarcity and Operational Sustainability

Concerns about resource scarcity, particularly water and energy, directly influence Citi's operational sustainability. This is especially relevant given its significant physical infrastructure and substantial data center operations, which are energy-intensive. For instance, in 2023, financial institutions globally faced increasing scrutiny over their energy consumption, with data centers accounting for a significant portion of this. Citi's commitment to improving energy efficiency and reducing waste is therefore crucial for both environmental stewardship and cost management.

Citi is actively pursuing strategies to minimize its environmental footprint and operational costs. This includes a strong focus on enhancing energy efficiency across its global operations and implementing robust waste reduction programs. The company is also emphasizing responsible supply chain management to ensure its partners adhere to environmental standards. Promoting digital solutions and reducing paper consumption are key initiatives in this effort, aligning with broader industry trends towards digitalization and sustainability.

- Energy Efficiency: Citi aims to reduce energy consumption in its data centers and office buildings.

- Waste Reduction: Initiatives focus on minimizing waste generation, particularly paper, through digital transformation.

- Supply Chain Responsibility: The company works to ensure its suppliers meet environmental performance criteria.

- Digital Solutions: Promoting digital banking and internal processes reduces reliance on physical resources.

Reputational Risk from Environmental Incidents

Citi faces significant reputational risk if associated with environmentally damaging projects or companies. This association can erode customer trust, deter investors, and hinder the attraction of top talent. For instance, in 2023, financial institutions faced increased scrutiny over their financing of fossil fuel projects, with some facing boycotts and divestment campaigns. A 2024 survey indicated that over 60% of consumers consider a company's environmental record when making purchasing decisions.

To counter this, robust environmental due diligence for clients and projects is paramount for Citi. This ensures alignment with growing public and regulatory expectations regarding sustainability. Failing to do so can result in lasting negative publicity, impacting brand value and market position. For example, a major bank in 2023 faced widespread criticism and a significant drop in its stock price after a controversial oil pipeline financing deal was revealed.

The financial sector's role in funding environmentally impactful activities is under intense observation. Reports from 2024 highlight that major banks continue to provide substantial funding to industries with high carbon emissions, drawing criticism from environmental groups and investors alike. This scrutiny underscores the need for proactive risk management and transparent communication regarding Citi's environmental commitments and client portfolio.

- Reputational Damage: Association with environmentally harmful activities can lead to a decline in public trust and investor confidence.

- Talent Acquisition: A poor environmental reputation can make it harder to attract and retain skilled employees who prioritize sustainability.

- Customer Loyalty: Consumers are increasingly factoring environmental practices into their purchasing decisions, impacting brand loyalty.

- Investor Scrutiny: Investors are increasingly demanding transparency and action on environmental, social, and governance (ESG) issues, impacting access to capital.

Environmental factors pose significant risks and opportunities for Citi, driven by climate change impacts and the global push for sustainability. Physical risks from extreme weather, like increased flooding in 2024, directly affect loan portfolios, while transition risks arise from the shift to a low-carbon economy impacting financed industries. Regulatory bodies are increasingly mandating climate risk disclosures, with new guidelines expected by 2025, pushing for greater transparency.

Investor and regulatory demand for robust ESG reporting is accelerating, pressuring Citi to integrate environmental considerations into its strategies. The sustainable finance market is projected to reach $50 trillion by 2025, presenting a substantial opportunity for green financial products. Governments are also intensifying scrutiny, leading to stricter regulations like mandatory climate risk stress testing for major banks.

Resource scarcity, particularly water and energy, impacts Citi's operational sustainability, especially for its energy-intensive data centers. Citi is actively pursuing energy efficiency and waste reduction, alongside responsible supply chain management and digital solutions to minimize its environmental footprint.

Reputational risk is a major concern, as association with environmentally damaging projects can erode trust and deter investment. Environmental due diligence is crucial to align with public and regulatory expectations, as a failure to do so can result in lasting negative publicity. The financial sector's role in funding high-carbon industries faces intense observation, underscoring the need for proactive risk management and transparent communication regarding Citi's environmental commitments.

| Environmental Factor | Impact on Citi | Data/Trend (2024/2025 Focus) |

|---|---|---|

| Climate Change (Physical Risks) | Increased default rates on loans due to extreme weather events. | Rising severity of storms in coastal regions observed in 2024. |

| Climate Change (Transition Risks) | Devaluation of assets in fossil fuel-dependent sectors, increasing credit risk. | Global shift towards low-carbon economy accelerating. |

| Regulatory Landscape | Mandatory climate risk disclosures and stress testing. | New guidelines expected by 2025; EU SFDR in effect. |

| Sustainable Finance Market | Opportunity for green bonds, loans, and investment products. | Projected to reach $50 trillion by 2025. |

| Reputational Risk | Loss of customer trust, investor confidence, and talent due to association with harmful projects. | Over 60% of consumers consider environmental record in 2024 purchasing decisions. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Citi draws from a robust blend of official government publications, reputable financial news outlets, and extensive market research reports. We meticulously gather data on economic indicators, regulatory changes, and technological advancements to ensure a comprehensive understanding of the macro-environment.