Citi Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citi Bundle

Curious about the intricate workings of a global financial giant like Citi? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Dive into the strategic core of Citi's operations with our detailed Business Model Canvas. Understand their value propositions, channels, and cost structures to gain a competitive edge.

Unlock the full strategic blueprint behind Citi's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Citi's strategic co-branding alliances are crucial for market penetration and customer loyalty. A prime example is the expansion of its partnership with American Airlines, making Citi the exclusive issuer of the AAdvantage co-branded card portfolio from 2026. This move is expected to bolster Citi's standing in the competitive consumer credit sector.

This significant alliance aims to enhance cardholder value and drive shareholder returns by deepening customer engagement through a robust loyalty program. The expanded partnership underscores Citi's commitment to leveraging co-branded credit cards as a key growth driver.

Citi has formed a key partnership with Apollo Global Management Inc., launching a substantial $25 billion private credit and direct lending program. This collaboration is a strategic move to bolster Citi's offerings to its corporate financial sponsor clients.

This alliance provides Citi's clients with enhanced access to a significant pool of private lending capital. The program addresses the increasing demand for private credit solutions in the market, a segment that has seen considerable growth.

Citi actively partners with leading technology providers to bolster its digital infrastructure and service offerings. A prime example is their collaboration with Google Cloud, specifically utilizing Vertex AI. This partnership is designed to accelerate productivity and modernize Citi's extensive data systems, a critical component of their ongoing digital transformation strategy.

Fintech and Innovation Ecosystems

Citi actively engages with fintech companies and participates in innovation hubs to co-create and enhance financial products. These collaborations are vital for maintaining a competitive edge and offering advanced solutions in the dynamic financial sector. For instance, in 2024, Citi continued its focus on digital transformation, investing heavily in partnerships that accelerate the development of AI-driven customer service and personalized banking experiences.

These strategic alliances allow Citi to leverage external expertise and emerging technologies, thereby improving existing services and introducing novel offerings. Such partnerships are instrumental in navigating the complexities of the modern financial landscape and ensuring the delivery of state-of-the-art financial tools to its diverse customer base.

- Fintech Collaborations: Citi partners with a range of fintechs to integrate new technologies and functionalities into its banking platforms.

- Innovation Programs: Participation in accelerators and innovation challenges fosters the development of next-generation financial solutions.

- Competitive Advantage: These partnerships are key to staying ahead in a rapidly evolving market by enabling access to cutting-edge technology and agile development processes.

- Service Enhancement: Collaborations aim to improve customer experience through digital tools, data analytics, and personalized financial services.

Interbank and Institutional Collaborations

Citi actively engages in interbank and institutional collaborations worldwide. These partnerships are crucial for providing syndicated loans, managing interbank clearing processes, and executing intricate cross-border transactions. For example, in 2023, Citi participated in a significant number of global syndicated loan facilities, demonstrating its role in facilitating large-scale financing. These collaborations are vital for extending its global reach and operational capabilities.

These alliances enable Citi to offer a wider array of financial products and services, leveraging the strengths of partner institutions. Such partnerships are fundamental to its ability to handle complex financial operations that might be beyond the scope of a single entity. In 2024, the trend of financial institutions forming strategic partnerships to navigate evolving market dynamics and regulatory landscapes is expected to continue, with Citi likely playing a prominent role.

- Syndicated Loans: Citi's participation in syndicated loans, a common practice in 2023 and continuing into 2024, allows it to underwrite and distribute larger credit facilities to corporations and governments.

- Interbank Clearing: Essential for the smooth functioning of global finance, interbank clearing partnerships ensure efficient settlement of transactions between financial institutions.

- Cross-Border Transactions: Collaborations are key to managing the complexities of international payments and capital flows, a core service for Citi's global client base.

- Global Reach: These partnerships amplify Citi's presence and service delivery across diverse geographical markets, reinforcing its position as a global financial powerhouse.

Citi's strategic partnerships are a cornerstone of its business model, enabling it to expand its reach and enhance its service offerings. A significant aspect of this is its collaboration with leading technology firms to drive digital innovation. For instance, Citi's partnership with Google Cloud, leveraging Vertex AI, aims to modernize data systems and boost productivity, a critical move in its 2024 digital transformation efforts.

Furthermore, Citi actively collaborates with fintech companies to integrate cutting-edge solutions and improve customer experiences. These alliances are vital for staying competitive and developing advanced financial products. The company also engages in extensive interbank and institutional partnerships globally, facilitating complex transactions like syndicated loans and cross-border payments, a practice that remained crucial throughout 2023 and into 2024.

| Partnership Type | Key Partners | Strategic Importance | Examples/Data |

|---|---|---|---|

| Co-branded Credit Cards | American Airlines | Market penetration, customer loyalty | Exclusive issuer of AAdvantage portfolio from 2026. |

| Private Credit | Apollo Global Management | Enhanced corporate client offerings | $25 billion private credit and direct lending program. |

| Technology Infrastructure | Google Cloud | Digital transformation, data modernization | Utilizing Vertex AI for productivity and data systems. |

| Fintech Collaborations | Various Fintechs | Service enhancement, competitive edge | Focus on AI-driven customer service and personalized banking in 2024. |

| Institutional & Interbank | Global Financial Institutions | Global reach, complex transactions | Significant participation in syndicated loans (2023). |

What is included in the product

A detailed breakdown of Citi's operations, outlining its customer segments, value propositions, and revenue streams.

Organized into the nine classic Business Model Canvas blocks, this overview provides insights into Citi's strategic approach and competitive landscape.

The Citi Business Model Canvas acts as a pain point reliever by providing a structured, visual representation that simplifies complex business strategies.

It helps teams quickly identify and address inefficiencies by offering a clear, actionable overview of all key business elements.

Activities

Citi's Global Consumer Banking and Credit Provision is a cornerstone of its operations, offering a comprehensive suite of products like retail banking, credit cards, and personal loans to individuals worldwide. This segment is dedicated to improving digital interactions and streamlining banking for its extensive customer base.

In 2024, Citi continued to invest heavily in digital transformation, aiming to simplify customer journeys. For instance, their mobile banking app saw increased adoption, facilitating millions of transactions daily. The bank’s credit card division remained a significant revenue driver, with outstanding balances reaching hundreds of billions of dollars globally.

Citi's corporate and investment banking services are a cornerstone activity, providing a full suite of solutions to global corporations, governments, and institutional clients. This encompasses crucial advisory for mergers and acquisitions, alongside the underwriting of debt and equity, and robust corporate lending capabilities, positioning Citi as a key player in facilitating international financial transactions.

In 2024, Citi's Institutional Clients Group, which houses these banking services, continued to be a significant revenue driver. For instance, their Global Banking segment, a major component of this group, demonstrated resilience, contributing substantially to the bank's overall financial performance, reflecting ongoing demand for their advisory and financing expertise in a dynamic global market.

Citi's securities brokerage and trading operations are a cornerstone of its business, facilitating transactions across a wide array of financial instruments like stocks, bonds, currencies, and raw materials for institutional clients worldwide.

These activities are vital for providing market liquidity and essential risk management tools, enabling clients to navigate complex financial landscapes efficiently.

In 2024, Citi's Global Markets division, which encompasses these operations, continued to be a significant revenue generator, reflecting strong client demand for its trading and advisory services in dynamic market conditions.

Wealth Management and Advisory

Citi is actively growing its wealth management arm, providing tailored investment advice, comprehensive financial planning, and dedicated private banking for affluent and high-net-worth clients. This strategic push targets enhanced profitability and stronger client engagement within this expanding market segment.

The company's commitment to wealth management is evident in its investment in technology and talent to deliver personalized client experiences. For instance, in 2024, Citi continued to invest in its digital platforms to offer more sophisticated tools for financial planning and investment management.

- Personalized Investment Advice: Offering customized portfolio management and strategic financial guidance.

- Financial Planning: Developing long-term plans covering retirement, estate planning, and wealth preservation.

- Private Banking Services: Providing exclusive banking, lending, and investment solutions for ultra-high-net-worth individuals.

- Growth Focus: Aiming to capture a larger share of the growing global wealth management market.

Digital Transformation and Technology Modernization

Citi is aggressively pursuing a multi-year digital transformation, injecting significant capital into modernizing its core systems. This initiative is crucial for enhancing cybersecurity defenses and embedding cutting-edge technologies, including artificial intelligence, across its operations. The goal is to streamline processes, elevate the client experience, and ensure robust regulatory adherence.

In 2024, Citi continued its substantial technology investments, with a reported $12 billion allocated to technology and operations. This spending reflects a commitment to digital innovation, aiming to improve efficiency and client interactions.

- Modernizing Core Systems: Citi is overhauling its legacy infrastructure to create a more agile and efficient technological backbone.

- Enhancing Cybersecurity: Significant resources are dedicated to strengthening defenses against evolving cyber threats, protecting client data and financial assets.

- Integrating Advanced Capabilities: The bank is actively incorporating AI and machine learning to personalize client services, automate tasks, and improve risk management.

Citi's key activities encompass providing a comprehensive range of financial services, from retail banking and credit cards to sophisticated corporate and investment banking solutions. They also engage in securities brokerage and trading, and are actively expanding their wealth management offerings. A significant ongoing effort involves a multi-year digital transformation to modernize systems and enhance client experience.

Delivered as Displayed

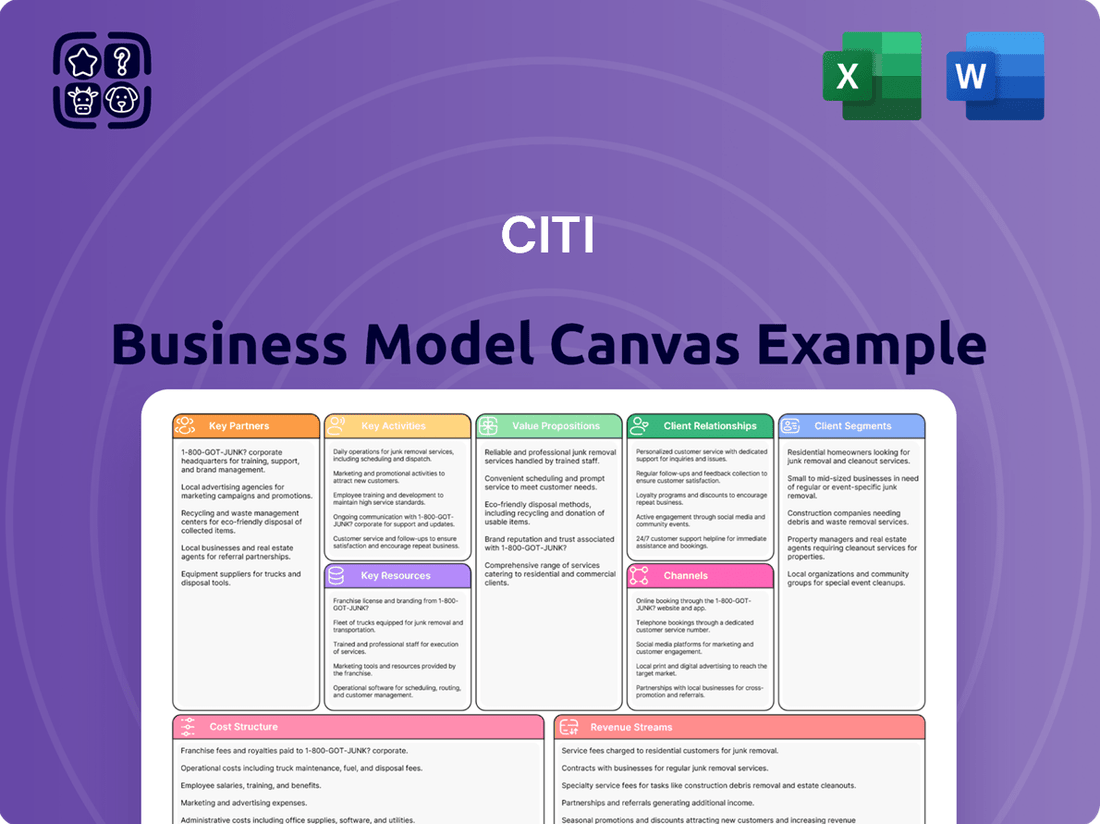

Business Model Canvas

This preview offers a direct look at the Citi Business Model Canvas you will receive. It's not a sample or a mockup; it's an actual segment of the complete document. Upon purchase, you'll gain full access to this exact, professionally formatted Business Model Canvas, ready for your strategic planning.

Resources

Citi's extensive global network, reaching over 160 countries and jurisdictions, is a cornerstone of its business model. This vast footprint allows Citi to cater to a diverse international clientele with complex cross-border financial requirements.

This expansive infrastructure facilitates seamless international financial flows, acting as a critical competitive advantage. For instance, in 2024, Citi continued to leverage this network to support significant global trade finance volumes, underpinning its role in international commerce.

Citi's robust financial capital, exemplified by its Common Equity Tier 1 (CET1) ratio, is a cornerstone resource. As of the first quarter of 2024, Citi reported a CET1 ratio of 13.0%, a figure that comfortably exceeds regulatory minimums and signifies substantial capacity to absorb unexpected losses.

This strong capital base empowers Citi to engage in significant lending activities, supporting its clients' growth and its own revenue generation. It also serves as a crucial buffer, ensuring the institution's stability and its ability to meet obligations even during periods of market stress, a critical factor for maintaining trust in the financial ecosystem.

Citi's significant investments in advanced technology, including its digital banking platforms, AI tools, and robust data analytics capabilities, are foundational to its business model. These technological assets are not just operational tools; they are key resources driving efficiency across all operations.

In 2024, Citi continued to prioritize technology spending, aiming to enhance its digital offerings and streamline customer interactions. These investments are directly linked to their ability to innovate and deliver new financial products and services more rapidly.

The firm's commitment to digital transformation is evident in its focus on AI and data analytics, which empower personalized client experiences and more sophisticated risk management. For instance, by leveraging data, Citi can better understand client needs, leading to tailored product offerings and improved service delivery, ultimately boosting client retention and acquisition.

Highly Skilled Human Capital and Leadership

Citi's approximately 229,000 full-time employees represent a cornerstone of its business model. This vast workforce includes seasoned leaders and highly specialized financial professionals who are critical to the company's operations.

Their collective expertise spans a wide array of financial services, from investment banking to consumer finance, and encompasses deep knowledge of global markets. This specialized skill set is indispensable for crafting and delivering intricate financial solutions to a diverse clientele.

The human capital at Citi is not just about numbers; it's about the quality of talent and leadership that drives innovation and client satisfaction. This skilled workforce is essential for navigating complex regulatory environments and maintaining strong, long-term client relationships.

- Talent Pool: Approximately 229,000 full-time employees globally.

- Expertise: Deep knowledge in diverse financial services and international markets.

- Leadership: Experienced professionals guiding strategic direction and client engagement.

- Value Proposition: Essential for delivering complex solutions and fostering client loyalty.

Strong Brand Reputation and Intellectual Capital

Citi's brand, meticulously cultivated over centuries, stands as a powerful testament to trust, reliability, and unparalleled global financial expertise. This deeply ingrained reputation is a critical intangible asset, directly influencing client acquisition and retention. In 2024, Citi continued to leverage this strength, with brand value estimates often placing it among the top global financial institutions, reflecting sustained client confidence.

Complementing its brand equity is Citi's substantial intellectual capital, encompassing deep expertise in financial innovation and astute market insights. This knowledge base is not merely theoretical; it translates into tangible advantages for clients seeking sophisticated financial solutions. Citi's ongoing investment in research and development, evident in its digital transformation initiatives throughout 2024, further bolsters this intellectual capital, ensuring its continued relevance and leadership in a rapidly evolving financial landscape.

- Brand Strength: Citi's brand is consistently recognized globally for trust and reliability, a key differentiator in the financial services sector.

- Intellectual Capital: Expertise in financial innovation and market analysis provides clients with cutting-edge solutions and strategic guidance.

- Client Attraction: The combination of a strong brand and intellectual capital serves as a magnet for both individual and institutional clients.

- Client Retention: Sustained trust and value delivery, driven by intellectual capital, foster long-term client relationships.

Citi's proprietary technology platforms, including its digital banking solutions and advanced analytics tools, are critical resources. These platforms enable efficient operations and the delivery of personalized financial services to a global customer base. In 2024, Citi continued to invest heavily in these digital assets, enhancing user experience and data processing capabilities.

The firm's data infrastructure, which supports sophisticated risk management and client insights, is another key resource. This allows Citi to offer tailored financial products and services, driving customer engagement and loyalty. Their commitment to data-driven decision-making underpins their competitive edge.

Citi's extensive customer base, comprising millions of retail, institutional, and corporate clients worldwide, is a vital resource. This diversified client portfolio provides stable revenue streams and cross-selling opportunities across its various business segments. In 2024, Citi actively worked on expanding its digital customer acquisition channels.

| Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Technology Platforms | Digital banking, AI, data analytics | Enhancing user experience, data processing |

| Data Infrastructure | Risk management, client insights | Tailored products, customer engagement |

| Customer Base | Retail, institutional, corporate clients | Stable revenue, cross-selling opportunities |

Value Propositions

Citi's value proposition centers on providing a vast array of financial products and services. This includes everything from everyday consumer banking and wealth management to complex corporate and investment banking, along with essential trade and treasury services.

This extensive portfolio allows Citi to cater to a wide range of clients, from individual consumers to large corporations, governments, and international institutions. By offering such a comprehensive suite, Citi aims to be a one-stop shop for diverse financial needs.

In 2024, Citi reported total revenue of $74.3 billion, demonstrating the scale of its operations across these varied financial segments. This broad offering is designed to meet the evolving financial requirements of a global clientele.

Citi's global reach is a cornerstone of its value proposition, facilitating over $3.3 trillion in cross-border transactions in 2023 alone. This extensive network allows multinational corporations to navigate international markets with ease, offering integrated solutions for trade finance, treasury management, and foreign exchange.

For businesses operating across multiple continents, Citi's ability to provide consistent banking services and support in over 160 countries is invaluable. This seamless integration simplifies complex international operations, reducing friction and enhancing efficiency for clients managing global supply chains and diverse financial needs.

Citi excels at offering specialized expertise, creating tailored solutions for distinct client groups. For instance, its Private Bank caters to ultra-high-net-worth individuals with bespoke wealth management strategies. This focus fosters deep, relevant client relationships.

The Institutional Clients Group, on the other hand, serves large corporations with sophisticated financial products and advisory services. In 2024, Citi’s Institutional Clients Group reported significant revenue growth, underscoring the success of its segment-specific approach in driving business outcomes.

Enhanced Digital Experience and Innovation

Citi is heavily investing in digital transformation and artificial intelligence, aiming to provide clients with cutting-edge, intuitive digital platforms and financial solutions. This focus ensures a seamless and modern banking experience.

These advancements translate into highly convenient, efficient, and secure methods for customers to manage their financial activities, from everyday transactions to complex investment management.

In 2023, Citi reported significant progress in its digital strategy, with digital clients growing by 5% year-over-year, and mobile banking engagement increasing by 10%.

Key innovations include:

- AI-powered fraud detection systems that have reduced false positives by 15% in the past year.

- Personalized financial insights delivered through the mobile app, leading to a 20% increase in user interaction with budgeting tools.

- Streamlined onboarding processes for new accounts, reducing average setup time by 30%.

- Enhanced security features, including advanced biometrics, to protect client data and transactions.

Trusted Partnership and Risk Management

Citi actively cultivates a reputation as a trusted partner, offering responsible financial services designed to foster client growth and broader economic progress. This commitment is underscored by significant investments in its operational infrastructure.

In 2024, Citi reported a robust risk-adjusted capital base, with its Common Equity Tier 1 (CET1) ratio standing at 13.8% as of the first quarter. This strong capital position directly translates into enhanced client confidence and security, assuring them of Citi's stability and reliability in managing their financial activities.

The bank's dedication to strengthening risk management and internal controls is a cornerstone of its value proposition. This focus is demonstrated through continuous enhancements to its data analytics capabilities and compliance frameworks, ensuring a secure environment for all financial transactions.

- Trusted Partnership: Citi emphasizes providing reliable financial solutions that support client expansion and economic advancement.

- Risk Management Focus: Significant investments in strengthening internal controls and risk management frameworks are a priority.

- Capital Strength: A strong CET1 ratio of 13.8% in Q1 2024 highlights financial stability and client security.

- Operational Enhancements: Ongoing improvements in data analytics and compliance bolster the safety of financial dealings.

Citi's value proposition is built on a foundation of comprehensive financial services, catering to a diverse global clientele from individuals to large institutions. This breadth of offerings, coupled with a strong emphasis on digital innovation and a commitment to being a trusted partner, forms the core of its client engagement strategy.

| Value Proposition Aspect | Description | Supporting Data (2023-2024) |

|---|---|---|

| Comprehensive Financial Solutions | Offering a wide spectrum of banking and financial products. | Total Revenue: $74.3 billion (2024) |

| Global Reach & Integration | Facilitating seamless international operations for clients. | Cross-border transactions: Over $3.3 trillion (2023) |

| Digital Innovation & User Experience | Providing cutting-edge, intuitive digital platforms. | Digital clients grew 5% YoY (2023); Mobile engagement up 10% (2023) |

| Specialized Expertise & Tailored Solutions | Delivering bespoke services for distinct client segments. | Significant revenue growth in Institutional Clients Group (2024) |

| Trusted Partnership & Financial Stability | Ensuring client confidence through robust risk management and capital strength. | CET1 Ratio: 13.8% (Q1 2024) |

Customer Relationships

Citi’s dedicated relationship management for institutional clients, corporations, and high-net-worth individuals is a cornerstone of its customer strategy. These clients benefit from personalized service delivered by dedicated relationship managers and expert advisory teams, ensuring their complex financial needs are met with tailored solutions and prompt attention. This focus on deep client engagement is crucial for retaining valuable business and fostering long-term partnerships.

Citi offers robust digital self-service through its mobile app and online banking platforms, allowing customers to manage accounts, execute transactions, and find support without direct human interaction. This digital-first strategy, a key component of their customer relationships, significantly boosts convenience for their consumer banking clients.

In 2024, Citi reported that over 90% of its retail banking transactions were conducted through digital channels, underscoring the success of their self-service model. This high adoption rate reflects customer preference for the ease and accessibility provided by their digital tools.

Citi's wealth management arm cultivates deep client connections by offering tailored financial guidance and holistic wealth planning. In 2024, Citi Private Bank advisors continued to focus on understanding individual client aspirations, leading to customized investment portfolios designed to meet specific objectives.

Loyalty Programs and Targeted Engagement

Citi cultivates customer loyalty through robust programs like its credit card rewards, offering points, cashback, and travel miles. These initiatives are designed to encourage repeat business and deepen customer relationships by providing tangible value. For instance, in 2024, Citi continued to enhance its co-branded credit card offerings, aiming to capture a larger share of consumer spending.

Targeted engagement is another cornerstone, where Citi leverages data analytics to personalize offers and communications. This approach ensures that customers receive relevant information and promotions, fostering a sense of being understood and valued. By segmenting its customer base, Citi can deliver tailored experiences that resonate more effectively.

- Credit Card Rewards: Citi's credit card portfolio, including partnerships like the American Airlines AAdvantage program, drives significant customer engagement and spending.

- Data-Driven Personalization: Utilizing customer data, Citi delivers targeted marketing campaigns and product recommendations.

- Customer Retention: Loyalty programs are key to reducing churn and increasing the lifetime value of customers.

- Partnership Value: Collaborations with airlines and other businesses expand the appeal and utility of Citi's loyalty offerings.

Proactive Communication and Financial Education

Citi actively engages customers with timely market insights and educational resources, aiming to foster financial literacy. This proactive stance goes beyond routine transactions, building stronger, trust-based relationships.

By offering personalized alerts and educational content, Citi empowers clients to navigate financial markets more confidently. This strategy is key to demonstrating a commitment to their long-term success.

- Proactive Market Insights: Citi provided over 50 market commentary pieces in the first half of 2024, reaching millions of clients.

- Financial Education Initiatives: In 2024, Citi's digital platforms hosted over 100 webinars and articles focused on investment strategies and financial planning.

- Personalized Alerts: The bank's alert system, which flags significant market movements or account activity, saw a 15% increase in user engagement in 2024.

- Client Well-being Focus: Survey data from late 2024 indicated that 70% of Citi clients felt more informed and secure due to the bank's educational outreach.

Citi's customer relationships are built on a dual approach: personalized, high-touch service for institutional and high-net-worth clients, and convenient digital self-service for retail customers. This strategy is supported by robust loyalty programs and data-driven personalization to foster engagement and retention.

| Customer Segment | Relationship Approach | Key Engagement Tactics | 2024 Data Point |

|---|---|---|---|

| Institutional & High-Net-Worth | Dedicated Relationship Management | Personalized advisory, tailored solutions | Focus on long-term partnerships |

| Retail Banking | Digital Self-Service | Mobile app, online banking, automated support | Over 90% of retail transactions digital |

| Wealth Management | Holistic Financial Guidance | Customized investment portfolios, wealth planning | Advisors focused on client aspirations |

| All Segments | Loyalty & Personalization | Credit card rewards, targeted offers, market insights | 15% increase in personalized alert engagement |

Channels

Citi's digital banking platforms, encompassing both mobile applications and online portals, serve as the bedrock for customer engagement and service delivery. These channels provide customers with convenient and comprehensive access to manage their finances, from checking balances and making payments to executing investments and seeking support, underscoring Citi's commitment to a digitally-driven customer experience.

In 2023, Citi reported that its digital channels facilitated a significant portion of customer interactions, with mobile banking usage growing substantially year-over-year. This digital-first approach allows for efficient service delivery and caters to the increasing preference of customers for self-service banking solutions, enhancing overall customer satisfaction and operational efficiency.

Citi's extensive global branch network and ATM fleet continue to be vital, especially for its consumer banking operations and customers who prefer or require cash services. As of the first quarter of 2024, Citi reported having approximately 2,300 branches worldwide, serving millions of customers. These physical touchpoints are crucial for building relationships and handling more intricate financial needs that may not be fully addressed by digital channels alone.

Relationship managers and sales teams are crucial for Citi's corporate, institutional, and wealth management clients. These dedicated professionals offer expert advice, streamline complex transactions, and cultivate long-term strategic partnerships, ensuring a personalized and high-touch client experience.

In 2024, Citi continued to invest in its relationship management infrastructure, recognizing that direct client interaction drives significant revenue. For instance, the bank's institutional clients group often leverages these teams to facilitate multi-billion dollar deals, underscoring the value of personal relationships in high-stakes financial services.

Call Centers and Customer Service

Citi leverages its extensive call centers and customer service operations as a crucial component of its customer relationships. These channels are designed to offer accessible and responsive support, addressing a broad spectrum of client needs from simple inquiries to complex issue resolution.

In 2024, Citi continued to invest in enhancing its customer service capabilities. For instance, the bank reported a significant increase in digital self-service options, aiming to reduce call volumes for routine transactions while ensuring human agents are available for more intricate matters. This focus on omnichannel support is key to maintaining client satisfaction across diverse demographics.

- Customer Reach: Citi's call centers serve millions of customers globally, providing 24/7 support for banking, credit card, and investment services.

- Service Efficiency: The bank aims to improve first-call resolution rates, with a target of over 80% for common inquiries by the end of 2024.

- Digital Integration: Customer service interactions are increasingly integrated with digital platforms, allowing for seamless transitions between self-service and agent support.

- Employee Training: Citi invests heavily in training its customer service representatives, ensuring they are equipped to handle a wide array of financial queries and provide expert advice.

Partnership and Co-Branding Networks

Citi leverages strategic partnerships, like its co-branded credit card programs with major airlines, as key channels for customer acquisition and engagement. These collaborations tap into the extensive networks of their partners, allowing Citi to reach a wider audience and offer integrated financial products.

For instance, Citi's partnership with American Airlines for their AAdvantage co-branded cards has historically been a significant driver of new card accounts and spending. In 2024, these types of partnerships continue to be crucial for expanding market reach and offering valuable rewards that resonate with specific customer segments.

- Customer Acquisition: Co-branding allows access to partner customer bases, driving new account openings.

- Enhanced Engagement: Integrated offerings, like airline miles on purchases, boost customer loyalty and transaction volume.

- Market Reach: Partnerships extend Citi's brand visibility and product offerings to new demographics.

- Revenue Streams: These collaborations generate fees and interest income, contributing to overall profitability.

Citi's channels are a multi-faceted approach to client interaction, blending digital convenience with personalized service. This mix ensures broad accessibility and caters to diverse customer needs, from everyday banking to complex financial solutions. The strategic deployment of these channels is central to Citi's customer relationship management and market penetration strategies.

Digital platforms, including mobile apps and online banking, are primary engagement points, facilitating seamless transactions and account management. Complementing this are the extensive physical branch and ATM networks, vital for cash services and in-person support. Relationship managers are key for high-value clients, offering tailored advice and fostering partnerships.

Customer service centers provide essential support, increasingly integrated with digital tools for efficient issue resolution. Strategic partnerships, such as co-branded credit cards, expand reach and drive customer acquisition by leveraging partner networks and offering integrated value propositions.

| Channel Type | Key Function | 2023/2024 Data Point | Strategic Importance |

| Digital Platforms (Mobile/Online) | Account Management, Transactions, Investments | Significant growth in mobile banking usage reported in 2023. | Core for customer engagement and self-service. |

| Physical Branches & ATMs | Cash Services, In-Person Support | Approx. 2,300 branches globally as of Q1 2024. | Essential for cash needs and relationship building. |

| Relationship Managers | Personalized Advice, Complex Transactions | Integral to institutional and wealth management client revenue in 2024. | Drives high-value client relationships and deal facilitation. |

| Call Centers/Customer Service | Inquiries, Issue Resolution, Support | Focus on enhancing digital self-service in 2024 to support human agents. | Provides accessible, responsive support across diverse needs. |

| Strategic Partnerships (e.g., Co-branded Cards) | Customer Acquisition, Engagement, Brand Reach | Co-branded cards remain crucial for market expansion in 2024. | Expands market access and offers integrated value. |

Customer Segments

Global consumers represent Citi's largest customer segment, encompassing individuals seeking everyday banking solutions like checking and savings accounts, credit cards, and personal loans. In 2024, Citi continued to focus on enhancing digital platforms to serve this vast base, aiming for seamless and accessible banking experiences. This segment is crucial for driving transaction volumes and retail deposit growth.

Citi's large corporate and multinational clients represent a significant segment, leveraging its global presence for intricate cross-border transactions and strategic financial management. These entities, often operating in diverse regulatory environments, rely on Citi for specialized corporate banking, investment banking, and comprehensive treasury and trade solutions.

In 2024, Citi's institutional clients group, which serves these large corporations, continued to be a cornerstone of its operations. The bank's ability to facilitate complex trade finance, manage global liquidity, and offer sophisticated capital markets access is crucial for businesses with extensive international supply chains and investment portfolios.

Governments and public sector institutions are key clients for Citi, utilizing a broad spectrum of financial services. These include crucial advisory roles for public finance, extensive financing options for infrastructure projects, and sophisticated treasury solutions to manage public funds efficiently. Citi's deep understanding of public sector needs positions it as a reliable partner in navigating complex financial landscapes.

Financial Institutions

Citi serves other financial institutions by offering a comprehensive suite of services. These include vital correspondent banking relationships, allowing seamless cross-border transactions. They also provide robust securities services, facilitating the clearing, settlement, and custody of financial assets. Furthermore, Citi offers sophisticated capital markets solutions, assisting other banks in raising capital and managing risk.

This segment is built upon Citi's extensive global network, which is a critical asset. This network enables efficient interbank operations and provides access to liquidity across numerous markets. Citi's deep expertise in managing complex international financial flows underpins its value proposition to these institutional clients.

In 2024, Citi's institutional clients group, which includes these financial institution services, generated significant revenue. For instance, their Global Markets division, a key component serving this segment, saw strong performance in trading revenues, reflecting the demand for their capital markets expertise. Their securities services business also experienced growth, with assets under custody and administration reaching substantial figures, demonstrating the trust placed in Citi by its peers.

- Correspondent Banking: Facilitates global payments and liquidity management for other banks.

- Securities Services: Offers custody, clearing, and settlement for a wide range of financial instruments.

- Capital Markets Solutions: Provides underwriting, trading, and advisory services for debt and equity offerings.

- Global Network Leverage: Utilizes Citi's worldwide presence to support interbank operations and market access.

Affluent and High-Net-Worth Individuals (Wealth Management)

Affluent and high-net-worth individuals represent a crucial customer segment for wealth management services. This group, characterized by substantial assets, actively seeks sophisticated financial planning, personalized investment strategies, and exclusive banking solutions. Citi caters to these needs through specialized offerings like Citigold and its Private Bank.

In 2024, the global wealth management market continued its robust expansion, with significant growth anticipated in services tailored for the affluent. For instance, the number of high-net-worth individuals globally, defined as those with investable assets of $1 million or more, was projected to exceed 22 million by the end of 2024, a testament to the increasing demand for expert financial guidance.

- Personalized Wealth Management: Citi provides bespoke financial advice and investment management to help affluent clients grow and preserve their wealth.

- Private Banking Services: Access to dedicated relationship managers, exclusive credit facilities, and tailored banking solutions for high-net-worth individuals.

- Investment Advisory: Expert guidance on diverse investment opportunities, including equities, fixed income, alternative investments, and estate planning.

- Wealth at Work: Solutions designed to support executives and professionals in managing and growing their personal wealth, often linked to their corporate benefits.

Citi's customer segments are diverse, ranging from everyday global consumers to large corporations and governments. The bank also serves other financial institutions and caters to affluent and high-net-worth individuals seeking specialized wealth management. Each segment leverages Citi's extensive global network and tailored financial solutions.

| Customer Segment | Key Services Offered | 2024 Focus/Data Point |

|---|---|---|

| Global Consumers | Everyday banking, credit cards, personal loans | Enhancing digital platforms for seamless experiences. |

| Large Corporates & Multinationals | Cross-border transactions, corporate & investment banking, treasury solutions | Facilitating complex trade finance and global liquidity management. |

| Governments & Public Sector | Public finance advisory, infrastructure financing, treasury solutions | Navigating complex financial landscapes for public funds. |

| Other Financial Institutions | Correspondent banking, securities services, capital markets solutions | Leveraging global network for interbank operations; strong trading revenue in Global Markets. |

| Affluent & High-Net-Worth Individuals | Wealth management, personalized investment strategies, private banking | Catering to a growing global high-net-worth population, projected to exceed 22 million in 2024. |

Cost Structure

Citi dedicates substantial resources to technology and digital transformation, encompassing everything from upgrading core IT systems to pioneering new digital products and services. For example, in 2023, Citi reported technology and operations expenses of $22.6 billion, a significant portion of which fuels these strategic investments.

These expenditures are vital for maintaining a competitive edge by improving operational efficiency, fostering innovation in product development, and ultimately elevating the client experience through seamless digital interactions.

Compensation and employee benefits represent a significant expenditure for Citi, reflecting its vast global operations and substantial headcount. In 2024, the company maintained a workforce of approximately 229,000 full-time employees worldwide, underscoring the scale of this cost category.

This major cost includes not only base salaries and performance-based bonuses but also comprehensive benefits packages such as health insurance, retirement plans, and other employee support programs essential for attracting and retaining talent across its diverse business segments.

Citi dedicates significant resources to regulatory compliance and risk management, a necessary expense for operating within global financial frameworks. In 2023, the company reported approximately $1.9 billion in consent order-related expenses, reflecting ongoing efforts to meet stringent regulatory demands and enhance internal controls. These costs are fundamental to mitigating operational risks and ensuring adherence to evolving legal and financial standards worldwide.

Marketing and Sales Expenses

Citi’s cost structure is significantly influenced by its investment in marketing and sales. These expenses are crucial for acquiring new customers and promoting its wide array of financial products, from credit cards to institutional services.

In 2024, financial institutions like Citi continue to allocate substantial resources to digital marketing, customer acquisition, and brand building. For instance, global marketing spending by financial services firms is projected to see continued growth, with a significant portion dedicated to online channels and data analytics to personalize customer outreach.

- Customer Acquisition Costs: Expenses related to attracting new clients for various banking and investment products.

- Advertising and Promotion: Costs for campaigns across digital, print, and broadcast media to enhance brand visibility and product awareness.

- Sales Force Compensation and Training: Investments in personnel responsible for direct sales and client relationship management.

- Market Research and Analytics: Spending on understanding market trends and customer behavior to optimize marketing strategies.

Operational and Administrative Overheads

Citi’s operational and administrative overheads represent a substantial portion of its cost structure. These costs encompass a wide range of expenses necessary for day-to-day business, including the upkeep of its extensive physical branch network and corporate offices, essential utilities, and fees for vital professional services like legal and accounting support. Administrative functions also contribute significantly to these overheads.

In 2024, Citi continued its strategic initiatives focused on organizational simplification. These efforts are designed to streamline operations and achieve a reduction in these overhead costs. For instance, the company has been actively divesting non-core businesses, which directly impacts the administrative infrastructure and associated expenses. The goal is to create a leaner, more efficient operating model.

- Rent and Facilities Management: Costs associated with maintaining a global network of physical branches and corporate offices.

- Utilities and Maintenance: Expenses for power, water, and general upkeep of all operational sites.

- Professional Services: Payments for legal counsel, audit firms, consulting, and other external expertise.

- Administrative Support: Salaries and benefits for human resources, IT support, and back-office functions.

Citi's cost structure is heavily influenced by its significant investments in technology and personnel. The bank spent $22.6 billion on technology and operations in 2023, underscoring its commitment to digital advancement and system upgrades. Furthermore, with approximately 229,000 employees globally in 2024, compensation and benefits constitute a major expense, reflecting the vast human capital required to manage its extensive operations.

Regulatory compliance and marketing also represent substantial costs. Citi incurred roughly $1.9 billion in consent order-related expenses in 2023, highlighting the ongoing investment in meeting stringent financial regulations. Marketing and sales efforts, crucial for customer acquisition and product promotion, continue to grow, with a notable shift towards digital channels and data analytics to personalize outreach.

| Cost Category | 2023/2024 Data Point | Significance |

|---|---|---|

| Technology & Operations | $22.6 billion (2023) | Fuels digital transformation and system upgrades. |

| Employee Count | ~229,000 (2024) | Indicates significant expenditure on salaries, benefits, and talent retention. |

| Regulatory Compliance | ~$1.9 billion (consent order-related, 2023) | Essential for mitigating risk and adhering to global financial standards. |

| Marketing & Sales | Continued growth, focus on digital | Drives customer acquisition and brand visibility. |

Revenue Streams

Net Interest Income (NII) is a cornerstone of Citi's revenue, representing the profit derived from the spread between interest earned on its vast portfolio of loans and investments and the interest paid on its customer deposits and other borrowings. This core banking activity is fundamental to its operations.

In the second quarter of 2025, Citi reported a robust 12% surge in Net Interest Income, a significant indicator of its expanding lending activities and effective management of its interest-bearing assets and liabilities. This growth was broad-based, reflecting positive momentum across its various business segments.

Investment banking fees are a core component of Citi's revenue, stemming from advisory services for mergers and acquisitions (M&A) and underwriting new debt and equity issuances. These fees represent a critical income stream, reflecting the bank's role in facilitating major corporate transactions and capital raising activities.

For the second quarter of 2024, Citi projected a substantial 50% increase in investment banking fees. This optimistic outlook suggests strong deal flow and successful execution of advisory and underwriting mandates during that period, highlighting the segment's importance to the bank's overall financial performance.

Citi's wealth management segment is a significant revenue generator, encompassing fees from asset management, investment advice, and brokerage services. This stream is experiencing robust growth, with wealth revenues climbing an impressive 20% in the second quarter of 2025, a testament to the expansion across Citi's diverse wealth management platforms.

Services (Treasury & Trade Solutions, Securities Services) Revenues

Citi's Services segment, which includes Treasury and Trade Solutions (TTS) and Securities Services, is a critical component of its business model, generating substantial revenue from institutional clients. This division leverages Citi's global network and technological capabilities to offer essential financial infrastructure.

The performance of this segment is a key indicator of Citi's strength in serving large corporations and financial institutions. For example, in the second quarter of 2025, Services revenues demonstrated robust growth, increasing by 8% compared to the same period in the prior year. This uplift signifies successful market penetration and a growing demand for its specialized offerings.

- Treasury and Trade Solutions (TTS): Provides payment, collection, and liquidity management services to corporations and governments globally.

- Securities Services: Offers custody, fund services, and investment support for institutional investors.

- Revenue Growth: Services revenues saw an 8% year-over-year increase in Q2 2025.

- Client Focus: Primarily serves institutional clients, acting as a vital partner in their global financial operations.

Branded Cards and Retail Banking Revenues

Citi's branded cards and retail banking operations are a bedrock of its revenue generation. This segment encompasses income derived from a wide array of consumer financial products, with a particular emphasis on its extensive portfolio of branded credit cards and everyday retail banking services.

The company's commitment to this sector is clearly demonstrated by its financial performance. For instance, U.S. Personal Banking revenues saw a healthy increase of 6% in the second quarter of 2025. This growth was notably fueled by robust expansion within its branded card offerings and its core retail banking operations.

- Branded Credit Cards: Revenue from interest income, fees, and interchange fees on a large base of co-branded and proprietary credit cards.

- Retail Banking Services: Income from checking and savings accounts, loans, mortgages, and other deposit-taking and lending activities for individual customers.

- Q2 2025 Performance: U.S. Personal Banking revenues grew by 6%, with branded cards and retail banking being key drivers of this uplift.

Citi's revenue streams are diverse, reflecting its global reach and comprehensive financial services. Net Interest Income, driven by lending and deposit activities, remains a core profit engine. Investment banking fees, generated from advisory and underwriting, highlight its role in capital markets.

The Services segment, encompassing Treasury and Trade Solutions and Securities Services, provides essential financial infrastructure to institutional clients, showing consistent growth. Wealth management fees from asset management and investment advice also contribute significantly, with strong recent performance.

Finally, branded cards and retail banking form a foundational revenue base, with U.S. Personal Banking revenues experiencing a notable uplift. These varied income sources underscore Citi's robust business model and its ability to serve a broad spectrum of clients.

| Revenue Stream | Key Activities | Q2 2025 Performance Highlight |

|---|---|---|

| Net Interest Income | Interest earned on loans vs. interest paid on deposits | 12% surge |

| Investment Banking Fees | M&A advisory, debt and equity underwriting | Projected 50% increase |

| Wealth Management | Asset management, investment advice, brokerage | 20% revenue climb |

| Services (TTS & Securities) | Global payment, custody, fund services | 8% revenue growth |

| Branded Cards & Retail Banking | Credit card interest/fees, retail banking products | U.S. Personal Banking up 6% |

Business Model Canvas Data Sources

The Citi Business Model Canvas is informed by a blend of internal financial data, extensive market research reports, and strategic analyses of competitor activities. These diverse sources ensure a comprehensive and accurate representation of Citi's operational and market positioning.