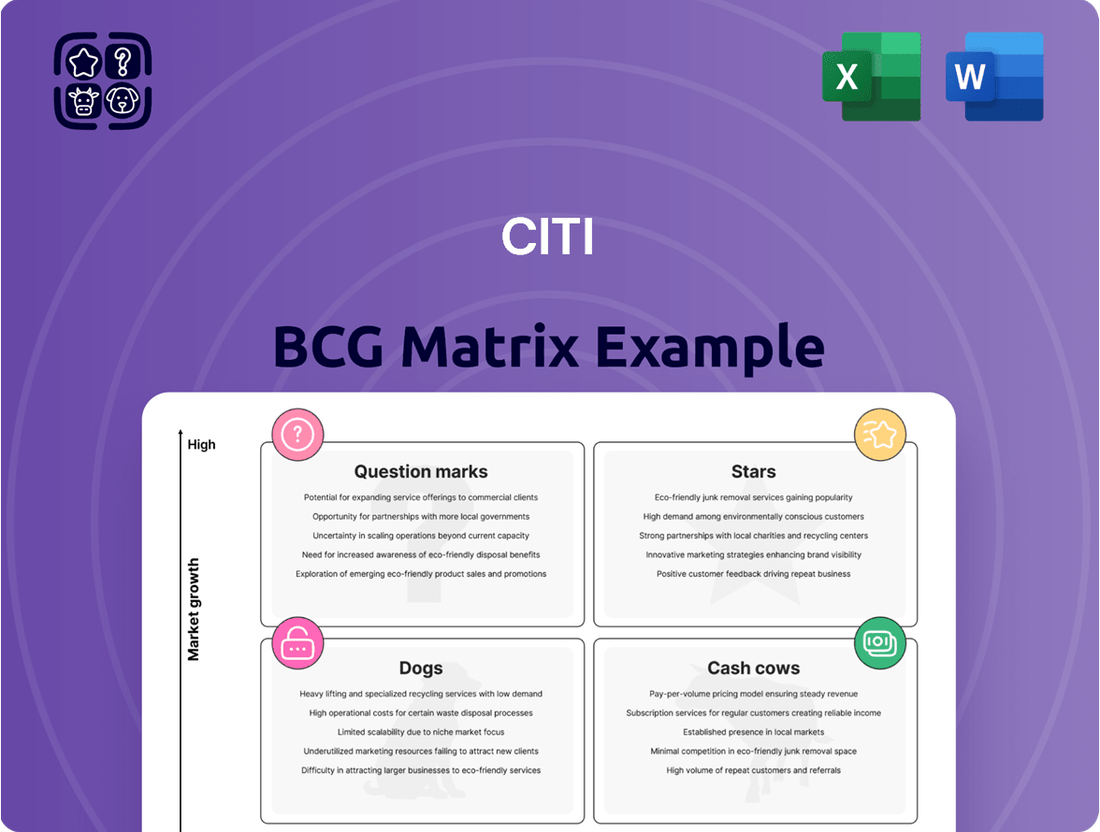

Citi Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citi Bundle

The Citi BCG Matrix categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a powerful framework for strategic resource allocation. Understand which of Citi's offerings are driving growth and which require careful consideration. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your investment portfolio.

Stars

Citi's Treasury and Trade Solutions (TTS) segment is a strong performer, exhibiting robust revenue growth and a notable increase in cross-border transaction volumes. This upward trend highlights the segment's presence in a dynamic and expanding market.

In the first half of 2025, Citi reported substantial revenue increases within its TTS operations, coupled with a significant uptick in the value of cross-border transactions processed. For instance, Q1 2025 saw revenue growth exceeding expectations, and Q2 continued this momentum with a further 8% year-over-year increase in transaction revenue.

The bank's strategic emphasis on expanding its Services franchise, with TTS at its core, is evident. Citi is actively investing in technology and talent to capture a larger share of global trade and payment flows, reinforcing its position as a market leader.

Securities Services stands out as a strong performer, consistently delivering double-digit revenue growth. For instance, Q3 2024 saw an impressive 24% revenue increase, following a solid 10% rise in Q2 2024. This marks the 16th consecutive quarter of growth for this vital business unit.

Citi's significant market share in the securities services sector is evident, with assets under custody and administration reaching a substantial $26 trillion. This reflects the growing demand for these services and Citi's established leadership position within this expanding market.

The company's commitment to this segment is demonstrated through ongoing strategic investments. These investments are crucial for maintaining its competitive edge and capitalizing on future growth opportunities in the global securities services landscape.

Citi is aggressively pursuing global leadership in wealth management, a sector poised for substantial growth. This strategic push is already yielding impressive results, with the segment experiencing a notable 24% revenue increase in Q1 2025, driven by strong client engagement and targeted investments.

The bank is actively expanding its wealth management footprint, particularly in key global markets, to attract and serve high-net-worth individuals more effectively. This expansion is supported by significant capital allocation aimed at enhancing service offerings and capturing a larger share of this lucrative market.

Institutional Clients Group (Markets & Banking)

The Markets division within Citi's Institutional Clients Group experienced a robust 12% revenue increase in the first quarter of 2025. This growth was primarily fueled by strong performance in Fixed Income and Equities, alongside a significant 84% surge in M&A advisory fees, highlighting a successful expansion in strategic advisory services.

Citi is actively pursuing market share gains across both its Banking and Markets segments. This strategic imperative involves continued investment in these core businesses, signaling a clear commitment to enhancing their competitive positioning and capitalizing on evolving market opportunities.

The Institutional Clients Group is strategically positioned to leverage the dynamism of global financial markets. This focus on key growth areas and market share expansion underscores a forward-looking approach to client engagement and revenue generation.

- Q1 2025 Markets Revenue Growth: 12% increase.

- Key Growth Drivers: Fixed Income, Equities, and an 84% spike in M&A advisory fees.

- Strategic Objective: Market share gains across Banking and Markets.

- Investment Focus: High-potential areas within the Institutional Clients Group.

Strategic AI and Digital Infrastructure Investments

Citi is heavily investing in its digital future, with a significant portion of its strategy focused on AI and robust digital infrastructure. This includes equipping 30,000 developers with AI tools and allocating billions to modernize its technology and infrastructure. These foundational investments, though not direct revenue generators, are crucial for enhancing operational efficiency and securing a competitive edge across all of Citi's business segments.

The bank's commitment to these areas is substantial. For instance, Citi's technology spending in 2023 was reported to be around $11 billion, with continued significant investments planned for 2024 and beyond as part of its multi-year transformation. This strategic push is designed to embed AI capabilities and advanced digital solutions throughout the organization, positioning Citi to lead in the rapidly evolving digital banking landscape.

- AI Deployment: 30,000 developers are being equipped with AI tools to drive innovation and efficiency.

- Infrastructure Modernization: Billions are being invested in upgrading technology and infrastructure to support future growth.

- Strategic Enabler: These investments are foundational, supporting competitive advantage across all business lines.

- Digital Leadership: Citi aims to be a leader in the digital banking era through these strategic technological advancements.

Stars in the Citi BCG Matrix represent business units with high market share in high-growth industries. Citi's Securities Services, with its consistent double-digit revenue growth and substantial assets under custody, fits this profile. Wealth Management, experiencing a 24% revenue increase in Q1 2025 and aggressive expansion, also demonstrates Star characteristics.

These segments are crucial for Citi's future, requiring continued investment to maintain their leading positions and capitalize on market expansion. Their strong performance and growth potential make them key drivers of the bank's overall success.

| Business Unit | Market Growth | Market Share | Revenue Growth (H1 2025) | Key Investment Area |

|---|---|---|---|---|

| Securities Services | High | High | Double-digit (24% in Q3 2024) | Technology & Talent |

| Wealth Management | High | Growing | 24% (Q1 2025) | Global Footprint & Service Enhancement |

What is included in the product

Strategic guidance for portfolio management, detailing investment, divestment, and holding strategies for each BCG Matrix quadrant.

The Citi BCG Matrix provides a clear, one-page overview, instantly alleviating the pain of deciphering complex portfolio data.

Cash Cows

Citi's U.S. Branded Cards segment operates within the mature U.S. Personal Banking market, serving as a significant revenue generator. This business line saw a healthy 9% revenue increase in the first quarter of 2025.

The growth is primarily attributed to an expansion in interest-earning balances and a deliberate strategy to attract customers with higher FICO scores. This focus on a stable, creditworthy customer base ensures consistent profitability and robust cash flow for the bank.

This strong and reliable cash generation from U.S. Branded Cards is crucial, as it provides the necessary financial backing to support investments and growth initiatives in other, potentially less mature, business areas within Citi.

Citi's extensive global network, spanning over 160 countries, and its deeply entrenched client relationships with multinational corporations are key indicators of its strength in the Cash Cows segment of the BCG Matrix. This mature, established infrastructure generates consistent revenue from traditional banking services, minimizing the need for significant new investment or aggressive marketing. For instance, in 2023, Citi reported total revenue of $77.4 billion, a testament to the ongoing strength of these core operations.

Citi's core deposit base, a significant component of its financial strength, stood at approximately $1.3 trillion as of early 2024. This massive and varied collection of customer deposits acts as a remarkably stable and cost-effective source of funding for the bank's operations.

This mature asset consistently generates net interest income, providing a reliable stream of capital. The sheer size and stability of this deposit base are fundamental to maintaining the overall robustness of Citi's balance sheet, underpinning its lending and investment capabilities.

Traditional Corporate Lending

Within Citi's Banking segment, traditional corporate lending to large, stable clients acts as a significant Cash Cow. This established portfolio boasts a high market share, leveraging long-term relationships to generate predictable interest income and consistent cash flow. Despite potentially modest growth prospects, this segment is a cornerstone of the bank's profitability and financial resilience.

This mature business line, a classic Cash Cow, provides a reliable stream of earnings for Citi. For instance, in 2024, the bank continued to benefit from its substantial corporate loan book, which underpins its overall financial health. The stability offered by these lending activities allows for consistent revenue generation, even in fluctuating market conditions.

- High Market Share: Citi's established position in corporate lending to large, stable clients signifies a dominant presence in this mature market.

- Predictable Income: Long-term relationships generate consistent interest income, a hallmark of a Cash Cow.

- Financial Stability: This segment reliably contributes to Citi's overall profitability and financial stability.

- Steady Cash Flow: The mature nature of the business ensures a steady and dependable cash flow for the bank.

High-Volume US Dollar Clearing Operations

Citi's high-volume U.S. dollar clearing operations, a cornerstone of its Treasury and Trade Solutions business, represent a classic Cash Cow in the BCG Matrix. These services are fundamental to global commerce, processing a significant portion of dollar-denominated transactions worldwide.

This segment boasts a dominant market share, leveraging Citi's extensive network and technological infrastructure. In 2024, the sheer volume of transactions processed underscores its stability and importance, generating consistent fee and interest income for the bank. While growth prospects are modest, the predictable and substantial revenue streams solidify its Cash Cow status.

- Dominant Market Share: Citi holds a leading position in U.S. dollar clearing, a critical service for international trade.

- Stable Revenue Generation: The business consistently produces significant fee and interest income due to high transaction volumes.

- Low Growth Prospects: While essential, the dollar clearing market experiences mature, low growth, typical of a Cash Cow.

- Foundational Financial Service: It underpins global financial flows, ensuring reliable and predictable earnings.

Citi's U.S. Branded Cards segment is a prime example of a Cash Cow, generating substantial and consistent revenue. This business line, benefiting from a stable customer base and expanding interest-earning balances, saw a 9% revenue increase in Q1 2025.

The bank's extensive global network and deep client relationships, particularly with multinational corporations, also contribute significantly to its Cash Cow status. These mature operations, like traditional corporate lending, leverage established market share to produce predictable interest income and steady cash flow, as evidenced by Citi's $77.4 billion in total revenue in 2023.

Citi's core deposit base, approximating $1.3 trillion in early 2024, serves as a highly stable and cost-effective funding source, generating consistent net interest income. Furthermore, its high-volume U.S. dollar clearing operations, a critical component of Treasury and Trade Solutions, consistently produce significant fee and interest income due to high transaction volumes and a dominant market share.

| Business Segment | BCG Category | Key Characteristics | Relevant 2024/2025 Data |

|---|---|---|---|

| U.S. Branded Cards | Cash Cow | High revenue generation, stable customer base, expanding balances | 9% revenue increase in Q1 2025 |

| Global Network & Corporate Relationships | Cash Cow | Mature operations, established market share, predictable income | $77.4 billion total revenue in 2023 |

| Core Deposit Base | Cash Cow | Stable funding, consistent net interest income | ~$1.3 trillion in early 2024 |

| U.S. Dollar Clearing Operations | Cash Cow | Dominant market share, high transaction volumes, consistent fee/interest income | Significant contribution to Treasury and Trade Solutions revenue |

What You’re Viewing Is Included

Citi BCG Matrix

The Citi BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no demo content, and no surprises—just a comprehensive strategic tool ready for your immediate use. You'll gain access to the complete analysis, enabling you to make informed decisions about your business portfolio without any further editing or revisions. This is the professional-grade report designed to provide actionable insights for your strategic planning.

Dogs

Citi's strategic pivot includes divesting its international consumer banking businesses in 14 markets, a move impacting regions like China, India, and Poland. This decision stems from a recognition that these operations lacked the scale and profitability needed for sustained success. For instance, in 2023, Citi announced the sale of its consumer banking business in Poland to Széchenyi Bank, marking a significant step in this global divestiture strategy.

These divested businesses were often characterized by smaller market shares and were not core to Citi's long-term growth ambitions. By exiting these segments, the bank aims to streamline its operations and concentrate resources on more promising areas. This strategic realignment is expected to enhance overall financial performance and improve capital allocation efficiency as Citi focuses on its core strengths.

The retail services segment, encompassing private label and co-brand credit cards, is exhibiting significant underperformance. Revenues saw an 11% drop in the first quarter of 2025, and credit card spend volume declined by 4% compared to the previous year.

These financial indicators, alongside elevated net charge-offs, paint a clear picture of a business struggling with both growth and market share. This segment is now a prime candidate for a thorough strategic evaluation, with potential divestiture being a strong consideration as Citi refines its consumer banking portfolio.

Legacy Technology Applications represent a significant challenge for Citi, as they are often costly to maintain and hinder innovation. Citi has been actively retiring these older systems, having retired over 1,250 since 2022, with a substantial 450 retired in 2024.

These legacy systems, while once critical, now introduce operational complexity and limit Citi's agility in today's fast-paced digital banking landscape. Their ongoing elimination is a key strategic move to boost efficiency and support the company's broader digital transformation objectives.

Non-Core or Fragmented Data Management Systems

Citi has recognized that its non-core or fragmented data management systems represent a significant challenge. These legacy systems, often siloed and inefficient, hinder effective data quality management and create operational burdens. For instance, the consolidation of multiple activity risk management platforms into a single, unified system underscores this effort.

These fragmented systems were not only inefficient but also posed compliance risks. The operational burden and limited strategic value of maintaining these disparate platforms likely acted as 'cash traps' for the organization. By addressing these data management weaknesses, Citi aims to improve overall operational efficiency and reduce compliance-related vulnerabilities.

- Data Consolidation: Citi is actively merging various activity risk management platforms into a singular, unified system.

- Efficiency Gains: Fragmented, legacy data systems were identified as inefficient and a source of compliance concerns.

- Reduced Operational Burden: The move away from non-core systems aims to alleviate operational overhead and free up resources.

- Strategic Value Enhancement: Unifying data management is expected to unlock greater strategic insights and reduce 'cash trap' scenarios.

Underperforming Global Consumer Banking Units (outside USPB and divested units)

These are the consumer banking operations outside the U.S. Personal Banking segment that Citi has not yet divested. They represent smaller, less competitive businesses within the global consumer banking landscape.

These units often face significant challenges, including low market share and limited growth potential due to intense competition. Consequently, they struggle to meet Citi's profitability and scale objectives. For instance, in 2023, Citi continued its strategic review of international consumer banking operations, with ongoing efforts to divest certain markets. While specific financial data for these remaining underperforming units isn't publicly broken out distinctly from broader segment reporting, the overall strategy aims to streamline operations and focus resources on core, high-growth areas.

- Low Market Share: These units typically hold a minor position in their respective markets.

- Limited Growth Prospects: The competitive environment hinders their ability to expand.

- Profitability Challenges: They often fail to achieve desired profit margins or return on equity targets.

- Strategic Review: Citi actively manages these units, often considering divestiture to optimize its global portfolio.

Citi's international consumer banking operations outside the U.S. Personal Banking segment, which have not yet been divested, can be viewed as the 'Dogs' in the BCG matrix. These units are characterized by low market share and limited growth potential in highly competitive global markets, often struggling to meet Citi's profitability and scale objectives.

The strategic rationale for managing these 'Dogs' is to streamline operations and reallocate resources to more promising areas. While specific financial data for these remaining underperforming units isn't always broken out distinctly, the overall strategy reflects a commitment to optimizing Citi's global portfolio by exiting less competitive businesses.

These businesses often represent a drag on overall performance due to their inability to achieve desired profit margins or return on equity targets. Citi's ongoing strategic review of these international consumer banking operations, including continued divestiture efforts in certain markets, underscores their classification as 'Dogs' requiring active management or exit.

For example, while specific figures for these remaining units are not separately detailed, Citi's broader strategy in 2023 continued to focus on divesting markets where its consumer banking presence lacked sufficient scale or competitive advantage.

Question Marks

Following its restructuring, Citi is pivoting towards targeted expansion in high-growth emerging markets, particularly focusing on institutional and wealth management services. This strategy identifies markets like India and AI-exposed East Asian economies as key areas for future growth.

These emerging markets represent significant opportunities, but Citi acknowledges the need for proactive investment to build or enhance its market share. Success hinges on a disciplined approach to resource allocation and operational execution within these dynamic regions.

Citi is heavily investing in next-generation digital products and AI-enhanced tools, like the predictive WayFinder in its mobile app. These innovations aim to boost client experience and internal efficiency. While these are in high-growth digital banking sectors, their market adoption is currently limited, meaning they need substantial funding to demonstrate value and achieve widespread use.

Citi is making significant strides in the blockchain and digital asset space, particularly within its Securities Services division. The bank favors private blockchain networks for these initiatives, recognizing the potential for efficiency and security in a rapidly evolving market. This strategic focus positions Citi to capitalize on the growth of digital assets, though market share and profitability remain subjects of ongoing development and investment.

Expansion in Commercial Banking Client Segment

Citi has clearly articulated its strategic intent to grow its presence within the Commercial Banking client segment. This focus suggests a perception of this segment as a high-potential area for future revenue and market share gains.

The bank's commitment to this expansion involves dedicated resources and strategic initiatives aimed at attracting and serving more commercial clients. Success here is crucial, as it could elevate the Commercial Banking segment to a 'Star' in Citi's BCG matrix, signifying strong growth and a dominant market position.

- Strategic Focus: Citi aims to significantly increase its footprint in Commercial Banking.

- Growth Opportunity: This segment is viewed as a key driver for future expansion.

- Investment & Acquisition: Targeted investments and client acquisition are central to this strategy.

- Potential Evolution: Successful expansion could classify Commercial Banking as a 'Star' in the BCG matrix.

Niche Investment Banking Advisory Areas

Within Citi's Markets segment, niche advisory areas are those specialized services or emerging sectors where the bank is actively developing expertise. These aren't yet dominant revenue drivers but show significant future growth potential. For instance, advisory services focused on the burgeoning sustainable finance and ESG (Environmental, Social, and Governance) integration for corporations are a prime example.

Another area is the specialized advice for rapidly evolving technology sub-sectors, such as quantum computing or advanced AI applications, where traditional financial models may not fully capture the value. Citi is investing in talent and research to build capabilities in these complex fields, aiming to become a go-to advisor as these markets mature.

- Sustainable Finance Advisory: Growing demand for ESG-linked debt and equity offerings. In 2023, global sustainable debt issuance reached approximately $1.5 trillion, indicating a substantial market opportunity.

- Digital Asset & Blockchain Advisory: Assisting traditional financial institutions and corporations in navigating the complexities of digital assets and blockchain technology implementation. The market for blockchain technology in financial services was projected to reach over $10 billion by 2024.

- Cybersecurity Risk Advisory: Providing strategic advice on managing and mitigating cybersecurity risks, a critical concern for all industries. Global spending on cybersecurity is expected to exceed $200 billion in 2024.

- Emerging Technology M&A Advisory: Focusing on mergers and acquisitions within rapidly innovating tech fields like AI, biotech, and advanced materials. The tech M&A landscape continues to be dynamic, with significant deal flow in specialized segments.

Question Marks in Citi's BCG Matrix represent business units or strategic initiatives that operate in high-growth markets but currently hold a low market share. These require significant investment to capture market potential, with the goal of transforming them into Stars.

Citi's investment in next-generation digital products, like AI-enhanced tools, and its focus on niche advisory areas within Markets, such as sustainable finance and digital assets, exemplify these Question Marks.

These areas, while promising due to market growth, need substantial capital and strategic development to increase their market share and become profitable growth engines.

The success of these Question Marks is critical for Citi's future growth, as they have the potential to become the Stars of tomorrow if managed effectively.

| Initiative | Market Growth | Market Share | Investment Need | Potential |

|---|---|---|---|---|

| AI-Enhanced Digital Products | High | Low | High | Star |

| Sustainable Finance Advisory | High | Low | High | Star |

| Digital Asset & Blockchain Advisory | High | Low | High | Star |

| Emerging Technology M&A Advisory | High | Low | High | Star |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and competitor analysis to ensure reliable, high-impact insights.