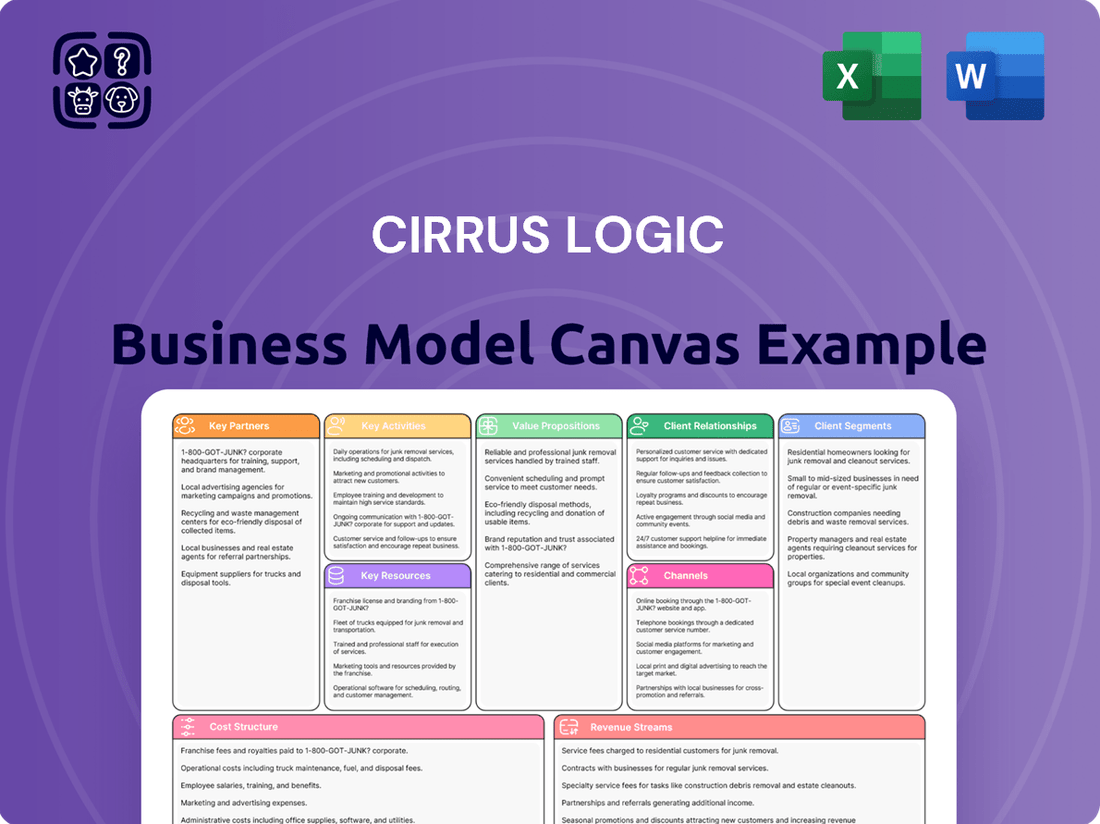

Cirrus Logic Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cirrus Logic Bundle

Unlock the strategic blueprint behind Cirrus Logic's innovative semiconductor business. This comprehensive Business Model Canvas details their customer relationships, key resources, and revenue streams, revealing how they consistently deliver high-value audio and voice solutions.

Dive deeper into Cirrus Logic’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Cirrus Logic operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Partnerships

Cirrus Logic, a fabless semiconductor company, depends on external foundries for manufacturing its chips. These crucial foundry partnerships ensure wafer fabrication, production capacity, and quality control for their advanced audio and low-power components.

In 2024, Cirrus Logic continued to leverage its relationships with leading foundries to meet demand for its high-performance mixed-signal chips. The company's strategy involves diversifying its foundry and assembly partners to mitigate supply chain risks and secure sufficient manufacturing capacity, a key factor in the volatile semiconductor market.

Cirrus Logic's success hinges on strategic collaborations with major electronics manufacturers, especially in the booming smartphone and laptop sectors. These partnerships are crucial for integrating their advanced audio and sensing solutions into cutting-edge devices.

A prime example is Cirrus Logic's long-standing and significant relationship with Apple. Historically, Apple has been a dominant customer, representing a substantial portion of Cirrus Logic's revenue, underscoring the importance of this single-customer dependency.

Beyond Apple, Cirrus Logic actively partners with other industry leaders. Their collaboration with companies like Compal Electronics, a major laptop manufacturer, highlights their commitment to co-developing innovative technologies and ensuring their components are at the forefront of new product designs.

Cirrus Logic actively engages technology and IP licensing partners to broaden its market presence and enhance its integrated circuit (IC) offerings. These collaborations are crucial for optimizing their silicon for specific software environments, thereby improving overall product performance and user experience.

For instance, partnerships that allow Cirrus Logic's technology to be integrated into larger digital ecosystems, such as those found in mobile devices or advanced audio systems, are vital. This strategic approach not only leverages their core competencies but also ensures their components are integral to the latest consumer electronics, driving innovation and adoption.

Ecosystem and Platform Partners

Cirrus Logic's business model thrives on strategic collaborations with platform developers. For instance, their long-standing partnership with Intel has been crucial for embedding Cirrus Logic's advanced audio solutions within the PC ecosystem, enabling seamless integration and driving demand for new audio features.

These alliances are vital for ensuring Cirrus Logic's technologies are not only compatible but also optimized across diverse operating systems and hardware architectures, a critical factor in reaching a broad customer base. Such integrations are key to unlocking new product categories and solidifying their market presence.

Key partnerships in this area include:

- Intel: Collaboration on PC audio solutions, enhancing performance and integration.

- Qualcomm: Partnerships for mobile audio components, leveraging their mobile platform dominance.

- Major PC Manufacturers (e.g., Dell, HP, Lenovo): Direct integration of Cirrus Logic audio chips into their flagship laptop and desktop lines.

- Smartphone OEMs (e.g., Samsung, Google): Integration into mobile devices, often featuring Cirrus Logic's digital signal processors for superior audio quality.

Research and Development Collaborations

Cirrus Logic actively pursues research and development collaborations to drive innovation in mixed-signal processing. These partnerships, often with leading academic institutions and other technology firms, are crucial for developing cutting-edge solutions. For instance, their collaboration with the Ann Richards School in Austin, Texas, highlights a commitment to fostering future talent and exploring novel applications for their technology.

These strategic alliances allow Cirrus Logic to access specialized expertise and share the risks and rewards associated with developing advanced semiconductor technologies. By pooling resources and knowledge, they can accelerate the pace of innovation and bring next-generation products to market more efficiently. This approach is vital in the rapidly evolving semiconductor industry.

- Academic Partnerships: Collaborating with universities provides access to fundamental research and emerging talent.

- Industry Alliances: Working with other companies can lead to integrated solutions and broader market reach.

- Talent Development: Initiatives like the robotics partnership with Ann Richards School aim to cultivate future engineers and innovators.

- Innovation Acceleration: R&D collaborations speed up the development cycle for complex mixed-signal solutions.

Cirrus Logic's key partnerships are foundational to its business model, enabling access to manufacturing, customer integration, and technological advancement. These alliances are critical for navigating the complex semiconductor landscape and delivering innovative solutions.

In 2024, Cirrus Logic continued to strengthen its relationships with major Original Equipment Manufacturers (OEMs) to ensure its advanced audio and mixed-signal components are integrated into leading consumer electronics. These collaborations are vital for market penetration and revenue generation.

The company’s foundry partners, such as TSMC and GlobalFoundries, remain indispensable for wafer fabrication, ensuring production capacity and adherence to stringent quality standards for Cirrus Logic's high-performance chips.

Cirrus Logic's strategic alliances also extend to platform providers and IP licensors, facilitating the optimization of their silicon for diverse software environments and expanding their technological reach.

| Partner Type | Key Partners | 2024 Relevance |

|---|---|---|

| Foundries | TSMC, GlobalFoundries | Essential for wafer manufacturing and capacity. |

| OEMs (Smartphones & PCs) | Apple, Samsung, Google, Dell, HP | Crucial for product integration and market access. |

| Platform & IP Providers | Intel, Qualcomm | Enables software optimization and ecosystem integration. |

| R&D Collaborators | Universities, Tech Firms | Drives innovation and future technology development. |

What is included in the product

A detailed breakdown of Cirrus Logic's strategy, covering key customer segments like consumer electronics manufacturers and outlining their value proposition of high-performance audio and voice ICs delivered through direct sales and distribution channels.

The Cirrus Logic Business Model Canvas offers a structured approach to identify and address critical operational inefficiencies, acting as a pain point reliever by clearly mapping out value propositions and customer segments.

By visually representing key partners and resources, the Cirrus Logic Business Model Canvas helps alleviate the pain of resource allocation and strategic alignment.

Activities

Cirrus Logic's key activity as a fabless semiconductor company revolves around the intricate design and development of sophisticated mixed-signal integrated circuits. This core function focuses on creating low-power, high-precision solutions, particularly for the audio market, which includes advanced amplifiers, codecs, and smart codecs.

Beyond audio, their expertise extends to high-performance mixed-signal products such as camera controllers and essential battery and power management ICs. This demanding work necessitates significant investment in research and development, coupled with the strategic utilization of their extensive patent portfolio to maintain a competitive edge.

In fiscal year 2024, Cirrus Logic reported revenues of $1.5 billion, underscoring the market demand for their specialized IC designs. The company's commitment to innovation is evident in its ongoing R&D expenditures, which are crucial for developing next-generation products and protecting their intellectual property.

Cirrus Logic's core strategy involves the continuous expansion and diversification of its product portfolio. This proactive approach allows them to tap into emerging applications and new market segments, thereby broadening their revenue streams. For instance, they have introduced new series of professional audio converters, catering to the high-fidelity audio market, and timing products specifically designed for the demanding automotive audio sector.

This expansion isn't limited to niche markets; Cirrus Logic also develops general market components. This dual focus on specialized and broad applications helps mitigate risk and capture a wider range of customer needs. In fiscal year 2024, the company continued to invest in research and development to fuel this portfolio growth, aiming to maintain its competitive edge in the evolving semiconductor landscape.

Cirrus Logic's customer engagement is deeply rooted in close collaboration, starting from the crucial design win phase and extending through product integration and continuous technical support. This partnership ensures their cutting-edge audio and voice processing solutions are perfectly tailored to meet the unique demands of their clients, fostering strong relationships and driving innovation.

This hands-on approach is vital for securing adoption in next-generation products, as demonstrated by Cirrus Logic's consistent success in the highly competitive mobile and digital audio markets. For instance, in fiscal year 2023, the company reported revenue of $1.6 billion, underscoring the effectiveness of their customer-centric strategy in maintaining market leadership and driving sales.

Supply Chain Management

Cirrus Logic's key activity of supply chain management is crucial for its fabless semiconductor model. This involves meticulously overseeing relationships with external foundries for wafer fabrication and assembly/test partners for final product packaging and testing. Ensuring a smooth flow of components and finished goods across this intricate global network is paramount to meeting customer demand and maintaining operational efficiency.

Effective inventory management is a core component, balancing the need for sufficient stock to fulfill orders against the costs of holding excess inventory. This requires sophisticated forecasting and close collaboration with manufacturing partners to align production schedules with market demand. For instance, in fiscal year 2024, Cirrus Logic reported inventory levels of $367.5 million, highlighting the significant capital tied up in managing its supply chain.

- Foundry and Assembly Partner Management: Maintaining strong, collaborative relationships with key manufacturing partners is essential for production yield, quality, and on-time delivery.

- Inventory Optimization: Implementing strategies to balance inventory levels, minimizing holding costs while ensuring product availability to meet customer orders.

- Risk Mitigation: Proactively identifying and addressing potential disruptions in the global supply chain, such as geopolitical events, natural disasters, or single-source dependencies, to ensure business continuity.

Intellectual Property Management and Protection

Cirrus Logic's core activities heavily revolve around the meticulous management and robust protection of its intellectual property. This is crucial for maintaining its competitive edge in the semiconductor industry.

A significant part of this involves strategically filing and defending its extensive patent portfolio. As of early 2024, Cirrus Logic held over 4,130 pending and issued patents globally, a testament to its continuous innovation and commitment to safeguarding its technological advancements.

- Patent Portfolio Growth: Actively pursuing new patent applications to cover emerging technologies and product innovations.

- IP Defense: Engaging in legal and administrative processes to defend its existing patents against infringement.

- Licensing and Monetization: Exploring opportunities to license its intellectual property to generate additional revenue streams.

Cirrus Logic's key activities are centered on the design and development of advanced mixed-signal integrated circuits, particularly for audio and voice applications. This includes creating sophisticated codecs, amplifiers, and power management ICs, which are vital for next-generation mobile devices and other consumer electronics. The company's commitment to innovation is underscored by its significant investment in research and development, a crucial element for maintaining its competitive advantage and expanding its product portfolio into new markets like automotive and industrial sectors.

The company also excels in customer collaboration, working closely with clients from the initial design phase through to product integration, ensuring their solutions meet specific requirements. This deep engagement is critical for securing design wins in competitive markets. Furthermore, Cirrus Logic meticulously manages its fabless supply chain, overseeing relationships with foundries and assembly partners to ensure efficient production and timely delivery of its high-performance semiconductor products.

Intellectual property management is another cornerstone activity, with Cirrus Logic actively growing and defending its extensive patent portfolio, which numbered over 4,130 global patents (pending and issued) by early 2024. This strategic focus on IP protection is fundamental to its business model and its ability to command premium pricing for its specialized chip designs.

| Key Activity | Description | Fiscal Year 2024 Impact/Data |

|---|---|---|

| IC Design & Development | Creating advanced mixed-signal integrated circuits for audio, voice, and power management. | Revenue of $1.5 billion; continued R&D investment for next-gen products. |

| Customer Collaboration | Partnering with clients from design win to integration and support. | Securing adoption in competitive mobile and digital audio markets. |

| Supply Chain Management | Overseeing external foundries and assembly partners, managing inventory. | Inventory levels of $367.5 million; ensuring production and delivery efficiency. |

| Intellectual Property Management | Growing and defending a robust patent portfolio. | Over 4,130 global patents (pending/issued) by early 2024; safeguarding technological advancements. |

Full Version Awaits

Business Model Canvas

The Cirrus Logic Business Model Canvas preview you are viewing is an exact representation of the final document you will receive upon purchase. This means you are seeing the actual structure, content, and formatting that will be delivered, ensuring complete transparency and no surprises. Once your order is processed, you will gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Cirrus Logic's extensive intellectual property, boasting over 4,130 worldwide patents for analog, mixed-signal, and audio DSP integrated circuits, forms a bedrock of their competitive strength.

This significant patent portfolio directly contributes to their revenue streams, safeguarding their innovative technologies and enabling premium pricing for their specialized semiconductor solutions.

Cirrus Logic's highly skilled engineering talent is a cornerstone of its business model. This team comprises experts in crucial areas like low-power, high-precision mixed-signal processing, embedded software development, and comprehensive systems-level IC engineering. Their deep knowledge is directly responsible for the continuous design, development, and innovation that fuels Cirrus Logic's product pipeline.

In 2024, Cirrus Logic continued to invest heavily in its engineering workforce, recognizing that specialized talent is paramount for maintaining its competitive edge in the semiconductor industry. The company's ability to attract and retain these engineers, who possess unique skills in areas like advanced analog design and digital signal processing, directly translates into the high-performance, low-power solutions that its customers demand.

Cirrus Logic's proprietary design methodologies and tools are central to its business model, allowing for the efficient creation of complex, high-performance mixed-signal integrated circuits. These specialized processes are critical for maintaining a competitive edge in the semiconductor industry, enabling the company to deliver innovative solutions for audio, voice, and haptic applications.

The company invests heavily in developing and refining these internal design capabilities. For instance, in fiscal year 2024, Cirrus Logic continued to focus on enhancing its digital and analog design flows, leveraging advanced simulation and verification techniques to accelerate product development cycles and ensure the highest levels of chip performance and reliability.

Strong Customer Relationships

Cirrus Logic's strong customer relationships are a cornerstone of its business model, particularly its deep, long-standing ties with major consumer electronics manufacturers. These partnerships are not just about sales; they represent a collaborative synergy that fuels innovation and ensures market relevance.

A prime example is Cirrus Logic's relationship with a leading smartphone original equipment manufacturer (OEM). This single customer accounted for approximately 31% of Cirrus Logic's total revenue in fiscal year 2023, highlighting the critical nature of these key relationships for revenue stability and predictability.

- Deep Partnerships: Long-term, collaborative relationships with top-tier consumer electronics companies are a vital resource.

- Revenue Stability: These established connections provide a predictable revenue stream, crucial for financial planning and investment.

- Product Development Insights: Close collaboration with major clients offers invaluable feedback and foresight into future product needs and market trends.

- Market Dominance: By serving leading players, Cirrus Logic solidifies its position within the high-value segments of the consumer electronics market.

Financial Capital

Cirrus Logic's financial capital is a cornerstone of its business model, allowing for robust investment in innovation and shareholder returns. The company consistently demonstrates high operating margins, which in fiscal year 2024, contributed to a strong financial foundation. This healthy financial position directly fuels their ability to invest heavily in research and development, pursue strategic acquisitions, and engage in share repurchase programs, all vital for maintaining a competitive edge.

- Strong Cash Flow: Cirrus Logic's operational efficiency translates into significant cash flow generation, providing the liquidity needed for strategic initiatives.

- Investment in R&D: High margins support sustained investment in developing next-generation audio and sensing solutions, crucial for market leadership.

- Strategic Acquisitions: Financial strength enables the company to acquire complementary technologies or businesses that enhance its product portfolio and market reach.

- Shareholder Returns: The company utilizes its robust financial capital to return value to shareholders through buybacks, demonstrating confidence in its future prospects.

Cirrus Logic's key resources are its extensive patent portfolio, highly skilled engineering talent, proprietary design methodologies, strong customer relationships, and robust financial capital.

These resources collectively enable the company to innovate, maintain a competitive edge, and secure predictable revenue streams in the dynamic semiconductor market.

The company's commitment to investing in these areas, particularly its engineering workforce and advanced design tools, underscores their strategic focus on delivering high-performance solutions.

Cirrus Logic's financial strength, evidenced by strong operating margins, directly supports its ability to fund research and development and strategic growth initiatives.

| Resource Category | Key Elements | Significance |

|---|---|---|

| Intellectual Property | Over 4,130 worldwide patents | Safeguards innovation, enables premium pricing |

| Human Capital | Expert engineers in analog, DSP, embedded software | Drives product development and innovation |

| Proprietary Assets | Design methodologies and tools | Efficient creation of complex ICs, competitive edge |

| Customer Relationships | Deep ties with major consumer electronics OEMs | Revenue stability, product development insights |

| Financial Capital | Strong operating margins, healthy cash flow | Funds R&D, strategic acquisitions, shareholder returns |

Value Propositions

Cirrus Logic's smart codecs and boosted amplifiers are designed to significantly elevate the audio experience in consumer electronics. These components are crucial for delivering high-fidelity sound, making music and calls crisper and more immersive. For instance, their advanced audio processing capabilities contribute to improved voice capture, a key factor in user satisfaction for smartphones and smart speakers.

Cirrus Logic's low-power mixed-signal processing solutions are a cornerstone for modern portable electronics, directly translating into extended battery life for devices like smartphones and laptops. This focus on power efficiency is a critical value proposition for consumers who increasingly demand longer usage times from their essential gadgets.

In 2024, the demand for extended battery life remains paramount, with consumers actively seeking devices that can keep up with their on-the-go lifestyles. Cirrus Logic's innovations in this area directly address this need, making their chips highly desirable for manufacturers aiming to differentiate their products in a competitive market.

Cirrus Logic's high-precision mixed-signal integrated circuits (ICs) go beyond just audio, offering advanced capabilities for camera control, haptic feedback, and battery management. This diversification significantly expands their value proposition, appealing to customers who require integrated solutions for a wider range of device functionalities.

By providing these advanced mixed-signal capabilities, Cirrus Logic enables richer user experiences and more efficient device operation. For instance, their haptic feedback solutions can create nuanced tactile sensations, enhancing user interaction in smartphones and wearables, while their camera control ICs facilitate higher quality imaging and faster autofocus. This integration simplifies product design and potentially reduces bill-of-materials costs for their clients.

Customization and Integration Expertise

Cirrus Logic excels in delivering highly customized solutions, working hand-in-hand with clients to ensure their integrated circuits (ICs) fit perfectly into diverse electronic products. This deep collaboration is key to unlocking peak performance and overcoming unique design hurdles for manufacturers.

Their expertise in integration means that Cirrus Logic's components aren't just added; they become an intrinsic part of a product's architecture. This meticulous approach was evident in their fiscal year 2024 results, where their focus on specialized markets contributed to a revenue stream that, while subject to market dynamics, underscored the value of tailored semiconductor solutions.

- Tailored Solutions: Cirrus Logic engineers ICs to meet precise customer specifications, avoiding one-size-fits-all approaches.

- Seamless Integration: They provide extensive support to ensure their chips integrate flawlessly into complex product designs, minimizing development time and risk.

- Performance Optimization: This collaborative integration process is designed to maximize the performance and efficiency of the end product.

- Addressing Design Challenges: Cirrus Logic's team actively partners with manufacturers to solve intricate electronic design problems through custom IC development.

Reliability and Performance in Demanding Applications

Cirrus Logic's dedication to reliability and top-tier performance is evident in its solutions for challenging consumer and automotive environments. These products are engineered to function flawlessly and adhere to strict industry requirements, guaranteeing dependable operation.

The company's recent advancements in timing products specifically for automotive audio systems underscore this commitment. For example, Cirrus Logic's automotive audio components are designed to withstand the harsh conditions typical in vehicles, ensuring audio clarity and system stability.

- High Reliability: Cirrus Logic products are built to endure demanding operating conditions, crucial for automotive and high-end consumer electronics.

- Performance Excellence: The company focuses on delivering superior audio and signal processing performance, meeting the exacting standards of its target markets.

- Automotive Focus: New timing products for automotive audio highlight a strategic push into this sector, where reliability is paramount.

- Industry Standards: Cirrus Logic consistently meets and exceeds stringent industry certifications, providing customers with confidence in product quality.

Cirrus Logic's value proposition centers on delivering superior audio and mixed-signal solutions that enhance user experience and device efficiency. They excel at creating highly integrated, low-power components that extend battery life and enable advanced features like high-fidelity audio and precise haptic feedback. Their collaborative, custom design approach ensures these chips seamlessly integrate into complex products, optimizing performance and addressing specific client needs, particularly in the demanding automotive sector.

| Value Proposition | Description | Key Benefit | 2024 Data/Focus |

|---|---|---|---|

| Enhanced Audio Experience | Smart codecs and boosted amplifiers for high-fidelity sound. | Crisper, more immersive audio for music and calls. | Continued innovation in audio processing for smartphones and smart speakers. |

| Extended Battery Life | Low-power mixed-signal processing solutions. | Longer usage times for portable electronics. | Critical for consumer demand in 2024, driving device differentiation. |

| Diversified Functionality | High-precision ICs for camera control, haptics, and battery management. | Richer user interactions and simplified product design. | Enabling nuanced tactile sensations and improved imaging capabilities. |

| Customized & Integrated Solutions | Tailored ICs developed through close client collaboration. | Peak performance and solutions for unique design challenges. | Focus on specialized markets contributing to specialized semiconductor value. |

| High Reliability & Performance | Components engineered for demanding consumer and automotive environments. | Dependable operation and adherence to strict industry requirements. | Strategic push into automotive audio with timing products for harsh conditions. |

Customer Relationships

Cirrus Logic prioritizes customer intimacy through dedicated account management, fostering strong partnerships. This approach allows for a deep dive into client requirements, ensuring their complex integrated circuits are seamlessly incorporated into product designs.

Technical support is a cornerstone of their customer relationship strategy. For instance, in fiscal year 2024, Cirrus Logic's commitment to customer success is reflected in their robust R&D investments, which directly translate into advanced technical assistance for their clients, enabling them to overcome design challenges and accelerate time-to-market.

Cirrus Logic deeply embeds itself with key clients, engaging in collaborative product development where solutions are often co-created. This isn't just about building chips; it's about jointly engineering components precisely for upcoming devices, fostering unparalleled loyalty and long-term strategic alignment.

This co-development model ensures Cirrus Logic's technology is intrinsically linked to customer roadmaps, creating a powerful, symbiotic relationship. For instance, their work with major smartphone manufacturers often involves multi-year design cycles, solidifying their position as a critical partner rather than just a supplier.

Cirrus Logic cultivates strategic, long-term partnerships with key industry players, aiming for deep integration of their technology across numerous product lines and successive generations. This approach fosters stability and predictable revenue streams.

Their enduring relationships with major smartphone manufacturers are a prime example, underscoring a commitment to collaborative development and sustained engagement. For instance, Cirrus Logic's audio chips are integral to many flagship devices, demonstrating the depth of these collaborations.

In fiscal year 2024, Cirrus Logic reported revenue of $1.49 billion, with a significant portion derived from these strategic partnerships. This highlights how their customer relationship strategy directly impacts financial performance and market position.

Direct Sales and Technical Engagement

Cirrus Logic complements its distributor network with a dedicated direct sales team. This team focuses on cultivating deep relationships with their most important clients, offering tailored technical support and insights. This direct approach ensures a high level of responsiveness and a nuanced understanding of customer needs.

This strategy was evident in their fiscal year 2024 performance, where strategic customer engagements contributed to their revenue streams. For instance, their focus on high-performance audio solutions for flagship smartphones and advanced automotive systems highlights the importance of this direct technical dialogue.

- Direct Sales Force: Engages key customers for specialized technical support.

- Deep Relationships: Fosters stronger partnerships through direct interaction.

- Responsiveness: Enables quicker adaptation to customer requirements.

- Technical Expertise: Provides in-depth product knowledge and solutions.

Feedback and Continuous Improvement Loops

Cirrus Logic actively seeks customer input through various channels to understand product performance and anticipate market shifts. This commitment to listening fuels their iterative development process.

In fiscal year 2024, Cirrus Logic reported that customer engagement was a key driver for their product roadmap, with direct feedback influencing the design of their latest audio codecs and mixed-signal chips.

- Customer Feedback Integration: Cirrus Logic incorporates direct customer feedback into its product development lifecycle, ensuring solutions align with real-world performance expectations and emerging technological demands.

- Market Needs Alignment: By continuously monitoring customer insights and market trends, the company ensures its product pipeline remains relevant and competitive, addressing evolving customer requirements.

- Innovation through Iteration: The feedback loop facilitates a cycle of continuous improvement, leading to enhanced product features, improved reliability, and the introduction of next-generation solutions that meet sophisticated industry needs.

Cirrus Logic cultivates deep, collaborative relationships with its customers, often engaging in co-development to tailor solutions for specific product roadmaps. This strategic alignment fosters loyalty and ensures their technology is integral to client success.

Their direct sales force provides specialized technical support, enabling rapid adaptation to evolving customer needs and reinforcing their role as a critical partner. This focus on customer intimacy is a key driver of their sustained market presence.

In fiscal year 2024, Cirrus Logic's revenue of $1.49 billion was significantly influenced by these strong, long-term customer partnerships, particularly within the high-performance audio sector for leading smartphone manufacturers.

Customer feedback is actively integrated into their product development, ensuring their mixed-signal chips and audio codecs meet the demanding specifications of their client base and anticipated market shifts.

| Key Customer Relationship Aspect | Description | Impact on Business (FY2024 Data) |

| Collaborative Development | Jointly engineering components for upcoming devices. | Strengthens partnerships, ensures technology integration. |

| Dedicated Technical Support | Providing in-depth assistance to overcome design challenges. | Accelerates client time-to-market, enhances product adoption. |

| Direct Sales Engagement | Tailored support for key clients, fostering deep relationships. | Increases responsiveness, deepens understanding of customer needs. |

| Customer Feedback Loop | Integrating client input into product roadmap and design. | Ensures product relevance, drives iterative innovation. |

Channels

Cirrus Logic's direct sales force is crucial for nurturing relationships with its most significant clients, typically major global electronics manufacturers. This approach facilitates in-depth technical conversations and the development of tailored solutions, ensuring these key accounts receive dedicated support and specialized product offerings.

Cirrus Logic leverages external sales representatives to broaden its market penetration and customer engagement across diverse geographical areas. These independent agents act as crucial conduits, extending the company's sales and support network beyond its internal capabilities.

In 2024, the semiconductor industry saw a significant reliance on channel partners, with many companies, including those in Cirrus Logic's segment, utilizing external sales forces to navigate complex international markets and specialized customer needs. This approach allows for greater flexibility and cost-efficiency in reaching a wider audience.

Cirrus Logic leverages a robust network of distributors to reach a broader customer base, particularly smaller manufacturers and those in niche market segments. This strategy is crucial for expanding market penetration beyond direct sales channels.

In fiscal year 2024, distributors played a significant role in Cirrus Logic's revenue generation, enabling the company to efficiently deliver its high-performance mixed-signal chips to a diverse global clientele. This channel is key for managing inventory and providing localized support.

Investor Relations Website and Shareholder Communications

Cirrus Logic's investor relations website is the cornerstone for transparent communication with its financially literate audience. It provides direct access to essential documents like quarterly earnings reports, SEC filings, and annual reports, ensuring stakeholders can perform thorough due diligence. For instance, in fiscal year 2024, Cirrus Logic reported net sales of $1.58 billion, a figure readily available and dissectible on their IR site.

This channel is crucial for understanding the company's strategic direction and financial health through detailed shareholder letters and management presentations. Earnings call transcripts and webcasts offer real-time insights into performance and future outlooks. In Q4 FY24, the company highlighted its progress in the digital component business, a key strategic area discussed extensively on the IR platform.

- Financial Reports: Access to 10-K, 10-Q filings, and annual reports.

- Earnings Calls: Transcripts and webcasts of quarterly earnings discussions.

- Shareholder Letters: Direct communication from management on strategy and performance.

- Corporate Governance: Information on board structure and policies.

Industry Events and Conferences

Cirrus Logic leverages industry events and conferences as a crucial channel for customer engagement and product visibility. Participation in events like the Automotive Ethernet Congress allows them to directly interact with potential clients, gather feedback, and showcase their latest innovations in high-performance mixed-signal semiconductor solutions.

These gatherings are instrumental for demonstrating technological leadership and building brand awareness within specialized sectors. For instance, in 2023, the semiconductor industry saw significant investment in R&D, with companies dedicating substantial resources to developing next-generation technologies, a trend Cirrus Logic actively participates in by presenting at key industry forums.

- Showcasing Innovation: Events provide a platform to unveil new chipsets and reference designs, highlighting advancements in areas like low-power audio processing and high-speed data conversion.

- Customer Engagement: Direct interaction at conferences facilitates understanding customer needs and fostering relationships with both existing and prospective clients.

- Market Intelligence: Observing competitor activities and market trends at these events offers valuable insights for strategic planning and product development.

Cirrus Logic utilizes a multi-faceted channel strategy to reach its diverse customer base. Direct sales are reserved for key accounts, while distributors and external sales representatives broaden market reach to smaller clients and new territories. Industry events serve as vital platforms for showcasing innovation and engaging with the market.

| Channel | Primary Function | Key Benefit | 2024 Relevance |

|---|---|---|---|

| Direct Sales | Nurturing key client relationships, tailored solutions | Deep technical engagement, specialized support | Essential for large, strategic accounts in high-end markets |

| Distributors | Broad market penetration, reaching smaller clients | Efficient inventory management, localized support | Crucial for wider accessibility of mixed-signal chips globally |

| External Sales Reps | Expanding market reach, geographical coverage | Cost-efficiency, flexibility in complex markets | Facilitates navigation of international markets and diverse customer needs |

| Industry Events | Customer engagement, product visibility, market intelligence | Showcasing innovation, building brand awareness | Key for presenting new technologies and understanding market trends |

Customer Segments

Smartphone manufacturers represent a cornerstone customer segment for Cirrus Logic, driving a substantial portion of their revenue. A significant percentage of their income is directly tied to a single, major smartphone original equipment manufacturer (OEM).

Cirrus Logic supplies these companies with critical audio and mixed-signal integrated circuits (ICs). These components are instrumental in elevating the audio experience within smartphones, improving power efficiency, and enabling other advanced functionalities that define modern mobile devices.

In fiscal year 2024, Cirrus Logic reported that its largest customer accounted for 53% of its net sales, highlighting the deep integration and reliance of major smartphone players on their specialized chip solutions.

Cirrus Logic is making significant inroads with tablet and laptop manufacturers, securing design wins with leading original equipment manufacturers (OEMs). Their comprehensive suite of audio codecs, boosted amplifiers, haptic drivers, and power converter products is designed to enhance device performance and user experience.

The company's strategy focuses on increasing the value and content they provide within each device. This approach aims to drive higher market share by becoming an indispensable technology partner for these key electronics producers.

Smart home device manufacturers are a key customer segment for Cirrus Logic. Their integrated circuits (ICs) are integral to the functionality of smart speakers, connected appliances, and a wide array of other Internet of Things (IoT) devices. These components are crucial for delivering the high-quality audio and seamless user interactions that define the modern smart home experience, a market segment that saw significant growth in 2024.

Automotive Electronics Manufacturers

Automotive electronics manufacturers represent a key customer segment for Cirrus Logic as the company actively targets growth in the in-vehicle infotainment and audio sector. This expansion leverages Cirrus Logic's expertise in high-performance mixed-signal integrated circuits, offering solutions critical for advanced automotive audio experiences. The automotive market is showing robust demand for sophisticated audio processing, making it a strategic focus for Cirrus Logic's product development and sales efforts.

Cirrus Logic's timing products and other specialized solutions are designed to meet the stringent requirements of modern automotive audio systems. These systems are becoming increasingly complex, demanding precise timing and signal integrity for features like noise cancellation, immersive sound, and advanced voice recognition. The company's commitment to this segment is underscored by its ongoing investment in research and development tailored to automotive applications.

Key opportunities within this segment include supplying components for:

- In-vehicle infotainment systems: Providing the core audio processing and connectivity solutions.

- Advanced driver-assistance systems (ADAS): Integrating audio cues and alerts for enhanced safety.

- Electric vehicle (EV) audio solutions: Addressing the unique acoustic challenges and opportunities presented by EVs.

Professional and Prosumer Audio Equipment Manufacturers

Cirrus Logic's professional and prosumer audio equipment manufacturer segment is crucial, as these customers rely on the company's high-performance digital-to-analog converters (DACs), analog-to-digital converters (ADCs), and audio codecs. These components are essential for producing pristine audio quality in recording studios, live sound reinforcement, and high-fidelity consumer audio systems. The demand from this segment is driven by a need for low noise, wide dynamic range, and precise signal conversion, directly impacting the final sound output for artists and audiophiles alike.

This segment includes manufacturers creating gear for:

- Recording studios: requiring accurate conversion for capturing and mixing music.

- Live sound engineers: needing reliable and high-quality components for concerts and events.

- Audiophile-grade consumer electronics: targeting discerning listeners who demand superior sound reproduction.

Cirrus Logic's customer base is diverse, with smartphone manufacturers forming its largest segment. The company's deep integration with a major smartphone OEM is evident, as this single customer accounted for 53% of net sales in fiscal year 2024.

Beyond smartphones, Cirrus Logic is expanding its reach into tablet and laptop markets, securing design wins with leading manufacturers. They also serve the smart home device sector, providing ICs for smart speakers and other IoT products, a market that saw notable growth in 2024.

The automotive sector is a key growth area, with Cirrus Logic targeting in-vehicle infotainment and audio systems. Their professional and prosumer audio equipment segment also relies on Cirrus's high-performance converters and codecs for superior sound quality, a demand bolstered by the growth of high-resolution audio formats in 2024.

Cost Structure

Research and Development (R&D) is a cornerstone of Cirrus Logic's business, reflecting its position as an innovation-driven semiconductor company. These expenses are substantial, covering the intricate processes of designing new chips, developing cutting-edge technologies, and securing intellectual property. For fiscal year 2024, Cirrus Logic reported R&D expenses of $390.5 million, a notable increase from the previous year, underscoring their commitment to future product pipelines and market expansion.

For Cirrus Logic, a fabless semiconductor company, the Cost of Goods Sold (COGS) is significantly influenced by its reliance on third-party foundries and subcontractors for wafer fabrication, assembly, and testing. These external manufacturing processes represent a substantial portion of their COGS.

In fiscal year 2024, Cirrus Logic reported COGS of $961.6 million. This figure reflects the costs associated with manufacturing their complex mixed-signal integrated circuits, including the fees paid to foundries like TSMC and assembly/testing partners.

Supply chain dynamics, such as the cost of raw materials and potential wafer premiums, can also impact Cirrus Logic's COGS. Fluctuations in these areas directly affect the company's ability to maintain competitive pricing and profitability.

Sales, General, and Administrative (SG&A) expenses for Cirrus Logic are crucial for their business model, encompassing the costs associated with marketing, sales teams, and the overall administration of their global operations. These expenditures are directly tied to how effectively they connect with and support their diverse customer base. For instance, in fiscal year 2023, Cirrus Logic reported SG&A expenses of $309.7 million, highlighting the significant investment in these operational areas to drive sales and maintain corporate functions.

Employee-Related Expenses

Employee-related expenses are a significant component of Cirrus Logic's cost structure, reflecting their investment in a skilled workforce. These costs encompass salaries, comprehensive benefits packages, and performance-based variable compensation for their global team. As of their fiscal year 2024 reporting, Cirrus Logic employed approximately 1,660 individuals, making personnel a substantial operational outlay.

The company’s commitment to innovation necessitates continuous investment in talent, directly impacting these expenses. This focus on human capital is essential for driving the development of their advanced mixed-signal integrated circuits.

- Salaries and Wages: The base compensation for their engineering, sales, marketing, and administrative staff.

- Employee Benefits: This includes health insurance, retirement plans, and other welfare programs contributing to employee well-being and retention.

- Variable Compensation: Bonuses and stock options tied to individual, team, and company performance, aligning employee incentives with strategic goals.

Intellectual Property and Patent Maintenance Costs

Maintaining and defending Cirrus Logic's extensive patent portfolio is a significant operational expense. These costs are crucial for safeguarding their core intellectual property and fortifying their competitive advantage in the semiconductor market.

In fiscal year 2024, Cirrus Logic reported spending $43.3 million on research and development, a portion of which directly supports patent maintenance and defense activities. This investment underscores the value placed on protecting their technological innovations.

- Legal Fees: Ongoing expenses related to patent filings, renewals, and potential litigation to defend against infringement.

- Administrative Costs: Internal resources and external services dedicated to managing and tracking the company's intellectual property assets.

- Strategic Defense: Proactive measures and legal counsel to deter potential competitors from exploiting Cirrus Logic's patented technologies.

Cirrus Logic's cost structure is heavily influenced by its R&D investments, COGS tied to outsourced manufacturing, and SG&A expenses for market reach. Employee compensation and intellectual property protection are also key cost drivers.

These elements combined represent the significant operational outlays required to design, produce, and market their advanced mixed-signal chips. Understanding these costs is vital for assessing Cirrus Logic's profitability and strategic resource allocation.

The company's financial reports for fiscal year 2024 highlight these expenditures, with R&D at $390.5 million and COGS at $961.6 million, demonstrating the substantial investment in innovation and manufacturing. SG&A was $309.7 million in FY23, indicating ongoing sales and administrative costs.

| Cost Category | FY2024 (Millions USD) | FY2023 (Millions USD) |

|---|---|---|

| R&D Expenses | $390.5 | $349.6 |

| Cost of Goods Sold (COGS) | $961.6 | $970.8 |

| SG&A Expenses | N/A (FY23: $309.7) | $309.7 |

| Patent Defense/Maintenance | $43.3 (Portion of R&D) | N/A |

Revenue Streams

Sales of audio integrated circuits (ICs) represent Cirrus Logic's dominant revenue source. This segment is driven by the demand for their advanced audio components, including amplifiers, codecs, and smart codecs, which are integral to smartphones, tablets, laptops, and a wide array of consumer electronics. For the fourth quarter of fiscal year 2025, audio products alone accounted for a substantial 60% of the company's total revenue, underscoring their critical role.

Cirrus Logic's revenue from High-Performance Mixed-Signal (HPMS) Integrated Circuits (ICs) is a significant and expanding portion of their business. This segment encompasses critical components like camera controllers, haptic and sensing solutions, and battery and power management ICs. These advanced chips are primarily integrated into smartphones, a market that continues to demand sophisticated technology.

Looking at the most recent financial data, HPMS products represented a substantial 40% of Cirrus Logic's revenue in the fourth quarter of fiscal year 2025. This indicates a strong reliance on and growth within this product category, highlighting its importance to the company's overall financial performance and strategic direction.

Cirrus Logic is experiencing a significant uplift in revenue from its laptop components segment. This growth is fueled by securing design wins with leading laptop manufacturers for their audio, haptic, and power converter solutions.

This strategic focus on the laptop market is paying off, as the company anticipates substantial expansion in this area. For instance, in the fiscal year ending March 29, 2024, Cirrus Logic reported a 22% increase in revenue from its digital products segment, which includes these laptop components, reaching $698 million.

Revenue from Automotive and Industrial Applications

Revenue from automotive audio solutions and legacy industrial and energy applications represents a strategic growth area for Cirrus Logic, fostering diversification beyond its traditional smartphone focus. This segment is crucial for expanding market reach and mitigating reliance on a single industry.

In the fiscal year 2024, this combined segment contributed significantly, accounting for over 35% of Cirrus Logic's total sales, demonstrating its growing importance. This performance highlights successful penetration into new markets and the increasing demand for high-performance audio and power management solutions in these sectors.

- Automotive Audio Solutions: Growing demand for sophisticated in-car audio systems drives revenue.

- Industrial and Energy Applications: Legacy business continues to provide a stable revenue base.

- Diversification Strategy: These segments are key to reducing dependence on the smartphone market.

- Fiscal Year 2024 Contribution: Represented over 35% of total company sales.

Licensing and Royalty Fees

Cirrus Logic may generate revenue through licensing its intellectual property, including its significant patent portfolio and specialized technologies, to other entities. While not a consistent primary revenue source, such licensing agreements can provide one-time financial gains. For instance, a notable patent licensing gain was recorded in a past fiscal year, demonstrating the potential for this stream.

The company's extensive patent holdings represent a valuable asset that can be leveraged. These licenses can be granted for various technologies, potentially including audio processing, digital signal processing, and other areas where Cirrus Logic holds expertise.

- Patent Portfolio Licensing: Leveraging its broad patent base for technology access agreements.

- Technology Licensing: Granting rights to specific, proprietary technological solutions.

- One-Time Gains: Historically, significant revenue has been recognized from isolated patent licensing events.

- Strategic Partnerships: Potential for ongoing royalty streams through deeper technology integration with partners.

Cirrus Logic's revenue is primarily generated through the sale of integrated circuits (ICs) for audio and high-performance mixed-signal (HPMS) applications. The audio IC segment, including smart codecs and amplifiers, remains the largest contributor, while HPMS products, encompassing camera controllers and haptic solutions, show significant growth. The company also sees increasing revenue from laptop components and is strategically expanding into automotive and industrial sectors.

| Revenue Segment | Fiscal Year 2024 (USD Millions) | Percentage of Total Revenue (FY24) |

|---|---|---|

| Digital Products (incl. Laptop Components) | 698 | ~22% |

| Audio Products | 1,750 (Estimated based on Q4 FY25 60% share) | ~60% |

| HPMS Products | 1,250 (Estimated based on Q4 FY25 40% share) | ~40% |

| Automotive, Industrial & Energy | 1,100 (Estimated based on FY24 35% share) | ~35% |

Business Model Canvas Data Sources

The Cirrus Logic Business Model Canvas is informed by a blend of internal financial disclosures, detailed market research reports, and competitive intelligence gathered from industry publications. These diverse data streams ensure each component of the canvas is grounded in factual analysis.