Cincinnati Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cincinnati Financial Bundle

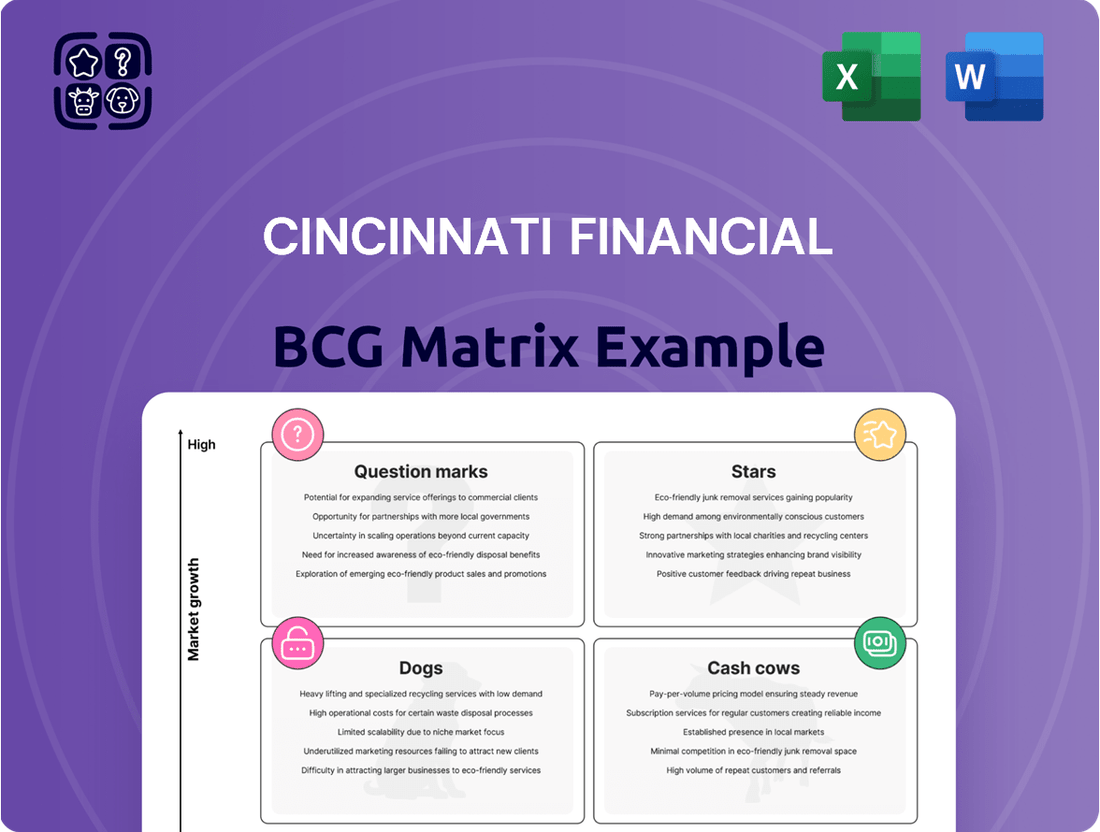

Curious about Cincinnati Financial's product portfolio performance? Our BCG Matrix analysis reveals which segments are driving growth (Stars), generating consistent revenue (Cash Cows), lagging behind (Dogs), or present future potential (Question Marks). This vital information is crucial for informed strategic planning.

Unlock the full potential of this analysis by purchasing the complete Cincinnati Financial BCG Matrix report. Gain access to detailed quadrant placements, actionable insights, and a clear roadmap to optimize your investment and product strategies for maximum impact.

Stars

Cincinnati Financial's commercial lines insurance segment is a star performer within its BCG matrix. In Q1 2025, this segment saw a robust 11% increase in net written premiums, highlighting significant market penetration and expansion.

Further solidifying its star status, the company reported an underwriting profit of $87 million for commercial lines in Q2 2025. This strong profitability, coupled with consistent high-single-digit price increases, underscores Cincinnati Financial's dominant position and growth trajectory in this crucial insurance market.

Excess and Surplus lines at Cincinnati Financial demonstrate significant momentum. In the first quarter of 2025, this segment experienced a strong 15% surge in net written premiums. This growth trajectory continued into the second quarter of 2025, with earned premiums also rising by 15%.

Cincinnati Financial is strategically prioritizing its excess and surplus offerings. The company is actively working to broaden its solutions in this area and improve accessibility to the Lloyd's of London market. This focus indicates a deliberate effort to capitalize on the high-growth potential within the excess and surplus lines sector.

Cincinnati Private Client℠, Cincinnati Financial's offering for high-net-worth individuals, demonstrated robust growth. Net written premiums saw a 10% increase in the first quarter of 2025 and a significant 25% jump in the second quarter of 2025. This performance suggests a strong position and expanding market share within the affluent client demographic.

Strategic Agency Appointments

Cincinnati Financial's strategy to expand its agency network is a key driver of its growth. In the first quarter of 2025, the company welcomed 137 new agency appointments, followed by an additional 258 in the first half of the year. This expansion is crucial for broadening its reach and capturing more market share.

These newly appointed agencies are already making a positive impact by generating new business premiums. This influx of new business indicates a strengthening distribution system, which is vital for sustained growth and competitive positioning in the insurance market.

- Agency Growth: 137 new appointments in Q1 2025 and 258 in the first half of 2025.

- Premium Contribution: New agencies are actively contributing to new business premiums.

- Distribution Network: Expansion signals a growing and strengthening distribution network.

- Market Share: The strategy supports overall market share expansion efforts.

Investment Income Growth

Cincinnati Financial's investment income, while not a direct product, significantly bolsters its financial strength and capacity for growth. This consistent increase in investment income acts as a crucial engine for the company, enabling strategic reinvestment into promising areas.

The company demonstrated robust performance in its investment income during the first half of 2025. Specifically, pretax investment income saw a notable rise of 14% in the first quarter and an even stronger 17.8% in the second quarter. This growth was primarily driven by increased interest income from its bond portfolio, providing a stable earnings base.

- Q1 2025 Pretax Investment Income Growth: 14%

- Q2 2025 Pretax Investment Income Growth: 17.8%

- Primary Driver: Bond interest income

- Impact: Provides stable earnings for reinvestment in growth initiatives

Cincinnati Financial's commercial lines and excess and surplus lines segments are clear stars, exhibiting impressive growth. Commercial lines saw an 11% premium increase in Q1 2025 and an $87 million underwriting profit in Q2 2025, supported by consistent price hikes. Excess and Surplus lines surged 15% in net written premiums in Q1 2025 and earned premiums also rose 15% in Q2 2025, with strategic expansion into Lloyd's of London. Cincinnati Private Client℠ also shone, with a 10% premium increase in Q1 2025 and a substantial 25% jump in Q2 2025, indicating strong performance in the high-net-worth market.

| Segment | Q1 2025 Net Written Premium Growth | Q2 2025 Performance Highlight |

|---|---|---|

| Commercial Lines | 11% | $87 million underwriting profit |

| Excess & Surplus Lines | 15% | 15% earned premium growth |

| Cincinnati Private Client℠ | 10% | 25% net written premium growth |

What is included in the product

Cincinnati Financial's BCG Matrix analysis categorizes its business units by market share and growth, guiding investment decisions.

A clear BCG Matrix visualizes Cincinnati Financial's portfolio, relieving the pain of strategic uncertainty by highlighting Stars and Cash Cows for focused investment.

Cash Cows

Cincinnati Financial's property casualty segment, a key Cash Cow, demonstrated resilience in early 2025. Despite elevated catastrophe losses impacting the first quarter, the segment saw a robust 11% growth in net written premiums for both Q1 and Q2 2025. This growth is attributed to successful premium growth strategies and implemented price adjustments.

The company's performance in 2024 further solidifies this segment's Cash Cow status. The property casualty combined ratio for the full year improved to a healthy 93.4%. This figure signifies a well-established and profitable core business, generating consistent cash flow for the organization.

Cincinnati Financial's established commercial lines portfolio is a prime example of a Cash Cow within its BCG Matrix. This segment consistently delivers robust underwriting profits, a testament to its strong market position in a mature industry.

In 2024, the company continued to see positive trends in this area, with average renewal pricing increases reflecting its ability to maintain and grow its share in a stable market. This reliable cash generation supports other ventures and overall company growth.

Cincinnati Financial's life insurance and fixed annuities function as cash cows within its portfolio. These are generally mature, low-growth offerings that reliably produce steady income.

The life insurance segment demonstrated this stability, reporting a net income of $21 million in the first quarter of 2025 and $26 million in the second quarter of 2025. This consistent performance highlights their role in providing predictable cash flow for the company.

Asset Management Services

Cincinnati Financial's asset management services are a key component of its diversified business. While specific growth rates for this segment aren't always broken out, it typically operates in a mature market, offering a stable, fee-based revenue stream that contributes significantly to the company's overall cash generation.

This segment bolsters Cincinnati Financial's financial offerings, providing a solid foundation. For instance, as of the first quarter of 2024, Cincinnati Financial reported total assets under management of approximately $116.9 billion, demonstrating the scale of this operation.

- Stable Revenue: Asset management provides a consistent, fee-driven income, acting as a reliable cash generator for the company.

- Market Maturity: Operating in a mature market suggests predictable, albeit potentially slower, growth, aligning with the characteristics of a cash cow.

- Diversification: This service adds breadth to Cincinnati Financial's portfolio, reducing reliance on any single business line.

- Scale of Operations: With assets under management reaching over $116 billion in early 2024, the segment's substantial size supports its cash cow status.

Strong Balance Sheet and Liquidity

Cincinnati Financial's strong balance sheet and ample liquidity are hallmarks of a cash cow. As of March 31, 2025, the parent company held $4.994 billion in cash and marketable securities.

This robust financial footing is further underscored by consolidated cash and total investments surpassing $30 billion by the second quarter of 2025.

- Robust Parent Company Liquidity: $4.994 billion in cash and marketable securities as of March 31, 2025.

- Substantial Consolidated Investments: Over $30 billion in consolidated cash and total investments by Q2 2025.

- Financial Flexibility: This strong liquidity enables consistent funding for operations, dividend payments, and strategic investments.

Cincinnati Financial's property casualty segment, a key Cash Cow, demonstrated resilience in early 2025, with net written premiums growing 11% in Q1 and Q2. The full year 2024 combined ratio of 93.4% confirms its status as a profitable core business, consistently generating strong cash flow.

The life insurance and fixed annuities also serve as reliable cash cows, offering stable, low-growth income streams. The life insurance segment reported net income of $21 million in Q1 2025 and $26 million in Q2 2025, highlighting their predictable cash contribution.

Asset management, with over $116.9 billion in assets under management by Q1 2024, provides a stable, fee-based revenue stream. This mature market segment contributes significantly to overall cash generation, reinforcing its cash cow characteristics.

The company's strong financial position, with $4.994 billion in cash and marketable securities as of March 31, 2025, and over $30 billion in consolidated cash and investments by Q2 2025, provides the financial flexibility characteristic of a successful cash cow.

| Segment | 2024 Combined Ratio (Property Casualty) | Q1 2025 Net Income (Life Insurance) | Q2 2025 Net Income (Life Insurance) | Assets Under Management (Q1 2024) |

|---|---|---|---|---|

| Property Casualty | 93.4% | N/A | N/A | N/A |

| Life Insurance | N/A | $21 million | $26 million | N/A |

| Asset Management | N/A | N/A | N/A | $116.9 billion |

What You’re Viewing Is Included

Cincinnati Financial BCG Matrix

The Cincinnati Financial BCG Matrix preview you see is the exact, fully formatted document you will receive upon purchase. This comprehensive report, designed for strategic clarity, contains no watermarks or demo content, ensuring you get an analysis-ready file immediately. What you are reviewing is the final version, meticulously crafted for professional use and ready for your business planning needs. Once purchased, this BCG Matrix report will be instantly downloadable, allowing you to leverage its insights without delay.

Dogs

Cincinnati Financial's personal lines in catastrophe-prone areas are a clear Dogs in the BCG matrix. In the first quarter of 2025, this segment reported a substantial underwriting loss of $357 million, with a combined ratio soaring to 151.3%. This performance was significantly dragged down by a surge in catastrophe-related claims.

The company is actively working on strategies like pricing adjustments and mitigating wildfire risks. However, the inherent geographic concentration of these perils presents a persistent challenge, leading to a situation where these operations consume more capital than they generate, a hallmark of a Dog in portfolio analysis.

Within Cincinnati Financial's portfolio, certain auto insurance lines may be categorized as 'dogs' if they consistently underperform. For instance, in 2024, the personal auto segment has been a notable concern due to escalating claims costs and a persistent high combined ratio, indicating that for every dollar of premium earned, more than a dollar was spent on claims and expenses. This situation necessitates a close examination of these specific auto lines.

If particular auto insurance products within the personal lines segment are experiencing a disproportionate number of claims or are unable to achieve profitability even after implementing rate adjustments, they are prime candidates for a 'dog' classification. Such lines might be draining resources without generating adequate returns, prompting a strategic re-evaluation of their future within the company's offerings.

Cincinnati Financial, like many established insurers, likely has legacy products that are becoming less competitive. These might be older policy types that don't fully address current market demands or consumer preferences, leading to a shrinking customer base. For instance, if a significant portion of their historical business was in traditional whole life policies without modern riders, these could be seen as dogs.

Such products typically exhibit stagnant or declining market share. While exact figures for specific legacy products aren't publicly detailed, the broader life insurance market in 2024 shows a continued shift towards more flexible and adaptable products like universal life and term life with riders, making older, less adaptable offerings inherently less attractive.

Inefficient or Outdated Operational Processes

Inefficient or outdated operational processes can significantly hinder Cincinnati Financial's performance, potentially categorizing them as 'dogs' in the BCG matrix. If internal operations, like claims processing or underwriting, rely on legacy systems, they can become resource drains, consuming capital and employee time without yielding commensurate revenue or market share growth. For instance, a 2024 report highlighted that companies with outdated IT infrastructure often experience a 20-30% increase in operational costs compared to peers leveraging modern technology.

Cincinnati Financial has acknowledged risks related to technology and data security breaches. Failure to invest in and upgrade technological infrastructures, or to adequately address cybersecurity vulnerabilities, could lead to operational inefficiencies and increased costs. A significant data breach, for example, could not only result in substantial financial penalties and remediation expenses but also damage customer trust, further weakening market position.

- Operational Inefficiency: Outdated systems can lead to slower processing times and higher error rates in areas like policy administration and claims handling.

- Resource Drain: Poorly optimized processes consume valuable financial and human capital that could be redirected to more profitable ventures.

- Technology Risk: The company's acknowledgment of technology and data security risks suggests potential vulnerabilities in its operational backbone.

- Competitive Disadvantage: Competitors with more agile and technologically advanced operations can offer better pricing or service, eroding market share.

Segments with Limited Geographic Reach or Niche Focus

Cincinnati Financial's "Dogs" in the BCG Matrix would likely represent insurance offerings with a very limited geographic footprint or those targeting highly specialized, niche markets. These segments, even within the company's operation across 46 states, might struggle to achieve significant market share or the necessary economies of scale to be profitable. For instance, a highly localized specialty insurance product, perhaps catering to a unique industry found only in a few counties, could fall into this category if it shows minimal growth and low profitability.

Such "dog" segments would be characterized by low market growth and low relative market share. If Cincinnati Financial has specific regional operations that consistently underperform compared to national benchmarks or competitors within those limited areas, those could also be classified as dogs. For example, if a particular state's commercial property insurance portfolio for Cincinnati Financial is not growing and holds a small market share, it might be a dog. The company's overall success in 46 states doesn't preclude the existence of these underperforming pockets.

- Limited Geographic Reach: Insurance products or services available in only a few specific states or regions, hindering broad customer acquisition.

- Niche Market Focus: Offerings targeting very specific, small customer segments with limited potential for scaling up.

- Low Market Share: These segments would hold a small percentage of their respective niche or regional markets.

- Struggling Profitability: Potential for low returns due to insufficient volume and high operational costs relative to revenue.

Cincinnati Financial's personal auto insurance lines, particularly those facing escalating claims costs and persistently high combined ratios in 2024, can be classified as Dogs. These segments struggle to achieve profitability, with expenditures often exceeding premium income, necessitating a strategic review of their viability.

Legacy products within the life insurance segment, such as older whole life policies lacking modern riders, may also be considered Dogs. These offerings often exhibit stagnant or declining market share as consumer preferences shift towards more adaptable insurance solutions.

Operational inefficiencies stemming from outdated IT infrastructure or unaddressed cybersecurity risks can also relegate certain business processes to Dog status. Such inefficiencies lead to increased operational costs, estimated to be 20-30% higher for companies with legacy systems compared to their technologically advanced peers.

Highly localized specialty insurance products or specific regional operations with minimal market share and low profitability, despite the company's presence in 46 states, can also be categorized as Dogs. These segments often lack the scale to generate sufficient returns, highlighting pockets of underperformance within the broader portfolio.

| Segment/Product | BCG Classification | Key Performance Indicators (2024/Q1 2025 Data) | Strategic Consideration |

|---|---|---|---|

| Personal Lines (Catastrophe-Prone Areas) | Dog | $357M underwriting loss (Q1 2025); 151.3% combined ratio (Q1 2025) | Pricing adjustments, risk mitigation, potential divestment |

| Certain Personal Auto Lines | Dog | Persistent high combined ratio; escalating claims costs | Rate adjustments, claims management review, product rationalization |

| Legacy Life Insurance Products | Dog | Stagnant or declining market share; shift in consumer preference | Product modernization, targeted marketing, potential phase-out |

| Inefficient/Outdated Operational Processes | Dog | Higher operational costs (20-30% increase); technology risks | Investment in IT modernization, cybersecurity enhancements |

Question Marks

Cincinnati Financial's strategic expansion into developing markets through new agency appointments, particularly those specializing in personal lines, positions these ventures as question marks within the BCG framework. While these appointments broaden the company's footprint, their ultimate contribution to profitability and market share in these less mature or intensely competitive regions is yet to be determined. For instance, emerging markets often present unique regulatory hurdles and consumer adoption rates that can impact an agency's immediate success.

Cincinnati Financial's strategic expansion into new geographies or product lines places these initiatives squarely in the question mark category of the BCG matrix. These ventures, by their very nature, are new and haven't yet established a dominant market share, necessitating substantial capital infusions to foster growth and prove their viability. For instance, if Cincinnati Financial were to enter the rapidly evolving InsurTech space in a new international market, this would represent a significant investment with uncertain future returns, typical of a question mark.

Cincinnati Financial's December 2024 announcement of strategic enhancements to its insurance operations structure positions these initiatives as question marks within the BCG framework. These changes are designed to boost efficiency and solidify the company's market standing.

The ultimate success of these structural adjustments, particularly in terms of market share growth and profitability improvements, remains uncertain. As such, they represent potential future stars or dogs, contingent on their actual performance in the coming periods.

Leveraging New Technologies like AI and Data Analytics

Cincinnati Financial sees significant opportunities in leveraging new technologies like AI and data analytics. These tools can dramatically improve underwriting precision, leading to more accurate risk assessment and pricing. Furthermore, AI can streamline claims processing, enhancing efficiency and customer satisfaction.

While these technological advancements offer high-growth potential, their current integration and widespread adoption within Cincinnati Financial are still in early stages. This positions them as question marks within the BCG matrix, indicating potential for future market dominance if successfully developed and implemented.

- Enhanced Underwriting: AI algorithms can analyze vast datasets to identify subtle risk patterns, potentially reducing losses and improving profitability. For instance, in 2024, the insurance industry saw increased investment in AI for risk assessment, with some firms reporting up to a 15% reduction in claims fraud through advanced analytics.

- Pricing Accuracy: By incorporating more granular data and predictive modeling, AI can enable more dynamic and precise pricing strategies, better reflecting individual risk profiles.

- Claims Processing Efficiency: Automation through AI can expedite claims handling, from initial intake to settlement, improving operational speed and customer experience.

Cincinnati Global Underwriting Ltd. and Cincinnati Re® Expansion

Cincinnati Re® and Cincinnati Global Underwriting Ltd. are recognized for their profitability and agility, effectively capitalizing on market openings. While their performance is strong, their ongoing expansion and capacity to consistently drive significant growth and market share within the broader reinsurance sector still present a question mark regarding their ultimate scale and dominance.

In 2024, Cincinnati Financial reported that its excess and surplus lines business, which includes Cincinnati Global Underwriting, saw a notable increase in net written premiums. This segment, often characterized by its flexibility, demonstrated its ability to adapt to evolving market conditions.

- Profitability and Nimbleness: Both Cincinnati Re® and Cincinnati Global Underwriting Ltd. have demonstrated strong profitability, a testament to their ability to identify and seize profitable opportunities in the reinsurance market.

- Market Opportunity Capture: Their nimble operational structure allows them to quickly adapt to changing market dynamics and underwrite risks that others may avoid, thereby capturing a larger share of profitable business.

- Expansion as a Question Mark: While successful, the ultimate scale and market dominance Cincinnati Re® and Cincinnati Global Underwriting Ltd. can achieve through continued expansion remain a point of observation.

- Contribution to Growth: Their consistent ability to contribute significantly to Cincinnati Financial's overall growth and market presence in the reinsurance space is a key factor, but the ceiling for this contribution is still being defined.

Cincinnati Financial's ventures into new markets and product lines, along with the integration of new technologies like AI, are currently categorized as question marks. These initiatives require significant investment and their future market share and profitability are not yet established. For instance, the company's expansion into emerging markets through new agency appointments in 2024 represents a strategic move with an uncertain outcome.

The success of these question marks hinges on their ability to gain traction and demonstrate consistent growth. If these ventures mature and capture significant market share, they could transition into stars. Conversely, if they fail to gain momentum or face insurmountable challenges, they might become dogs.

Cincinnati Financial's strategic enhancements to its insurance operations structure, announced in December 2024, also fall into the question mark category. While intended to boost efficiency, their ultimate impact on market share and profitability is yet to be seen, making them areas of observation for future performance.

The company's investment in AI and data analytics for underwriting and claims processing, while promising high growth, is still in its early stages of adoption. This positions these technological advancements as question marks, with their potential to become market leaders contingent on successful implementation and integration.

| Initiative | BCG Category | Rationale | Key Data/Observation (2024) |

|---|---|---|---|

| New Agency Appointments (Emerging Markets) | Question Mark | Expansion into less mature or competitive regions; market share and profitability uncertain. | Strategic focus on personal lines expansion in new geographies. |

| InsurTech Integration (New Markets) | Question Mark | High-growth potential but requires substantial capital and faces uncertain adoption rates. | Represents a significant investment with uncertain future returns. |

| AI & Data Analytics in Operations | Question Mark | Early stages of integration and adoption; high growth potential if successful. | AI can improve underwriting precision and claims processing efficiency. |

| Cincinnati Re® & Cincinnati Global Underwriting Expansion | Question Mark | Strong profitability and agility, but ultimate scale and market dominance through expansion are still being defined. | Notable increase in net written premiums for excess and surplus lines business. |

BCG Matrix Data Sources

Our Cincinnati Financial BCG Matrix is constructed using a blend of internal financial statements, industry growth rate data, and market share analysis from reputable financial databases.