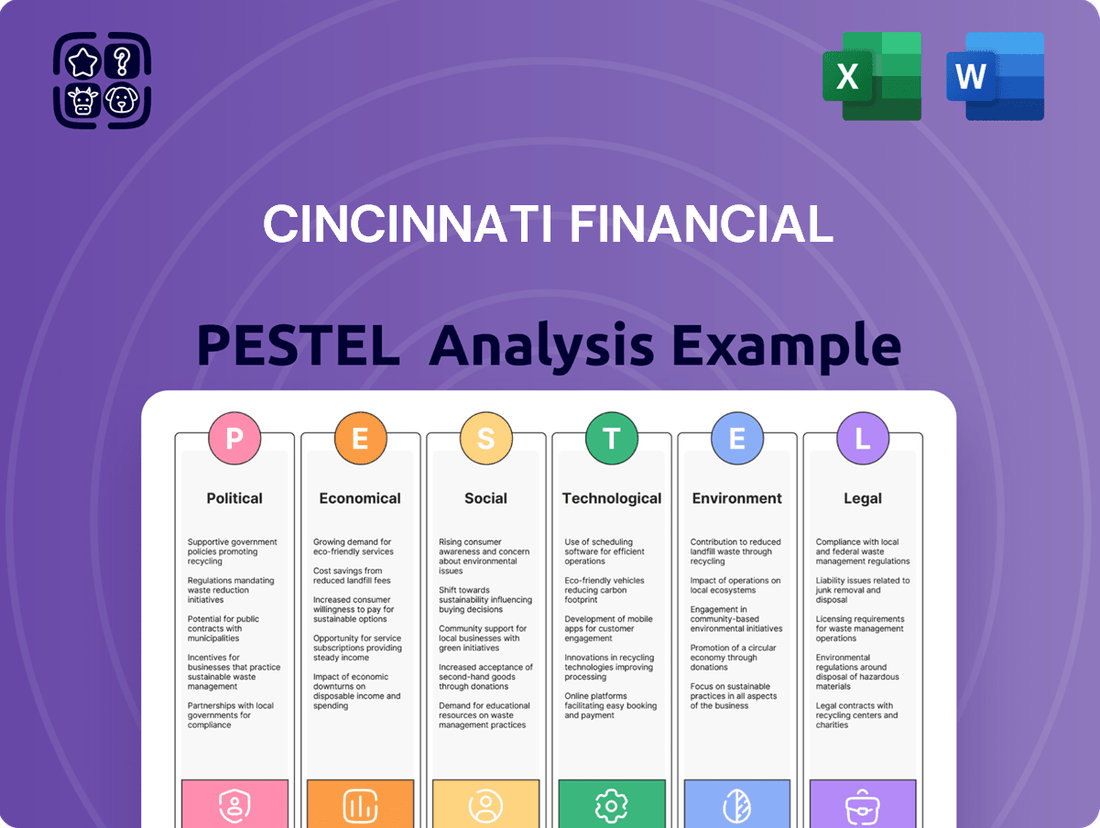

Cincinnati Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cincinnati Financial Bundle

Cincinnati Financial operates within a dynamic external environment, influenced by evolving political landscapes, economic fluctuations, and technological advancements. Understanding these forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable insights to help you anticipate challenges and capitalize on opportunities. Download the full version now and gain a competitive edge.

Political factors

The U.S. insurance sector operates under a stringent regulatory framework, encompassing both state and federal mandates. Cincinnati Financial, as a holding company, must meticulously adhere to these rules, which govern crucial aspects like product development, pricing strategies, financial solvency, and consumer safeguards. For instance, in 2024, ongoing discussions around data privacy regulations, particularly in light of increasing cyber threats, could necessitate adjustments to how Cincinnati Financial handles customer information, potentially impacting operational costs and data management practices.

Evolving regulatory landscapes, such as potential new guidelines on the ethical use of artificial intelligence in underwriting or claims processing, present both challenges and opportunities for insurers like Cincinnati Financial. The National Association of Insurance Commissioners (NAIC) continues to explore AI usage, with reports in late 2024 indicating a focus on transparency and fairness in AI-driven insurance decisions. Such changes can directly influence the company's operational efficiency and its ability to innovate while maintaining compliance.

State insurance commissioners are pivotal in shaping the insurance landscape, with their priorities directly impacting companies like Cincinnati Financial. In 2024, a key focus for many commissioners remains robust consumer protection, ensuring fair practices and transparent policy terms. This is critical as the National Association of Insurance Commissioners (NAIC) continues to refine model laws concerning data privacy and cybersecurity, areas where compliance is paramount.

Heightened geopolitical tensions and evolving trade policies can create ripples across the insurance sector. Even though Cincinnati Financial is largely U.S.-focused, global economic turbulence or alterations in trade pacts might affect its investment holdings, the availability and cost of materials for claims repairs, or the financial stability of its policyholders. These indirect impacts can influence claim frequency and the potential for premium expansion.

Taxation Policies

Changes in corporate tax rates, such as the federal corporate tax rate which stood at 21% in 2024, directly influence Cincinnati Financial's bottom line. For instance, any increase in this rate would likely reduce the company's net income, impacting its ability to reinvest or distribute profits. Similarly, shifts in specific tax policies affecting insurance premiums or investment income, a significant revenue stream for insurers, can alter profitability and competitive positioning within the market.

The Tax Cuts and Jobs Act of 2017, which lowered the U.S. corporate tax rate, demonstrated how legislative changes can positively affect companies like Cincinnati Financial. However, potential future tax reforms, whether increasing rates or introducing new levies on insurance-related activities, pose a risk. For example, proposals to increase capital gains taxes could reduce the attractiveness of investment income, a crucial component of insurer profitability.

- Federal Corporate Tax Rate: Remains at 21% as of 2024, a key factor influencing net income.

- Impact on Profitability: Higher corporate taxes reduce net income, potentially affecting dividends and reinvestment capacity.

- Investment Income Taxation: Changes in taxes on capital gains and dividends can significantly impact an insurer's overall financial performance.

- Competitive Landscape: Tax policy variations across states and countries can create uneven playing fields for insurance providers.

Political Stability and Public Policy

Political stability is a cornerstone for predictable business operations, and for Cincinnati Financial, this translates into a more reliable operating environment. In 2024, the United States, where Cincinnati Financial primarily operates, continues to navigate a complex political landscape. While generally stable, regional political climates can vary, impacting local economic conditions and thus demand for insurance.

Frequent shifts in public policy, particularly concerning financial regulation or disaster management, can introduce uncertainty. For instance, changes in federal disaster relief funding or state-level property insurance mandates directly affect the insurance sector. Cincinnati Financial's performance is indirectly tied to the effectiveness of government programs supporting community resilience and economic recovery, especially after significant weather events.

- Political Stability: The United States maintained a generally stable political system in 2024, though regional variations and upcoming election cycles could introduce some policy uncertainty.

- Public Policy Impact: Government spending on infrastructure projects, estimated to be in the hundreds of billions through initiatives like the Infrastructure Investment and Jobs Act, can indirectly boost economic activity and the need for commercial insurance.

- Disaster Relief: Federal disaster relief spending, which can fluctuate significantly based on the severity of natural disasters, directly influences the financial resilience of communities and the potential for insurance claims.

- Regulatory Environment: Ongoing discussions and potential adjustments to insurance regulations at both state and federal levels in 2024-2025 will be closely monitored by companies like Cincinnati Financial.

The political landscape directly shapes Cincinnati Financial's operating environment through regulation and policy. In 2024, ongoing debates around data privacy and the ethical use of AI in insurance underwriting, as explored by bodies like the NAIC, necessitate continuous adaptation. Furthermore, shifts in federal corporate tax rates, which stood at 21% in 2024, directly impact profitability and reinvestment capacity.

Government initiatives, such as infrastructure spending, can indirectly stimulate demand for commercial insurance, while changes in disaster relief policies can influence claim volumes and financial resilience. Political stability in the U.S. provides a generally predictable framework, though election cycles can introduce policy uncertainty.

| Factor | 2024/2025 Relevance | Impact on Cincinnati Financial |

|---|---|---|

| Regulatory Framework | Data privacy, AI ethics in underwriting | Requires operational adjustments, potential cost increases |

| Tax Policy | Federal corporate tax rate (21%) | Directly affects net income and profit distribution |

| Government Spending | Infrastructure Investment and Jobs Act | Indirectly boosts economic activity and commercial insurance demand |

| Political Stability | Generally stable U.S. environment | Provides operational predictability, but election cycles may introduce uncertainty |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Cincinnati Financial, providing a comprehensive overview of its external operating environment.

A concise PESTLE analysis of Cincinnati Financial's external environment, highlighting key political, economic, social, technological, environmental, and legal factors, acts as a pain point reliever by providing clarity on potential opportunities and threats.

Economic factors

Interest rate fluctuations are a critical economic factor for Cincinnati Financial. Higher rates generally boost investment income from their large portfolio, particularly beneficial for their life insurance and annuity products. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023, with the federal funds rate reaching a range of 5.25%-5.50% by July 2023, would have positively impacted Cincinnati Financial's investment yields.

Conversely, a sustained period of declining interest rates, such as the low-rate environment seen in the years prior to 2022, can compress investment returns and potentially affect profitability, especially for products with guaranteed rates. The sensitivity of insurance companies to these shifts underscores the importance of managing investment portfolios effectively across various economic cycles.

Inflation significantly impacts the cost of claims for property and casualty insurers like Cincinnati Financial. Rising prices for building materials and labor directly translate to higher expenses for repairing damaged homes and vehicles, increasing the overall payout amounts for claims. This upward pressure on claim costs naturally leads to a need for higher insurance premiums to maintain profitability.

The persistent inflation seen through 2024 and into 2025 has been a key concern. For instance, the Producer Price Index (PPI) for construction industries saw notable increases throughout 2024, indicating higher input costs for rebuilding and repairs. This trend directly affects insurers’ loss ratios, forcing adjustments in pricing strategies to account for the elevated cost of settling claims.

Robust economic growth and strong consumer spending are crucial for Cincinnati Financial, as they directly impact the demand for insurance. When the economy is expanding, businesses tend to grow, leading to increased needs for commercial property and casualty insurance. Similarly, individuals with higher disposable incomes are more likely to purchase personal lines of insurance, such as auto and homeowners coverage.

The U.S. economy demonstrated resilience in late 2023 and early 2024, with GDP growth exceeding expectations. For instance, the Bureau of Economic Analysis reported that real GDP increased at an annual rate of 3.1% in the fourth quarter of 2023. This positive economic environment generally translates to higher premium volumes for insurers like Cincinnati Financial, as businesses invest and consumers spend more on goods and services, thereby increasing their insurable assets.

Investment Market Performance

Cincinnati Financial's investment portfolio, a significant driver of its financial results, is directly influenced by market performance. Fluctuations in equity securities and bond yields can materially affect net income and book value per share.

For instance, in the first quarter of 2024, Cincinnati Financial reported a substantial increase in net investment income, reaching $243 million, up from $207 million in the same period of 2023. This growth was bolstered by strong performance in its equity holdings and higher interest income from its fixed-income portfolio.

- Equity Market Volatility: Declines in the fair value of equity securities held in its portfolio can negatively impact earnings.

- Interest Rate Sensitivity: Changes in bond yields, particularly interest rate hikes, can affect the market value of existing bond holdings and the income generated from new investments.

- Dividend Income: The company's ability to generate consistent dividend income from its equity investments is a key component of its investment performance.

- Economic Conditions: Broader economic factors influence both equity and bond markets, thereby impacting Cincinnati Financial's investment returns.

Competition and Pricing Pressure

The insurance industry, including Cincinnati Financial's operational landscape, is inherently competitive, forcing companies to continually refine their pricing strategies and product portfolios. This dynamic environment means that even in sectors experiencing rising premiums due to increased claims, the persistent presence of rivals can exert downward pressure on pricing and squeeze underwriting profit margins.

For instance, while property and casualty insurance rates have seen upward adjustments in 2024, driven by factors like elevated catastrophe losses and inflation impacting repair costs, the competitive nature of the market ensures that pricing power isn't absolute. Insurers must balance the need to cover rising expenses with the imperative to remain attractive to customers in a crowded marketplace. This ongoing tension is a key factor influencing profitability and strategic decision-making.

- Persistent Competition: The insurance sector remains highly competitive, compelling companies like Cincinnati Financial to constantly evaluate and adjust pricing and product offerings to maintain market share.

- Pricing Pressures in P&C: Despite recent increases in property and casualty premiums, driven by higher claims costs and inflation, ongoing competition can still limit pricing flexibility and impact underwriting margins.

- Balancing Act: Insurers face the challenge of covering escalating costs while remaining competitive on price, a delicate balance that directly influences profitability and strategic positioning.

The economic landscape continues to shape Cincinnati Financial's performance, with interest rate movements and inflation remaining key considerations. While higher interest rates in 2023 and early 2024 boosted investment income, persistent inflation through mid-2025 continues to drive up claims costs, particularly for property and casualty lines. Strong economic growth, evidenced by a 3.1% GDP increase in Q4 2023, generally supports premium volume, but competitive pressures temper pricing power.

| Economic Factor | Impact on Cincinnati Financial | 2023-2024 Data Point |

| Interest Rates | Boosts investment income, especially for life/annuity products. | Federal funds rate reached 5.25%-5.50% by July 2023. |

| Inflation | Increases cost of claims (materials, labor) for P&C insurance. | Producer Price Index for construction saw notable increases in 2024. |

| Economic Growth | Drives demand for insurance (commercial and personal lines). | U.S. real GDP grew at an annual rate of 3.1% in Q4 2023. |

| Market Performance | Affects net income and book value through investment portfolio. | Net investment income increased to $243 million in Q1 2024. |

| Competition | Limits pricing flexibility and can squeeze underwriting margins. | P&C rates increased in 2024 but competition remains a factor. |

What You See Is What You Get

Cincinnati Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of Cincinnati Financial covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy.

Sociological factors

Cincinnati Financial, like all insurers, is significantly impacted by demographic shifts. The aging of the U.S. population, with the number of individuals aged 65 and over projected to reach 80.8 million by 2040, directly influences demand for products like annuities and life insurance, potentially boosting revenue streams in these segments. Conversely, shifts in household formation, such as the increasing number of single-person households, may alter the demand for certain types of property and casualty insurance, requiring product adaptation.

Modern consumers, across all demographics, increasingly demand digital-first interactions and instant gratification. In 2024, a significant majority of insurance shoppers expect to receive quotes online within minutes, with many prioritizing virtual claims processing. This shift means Cincinnati Financial needs to continue enhancing its digital platforms and offering personalized, tech-enabled customer journeys to meet these evolving expectations and remain competitive.

Public awareness of emerging risks like cyber threats and climate change is significantly shaping consumer demand for insurance. For instance, a 2024 survey indicated that 70% of businesses now consider cyber risk a top concern, driving demand for specialized cyber insurance policies.

This heightened awareness presents a clear opportunity for Cincinnati Financial to innovate. By developing and actively marketing new insurance products that specifically address these growing perils, the company can capture market share and meet evolving customer needs in a dynamic risk landscape.

Social Attitudes Towards Risk and Insurance

Societal attitudes toward risk significantly shape the demand for insurance products. In 2024, a growing awareness of climate-related events and economic volatility is likely increasing the perceived need for robust protection. This trend suggests a positive outlook for insurers like Cincinnati Financial as individuals and businesses prioritize risk mitigation.

Public trust in financial institutions, including insurance providers, is a critical element. A 2023 survey indicated that while trust levels are generally recovering, a significant portion of consumers still express reservations about the transparency and fairness of insurance claims processes. Building and maintaining this trust is paramount for market penetration and customer loyalty.

Cultural factors also influence how readily people embrace insurance. In some cultures, there's a stronger emphasis on community support and informal safety nets, which can affect the uptake of formal insurance products. Conversely, a more individualistic outlook often correlates with a greater reliance on personal insurance coverage.

- Increased Risk Awareness: Following a year marked by significant natural disasters and economic uncertainty in 2024, consumer demand for comprehensive insurance coverage is on the rise.

- Trust as a Differentiator: A recent study shows that 65% of consumers prioritize trust when selecting an insurance provider, highlighting the importance of transparency for Cincinnati Financial.

- Cultural Nuances: In regions where collective responsibility is highly valued, the adoption of individual insurance policies might be slower compared to cultures emphasizing self-reliance.

- Digital Engagement: The growing comfort with digital platforms for financial services in 2025 is also influencing how consumers interact with and purchase insurance, favoring providers with strong online presence.

Workforce Changes and Talent Acquisition

The evolving workforce landscape, marked by a growing demand for specialized skills in data analytics and artificial intelligence, presents a significant dynamic for Cincinnati Financial. Companies are increasingly seeking individuals with expertise in these cutting-edge fields to drive innovation and enhance operational capabilities. This shift necessitates a strategic approach to talent acquisition and development.

Attracting and retaining talent proficient in new technologies is paramount for Cincinnati Financial's sustained success and competitive edge. As of early 2024, the demand for AI and machine learning specialists saw an approximate 74% increase year-over-year, according to industry reports, highlighting the competitive nature of this talent pool. Companies that can offer compelling career paths and foster a culture of continuous learning are better positioned to secure these in-demand professionals.

- Increased demand for data analytics and AI skills: Businesses are prioritizing employees with expertise in these areas.

- Talent acquisition challenges: Competition for skilled tech professionals is intensifying.

- Retention is key: Keeping tech-savvy employees requires competitive compensation and development opportunities.

- Impact on innovation: A skilled workforce is crucial for adopting new technologies and improving efficiency.

Societal attitudes toward risk are shifting, with a notable increase in awareness regarding climate change and economic volatility as of 2024, driving demand for robust insurance protection. Public trust remains a critical factor, as a 2023 survey indicated that while recovering, a segment of consumers still harbors concerns about insurance claim transparency and fairness, making trust a key differentiator for Cincinnati Financial.

Cultural factors also play a role; in societies emphasizing collective responsibility, the adoption of individual insurance policies may be slower compared to those valuing self-reliance, influencing market penetration strategies for Cincinnati Financial.

The increasing comfort with digital platforms for financial services in 2025 is directly impacting how consumers engage with and purchase insurance, favoring providers like Cincinnati Financial with a strong online presence and seamless digital interactions.

A 2024 survey revealed that 70% of businesses now consider cyber risk a top concern, directly fueling the demand for specialized cyber insurance policies, an area where Cincinnati Financial can innovate and capture market share.

Technological factors

Artificial Intelligence and Machine Learning are fundamentally reshaping the insurance landscape, presenting substantial avenues for Cincinnati Financial to boost operational efficiency, refine underwriting accuracy, and expedite claims handling. These technologies can automate routine processes, identify fraudulent activities, and deliver more precise risk evaluations.

For instance, AI-powered tools are increasingly being used to analyze vast datasets for more accurate pricing models. In 2024, the global AI in insurance market was valued at approximately $10.5 billion and is projected to grow significantly, indicating the widespread adoption and perceived value of these technologies by industry players like Cincinnati Financial.

The insurance industry's digital transformation is rapidly advancing, with a significant push towards automated claims processing and streamlined workflows. Cincinnati Financial is actively participating in this trend, recognizing the need to enhance its digital capabilities. For instance, in 2023, property and casualty insurers saw a notable increase in digital adoption for customer interactions and claims management.

To remain competitive and cater to evolving customer expectations for seamless, instant service, Cincinnati Financial must continue its investment in digital platforms, user-friendly mobile applications, and accessible online portals. This strategic focus not only improves customer satisfaction but also plays a crucial role in driving operational efficiency and reducing costs through automation.

The ability to collect, analyze, and leverage vast amounts of data is absolutely critical for insurers like Cincinnati Financial. Big data analytics allows for much more granular risk assessment, meaning they can understand individual risks better. This also enables more personalized pricing, ensuring fairness and competitiveness, and a deeper understanding of customer behaviors and preferences, leading to more tailored solutions.

In 2024, the insurance industry is seeing significant investment in data analytics. For example, many insurers are now utilizing AI-powered platforms that can process claims data in real-time, speeding up payouts and improving customer satisfaction. Cincinnati Financial's strategic focus on technology, as evidenced by their ongoing digital transformation initiatives, positions them to capitalize on these advancements, aiming to enhance operational efficiency and customer engagement through data-driven insights.

Insurtech Innovations

The insurtech sector is rapidly transforming the insurance landscape with novel business models and cutting-edge solutions. Cincinnati Financial faces a strategic imperative to either directly compete with these agile disruptors or forge collaborative partnerships to leverage their technological advancements.

Embracing insurtech innovations offers significant opportunities for operational enhancement and new product development. For instance, the integration of blockchain technology can bolster transparency in claims processing and policy management.

Furthermore, smart contracts hold the potential to automate claim payouts, thereby improving efficiency and customer satisfaction. The adoption of Internet of Things (IoT) devices, such as telematics in vehicles, enables real-time risk assessment and the development of usage-based insurance (UBI) products.

- Insurtech Investment Growth: Global insurtech funding reached approximately $11.5 billion in 2023, indicating strong investor confidence in the sector's disruptive potential.

- Blockchain Adoption: A 2024 survey found that over 60% of insurers are exploring or piloting blockchain solutions for improved data security and process automation.

- IoT in Insurance: Usage-based insurance, powered by IoT, is projected to grow significantly, with estimates suggesting it could account for over 20% of the auto insurance market by 2028.

- Smart Contract Efficiency: Early adopters of smart contracts in claims processing have reported reductions in payout times by as much as 40%.

Cybersecurity Technologies

As Cincinnati Financial's digital footprint grows, so does the critical need for advanced cybersecurity measures. The company's commitment to investing in cutting-edge security technologies is paramount for safeguarding sensitive customer information against evolving cyber threats.

Protecting against data breaches and maintaining customer trust are core objectives. In 2023, the global average cost of a data breach reached $4.45 million, highlighting the substantial financial and reputational risks. Cincinnati Financial's proactive stance on cybersecurity is therefore a key factor in its operational resilience and market standing.

Key cybersecurity investments for Cincinnati Financial likely include:

- AI-powered threat detection: Utilizing artificial intelligence to identify and respond to sophisticated cyberattacks in real-time.

- Advanced encryption: Implementing robust encryption protocols to secure data both in transit and at rest.

- Zero-trust architecture: Adopting a security model that verifies every access attempt, regardless of origin, to minimize the attack surface.

- Regular security audits and penetration testing: Proactively identifying vulnerabilities through simulated attacks to strengthen defenses.

Technological advancements are revolutionizing insurance, with AI and machine learning offering significant gains in efficiency and accuracy for Cincinnati Financial. The global AI in insurance market was valued at roughly $10.5 billion in 2024, underscoring the industry's embrace of these tools for better underwriting and claims processing.

Digital transformation is a key focus, with insurers like Cincinnati Financial enhancing digital capabilities for customer interactions and claims management; property and casualty insurers saw increased digital adoption in 2023. Investing in user-friendly digital platforms and mobile applications is crucial for meeting customer expectations and improving operational efficiency.

The insurtech sector presents both competitive challenges and collaborative opportunities, with global insurtech funding reaching about $11.5 billion in 2023. Innovations like blockchain and smart contracts offer enhanced transparency and efficiency, while IoT devices enable usage-based insurance models, which are projected to capture over 20% of the auto insurance market by 2028.

Cybersecurity is paramount as Cincinnati Financial's digital presence expands, with the global average cost of a data breach reaching $4.45 million in 2023. Proactive investment in AI-powered threat detection, advanced encryption, and zero-trust architecture is essential for safeguarding data and maintaining customer trust.

| Technology Area | 2024/2025 Data Point | Impact for Cincinnati Financial |

|---|---|---|

| AI & Machine Learning | Global AI in insurance market ~ $10.5 billion (2024) | Improved underwriting accuracy, claims processing efficiency |

| Digital Transformation | Increased digital adoption in P&C insurance (2023) | Enhanced customer experience, streamlined operations |

| Insurtech Funding | Global insurtech funding ~ $11.5 billion (2023) | Opportunities for partnerships, competitive pressure |

| IoT in Insurance | Usage-based insurance ~ 20% of auto market by 2028 | New product development, real-time risk assessment |

| Cybersecurity Costs | Global average data breach cost ~ $4.45 million (2023) | Necessity for robust security investments, data protection |

Legal factors

Cincinnati Financial navigates a fragmented U.S. insurance landscape governed by state-specific regulations covering everything from licensing and solvency to market conduct and product approvals. This necessitates a robust compliance infrastructure to manage varying requirements across its operating territories.

The National Association of Insurance Commissioners (NAIC) significantly shapes these regulations by developing model laws and guidelines, many of which are adopted by individual states. For instance, the NAIC's Solvency Modernization Initiative, ongoing since its inception, influences capital requirements and risk management practices that Cincinnati Financial must adhere to.

Cincinnati Financial, like all financial institutions, faces increasing scrutiny under data privacy laws. The General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S. are prime examples of this trend, impacting how customer data is handled globally. In 2024, regulatory bodies continued to emphasize stringent data protection, with fines for non-compliance reaching millions of dollars for some companies.

Compliance with these evolving privacy protections is not just about avoiding penalties; it's fundamental to maintaining consumer trust. A data breach or misuse of personal information can severely damage Cincinnati Financial's reputation. As of early 2025, reports indicate a continued rise in cyber threats targeting financial data, making robust privacy measures a critical operational necessity.

The insurance sector, including companies like Cincinnati Financial, faces significant litigation risks. These can range from standard claims disputes and class-action lawsuits to newer challenges such as climate change-related litigation and claims involving per- and polyfluoroalkyl substances (PFAS). These legal battles can directly affect financial performance and a company's public image.

For instance, in 2023, the insurance industry continued to see a rise in complex litigation. While specific figures for Cincinnati Financial's litigation expenses for the most recent periods are proprietary, the broader industry's exposure to such claims underscores the importance of robust legal risk management. The potential for large settlements or judgments means that proactive legal defense and compliance are crucial for maintaining stability and profitability.

Artificial Intelligence (AI) Regulation

As artificial intelligence (AI) becomes more integrated into financial services, regulatory bodies are increasing their focus on AI governance and potential biases. Cincinnati Financial must stay abreast of these evolving legal frameworks, particularly concerning the ethical and equitable deployment of AI in core functions like underwriting and claims handling.

The landscape of AI regulation is rapidly changing, with a significant push for transparency and accountability in algorithmic decision-making. For instance, the European Union's AI Act, expected to be fully implemented by 2025, categorizes AI systems by risk, imposing stricter requirements on high-risk applications, which could include insurance underwriting tools.

- Data Privacy Compliance: Navigating regulations like GDPR and CCPA, which govern how customer data used to train AI models is collected, stored, and processed, is crucial.

- Algorithmic Fairness and Bias Mitigation: Ensuring AI models do not perpetuate or amplify existing societal biases in areas like pricing or risk assessment is a key legal and ethical imperative.

- Transparency and Explainability: Regulators are increasingly demanding that AI systems' decision-making processes be understandable, especially when they impact consumers.

- Sector-Specific Guidelines: Anticipating and adapting to potential AI-specific regulations within the insurance industry, which may emerge from bodies like the NAIC in the US, is vital for compliance.

Consumer Protection Laws

Consumer protection laws are a significant legal factor for Cincinnati Financial. These regulations govern everything from how policies are sold and premiums are set to how claims are handled, ensuring fair treatment for policyholders. For instance, laws mandating clear disclosure of policy terms and conditions are crucial for building trust and avoiding disputes. In 2024, the insurance industry continued to see regulatory scrutiny focused on transparency and accessibility in consumer interactions.

Adherence to these consumer protection statutes is not just a matter of compliance but is fundamental to Cincinnati Financial's market conduct and long-term customer satisfaction. Violations can lead to substantial fines and reputational damage, impacting the company's ability to attract and retain clients. The National Association of Insurance Commissioners (NAIC) regularly updates model laws and guidelines that influence state-level consumer protection frameworks, impacting insurers nationwide.

Key areas of consumer protection legislation impacting Cincinnati Financial include:

- Disclosure Requirements: Mandating clear and understandable information about policy coverage, exclusions, and costs.

- Fair Claims Practices: Prohibiting unfair or deceptive practices in the investigation and settlement of insurance claims.

- Rate Regulation: Oversight of premium adjustments to ensure they are not unfairly discriminatory or excessive.

- Privacy Protections: Safeguarding sensitive customer data collected during insurance transactions.

Cincinnati Financial operates within a complex web of state and federal laws that directly impact its business operations, from product development to claims handling. These legal frameworks are dynamic, requiring continuous adaptation and robust compliance strategies.

The company must adhere to stringent solvency requirements, market conduct regulations, and product approval processes that vary significantly by state. For instance, in 2024, many states continued to refine their cybersecurity regulations for insurers, impacting data handling and breach notification protocols.

Litigation risk remains a significant legal factor, with potential for class-action lawsuits and claims related to emerging issues like climate change and environmental liabilities. In 2023, the insurance industry faced increased litigation costs overall, underscoring the need for proactive legal defense and risk management.

As AI adoption grows, Cincinnati Financial must navigate evolving legal landscapes concerning data privacy, algorithmic fairness, and transparency. The EU's AI Act, with full implementation anticipated by 2025, sets a precedent for stricter regulations on high-risk AI applications, potentially influencing U.S. approaches to AI in insurance.

Environmental factors

Cincinnati Financial, like all insurers, faces escalating costs from climate change. The increasing frequency and intensity of events like wildfires, hurricanes, and floods directly translate to higher property and casualty claims. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate weather and climate disasters each exceeding $1 billion in damages, a record number of billion-dollar disasters. This trend puts pressure on insurers to raise premiums and, in some instances, re-evaluate their exposure in highly vulnerable regions.

Cincinnati Financial, like many in the insurance sector, is navigating a landscape where environmental, social, and governance (ESG) factors increasingly shape investor choices and public perception. The company is likely feeling pressure to integrate more sustainable practices into its operations and investment portfolios.

A key aspect of this is assessing and disclosing its exposure to climate-related risks, a growing concern for insurers. For instance, in 2024, the insurance industry as a whole saw significant losses attributed to extreme weather events, underscoring the financial implications of environmental shifts.

Resource scarcity and supply chain disruptions, often exacerbated by extreme weather events, directly affect the cost and availability of materials for property repairs. For Cincinnati Financial, this translates into potentially higher claims payouts and longer timelines for settling property damage claims, impacting profitability and customer satisfaction.

In 2024, the insurance industry, including companies like Cincinnati Financial, faced rising costs for construction materials. For instance, lumber prices, a key component in property repairs, saw significant fluctuations throughout the year, driven by supply chain bottlenecks and demand. This directly impacts the indemnity costs associated with property insurance policies.

Pollution and Environmental Liability

Cincinnati Financial faces significant exposure from pollution and environmental liabilities within its commercial insurance lines. The company must meticulously assess and price these risks, as evolving regulations and emerging scientific understanding can expand the definition and scope of environmental accountability. For instance, as of late 2024, the increasing focus on per- and polyfluoroalkyl substances (PFAS) contamination is creating new avenues for liability claims, impacting businesses across various sectors and, by extension, their insurers.

The company's underwriting and claims management processes need to be robust enough to handle the complexities of environmental exposures. This includes staying abreast of legislative changes and scientific advancements that could redefine what constitutes a reportable incident or a compensable environmental damage. The potential for unforeseen environmental events and the long-tail nature of many pollution claims necessitate conservative reserving and proactive risk mitigation strategies.

- Regulatory Scrutiny: Increased government oversight on environmental compliance, particularly concerning emissions and waste disposal, can lead to higher premiums for insured businesses and potential claims for non-compliance.

- Climate Change Impact: Extreme weather events, exacerbated by climate change, can trigger or worsen pollution incidents, such as chemical spills from damaged facilities, creating new underwriting challenges.

- Litigation Trends: Evolving legal interpretations of environmental laws and a growing public awareness of environmental issues contribute to a dynamic litigation landscape, potentially increasing claim frequency and severity.

- Scientific Advancements: New research identifying previously unknown environmental hazards or refining methods for detecting contamination can broaden the scope of existing liabilities for Cincinnati Financial.

Geographical Risk Exposure

Cincinnati Financial's geographical risk exposure is a critical environmental factor. The company's concentration of insured properties in regions susceptible to specific environmental hazards, such as coastal areas facing hurricane risks or drier zones prone to wildfires, directly influences its potential for climate-related losses.

For instance, during the 2023 hurricane season, the Southeast US experienced significant storm activity, impacting insurers with substantial claims. Cincinnati Financial's portfolio in these areas would have been directly affected.

Strategic adjustments to coverage terms and pricing in these high-risk geographical zones are becoming increasingly vital for managing potential environmental impacts on the company's financial performance.

- Coastal Exposure: Properties insured in hurricane-prone coastal regions represent a significant concentration of risk.

- Wildfire Zones: Insured assets in arid or drought-prone areas face elevated wildfire risks.

- Climate Change Impact: Increasing frequency and severity of extreme weather events due to climate change heighten these geographical risks.

- Reinsurance Strategies: Geographical risk concentration necessitates robust reinsurance strategies to mitigate large-scale losses.

Cincinnati Financial faces significant financial implications from climate change, with an increasing number of billion-dollar weather disasters in the U.S. impacting claims. The company's exposure to environmental liabilities, particularly concerning pollution and emerging contaminants like PFAS, necessitates careful risk assessment and pricing. Furthermore, its geographical concentration of insured properties in high-risk areas like coastal regions and wildfire zones requires strategic adjustments to coverage and robust reinsurance.

PESTLE Analysis Data Sources

Our PESTLE analysis for Cincinnati Financial is built on a robust foundation of data from reputable sources. We utilize reports from financial regulatory bodies, economic indicators from government agencies, and industry-specific market research to ensure comprehensive insights.