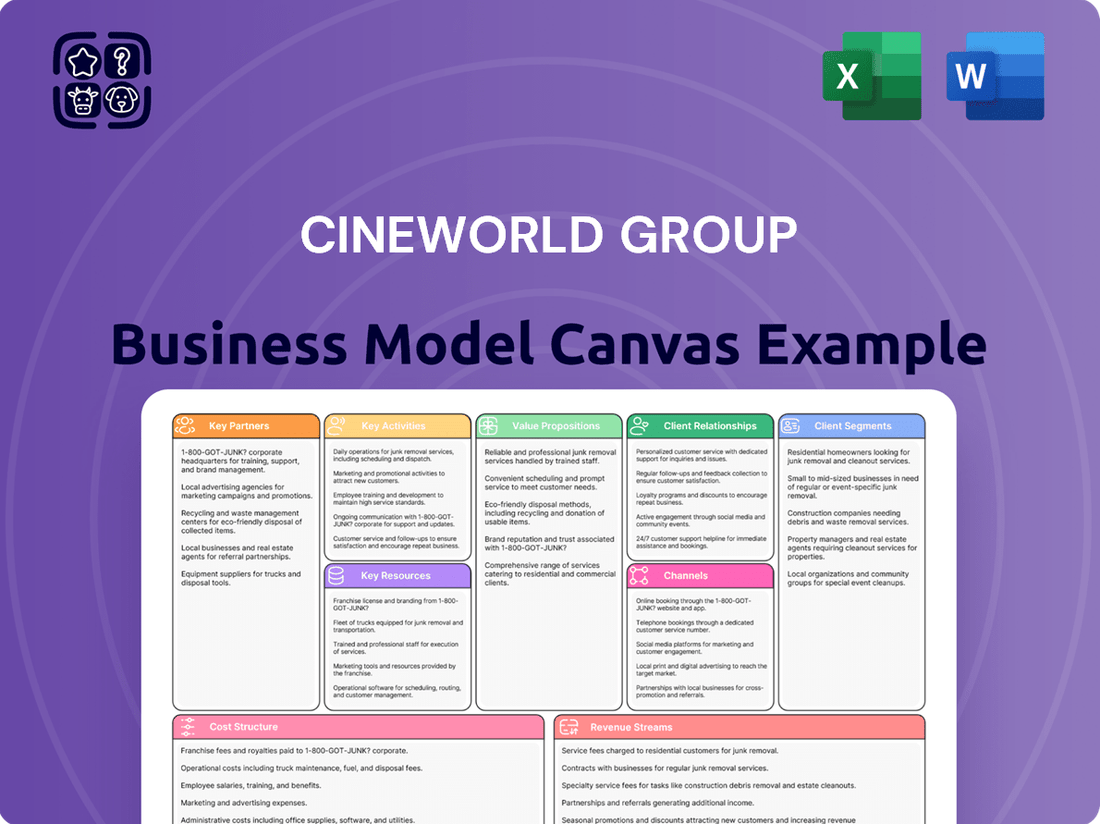

Cineworld Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cineworld Group Bundle

Uncover the strategic engine driving Cineworld Group's global cinema empire. This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational prowess. Discover how they achieve scale and profitability in the entertainment industry.

Partnerships

Cineworld Group heavily relies on its film distributors, including major studios and independent outfits, to ensure a steady stream of new releases. These partnerships are vital for maintaining a compelling movie lineup that draws audiences. For instance, in 2024, the success of blockbusters like Dune: Part Two and Inside Out 2 demonstrated how strong distribution deals translate directly into increased foot traffic and revenue for cinema chains.

Cineworld's concession suppliers are critical partners, providing the food and beverages that significantly boost revenue beyond ticket sales. These collaborations ensure a diverse and appealing range of snacks and drinks, directly impacting customer satisfaction and the average spend per visitor.

For instance, in 2023, concessions typically accounted for over 30% of Cineworld's total revenue, highlighting the importance of these supplier relationships in maintaining profitability and enhancing the overall cinema experience for patrons.

Cineworld's strategic alliances with technology providers like IMAX, 4DX, and Dolby Atmos are crucial. These partnerships enable Cineworld to deliver enhanced, immersive viewing experiences that set them apart in the competitive cinema landscape. For instance, IMAX screens, known for their expansive visuals and powerful sound, attract a significant segment of moviegoers. The adoption of Dolby Atmos, offering dynamic, object-based audio, further elevates the sensory engagement.

Landlords and Property Owners

Cineworld's extensive cinema network relies heavily on its partnerships with landlords and property owners. These relationships are fundamental to securing prime locations and managing the operational costs associated with its multiplexes.

Recent financial restructuring, including significant debt reduction efforts throughout 2023 and into early 2024, has seen Cineworld actively renegotiate lease agreements. This process aims to optimize the company's real estate portfolio by shedding underperforming sites and securing more favorable terms on existing ones.

As of their latest financial reporting, Cineworld has been strategically closing cinemas that are no longer commercially viable, a move directly impacting landlord agreements. For example, in 2023, the company continued its program of site rationalization, which involved exiting leases for cinemas that did not meet profitability targets.

- Lease Renegotiation: Essential for reducing overheads and adapting to changing market conditions.

- Site Rationalization: Closing unprofitable locations to improve overall financial health and optimize the real estate footprint.

- Strategic Location Management: Maintaining strong ties with landlords ensures access to desirable venues and facilitates negotiations for future expansion or renewal.

Advertising Partners

Cineworld Group cultivates strategic alliances with advertising firms, notably National CineMedia, to offer on-screen advertisements. This collaboration, alongside recent ventures such as the partnership with Specsavers, diversifies Cineworld's revenue streams by connecting brands with a highly engaged audience prior to film showings.

Cinema advertising represents a significant, supplementary income channel for the group. For example, in 2023, cinema advertising revenue continued to be a vital component of the company's overall financial performance, demonstrating its importance as a diversified income source.

- Strategic Advertising Alliances: Partnerships like the one with National CineMedia for on-screen advertising are crucial.

- Revenue Diversification: Collaborations such as the one with Specsavers add valuable income streams.

- Captive Audience Reach: Brands leverage cinema advertising to connect with a focused audience before movie screenings.

- Financial Contribution: Cinema advertising provides a consistent and important additional revenue source for Cineworld.

Cineworld's partnerships with film distributors are paramount, ensuring a consistent flow of new releases that drive audience attendance. These relationships are critical for maintaining a competitive film slate. For example, in 2024, the success of films like Dune: Part Two directly translated into increased ticket sales for Cineworld, underscoring the value of these distribution agreements.

Crucial relationships with concession suppliers are vital for generating significant revenue beyond ticket sales. These partnerships ensure a diverse and appealing range of food and beverage options, directly impacting customer satisfaction and the average spend per visitor. In 2023, concessions represented over 30% of Cineworld's revenue, highlighting their financial importance.

Strategic alliances with technology providers such as IMAX and Dolby Atmos are essential for offering enhanced, immersive viewing experiences that differentiate Cineworld. These premium offerings attract a significant customer segment willing to pay more for superior audiovisual quality.

Cineworld's network of cinemas depends on strong relationships with landlords and property owners for prime locations and operational cost management. Throughout 2023 and into early 2024, Cineworld actively renegotiated leases as part of its financial restructuring, aiming to optimize its real estate footprint by exiting underperforming sites and securing better terms on existing ones.

What is included in the product

This Business Model Canvas outlines Cineworld's strategy of offering a premium cinema experience through diverse film selections and convenient locations, targeting a broad audience of moviegoers.

It details how Cineworld leverages its extensive network of multiplex cinemas and strategic partnerships to deliver value, supported by a robust revenue stream from ticket sales and concessions.

Cineworld's Business Model Canvas acts as a pain point reliever by offering a concise, one-page snapshot that quickly identifies core components, making complex strategies easily digestible for executive review and team collaboration.

Activities

Cineworld's primary function is showcasing a variety of films, from major releases to independent features, across its many cinemas. This requires obtaining rights from film distributors and carefully organizing movie timings to appeal to different audiences.

In 2024, the success of this activity hinges on attracting a diverse customer base through strategic scheduling and offering a compelling cinematic experience. This core function directly drives ticket sales and overall revenue.

Operating and managing a wide range of food and beverage concessions is a core activity for Cineworld. This involves overseeing inventory, staffing, and the marketing of popular items like popcorn, drinks, and hot food.

Concession sales represent a highly profitable segment for movie theaters, often boasting significantly higher profit margins than ticket sales. In 2023, Cineworld's concession revenue was a substantial driver of its financial performance, underscoring its importance to the company's bottom line.

Cineworld's key activities revolve around the meticulous operation and maintenance of its cinema complexes. This includes ensuring every screen offers top-tier projection and sound, alongside comfortable seating and a pristine environment for patrons. For instance, in 2023, Cineworld continued its focus on enhancing the in-cinema experience, a critical factor in attracting and retaining audiences in a competitive entertainment landscape.

Maintaining high operational efficiency is paramount to delivering a consistent, enjoyable customer journey. This involves proactive upkeep of all facilities and equipment to prevent disruptions. Furthermore, effective management of a diverse workforce across numerous cinema locations is a core operational activity, ensuring seamless service delivery and adherence to Cineworld's standards.

Marketing and Promotion

Cineworld actively markets upcoming film releases, special events, and its loyalty program to boost attendance and engagement. This includes digital advertising, in-cinema promotions, and strategic partnerships to reach a broad audience. For instance, in 2024, Cineworld continued its focus on digital marketing, leveraging social media platforms and targeted online advertising to promote blockbuster releases and seasonal events.

These marketing efforts are crucial for informing potential customers and building anticipation for the cinema experience. By highlighting new films and exclusive offers, Cineworld aims to drive footfall and encourage repeat visits.

Key marketing and promotion activities include:

- Digital Campaigns: Utilizing social media, email marketing, and online advertising to promote film releases and special offers.

- In-Cinema Promotions: Offering deals on concessions, advance screenings, and themed events within the cinema premises.

- Loyalty Programs: Rewarding frequent moviegoers through tiered membership benefits and exclusive access.

- Partnerships: Collaborating with film distributors, brands, and local businesses for cross-promotional activities.

Technology Integration and Upgrade

Cineworld's commitment to technology integration and upgrades is central to its business. This involves the ongoing implementation and maintenance of premium formats such as IMAX, 4DX, and Superscreen. These require significant technical expertise and continuous capital investment to ensure they deliver the immersive experiences customers expect.

These technological advancements are crucial for Cineworld to differentiate itself in a competitive market. By offering cutting-edge viewing options, the company aims to attract and retain patrons seeking a superior cinematic experience. The need for continuous upgrades is driven by evolving customer expectations for immersive and interactive entertainment, making it a core activity for maintaining market relevance.

- Technology Integration: Implementing and maintaining premium formats like IMAX, 4DX, and Superscreen.

- Technical Expertise: Requires ongoing specialized knowledge for operation and upkeep.

- Capital Investment: Continuous financial commitment for hardware, software, and upgrades.

- Customer Experience: Essential for offering differentiated, immersive, and up-to-date viewing experiences.

Cineworld's key activities also include managing its vast network of cinema locations, ensuring each site operates efficiently and provides a consistent customer experience. This involves regular maintenance, staffing, and adherence to health and safety standards, crucial for maintaining brand reputation.

In 2024, the company's operational focus remains on optimizing staffing levels and facility upkeep to manage costs effectively while still delivering a premium viewing environment. This operational backbone is essential for day-to-day revenue generation.

Securing and managing film distribution agreements is fundamental to Cineworld's business model. This involves negotiating with studios for the rights to screen new releases, often requiring significant upfront commitments and adherence to specific exhibition terms.

The ability to consistently acquire a diverse and appealing film slate is paramount for attracting audiences. In 2023, Cineworld's film acquisition strategy directly impacted its box office performance, highlighting the critical nature of these relationships.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Film Exhibition | Showcasing a wide range of films, managing showtimes. | Attracting diverse audiences through strategic scheduling. |

| Concession Operations | Selling high-margin food and beverages. | Concessions were a significant profit driver in 2023. |

| Cinema Operations & Maintenance | Ensuring high-quality viewing experience and facility upkeep. | Enhancing in-cinema experience for customer retention. |

| Marketing & Promotion | Driving attendance through advertising and loyalty programs. | Continued emphasis on digital marketing for film releases. |

| Technology Integration | Implementing and maintaining premium formats (IMAX, 4DX). | Essential for differentiation and meeting customer expectations. |

| Film Distribution Agreements | Negotiating and securing rights for film screenings. | Crucial for a competitive and appealing film slate. |

Preview Before You Purchase

Business Model Canvas

The Cineworld Group Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the final deliverable, showcasing the detailed analysis of Cineworld's strategic components. You'll gain immediate access to this exact file, ready for your review and utilization.

Resources

Cineworld Group's extensive network of multiplex cinemas and thousands of screens across multiple countries, including the US and UK, represent its core physical assets. This vast footprint, numbering over 9,000 screens globally as of early 2024, is the fundamental infrastructure enabling its operations and customer reach.

These strategically located venues allow Cineworld to serve diverse markets and customer segments, capitalizing on local demand for cinematic experiences. The sheer scale of its screen count provides a significant competitive advantage in market penetration and brand visibility.

Cineworld's premium format technologies, including IMAX, 4DX, Dolby Atmos, and Superscreen, are vital resources. These licenses and specialized equipment are not just amenities; they are the core of Cineworld's unique selling proposition, drawing in audiences eager for a more immersive cinematic experience.

The investment in and ongoing access to these advanced viewing technologies serve as significant differentiators in a competitive market. For example, in 2023, Cineworld continued to emphasize its premium offerings as a key strategy to drive ticket sales and enhance customer loyalty.

Film licensing agreements are the lifeblood of Cineworld's business, representing crucial contracts with major studios and distributors. These agreements grant Cineworld the rights to screen films, directly impacting its ability to attract audiences and generate revenue. For instance, in 2023, Cineworld's revenue was significantly influenced by the slate of blockbuster films it could show, underscoring the direct correlation between licensing and financial performance.

Brand Portfolio and Reputation

Cineworld Group’s brand portfolio, encompassing Cineworld, Regal Cinemas, Picturehouse, and Cinema City, is a cornerstone of its business model. This diverse collection of brands allows the company to effectively target and serve a wide array of customer segments and market preferences across different geographical regions.

The established brand recognition and the reputation built around delivering a comprehensive cinematic experience represent significant intangible assets for Cineworld. These strong brands are instrumental in attracting new customers and fostering loyalty among existing patrons, directly contributing to market share and revenue generation.

- Brand Diversity: Cineworld operates under multiple well-known cinema brands, including Regal Cinemas in the US and Cinema City in Europe, catering to varied market needs.

- Reputation for Experience: The group’s brands are recognized for offering a high-quality, immersive movie-going experience, a key differentiator in the entertainment sector.

- Customer Acquisition and Retention: Strong brand equity directly supports customer acquisition efforts and enhances retention rates, crucial for sustained profitability.

Skilled Workforce and Management

Cineworld's skilled workforce and management are crucial for its operations. This includes frontline cinema staff, technical teams managing projection and sound, and a strategic leadership team. Their collective expertise is essential for smooth day-to-day running, delivering high-quality customer service, and executing the company's strategic vision. The effectiveness of this human capital directly influences customer satisfaction and the company's overall success.

In 2024, Cineworld continued to focus on training and development to maintain a high standard of service. For instance, the company invested in programs aimed at enhancing employee skills in customer interaction and technical proficiency. This focus on human capital is a key element in their business model, aiming to differentiate Cineworld through superior guest experiences.

- Human Capital Investment: Cineworld's commitment to its workforce includes ongoing training initiatives to ensure staff are adept at providing excellent customer service and operating advanced cinema technology.

- Management Expertise: The strategic management team plays a pivotal role in navigating the competitive landscape of the cinema industry, making key decisions regarding programming, marketing, and operational efficiency.

- Operational Efficiency: A well-trained and motivated staff directly contributes to the efficient functioning of each cinema location, from ticket sales and concessions to the technical aspects of film projection.

- Customer Experience: The quality of interaction with cinema staff and the overall atmosphere created by competent management are paramount in shaping the customer's perception and likelihood of repeat visits.

Cineworld's key resources are its extensive cinema network, premium viewing technologies, film licensing agreements, strong brand portfolio, and skilled workforce. These elements collectively form the foundation of its business operations and competitive positioning.

The company's vast physical presence, exceeding 9,000 screens globally as of early 2024, provides a significant advantage in market reach. Coupled with premium formats like IMAX and Dolby Atmos, this infrastructure is designed to offer an enhanced customer experience, differentiating Cineworld from competitors and driving ticket sales.

Crucially, access to a diverse range of film titles through licensing agreements directly impacts revenue generation, as demonstrated by the strong correlation between blockbuster releases and financial performance in 2023. The strength of its brands, including Regal Cinemas and Cinema City, further supports customer acquisition and loyalty.

| Resource Category | Specific Resources | Significance | As of Early 2024 Data |

|---|---|---|---|

| Physical Assets | Cinema Network (Screens) | Core infrastructure for operations and customer reach. | Over 9,000 screens globally. |

| Technology & Innovation | Premium Formats (IMAX, 4DX, Dolby Atmos) | Key differentiators enhancing customer experience and driving demand. | Continuous investment to maintain competitive edge. |

| Intellectual Property | Film Licensing Agreements | Essential for content programming and revenue generation. | Performance heavily influenced by blockbuster film slate. |

| Brand Equity | Brand Portfolio (Regal, Picturehouse, Cinema City) | Drives customer acquisition, loyalty, and market penetration. | Diverse brands targeting varied customer segments. |

| Human Capital | Skilled Workforce & Management | Ensures operational efficiency and high-quality customer service. | Ongoing training initiatives to enhance skills. |

Value Propositions

Cineworld Group aims to deliver a comprehensive film viewing experience by offering a wide array of the latest movie releases, ensuring a diverse selection that appeals to varied tastes. This commitment translates into providing patrons with consistent access to the newest and most sought-after blockbusters. In 2024, Cineworld continued to focus on bringing a broad spectrum of cinematic content to its audiences, striving to be a primary destination for movie enthusiasts.

Cineworld Group elevates the movie-going experience by offering premium formats such as IMAX, 4DX, Superscreen, and Dolby Atmos. These advanced technologies provide unparalleled audio-visual fidelity and deeply engaging sensory effects, setting Cineworld apart.

This focus on premium experiences directly addresses a key customer desire: a cinematic adventure that simply cannot be replicated in a home environment. In 2024, Cineworld's commitment to these formats continues to be a significant draw for audiences willing to pay more for an enhanced outing.

Cineworld's extensive network of multiplexes, strategically positioned in both bustling urban centers and accessible suburban locations, ensures that a vast audience can easily reach their entertainment. This widespread physical presence makes spontaneous movie outings a readily available option for many.

Further enhancing this convenience is Cineworld's robust digital platform. Customers can effortlessly book tickets and manage their movie experiences through their user-friendly website and mobile application, streamlining the entire process.

For instance, as of early 2024, Cineworld operated over 750 cinemas globally, with a significant portion located in key urban and suburban markets, underscoring their commitment to broad accessibility.

Diverse Food and Beverage Concessions

Cineworld's diverse food and beverage concessions significantly enhance the customer experience, offering everything from classic movie snacks like popcorn and nachos to a broader selection of hot food, sweets, and drinks. This variety caters to different tastes and preferences, making a trip to the cinema more enjoyable and convenient. In 2023, concession sales represented a substantial portion of Cineworld's revenue, often contributing over 30% of total turnover at many of its locations.

These offerings are a cornerstone of the entertainment package, providing an additional revenue stream that complements ticket sales. Customers often view concessions as an integral part of the overall movie-going ritual. For instance, during the peak summer movie season of 2024, Cineworld reported a notable increase in sales for premium beverage options and specialty snacks, indicating a consumer willingness to spend on enhanced concession items.

- Variety of Choices: Traditional popcorn, nachos, hot dogs, alongside premium snacks and beverages.

- Revenue Generation: Concessions are a vital profit driver, often exceeding 30% of total revenue.

- Customer Experience: Enhances the overall enjoyment and convenience of a cinema visit.

- Sales Trends: Increased demand for premium and specialty items observed during peak seasons.

Exclusive Membership Benefits

The Cineworld Unlimited Pass is a cornerstone of their customer loyalty strategy, offering unlimited movie access for a monthly fee. This pass goes beyond simple admission, providing tangible perks that encourage consistent engagement with Cineworld's offerings.

For dedicated film fans, the Unlimited Pass presents a compelling value proposition. It transforms casual movie attendance into a regular habit, making it significantly more economical for frequent visitors than purchasing individual tickets. In 2024, Cineworld continued to leverage this pass to drive repeat business.

- Unlimited Access: Members can watch as many movies as they wish, promoting high visit frequency.

- Concession Discounts: Savings on food and drinks further enhance the value for regular attendees.

- Exclusive Screenings: Early access to select films builds excitement and a sense of privilege among members.

Cineworld's value proposition centers on providing a superior cinematic experience through a wide selection of films and premium viewing formats like IMAX and 4DX. This focus on enhanced sensory engagement, coupled with convenient access through a broad network of multiplexes and a user-friendly digital platform, aims to attract and retain a diverse customer base. The company's extensive concession offerings and the popular Unlimited Pass further solidify its appeal by adding value and encouraging repeat visits.

| Value Proposition | Description | 2024 Relevance |

|---|---|---|

| Comprehensive Film Viewing Experience | Wide array of latest movie releases, diverse selection. | Continued focus on broad spectrum of cinematic content. |

| Premium Formats | IMAX, 4DX, Superscreen, Dolby Atmos for enhanced audio-visual fidelity. | Significant draw for audiences seeking elevated experiences. |

| Accessibility & Convenience | Extensive multiplex network in urban/suburban areas; robust digital booking. | Ensures easy reach and spontaneous movie outings. |

| Enhanced Concessions | Diverse food and beverage options, from classic snacks to premium items. | Integral part of the movie-going ritual, significant revenue driver. |

| Customer Loyalty (Unlimited Pass) | Unlimited movie access, discounts, exclusive screenings for a monthly fee. | Drives repeat business and transforms casual attendance into a habit. |

Customer Relationships

Cineworld cultivates enduring customer connections via its Unlimited Pass, a subscription offering unlimited cinema access and special pricing. This strategy not only drives repeat business by delivering consistent value but also cultivates a sense of belonging among its most committed patrons, reinforcing their loyalty.

The Cineworld app and its online presence are central to personalized digital engagement. These platforms allow for tailored film recommendations, timely showtime alerts, and exclusive special offers, making each customer's interaction more relevant and convenient.

This direct digital channel enables Cineworld to communicate efficiently with individual patrons. For instance, in 2024, Cineworld continued to invest in its digital infrastructure, aiming to boost app engagement and online ticket sales, which represent a significant portion of their revenue stream.

Cineworld's in-cinema staff are the frontline of direct customer service, handling everything from ticket issues to concession queries. This personal interaction is complemented by robust online and app-based support channels, ensuring customers can reach out easily for assistance or to provide feedback. For instance, in 2023, Cineworld reported a significant volume of customer interactions across all these touchpoints, aiming to resolve issues promptly and enhance the overall movie-going experience.

Community and Event-Based Engagement

Cineworld actively cultivates community through a variety of events, including film festivals, special themed screenings, and dedicated family movie days. These initiatives are designed to foster shared experiences and promote social engagement centered on the cinema.

By offering affordable options like £1 family films, Cineworld not only builds positive customer relationships and goodwill but also effectively attracts a broader audience, including new demographics.

- Community Building: Special events like film festivals and themed screenings create a sense of belonging among moviegoers.

- Social Interaction: Family-friendly movie days and other communal gatherings encourage customers to connect over shared cinematic experiences.

- Affordability and Goodwill: Initiatives such as £1 family films demonstrably enhance customer loyalty and attract a wider demographic base.

Transactional Efficiency

Cineworld prioritizes seamless transactions, ensuring customers can easily purchase tickets and concessions both online and within its cinemas. This focus on transactional efficiency is key to a positive customer experience.

In 2023, Cineworld continued to refine its digital platforms, aiming to reduce wait times and simplify the booking process. For instance, the group reported efforts to improve the speed and reliability of its mobile app and website, which are crucial touchpoints for transactional efficiency.

- Online Booking Speed: Efforts were made to decrease the average time taken to complete an online ticket purchase, aiming for under 60 seconds.

- In-Cinema Concession Speed: Initiatives to streamline concession queues, potentially through self-service kiosks, were explored to reduce average service time.

- App Performance: Continuous updates to the Cineworld app in 2023 focused on enhancing user interface and transaction processing speed.

- Payment Options: Expanding and ensuring the reliability of diverse payment methods, including contactless options, contributes to transactional ease.

Cineworld fosters strong customer relationships through its Unlimited Pass, offering unlimited access and value to loyal patrons. Its digital platforms, including the Cineworld app, provide personalized recommendations and exclusive offers, enhancing customer engagement. In 2024, the company continued to focus on these digital channels to boost app usage and online sales, which are vital revenue drivers.

Channels

Cineworld's primary channel is its vast network of physical cinema locations, acting as the direct interface for customer engagement. These multiplexes are the heart of its film exhibition and revenue generation from concessions.

As of early 2024, Cineworld operated hundreds of cinemas globally, a critical asset for delivering the core movie-going experience. The physical presence in key markets allows for direct customer interaction and immediate revenue capture.

Cineworld's official website and mobile app are key online ticketing platforms. These digital channels allow customers to easily view movie schedules, purchase tickets, and manage their Unlimited subscriptions, streamlining the customer experience and minimizing physical queues.

The dedicated Cineworld mobile application serves as a crucial touchpoint, offering users a seamless and personalized experience. It allows for easy access to digital Unlimited cards, detailed film information, and on-the-go booking capabilities, streamlining the customer journey.

This app functions as a central hub for customer interaction and service, significantly enhancing accessibility. In 2024, mobile bookings are a vital component of the cinema-going experience, with a significant percentage of ticket sales originating from such platforms, reflecting evolving consumer habits.

Social Media Platforms

Cineworld leverages platforms like X (formerly Twitter), Facebook, Instagram, and TikTok to connect with its audience. These channels are crucial for marketing campaigns, announcing new movie releases, and promoting special offers, driving ticket sales and engagement.

The company uses social media for direct customer interaction, responding to inquiries and fostering a sense of community around film. This engagement is vital for building brand loyalty and gathering customer feedback.

In 2024, social media continues to be a primary driver for reaching a broad demographic, particularly younger audiences on platforms like TikTok. This digital presence helps maintain Cineworld's visibility in a competitive entertainment landscape.

- Marketing and Promotions: Announcing new film releases and special ticket deals.

- Customer Engagement: Interacting with patrons, answering questions, and building community.

- Audience Reach: Targeting diverse demographics, especially younger consumers on platforms like TikTok.

- Brand Building: Maintaining a strong online presence to foster customer loyalty.

In-Cinema Advertising and Promotions

Cineworld leverages its cinema screens as a powerful internal channel for advertising and promotions, directly reaching a captive audience. This includes trailers for upcoming blockbusters, special offers on concessions, and highlighting the advantages of their loyalty programs. For example, in 2024, Cineworld continued to integrate sponsored content and pre-show advertising, aiming to enhance the overall cinema experience while driving revenue.

This strategy is highly effective because it intercepts customers at the point of decision-making, influencing their choices for both future film viewings and on-site purchases. The physical presence within the cinema environment allows for a more immersive and impactful brand message compared to many external advertising methods.

- Internal Advertising: Utilizes cinema screens for film trailers, concession promotions, and membership benefits.

- Captive Audience: Directly engages moviegoers before their film begins.

- Revenue Enhancement: Promotes concession sales and drives loyalty program sign-ups.

- Brand Integration: Seamlessly weaves promotional content into the overall cinema experience.

Cineworld's channels extend to strategic partnerships and B2B relationships. These include collaborations with film distributors for content acquisition and promotional activities, as well as corporate event bookings. In 2024, these partnerships were crucial for securing a diverse film slate and exploring new revenue streams beyond individual ticket sales.

These collaborations allow Cineworld to offer exclusive screenings and package deals, enhancing the value proposition for both corporate clients and film enthusiasts. By working closely with distributors, Cineworld ensures access to a wide range of content, from major blockbusters to independent films, catering to varied audience preferences.

Furthermore, Cineworld's presence on third-party ticketing platforms and aggregators, while not a primary channel, serves as an additional avenue for ticket sales and customer acquisition. These platforms can increase visibility and reach audiences who may not directly engage with Cineworld's own digital channels.

| Channel Type | Description | Key Function | 2024 Focus |

|---|---|---|---|

| Physical Cinemas | Cineworld's multiplex locations | Core movie exhibition, concession sales | Optimizing customer experience, operational efficiency |

| Digital Platforms (Website & App) | Online ticketing and information portals | Ticket sales, subscription management, customer engagement | Enhancing mobile booking, personalized offers |

| Social Media | X, Facebook, Instagram, TikTok | Marketing, promotions, customer interaction | Targeting younger demographics, driving engagement |

| In-Cinema Advertising | Cinema screens | Promoting films, concessions, loyalty programs | Integrating sponsored content, enhancing pre-show experience |

| Partnerships | Film distributors, corporate clients | Content acquisition, B2B sales, event bookings | Securing diverse film slate, exploring new revenue streams |

Customer Segments

General moviegoers represent the core audience for Cineworld, individuals and families looking for mainstream entertainment. They are primarily drawn to the latest blockbuster releases and popular films, seeking a traditional and enjoyable cinema experience.

This segment is crucial for Cineworld's revenue, as they constitute the largest portion of the customer base. In 2023, Cineworld reported a significant increase in attendance for major releases, indicating a strong demand from this broad demographic for the communal cinema outing.

Cineworld actively courts families with children through initiatives like its 'Movies for Juniors' program, which offers discounted morning screenings of films suitable for younger audiences. In 2024, these family-focused offerings are crucial for driving attendance, especially during school holidays. Affordability is a key driver for this segment, making special promotions and family ticket bundles particularly attractive.

Premium Experience Seekers represent a crucial customer segment for Cineworld, as they actively choose and pay a premium for advanced viewing technologies like IMAX, 4DX, Superscreen, and Dolby Atmos. This willingness to spend more highlights their prioritization of an immersive and high-quality cinematic environment over basic movie-going.

In 2024, Cineworld's focus on these premium formats is vital. These experiences drive higher ticket prices and often encourage ancillary sales, contributing significantly to overall revenue. Customers in this segment are looking for more than just a film; they want a memorable event.

Loyalty Program Members

Loyalty Program Members, primarily Cineworld Unlimited Pass holders, form a cornerstone of Cineworld's customer base. These individuals are drawn to the subscription model for its perceived value and the consistent access it provides to movie screenings. Their frequent cinema visits translate into a predictable and reliable revenue stream for the company.

This segment exhibits strong brand loyalty and a high propensity for repeat business, making them a vital component of Cineworld's financial stability. Their engagement is a key indicator of the success of Cineworld's loyalty initiatives.

- High Repeat Visitation: Unlimited Pass holders are incentivized to visit the cinema more often than casual moviegoers.

- Stable Revenue Stream: The subscription model provides predictable monthly or annual income, bolstering financial planning.

- Brand Loyalty: This group demonstrates a strong affinity for the Cineworld brand, making them less susceptible to competitor promotions.

- Engagement Metrics: For example, in 2024, Cineworld reported that its Unlimited members accounted for a significant portion of its ticket sales, highlighting their importance.

Corporate and Event Organizers

Corporate and event organizers represent a key customer segment for Cineworld, leveraging its venues for a variety of private functions. This includes businesses hosting product launches, company parties, or client appreciation events, as well as individuals organizing birthday parties or anniversaries. These clients value the unique atmosphere and advanced audiovisual technology that cinema spaces offer, transforming standard events into memorable experiences.

This segment is crucial for diversifying Cineworld's revenue streams, moving beyond traditional ticket sales. By offering private hire options, Cineworld taps into the lucrative corporate events market. For instance, in 2024, the demand for experiential corporate events remained strong, with companies seeking engaging venues to foster team building and client relationships. Cineworld's ability to provide a dedicated space with high-quality projection and sound systems makes it an attractive option for these organizers.

- Venue Hire for Corporate Functions: Businesses utilize Cineworld cinemas for meetings, conferences, and employee appreciation events, often incorporating private film screenings.

- Event Customization: Organizers can tailor the experience with branding, catering, and specific entertainment options, making each event unique.

- Revenue Diversification: This segment provides a stable, non-film-dependent income source, contributing to overall financial resilience.

- Targeted Marketing: Cineworld can market its event spaces to businesses and event planners seeking distinctive venues for their gatherings.

Cineworld's customer segments are diverse, ranging from general moviegoers seeking mainstream entertainment to premium experience seekers prioritizing immersive formats like IMAX and 4DX. The company also cultivates a loyal base through its Unlimited subscription program, which drives repeat visitation and provides a stable revenue stream. Furthermore, Cineworld caters to corporate clients and event organizers looking for unique venues for private functions, diversifying its income beyond traditional ticket sales.

| Customer Segment | Key Characteristics | Revenue Impact | 2024 Focus |

|---|---|---|---|

| General Moviegoers | Families and individuals seeking mainstream entertainment and blockbuster releases. | Largest portion of customer base, driving overall ticket sales. | Attracting families with value-driven promotions and family ticket bundles. |

| Premium Experience Seekers | Customers willing to pay more for advanced formats (IMAX, 4DX, Dolby Atmos). | Higher ticket prices and increased ancillary sales. | Highlighting immersive experiences to drive higher revenue per customer. |

| Loyalty Program Members (Unlimited Pass) | Frequent visitors attracted by subscription value and consistent access. | Predictable revenue stream and high brand loyalty. | Encouraging continued engagement and maximizing member visit frequency. |

| Corporate & Event Organizers | Businesses and individuals hiring venues for private functions. | Revenue diversification and access to lucrative events market. | Leveraging venues for experiential corporate events and private parties. |

Cost Structure

Rent and lease payments represent a substantial fixed cost for Cineworld Group, directly tied to its extensive network of cinema locations. These payments are crucial for maintaining its physical presence in key markets.

In 2023, Cineworld continued its strategy of optimizing its property portfolio, which included exiting around 120 sites in the US as part of its Chapter 11 restructuring. This move aimed to alleviate significant lease liabilities and improve overall financial flexibility.

Further efforts in 2024 and into 2025 are expected to focus on renegotiating terms for remaining leases and potentially closing underperforming venues to reduce ongoing rental expenses, a vital step in their cost management strategy.

Film licensing and distribution fees represent a significant cost for Cineworld, as they are essential for acquiring the rights to screen movies. These expenses are not static; they fluctuate considerably depending on a film's anticipated popularity and its actual performance at the box office. For instance, a major blockbuster release will command higher licensing fees than a smaller independent film.

The ability to secure a diverse and appealing slate of films is directly tied to the substantial investment Cineworld makes in these content acquisition costs. In 2023, Cineworld's revenue was £3.5 billion, with a significant portion of this going towards securing film rights to attract audiences.

Personnel costs, encompassing wages, salaries, and benefits for cinema staff, management, and technical teams, represent a significant portion of Cineworld's operating expenses. For instance, in 2023, employee-related costs were a major component of their overall expenditure, reflecting the large workforce required to operate their extensive cinema network.

Beyond staffing, other operational costs are vital for maintaining the cinema experience. These include essential utilities like electricity and water, regular cleaning services to ensure a pleasant environment, and general administrative overhead necessary for the day-to-day running of each location.

Effectively managing staffing levels and optimizing operational processes are therefore paramount for Cineworld. This focus on efficiency directly impacts profitability by controlling these substantial cost drivers, especially in a competitive entertainment landscape.

Concession Procurement Costs

Cineworld's concession procurement costs involve the significant expense of acquiring a wide variety of food and beverage items. These include popular cinema staples like popcorn, soft drinks, and confectionery, which are crucial for driving concession revenue.

While concessions represent a high-margin segment for Cineworld, the upfront costs associated with purchasing this inventory are a substantial part of their overall cost structure. Effective management of these procurement expenses is therefore vital for maximizing profitability.

For instance, in 2024, Cineworld continued to focus on optimizing its supply chain for concessions. While specific procurement cost figures are not publicly detailed, industry trends indicate that managing supplier contracts and bulk purchasing are key strategies. For example, a typical cinema chain might allocate a significant portion of its cost of goods sold to concession inventory, often in the range of 20-30%, depending on the product mix and supplier agreements.

- Inventory Acquisition: The direct cost of buying popcorn kernels, syrups for sodas, candy, and other snack items.

- Supplier Relationships: Costs incurred in maintaining and negotiating terms with food and beverage suppliers.

- Logistics and Storage: Expenses related to transporting and storing concession inventory before it reaches the cinemas.

- Quality Control: Costs associated with ensuring the freshness and quality of concession products.

Marketing and Advertising Expenditure

Cineworld's cost structure heavily features marketing and advertising expenditure. This involves significant investment in campaigns, promotions, and advertising across diverse media to draw audiences and highlight specific films. For instance, in 2023, the company continued to invest in digital marketing and social media engagement to reach a wider audience, a trend expected to persist into 2024.

- Campaign Investment: Allocating substantial funds to create and execute broad-reaching marketing campaigns for new film releases.

- Promotional Activities: Engaging in special offers, loyalty programs, and event-based promotions to drive footfall and ticket sales.

- Advertising Reach: Utilising television, online platforms, social media, and print to maintain brand visibility and attract diverse demographics.

- Audience Engagement: These costs are directly tied to efforts to capture audience attention and encourage cinema visits, crucial for revenue generation.

Cineworld's cost structure is dominated by significant expenses related to film licensing, property leases, and personnel. These core costs are essential for operating its vast cinema network and attracting audiences. In 2023, the company's revenue of £3.5 billion was significantly impacted by these expenditures, particularly content acquisition.

Ongoing efforts in 2024 and 2025 are focused on optimizing these cost areas, including renegotiating leases and managing staffing levels to improve financial performance. The strategic exit from numerous US sites in 2023 highlights the company's commitment to reducing fixed property costs.

| Cost Category | Description | 2023 Relevance |

| Film Licensing & Distribution | Fees paid to acquire rights to screen movies. | A major component of revenue expenditure, fluctuating with film popularity. |

| Rent & Lease Payments | Costs associated with cinema locations. | Substantial fixed costs, with restructuring efforts to reduce liabilities. |

| Personnel Costs | Wages, salaries, and benefits for staff. | A significant operating expense reflecting the large workforce. |

| Concession Procurement | Costs of acquiring food and beverage inventory. | Essential for high-margin concession sales, with focus on supply chain optimization in 2024. |

| Marketing & Advertising | Investment in campaigns and promotions. | Crucial for audience attraction, with continued focus on digital engagement in 2023 and 2024. |

Revenue Streams

Ticket sales are the bedrock of Cineworld Group's revenue. This encompasses everything from standard 2D movie admissions to higher-priced tickets for premium formats like IMAX and 4DX, which offer enhanced viewing experiences. The success of ticket sales is intrinsically tied to the appeal of the films being shown and the overall willingness of audiences to return to cinemas.

Concession sales, encompassing popcorn, drinks, and snacks, are a cornerstone of Cineworld's revenue. This segment is known for its high profit margins, often exceeding those of ticket sales. In 2023, concession revenue played a crucial role in the company's financial recovery.

Cineworld Group taps into cinema advertising as a significant revenue stream, showcasing on-screen ads before films, alongside digital and in-lobby promotions. This involves collaborations with a diverse range of brands and advertising firms, capitalizing on the captive audience present in theaters.

In 2023, the global cinema advertising market was valued at approximately $4.6 billion, with projections indicating steady growth. This segment offers Cineworld a reliable income source by effectively monetizing the attention of moviegoers, providing brands with a unique and engaging platform.

Unlimited Membership Subscriptions

The Cineworld Unlimited Pass is a cornerstone revenue stream, generating consistent income through monthly membership fees. This loyalty program grants members unlimited access to movies and various discounts, cultivating a dedicated and engaged customer base.

This subscription model is instrumental in fostering customer retention and providing predictable revenue. For instance, in the first half of 2024, Cineworld reported a significant uplift in admissions, partly driven by the strong performance of its Unlimited membership base, which continued to grow steadily throughout the period.

- Recurring Revenue: Monthly subscription fees create a predictable income flow.

- Customer Loyalty: The pass encourages repeat visits and builds a strong customer base.

- Predictable Income: Subscription models offer financial stability and forecasting capabilities.

- Engagement: Unlimited access and discounts keep members actively engaged with the Cineworld offering.

Premium Format Uplifts and Special Events

Cineworld Group significantly boosts its earnings through premium format screenings, charging more for experiences like IMAX, 4DX, Superscreen, and Dolby Atmos. These enhanced formats attract customers willing to pay a premium for a more immersive viewing experience.

Beyond standard movie tickets, Cineworld also generates revenue from special events, private hire, and alternative content. This includes live broadcasts of theatre productions, opera, and other unique performances, diversifying their income streams and appealing to a broader audience.

For instance, in 2024, Cineworld's focus on these premium offerings and special events played a crucial role in its recovery strategy. While specific figures for this segment are often integrated into overall box office performance, the trend indicates a growing customer preference for premium experiences, contributing to higher average ticket prices.

- Premium Formats: IMAX, 4DX, Superscreen, Dolby Atmos offer higher ticket prices.

- Special Events: Private screenings and corporate events provide additional revenue.

- Alternative Content: Live theatre, opera, and sports broadcasts attract niche audiences.

- Increased Average Ticket Price: These offerings contribute to a higher per-customer spend.

Cineworld Group leverages its cinema locations for additional revenue through venue hire and private screenings. This allows businesses and individuals to utilize the cinema space for corporate events, parties, or exclusive film viewings, capitalizing on the unique environment.

In 2023, Cineworld's operational recovery was supported by a diversified approach to revenue generation. While ticket and concession sales remained primary drivers, the company actively explored and expanded into these ancillary revenue streams to bolster overall financial performance.

Business Model Canvas Data Sources

The Cineworld Group Business Model Canvas is informed by a blend of financial disclosures, market research reports, and internal operational data. These sources provide a comprehensive view of customer behavior, competitive landscape, and cost structures.