Cineworld Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cineworld Group Bundle

Cineworld Group faces significant competitive pressures, with intense rivalry among cinema chains and the looming threat of substitutes like streaming services. Understanding the bargaining power of both suppliers (film distributors) and buyers (moviegoers) is crucial for navigating this dynamic market.

The complete report reveals the real forces shaping Cineworld Group’s industry—from supplier influence to the threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Film distributors, especially the major studios like Disney and Warner Bros., wield considerable bargaining power over Cineworld. They control the supply of blockbuster films, which are the primary drivers of ticket sales and revenue for cinema chains. In 2024, the continued dominance of tentpole releases underscores this reliance.

The concentrated nature of the film distribution industry, with only a handful of major studios, limits Cineworld's options for securing desirable content. This scarcity of alternative suppliers for popular movies significantly enhances the distributors' leverage in negotiations over terms and revenue sharing.

Cineworld's entire business model is built upon its ability to attract audiences with a consistent stream of new and popular films. The critical dependence on these distributors for their product makes the relationship a key factor in Cineworld's operational success and profitability throughout 2024.

Technology providers like IMAX and 4DX hold significant bargaining power with Cineworld. Their unique, immersive cinema formats are a key draw for customers, allowing Cineworld to differentiate its offerings in a competitive market. For example, IMAX reported a strong performance in 2024, with its premium large-format screens continuing to attract audiences seeking enhanced viewing experiences.

The proprietary nature of their equipment and licensing models further strengthens their position. Cineworld's reliance on these specialized technologies means switching costs can be substantial, limiting its flexibility. Cineworld's continued investment in these premium formats underscores their critical role in delivering a compelling and differentiated movie-going experience to its patrons.

Suppliers of food and beverages for Cineworld's concessions generally hold moderate bargaining power. While a wide array of suppliers exist for common concession items, the presence of exclusive or highly sought-after brands can increase their leverage. In 2023, concession sales represented a substantial portion of Cineworld's revenue, underscoring the importance of these supplier relationships.

Property Landlords

Property landlords wield significant bargaining power over Cineworld, particularly for its prime multiplex locations. This was evident in Cineworld's 2023 financial restructuring, where rent reductions and the strategic exit from underperforming sites were key components. The high costs associated with relocating or establishing new cinema venues further solidify landlords' leverage, as Cineworld faces substantial financial penalties or operational disruptions if lease agreements are not met or renegotiated favorably.

Long-term lease agreements, often a standard in the property rental market, inherently restrict Cineworld's operational flexibility. These contracts can lock the company into paying for spaces that may no longer be strategically viable or profitable. The impact of this landlord power is directly reflected in Cineworld's financial performance, as demonstrated by the necessity of rent renegotiations and site closures during its recent financial challenges.

The bargaining power of property landlords for Cineworld can be understood through several key factors:

- Location Dependence: Cineworld's business model relies heavily on high-traffic, accessible locations, giving landlords of such prime sites considerable negotiating strength.

- Lease Commitments: Existing long-term leases create inflexibility and significant costs if Cineworld wishes to exit or alter its property footprint.

- Relocation Costs: The substantial expense and operational disruption involved in moving or building new cinemas empower landlords by making Cineworld hesitant to abandon existing leases.

- Financial Restructuring Impact: Cineworld's 2023 restructuring plan, which included rent concessions, underscores the direct influence landlords have on the company's financial health and strategic decisions.

Labor and Talent

The bargaining power of labor and talent presents a significant factor for Cineworld. While individual cinema staff might have limited individual leverage, collective action or widespread labor shortages can amplify their power, potentially leading to increased wage demands or improved working conditions.

The impact of talent, particularly through industry-wide actions like strikes, can directly affect Cineworld's operations. The 2023 Hollywood writers' and actors' strikes, for instance, led to significant disruptions in film production and release schedules, indirectly impacting cinema attendance and revenue for operators like Cineworld. This demonstrates how the collective bargaining power of creative talent can ripple through the entire film ecosystem.

Key considerations regarding labor and talent bargaining power for Cineworld include:

- Cinema Staff Wages: Rising minimum wages or demands for better compensation from front-line staff can increase operating costs.

- Unionization: The potential for increased unionization among cinema employees could strengthen their collective bargaining position.

- Talent Strikes: Industry-wide strikes by actors, writers, or directors can halt film production, delaying releases and impacting Cineworld's content pipeline and box office performance.

- Labor Shortages: In tight labor markets, Cineworld may face challenges in attracting and retaining staff, potentially driving up labor costs.

The bargaining power of suppliers for Cineworld is a critical element in its operational strategy, particularly concerning film distributors and technology providers. Major film studios, holding exclusive rights to blockbuster content, significantly influence Cineworld's revenue streams, dictating terms and revenue splits. This was highlighted in 2024 with the continued reliance on tentpole releases for audience draw.

Technology providers like IMAX also exert considerable influence due to their proprietary, high-demand formats, which are essential for differentiating Cineworld's premium offerings. The costs associated with these specialized technologies and their licensing models create substantial switching costs, limiting Cineworld's flexibility in supplier relationships.

Suppliers of concession items generally have moderate power, though exclusive brands can increase their leverage, especially given that concessions represented a significant revenue portion for Cineworld in 2023.

| Supplier Type | Bargaining Power | Key Factors | Impact on Cineworld (2024 Focus) |

|---|---|---|---|

| Film Distributors (Major Studios) | High | Exclusive content rights, blockbuster reliance, concentrated industry | Directly impacts revenue share and content availability for key releases. |

| Technology Providers (e.g., IMAX) | High | Proprietary technology, high switching costs, customer demand for premium formats | Essential for differentiation; investment in these formats continues to be a priority. |

| Concession Suppliers | Moderate | Availability of alternatives, but exclusive brands can increase leverage | Important for ancillary revenue; supplier relationships are managed to maintain profitability. |

What is included in the product

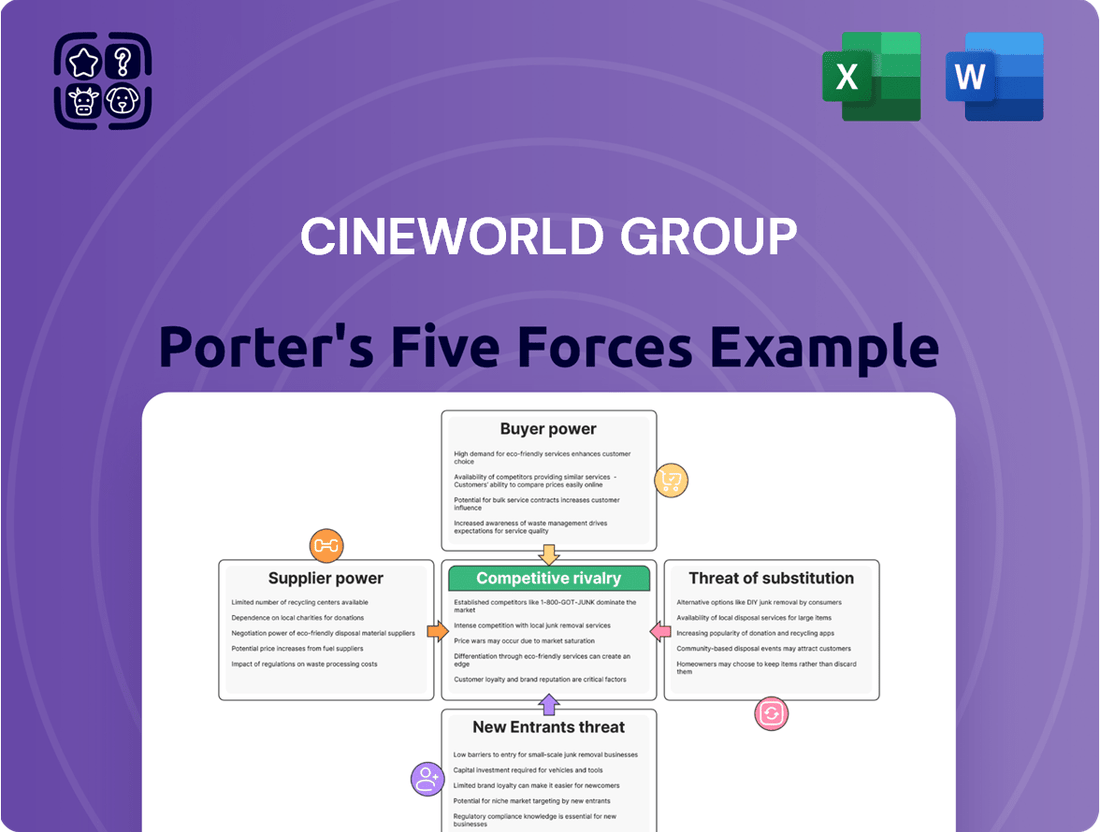

This analysis unpacks the competitive forces impacting Cineworld Group, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the cinema industry.

Instantly identify and strategize against competitive pressures with a dynamic, visual representation of Cineworld's Porter's Five Forces.

Quickly assess the impact of each force on Cineworld's profitability and develop targeted strategies for sustained competitive advantage.

Customers Bargaining Power

Individual moviegoers possess moderate bargaining power, primarily because cinema attendance is a discretionary expense and a wide array of entertainment options exist. In 2024, consumers have more choices than ever, from streaming services to live events, making it easier to substitute moviegoing.

Cineworld attempts to mitigate this by offering loyalty programs, such as its Unlimited subscription, which provides discounts and incentives to encourage repeat business. Despite these efforts, consumers can readily switch to competitors or opt for entirely different leisure activities if they perceive better value elsewhere.

To justify its pricing, Cineworld is focusing on enhancing the overall cinema experience through premium formats and improved amenities, aiming to create a differentiated offering that commands higher ticket prices and fosters customer loyalty.

Customers making large group bookings or corporate clients can exert a degree of bargaining power due to the significant sales volume they represent. For instance, in 2023, Cineworld's revenue was £1.7 billion, and securing substantial bookings from corporate entities could influence pricing and service offerings.

Cineworld often develops customized packages or offers discounts to attract and retain these valuable customer segments. These clients are typically driven by the prospect of good value and competitive pricing for their bulk purchases.

Subscribers to loyalty programs like Cineworld Unlimited wield increased bargaining power. For a fixed monthly fee, they gain access to unlimited movies, discounts on concessions, and exclusive screenings. This incentivizes loyalty and frequent visits, but also makes these customers keenly aware of pricing and benefit adjustments. In 2023, Cineworld's Unlimited program was a key strategy to retain customers in a competitive market, with a significant portion of their regular moviegoers enrolled.

Price Sensitivity of Customers

Customer price sensitivity is a significant concern for Cineworld, particularly with the ongoing cost of living pressures and a growing array of more affordable entertainment alternatives. This sensitivity directly impacts Cineworld's ability to set competitive pricing for tickets and concessions, a delicate balancing act required to ensure both market appeal and revenue generation.

The average cinema ticket prices have reached historic highs, suggesting that consumers are becoming more attuned to the cost of moviegoing. This trend implies that a significant portion of Cineworld's customer base may be highly responsive to price changes, potentially leading to reduced attendance if prices are perceived as too steep.

- Rising Cost of Living: Economic factors are making consumers more discerning about discretionary spending.

- Alternative Entertainment: Streaming services and other leisure activities offer lower-cost options.

- Ticket Price Inflation: Average ticket prices have seen an upward trend, increasing customer price sensitivity.

- Revenue vs. Competitiveness: Cineworld must carefully manage pricing to remain competitive without sacrificing profitability.

Access to Information and Reviews

Customers today have unprecedented access to information, readily available through online platforms and social media. This wealth of data, including film reviews, cinema experience feedback, and detailed pricing comparisons, significantly amplifies their bargaining power. For instance, a study in early 2024 indicated that over 70% of consumers consult online reviews before making purchasing decisions, a trend that directly impacts cinema attendance.

This transparency empowers consumers to make more informed choices, easily comparing Cineworld's offerings against those of competitors and even alternative entertainment options. The ability to quickly gauge audience sentiment and identify value propositions means customers can exert greater pressure on pricing and service quality. In 2023, user-generated content platforms saw a 15% increase in engagement related to entertainment reviews, highlighting this shift.

Consequently, positive word-of-mouth and strong online reviews are no longer just beneficial but essential for Cineworld to attract and retain audiences. A cinema's reputation, built through accessible customer feedback, directly influences ticket sales. For example, films with overwhelmingly positive online critic and audience scores in 2024 consistently outperformed those with mixed or negative reception, demonstrating the tangible impact of accessible information.

- Increased Online Information: Consumers can easily access film reviews, cinema experiences, and pricing details across various digital channels.

- Informed Decision-Making: This transparency allows customers to compare Cineworld's offerings with competitors and substitutes, enhancing their ability to negotiate or seek better value.

- Impact of Reviews: Positive reviews and word-of-mouth are critical drivers of audience attraction, directly influencing ticket sales and customer loyalty.

- Data Supporting Transparency: Over 70% of consumers consult online reviews before purchasing, and engagement on review platforms increased by 15% in 2023, underscoring the power of accessible information.

The bargaining power of individual moviegoers remains a significant factor for Cineworld. With numerous entertainment alternatives available, consumers in 2024 can easily shift their spending away from cinema, especially given rising ticket prices. For instance, the average cinema ticket price has continued its upward trend, making consumers more sensitive to value.

Cineworld's loyalty programs, like Unlimited, aim to lock in customers, but these subscribers are also highly aware of pricing. The company's strategy to enhance the overall cinema experience through premium offerings is an attempt to justify higher prices and retain this segment. However, the ease with which customers can access information online, including reviews and price comparisons, further amplifies their ability to exert pressure on Cineworld.

| Factor | Impact on Cineworld | Customer Action |

|---|---|---|

| Discretionary Spending | Moderate | Switch to cheaper entertainment |

| Availability of Alternatives | High | Choose streaming, live events, etc. |

| Online Information Access | High | Compare prices and reviews easily |

| Loyalty Program Awareness | Moderate | Monitor pricing and benefits closely |

Same Document Delivered

Cineworld Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Cineworld Group's competitive landscape through Porter's Five Forces, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This comprehensive analysis provides actionable insights into the strategic challenges and opportunities facing Cineworld.

Rivalry Among Competitors

The cinema industry is quite concentrated, with a few major players dominating the landscape. Think of giants like AMC Entertainment and Cinemark; they're not just national players but have a significant global footprint, making the rivalry fierce. Cineworld, being one of the largest of these global chains, finds itself in direct competition with these established names for prime locations, lucrative film distribution deals, and ultimately, moviegoers' attention.

This intense competition among these large entities naturally pushes them to innovate and be strategic with their pricing. For instance, in 2023, AMC Theatres reported a revenue of approximately $4.4 billion, showcasing the scale of operations and the financial stakes involved in capturing market share. Cineworld, likewise, is constantly evaluating its strategies to stay competitive in this environment.

The global box office is expected to see growth, but recent years have presented hurdles. Disruptions in content pipelines and the impact of labor strikes, such as the 2023 Hollywood writers' and actors' strikes, have tempered the industry's overall growth trajectory. This volatility can intensify rivalry as companies vie for market share in a less predictable environment.

Despite these challenges, the outlook for cinema is brightening. Projections indicate that 2025 is anticipated to be a robust year for the industry, driven by a strong slate of anticipated blockbuster releases. This renewed optimism suggests a potential rebound in attendance and revenue, which could, however, also attract increased competition as firms seek to capitalize on the upswing.

Cineworld strives to stand out by offering premium experiences such as IMAX and 4DX, comfortable recliner seating, and a broader selection of food and drinks. These features aim to elevate the overall movie-going experience for patrons.

However, the competitive landscape is intense, with rivals like Odeon and Vue also investing heavily in similar premium formats and amenities. This necessitates ongoing innovation and investment from Cineworld to ensure its offerings remain attractive and distinct in the market.

For instance, in 2023, Cineworld continued to upgrade its auditoriums with recliner seats, with a significant portion of its UK sites now featuring this upgrade. This ongoing investment in differentiation is critical for capturing and holding customer loyalty in a market where competitors are also enhancing their facilities.

Exit Barriers

Cineworld faces substantial exit barriers due to the high fixed costs inherent in its operations. These include significant outlays for property leases, specialized projection and sound equipment, and a substantial workforce required to run its cinema complexes.

These substantial sunk costs make it economically challenging for Cineworld, or any exhibitor, to simply cease operations or divest individual sites. This difficulty in exiting the market means that competition can persist even when the industry experiences periods of reduced demand or profitability, as companies are reluctant to abandon their investments.

The company's 2023 restructuring efforts, which involved closing underperforming locations, underscore the practical difficulties and financial implications of exiting unprofitable cinema sites. This process often entails lease termination penalties and the disposal of specialized assets at potentially significant losses.

- High Fixed Costs: Property leases, specialized equipment, and staffing represent significant financial commitments that are difficult to recoup upon exit.

- Asset Specificity: Cinema-specific equipment has limited alternative uses, increasing the cost of exiting a market.

- Restructuring Challenges: Cineworld's ongoing restructuring highlights the financial and operational hurdles involved in closing unprofitable venues.

Brand Loyalty and Switching Costs

While Cineworld's Unlimited subscription aims to foster loyalty, the reality for consumers is that switching to a competitor is generally effortless and inexpensive. This low barrier to switching means that Cineworld faces intense pressure to continually offer compelling reasons for patrons to choose their cinemas over others. For instance, in 2023, the average UK cinema ticket price hovered around £7.50, making price a significant factor in consumer decisions when loyalty programs don't offer a substantial perceived advantage.

The ease with which customers can opt for alternative entertainment, such as streaming services or other leisure activities, further amplifies competitive rivalry. Cineworld's success hinges on its ability to consistently provide a superior cinematic experience, encompassing comfortable seating, high-quality projection and sound, and a diverse film selection. Failing to deliver on these fronts can quickly lead to customer attrition, especially when competitors are actively vying for the same audience.

- Low Switching Costs: Consumers can easily shift between cinema chains or choose alternative entertainment options.

- Loyalty Program Impact: Programs like Cineworld Unlimited aim to build loyalty but face challenges due to low switching costs.

- Competitive Pressure: Cineworld must consistently offer superior value and experience to retain customers amidst intense competition.

The competitive rivalry in the cinema industry is undeniably intense, with major global players like AMC Entertainment and Cinemark vying for market share. Cineworld, as one of these giants, faces direct competition for prime locations and audience attention, forcing constant strategic adjustments and innovation in offerings.

This rivalry is further fueled by the need to attract customers in a market where switching costs are low, and alternative entertainment options abound. Cineworld's efforts to differentiate through premium experiences, such as recliner seating and enhanced food options, are met by similar investments from competitors like Odeon and Vue, necessitating continuous upgrades to remain competitive.

| Competitor | 2023 Revenue (Approx.) | Key Differentiators |

|---|---|---|

| AMC Entertainment | $4.4 billion | Large global footprint, premium formats |

| Cinemark | Not specified | Focus on experiential offerings |

| Odeon | Not specified | Investment in premium formats and amenities |

| Vue | Not specified | Similar investment in premium formats and amenities |

SSubstitutes Threaten

Streaming services like Netflix and Disney+ represent a formidable threat to Cineworld. Their extensive on-demand content libraries, including exclusive original productions and timely releases, offer unparalleled convenience and value directly to consumers' homes. This accessibility directly competes with the traditional cinema outing.

The allure of affordability and a vast selection of entertainment on streaming platforms provides a compelling alternative to visiting a physical cinema. For instance, by mid-2024, major streaming services continued to expand their subscriber bases, demonstrating sustained consumer preference for home-based entertainment options.

This shift has demonstrably impacted cinema attendance, prompting the industry, including Cineworld, to explore hybrid release strategies. In 2023, for example, several major film studios experimented with shorter exclusive theatrical windows before making films available on streaming platforms, reflecting the growing influence of these digital alternatives.

The threat of substitutes for Cineworld Group's core offering, cinema attendance, is significantly amplified by advancements in home entertainment. High-definition televisions, immersive soundbars, and the burgeoning virtual reality market allow consumers to create compelling viewing experiences within their own homes. This direct competition means that for many films, especially those not requiring the unique scale of a cinema, the allure of a night out at the movies diminishes.

In 2024, the home entertainment sector continued its robust growth, with the global market for smart TVs alone projected to reach over $250 billion. This trend directly impacts cinema attendance by offering a convenient and increasingly sophisticated alternative, potentially diverting a significant portion of consumer entertainment spending away from traditional movie theaters.

Consumers have a wide array of choices for their discretionary spending on entertainment beyond just movie theaters. Options like attending live concerts, cheering at sporting events, or enjoying theatrical performances all vie for consumer attention and wallets. In 2024, the live entertainment sector continued its robust recovery, with major music festivals and sporting leagues reporting strong ticket sales and revenue growth, indicating a significant draw on consumer leisure budgets.

These alternative out-of-home entertainment activities directly compete with cinema attendance, potentially reducing the demand for movie tickets. For instance, a significant portion of younger demographics, a key cinema-going audience, often prioritizes experiences like concerts and festivals. This means that a substantial amount of disposable income that might have gone to movie tickets is instead allocated to these other engaging events.

Recognizing this competitive landscape, cinema chains are adapting by incorporating alternative content. Cineworld, for example, has been exploring the screening of concert films and live events. This strategy aims to capture a segment of the entertainment market that might otherwise be lost to dedicated concert venues or sports arenas, leveraging the cinema infrastructure for a broader range of live experiences.

Gaming

The gaming industry poses a significant threat of substitution for traditional cinema, especially for younger audiences seeking interactive entertainment. Immersive virtual reality experiences and sophisticated online multiplayer games offer compelling alternatives to passive movie viewing.

The sheer scale of the gaming market underscores its competitive strength against film. In 2023, the global video game market was projected to generate over $184 billion in revenue, far surpassing the global box office gross.

- Gaming's Market Dominance: The global gaming market's revenue significantly outpaces that of the film industry, indicating a strong draw for consumer entertainment budgets.

- Shifting Consumer Preferences: Younger demographics, in particular, are increasingly opting for interactive gaming experiences over traditional cinematic releases.

- Technological Advancements: Innovations in gaming technology, such as virtual reality and augmented reality, create more engaging and immersive entertainment options.

Social Media and Short-Form Video Content

The proliferation of social media and short-form video platforms like TikTok and YouTube presents a significant threat of substitutes for traditional cinema experiences. These platforms offer readily available, often free, entertainment that caters to shorter attention spans and a desire for instant gratification.

While not a direct replacement for a feature film, this content competes directly for consumers' leisure time and attention, particularly impacting younger demographics. For instance, in 2024, TikTok reported over 1 billion monthly active users globally, demonstrating its massive reach and engagement.

This shift in entertainment consumption habits can divert potential moviegoers away from cinemas. Consider these points:

- Competition for Leisure Time: Short-form video platforms capture significant user engagement, directly competing with the time allocated for cinema visits.

- Accessibility and Cost: The low or no cost associated with social media content makes it an attractive alternative to paid movie tickets.

- Audience Demographics: Younger audiences, a key demographic for movie theaters, are heavily engaged with these platforms, potentially reducing their interest in traditional cinema.

- Content Variety: The sheer volume and diversity of content available on social media can satisfy a wide range of entertainment preferences, further fragmenting audience attention.

The threat of substitutes for Cineworld is multifaceted, encompassing digital streaming, other out-of-home entertainment, and interactive gaming. These alternatives offer convenience, varied pricing, and different engagement models that directly compete for consumer leisure time and spending.

In 2024, the continued growth of streaming services and the robust recovery of live events highlight the diverse entertainment landscape Cineworld operates within. The gaming industry's substantial revenue, exceeding $184 billion in 2023, further underscores the intense competition for consumer attention and disposable income.

Cineworld's strategic response involves exploring alternative content like concert films, aiming to leverage its infrastructure for a broader entertainment appeal. However, the fundamental shift towards home-based and interactive entertainment presents an ongoing challenge to traditional cinema attendance.

Entrants Threaten

The cinema industry demands significant capital for prime real estate, cutting-edge projection and sound technology like IMAX and Dolby Atmos, and comfortable seating. For instance, building a new multiplex can easily cost tens of millions of dollars. This substantial upfront financial commitment creates a formidable barrier, deterring many new companies from entering the market.

Established brand loyalty and market dominance pose a significant barrier for new cinema operators. Cineworld, for instance, benefits from strong brand recognition and customer loyalty programs like Cineworld Unlimited, which fosters repeat business. Acquiring a comparable market share and building a network of multiplexes requires substantial upfront investment and time, making it difficult for newcomers to gain immediate traction.

Securing a consistent supply of popular film content from major studios is paramount for cinema operators like Cineworld. New entrants face a significant hurdle in building the necessary relationships with film distributors to guarantee favorable terms and access to anticipated movie releases. Established chains, often with larger commitments and proven track records, are typically prioritized by distributors.

The film distribution landscape is largely controlled by a few dominant players, making it challenging for newcomers to break in and negotiate equitable terms. In 2023, the top six Hollywood studios accounted for over 80% of global box office revenue, highlighting the concentrated power within content supply chains, a barrier new entrants must overcome.

Regulatory Hurdles and Licensing

New entrants to the cinema industry, like Cineworld, must overcome significant regulatory hurdles. Obtaining operating licenses, adhering to stringent health and safety regulations, and complying with local zoning ordinances are all essential but complex steps. For instance, in the UK, the Health and Safety Executive enforces various regulations that cinemas must meet, requiring substantial investment in compliance and ongoing monitoring.

These legal and administrative requirements act as a barrier, increasing the time and cost associated with market entry. This complexity can deter potential new players, thereby protecting incumbent firms like Cineworld. The need for specialized legal counsel and thorough due diligence further elevates the entry cost.

- Licensing requirements for cinema operations can vary significantly by region, impacting setup costs.

- Safety standards, including fire safety and accessibility, necessitate ongoing investment and compliance checks.

- Local zoning laws can restrict where new cinemas can be established, limiting strategic location choices.

Evolving Consumer Preferences and Technology

The threat of new entrants in the cinema industry is significantly influenced by evolving consumer preferences and rapid technological advancements. New players must make substantial investments to keep pace with innovations like immersive sound systems, advanced projection technologies, and the integration of AI in content creation and delivery, making it a costly barrier to entry.

For instance, the demand for premium experiences, such as IMAX and Dolby Cinema, requires significant capital outlay. New entrants need to not only match these offerings but also anticipate future shifts, like the growing interest in interactive cinema or personalized viewing experiences, to remain competitive and attract audiences.

- Technological Investment: New entrants face high costs to adopt cutting-edge cinema technologies, including advanced projection, immersive audio, and potentially AI-driven content personalization.

- Consumer Experience Focus: Anticipating and catering to evolving consumer demands for premium and unique cinematic experiences is crucial for new market participants.

- Content Adaptation: The ability to adapt to new filmmaking techniques and content delivery methods, potentially influenced by AI, is a key challenge for newcomers.

The threat of new entrants for Cineworld remains moderate due to substantial capital requirements for prime locations and advanced technology. For example, establishing a modern multiplex can cost upwards of $20 million, a significant hurdle for potential competitors. Furthermore, established brands and loyalty programs, like Cineworld Unlimited, create a strong customer base that is difficult for newcomers to penetrate quickly.

Securing favorable film distribution agreements is another key barrier, as major studios often prioritize established chains. In 2023, Hollywood studios continued to dominate global box office revenue, making it challenging for new players to access desirable content on competitive terms. Regulatory compliance, including licensing and safety standards, also adds to the cost and complexity of market entry.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point |

|---|---|---|---|

| Capital Requirements | High cost of real estate, technology, and infrastructure. | Significant deterrent due to substantial upfront investment. | Multiplex construction costs can exceed $20 million. |

| Brand Loyalty & Market Share | Established customer base and loyalty programs. | Difficult for new entrants to gain immediate traction and market share. | Cineworld Unlimited programs foster repeat business. |

| Access to Content | Dependence on film studios for popular releases. | Newcomers struggle to negotiate favorable terms with dominant distributors. | Top Hollywood studios accounted for over 80% of global box office revenue in 2023. |

| Regulatory Compliance | Licensing, safety, and zoning regulations. | Increases time, cost, and complexity of market entry. | UK Health and Safety Executive regulations require ongoing investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cineworld Group leverages data from their annual reports, investor presentations, and financial statements. We also incorporate industry-specific market research reports and competitor analysis from reputable sources like IBISWorld and Statista to provide a comprehensive view of the competitive landscape.