Cincinnati Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cincinnati Financial Bundle

Unlock the full strategic blueprint behind Cincinnati Financial's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Independent insurance agencies are the bedrock of Cincinnati Financial's distribution strategy. These partnerships are vital for bringing their diverse insurance offerings, from commercial policies to personal lines, directly to customers. In 2024, these agencies continued to be the primary interface for policyholders, underscoring their importance in sales and customer service.

Cincinnati Financial is committed to nurturing these relationships and actively recruits new agencies to broaden its market presence. This focus on agency development is key to maintaining and growing its customer base across all product lines.

Reinsurance providers are crucial partners for Cincinnati Financial, enabling them to transfer a portion of their underwriting risk, especially for substantial or catastrophic events. This risk-sharing mechanism is fundamental to their strategy for managing exposure and maintaining financial resilience, ensuring they can consistently meet their obligations to policyholders.

In 2023, Cincinnati Financial's property casualty insurance segment saw its combined ratio improve to 90.4%, partly due to effective reinsurance arrangements that cushioned the impact of large losses. The availability and cost of reinsurance directly influence their capacity to underwrite a broad range of risks and remain competitive in the insurance market.

Cincinnati Financial actively cultivates partnerships with leading technology and data analytics firms. These collaborations are crucial for refining underwriting models and ensuring competitive pricing in the dynamic insurance market. For instance, in 2024, the company continued to integrate advanced analytics to better predict risk, aiming to improve loss ratios.

By leveraging automation and artificial intelligence through these partnerships, Cincinnati Financial enhances the speed and accuracy of claims processing. This focus on operational efficiency, supported by robust data analytics, is vital for maintaining a competitive edge. In 2024, investments in AI-driven claims assessment tools were a significant part of this strategy.

Asset Management Service Providers

Cincinnati Financial utilizes external asset management service providers to complement its in-house capabilities, particularly for specialized investment strategies or to broaden its investment diversification. These collaborations are crucial for optimizing investment income, a key driver of the company's financial performance.

In 2023, Cincinnati Financial's investment income played a substantial role in its profitability. The company reported significant earnings from its investment portfolio, underscoring the importance of effective asset management, whether internal or external.

- Diversification: External managers offer access to niche markets and strategies not always covered by internal teams.

- Specialization: Partnerships leverage expertise in areas like alternative investments or specific geographic regions.

- Risk Management: Collaborating with multiple providers can help spread investment risk across different management styles and asset classes.

- Performance Enhancement: Strategic use of external managers can boost overall portfolio returns, contributing to robust investment income.

Legal and Regulatory Compliance Partners

Cincinnati Financial relies on legal and regulatory compliance partners to navigate the insurance industry's intricate landscape. These alliances are crucial for staying compliant with diverse state and federal laws, which is fundamental to maintaining operational integrity.

These partnerships are essential for managing litigation risks and ensuring adherence to evolving regulatory requirements. For instance, in 2024, the insurance sector continued to see increased scrutiny on data privacy and cybersecurity, making expert legal counsel indispensable.

- Legal Counsel: Providing guidance on policy language, contract disputes, and corporate governance.

- Regulatory Consultants: Ensuring compliance with state insurance departments and federal regulations.

- Risk Management Specialists: Identifying and mitigating legal and compliance-related risks.

- Compliance Software Providers: Implementing tools to track and manage regulatory adherence.

Cincinnati Financial's key partnerships are primarily with independent insurance agencies, which serve as its main distribution channel. These agencies are crucial for reaching customers across various insurance lines, from personal auto to complex commercial risks. In 2024, the company continued to strengthen these relationships, recognizing their pivotal role in sales and client servicing.

Reinsurance partners are essential for managing underwriting risk, particularly for large or catastrophic events. This risk-sharing allows Cincinnati Financial to maintain financial stability and underwriting capacity. For example, in 2023, the company's property casualty segment benefited from reinsurance, contributing to a combined ratio of 90.4%.

Collaborations with technology and data analytics firms are vital for enhancing underwriting accuracy and operational efficiency. These partnerships support the integration of advanced analytics and AI tools, as seen in 2024 with investments in AI-driven claims assessment, aiming to improve loss ratios and claims processing speed.

External asset managers are engaged to optimize investment income and diversify the company's portfolio. These relationships provide access to specialized strategies and expertise, contributing to the robust investment earnings that bolstered Cincinnati Financial's profitability in 2023.

| Key Partnership Type | Role | 2023/2024 Impact Example |

|---|---|---|

| Independent Insurance Agencies | Distribution & Customer Interface | Primary sales and service channel for all product lines. |

| Reinsurance Providers | Risk Transfer & Capacity | Helped manage large losses, contributing to a 90.4% P&C combined ratio in 2023. |

| Technology & Data Analytics Firms | Underwriting & Operational Efficiency | Integration of AI for claims processing and advanced risk modeling in 2024. |

| External Asset Managers | Investment Optimization & Diversification | Contributed to strong investment income supporting overall profitability in 2023. |

What is included in the product

A detailed, pre-written business model for Cincinnati Financial, outlining its customer segments, value propositions, and channels, all grounded in its established market strategy.

This model provides a clear, narrative-driven overview of Cincinnati Financial's operations, designed for informed decision-making and analysis of its competitive landscape.

Cincinnati Financial's Business Model Canvas provides a clear, structured overview, simplifying complex strategies into an easily digestible format for rapid assessment and strategic alignment.

Activities

Underwriting and policy issuance form the bedrock of Cincinnati Financial's operations, involving the meticulous assessment of risk across diverse insurance segments. This includes evaluating applications for commercial, personal, life, and specialized excess and surplus lines coverage to determine appropriate terms and premiums.

In 2023, Cincinnati Financial's disciplined underwriting approach contributed to a strong performance. For instance, their property casualty combined ratio, a key indicator of underwriting profitability, stood at an impressive 87.1%, reflecting effective risk selection and pricing.

This core activity is crucial for profitability, as sound judgment combined with data analytics allows the company to manage its risk exposure effectively and ensure the long-term viability of its insurance products.

Cincinnati Financial's claims management and service is central to its strategy, focusing on delivering fast, fair, and empathetic support to policyholders. This core activity involves efficient claim processing, thorough investigation of incidents, and ensuring prompt, equitable settlements, which is crucial for attracting and retaining desirable business.

In 2023, Cincinnati Financial demonstrated its commitment to service excellence with a strong claims satisfaction rating. The company processed a significant volume of claims across its various lines of business, maintaining a claims expense ratio that reflects effective cost management while prioritizing policyholder experience.

Cincinnati Financial's investment management is a core activity, managing a vast portfolio that significantly contributes to its revenue. This involves carefully allocating assets, diversifying across various investment types, and actively managing both fixed-income securities and equities to enhance returns and ensure financial stability.

In 2024, Cincinnati Financial's investment income played a crucial role in its overall profitability. For instance, their substantial holdings in fixed-maturity securities and equities are managed with a focus on generating consistent income and capital appreciation, directly supporting their insurance operations and overall financial health.

Agency Relationship Management and Expansion

Cincinnati Financial actively cultivates and expands its network of independent insurance agencies, recognizing them as a cornerstone of its distribution. This involves a strategic approach to appointing new partners and nurturing existing relationships.

The company provides comprehensive support and resources to these agencies, aiming to foster effective collaboration. This support is crucial for driving growth in net written premiums and increasing overall market share.

- Agency Appointment and Growth: Cincinnati Financial focuses on identifying and onboarding new, high-quality independent agencies to broaden its reach.

- Partnership Support: The company offers ongoing training, marketing assistance, and product expertise to help agency partners succeed.

- Performance Monitoring: Key metrics are tracked to ensure agencies are meeting performance expectations and contributing to premium growth.

- Market Penetration: By strengthening agency relationships, Cincinnati Financial aims to deepen its penetration in existing markets and enter new ones.

In 2024, Cincinnati Financial continued to emphasize this agency-centric model, which has historically been a key driver of its consistent performance and expansion.

Product Development and Diversification

Cincinnati Financial actively pursues product development and diversification to cater to changing customer demands and seize market opportunities. This includes expanding its insurance offerings and broadening its geographic reach.

In 2024, the company continued to refine its product portfolio, focusing on areas with growth potential. This strategic approach helps maintain its competitive edge in the insurance sector.

- Product Innovation: Cincinnati Financial consistently works on creating new insurance products and enhancing existing ones to meet the evolving needs of its diverse customer base.

- Geographic Expansion: The company strategically expands into new territories, allowing it to tap into fresh markets and serve a wider range of clients.

- Capability Enhancement: Ongoing investment in developing new capabilities, such as advanced data analytics for underwriting, strengthens its service offerings and operational efficiency.

- Market Responsiveness: By diversifying its products and presence, Cincinnati Financial ensures it remains relevant and adaptable to shifts in customer preferences and economic conditions.

Cincinnati Financial’s key activities revolve around its core insurance operations and strategic growth initiatives. These include meticulous underwriting and policy issuance, efficient claims management, and robust investment management to ensure financial stability and profitability.

The company also focuses on cultivating its network of independent insurance agencies, which serve as a vital distribution channel, and actively engages in product development and diversification to adapt to market changes and customer needs.

In 2024, Cincinnati Financial continued to leverage these activities, with a particular emphasis on strengthening agency relationships and enhancing its product offerings to drive premium growth and market penetration.

| Key Activity | Description | 2024 Data/Focus |

| Underwriting & Policy Issuance | Assessing risk and issuing insurance policies across various lines. | Disciplined underwriting to maintain profitability; focus on risk selection. |

| Claims Management & Service | Processing and settling claims efficiently and fairly. | Prioritizing policyholder experience and effective cost management in claims handling. |

| Investment Management | Managing a diverse investment portfolio to generate income and capital appreciation. | Generating consistent income from fixed-income securities and equities to support insurance operations. |

| Agency Network Cultivation | Building and supporting relationships with independent insurance agencies. | Strengthening partnerships to drive premium growth and expand market reach. |

| Product Development & Diversification | Creating new insurance products and expanding into new markets. | Refining product portfolio to capitalize on growth opportunities and maintain competitiveness. |

Preview Before You Purchase

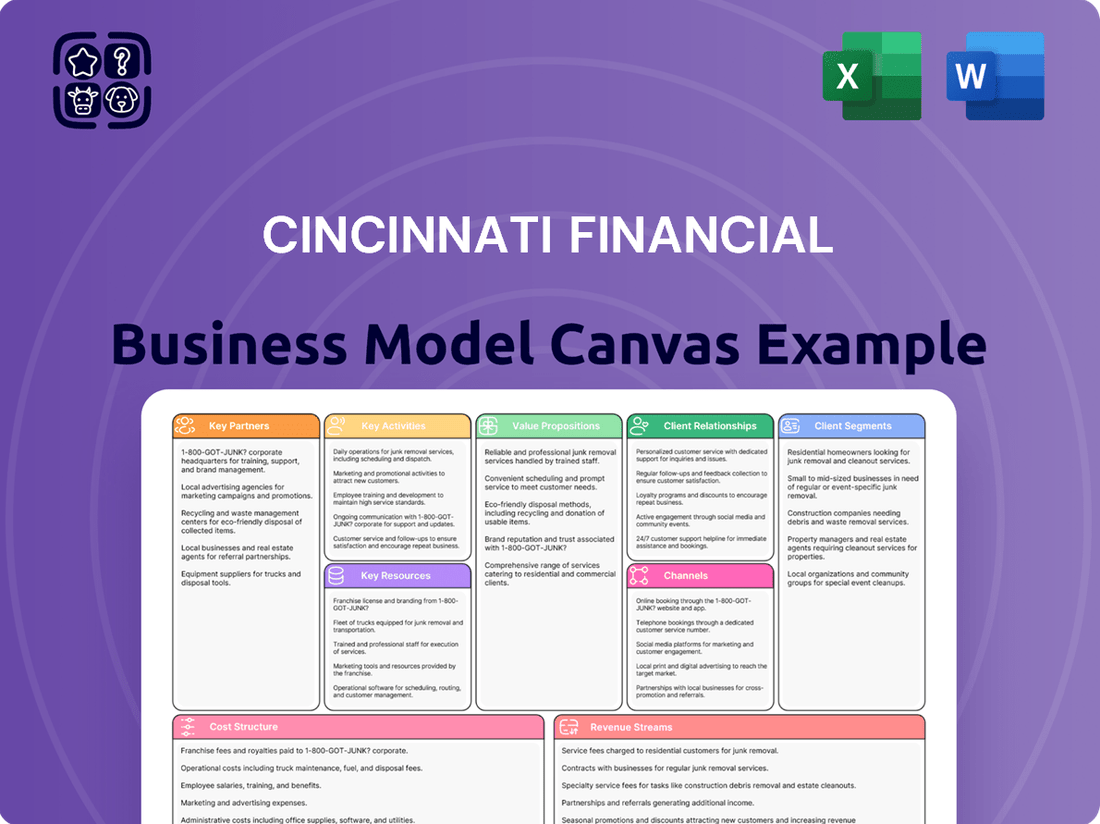

Business Model Canvas

The Cincinnati Financial Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You can confidently assess the quality and completeness of the Business Model Canvas before committing to your purchase.

Resources

Cincinnati Financial's substantial financial capital and diversified investment portfolio are crucial for its operations. This financial strength allows the company to effectively manage claims and generate considerable investment income, providing a stable foundation for its business.

As of December 31, 2024, Cincinnati Financial reported consolidated cash and total investments exceeding $29 billion. This significant figure highlights the company's robust financial resources, which are fundamental to its ability to absorb potential losses and maintain operational stability.

Cincinnati Financial's extensive network of independent insurance agencies is a cornerstone of its business model, acting as its primary distribution channel. These agencies are crucial for reaching local markets and building deep client relationships, providing a significant competitive edge.

In 2024, this network continues to be a vital asset, enabling Cincinnati Financial to effectively serve a broad customer base. The company's reliance on these professional partnerships underscores their importance in driving sales and customer loyalty.

Cincinnati Financial's success hinges on its highly skilled workforce. This includes expert underwriters who accurately assess risk, claims adjusters who efficiently manage payouts, and investment professionals who grow the company's assets. In 2023, the company reported a robust employee retention rate, indicating the value placed on its experienced talent pool.

The depth of expertise across various departments, from underwriting to claims handling and investment management, directly translates into superior customer service and operational efficiency. This talent is crucial for maintaining strong client relationships and achieving strategic objectives in a competitive insurance market.

Proprietary Underwriting and Pricing Models

Cincinnati Financial leverages advanced underwriting and pricing models as a core proprietary resource. These sophisticated methods, which may incorporate telematics and usage-based insurance data, are fundamental to achieving accurate pricing and driving underwriting profit. This intellectual capital directly fuels the company's competitive edge in the insurance market.

The effectiveness of these models is evident in their contribution to financial performance. For instance, in 2024, Cincinnati Financial reported a robust combined ratio, a key indicator of underwriting profitability, demonstrating the power of their refined pricing strategies.

- Advanced Analytics: Utilizes proprietary algorithms for risk assessment and premium calculation.

- Usage-Based Insurance (UBI): Incorporates telematics data to tailor premiums based on driving behavior, enhancing fairness and accuracy.

- Pricing Accuracy: These models are designed to reflect true risk, minimizing adverse selection and maximizing profitability.

- Competitive Advantage: Differentiates Cincinnati Financial by offering more precise and potentially attractive pricing to policyholders.

Technology Infrastructure and Data Systems

Cincinnati Financial’s technology infrastructure and data systems are the backbone of its operations, enabling seamless policy administration and claims processing. These systems are crucial for maintaining efficiency and ensuring the security of sensitive customer data.

The company’s commitment to modernization is evident in its adoption of advanced technologies. For instance, in 2023, Cincinnati Financial continued to invest in cloud-based solutions to enhance scalability and data accessibility, supporting its growing digital footprint.

Further strengthening its operational effectiveness, Cincinnati Financial leverages data analytics and artificial intelligence. These tools help in risk assessment, fraud detection, and personalized customer service, driving better business outcomes.

- Cloud Adoption: Facilitates scalable and secure data storage, improving operational agility.

- AI and Analytics: Enhances risk management, claims efficiency, and customer insights.

- Data Security: Protects sensitive information, building trust and compliance.

- Operational Efficiency: Streamlines policy administration and claims handling through robust systems.

Cincinnati Financial's key resources include its significant financial capital, an extensive network of independent insurance agencies, a highly skilled workforce, advanced underwriting and pricing models, and a robust technology infrastructure. These elements collectively underpin its operational stability, market reach, and competitive advantage.

As of December 31, 2024, the company's consolidated cash and total investments surpassed $29 billion, demonstrating substantial financial backing. This financial strength enables effective claims management and robust investment income generation, crucial for sustained operations and growth.

| Resource Category | Key Components | 2024 Data/Impact |

|---|---|---|

| Financial Capital | Cash and Investments | >$29 billion (as of Dec 31, 2024) |

| Distribution Network | Independent Insurance Agencies | Primary channel, driving sales and client relationships |

| Human Capital | Skilled Underwriters, Claims Adjusters, Investment Professionals | High retention rate (2023), driving efficiency and service |

| Intellectual Capital | Advanced Underwriting & Pricing Models (incl. UBI) | Contributed to strong combined ratio (2024), enhancing profitability |

| Technology & Data | Cloud Infrastructure, AI, Data Analytics | Continued investment (2023) in cloud solutions, improving scalability and data access |

Value Propositions

Cincinnati Financial's comprehensive insurance coverage is a cornerstone of its value proposition, offering a wide array of products designed to meet diverse needs. This includes robust commercial lines for businesses, personal lines for individuals, and specialized excess and surplus lines for unique risks.

Further expanding its reach, Cincinnati Financial also provides life insurance and fixed annuities, creating a holistic financial security offering. In 2023, the company reported strong performance across its segments, with property casualty combined ratio improving to 90.6%, indicating effective underwriting and claims management, which supports the value of its broad coverage.

Cincinnati Financial's commitment to its network of independent insurance agencies is a cornerstone of its business model, ensuring that decisions are made locally. This approach empowers agents with the knowledge and authority to provide personalized service, directly benefiting policyholders with solutions tailored to their specific needs and local market conditions.

This agent-centered strategy fosters strong relationships built on trust and loyalty, as policyholders receive dedicated support from professionals who understand their community. In 2024, Cincinnati Financial continued to emphasize this partnership, recognizing that local expertise is key to delivering exceptional value and maintaining a competitive edge in the insurance industry.

Cincinnati Financial's robust financial strength, bolstered by a significant investment portfolio, offers a bedrock of security for its policyholders and investors. This financial muscle directly translates into the company's unwavering capacity to meet its obligations, ensuring timely claims payments and long-term stability.

In 2023, Cincinnati Financial reported total investments of $32.6 billion, a testament to its prudent asset management. This substantial portfolio, combined with a history of consistent profitability, underpins the trust placed in the company by its diverse customer base and shareholders alike.

Fast, Fair, and Empathetic Claims Service

Cincinnati Financial's core value proposition centers on delivering claims service that is not only fast and fair but also deeply empathetic. This focus is designed to offer customers a sense of security and reassurance, particularly during stressful situations.

This dedication to superior claims handling directly contributes to enhanced customer loyalty and retention. By prioritizing a positive experience during a critical touchpoint, Cincinnati Financial builds trust and strengthens its brand reputation.

In 2024, the company's commitment to this value proposition is evident in its operational efficiency and customer feedback. For instance, Cincinnati Financial consistently aims for:

- Prompt resolution of claims

- Fair and transparent claim assessments

- Compassionate communication throughout the claims process

Tailored Solutions for Diverse Needs

Cincinnati Financial leverages its independent agency network to craft insurance policies that precisely match the unique needs of a broad client base. This approach allows for highly personalized coverage, whether for a burgeoning small business or an individual with substantial assets.

This adaptability means clients receive insurance that truly fits their situation, rather than a one-size-fits-all product. For example, in 2024, Cincinnati Financial's commercial lines likely continued to see strong demand for tailored property and casualty coverage, reflecting diverse industry risks.

- Customization for Small Businesses: Offering policies that adapt to evolving operational risks and asset values.

- High-Net-Worth Solutions: Providing specialized coverage for unique personal property and liability exposures.

- Independent Agency Advantage: Enabling agents to act as trusted advisors, understanding and recommending the best-fit solutions.

- Risk-Specific Underwriting: Ensuring that premiums and coverage accurately reflect the distinct risk profiles of each client.

Cincinnati Financial's value proposition is built on providing comprehensive insurance solutions through a trusted network of independent agents. This strategy ensures personalized service and local expertise, allowing for tailored policies that meet diverse customer needs, from small businesses to high-net-worth individuals.

The company's financial strength, evidenced by its substantial investment portfolio, provides a bedrock of security and capacity for claims payments. This financial stability, coupled with a commitment to superior, empathetic claims service, fosters strong customer loyalty and reinforces the brand's reputation for reliability.

Cincinnati Financial's dedication to its independent agency channel in 2024 continues to be a key differentiator, enabling customized risk-specific underwriting and policy creation. This focus on local knowledge and tailored solutions ensures clients receive insurance that accurately reflects their unique circumstances and risk profiles.

| Value Proposition Element | Description | Supporting Data/Fact (as of 2023/2024 estimates) |

|---|---|---|

| Comprehensive Insurance Coverage | Wide array of products for commercial, personal, life, and specialized risks. | Property casualty combined ratio improved to 90.6% in 2023, indicating underwriting efficiency. |

| Independent Agency Network | Local decision-making and personalized service from knowledgeable agents. | Continued emphasis on agent partnerships in 2024 to deliver tailored solutions. |

| Financial Strength & Stability | Robust investment portfolio backing claims payments and long-term security. | Total investments of $32.6 billion in 2023. |

| Superior Claims Service | Fast, fair, and empathetic claims handling to build trust and loyalty. | Focus on prompt resolution, transparent assessments, and compassionate communication. |

| Policy Customization | Tailored insurance solutions for specific client needs and risk profiles. | Adaptability for small businesses and high-net-worth individuals, with strong demand for tailored commercial lines in 2024. |

Customer Relationships

Cincinnati Financial's customer relationships are deeply rooted in its dedicated network of independent insurance agents. These agencies serve as the primary conduit, acting as trusted advisors who build and maintain direct, localized connections with policyholders.

This model emphasizes personalized service and long-term partnerships. In 2024, Cincinnati Financial continued to rely on this established network, which is crucial for understanding and meeting the diverse needs of its customer base across various regions.

Cincinnati Financial’s independent agent network is a cornerstone of its customer relationships, offering policyholders personalized service and localized support. This strategy ensures clients receive advice tailored to their specific needs, fostering a deeper connection and boosting loyalty.

In 2024, this personalized approach continued to resonate, contributing to Cincinnati Financial's strong customer retention rates. The emphasis on local agents means policyholders have accessible points of contact who understand their community and individual circumstances, a key differentiator in the insurance market.

Cincinnati Financial’s customer relationships are deeply rooted in its claims service excellence. The company prioritizes fast, fair, and empathetic handling of claims, which is crucial when policyholders are experiencing difficult times.

This commitment to efficient and compassionate claims processing directly builds trust and reinforces Cincinnati Financial's reputation as a reliable partner. For instance, in 2023, the company reported a strong claims satisfaction score, reflecting this dedication.

Proactive Communication and Engagement

Cincinnati Financial prioritizes proactive communication to build strong relationships with its agents and policyholders. This includes regular updates on policy changes, new services, and relevant market trends, fostering transparency and keeping clients informed.

This consistent engagement ensures clients feel valued and understand the ongoing support they receive. For instance, in 2024, Cincinnati Financial continued its tradition of providing agents with detailed market analysis and educational resources to better serve policyholders.

Key aspects of their proactive engagement include:

- Regularly scheduled agent training sessions focusing on product updates and customer service best practices.

- Timely policyholder notifications regarding renewals, claims processing, and available discounts.

- Dissemination of market insights and industry news through dedicated newsletters and online portals.

- Dedicated support channels for agents and policyholders to address inquiries promptly.

Long-Term Partnership Approach

Cincinnati Financial cultivates enduring relationships by viewing insurance as an ongoing necessity, not a one-time transaction. This philosophy underpins their commitment to providing stable, dependable service over many years.

Their strategy focuses on consistent engagement and proactive adaptation to changing customer requirements. This ensures they remain a valuable and reliable partner throughout the customer lifecycle.

- Long-Term Vision: Cincinnati Financial prioritizes building lasting connections, understanding that customer needs evolve over time.

- Consistent Service: They are dedicated to delivering reliable service, fostering trust and continuity for their policyholders.

- Adaptability: The company actively adjusts its offerings and support to meet the dynamic needs of its customer base.

- Agent Reliability: Cincinnati Financial strives to be a consistent and dependable market for its network of agents, supporting their long-term business success.

Cincinnati Financial's customer relationships are built on personalized service through its extensive network of independent insurance agents, who act as trusted local advisors. This model fosters long-term partnerships by offering tailored advice and support, which is crucial for meeting diverse customer needs. In 2024, this approach continued to drive strong customer retention, highlighting the value of localized expertise.

The company also emphasizes exceptional claims service, prioritizing fast, fair, and empathetic handling to build trust during difficult times. Proactive communication, including regular updates and market insights shared with agents and policyholders, further strengthens these bonds. Cincinnati Financial views insurance as an ongoing partnership, consistently adapting its services to meet evolving customer requirements.

| Customer Relationship Aspect | Description | 2024 Focus/Impact |

|---|---|---|

| Independent Agent Network | Primary channel for personalized service and local support. | Continued reliance for localized advice and strong customer connections. |

| Claims Service Excellence | Fast, fair, and empathetic claims handling. | Key driver of trust and reinforcing the company's reliable partner image. |

| Proactive Communication | Regular updates, market insights, and educational resources. | Fostering transparency and keeping clients informed and valued. |

| Long-Term Partnership Philosophy | Viewing insurance as an ongoing necessity, not a one-time transaction. | Commitment to stable, dependable service and adaptability to customer needs. |

Channels

Independent insurance agencies are the backbone of Cincinnati Financial's distribution strategy, acting as the primary channel for reaching customers. These agencies are crucial for selling and servicing a wide array of products, including commercial, personal, life, and surplus lines insurance.

In 2024, Cincinnati Financial continued to leverage this vast network, which is instrumental in their market penetration across numerous states. This established agency system allows for localized expertise and customer relationships, a key differentiator in the insurance market.

Cincinnati Financial's business model heavily relies on its network of independent agents for direct engagement with policyholders. These agents are crucial for policy service, claims handling, and building lasting customer relationships, ensuring a consistent and high-quality experience that underpins the company's customer-centric approach.

In 2024, Cincinnati Financial continued to emphasize this agent-centered strategy. This approach allows for personalized service and expert advice, distinguishing them in the insurance market. The company provides extensive support and resources to its agents, empowering them to effectively manage policyholder needs and foster loyalty.

Cincinnati Financial leverages a robust online presence, featuring an investor relations website that acts as a primary channel for disseminating financial reports and company updates. This digital hub is crucial for transparency and accessibility for stakeholders, including shareholders and potential investors.

Digital tools are integral to supporting Cincinnati Financial's agency force. These platforms likely streamline client interactions, policy management, and claims processing, enhancing efficiency and service delivery for agents and, by extension, policyholders.

In 2024, companies across the insurance sector are increasingly investing in digital transformation. For instance, many insurers are reporting higher engagement on their investor portals, with traffic often surging around earnings releases and major company announcements, underscoring the importance of these online channels for communication.

Reinsurance Operations (Cincinnati Re and Cincinnati Global Underwriters Ltd.)

Cincinnati Re and Cincinnati Global Underwriters Ltd. are key channels for Cincinnati Financial, enabling participation in the assumed reinsurance market and global specialty underwriting. These operations allow the company to diversify its revenue streams beyond direct insurance and access a wider pool of risks.

Through these channels, Cincinnati Financial can offer specialized insurance products on a global scale, enhancing its competitive position. In 2024, the property and casualty reinsurance segment, which includes these operations, continued to be a significant contributor to the company's overall results, demonstrating the strategic importance of reinsurance in its business model.

- Cincinnati Re: Facilitates the company's assumed reinsurance business, allowing it to take on risks from other insurance companies.

- Cincinnati Global Underwriters Ltd.: Focuses on underwriting specialty risks on a global basis, expanding the company's reach and product diversity.

- Market Participation: These subsidiaries enable Cincinnati Financial to engage with the broader reinsurance market, benefiting from diversification and potential profit opportunities.

- Strategic Importance: Reinsurance operations are crucial for risk management, capital efficiency, and the expansion of underwriting capabilities into new territories and specialized lines of business.

Corporate Communications and Investor Relations

Cincinnati Financial leverages a multi-channel approach for corporate communications and investor relations. This includes disseminating quarterly and annual financial results, strategic updates, and insights into corporate governance through press releases and dedicated investor calls. Their investor relations website serves as a central hub for this information, fostering transparency and engagement with shareholders and the broader financial community.

In 2024, the company continued to emphasize clear communication. For instance, their investor relations portal provides easy access to filings, presentations, and webcasts. This proactive communication strategy is crucial for maintaining investor confidence and facilitating informed decision-making by stakeholders.

- News Releases: Timely dissemination of financial performance and significant corporate events.

- Investor Calls: Quarterly webcasts and conference calls to discuss results and strategy.

- Investor Relations Website: A comprehensive resource for financial reports, presentations, and governance information.

- Shareholder Engagement: Direct communication to foster understanding and trust.

Cincinnati Financial's distribution primarily relies on independent insurance agencies, a strategy that remained central in 2024. These agencies are vital for selling and servicing a broad product range, fostering localized expertise and customer relationships that drive market penetration.

Digital channels, including a robust investor relations website, are key for disseminating financial data and company updates in 2024. This online presence supports transparency and accessibility for stakeholders, complementing the agent network with efficient information flow.

Subsidiaries like Cincinnati Re and Cincinnati Global Underwriters Ltd. serve as crucial channels for assumed reinsurance and global specialty underwriting, diversifying revenue and expanding market reach. These operations contributed significantly to the company's overall results in 2024, highlighting their strategic importance for risk management and growth.

Customer Segments

Small and mid-sized businesses are a cornerstone of Cincinnati Financial's commercial insurance offerings. These enterprises typically require a robust package of property and casualty coverage, encompassing protection for their premises and operations (commercial multi-peril), employee injuries (workers' compensation), and vehicle fleets (commercial auto insurance). In 2024, this segment continued to be a vital part of their growth strategy, with a strong emphasis on providing these essential coverages.

These businesses often depend on the expertise of local, independent insurance agents to navigate their specific risk profiles and secure appropriate, customized coverage. This agent-centric approach allows Cincinnati Financial to effectively serve a diverse array of small and mid-sized enterprises across various industries, ensuring they receive tailored solutions that meet their unique needs.

Individual homeowners and auto owners represent a core customer segment for Cincinnati Financial. This group seeks comprehensive protection for their most valuable personal assets, including their homes and vehicles. The company offers a range of products tailored to these needs, such as homeowner’s insurance, dwelling fire policies, and personal auto coverage.

Beyond basic home and auto protection, Cincinnati Financial also serves individuals needing coverage for other personal property and liability risks. This includes inland marine insurance for items like jewelry or art, personal umbrella liability for enhanced protection, and watercraft insurance for boat owners. In 2024, the personal lines segment continued to be a significant contributor to the company's overall revenue, reflecting the ongoing demand for these essential insurance products among individual consumers.

Cincinnati Financial caters to high-net-worth individuals by offering specialized personal lines insurance. This segment demands comprehensive and customized coverage solutions tailored to their unique asset portfolios and lifestyle needs.

The company's high-net-worth product experienced notable growth in the second quarter of 2025, underscoring its success in attracting and retaining these affluent clients. This growth reflects the increasing demand for sophisticated insurance offerings within this demographic.

Individuals Seeking Life Insurance and Annuities

Cincinnati Financial, through its life insurance subsidiary, caters to individuals prioritizing long-term financial security and protection. This segment is crucial for those planning for the future, seeking coverage against life's uncertainties.

The company offers a comprehensive suite of life insurance products, including term life, whole life, and universal life insurance. These options provide flexibility and varying levels of coverage to meet diverse needs. Additionally, disability income insurance is available, safeguarding against loss of earnings due to illness or injury.

Fixed annuities are also a key offering for this customer segment. These products are designed for individuals focused on accumulating wealth and generating reliable income streams during retirement. In 2024, the life insurance sector continued to see strong demand, with a significant portion of individuals recognizing the importance of these financial planning tools.

- Product Offerings: Term life, whole life, universal life insurance, disability income insurance, and fixed annuities.

- Customer Focus: Individuals engaged in long-term financial planning and seeking robust protection.

- Market Relevance: The demand for life insurance and annuity products remained robust in 2024, reflecting a growing awareness of financial preparedness.

Businesses Requiring Excess and Surplus Lines Coverage

This customer segment is crucial for Cincinnati Financial, encompassing businesses that operate outside the scope of standard insurance offerings. These are often companies with unique operational risks, challenging exposures, or a history that makes them difficult to insure through admitted carriers. Cincinnati Financial steps in to provide essential coverage for these entities, ensuring they have protection for their specialized needs.

Cincinnati Financial's excess and surplus (E&S) lines division, often operating under its subsidiary The Cincinnati Insurance Company, addresses this market. They offer specialized commercial casualty and commercial property insurance policies designed to meet these specific, often complex, risk profiles. This allows businesses with non-standard exposures to obtain the necessary financial protection.

For instance, in 2024, the E&S market continued to demonstrate robust growth, driven by capacity constraints in the standard market and increasing complexity of risks. Cincinnati Financial's participation in this segment allows it to capture premium from businesses that might otherwise be underserved. This strategic focus on specialized risks is a key differentiator.

- Businesses with unique or high-risk profiles: These companies often have operations or assets that fall outside the typical underwriting guidelines of standard insurance markets.

- Need for specialized coverage: Cincinnati Financial provides tailored commercial casualty and commercial property insurance solutions to address these non-standard exposures.

- E&S Market Growth: The excess and surplus lines market saw continued expansion in 2024, with premiums growing significantly, indicating a strong demand for specialized insurance products.

- Risk Mitigation: By offering E&S coverage, Cincinnati Financial enables these businesses to manage their unique risks effectively, ensuring operational continuity.

Cincinnati Financial serves a broad spectrum of customers, from small and mid-sized businesses needing essential property and casualty coverage to individuals seeking protection for their homes and vehicles. The company also caters to high-net-worth individuals with specialized offerings and those prioritizing long-term financial security through life insurance and annuities. Furthermore, they provide crucial coverage for businesses with unique or high-risk profiles through their excess and surplus lines division.

In 2024, the personal lines segment remained a significant revenue contributor, highlighting the consistent demand for homeowner and auto insurance. The life insurance sector also saw strong demand, with many individuals recognizing the importance of financial planning tools like life insurance and annuities for future security. The excess and surplus (E&S) market experienced robust growth in 2024, with premiums increasing significantly, underscoring the need for specialized insurance products for businesses with non-standard exposures.

| Customer Segment | Key Needs | 2024 Market Trend |

|---|---|---|

| Small & Mid-Sized Businesses | Property, Casualty, Workers' Comp, Commercial Auto | Continued vital growth driver for commercial insurance. |

| Individual Homeowners & Auto Owners | Home, Auto, Dwelling Fire, Inland Marine, Umbrella Liability | Significant revenue contributor; ongoing demand for essential products. |

| High-Net-Worth Individuals | Specialized, customized asset and lifestyle protection | Notable growth in Q2 2025, indicating success in attracting affluent clients. |

| Individuals seeking Long-Term Security | Life Insurance (Term, Whole, Universal), Disability Income, Fixed Annuities | Robust demand; growing awareness of financial preparedness. |

| Businesses with Unique/High-Risk Profiles | Specialized Commercial Casualty & Property (E&S) | Robust growth in E&S market; increasing demand for specialized products. |

Cost Structure

Claims and loss adjustment expenses represent Cincinnati Financial's primary cost driver, encompassing all payouts for insured events and the operational costs of managing these claims. This substantial outlay directly reflects the company's core insurance business, covering everything from property damage and liability settlements to life insurance benefits.

In 2023, Cincinnati Financial reported a combined ratio of 92.4%, indicating that for every dollar of premium earned, 92.4 cents were spent on claims and expenses. This metric highlights the significant portion of revenue dedicated to fulfilling policyholder obligations and the efficiency of their claims handling processes.

Underwriting and policy acquisition costs are crucial for Cincinnati Financial, encompassing the expenses tied to evaluating risk and bringing new policies onto their books. These include salaries for their underwriting teams who meticulously assess potential clients and the commissions paid to the independent agencies that are key to their distribution strategy.

In 2024, these costs directly impact the company's ability to grow its premium base. For instance, Cincinnati Financial's reliance on independent agents means a significant portion of these costs are sales commissions, which are essential for incentivizing agency partners to place business with them. Marketing efforts to attract new customers also fall under this umbrella.

Operating and administrative expenses for Cincinnati Financial are crucial for supporting its core insurance and financial services. These costs include salaries and benefits for a significant administrative workforce, alongside expenditures on office spaces, utilities, and the maintenance of robust technology infrastructure necessary for managing policies, claims, and customer service.

In 2023, Cincinnati Financial reported total operating expenses of $5.8 billion. A substantial portion of this was attributed to underwriting and business expenses, which include many of these administrative overheads, reflecting the significant investment in maintaining efficient operations across its diverse business segments.

Reinsurance Premiums Ceded

Cincinnati Financial incurs significant costs by purchasing reinsurance to offload a portion of its underwriting risk. This strategic move is crucial for managing its exposure to catastrophic events and large, unpredictable claims, thereby bolstering financial stability.

In 2023, Cincinnati Financial's property casualty segment, which heavily utilizes reinsurance, generated $7.7 billion in net written premiums. The cost of reinsurance, while not directly itemized as a separate line item in all public disclosures, is a substantial component of the overall underwriting expenses for this segment. For instance, a typical property casualty insurer might allocate anywhere from 5% to 30% of its gross written premiums to reinsurance, depending on the lines of business and risk appetite. This expenditure directly impacts the company's profitability by reducing the net income retained from its underwriting activities.

- Reinsurance Premiums Ceded: The primary cost is the direct payment of premiums to reinsurers for transferring risk.

- Risk Management: This cost is essential for protecting the company from severe financial impacts due to large-scale disasters or an accumulation of significant claims.

- Financial Stability: By ceding premiums, Cincinnati Financial enhances its solvency and ability to meet its obligations to policyholders.

- Profitability Impact: While a necessary expense, the cost of reinsurance directly reduces the profit margin on underwritten business.

Investment Management Expenses

Cincinnati Financial incurs costs for managing its significant investment portfolio. These expenses are crucial for generating investment income, which is a key revenue stream.

These costs include fees paid to external asset managers, the expense of conducting thorough investment research, and the operational costs associated with trading securities. For instance, in 2023, Cincinnati Financial reported investment income of $1.4 billion, but managing these assets involves direct costs that reduce the net benefit.

- Asset Management Fees: Payments to professional managers overseeing portions of the investment portfolio.

- Research Costs: Expenses for financial analysis, market data, and economic forecasting to inform investment decisions.

- Trading Expenses: Costs related to buying and selling securities, including brokerage commissions and transaction fees.

Cincinnati Financial's cost structure is dominated by claims and loss adjustment expenses, reflecting its core insurance operations. Underwriting and policy acquisition costs, including agent commissions, are also significant. Operating and administrative expenses support the business, while reinsurance premiums are crucial for risk management, directly impacting profitability.

In 2023, Cincinnati Financial reported a combined ratio of 92.4%, meaning 92.4% of premiums were used for claims and expenses. Total operating expenses reached $5.8 billion in 2023, with a substantial portion allocated to underwriting and business expenses. The company's investment income in 2023 was $1.4 billion, offset by management and trading costs.

| Cost Category | Description | 2023 Impact/Data |

|---|---|---|

| Claims & Loss Adjustment | Payouts for insured events and claim management costs. | Combined Ratio of 92.4% in 2023. |

| Underwriting & Policy Acquisition | Risk evaluation, sales commissions, marketing. | Significant portion of total operating expenses. |

| Operating & Administrative | Salaries, benefits, technology, office expenses. | Part of $5.8 billion total operating expenses in 2023. |

| Reinsurance Premiums | Cost of transferring risk to reinsurers. | Essential for financial stability, reduces profit margin. |

| Investment Management | Fees for asset managers, research, trading. | Offsetting the $1.4 billion investment income in 2023. |

Revenue Streams

Cincinnati Financial's primary revenue driver is property and casualty insurance premiums. This income stems from policies covering commercial, personal, and specialized excess and surplus lines risks. The company has demonstrated a strong track record of increasing its net written premiums.

For instance, in the first quarter of 2024, Cincinnati Financial reported net written premiums of $2.3 billion, a notable increase compared to the same period in 2023. This growth reflects the company's ability to attract and retain customers across its diverse insurance offerings.

Cincinnati Financial generates revenue from premiums collected on life insurance policies, including term, whole, and universal life options, as well as fixed annuities. These products are offered through its subsidiary, The Cincinnati Life Insurance Company.

In 2024, the life insurance segment, while smaller than property casualty, is a vital component of earned premiums, demonstrating stable growth and contributing to the company's diversified revenue base.

Cincinnati Financial generates significant revenue from its substantial investment portfolio, a crucial component of its financial performance. This income primarily stems from interest earned on its extensive bond holdings and dividends received from its equity investments.

In 2023, Cincinnati Financial's net investment income reached $928 million, a notable increase from $735 million in 2022, underscoring its growing importance. This reflects the strategic management of its large capital base to produce consistent returns.

Net Investment Gains/Losses

Net investment gains and losses are a key component of Cincinnati Financial's revenue, primarily stemming from changes in the fair value of its extensive investment portfolio. These fluctuations directly influence the company's net income, with positive market movements leading to substantial gains that bolster overall profitability.

For instance, in the first quarter of 2024, Cincinnati Financial reported significant investment gains. The company's total investment income, which includes net investment gains, reached $445 million. This was a notable increase from $291 million in the same period of 2023, showcasing the impact of favorable market conditions on this revenue stream.

- Equity Securities: Fluctuations in the market value of stocks held in the investment portfolio.

- Fixed Income Securities: Changes in the value of bonds and other debt instruments due to interest rate movements and credit quality.

- Other Investments: Gains or losses from alternative investments or other financial instruments.

- Market Impact: Strong equity markets in early 2024 contributed positively to these gains.

Reinsurance Premiums Assumed

Cincinnati Financial generates revenue by assuming risk from other insurance companies through its reinsurance operations, Cincinnati Re and Cincinnati Global Underwriting Ltd. This practice diversifies the company's income streams and fuels premium growth.

In 2023, Cincinnati Financial's total net written premiums across all segments, including reinsurance, reached $8.7 billion, a notable increase from the previous year. The reinsurance segment plays a crucial role in this overall performance.

- Reinsurance Premiums Assumed: Revenue derived from taking on risk from other insurance carriers.

- Diversification of Revenue: This segment contributes to a broader and more stable income base for Cincinnati Financial.

- Premium Growth Driver: The reinsurance business actively supports the company's overall premium expansion.

- Risk Management Tool: While a revenue source, it also serves as a mechanism for managing and spreading risk.

Cincinnati Financial's revenue streams are robust and diversified. The core business remains property and casualty insurance, with significant growth in net written premiums. This is complemented by income from life insurance and fixed annuities, contributing to a stable earned premium base.

Investment income is another critical pillar, with strong performance in both net investment income and net investment gains. The company's substantial portfolio generated $445 million in total investment income in Q1 2024, up from $291 million in Q1 2023, highlighting successful capital management.

Furthermore, reinsurance operations, including Cincinnati Re and Cincinnati Global Underwriting Ltd., actively contribute to premium growth and revenue diversification. The company's total net written premiums across all segments reached $8.7 billion in 2023, reflecting the expanding reach of its insurance and reinsurance offerings.

| Revenue Stream | 2023 Performance | Q1 2024 Performance |

|---|---|---|

| Property & Casualty Premiums | Significant net written premium growth | $2.3 billion net written premiums (Q1 2024) |

| Life Insurance & Annuities | Stable growth contributing to earned premiums | Vital component of earned premiums |

| Net Investment Income | $928 million | Included in total investment income of $445 million |

| Net Investment Gains | Positive impact on profitability | Included in total investment income of $445 million |

| Reinsurance Operations | $8.7 billion total net written premiums (all segments) | Active contributor to premium growth |

Business Model Canvas Data Sources

The Cincinnati Financial Business Model Canvas is informed by their extensive financial disclosures, actuarial reports, and investor relations materials. These sources provide a deep understanding of their revenue streams, cost structures, and key resources.