Cirrus Logic PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cirrus Logic Bundle

Navigate the complex external forces shaping Cirrus Logic's trajectory with our comprehensive PESTLE analysis. Uncover critical political, economic, social, technological, legal, and environmental factors that influence its market position and future growth. Equip yourself with actionable intelligence to make informed strategic decisions. Download the full PESTLE analysis now and gain a significant competitive advantage.

Political factors

Geopolitical tensions, especially between the US and China, continue to shape the semiconductor landscape. These tensions manifest as tariffs, export controls, and trade restrictions, directly affecting companies like Cirrus Logic. For instance, in 2023, the US expanded export controls on advanced semiconductors to China, impacting the flow of critical technologies and potentially increasing operational costs for global players. This environment necessitates strategic adjustments, such as diversifying manufacturing and sourcing locations, to build resilience against supply chain disruptions.

Governments are actively supporting the semiconductor industry, with initiatives like the US CHIPS and Science Act of 2022, which allocated $52.7 billion for domestic manufacturing and research. These substantial investments aim to bolster national semiconductor production and reduce dependence on overseas suppliers.

Such government programs present a significant opportunity for companies like Cirrus Logic. By fostering domestic innovation and potentially encouraging the relocation of manufacturing closer to major consumer markets, these incentives could lead to more resilient supply chains and new avenues for growth.

Semiconductors are now recognized as vital national security assets, powering everything from advanced defense systems to critical infrastructure. This heightened awareness translates into increased government scrutiny and intervention in the semiconductor supply chain, influencing global trade dynamics.

In 2024, the US CHIPS and Science Act continued to allocate billions to bolster domestic semiconductor manufacturing, directly impacting companies like Cirrus Logic by incentivizing onshoring and potentially altering international partnerships. This focus on supply chain resilience, driven by national security imperatives, means geopolitical stability and government policies will be paramount considerations for Cirrus Logic's strategic planning.

Regulatory Environment for Manufacturing

The political climate significantly shapes the regulatory landscape for semiconductor manufacturing. This includes critical areas like environmental protection standards and labor laws, which directly impact operational costs and processes. For instance, stricter emissions regulations, a growing trend in many developed nations as of 2024, can necessitate substantial investments in pollution control technology, thereby increasing capital expenditure for fabrication plants.

Changes in these regulations can directly affect production costs and the feasibility of expansion. For example, new environmental compliance requirements could add millions to the cost of building a new fab or upgrading an existing one. Similarly, shifts in labor laws, such as minimum wage increases or new worker safety mandates, can alter the overall cost structure for manufacturers. The US CHIPS and Science Act, enacted in 2022, aims to bolster domestic semiconductor manufacturing through incentives, but it also comes with specific requirements regarding workforce development and supply chain transparency, illustrating the complex interplay between political initiatives and regulatory frameworks.

Key aspects of the regulatory environment impacting semiconductor manufacturing include:

- Environmental Regulations: Compliance with air and water quality standards, hazardous waste disposal, and energy efficiency mandates are crucial. For example, the European Union's Green Deal objectives are increasingly influencing industrial regulations, pushing for more sustainable manufacturing practices.

- Labor Laws: Regulations concerning worker safety, wages, benefits, and unionization rights directly impact operational expenses and workforce management.

- Trade Policies and Tariffs: Government policies on international trade, including tariffs and export controls, can significantly affect the cost of imported materials and the competitiveness of exported goods.

- Intellectual Property Protection: Robust legal frameworks for protecting intellectual property are vital for innovation-driven industries like semiconductors.

Intellectual Property Protection Policies

Government policies on intellectual property (IP) protection are paramount for fabless semiconductor firms like Cirrus Logic. These policies directly impact the company's ability to safeguard its innovative chip designs and maintain a competitive advantage. Strong IP protection ensures that Cirrus Logic’s investments in research and development are secure from infringement, allowing it to monetize its technological advancements.

In 2024 and 2025, the global landscape for IP protection continues to evolve, with varying degrees of enforcement across different jurisdictions. For instance, the United States continues to prioritize robust patent protections, which is beneficial for companies like Cirrus Logic that heavily rely on their patent portfolio. Conversely, some emerging markets may present challenges in IP enforcement, requiring companies to adopt strategic approaches to protect their innovations.

- US Patent and Trademark Office (USPTO) filings: Cirrus Logic actively files patents to protect its core technologies in areas such as digital signal processing and audio codecs.

- International IP Treaties: Adherence to treaties like the Patent Cooperation Treaty (PCT) aids in securing patent rights across multiple countries.

- Trade Secret Protection: Beyond patents, companies also focus on protecting trade secrets, which are vital for maintaining a competitive edge in the rapidly evolving semiconductor industry.

- Enforcement Actions: The success of IP protection often hinges on the government's willingness and ability to enforce these laws through legal channels, deterring potential infringers.

Geopolitical tensions, particularly between the US and China, continue to influence the semiconductor market, leading to trade restrictions and export controls that impact companies like Cirrus Logic. Government incentives, such as the US CHIPS and Science Act of 2022, are bolstering domestic manufacturing and research, presenting opportunities for onshoring and supply chain resilience. Semiconductors are increasingly viewed as national security assets, intensifying government oversight and intervention in the industry.

What is included in the product

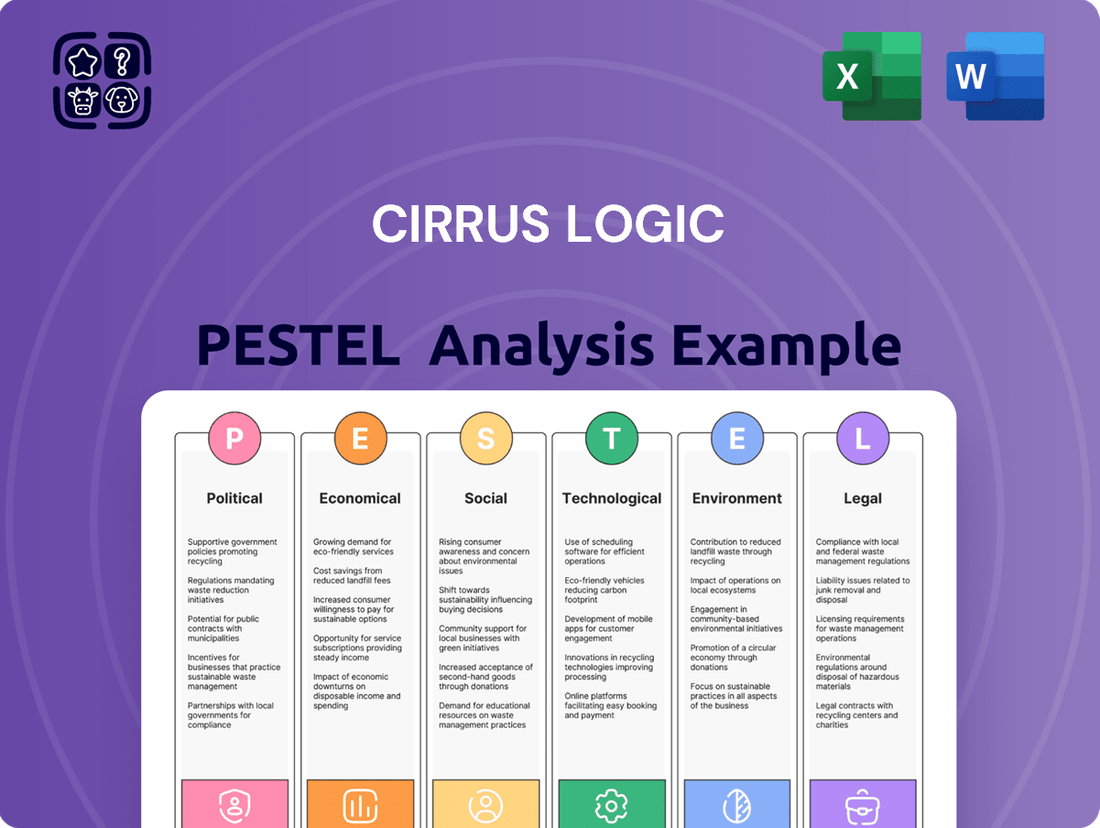

This PESTLE analysis examines the external macro-environmental factors impacting Cirrus Logic, covering political, economic, social, technological, environmental, and legal influences.

It provides a comprehensive overview of the opportunities and threats Cirrus Logic faces within its operating landscape.

Cirrus Logic's PESTLE analysis offers a concise, easily digestible summary, simplifying complex external factors for quick referencing in meetings and presentations.

Economic factors

Cirrus Logic's success is closely linked to the consumer electronics sector, especially with devices like smartphones, tablets, and smart home gadgets. The market is projected to keep expanding through 2025 and beyond.

This growth is fueled by key trends such as the widespread adoption of 5G technology, the increasing integration of artificial intelligence, and growing disposable incomes in developing economies. These factors directly translate to increased revenue opportunities for Cirrus Logic.

For instance, the global consumer electronics market was valued at approximately $1.1 trillion in 2023 and is expected to reach $1.5 trillion by 2028, exhibiting a compound annual growth rate of around 6.5%. This upward trajectory presents a significant tailwind for companies like Cirrus Logic.

The semiconductor industry has faced significant supply chain disruptions, with forecasts suggesting potential continued constraints in mature process nodes through 2025 and 2026. This instability directly impacts companies like Cirrus Logic, which rely on a steady flow of components.

Despite a general market recovery, raw material scarcity and geopolitical tensions remain key challenges, potentially increasing production costs and affecting delivery timelines for Cirrus Logic. For instance, the global semiconductor market saw a slight contraction in 2023 but is projected to grow in 2024 and beyond, yet specific segments may still experience bottlenecks.

The semiconductor sector is inherently R&D-driven, with significant capital allocated to cutting-edge advancements such as artificial intelligence and sophisticated mixed-signal processing. For instance, in fiscal year 2024, Cirrus Logic reported R&D expenses of $442.1 million, reflecting a commitment to innovation.

Maintaining a competitive edge in this dynamic market hinges on Cirrus Logic's sustained R&D investment. This allows the company to pioneer novel solutions and effectively respond to shifting market needs, ensuring its relevance in areas like high-performance audio and advanced connectivity.

Inflation and Cost Pressures

Inflationary pressures and rising costs for essential inputs like raw materials, manufacturing equipment, and skilled labor present a significant challenge for semiconductor companies, including Cirrus Logic. These escalating expenses directly impact gross margins and overall profitability. For instance, the average price of semiconductor manufacturing equipment saw a notable increase in 2024, putting pressure on capital expenditure budgets.

Navigating these economic headwinds requires strategic adjustments. Cirrus Logic, like its peers in the semiconductor industry, may need to implement price adjustments for its products to offset increased production costs. Simultaneously, a focus on operational efficiency, such as optimizing supply chains and streamlining manufacturing processes, becomes crucial for maintaining financial performance and competitive pricing.

- Rising Input Costs: The cost of key raw materials for semiconductor production, such as silicon wafers and specialized chemicals, continued to experience upward trends through early 2025, impacting Cirrus Logic's cost of goods sold.

- Labor Market Dynamics: Wage inflation for specialized engineering and manufacturing talent in the tech sector remained a factor in 2024 and into 2025, contributing to higher operating expenses for companies like Cirrus Logic.

- Impact on Margins: Persistent inflation can squeeze gross margins if companies are unable to fully pass on increased costs to customers, potentially affecting Cirrus Logic's profitability.

Foreign Exchange Rate Fluctuations

As a global player, Cirrus Logic's financial performance is inherently tied to the volatility of foreign exchange rates. When the company earns revenue or incurs expenses in currencies different from its reporting currency (USD), fluctuations can significantly alter the translated value of those transactions, impacting reported profits. For instance, a stronger US dollar could reduce the value of foreign earnings when converted back, while a weaker dollar could have the opposite effect.

These currency movements can create headwinds or tailwinds for Cirrus Logic's top and bottom lines. For example, if a substantial portion of their sales are in Euros and the Euro weakens against the dollar, the reported revenue from those sales will be lower. Conversely, if their manufacturing costs are heavily weighted in a depreciating currency, it could lead to favorable cost reductions.

For the fiscal year ending March 29, 2024, Cirrus Logic reported total net sales of $1.57 billion. The company's global operations mean a portion of these sales and associated costs are denominated in various foreign currencies, making them susceptible to FX impacts. While specific figures detailing the net impact of foreign exchange on Cirrus Logic's 2024 profitability are not publicly itemized in a way that isolates this single factor, the company's financial reports consistently acknowledge this as a risk factor.

- Global Sales Exposure: Cirrus Logic's international sales, a significant portion of its revenue, are subject to the strengthening or weakening of the US dollar against other major currencies.

- Cost of Goods Sold: Expenses related to manufacturing and supply chain, potentially incurred in foreign currencies, also face FX translation risks.

- Profitability Impact: Adverse currency movements can erode profit margins or inflate them, depending on the net effect on revenues versus expenses.

- Reporting Currency: As a US-based company, Cirrus Logic reports its financial results in US dollars, meaning currency fluctuations directly affect the reported value of its international business activities.

Economic factors significantly shape Cirrus Logic's operational landscape and financial performance. Inflationary pressures, particularly in raw materials and labor, directly impact the cost of goods sold and operating expenses, potentially squeezing profit margins if cost increases cannot be fully passed on. For instance, the average cost of semiconductor manufacturing equipment saw an increase in 2024, affecting capital expenditure.

Currency exchange rate volatility presents another key economic consideration for Cirrus Logic, given its global sales and operations. Fluctuations in the US dollar against other currencies can impact the translated value of foreign revenues and expenses, thereby affecting reported profits. The company's fiscal year 2024 net sales reached $1.57 billion, with a portion of these transactions occurring in foreign currencies.

The broader economic outlook, including consumer spending power and global economic growth, directly influences demand for consumer electronics, Cirrus Logic's primary market. Projections indicate continued growth in this sector through 2025, driven by trends like 5G adoption and AI integration, which are positive indicators for the company.

Supply chain stability and input costs remain critical economic variables. While the global semiconductor market is expected to grow in 2024, potential bottlenecks in mature process nodes could persist through 2025 and 2026, impacting production volumes and costs for Cirrus Logic.

Same Document Delivered

Cirrus Logic PESTLE Analysis

The preview shown here is the exact Cirrus Logic PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the external factors influencing Cirrus Logic.

The content and structure shown in the preview is the same document you’ll download after payment, offering a detailed breakdown of political, economic, social, technological, legal, and environmental influences on Cirrus Logic.

Sociological factors

Consumers are increasingly prioritizing superior audio experiences and energy-efficient designs in their electronic devices. This shift directly impacts Cirrus Logic's focus on developing high-performance, low-power components for smartphones, smart home devices, and wearables. For instance, the global wearable market is projected to reach $150 billion by 2026, highlighting the growing consumer appetite for these connected products.

The increasing integration of digital technologies into daily life, from remote work to online learning and entertainment, directly fuels the demand for the sophisticated audio and voice processing chips Cirrus Logic provides. For instance, a significant portion of the global workforce continued to embrace hybrid or fully remote models in 2024, requiring reliable audio solutions for communication devices.

This societal trend underpins the robust growth of the consumer electronics market, a key sector for Cirrus Logic. In 2024, global consumer electronics sales were projected to reach over $1 trillion, with audio-visual equipment and personal electronics showing consistent year-over-year increases, directly benefiting companies like Cirrus Logic.

The semiconductor industry grapples with a significant global talent deficit, especially for engineers and technicians with expertise in cutting-edge fields like artificial intelligence. This shortage directly impacts companies like Cirrus Logic, making it harder to find and keep the specialized skills needed for innovation and production.

To counter this, Cirrus Logic must prioritize offering competitive compensation packages, robust training programs, and forging strong alliances with universities and technical schools. These strategies are crucial for attracting and retaining the highly skilled workforce essential for staying ahead in the rapidly evolving semiconductor landscape.

For instance, in 2024, the demand for AI chip designers was projected to outstrip supply by a considerable margin, highlighting the critical need for companies to invest in talent development and recruitment pipelines.

Societal Expectations for Sustainability

Societal expectations are increasingly pushing companies like Cirrus Logic towards more sustainable operations and the creation of eco-friendly products. This shift is directly impacting consumer choices, with a growing demand for devices that are both recyclable and energy-efficient.

This trend significantly influences product design and manufacturing within the consumer electronics sector. For instance, by 2025, the global market for sustainable electronics is projected to reach $165 billion, highlighting the financial imperative behind these societal shifts.

- Growing Consumer Demand: A significant portion of consumers, particularly younger demographics, actively seek out brands demonstrating strong environmental responsibility.

- Regulatory Influence: Evolving environmental regulations, such as those concerning e-waste and energy efficiency standards, are compelling manufacturers to adopt greener practices.

- Brand Reputation and Loyalty: Companies perceived as sustainable often enjoy enhanced brand reputation and stronger customer loyalty, translating into competitive advantage.

- Supply Chain Scrutiny: Societal pressure extends to the entire supply chain, requiring companies to ensure ethical and environmentally sound sourcing of materials.

User Experience and Accessibility Demands

The growing demand for user-friendly and accessible electronic devices directly impacts the need for sophisticated mixed-signal processing. Consumers expect intuitive interfaces and effortless connectivity, pushing manufacturers to integrate advanced solutions. Cirrus Logic's expertise in mixed-signal chips directly supports these user experience enhancements, making their technology crucial for a wide range of consumer electronics.

For instance, the global smart home market, heavily reliant on seamless user interaction, was projected to reach over $150 billion in 2024, with strong growth continuing into 2025. This trend underscores the importance of Cirrus Logic's contribution to creating more responsive and integrated smart devices.

- Intuitive Interfaces: Consumers increasingly expect simple, gesture-based controls and voice command integration, requiring powerful processing capabilities.

- Seamless Connectivity: The proliferation of IoT devices necessitates robust, low-power mixed-signal solutions for reliable wireless communication and data transfer.

- Accessibility Features: Growing awareness and regulatory push for accessibility in electronics demand specialized audio and sensor processing, areas where Cirrus Logic excels.

- Enhanced User Experience: These factors collectively drive demand for high-performance, energy-efficient chips that enable richer, more accessible interactions with technology.

Societal trends highlight a growing consumer demand for personalized and immersive audio experiences, driving the need for advanced audio processing solutions. This is evident in the projected 15% year-over-year growth for the global headphones market through 2025, reaching an estimated $30 billion. Furthermore, increasing awareness around mental well-being and the desire for enhanced productivity are fueling demand for sophisticated voice-activated interfaces and smart home audio systems.

Technological factors

Cirrus Logic's core business in audio processing is being reshaped by rapid advancements in AI and machine learning. These technologies are driving innovation in areas like AI-driven audio processing software and edge AI chips, which are crucial for creating more sophisticated audio experiences.

The development of neural audio codecs, for instance, promises to enhance audio quality and efficiency, directly impacting the demand for specialized processing solutions. This technological evolution presents significant opportunities for Cirrus Logic to integrate these capabilities into their product portfolio, but also introduces competitive pressures from companies developing advanced AI audio solutions.

The relentless pursuit of smaller, more potent, and energy-conscious electronics, especially in the booming mobile and wearable sectors, is a major catalyst for advancements in semiconductor engineering. This trend directly fuels the need for sophisticated chip designs that can deliver high performance without draining battery life.

Cirrus Logic's strategic emphasis on developing low-power, high-precision mixed-signal integrated circuits perfectly positions the company to capitalize on this critical technological shift. Their solutions are designed to meet the stringent power budgets and performance requirements of next-generation portable devices.

For instance, the global smartphone market, a key consumer of Cirrus Logic's technology, is projected to see shipments reach approximately 1.17 billion units in 2024, with a continued emphasis on battery longevity and compact designs. Similarly, the wearable technology market is expected to grow significantly, with smartwatches and other wearables demanding even greater power efficiency, a core competency for Cirrus Logic.

The ongoing rollout and adoption of 5G networks globally are creating substantial demand for advanced semiconductors, directly benefiting companies like Cirrus Logic. As of early 2024, 5G network coverage continues to expand, with many regions seeing significant infrastructure build-out, driving the need for new chipsets in smartphones and other connected devices.

Cirrus Logic's audio and voice processing solutions are integral to the high-performance smartphones and emerging connected devices that leverage 5G's enhanced capabilities. The increased data speeds and lower latency offered by 5G enable richer multimedia experiences and new applications, all of which rely on sophisticated semiconductor components, including those designed by Cirrus Logic.

Emergence of New Product Categories (e.g., AI PCs, Wearables)

The tech landscape is rapidly evolving with new product categories like AI PCs and advanced wearables gaining traction. For instance, the global AI PC market is projected to reach $177.4 billion by 2028, demonstrating substantial growth potential. Cirrus Logic's success hinges on its capacity to embed its audio and voice processing technologies into these innovative devices.

The increasing sophistication of smart home devices also presents a significant opportunity. Consider the smart home market, which is expected to grow at a compound annual growth rate of over 12% through 2027. Cirrus Logic's ability to provide high-performance, low-power solutions for these connected ecosystems will be key to capturing new revenue streams and maintaining its competitive edge.

- AI PC Market Growth: Expected to reach $177.4 billion by 2028.

- Wearable Technology Expansion: The wearables market continues to see innovation and increased consumer adoption.

- Smart Home Device Penetration: This sector is growing at over 12% annually through 2027.

- Cirrus Logic's Role: Integration of audio and voice solutions into these emerging product categories is crucial for future revenue.

Intellectual Property and Design Complexity

The semiconductor industry is witnessing a significant surge in chip design complexity, making intellectual property (IP) an increasingly vital asset. This trend directly impacts companies like Cirrus Logic, which operates as a fabless semiconductor vendor.

Cirrus Logic's competitive edge is heavily dependent on its substantial IP portfolio and its ongoing commitment to design innovation. This focus allows them to maintain their standing in a rapidly evolving market.

For instance, the average number of transistors in leading-edge chips has grown exponentially; by 2024, advanced processors can contain hundreds of billions of transistors, each requiring intricate design and robust IP protection.

- Growing Chip Complexity: The sheer number of transistors in advanced chips is escalating, demanding sophisticated design tools and methodologies.

- IP as a Differentiator: A strong IP portfolio is crucial for fabless companies like Cirrus Logic to protect their innovations and secure market share.

- Innovation Investment: Continuous investment in research and development is necessary to create new, differentiated designs and maintain a technological advantage.

Technological advancements in AI and machine learning are fundamentally altering the audio processing landscape, driving demand for sophisticated edge AI chips and AI-driven audio software. Neural audio codecs are emerging, promising better audio quality and efficiency, directly impacting the need for specialized processing solutions like those Cirrus Logic develops.

The constant push for smaller, more powerful, and energy-efficient electronics, especially in mobile and wearables, necessitates advanced semiconductor engineering. Cirrus Logic's focus on low-power, high-precision mixed-signal ICs aligns perfectly with this trend, meeting the stringent power and performance demands of next-generation portable devices.

The expansion of 5G networks globally is a significant driver for advanced semiconductors, benefiting companies like Cirrus Logic. The increased data speeds and lower latency of 5G enable richer multimedia experiences and new applications that rely on sophisticated chip components.

Emerging product categories such as AI PCs and advanced wearables are creating new avenues for growth. Cirrus Logic's success will be tied to its ability to integrate its audio and voice processing technologies into these innovative devices, capitalizing on markets like the AI PC sector projected to reach $177.4 billion by 2028.

The increasing complexity of chip design, with advanced processors containing hundreds of billions of transistors by 2024, underscores the importance of intellectual property (IP). For fabless companies like Cirrus Logic, a strong IP portfolio and continuous investment in R&D are crucial for maintaining a competitive edge and protecting innovations.

Legal factors

Intellectual property laws, especially patent protection, are crucial for Cirrus Logic, a fabless semiconductor company. Their business thrives on innovation, and a robust patent portfolio safeguards their unique designs and technologies from being copied by competitors.

Cirrus Logic's significant investment in research and development directly translates into its intellectual property assets. As of early 2024, the company actively manages a substantial number of patents, a testament to its ongoing commitment to technological advancement and market differentiation.

International trade regulations and export controls, particularly concerning advanced semiconductor technology, pose significant legal hurdles for Cirrus Logic. These rules can directly limit where and to whom the company can sell its products, impacting market access and customer relationships. For instance, in 2024, ongoing geopolitical tensions and evolving national security concerns continue to shape export restrictions, requiring diligent adherence to prevent legal repercussions.

Compliance with these intricate trade laws is not optional; it's a fundamental requirement for Cirrus Logic's global operations. Failure to navigate tariffs, sanctions, and specific export licensing for semiconductor components can lead to substantial fines, reputational damage, and the loss of critical business opportunities. The company must stay abreast of these dynamic legal frameworks to ensure uninterrupted business flow.

Cirrus Logic, though a fabless semiconductor company, faces environmental compliance challenges through its manufacturing partners. Regulations concerning water usage, waste disposal, and the handling of hazardous materials in the semiconductor industry, particularly in key markets like the EU and US, directly influence its supply chain's operational costs and efficiency. For instance, the EU's updated directives on chemical substances and waste management in 2024 and ongoing US EPA initiatives continue to push for more sustainable manufacturing practices, potentially increasing supplier costs that could be passed on to Cirrus Logic.

Data Privacy and Security Regulations

Cirrus Logic's components are integral to many consumer electronics, placing it in a position where it must consider global data privacy and security mandates. Regulations like the European Union's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) set stringent rules for handling personal information. Although Cirrus Logic doesn't directly manage end-user data, its semiconductor solutions enable devices that must adhere to these privacy frameworks. For instance, in 2023, fines under GDPR exceeded €1.5 billion, highlighting the significant financial implications of non-compliance for companies operating in the digital space.

The increasing focus on data protection means that Cirrus Logic must ensure its hardware designs facilitate compliance for its customers. This includes considerations for data encryption, secure element integration, and minimizing data collection where possible within the chip architecture. As of early 2024, there's a growing trend towards more comprehensive data privacy legislation worldwide, impacting the entire supply chain of connected devices.

This indirect exposure necessitates proactive engagement with evolving legal landscapes to maintain market access and customer trust. Key areas of focus for Cirrus Logic include:

- Hardware-level security features: Ensuring chips support robust encryption and secure boot processes.

- Data minimization design principles: Architecting solutions that reduce the need for sensitive data processing.

- Customer compliance support: Providing documentation and technical guidance to help device manufacturers meet regulatory obligations.

- Monitoring legislative changes: Staying abreast of new and updated data privacy laws across key markets.

Product Safety and Standards Compliance

Cirrus Logic's diverse product portfolio, ranging from audio components to mixed-signal integrated circuits, necessitates strict adherence to a complex web of international product safety and quality standards. These regulations, which vary by region and product application, are critical for ensuring consumer well-being and maintaining market access. Failure to comply can result in significant penalties, product recalls, and damage to brand reputation.

For instance, in the European Union, products must meet directives like the Restriction of Hazardous Substances (RoHS) and Restriction, Evaluation, Authorisation and Restriction of Chemicals (REACH), alongside general product safety directives. In the United States, the Consumer Product Safety Commission (CPSC) sets standards, and specific certifications like UL (Underwriters Laboratories) are often required for electronic components. These legal frameworks directly impact Cirrus Logic's design, manufacturing, and supply chain processes.

- Global Standards: Cirrus Logic must navigate standards such as IEC 62368-1 for audio/visual and information technology equipment, which replaced older safety standards like IEC 60950-1 and IEC 60065.

- Regional Compliance: Compliance with specific regional regulations, like those set by the FCC in the US for electromagnetic compatibility (EMC), is mandatory for market entry.

- Supply Chain Scrutiny: The company's commitment to ethical sourcing and material compliance, as highlighted by industry trends in 2024 and projected for 2025, is increasingly scrutinized by both regulators and customers.

Intellectual property laws are paramount for Cirrus Logic, protecting its innovative semiconductor designs. As of early 2024, the company actively manages a substantial patent portfolio, reflecting its commitment to technological advancement and market differentiation.

International trade regulations and export controls, particularly for advanced semiconductor technology, present significant legal challenges. Geopolitical tensions in 2024 continue to shape export restrictions, necessitating diligent adherence to prevent legal repercussions and ensure market access.

Cirrus Logic must also navigate global data privacy and security mandates, such as GDPR and CCPA, as its components enable devices that handle personal information. The company's hardware designs must facilitate customer compliance, with a growing trend towards comprehensive data privacy legislation worldwide impacting the entire supply chain through early 2024.

Product safety and quality standards, including EU's RoHS and REACH, and US CPSC regulations, are critical for Cirrus Logic's market access. For instance, IEC 62368-1 is a key safety standard for audio/visual and IT equipment, impacting component design and supply chain scrutiny through 2025.

Environmental factors

Semiconductor manufacturing, a core activity for Cirrus Logic's supply chain, demands significant water and energy. For instance, the global semiconductor industry consumed an estimated 10.4 billion cubic meters of water in 2023, with energy consumption also being substantial. This high resource usage puts pressure on manufacturing partners to adopt greener processes.

Growing concerns about water scarcity and the drive for energy efficiency mean Cirrus Logic's partners must increasingly demonstrate sustainable practices. Failure to do so could lead to operational disruptions or higher costs due to stricter environmental regulations, impacting the company's overall supply chain resilience and reputation.

The growing global concern over electronic waste (e-waste) directly affects companies like Cirrus Logic, which supply components for consumer electronics. As governments worldwide implement stricter regulations on how these devices are produced, managed, and ultimately disposed of, Cirrus Logic faces indirect pressure to support more sustainable product lifecycles. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive, continually updated, aims to increase collection and recycling rates, pushing manufacturers to design for easier disassembly and material recovery.

There's increasing pressure on companies, especially within the semiconductor sector, to shrink their carbon footprint and actively combat climate change. This scrutiny extends to Cirrus Logic's internal operations and how its suppliers perform environmentally, with a keen eye on greenhouse gas reduction goals and the use of renewable energy sources.

In 2023, Cirrus Logic reported its Scope 1 and Scope 2 greenhouse gas emissions were 2,100 metric tons of CO2 equivalent, a 5% decrease from 2022, demonstrating progress in their direct operational impact.

Supply Chain Environmental Practices

Cirrus Logic recognizes that its environmental footprint extends beyond its direct operations to its extensive supply chain. The company is committed to ensuring its manufacturing partners adhere to stringent environmental standards and actively implement sustainable practices. This focus is crucial for minimizing the collective environmental impact associated with the production of its semiconductor solutions.

In 2023, a significant portion of the semiconductor industry, including companies like Cirrus Logic, faced increasing scrutiny regarding Scope 3 emissions, which encompass the indirect emissions from a company's value chain. For instance, the Responsible Business Alliance (RBA), a widely adopted industry standard, mandates environmental compliance for its member companies' suppliers, covering areas like waste management and chemical usage.

- Supplier Audits: Cirrus Logic conducts regular environmental audits of its key manufacturing partners to verify compliance with its supplier code of conduct and relevant environmental regulations.

- Sustainable Sourcing: Efforts are underway to identify and partner with suppliers who demonstrate a commitment to renewable energy adoption and reduced water consumption in their manufacturing processes.

- Conflict Minerals: The company continues to uphold its commitment to responsible sourcing of raw materials, including efforts to ensure that minerals used in its products are not sourced from regions that finance conflict.

Material Sourcing and Hazardous Substances

The semiconductor industry's reliance on diverse materials, some of which carry inherent hazards, presents a significant environmental consideration for companies like Cirrus Logic. The global push towards sustainability is intensifying scrutiny on how these materials are sourced and managed throughout the supply chain.

Regulations targeting hazardous substances, such as the growing concerns around PFAS, directly influence manufacturing processes. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to evolve, impacting the use of various chemicals in electronics manufacturing, which can affect Cirrus Logic's partners. In 2023, the U.S. Environmental Protection Agency also proposed new regulations on PFAS, highlighting a global trend toward stricter controls.

- Growing Regulatory Landscape: Increased global regulations on hazardous substances, including PFAS, are compelling manufacturers to seek safer alternatives and modify production processes.

- Supply Chain Scrutiny: Consumers and regulators are demanding greater transparency and accountability regarding the environmental impact of material sourcing, pushing for sustainable practices from suppliers.

- Impact on Manufacturing: Changes in material availability or increased compliance costs due to hazardous substance regulations can affect the operational efficiency and cost structure of Cirrus Logic's manufacturing partners.

Cirrus Logic, like many in the semiconductor industry, faces mounting pressure regarding its environmental impact, particularly concerning resource consumption and waste. The significant water and energy demands of semiconductor manufacturing mean that partners must increasingly adopt sustainable processes to mitigate risks associated with scarcity and regulation. For example, the global semiconductor industry's water consumption was estimated at 10.4 billion cubic meters in 2023, highlighting the scale of this challenge.

The company is actively addressing its carbon footprint, with Scope 1 and Scope 2 greenhouse gas emissions decreasing by 5% to 2,100 metric tons of CO2 equivalent in 2023. Furthermore, the increasing focus on Scope 3 emissions, encompassing the entire value chain, necessitates strong supplier adherence to environmental standards, such as those promoted by the Responsible Business Alliance.

Stricter global regulations on hazardous substances, including PFAS, are compelling manufacturers to seek safer alternatives and modify production processes, impacting material availability and compliance costs for Cirrus Logic's partners. The evolving REACH regulation in the EU and proposed EPA regulations on PFAS in the U.S. exemplify this trend, driving demand for greater transparency and accountability in material sourcing.

| Environmental Factor | Impact on Cirrus Logic | Key Data/Trends (2023/2024) |

| Resource Consumption (Water & Energy) | Supply chain resilience, operational costs, partner compliance pressure | Semiconductor industry water consumption: ~10.4 billion m³ (2023) |

| Greenhouse Gas Emissions | Reputational risk, regulatory compliance, investor scrutiny | Cirrus Logic Scope 1 & 2 GHG emissions: 2,100 metric tons CO2e (down 5% from 2022) |

| Electronic Waste (E-waste) | Product lifecycle management, regulatory compliance (e.g., WEEE Directive) | Increasing global regulations on e-waste collection and recycling |

| Hazardous Substances | Manufacturing process changes, material sourcing, compliance costs | Proposed U.S. EPA PFAS regulations; evolving EU REACH regulation |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Cirrus Logic is built on a robust foundation of data from leading market research firms, semiconductor industry analysis reports, and official financial disclosures. We incorporate insights from technology trend forecasts and economic indicators to ensure comprehensive coverage.