Cirrus Logic Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cirrus Logic Bundle

Cirrus Logic navigates a complex semiconductor landscape where buyer power from major device manufacturers significantly shapes its market. Understanding the intensity of rivalry and the threat of new entrants is crucial for sustained success in this competitive arena.

The complete report reveals the real forces shaping Cirrus Logic’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Cirrus Logic, operating as a fabless semiconductor company, is significantly dependent on a small group of advanced foundries for its chip production. This reliance is amplified by the market's concentration, with giants like TSMC and Samsung holding substantial sway. These foundries possess unique technological capabilities and require immense capital investment, making it difficult for new players to emerge and limiting Cirrus Logic's negotiating power.

The dominance of a few key foundries means Cirrus Logic faces fewer viable manufacturing alternatives. This scarcity of options can translate into increased manufacturing costs and less favorable contract terms, directly impacting Cirrus Logic's profitability and its ability to secure critical production capacity. For instance, TSMC's market share in advanced nodes often exceeds 50%, underscoring the limited choices available to companies like Cirrus Logic.

Cirrus Logic, as a fabless semiconductor company, faces significant supplier bargaining power due to high switching costs. The process of changing foundries or other critical component suppliers requires extensive redesigns, rigorous re-qualification, and can lead to costly product launch delays. For instance, in 2023, Cirrus Logic's reliance on a limited number of advanced foundries for its complex mixed-signal chips meant that any disruption or price increase from these suppliers could have a substantial impact on its cost of goods sold and production timelines.

Suppliers possessing proprietary technologies and materials hold significant bargaining power, especially when their contributions are essential and difficult to substitute. For Cirrus Logic, this is particularly relevant in the high-precision mixed-signal semiconductor market. Companies that control unique manufacturing processes or hold critical intellectual property for specialized components can command higher prices or dictate terms, directly impacting Cirrus Logic's cost structure and product development timelines.

Supplier's Ability for Forward Integration

While it's uncommon for semiconductor foundries to directly design end-products and compete with their fabless clients, the theoretical ability for these suppliers to integrate forward presents a latent threat. This potential, however unlikely in practice, can bolster their leverage in negotiations.

The threat of forward integration by suppliers, even if a distant possibility, means Cirrus Logic must consider a scenario where its foundry partners could potentially develop their own chip designs or even compete in specific market segments. This strategic option for suppliers, even if not actively pursued, influences their bargaining power.

- Foundry Integration Threat: The potential for foundries to move into chip design and product development, though rare, can shift negotiation dynamics.

- Supplier Leverage: This theoretical capability grants suppliers a stronger position, influencing pricing and terms for Cirrus Logic.

- Strategic Consideration: Cirrus Logic must factor this supplier capability into its long-term supply chain strategy, even if the immediate risk is low.

Global Supply Chain Dynamics and Geopolitics

Global supply chain dynamics, particularly in the semiconductor industry, are increasingly shaped by geopolitical tensions and trade policies. For instance, the US CHIPS and Science Act, enacted in 2022, aims to bolster domestic semiconductor manufacturing, potentially altering global supplier relationships and increasing the leverage of those with established or expanding domestic capabilities. This environment can lead to greater bargaining power for suppliers who can navigate or benefit from these shifts.

Trade restrictions and re-shoring initiatives further complicate the landscape, creating potential bottlenecks and driving up costs for companies like Cirrus Logic. As nations prioritize national security and economic resilience, the availability and pricing of critical components can become more volatile. This situation empowers suppliers who control essential materials or advanced manufacturing processes, as demand may outstrip supply in certain regions.

The concentration of advanced semiconductor manufacturing in specific geographic areas, such as Taiwan, also grants significant bargaining power to suppliers in those regions. Disruptions, whether from natural disasters or geopolitical events, can have widespread impacts. For example, the drought in Taiwan in 2021-2022 affected water-intensive semiconductor fabrication, highlighting supplier vulnerability and their ability to dictate terms when essential resources are scarce.

- Geopolitical Influence: National security concerns and trade disputes, such as US-China technology restrictions, can limit supply options and increase reliance on a smaller pool of providers.

- Re-shoring Pressures: Government incentives for domestic production can shift manufacturing capacity, potentially benefiting suppliers with existing or expanding facilities in target countries.

- Supply Chain Concentration: The high capital expenditure and specialized knowledge required for advanced chip manufacturing lead to a limited number of key suppliers, enhancing their negotiation leverage.

- Resource Scarcity: Factors like water shortages impacting fabrication plants, as seen in Taiwan, can temporarily boost the bargaining power of suppliers controlling essential manufacturing inputs.

Cirrus Logic's bargaining power with its suppliers, particularly advanced foundries, is constrained by the industry's high concentration and capital intensity. The limited number of foundries capable of producing cutting-edge semiconductors, such as TSMC and Samsung, means Cirrus Logic has few alternatives. This dependency is further exacerbated by the substantial costs and time involved in switching suppliers, which can include extensive product redesign and requalification processes. In 2023, for example, the cost of wafer fabrication for advanced nodes remained high, reflecting the foundries' strong market position.

| Factor | Impact on Cirrus Logic | Supporting Data/Example |

| Supplier Concentration | High bargaining power for foundries | TSMC's market share in advanced nodes often exceeds 50%. |

| Switching Costs | High costs and delays to change suppliers | Redesign and requalification can take months and cost millions. |

| Proprietary Technology | Foundries dictate terms for essential processes | Access to leading-edge manufacturing nodes is critical and limited. |

| Geopolitical Factors | Potential for supply disruptions and price volatility | US CHIPS Act and global trade policies influence manufacturing locations and costs. |

What is included in the product

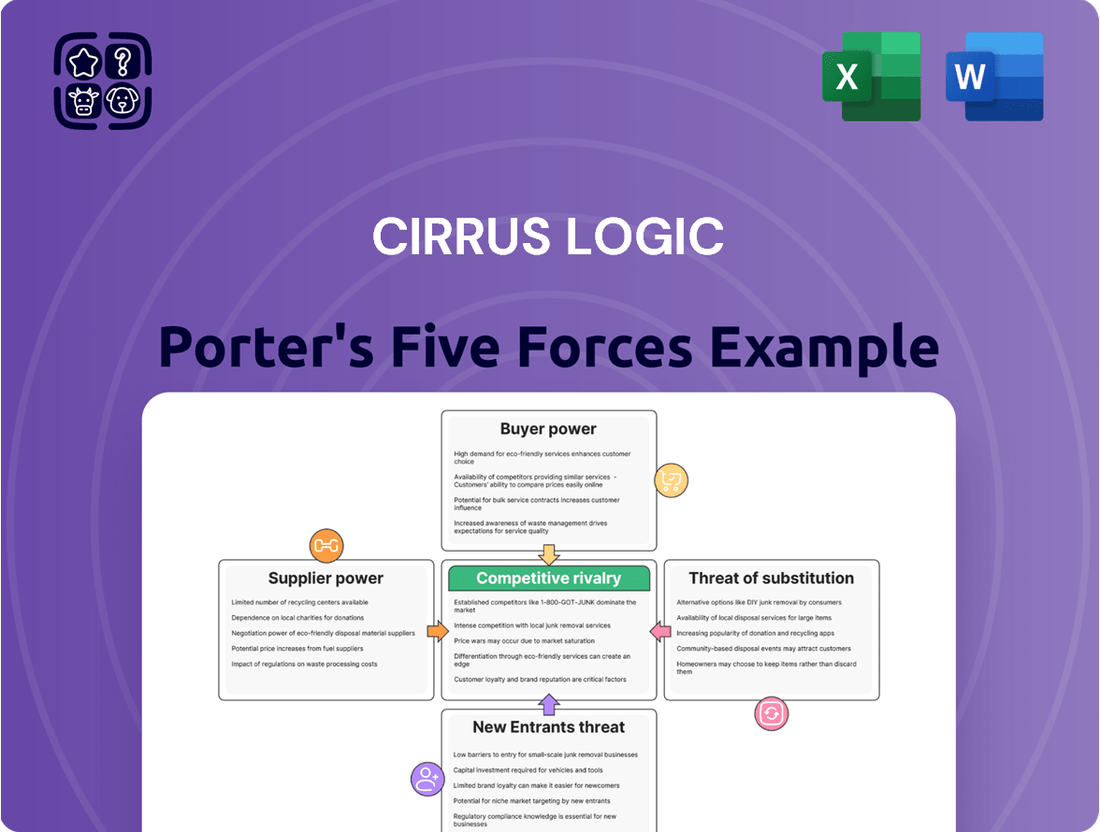

This analysis examines the competitive forces impacting Cirrus Logic, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the semiconductor industry.

Instantly identify and strategize against competitive pressures with a visual breakdown of Cirrus Logic's industry landscape.

Streamline understanding of supplier power and buyer bargaining to proactively mitigate margin erosion.

Customers Bargaining Power

Cirrus Logic's reliance on a few major clients, particularly Apple, significantly amplifies customer bargaining power. For instance, in fiscal year 2024, Apple represented approximately 54% of Cirrus Logic's total revenue, a slight increase from the prior year. This concentration means that a substantial portion of Cirrus Logic's business is directly influenced by the purchasing decisions and demands of a single, powerful entity.

This dependence grants Apple considerable leverage over Cirrus Logic concerning pricing negotiations, product development roadmaps, and delivery timelines. The potential for a major customer to shift its business or demand more favorable terms puts Cirrus Logic in a position where it must carefully manage these relationships to maintain its revenue streams.

Large, resource-rich customers, especially those prioritizing component control, might consider developing their own mixed-signal integrated circuits. This potential for backward integration, though complex, can significantly impact Cirrus Logic's pricing flexibility and bargaining strength.

For instance, a major client like Apple, with its vast financial and technical capabilities, could theoretically explore in-house chip development. Such a move, even if only a credible threat, would naturally constrain Cirrus Logic's ability to command higher prices or dictate terms in negotiations.

The standardization of components significantly impacts the bargaining power of Cirrus Logic's customers. When components are easily sourced from multiple vendors, customers can leverage this availability to negotiate lower prices or demand better terms. This is because switching costs are minimal if a competitor offers a similar, readily available part.

Cirrus Logic actively works to counter this by specializing in custom and high-precision mixed-signal integrated circuits. These differentiated products are not easily interchangeable, thereby reducing the direct threat of standardization and strengthening Cirrus Logic's position against powerful buyers. For instance, in the competitive audio codec market, Cirrus Logic's proprietary designs and integration capabilities create a barrier to easy substitution.

Price Sensitivity of Customers

Cirrus Logic operates in the consumer electronics sector, where its clients, the manufacturers of devices like smartphones and audio equipment, are acutely focused on cost control. This intense pressure to minimize expenses directly translates into a high degree of price sensitivity among these customers. Consequently, Cirrus Logic must consistently offer competitive pricing to secure and retain business, which can put a strain on its profit margins.

This price sensitivity is a significant factor influencing Cirrus Logic's profitability. For instance, in the dynamic semiconductor industry, where component costs are a major driver of final product pricing, customers often seek the lowest possible prices for integrated circuits. This means Cirrus Logic faces constant pressure to negotiate favorable terms and manage its own production costs effectively to remain competitive.

- Customer Price Sensitivity: High in the consumer electronics market, forcing competitive pricing.

- Impact on Margins: Pressure to keep prices low can compress Cirrus Logic's profit margins.

- Competitive Landscape: Customers actively seek cost-effective solutions from multiple suppliers.

- Negotiating Power: Large volume buyers can leverage their purchasing power for better deals.

Demand for End Products

The overall demand for consumer electronics, like smartphones and laptops, significantly influences the order volumes Cirrus Logic receives. For instance, the global smartphone market saw shipments of approximately 1.17 billion units in 2023, a slight decrease from 2022, indicating potential shifts in consumer spending that could affect Cirrus Logic's customer leverage.

When these end markets experience downturns or slower growth, customers, such as major smartphone manufacturers, gain more bargaining power. They can then push for more favorable pricing or demand greater flexibility in order volumes, directly impacting Cirrus Logic's revenue and profit margins.

- Consumer electronics demand directly dictates Cirrus Logic's order volumes.

- Global smartphone shipments in 2023 were around 1.17 billion units.

- Market fluctuations can empower customers to negotiate pricing and volume terms more aggressively.

- Slower growth in end markets increases customer bargaining power.

Cirrus Logic's customers, particularly large electronics manufacturers, wield significant bargaining power due to their substantial purchasing volumes and the availability of alternative suppliers. This leverage allows them to negotiate favorable pricing and terms, potentially impacting Cirrus Logic's profitability. The company's heavy reliance on a few key clients, such as Apple which accounted for approximately 54% of revenue in fiscal year 2024, further amplifies this customer power.

| Customer Characteristic | Impact on Cirrus Logic | Supporting Data (FY24) |

|---|---|---|

| Customer Concentration | High leverage for major clients | Apple revenue share: ~54% |

| Price Sensitivity | Pressure on pricing and margins | Consumer electronics market focus on cost |

| Component Standardization Threat | Risk of commoditization | Need for differentiation in audio codecs |

| End-Market Demand Fluctuations | Increased customer power during downturns | Global smartphone shipments ~1.17 billion units (2023) |

What You See Is What You Get

Cirrus Logic Porter's Five Forces Analysis

This preview showcases the complete Cirrus Logic Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape within the semiconductor industry. You're viewing the exact document you'll receive, meticulously detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry. Once your purchase is complete, you'll gain immediate access to this professionally formatted and ready-to-use strategic assessment.

Rivalry Among Competitors

The mixed-signal semiconductor market, where Cirrus Logic operates, is crowded with numerous and diverse competitors. This includes giants like Analog Devices, Texas Instruments, NXP, and Infineon, alongside many smaller, specialized firms, all vying for market share. This intense competition means companies must constantly innovate and offer compelling value to stand out.

Cirrus Logic operates in a sector where innovation is paramount, necessitating substantial and ongoing investment in research and development. This high R&D intensity is a direct driver of competitive rivalry, as companies must continually develop new, more advanced, and energy-efficient semiconductor solutions to stay ahead. For instance, in fiscal year 2023, Cirrus Logic reported R&D expenses of $355.8 million, highlighting the significant resources dedicated to maintaining a competitive edge through technological advancement.

Cirrus Logic thrives on differentiating its low-power, high-precision mixed-signal chips through advanced audio quality and power efficiency. This focus allows them to carve out a niche in a competitive semiconductor landscape.

The company's innovation pace is critical, as demonstrated by recent product launches like the CS35L41 Boosted Amplifier and the CS42L43 Smart Codec. These advancements aim to provide superior performance and unique features that set Cirrus Logic apart from rivals.

In 2024, the semiconductor industry continues to see rapid technological evolution, making Cirrus Logic's commitment to ongoing product innovation a key factor in maintaining its competitive edge and market share.

Market Growth and Opportunities

The mixed-signal integrated circuit (IC) market is experiencing robust expansion, with projections indicating substantial growth fueled by key sectors like consumer electronics, automotive, and telecommunications. This surge is particularly amplified by the widespread adoption of 5G technology and the increasing integration of artificial intelligence (AI) across various applications.

This expanding market naturally draws in new entrants and intensifies competition among existing players. Companies are employing aggressive strategies to secure a larger share of this lucrative and growing market, leading to a more dynamic competitive landscape.

- Projected Market Growth: The global mixed-signal IC market is expected to reach approximately $35 billion by 2027, exhibiting a compound annual growth rate (CAGR) of around 7.5% from 2022.

- Key Growth Drivers: Demand from 5G infrastructure, advanced driver-assistance systems (ADAS) in automotive, and the proliferation of AI-enabled consumer devices are primary catalysts for this growth.

- Competitive Intensification: The attractiveness of the market encourages both established semiconductor giants and emerging players to invest heavily in R&D and production, leading to increased price pressures and innovation races.

- Strategic Imperatives: Companies like Cirrus Logic must focus on differentiating their product portfolios through specialized solutions and strong customer relationships to navigate this competitive environment effectively.

Customer Switching Costs for End-Users

For end-users of consumer electronics, the ability to switch between devices is remarkably easy, meaning they face very low switching costs. This lack of friction for the consumer means that the performance of components like Cirrus Logic's audio and mixed-signal chips directly impacts the overall appeal of the final product. If a device using Cirrus Logic's technology doesn't offer a superior audio experience, consumers can readily opt for a competitor's product without significant hassle or expense.

This low end-user switching cost translates into indirect pressure on Cirrus Logic. The company must ensure its semiconductor solutions consistently contribute to a premium user experience to maintain demand from device manufacturers. For instance, in 2023, the global smartphone market saw shipments of approximately 1.17 billion units, highlighting the vast number of consumer choices where audio quality can be a differentiator.

- Low End-User Switching Costs: Consumers can easily switch between smartphones, laptops, and other audio-dependent devices, regardless of the specific chip manufacturer.

- Indirect Pressure on Cirrus Logic: The ease of consumer choice means Cirrus Logic's components must enable a demonstrably better user experience to be favored by device makers.

- Market Context: With billions of consumer electronics units shipped annually, even small improvements in perceived audio quality driven by components can influence purchasing decisions.

The competitive rivalry within the mixed-signal semiconductor market is fierce, driven by a high concentration of established players and a constant need for innovation. Cirrus Logic faces intense pressure from giants like Analog Devices and Texas Instruments, as well as numerous specialized firms, all vying for market share in a sector experiencing robust growth. This dynamic necessitates substantial R&D investment, with Cirrus Logic allocating $355.8 million in fiscal year 2023 to maintain its technological edge.

The expanding market, projected to reach $35 billion by 2027 with a 7.5% CAGR, fuels this rivalry, encouraging aggressive strategies and innovation races. Key growth drivers such as 5G, AI, and automotive advancements intensify competition, pushing companies to differentiate through specialized solutions and strong customer relationships.

Low end-user switching costs in consumer electronics, such as smartphones where 1.17 billion units were shipped in 2023, place indirect pressure on Cirrus Logic. Manufacturers must ensure components like Cirrus Logic's chips deliver a superior user experience, particularly in audio quality, to appeal to consumers who can easily switch between brands.

| Competitor | Key Product Areas | R&D Focus |

| Analog Devices | Signal processing, data converters, power management | High-performance analog, mixed-signal integration |

| Texas Instruments | Analog ICs, embedded processors, microcontrollers | Broad portfolio, cost-efficiency, connectivity |

| NXP Semiconductors | Automotive, industrial, IoT solutions | Secure connectivity, automotive processing |

| Infineon Technologies | Automotive, industrial power semiconductors, IoT | Power efficiency, automotive safety, IoT security |

SSubstitutes Threaten

The increasing trend towards higher integration in System-on-Chips (SoCs) presents a significant threat to companies like Cirrus Logic. As more functionalities, including audio and mixed-signal processing, are consolidated onto single chips, the demand for specialized, standalone mixed-signal ICs diminishes. This consolidation means that a single SoC could potentially replace multiple discrete components, directly impacting the market for specialized chip providers.

The threat of substitutes for Cirrus Logic's core business, particularly in audio and sensing, is a significant consideration. While Cirrus Logic excels in developing specialized mixed-signal integrated circuits (ICs), alternative approaches could emerge that offer similar or even superior performance without relying on dedicated hardware. For example, advancements in software-defined audio processing, leveraging powerful mobile processors or dedicated digital signal processors (DSPs) in host devices, could diminish the need for specialized audio codecs and amplifiers. Similarly, in sensing, novel sensor fusion techniques or entirely different physical sensing principles might reduce the demand for the specific types of mixed-signal ICs Cirrus Logic currently provides. The increasing computational power available in consumer electronics, coupled with sophisticated software algorithms, presents a viable pathway for substitutes to emerge and capture market share.

Device manufacturers, Cirrus Logic's primary customers, constantly evaluate their component choices based on critical factors such as cost, performance, power efficiency, and the physical space components occupy on a circuit board. If alternative technologies emerge that offer significant improvements in these areas, the likelihood of customers switching away from Cirrus Logic's offerings increases substantially. For instance, a new audio codec that is 15% cheaper and consumes 10% less power could be a strong incentive to switch, even if it means re-engineering their designs.

In-house Development by Large OEMs

Large original equipment manufacturers (OEMs) with substantial research and development budgets, such as Apple or Samsung, possess the capability to develop their own proprietary mixed-signal integrated circuits. This internal development acts as a direct substitute for acquiring components from third-party suppliers like Cirrus Logic. For instance, in 2023, Apple's R&D spending reached approximately $29.9 billion, indicating their capacity for significant in-house technological development.

This threat is particularly potent in high-volume markets where customization and performance optimization are critical. When OEMs bring chip design in-house, it directly reduces the addressable market for external component vendors. This strategic move can lead to a significant portion of their previously supplied business being captured by the OEM's internal operations.

- OEMs with strong R&D can develop custom mixed-signal solutions internally.

- This backward integration directly substitutes for purchasing external components.

- High R&D spending by major OEMs, like Apple's nearly $30 billion in 2023, signals this capability.

- Internal development reduces the market available for third-party component suppliers.

Evolution of Industry Standards

The evolution of industry standards presents a significant threat of substitution for Cirrus Logic. For instance, the ongoing development of advanced wireless audio codecs and new communication protocols could render existing chipsets less competitive. This shift could favor alternative solutions that offer enhanced performance, lower power consumption, or greater integration, potentially impacting demand for Cirrus Logic's specialized audio components.

New standards can directly substitute existing technologies, forcing companies to adapt or risk obsolescence. For example, the widespread adoption of a new, highly efficient audio processing standard could diminish the need for Cirrus Logic's current DSP architectures. Companies that can quickly pivot to support these emerging standards will be better positioned, while those that lag may see their market share erode.

Consider the impact of advancements in chip-level integration. If competitors develop highly integrated System-on-Chips (SoCs) that incorporate advanced audio processing capabilities alongside other functionalities, these could serve as direct substitutes for Cirrus Logic's discrete audio components. This trend is evident in the mobile space, where SoC vendors are increasingly bundling high-fidelity audio solutions.

The threat is exacerbated by the rapid pace of technological change. For example, the transition from Bluetooth Classic to Bluetooth Low Energy (BLE) audio standards required significant adaptation. Cirrus Logic's ability to anticipate and respond to such shifts, such as supporting the LE Audio standard, is crucial to mitigating this threat. Failure to do so could lead to substitutes gaining traction.

The threat of substitutes for Cirrus Logic stems from advancements in integrated solutions and evolving industry standards that can replace specialized mixed-signal ICs. Companies like Cirrus Logic face competition from highly integrated System-on-Chips (SoCs) that bundle audio and sensing functionalities, reducing the need for discrete components. Furthermore, the emergence of new wireless audio standards and improved software-based processing can also act as substitutes, potentially diminishing demand for Cirrus Logic's core offerings.

Major original equipment manufacturers (OEMs) with substantial research and development budgets, such as Apple and Samsung, pose a significant threat by developing their own proprietary mixed-signal integrated circuits. This internal development directly substitutes for purchasing components from third-party suppliers like Cirrus Logic. For instance, Apple's reported R&D spending of approximately $29.9 billion in 2023 highlights their capacity for significant in-house technological innovation, potentially reducing their reliance on external vendors for critical components.

The rapid evolution of industry standards, such as the transition to Bluetooth LE Audio, presents another avenue for substitution. Cirrus Logic's ability to adapt and support these new standards is critical. For example, failing to fully embrace and integrate support for LE Audio could lead to alternative solutions, potentially built around different architectures or chipsets, gaining market traction and displacing existing products.

| Threat Category | Description | Example Impact | Key Data Point |

| Integrated SoCs | Consolidation of functionalities onto single chips | Reduced demand for discrete mixed-signal ICs | Increasing integration in mobile SoCs |

| Software-Defined Processing | Leveraging host device processing power | Diminished need for specialized audio codecs | Growth in computational power of smartphones |

| In-house OEM Development | Large OEMs designing their own chips | Direct substitution for third-party components | Apple's 2023 R&D spending: ~$29.9 billion |

| Evolving Industry Standards | New protocols and codecs | Potential obsolescence of existing chipsets | Adoption of Bluetooth LE Audio standard |

Entrants Threaten

Establishing and operating semiconductor foundries demands immense capital, with the cost of building a new leading-edge fab often exceeding $20 billion. This substantial financial hurdle significantly deters new players from entering the manufacturing side of the industry, thereby limiting the direct threat of new, fully integrated semiconductor companies.

While Cirrus Logic operates as a fabless semiconductor company, the high capital investment required for foundry operations indirectly benefits them. The scarcity of advanced foundries, such as TSMC or GlobalFoundries, means that new, fully integrated competitors would face these same massive capital barriers, making it difficult for them to emerge and compete directly with established fabless players.

Developing advanced mixed-signal integrated circuits (ICs) requires substantial, ongoing investment in research and development. This includes not only cutting-edge technology but also securing highly specialized engineering talent and sophisticated design software, making it a significant hurdle for newcomers.

For instance, companies like Cirrus Logic invest heavily in R&D to maintain their technological edge. In fiscal year 2023, Cirrus Logic reported R&D expenses of $365.5 million, highlighting the immense capital required to innovate and compete in this sector.

These high upfront and continuous R&D costs create a formidable barrier to entry. New companies would need considerable financial backing to match the innovation capabilities of established players like Cirrus Logic, thereby limiting the threat of new entrants.

Cirrus Logic's extensive intellectual property, boasting over 1,000 patents in analog and digital signal processing, acts as a significant barrier to entry. Newcomers would face substantial hurdles in replicating this established technological foundation or securing necessary licenses, which are both capital-intensive and time-consuming endeavors.

Access to Key Customers and Supply Chains

New companies face a substantial hurdle in establishing connections with major consumer electronics manufacturers and integrating into their existing supply chains. Cirrus Logic's advantage lies in its deep-rooted partnerships with leading clients, which new entrants find difficult to replicate.

For instance, Cirrus Logic's revenue from its top four customers accounted for approximately 66% of its total revenue in fiscal year 2023, highlighting the critical nature of these relationships. Breaking into these established networks requires significant time, investment, and proven reliability.

- Customer Loyalty: Established players like Cirrus Logic benefit from long-term customer loyalty, making it hard for new entrants to displace them.

- Supply Chain Integration: Gaining access to and becoming a trusted component supplier within the complex supply chains of major electronics brands is a significant barrier.

- Switching Costs: High switching costs for manufacturers, involving re-qualification of components and potential redesigns, further deter new suppliers.

Economies of Scale and Experience Curve

Established players like Cirrus Logic leverage significant economies of scale across their operations. This includes design, manufacturing, and supply chain management, leading to lower per-unit costs that new market entrants would find challenging to replicate. For instance, in 2023, Cirrus Logic reported revenues of $1.6 billion, demonstrating a scale that underpins its cost advantages.

The experience curve further solidifies this barrier. As companies like Cirrus Logic gain more experience in producing their specialized audio and voice chips, their efficiency increases, further reducing costs. This cumulative learning process makes it difficult for newcomers to achieve comparable cost efficiencies, especially in the highly competitive semiconductor industry.

- Economies of Scale: Cirrus Logic's established volume in chip production allows for reduced per-unit costs in R&D, manufacturing, and distribution.

- Experience Curve Benefits: Years of operational experience translate into process efficiencies and cost reductions that are hard for new entrants to match.

- Capital Investment: New entrants face substantial upfront capital requirements to build similar-scale operations and achieve competitive cost structures.

- Price Competition: Without matching Cirrus Logic's scale and experience, new entrants would struggle to compete on price, limiting their market penetration.

The threat of new entrants for Cirrus Logic is relatively low. The immense capital required for semiconductor foundry operations, often exceeding $20 billion for a new leading-edge fab, presents a significant financial barrier. Furthermore, the high and continuous investment in R&D, coupled with the need for specialized talent and sophisticated design software, makes it challenging for newcomers to compete with established players like Cirrus Logic.

Cirrus Logic's extensive intellectual property portfolio, comprising over 1,000 patents, and its deeply entrenched relationships with major consumer electronics manufacturers, which accounted for about 66% of its FY2023 revenue, create substantial barriers. These established customer loyalties and the high switching costs for manufacturers, involving component re-qualification and potential redesigns, further deter new suppliers from entering the market.

Economies of scale and experience curve benefits also contribute to limiting new entrants. Cirrus Logic's $1.6 billion in revenue for 2023 reflects an operational scale that allows for lower per-unit costs, which new companies would struggle to match. The cumulative learning process from years of experience in producing specialized chips translates into process efficiencies and cost reductions that are difficult for newcomers to replicate, thereby limiting price competition.

Porter's Five Forces Analysis Data Sources

Our Cirrus Logic Porter's Five Forces analysis is built upon a robust foundation of data, including company financial reports, industry analyst research, and market intelligence from leading technology publications. This blend of sources provides a comprehensive view of competitive dynamics.