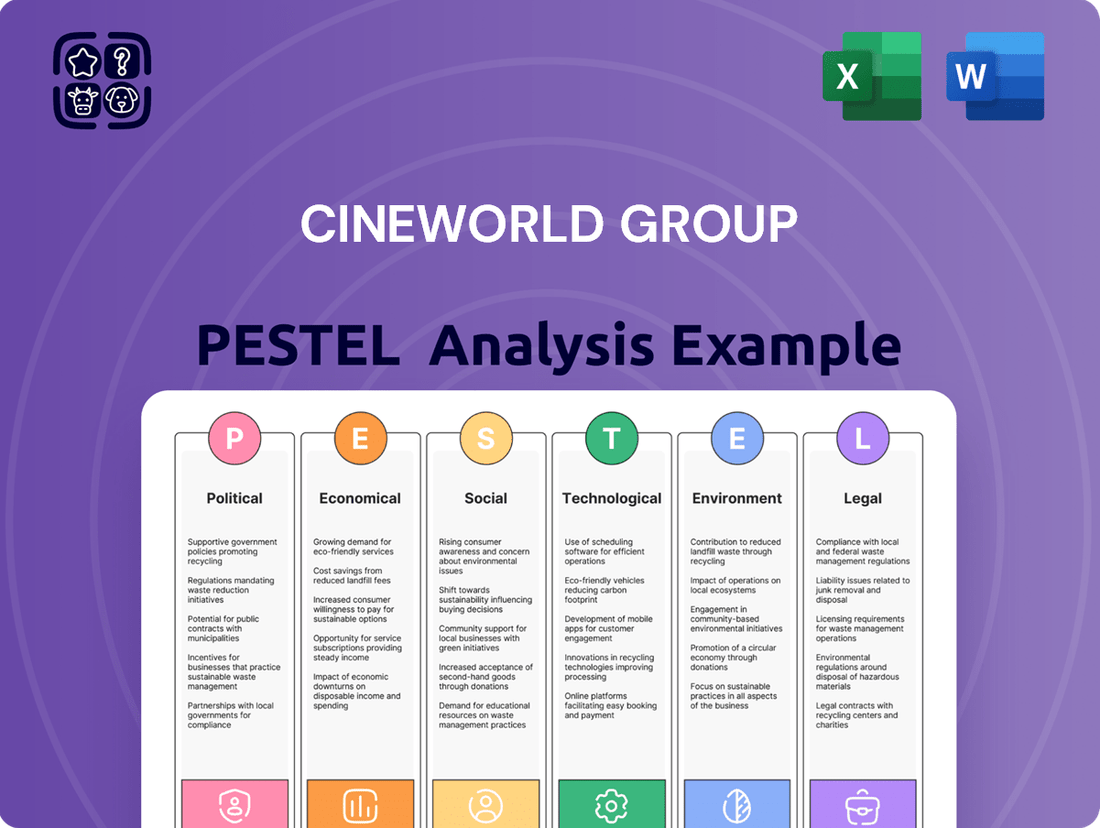

Cineworld Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cineworld Group Bundle

Cineworld Group operates within a dynamic environment shaped by political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks. Understanding these external forces is crucial for navigating challenges and capitalizing on opportunities in the cinema industry. Gain a competitive edge by exploring these critical factors.

Our comprehensive PESTLE analysis delves deep into how these macro-environmental elements are impacting Cineworld's strategic decisions and future trajectory. Equip yourself with the knowledge to anticipate market shifts and refine your own business strategies. Download the full report for actionable intelligence.

Political factors

Government regulations, particularly those concerning public health and safety, have a profound impact on cinema operators like Cineworld. The COVID-19 pandemic highlighted this, with widespread lockdowns and capacity restrictions severely limiting operations. For instance, during various periods in 2020 and 2021, many of Cineworld's global locations faced significant operational constraints due to these mandates.

Beyond public health, policies on content classification and advertising also shape the industry. These regulations dictate what films can be shown and how they can be marketed, influencing Cineworld's programming choices and revenue potential. Compliance with these diverse governmental frameworks is a constant factor in the company's strategic planning and day-to-day operations.

Cineworld's global footprint means it's highly sensitive to geopolitical stability. For instance, ongoing conflicts or political unrest in key markets can deter moviegoers and disrupt supply chains for film distribution. The company's significant presence in the US and UK, for example, means that any major shifts in their international relations could impact film licensing agreements and operational costs.

Government subsidies can significantly boost the film and cinema sector. For instance, many countries offer tax credits for local film production, which indirectly supports cinema attendance by ensuring a steady stream of diverse content. In 2024, the UK's Film Tax Relief continued to incentivize production, with over £500 million claimed by film and TV productions in the fiscal year ending March 2023, demonstrating its ongoing impact.

Conversely, new taxes or changes to existing ones can directly affect Cineworld's bottom line. An increase in Value Added Tax (VAT) on cinema tickets, for example, would raise prices for consumers and potentially reduce demand. In 2024, several European nations were reviewing their tax policies, and any adverse changes to entertainment levies or corporate tax rates in key markets like the US or UK could add substantial operating costs for Cineworld.

Labor Laws and Employment Policies

Labor laws, such as minimum wage, working hours, and union rights, directly influence Cineworld's operating expenses and how it manages its staff. For instance, in the UK, the National Living Wage increased to £11.44 per hour for those aged 21 and over from April 2024, impacting payroll costs for Cineworld's UK operations.

Shifts in employment policies across the diverse countries where Cineworld operates require constant adaptation of staffing models and pay scales. This includes navigating varying regulations on employee benefits and contract types, which can add complexity and cost to workforce planning.

The significant labor disputes in the entertainment industry, like the 2023 Hollywood strikes involving the SAG-AFTRA and WGA unions, directly impacted film release calendars. This disruption affected Cineworld's ability to secure content and consequently, its revenue streams, highlighting the vulnerability of its business to such industrial actions.

- Minimum Wage Impact: An increase in minimum wage rates, such as the aforementioned rise in the UK, directly increases Cineworld's labor costs per employee.

- Regulatory Compliance: Adhering to different labor laws in countries like the US, UK, and Ireland requires robust compliance frameworks, potentially leading to legal and administrative expenses.

- Unionization Trends: The potential for increased unionization among cinema staff could lead to collective bargaining agreements that might raise wage and benefit costs for Cineworld.

- Strike Effects: The 2023 strikes caused delays in major film releases, directly reducing box office potential and, therefore, Cineworld's ticket and concession sales.

Government Support for Arts and Culture

Government support for the arts and culture sector, including funding for film festivals and cultural programs, can indirectly boost cinema chains like Cineworld by cultivating a strong film-going culture. A politically supportive environment for cultural industries generally translates to a more conducive operating landscape.

For instance, the UK government's Creative Industries Sector Vision, launched in 2023, aims to grow the sector by £50 billion by 2030, with film and TV production being a key focus. Such initiatives can lead to increased domestic film production and a greater variety of content available to cinemas.

- Increased Content Diversity: Government funding for independent filmmakers and cultural projects can lead to a richer and more diverse film slate, attracting broader audiences to cinemas.

- Favorable Regulatory Environment: A government that values cultural output may implement policies that benefit the exhibition sector, such as tax incentives for cinema construction or operation.

- Enhanced Public Engagement: Initiatives promoting cultural participation can foster a habit of attending cultural events, including cinema visits, thereby increasing footfall.

Government policies on public health and safety directly impact Cineworld's operations, as seen with COVID-19 restrictions. Content classification and advertising regulations also influence film programming and marketing strategies. Geopolitical stability is crucial, as unrest in key markets can deter audiences and disrupt film distribution.

Government subsidies, like the UK's Film Tax Relief, can boost the industry by incentivizing production, potentially leading to more content for cinemas. Conversely, tax changes, such as increased VAT on tickets, can negatively affect consumer demand and Cineworld's revenue. Labor laws, including minimum wage adjustments like the UK's National Living Wage increase to £11.44 per hour from April 2024, directly impact payroll costs.

The 2023 Hollywood strikes, involving SAG-AFTRA and WGA, significantly disrupted film release schedules, impacting Cineworld's content availability and revenue. Government support for arts and culture, such as the UK's Creative Industries Sector Vision aiming to grow the sector by £50 billion by 2030, can foster a positive environment for cinema attendance by promoting a film-going culture.

| Factor | Impact on Cineworld | Data/Example (2024/2025) |

| Public Health Regulations | Operational restrictions, capacity limits | Continued vigilance on health protocols in cinemas post-pandemic. |

| Tax Policies | Ticket pricing, profitability | Potential review of entertainment levies in European markets; UK corporate tax rate at 25% (2024). |

| Labor Laws | Labor costs, workforce management | UK National Living Wage £11.44/hr (21+); potential for union negotiations impacting wages. |

| Industry Support | Content availability, audience development | UK's Creative Industries Sector Vision targets £50bn growth by 2030; potential for increased domestic film production. |

What is included in the product

This PESTLE analysis delves into the external macro-environmental forces impacting Cineworld Group, examining Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides a comprehensive overview of how these forces create both challenges and opportunities for the cinema giant.

A clear, concise summary of Cineworld's PESTLE analysis, highlighting key external factors impacting the cinema industry, serves as a pain point reliever by enabling swift understanding of market dynamics for strategic decision-making.

Economic factors

The overall health of the global economy and the amount of money consumers have left to spend directly affect how many people go to the movies and how much they spend on snacks. When the economy is struggling or in a recession, people tend to cut back on non-essential spending like entertainment, which can hurt Cineworld's income from tickets and concessions.

On the flip side, when the economy is doing well, consumers feel more confident and are more likely to spend money on leisure activities, leading to increased cinema attendance. The global cinema market is expected to reach $33 billion in 2025, showing a positive trend that could benefit companies like Cineworld if economic conditions remain favorable.

Rising inflation in 2024 and projected into 2025 significantly impacts Cineworld's operational expenses. Costs for essential inputs like utilities, wages, and supplies for concessions have seen notable increases, directly affecting the company's bottom line. For instance, the UK's Consumer Price Index (CPI) remained elevated throughout 2024, impacting the cost of goods and services Cineworld relies on.

The challenge lies in balancing these escalating operating costs with the need to maintain competitive ticket and concession prices. If Cineworld cannot pass these increased costs onto consumers without a significant drop in demand, profit margins will inevitably shrink. This delicate equilibrium is a critical consideration for the company's financial health.

Cineworld's ongoing restructuring efforts, particularly those implemented in late 2023 and continuing through 2024, are largely focused on mitigating these high and often unsustainable operating costs. The aim is to streamline operations and find efficiencies to better absorb inflationary pressures.

As a global operator, Cineworld Group's financial results are significantly influenced by exchange rate fluctuations. When converting revenues and expenses from its various international markets back to its reporting currency, typically the British Pound, currency movements can create substantial swings in reported earnings. For instance, a stronger Pound can make overseas earnings appear smaller, while a weaker Pound can inflate them.

The volatility of major currency pairs, such as the USD/GBP and EUR/GBP, directly impacts Cineworld's profitability and overall financial health. For example, if Cineworld earns a significant portion of its revenue in US Dollars, a depreciation of the dollar against the pound would negatively affect its reported sterling-denominated profits. Conversely, a strengthening dollar would have a positive impact.

In 2024 and looking into 2025, the foreign exchange market has shown considerable volatility. The Bank of England's Monetary Policy Committee has been actively managing interest rates, which in turn influences the GBP's strength. For Cineworld, this means that strategic hedging or careful management of foreign currency exposure is crucial to mitigate the impact of unpredictable exchange rate movements on its consolidated financial statements.

Competition from Home Entertainment and Streaming Services

The increasing accessibility and affordability of home entertainment, particularly streaming services, pose a substantial competitive challenge to traditional cinema operations like Cineworld. Consumers now have a vast array of content readily available in their homes, often at a lower per-viewing cost than a cinema ticket.

This shift in consumer behavior has been amplified by the COVID-19 pandemic, which accelerated the adoption of streaming platforms. For instance, by the end of 2024, global streaming subscriptions were projected to surpass 1.7 billion, indicating a significant portion of entertainment budgets being allocated to these services. This directly competes for leisure time and disposable income previously earmarked for cinema visits.

- Increased Streaming Subscriptions: Global streaming subscriptions are projected to exceed 1.7 billion by the end of 2024, a stark contrast to cinema attendance figures.

- Content Availability: Major studios are increasingly releasing films directly to streaming or simultaneously in cinemas and on streaming platforms, diminishing the exclusivity of the theatrical window.

- Consumer Preference Shift: Surveys in late 2024 indicated that a growing percentage of consumers prefer the convenience and cost-effectiveness of home viewing for a significant portion of new releases.

Film Production and Release Schedules

The availability of a compelling slate of new film releases is paramount for attracting audiences back to cinemas. A robust pipeline of anticipated blockbusters and diverse genres directly correlates with increased ticket sales and overall box office performance.

Disruptions to film production, exemplified by the significant impact of the 2023 Hollywood strikes affecting both actors and writers, can create a noticeable gap in the supply of new content. This scarcity of fresh releases directly translates to a weaker film pipeline, potentially leading to a downturn in box office revenue for cinema chains like Cineworld.

Looking ahead, industry analysts anticipate a stronger film lineup to bolster recovery efforts. For instance, the projected release schedule for 2025 includes several highly anticipated sequels and original productions, which are expected to significantly drive cinema attendance and contribute positively to Cineworld's financial performance.

- Crucial Factor: A strong slate of new movie releases is essential for driving cinema attendance.

- Impact of Disruptions: The 2023 actor and writer strikes led to a weaker film pipeline, negatively impacting box office revenue.

- 2025 Outlook: A robust film lineup is projected to support recovery in 2025, with major studio releases expected to boost ticket sales.

Economic downturns and inflation directly impact Cineworld's revenue and costs. As of late 2024, persistent inflation in the UK and globally increased operational expenses for utilities, wages, and supplies, squeezing profit margins. While the global cinema market is projected to reach $33 billion by 2025, indicating growth potential, this is contingent on favorable economic conditions and consumer spending power.

Exchange rate volatility also plays a significant role. For instance, fluctuations in the USD/GBP and EUR/GBP exchange rates in 2024 and into 2025 directly affect Cineworld's reported earnings when converting international revenues. Careful currency management is crucial to mitigate these impacts.

The competitive landscape is further shaped by the increasing affordability and accessibility of home entertainment. Global streaming subscriptions were projected to exceed 1.7 billion by the end of 2024, diverting consumer spending and leisure time away from cinemas. This trend, accelerated by the pandemic, presents an ongoing challenge for traditional cinema operators.

A strong pipeline of new film releases is vital for Cineworld's success. The 2023 Hollywood strikes disrupted content supply, impacting box office performance. However, the projected film slate for 2025, featuring anticipated blockbusters, is expected to drive recovery and boost cinema attendance.

| Economic Factor | Impact on Cineworld | Data/Outlook |

| Inflation | Increased operating costs, reduced profit margins | UK CPI elevated throughout 2024; projected to remain a concern into 2025. |

| Consumer Spending | Directly affects ticket and concession sales | Global cinema market projected to reach $33 billion by 2025, dependent on economic health. |

| Exchange Rates | Volatility impacts reported international earnings | USD/GBP and EUR/GBP showed considerable volatility in 2024, expected to continue into 2025. |

| Home Entertainment Competition | Diversion of consumer spending and leisure time | Global streaming subscriptions projected to exceed 1.7 billion by end of 2024. |

| Film Slate Availability | Drives cinema attendance and revenue | 2023 strikes impacted pipeline; 2025 slate anticipated to boost recovery. |

Preview Before You Purchase

Cineworld Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Cineworld Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

Consumer preferences for entertainment are in constant flux, with a significant trend towards digital and at-home viewing experiences. This shift presents a challenge for traditional cinema operators like Cineworld, requiring them to innovate and highlight the unique value proposition of the theatrical experience.

In 2024, a substantial 68% of global movie viewers utilized streaming services, underscoring the growing dominance of digital platforms. To counter this, Cineworld must focus on differentiating its offerings, emphasizing the communal and immersive nature of cinema-going that cannot be replicated at home.

Demographic shifts are profoundly impacting the cinema industry, with Cineworld needing to adapt. For instance, the increasing proportion of older adults in many developed nations might lead to a greater demand for films appealing to a mature audience, potentially shifting away from the youth-centric blockbusters that have long dominated. Conversely, a growing youth demographic, particularly in emerging markets, presents an opportunity for increased attendance if content resonates.

Understanding and segmenting these evolving audiences is crucial for Cineworld's strategic planning. In the UK, for example, while the 16-24 age group remains a significant cinema-going demographic, there's also a growing interest from families and older individuals in specific film genres. Cineworld's success hinges on its ability to tailor marketing campaigns and film selections to these diverse segments, ensuring broad appeal across different age groups and preferences.

Broader social trends significantly influence cinema attendance. The growing preference for shared experiences, a resurgence of nostalgia for traditional cinema, and a general desire for out-of-home entertainment are key drivers. For instance, in 2024, the global box office saw a notable recovery, with many markets exceeding pre-pandemic levels, indicating a strong public appetite for communal viewing experiences.

Cineworld actively seeks to cater to these evolving preferences by offering a comprehensive film viewing experience. This includes investing in premium formats like IMAX and the recently expanded ScreenX, alongside a diverse range of concessions, to attract a broad audience seeking more than just a movie. The company's strategy aims to capitalize on the enduring appeal of the big screen, particularly as audiences return to cinemas post-pandemic.

Impact of Health Concerns and Public Safety Perceptions

Public health concerns, starkly highlighted by the COVID-19 pandemic, directly influence cinema attendance. Fear of contagion and evolving government restrictions, such as capacity limits or temporary closures, significantly reduce foot traffic. For instance, in 2020, global box office revenue plummeted by an estimated 72% compared to 2019, demonstrating the profound impact of such health crises on the industry.

Consumer confidence hinges on perceptions of safety and cleanliness within cinema venues. Cinemas implementing enhanced hygiene protocols, like frequent sanitization and improved ventilation, are better positioned to attract patrons. A 2023 survey indicated that over 60% of moviegoers consider venue cleanliness a critical factor in their decision to attend.

- Health Scares: Events like pandemics directly deter attendance due to contagion fears.

- Safety Perceptions: Cleanliness and safety measures are paramount for consumer trust.

- Regulatory Impact: Government restrictions tied to public health can force closures or limit capacity.

- Consumer Confidence: A perceived safe environment is key to encouraging cinema visits.

Cultural Importance of Cinema

Cinema's deep-rooted cultural significance as a shared experience and a powerful storytelling medium continues to draw crowds, a trend Cineworld aims to capitalize on. By providing a full-service movie-going experience featuring new releases and premium formats, the company taps into this enduring appeal.

This cultural pull is supported by robust market growth. The global film media market is anticipated to reach an impressive $117.69 billion by 2025, highlighting the continued economic relevance of cinematic entertainment.

- Enduring Appeal: Cinema remains a significant cultural touchstone for communal entertainment and narrative consumption.

- Cineworld's Strategy: The company focuses on delivering a complete cinematic experience, including access to the newest films and advanced viewing formats.

- Market Projection: The global film media market is expected to hit $117.69 billion in 2025, underscoring the sector's strong economic outlook.

Sociological factors significantly shape Cineworld's operating environment, influencing consumer behavior and industry trends. The ongoing shift towards at-home entertainment, with 68% of global movie viewers using streaming services in 2024, necessitates Cineworld's focus on the unique communal and immersive aspects of cinema. Demographic changes, such as an aging population in developed nations and a growing youth demographic in emerging markets, require tailored content strategies to appeal to diverse age groups.

The enduring cultural significance of cinema as a shared experience, coupled with a desire for out-of-home entertainment, supports Cineworld's strategy of offering premium formats like IMAX and ScreenX. This approach aims to capitalize on the projected growth of the global film media market, expected to reach $117.69 billion by 2025, reflecting a strong public appetite for cinematic events.

| Sociological Factor | Impact on Cineworld | Supporting Data/Trend |

|---|---|---|

| Shift to At-Home Entertainment | Decreased cinema attendance, need for differentiation | 68% of global viewers used streaming in 2024 |

| Demographic Shifts | Need for diverse content and marketing | Growing older populations in developed nations; youth growth in emerging markets |

| Cultural Significance of Cinema | Reinforces value of communal viewing | Global film media market projected to reach $117.69 billion by 2025 |

| Consumer Preference for Experiences | Opportunity to enhance cinema offerings | Increased demand for premium formats and out-of-home entertainment |

Technological factors

Technological advancements are reshaping the cinema landscape, with innovations like IMAX, 4DX, and Dolby Atmos creating highly immersive experiences that home entertainment struggles to replicate. These premium formats are crucial for drawing audiences seeking a superior, differentiated viewing. For instance, Cineworld's investment in Superscreen and IMAX locations aims to capture this demand for enhanced sensory engagement.

Cineworld's operational efficiency and customer engagement are increasingly tied to its digital platforms, which handle everything from ticket sales to loyalty programs. This digital reliance is a key technological factor shaping the company's future.

The company's ongoing digital transformation, incorporating tools like chatbots and conversational AI, represents a significant effort to modernize its customer interactions and internal processes. This modernization is vital for staying competitive in a rapidly evolving market.

For instance, by the end of 2024, it's projected that over 80% of all movie ticket purchases will be made online, a trend Cineworld must actively leverage through its digital channels to maintain market share and enhance customer convenience.

Virtual Reality (VR) and Augmented Reality (AR) present intriguing technological avenues for Cineworld. While nascent, these immersive technologies could revolutionize the cinema experience, offering patrons interactive pre-show content or entirely new forms of entertainment beyond traditional film viewing. This innovation could be a key differentiator in attracting and retaining audiences in an increasingly competitive entertainment landscape.

The potential for VR and AR integration is underscored by the robust growth in related digital content sectors. For instance, the global 3D animation market is on a strong upward trajectory, with projections indicating it will nearly double to approximately $40 billion by 2028. This expansion suggests a growing consumer appetite for sophisticated visual and interactive experiences, which VR and AR can directly cater to.

Data Analytics and Personalization

Cineworld can leverage advanced data analytics to deeply understand its audience. By analyzing viewing patterns and demographic information, the company can move beyond broad marketing to highly personalized campaigns. This means suggesting films patrons are likely to enjoy and offering specific concession deals, boosting engagement and repeat visits.

The effective use of data analytics is crucial for optimizing Cineworld's operations and enhancing customer loyalty. For instance, in 2024, many cinema chains reported increased revenue from personalized loyalty programs that offer tailored discounts and early access to popular screenings. This data-driven approach allows Cineworld to anticipate consumer needs and proactively adjust its content and promotional strategies.

- Personalized Film Recommendations: Utilizing algorithms to suggest movies based on past viewing history and stated preferences.

- Targeted Concession Offers: Offering discounts on popcorn or drinks to specific customer segments based on their purchase history.

- Predictive Analytics for Demand: Forecasting attendance for specific films and showtimes to optimize staffing and inventory.

- Customer Segmentation: Dividing the customer base into groups for more effective and relevant marketing communications.

Impact of Artificial Intelligence (AI)

Artificial intelligence is increasingly being integrated into the cinema industry to streamline operations. For Cineworld, this means opportunities in optimizing film scheduling for maximum attendance and managing concession inventory more efficiently to reduce waste. The company's commitment to adopting new technologies, including AI, is crucial for staying competitive in the evolving entertainment landscape. For instance, AI-powered analytics can predict audience demand for specific films and showtimes, allowing for better resource allocation.

The application of AI extends to enhancing the viewing experience itself. Beyond operational efficiencies, AI can be leveraged in post-production for tasks like color grading and visual effects, potentially improving film quality. Cineworld's willingness to invest in such technological advancements will be a determining factor in its ability to adapt to future industry trends and maintain a strong market position. As of early 2025, many cinema chains are exploring AI-driven personalized marketing campaigns to boost ticket sales.

- Optimized Scheduling: AI algorithms can analyze historical data and predict attendance for different movie showings and times, leading to more efficient staffing and seating arrangements.

- Concession Inventory Management: Predictive AI can forecast demand for food and beverage items, minimizing stockouts and reducing spoilage.

- Enhanced Post-Production: AI tools are being developed to assist in film editing, sound mixing, and visual effects, potentially speeding up production timelines and reducing costs.

- Personalized Marketing: AI can analyze customer viewing habits to deliver targeted promotions and recommendations, increasing engagement and ticket sales.

Technological advancements are fundamentally altering how audiences engage with cinema. Premium formats like IMAX and Dolby Atmos, which Cineworld actively invests in, offer immersive experiences that are difficult to replicate at home, driving attendance. By the end of 2024, over 80% of movie ticket purchases are expected to be online, highlighting the critical need for robust digital platforms for sales and customer interaction.

Cineworld's digital transformation includes adopting AI for optimized scheduling and inventory management, as well as personalized marketing campaigns. For instance, AI-driven analytics can predict audience demand, helping allocate resources efficiently. Many cinema chains in early 2025 are exploring these AI-powered strategies to boost ticket sales and customer loyalty.

Legal factors

Cineworld's vast cinema portfolio relies heavily on complex lease agreements, a critical legal factor impacting its operations and financial health. The company's recent financial struggles, including Chapter 11 bankruptcy proceedings in the US and administration in the UK, have led to significant lease renegotiations and site closures. For instance, as of late 2023, Cineworld was still navigating numerous legal disputes with landlords concerning rent arrears and lease terminations, a direct consequence of its restructuring efforts to reduce substantial operating costs.

Cineworld's reliance on film distribution hinges on navigating intricate intellectual property rights and licensing agreements with major studios. These contracts are foundational to its business, dictating which films can be screened and under what terms. Failure to secure or maintain these licenses, governed by copyright law, directly impacts revenue streams.

Cineworld's journey through Chapter 11 bankruptcy protection in the United States, filed in September 2022, highlights the critical impact of insolvency laws on large corporations. This legal process allowed the company to reorganize its substantial debt burden, estimated to be around $5 billion at the time of filing. The restructuring plan, approved by the court in mid-2023, involved significant deleveraging and a change in ownership, demonstrating how bankruptcy laws can facilitate survival but also fundamentally alter a company's structure.

Simultaneously, Cineworld has navigated restructuring efforts in the UK under its administration. These parallel legal frameworks underscore the complexity of managing cross-border financial distress. The company's ability to emerge from these proceedings, albeit in a transformed state, showcases the adaptive nature of corporate law in addressing severe financial challenges faced by global entities.

Consumer Protection Laws

Consumer protection laws, including those governing data privacy and advertising, directly shape Cineworld's customer interactions. These regulations are critical for maintaining consumer trust and avoiding costly legal repercussions. For instance, the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018, imposes strict rules on how companies like Cineworld collect, process, and store customer data, with potential fines reaching up to 4% of global annual revenue.

Cineworld must adhere to advertising standards to ensure its marketing is truthful and not misleading. Failure to comply can lead to reputational damage and regulatory action. In the UK, the Advertising Standards Authority (ASA) actively monitors advertising practices, and in 2023, the ASA upheld numerous complaints against various businesses for misleading claims, highlighting the importance of accurate promotional content in the entertainment sector.

- Data Privacy Compliance: Adherence to regulations like GDPR and similar frameworks worldwide is paramount for safeguarding customer information and preventing breaches.

- Advertising Integrity: Ensuring all promotional materials are accurate and transparent is crucial to avoid penalties from bodies like the ASA.

- Consumer Rights Enforcement: Understanding and respecting consumer rights related to ticket purchases, refunds, and service quality is essential for customer satisfaction.

- Digital Interaction Scrutiny: Laws governing online sales, ticketing platforms, and loyalty programs require careful navigation to ensure fair practices.

Antitrust and Competition Laws

Antitrust and competition laws are a significant legal consideration for Cineworld Group. As a major player in the cinema industry, Cineworld's operations, including potential mergers and acquisitions, are subject to scrutiny by regulatory bodies to prevent monopolistic practices and ensure fair competition.

Authorities like the UK's Competition and Markets Authority (CMA) and the US Federal Trade Commission (FTC) actively monitor market concentration. For instance, in 2023, the CMA continued to review various market activities across sectors for potential anti-competitive impacts, a trend that would naturally extend to large cinema operators like Cineworld.

- Regulatory Oversight: Cineworld must navigate antitrust regulations in all operating jurisdictions, impacting its growth strategies.

- Merger and Acquisition Scrutiny: Any significant deals Cineworld pursues will undergo rigorous review by competition authorities.

- Market Dominance Concerns: Cineworld's substantial market share in key regions could attract regulatory attention regarding its competitive practices.

Cineworld's extensive network of cinemas is underpinned by numerous lease agreements, making property law a crucial factor. The company's financial restructuring, including its Chapter 11 bankruptcy filing in September 2022, necessitated significant lease renegotiations. As of early 2024, Cineworld continued to address ongoing disputes with landlords regarding outstanding rent and lease terminations, a direct outcome of its efforts to streamline its property portfolio and reduce costs.

Intellectual property law governs Cineworld's core business of film exhibition, requiring adherence to licensing agreements with film distributors. These contracts dictate film availability and screening terms, directly impacting revenue. Ensuring compliance with copyright law is essential to avoid legal challenges and maintain access to content.

The company's financial health is heavily influenced by insolvency and corporate restructuring laws, as evidenced by its Chapter 11 proceedings in the US and administration in the UK. These legal frameworks allowed Cineworld to manage its substantial debt, which was approximately $5 billion when it filed for bankruptcy. The approved restructuring plan in mid-2023 resulted in significant debt reduction and a change in ownership, demonstrating the profound impact of these laws on corporate survival.

Consumer protection laws, including data privacy regulations like GDPR, directly affect Cineworld's customer engagement strategies. GDPR, enacted in 2018, imposes strict rules on handling customer data, with potential fines up to 4% of global annual revenue for non-compliance. Similarly, advertising standards, enforced by bodies like the Advertising Standards Authority (ASA), require truthful and transparent marketing to prevent regulatory action and reputational damage.

Antitrust and competition laws are critical for Cineworld, given its significant market presence. Regulatory bodies such as the UK's Competition and Markets Authority (CMA) and the US Federal Trade Commission (FTC) monitor market concentration. Any mergers or acquisitions undertaken by Cineworld would face rigorous scrutiny to ensure fair competition, a trend observed in 2023 reviews across various industries.

Environmental factors

Cineworld's operations, like all cinemas, demand substantial energy for lighting, climate control, and projection systems. This inherent energy intensity means the company is a significant contributor to carbon emissions.

Facing increasing pressure from stakeholders and regulators, Cineworld is focused on reducing its carbon footprint and enhancing energy efficiency to align with sustainability targets. This is a critical environmental consideration for the business.

In its recent reporting, Cineworld highlighted a positive trend, noting a reduction in its emissions intensity relative to its revenue. This suggests progress in decoupling operational growth from environmental impact, with emissions intensity per unit of revenue decreasing.

Cineworld's operations, particularly at its concessions, create significant waste from items like popcorn bags, drink cups, and food packaging. Effective waste management and recycling are therefore essential for the company to reduce its environmental footprint.

As of the first half of 2024, the UK government continued to emphasize targets for reducing single-use plastics and increasing recycling rates across various sectors. This regulatory pressure means Cineworld must invest in and promote robust recycling initiatives to maintain compliance and appeal to environmentally conscious consumers.

Cineworld's cinema operations, like many public venues, rely on water for essential functions such as maintaining restrooms, general cleaning, and potentially for food and beverage preparation. These daily uses, while seemingly minor individually, contribute to the company's overall environmental footprint and operational expenses.

Implementing efficient water management strategies is becoming increasingly critical for companies like Cineworld. Not only does this align with growing environmental sustainability expectations from consumers and regulators, but it also offers a tangible pathway to reduce operational costs. For instance, investing in low-flow fixtures or water-efficient cleaning protocols can lead to measurable savings on utility bills.

While specific 2024 or 2025 water usage figures for Cineworld are not publicly detailed in their latest reports up to July 2025, the industry trend is towards greater water conservation. Major cinema chains globally are exploring technologies and practices to minimize water consumption, recognizing its dual benefit of environmental stewardship and cost reduction. This focus is expected to intensify as water scarcity concerns grow in various regions where Cineworld operates.

Supply Chain Sustainability

Cineworld's reliance on a complex supply chain for everything from popcorn and drinks to cleaning supplies presents environmental challenges. The sourcing of these materials, particularly for concessions, carries inherent ecological footprints. In 2023, the global food and beverage industry faced increased scrutiny regarding its environmental impact, with a growing emphasis on sustainable sourcing practices.

The company's operational efficiency is also tied to the environmental impact of transporting these goods. As of early 2024, logistics and transportation remain a significant contributor to global carbon emissions, prompting businesses like Cineworld to explore greener shipping methods and optimize delivery routes.

- Sustainable Sourcing: Cineworld's commitment to sourcing concession items from suppliers with demonstrable sustainability credentials is a key environmental consideration. This includes looking at packaging, ingredient origins, and ethical labor practices.

- Transportation Emissions: The environmental impact of moving goods to Cineworld's numerous cinema locations globally is substantial. Efforts to reduce these emissions through route optimization and potentially exploring lower-emission transport options are crucial.

- Waste Management: Beyond sourcing, the disposal of packaging and unsold goods within the supply chain also has environmental implications that Cineworld must manage responsibly.

Climate Change and Extreme Weather Events

Climate change presents a significant environmental challenge for Cineworld. More frequent and intense extreme weather events, such as severe storms or heatwaves, can directly impact cinema operations. These events could lead to temporary closures due to safety concerns or damage to infrastructure, as well as reduced foot traffic as consumers stay home. For instance, in 2024, parts of Europe experienced record-breaking heatwaves, potentially deterring attendance at outdoor or poorly air-conditioned venues.

Adapting to these potential disruptions is a crucial long-term environmental consideration for Cineworld. This involves developing contingency plans for weather-related closures and investing in resilient infrastructure. The company must also consider how changing climate patterns might affect consumer behaviour and leisure spending in different regions. For example, prolonged periods of extreme weather might shift entertainment preferences towards indoor activities, which could benefit cinemas, but the disruption itself poses a risk.

The broader impacts of climate change also extend to supply chains and energy costs, which can indirectly affect Cineworld's profitability and operational efficiency. Ensuring business continuity in the face of these environmental shifts requires proactive risk management and strategic planning.

Cineworld's energy consumption for lighting, climate control, and projection systems is substantial, contributing to its carbon footprint. The company is actively working to reduce this impact, noting a decrease in emissions intensity relative to revenue in its recent reports. For example, in the first half of 2024, emissions intensity per unit of revenue saw a decline, indicating progress in environmental efficiency.

Waste management, particularly from concession packaging, is another key environmental focus. With the UK government continuing to push for reduced single-use plastics and higher recycling rates as of early 2024, Cineworld must bolster its recycling initiatives to ensure compliance and meet consumer expectations.

Water usage for essential operations like restrooms and cleaning is also an environmental consideration. Implementing water-saving measures, such as low-flow fixtures, is crucial for both environmental stewardship and cost reduction, a trend observed across the industry as water scarcity concerns grow.

The environmental impact of Cineworld's supply chain, from sourcing concession items to transporting goods, is significant. The company is increasingly looking at sustainable sourcing and greener logistics to mitigate these effects, a move aligned with global industry trends observed throughout 2023 and into 2024.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Cineworld Group draws from a diverse range of authoritative sources, including financial reports from regulatory bodies, industry-specific market research, and governmental policy updates. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the cinema industry.