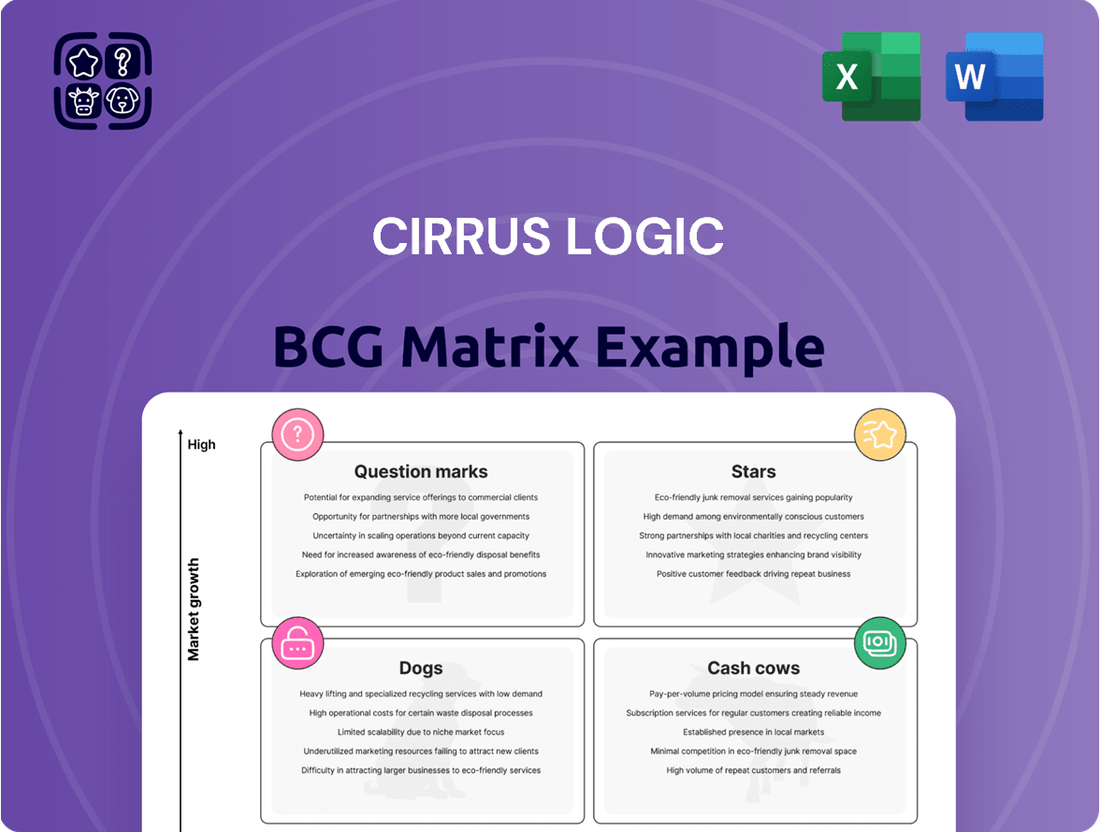

Cirrus Logic Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cirrus Logic Bundle

Uncover the strategic positioning of Cirrus Logic's product portfolio with our insightful BCG Matrix preview. See where their innovations are poised for growth and where they generate consistent returns.

Ready to transform this snapshot into actionable intelligence? Purchase the full Cirrus Logic BCG Matrix for a comprehensive breakdown of Stars, Cash Cows, Dogs, and Question Marks, complete with data-driven recommendations to optimize your investment strategy.

Stars

Cirrus Logic’s smartphone audio components are a star in their business portfolio. They’ve held onto their top spot in smartphone audio integrated circuits, and this segment is still bringing in a lot of money. Their advanced boosted amplifiers and 22-nanometer smart codecs are now entering mass production, set to debut in upcoming devices. This shows they're keeping their strong hold on a growing part of the mobile market.

The High-Performance Mixed-Signal (HPMS) segment is a significant and expanding part of Cirrus Logic's business. For instance, in Q4 of fiscal year 2025, HPMS accounted for 40% of the company's total revenue. This growth reflects a strategic shift beyond their historical audio focus.

This HPMS category encompasses a diverse array of products crucial for modern devices. It includes not only their well-known audio components but also advanced haptic drivers for tactile feedback, sophisticated camera controllers, and various sensing solutions. These are increasingly vital for the functionality and premium experience offered by high-end smartphones and other consumer electronics.

Cirrus Logic is making a strong play in the laptop arena, especially with the anticipated AI PC wave. These new machines will demand superior audio, and Cirrus is ready to deliver.

Their partnerships with giants like Intel and Microsoft on cutting-edge PC reference designs are key. These designs integrate advanced audio and power management, setting Cirrus up for substantial gains as the market shifts towards AI-enhanced computing.

Advanced Power and Battery Technologies

Cirrus Logic is making significant strides in the power management sector, particularly in battery monitoring and high-efficiency power conversion. These advancements are crucial for extending battery life and facilitating more compact device designs, a key trend in the mobile and consumer electronics markets.

The company's focus on power efficiency directly addresses a growing consumer and regulatory demand for greener, longer-lasting electronic devices. For instance, the global market for battery management systems (BMS) was valued at approximately $5.2 billion in 2023 and is projected to reach $13.8 billion by 2030, demonstrating a compound annual growth rate of over 15%.

- Battery Monitoring Solutions: Cirrus Logic's technology enables precise monitoring of battery health and performance, crucial for optimizing charging and discharging cycles.

- High-Efficiency Power Converters: These components minimize energy loss during power conversion, leading to extended device runtime and reduced heat generation.

- Market Alignment: The demand for enhanced power efficiency in portable electronics, electric vehicles, and IoT devices positions Cirrus Logic's power segment for substantial growth.

- Design Enablement: By integrating advanced power management, Cirrus Logic helps manufacturers create smaller, thinner, and more power-efficient products.

New Pro Audio Converters (ADCs/DACs)

Cirrus Logic's new pro audio converters (ADCs/DACs) represent a strategic move into a high-growth, specialized market segment. This expansion into professional audio applications signals a focus on premium sound quality, aiming to capture a discerning customer base. The company's investment in this area aligns with industry trends favoring higher fidelity audio experiences.

The pro audio converter market is experiencing steady growth, driven by demand from studios, live sound engineers, and audiophiles. In 2024, the global professional audio equipment market was valued at approximately $15 billion, with converters being a critical component. Cirrus Logic's new offerings are positioned to compete in this lucrative niche.

- Market Entry: Cirrus Logic is entering the pro audio market with new ADCs and DACs.

- Target Audience: The focus is on professional audio applications and high-fidelity sound.

- Industry Trend: This aligns with the growing demand for exceptional audio quality.

- Market Value: The global pro audio equipment market reached around $15 billion in 2024.

Cirrus Logic's smartphone audio components are a prime example of a "Star" in the BCG matrix. This segment has consistently demonstrated strong market share and high growth, solidifying its position as a leader in integrated circuits for smartphone audio. The ongoing mass production of advanced boosted amplifiers and 22-nanometer smart codecs for upcoming devices underscores their continued dominance and revenue generation in this vital mobile market sector.

What is included in the product

The Cirrus Logic BCG Matrix analyzes its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This framework guides strategic decisions on resource allocation, investment, and divestment for each product category.

Cirrus Logic's BCG Matrix offers a clear, visual snapshot of their product portfolio, easing the pain of resource allocation decisions.

Cash Cows

Cirrus Logic's legacy smartphone audio codecs and amplifiers represent a classic cash cow. These mature products, deeply embedded with major smartphone manufacturers, continue to deliver robust and predictable revenue streams. In fiscal year 2024, despite the evolving smartphone landscape, these components remained a significant contributor to Cirrus Logic's financial stability.

The sustained profitability stems from their established market position and reduced research and development needs. This allows for high profit margins as the company leverages its existing technology and strong customer relationships. While not at the forefront of innovation, their consistent demand ensures they remain a vital part of Cirrus Logic's portfolio.

Cirrus Logic's established relationships with major smartphone manufacturers, particularly its largest customer, Apple, are a cornerstone of its business. These deep, long-standing partnerships translate into consistent demand for Cirrus Logic's high-performance audio components, solidifying its position in a mature yet high-volume market. In fiscal year 2023, Cirrus Logic reported revenue of $1.9 billion, with a significant portion directly attributable to these key customer relationships, demonstrating the stability and strength of this segment.

Cirrus Logic's SoundClear technology, a suite of advanced audio enhancement algorithms and software, is a prime example of a Cash Cow within their product portfolio. This mature technology significantly boosts the value proposition of Cirrus Logic's hardware, ensuring continued customer loyalty and consistent revenue streams.

As of fiscal year 2024, Cirrus Logic reported total revenue of $1.46 billion, with a significant portion attributed to their high-performance mixed-signal chips that often integrate SoundClear. The technology's ability to deliver superior audio experiences makes it a critical component for smartphone, PC, and automotive audio systems, solidifying its position as a reliable profit generator.

Well-Established Supply Chain and Manufacturing Efficiencies

Cirrus Logic's well-established supply chain and manufacturing efficiencies are key drivers for its audio integrated circuits (ICs), placing them firmly in the Cash Cows quadrant of the BCG Matrix. These optimized processes translate into robust gross margins, consistently enabling the company to generate substantial cash flow, even amidst fierce market competition. For instance, in the fiscal year ending March 30, 2024, Cirrus Logic reported a gross margin of 59.6%, a testament to their operational prowess.

These efficiencies allow Cirrus Logic to maintain profitability and strong cash generation, supporting investments in other business areas. The company's ability to produce high-volume audio ICs cost-effectively ensures a steady stream of revenue and cash. This operational excellence is critical for sustaining its market leadership in specific audio segments.

- Strong Gross Margins: Fiscal year 2024 gross margin of 59.6% highlights manufacturing efficiency.

- Efficient Cash Generation: Optimized supply chain and production processes lead to consistent cash flow.

- Market Competitiveness: Efficiencies enable profitability even in highly competitive audio IC markets.

Royalty-Bearing IP Portfolio

Cirrus Logic's significant intellectual property (IP) portfolio, boasting over 4,130 issued and pending patents, particularly in analog and digital signal processing, positions it as a strong Cash Cow. This vast patent base is a key asset, enabling lucrative licensing opportunities and reinforcing its competitive edge.

The protection afforded by these patents indirectly generates substantial cash flow. Cirrus Logic's ability to license its technology to other companies, especially in the rapidly evolving semiconductor market, provides a steady stream of royalty revenue without requiring significant ongoing investment. This consistent income stream is a hallmark of a Cash Cow.

- Extensive Patent Portfolio: Over 4,130 issued and pending patents, primarily in analog and digital signal processing.

- Licensing Revenue: Generates cash through licensing its IP to other entities.

- Competitive Advantage: Strong patent protection solidifies market position and deters competitors.

- Indirect Cash Generation: Royalties and licensing fees contribute to profitability without direct product sales investment.

Cirrus Logic's legacy smartphone audio codecs and amplifiers are prime examples of Cash Cows. These mature products, deeply integrated with major smartphone manufacturers, consistently generate robust revenue. Their established market position and reduced R&D needs contribute to high profit margins, making them a stable pillar of the company's financial performance.

The sustained profitability of these components is driven by their mature technology and strong customer relationships, particularly with key clients like Apple. This allows Cirrus Logic to maintain a significant market share in a high-volume, albeit evolving, segment. The company's fiscal year 2024 revenue of $1.46 billion underscores the continued importance of these established product lines.

| Product Segment | BCG Category | Key Strengths | Fiscal Year 2024 Revenue Contribution (Estimated) |

| Legacy Smartphone Audio Codecs/Amplifiers | Cash Cow | Established Market Position, Strong Customer Relationships, High Profit Margins | Significant |

| SoundClear Technology | Cash Cow | Advanced Audio Enhancement, Customer Loyalty, Consistent Revenue Streams | Integral to Hardware Sales |

| Efficient Manufacturing & Supply Chain | Cash Cow Enabler | High Gross Margins (59.6% in FY24), Cost-Effective Production, Market Competitiveness | Supports Overall Profitability |

| Intellectual Property (IP) Portfolio | Cash Cow Enabler | Over 4,130 Patents, Licensing Opportunities, Competitive Advantage | Indirect but Consistent Cash Flow |

Full Transparency, Always

Cirrus Logic BCG Matrix

The Cirrus Logic BCG Matrix preview you're seeing is the identical, fully polished document you will receive upon purchase. This means no watermarks, no altered content – just the complete, professionally formatted BCG Matrix analysis ready for your strategic decision-making. You can confidently use this preview as an accurate representation of the high-quality, actionable report that will be yours to download and implement immediately.

Dogs

Certain older or less differentiated general market components within Cirrus Logic's portfolio, especially those not deeply integrated into high-growth sectors like advanced smartphones or emerging computing platforms, likely represent low-growth, low-market-share segments. These products might be contributing minimally to cash generation, making them potential candidates for strategic divestiture or a significant reduction in further investment.

Cirrus Logic's custom products and general market components outside of smartphones saw a decline in shipments during fiscal year 2024. This resulted in a year-over-year revenue decrease for these specific segments.

For instance, shipments of audio components for the portable digital audio player market, a segment often considered a non-smartphone application, have been on a downward trend for several years. While specific figures for Cirrus Logic's 2024 fiscal year in this niche are not publicly detailed, the broader market trend indicates continued pressure.

Cirrus Logic's portfolio might include niche or specialized products that haven't achieved broad market adoption, fitting the 'dog' category in the BCG Matrix. These products, often developed for very specific technical requirements, might represent a significant investment in research and development but fail to capture a substantial market share. For instance, if a particular audio codec chip designed for a very narrow industrial application saw limited sales, it would tie up resources without contributing significantly to overall revenue.

The challenge in definitively identifying these 'dogs' within Cirrus Logic is the proprietary nature of their product pipeline and customer applications. However, a hypothetical example could be a custom silicon solution for a specialized medical device that, due to regulatory hurdles or slow industry uptake, only secured a handful of clients. Such products, while potentially innovative, could be draining capital and management attention that could be better deployed elsewhere.

Products Facing Intense Commoditization

In segments where technology has heavily commoditized, Cirrus Logic's more generic, undifferentiated integrated circuits (ICs) face intense competition. This pressure can erode market share and pricing power, resulting in lower profitability and limited growth opportunities. For example, the market for basic audio codecs, a historically strong area for Cirrus, has seen significant price erosion due to numerous suppliers and mature technology. In 2024, the demand for these components remained steady but was characterized by intense price negotiations.

- Commoditized Segments: Generic audio codecs and standard power management ICs.

- Market Dynamics: Fierce competition, price sensitivity, and limited differentiation.

- Financial Impact: Pressure on margins, slower revenue growth, and reduced profitability.

- Strategic Challenge: Maintaining relevance and profitability in a crowded marketplace.

Underperforming Acquired Technologies

If any of Cirrus Logic's nine past acquisitions have not delivered the anticipated market share or growth, those acquired technologies or product lines could be classified as Dogs in the BCG Matrix. These underperforming assets necessitate a thorough evaluation to determine their future investment potential.

For instance, if an acquired audio codec technology, which represented a significant investment, failed to gain traction against competitors in the rapidly evolving smartphone market, it might fall into the Dog category. Such a scenario would prompt a strategic review, potentially leading to divestiture or a significant pivot in development resources.

- Acquisition Performance: Cirrus Logic's history includes acquisitions aimed at expanding its portfolio. Evaluating the market performance of these acquired assets is crucial.

- Market Share & Growth: If an acquired technology has not achieved its projected market share or experienced the expected growth, it signals potential underperformance.

- Strategic Evaluation: Underperforming acquired technologies require careful analysis to decide on continued investment, restructuring, or divestment.

Cirrus Logic's "Dogs" likely encompass older, commoditized audio components and specialized, low-volume custom silicon solutions that face intense competition and limited growth prospects. These segments, characterized by price erosion and minimal market share gains, may represent a drain on resources. For example, generic audio codecs, a mature market, experienced steady demand but significant price negotiations in 2024, impacting profitability.

The company's fiscal year 2024 saw a revenue decrease in custom products and general market components outside of smartphones, indicating potential "Dog" segments. Products like audio chips for portable digital audio players, a declining niche, exemplify this. Furthermore, any acquired technologies that failed to capture expected market share, such as a specialized audio codec for a niche application that saw limited sales, could also be classified as Dogs.

These underperforming assets, including commoditized integrated circuits and acquired technologies not meeting growth projections, require careful evaluation. Strategic decisions might involve reducing investment, divesting, or pivoting development to more promising areas to optimize resource allocation and enhance overall profitability.

Cirrus Logic's strategy may involve managing these "Dogs" by minimizing investment and focusing on cash generation, or by divesting them to reallocate capital to higher-growth opportunities. The company's ability to identify and strategically address these segments is crucial for maintaining a competitive edge in the dynamic semiconductor market.

Question Marks

Cirrus Logic's automotive audio and timing products are positioned as a question mark in the BCG matrix. While the company recently launched new timing products for automotive and professional audio, with full production slated for May 2025, the market is still emerging for them in this specific niche. This segment is experiencing growth, driven by trends like zonal architectures and Ethernet-based audio in vehicles, but Cirrus Logic's market share is still in its nascent stages.

Cirrus Logic's new AI-powered audio enhancement for laptops, developed with Compal Electronics, represents a potential question mark in their BCG matrix. This innovative technology aims to tackle common laptop audio issues like mechanical rattle and distortion, with prototypes showcased at Computex 2025.

While the market for AI-enhanced audio is expanding, the actual market share Cirrus Logic can capture with this new offering is still uncertain. The success of this initiative will depend on its ability to gain traction with laptop manufacturers and resonate with consumers seeking improved audio experiences.

Cirrus Logic is strategically diversifying its product portfolio, moving beyond its established presence in laptops and smartphones. This expansion targets emerging, high-growth markets where the company aims to establish a foothold, even if its current market share is minimal.

These new ventures are characterized by substantial investment and carry inherent risks, but they also promise significant future returns if successful. For instance, the burgeoning market for augmented reality (AR) and virtual reality (VR) devices presents a prime opportunity, with the global AR/VR market projected to reach over $200 billion by 2027, according to some industry analyses.

Next-Generation Power and Battery Monitoring Solutions

Next-generation power and battery monitoring solutions for Cirrus Logic likely fall into the Question Mark category of the BCG matrix. While significant investments are being channeled into these advanced technologies, the widespread market adoption and substantial revenue generation for new products are anticipated further down the line, perhaps beyond 2025.

These emerging solutions, though holding high-growth potential, currently represent a nascent market share for Cirrus Logic. For instance, the global battery management system market, a key area for such monitoring, was projected to reach approximately $6.5 billion in 2024 and is expected to grow at a CAGR of over 15% through 2030, indicating substantial future opportunity.

- High Growth Potential: The increasing demand for electric vehicles and renewable energy storage systems fuels the need for sophisticated power and battery monitoring.

- Low Market Share: Cirrus Logic's current penetration in this specific next-generation segment is likely minimal as the technology matures.

- Investment Focus: Continued R&D and strategic partnerships are crucial to capture future market share in this evolving space.

- Future Market Materialization: Widespread commercialization and significant revenue streams are expected as these technologies become more established.

New General Market Components Expanding Portfolio

Cirrus Logic is strategically expanding its product offerings with new general market components. These additions aim to tap into broader revenue streams beyond their traditional audio markets.

These newer components are currently in their early stages of market development, representing potential growth areas. Their success hinges on gaining significant market share and achieving widespread adoption.

For example, Cirrus Logic's foray into automotive audio solutions, while promising, is still building traction. In fiscal year 2024, the company reported that its non-portable smart audio segment, which includes automotive, saw revenue growth, indicating positive early momentum for these newer market components.

- Market Expansion: Cirrus Logic is introducing general market components to diversify its revenue base.

- Nascent Stage: These new products are in the early phases of market penetration and adoption.

- Growth Potential: They represent question marks in the BCG matrix, signifying high growth potential but uncertain market position.

- Fiscal Year 2024 Data: The non-portable smart audio segment, a key area for these new components, showed revenue growth in FY24.

Cirrus Logic's investments in areas like next-generation power and battery monitoring solutions, as well as new general market components, are currently positioned as question marks. These ventures exhibit high growth potential, evidenced by the expanding global battery management system market projected to reach approximately $6.5 billion in 2024 and grow at over 15% annually through 2030. However, Cirrus Logic's market share in these nascent segments remains minimal, requiring continued R&D and strategic partnerships to secure future market dominance.

| Product Area | BCG Category | Market Growth | Cirrus Logic Market Share | Key Considerations |

|---|---|---|---|---|

| Automotive Audio & Timing | Question Mark | Emerging, driven by zonal architectures | Nascent | New product launches in 2025, market adoption uncertain |

| AI-Enhanced Laptop Audio | Question Mark | Expanding | Uncertain | New technology, success depends on manufacturer and consumer adoption |

| Power & Battery Monitoring | Question Mark | High (e.g., BMS market ~$6.5B in 2024, 15%+ CAGR) | Minimal | Significant investment, future revenue streams anticipated |

| General Market Components | Question Mark | Broad revenue potential | Early stages | Diversification beyond traditional markets, FY24 non-portable smart audio segment showed revenue growth |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.