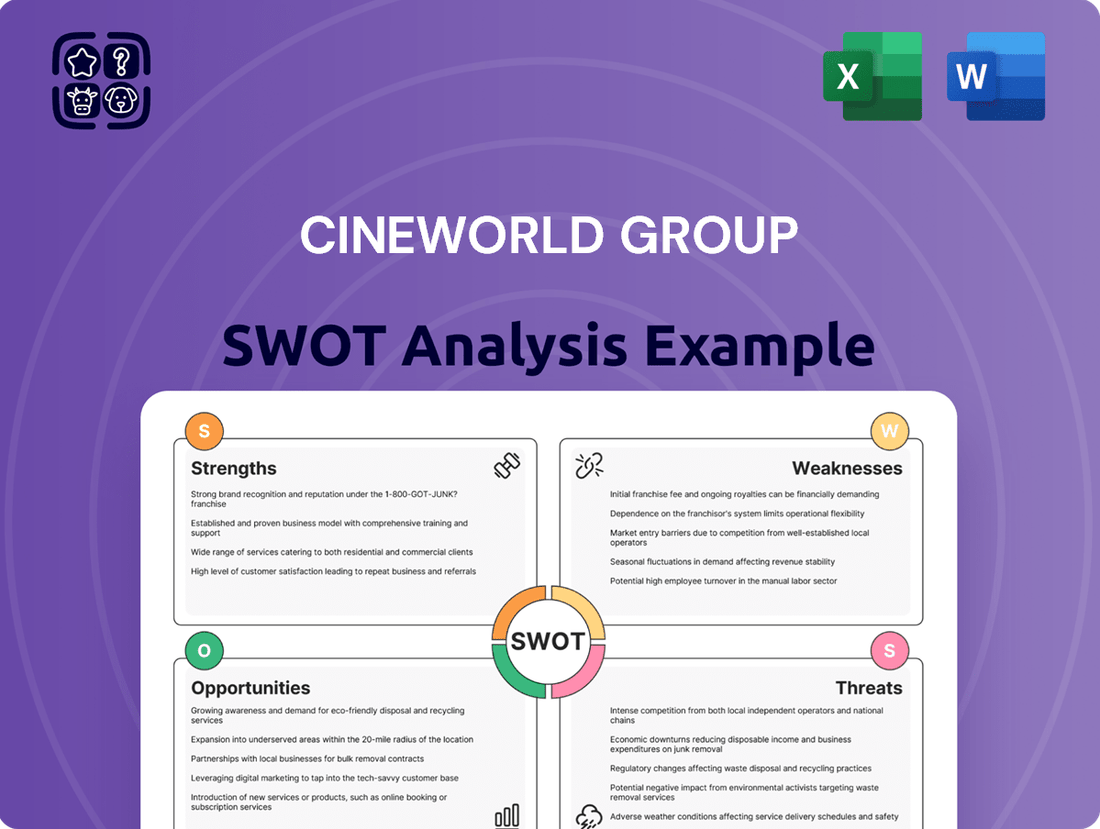

Cineworld Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cineworld Group Bundle

Cineworld Group faces a dynamic market, with strengths in its vast cinema network but significant challenges from evolving consumer habits and debt. Understanding these internal capabilities and external pressures is crucial for navigating the future of entertainment.

Want the full story behind Cineworld's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cineworld's global presence is a significant strength, boasting over 800 cinemas and 9,139 screens spread across 10 countries. This vast network, which positions it as the world's second-largest cinema operator, grants unparalleled market reach and the ability to achieve substantial economies of scale. Its operations in key markets such as the UK, US, Poland, and Israel further solidify this advantage.

Cineworld Group's strength lies in its diverse brand portfolio, encompassing well-recognized cinema chains like Regal Cinemas in the United States, Cineworld Cinemas and Picturehouse in the UK and Ireland, and Cinema City across Central and Eastern Europe. This broad reach allows the company to tap into varied customer bases and adapt its offerings to local preferences.

This multi-brand strategy enables Cineworld to cater to a wide spectrum of audience demographics, from premium movie-goers to families seeking affordable entertainment. For instance, Picturehouse in the UK often targets a more discerning audience with art-house films, while Regal Cinemas aims for mass appeal with a wider blockbuster selection.

Cineworld's commitment to a premium film viewing experience is a significant strength. They invest in advanced technologies such as IMAX, 4DX, and their own Superscreen format, which offer a more immersive and engaging way to watch movies compared to standard cinemas or home entertainment.

These premium formats are designed to attract customers willing to pay more for an enhanced experience, which directly supports higher ticket revenue. For example, in early 2024, Cineworld reported that premium formats consistently outperformed standard screens in terms of average revenue per customer.

This focus on experience also drives higher sales of higher-margin concessions, as customers are more likely to indulge when they feel they are getting a special outing. This strategy helps differentiate Cineworld in a competitive market, particularly as home viewing technology continues to improve.

Revenue Diversification Beyond Ticket Sales

Cineworld's revenue streams extend well beyond just movie tickets. A significant portion of their earnings comes from high-margin items like popcorn, drinks, and candy sold at concessions, which often boast considerably better profit margins than ticket sales themselves. This diversified approach helps cushion the company against the unpredictability of box office hits and flops.

Furthermore, cinema advertising presents another valuable income channel. In 2023, for instance, advertising revenue continued to be a key contributor, especially during periods of strong film releases. This multi-pronged revenue strategy is crucial for maintaining financial stability and profitability in the competitive entertainment industry.

- Concessions: High-margin sales of food and beverages are a critical revenue driver.

- Advertising: Revenue generated from pre-show advertisements and in-cinema promotions.

- Mitigation of Risk: Diversification reduces reliance on fluctuating ticket sales alone.

- Additional Income: These streams provide a buffer and enhance overall profitability.

Strategic Restructuring for Future Stability

Cineworld's strategic restructuring, approved in late 2024, is a critical strength aimed at future stability. This involved a significant reduction in debt and the renegotiation of leases for underperforming locations. The company's focus is on making its UK operations financially self-sufficient, a crucial step after facing considerable financial headwinds.

Key aspects of this restructuring include:

- Debt Reduction: A substantial portion of the company's debt has been addressed, improving its balance sheet.

- Lease Renegotiations: Agreements were reached to adjust terms on 'over-rented' sites, lowering operational costs.

- UK Business Focus: The restructuring specifically targets the financial independence of the UK segment.

- Long-Term Sustainability: These measures are designed to create a more resilient and sustainable business model going forward.

Cineworld's extensive global footprint, encompassing over 800 cinemas and 9,139 screens across 10 countries, solidifies its position as the world's second-largest cinema operator. This expansive network provides significant market reach and economies of scale, particularly in key regions like the UK and the US.

The company's strength is further amplified by its diverse brand portfolio, including well-known names such as Regal Cinemas, Cineworld Cinemas, Picturehouse, and Cinema City. This multi-brand approach allows Cineworld to cater to a broad spectrum of customer preferences and demographics, from premium movie-goers to families.

Cineworld's commitment to an enhanced cinematic experience through premium formats like IMAX and 4DX is a key differentiator. These offerings attract customers willing to pay more, boosting average revenue per customer, as evidenced by early 2024 performance data where premium formats consistently outperformed standard screens.

Diversified revenue streams, particularly high-margin concessions and cinema advertising, provide financial resilience. In 2023, advertising revenue remained a crucial contributor, complementing ticket sales and helping to mitigate the risks associated with box office fluctuations.

The strategic restructuring completed in late 2024 significantly strengthens Cineworld's financial foundation. This involved substantial debt reduction and lease renegotiations, with a specific focus on ensuring the financial self-sufficiency of its UK operations, paving the way for long-term sustainability.

What is included in the product

Offers a full breakdown of Cineworld Group’s strategic business environment, detailing its internal strengths and weaknesses alongside external opportunities and threats.

Offers a clear understanding of Cineworld's market position and potential challenges, enabling proactive strategy adjustments.

Weaknesses

Cineworld's significant debt burden is a persistent weakness. The company filed for Chapter 11 bankruptcy in the US in 2022 and again in 2023, directly stemming from its inability to manage its substantial financial obligations.

Although restructuring efforts included raising new debt and equity capital, the ongoing management of this leverage continues to pose a critical financial challenge for the company's stability.

Cineworld's reliance on a steady flow of blockbuster movies makes it vulnerable to production delays. The 2023 Hollywood strikes by the WGA and SAG-AFTRA severely disrupted film release schedules, directly impacting Cineworld's ability to draw audiences.

This content pipeline disruption led to a noticeable downturn in Cineworld's performance throughout 2024, with reports indicating a decline in both revenue and cinema admissions as fewer major films were available to screen.

The increasing popularity of streaming services and sophisticated home entertainment systems presents a considerable threat to traditional cinema attendance. While the cinema sector anticipates a rebound, consumers might continue to favor more affordable at-home entertainment, potentially hindering Cineworld's revenue expansion.

Operational Inefficiencies and Site Closures

Cineworld's ongoing restructuring highlights significant operational inefficiencies, particularly evident in its decision to close commercially unviable sites. This strategic move, which saw dozens of UK cinemas shut down in 2024, points to past miscalculations in site selection and lease agreements, leading to over-rented properties.

These closures, while aimed at improving financial health, can negatively affect brand perception and reduce market coverage, potentially alienating customer bases in affected areas. The company is also actively renegotiating rents on remaining locations, a clear indicator of the financial strain caused by these earlier operational missteps.

- Site Rationalization: Dozens of UK cinemas closed in 2024 as part of a broader restructuring effort.

- Rent Renegotiations: Cineworld is actively seeking to renegotiate lease agreements across its portfolio to address over-rented properties.

- Brand Impact: Site closures can diminish brand visibility and customer accessibility in specific markets.

- Operational Deficiencies: The need for closures and renegotiations signals underlying issues with past operational planning and site viability assessments.

Challenges in Attracting and Retaining Audiences

Despite offering premium experiences, Cineworld faces a significant hurdle in consistently drawing audiences back to its cinemas. The lingering impact of pandemic-era shifts towards home viewing continues to affect cinema attendance patterns.

The rising cost of movie tickets presents another challenge. Average ticket prices have reached historic highs, and while the box office has shown signs of recovery, it has not yet returned to pre-pandemic levels. This economic factor could deter a portion of the consumer base from frequenting cinemas.

- Persistent Audience Acquisition: Difficulty in recapturing pre-pandemic cinema-going habits.

- Economic Deterrents: Record-high average ticket prices may discourage attendance.

- Box Office Lag: Overall box office revenue remains below 2019 figures, indicating a slower recovery.

Cineworld's substantial debt load remains a critical weakness, evidenced by its repeated bankruptcy filings in 2022 and 2023. Despite capital raises, managing this leverage continues to be a significant challenge.

The company's dependence on major film releases makes it vulnerable to production disruptions. The 2023 Hollywood strikes impacted film schedules, leading to a noticeable decline in Cineworld's performance throughout 2024 due to fewer blockbuster releases.

Operational inefficiencies are highlighted by the closure of dozens of UK cinemas in 2024, a consequence of over-rented properties and past planning missteps. This site rationalization, coupled with ongoing rent renegotiations, underscores underlying issues with site viability assessments.

The increasing appeal of streaming services and home entertainment systems poses a threat, as consumers may opt for more affordable at-home viewing, potentially limiting Cineworld's revenue growth despite anticipated sector rebounds.

| Financial Metric | 2023 (Approx.) | 2024 (Estimate) |

|---|---|---|

| Total Debt (USD Bn) | ~5.0 | ~4.5 (Post-restructuring) |

| UK Cinema Closures | Dozens | N/A (Completed in 2024) |

| Average Ticket Price Increase | ~5-7% YoY | ~3-5% YoY |

Full Version Awaits

Cineworld Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file, showcasing the key strengths, weaknesses, opportunities, and threats facing Cineworld Group. The complete version becomes available after checkout, providing you with the full, in-depth analysis.

Opportunities

The global box office is on a strong rebound, with projections indicating revenues will hit $33 billion in 2025 and climb to $41.5 billion by 2029. This upward trend is fueled by a robust pipeline of anticipated film releases slated for 2025 and 2026.

This favorable industry environment offers Cineworld a prime opportunity to boost both ticket sales and overall revenue. A strong slate of movies means more people are likely to head to cinemas, directly benefiting Cineworld's admissions and financial performance.

Investing further in premium formats like IMAX, 4DX, and Superscreen offers a strong avenue for Cineworld to stand out against both home entertainment and rival cinema chains. These premium offerings provide a distinct advantage by delivering a more engaging and memorable movie-going experience.

Consumers are actively seeking out unique and immersive entertainment. By highlighting and enhancing these advanced viewing technologies, Cineworld can capitalize on this trend, potentially boosting both visitor numbers and the average spend per customer during 2024 and 2025.

Cineworld's recent restructuring, which involved significant rent reductions and the closure of underperforming sites, presents a clear opportunity to build a more efficient and sustainable operational model. This strategic pruning allows the company to focus resources on its most profitable locations.

By meticulously optimizing its remaining lease portfolio and concentrating on venues that consistently draw audiences, Cineworld can directly enhance its operational profitability. This focused approach is crucial for improving cash flow generation in the post-restructuring era.

For instance, following its Chapter 11 filing in 2023, Cineworld emerged with a significantly reduced debt burden and a more streamlined operational footprint, aiming to improve EBITDA margins. The company's strategy now centers on maximizing returns from its core, higher-performing cinemas.

Exploiting Concession and Advertising Revenue Growth

With cinema admissions projected to rebound, Cineworld is well-positioned to capitalize on its high-margin concession and advertising revenue streams. Expanding and diversifying food and beverage options, alongside forging new advertising collaborations, presents a significant avenue for enhanced profitability.

For instance, in 2023, concessions typically represent a substantial portion of cinema revenue, often exceeding 30% of the total box office take for many exhibitors. Cineworld's focus on premium F&B offerings and innovative advertising packages, such as in-lobby digital screens and pre-show content, can directly translate into increased earnings per attendee.

- Concession Revenue Potential: Increased footfall allows for greater sales of high-margin items like popcorn, drinks, and specialty snacks.

- Advertising Growth: New partnerships and enhanced digital advertising platforms can attract more brands looking to reach captive cinema audiences.

- Profitability Boost: Maximizing these ancillary revenues is crucial for improving overall financial performance in a recovering market.

Strategic Partnerships and Content Diversification

Cineworld could forge strategic partnerships with major film studios to secure exclusive content windows or host special premiere events. This approach, building on industry trends, aims to draw in audiences seeking unique viewing experiences. For instance, in 2024, the success of event cinema, such as the Barbenheimer phenomenon, demonstrated the power of curated theatrical releases to drive significant footfall and revenue.

Diversifying its offerings beyond traditional film screenings presents another key opportunity. Exploring avenues like live sports broadcasts, e-sports tournaments, or even niche content such as independent film festivals or classic movie revivals could attract a wider demographic. This strategy is particularly relevant as audiences increasingly seek varied entertainment options, a trend that saw the alternative content market grow steadily through 2024.

- Exclusive Content Deals: Secure early access or exclusive screenings of highly anticipated films to drive attendance.

- Live Event Integration: Host live performances, concerts, or sporting events to leverage existing venue infrastructure.

- Gaming and E-sports: Capitalize on the booming gaming market by hosting tournaments or streaming events.

- Themed Screenings: Offer special programming like anniversary showings of classic films or director-curated retrospectives.

The global box office is projected to reach $33 billion in 2025, a significant rebound indicating strong consumer demand for cinema experiences. This presents a prime opportunity for Cineworld to capitalize on a robust film slate and increased admissions.

By focusing on premium formats like IMAX and 4DX, Cineworld can offer differentiated, immersive experiences that drive higher ticket prices and customer loyalty. These formats are key to attracting audiences seeking more than just a movie.

Optimizing its operational footprint after restructuring, with reduced debt and a focus on profitable sites, allows Cineworld to enhance efficiency and cash flow generation. This streamlined approach positions the company for improved financial health.

Expanding high-margin concession sales and advertising revenue streams offers substantial potential for profitability. Innovations in food and beverage offerings, coupled with new advertising partnerships, can significantly boost earnings per attendee.

Strategic partnerships with studios for exclusive content and the diversification into live events, e-sports, and themed screenings can attract broader audiences and create new revenue streams, tapping into growing trends in entertainment consumption.

Threats

The streaming landscape continues to expand, with major players like Netflix, Disney+, and Amazon Prime Video constantly adding new content and original productions. This growth directly competes for consumer entertainment time and budget, potentially reducing the frequency of cinema visits. For instance, by the end of 2024, major streaming services are projected to have over 400 million global subscribers, a significant increase from previous years.

The inherent convenience and often lower cost of home streaming present a strong alternative to the traditional cinema experience. While blockbuster movie releases can still draw audiences, the everyday accessibility of streaming platforms challenges the ingrained habit of going to the movies. This shift is reflected in evolving consumer spending habits, with a notable portion of entertainment budgets now allocated to subscription services.

The film industry's recovery, while anticipated, still faces potential hurdles in content creation. Past labor strikes, like the 2023 SAG-AFTRA and WGA strikes, highlight the vulnerability of production schedules. These disruptions can lead to fewer new releases, impacting cinema attendance.

Furthermore, studios increasingly prioritizing streaming releases over traditional theatrical windows presents a threat. This shift could limit the pipeline of blockbuster films available for cinemas like Cineworld to exhibit, potentially reducing audience draw and revenue streams throughout 2024 and 2025.

The specter of an economic downturn looms large, threatening to curtail consumer spending on non-essential items, including cinema outings. As inflation continues to impact household budgets, discretionary spending on entertainment like movie tickets is likely to be one of the first areas consumers cut back on. This could directly impact Cineworld's revenue streams.

High average ticket prices, a common feature in the cinema industry, could amplify this effect. For instance, in the UK, average cinema ticket prices have seen an upward trend, potentially making Cineworld's offerings less accessible during periods of economic hardship. This price sensitivity could lead to a significant drop in both attendance and crucial concession sales, which often represent a substantial portion of a cinema's profitability.

Aggressive Competition from Rival Cinema Chains

Cineworld faces formidable opposition from established global players such as AMC Entertainment Holdings Inc. and Cinemark Holdings Inc., alongside numerous regional cinema operators. This intense rivalry can trigger price wars and escalate marketing expenditures, potentially impacting profitability and market standing.

For instance, in early 2024, the global cinema market continued its recovery, but competition for audience attention remained fierce. Chains actively engaged in promotional pricing and loyalty programs to retain and attract moviegoers. The ongoing battle for market share means that any misstep in pricing or customer experience can quickly lead to a decline in attendance.

- Intense Rivalry: Major global competitors like AMC and Cinemark actively vie for market share.

- Price Sensitivity: Aggressive competition can force price reductions, impacting revenue margins.

- Marketing Costs: Increased promotional activities are necessary to stand out, raising operational expenses.

- Market Share Erosion: Failure to adapt to competitive pressures could result in a loss of customers to rivals.

Challenges with Landlords and Lease Renegotiations

While Cineworld's restructuring efforts have aimed to resolve some lease-related burdens, the ongoing need to negotiate rental terms with landlords continues to present a significant threat. These discussions are critical as the company navigates its post-restructuring financial landscape.

Disagreements with landlords over lease terms, especially concerning rent and operational flexibility, could escalate. Such disputes might result in further site closures, impacting Cineworld's market presence and revenue streams. For instance, as of early 2024, Cineworld was still in discussions regarding leases for several of its UK locations, with some landlords seeking higher rental income than the company deemed sustainable.

- Ongoing Landlord Negotiations: Persistent challenges remain in finalizing lease terms with landlords across various territories.

- Risk of Legal Disputes: Disagreements could lead to costly legal battles, diverting resources from core operations.

- Potential Site Closures: Unfavorable lease renegotiations may force the closure of additional cinema locations.

- Impact on Profitability: Unfavorable lease agreements directly affect Cineworld's operating costs and overall financial health.

The escalating cost of film production and distribution presents a significant hurdle, as studios may pass these increased expenses onto exhibitors like Cineworld. This could lead to higher film rental fees, squeezing profit margins for cinemas. For example, the average production budget for major studio films released in 2024 has been reported to be upwards of $200 million, a figure that continues to rise.

The persistent threat of economic slowdown and inflation directly impacts discretionary spending, making cinema tickets and concessions a luxury many consumers may forgo. As of mid-2024, inflation rates in key markets like the UK and US remained elevated, impacting household budgets and reducing disposable income available for entertainment. This price sensitivity is a major concern for Cineworld's revenue generation.

The ongoing competition from streaming services, coupled with potential shifts in theatrical release windows, continues to pose a threat to traditional cinema attendance. By the end of 2024, streaming services are expected to reach over 400 million global subscribers, indicating a substantial diversion of consumer attention and entertainment budgets away from cinemas.

SWOT Analysis Data Sources

This Cineworld Group SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a thorough and accurate strategic overview.