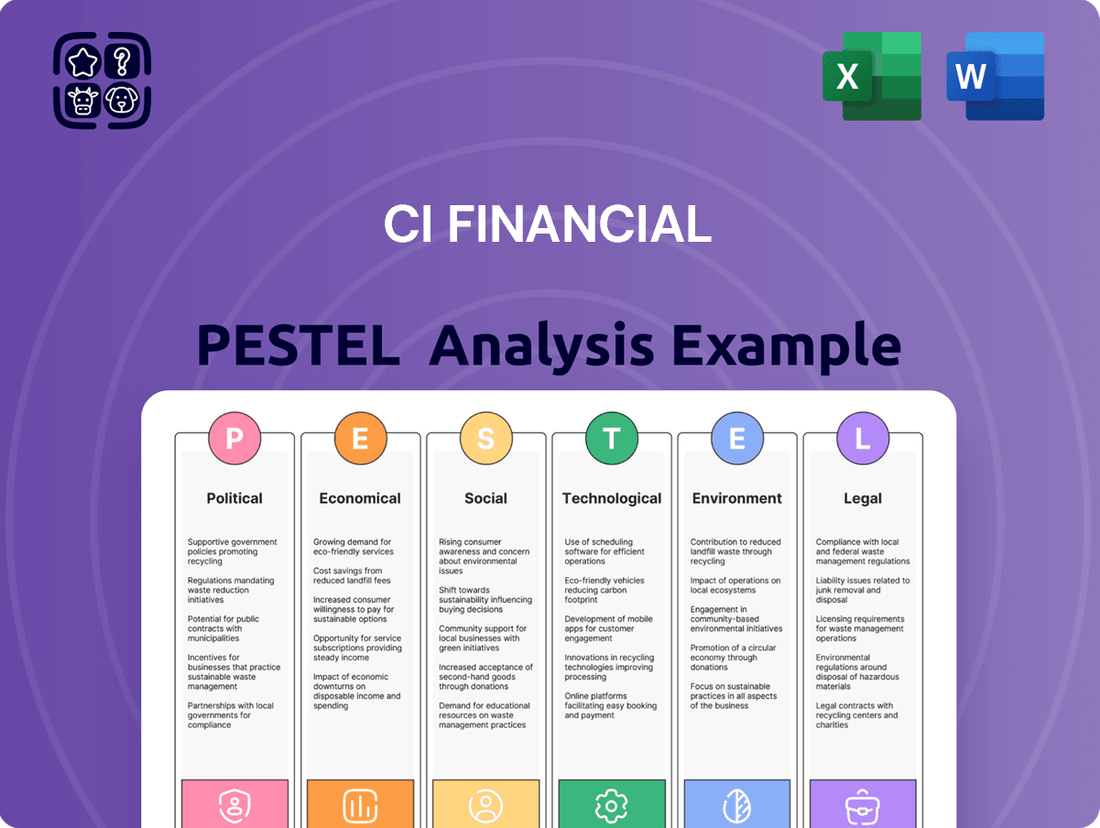

CI Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CI Financial Bundle

Gain a competitive advantage with our in-depth PESTLE Analysis of CI Financial. We meticulously dissect the political, economic, social, technological, legal, and environmental factors that are actively shaping the company's operational landscape and future trajectory. Understand the nuances of regulatory changes and economic shifts that could impact growth, and leverage these insights to refine your investment strategy or business planning. Download the full version now for actionable intelligence that empowers smarter, data-driven decisions.

Political factors

The political landscapes in Canada and the United States, CI Financial's core markets, directly shape economic stability and regulatory certainty. Changes in government, such as the potential shifts within Canada's Liberal Party leadership ahead of the next federal election expected by fall 2025, can lead to significant economic and fiscal policy adjustments. Similarly, the upcoming U.S. presidential election in November 2024 introduces considerable uncertainty regarding future tax regulations and financial market oversight. These anticipated policy shifts can impact market sentiment and influence investment strategies for wealth management firms like CI Financial.

The regulatory framework for financial services is in constant flux, with the U.S. Securities and Exchange Commission (SEC) under Chair Gensler continuing to prioritize areas like private fund oversight and enhanced disclosure requirements in 2024. These shifts can increase compliance costs for firms like CI Financial, potentially impacting their operational expenses by millions annually to adapt internal systems and reporting. Staying ahead of these evolving regulatory trends is crucial for maintaining a competitive edge and ensuring product offerings remain compliant.

CI Financial, as a global asset manager, faces direct exposure to shifts in international trade policies and the imposition of tariffs. Protectionist measures and trade disputes, such as those related to digital services taxes, create significant market volatility affecting global investment performance. For example, the Canadian Digital Services Tax, effective January 1, 2024, could trigger retaliatory U.S. tariffs, impacting CI Financial's cross-border operations and client portfolios. Such geopolitical tensions directly influence financial markets and investment flows, posing a risk to CI Financial's revenue streams. Consequently, monitoring these trade dynamics is crucial for strategic planning through late 2024 and into 2025.

Take-Private Transaction by Foreign Entity

CI Financial's agreement to be taken private by Mubadala Capital, an affiliate of an Abu Dhabi sovereign wealth fund, introduces a significant political dimension. This transaction, valued at approximately C$5.3 billion, is subject to rigorous regulatory approvals in Canada, including from the Ministry of Finance and Investment Canada Act review, navigating political sensitivities surrounding foreign ownership of a major Canadian financial institution. While the deal is expected to provide long-term, stable capital, it brings increased scrutiny regarding national interests.

- Mubadala Capital's proposed acquisition of CI Financial.

- Canadian regulatory review under Investment Canada Act.

- Political considerations of foreign control over financial assets.

- Focus on long-term capital versus national economic sovereignty.

Focus on Domestic Economic Resilience

There is a growing political focus in Canada on domestic economic resilience, influencing investment flows within the country. This shift, evident in 2024 policy discussions, aims to strengthen the Canadian market, creating opportunities for domestic asset managers like CI Financial. Policies supporting Canadian innovation and infrastructure could divert capital from historically dominant U.S. markets, where confidence in sustained outperformance has softened.

- Canadian government initiatives in 2024-2025 may prioritize domestic capital deployment.

- CI Financial's Canadian-focused strategies could benefit from this policy shift.

- A 2024 Ipsos Reid poll indicated a slight decrease in Canadian investor confidence towards exclusively U.S. market exposure.

Upcoming U.S. and Canadian elections in late 2024 and by fall 2025 create policy uncertainty affecting tax and financial oversight. Regulatory shifts, like the 2024 Canadian Digital Services Tax, can trigger retaliatory tariffs impacting cross-border operations. The C$5.3 billion Mubadala Capital acquisition faces rigorous 2024-2025 Investment Canada Act review, highlighting foreign ownership sensitivities. Moreover, 2024 Canadian policy discussions increasingly prioritize domestic economic resilience, influencing capital flows.

| Political Factor | Key Impact | Timeline/Data (2024/2025) |

|---|---|---|

| Election Cycles | Policy uncertainty, market sentiment | U.S. Presidential Election (Nov 2024), Canada Federal Election (by Fall 2025) |

| Regulatory Changes | Compliance costs, operational adjustments | SEC private fund oversight (2024), Canadian Digital Services Tax (Jan 1, 2024) |

| Foreign Ownership | Regulatory scrutiny, national interest debate | Mubadala Capital C$5.3B acquisition (2024-2025 Investment Canada Act review) |

What is included in the product

This PESTLE analysis thoroughly examines the external macro-environmental forces impacting CI Financial, dissecting each category to reveal specific threats and opportunities relevant to its operations.

It offers a strategic framework for understanding how political, economic, social, technological, environmental, and legal shifts can shape CI Financial's competitive landscape and future growth.

CI Financial's PESTLE Analysis provides a clear and actionable framework, relieving the pain of navigating complex external factors by offering a concise summary ideal for quick alignment across teams and departments.

Economic factors

Central bank policies on interest rates in Canada and the U.S. significantly influence economic conditions and market performance, directly impacting CI Financial's operations. As of mid-2024, market expectations widely anticipate the Bank of Canada and the U.S. Federal Reserve to initiate interest rate cuts through 2025, potentially lowering short-term rates. This environment could make fixed-income investments more attractive, influencing investor allocations. However, the precise timing and magnitude of these rate adjustments remain a key variable, with the Bank of Canada having already begun cuts in June 2024, and the Fed's path still being closely monitored.

After a period of normalization in 2024, with the U.S. CPI moderating to around 3.2%, inflation is expected to stabilize near the 2.5% mark by mid-2025, contributing to a more favorable investment backdrop. Global GDP is projected to see steady growth, with the IMF forecasting 3.2% for both 2024 and 2025, though the pace will vary by region. The U.S. economy shows resilience, anticipated to grow by 2.7% in 2024 and 1.9% in 2025, while Canada's GDP is forecast at 1.4% for 2024 and 2.3% for 2025. CI Financial's performance is closely tied to these macroeconomic trends, which directly influence asset valuations and investor confidence, impacting its assets under management and fee revenues.

CI Financial's significant operations in both Canada and the U.S. mean its financial results are directly impacted by USD/CAD exchange rate volatility. A strengthening U.S. dollar can inflate reported expenses or dilute revenues when translated. The notable slide in the U.S. dollar during 2025, with the USD/CAD exchange rate trending towards 1.30, affects the translation of U.S.-denominated assets and revenues. This depreciation could lead to lower reported Canadian dollar revenue from its U.S. wealth management segment, which represented a substantial portion of its assets under management as of Q4 2024.

Mergers and Acquisitions (M&A) Activity

The wealth management sector continues to experience significant M&A activity, a trend CI Financial has actively leveraged to expand its footprint, particularly through numerous acquisitions of U.S. RIA firms.

This industry consolidation is largely driven by the imperative for scalability to offset downward pressure on fees and enhance competitive positioning.

CI Financial's strategic acquisition approach has been central to its aggressive expansion in the U.S. market, aiming to grow its assets under management.

- CI Financial completed 30 U.S. RIA acquisitions by early 2023, significantly boosting its U.S. wealth management AUM.

- The company's strategic focus in 2024-2025 includes continued integration and optimization of these acquired firms.

- Industry-wide M&A in wealth management remains robust, with over 200 transactions expected in North America in 2024.

Market Performance and Asset Levels

CI Financial's revenue is largely driven by its assets under management (AUM), directly influenced by market performance and net sales. Robust equity market returns in recent periods have notably benefited the company. However, future market returns are anticipated to be more moderate. The company's AUM and advisement reached an all-time high, exceeding $490 billion CAD, by the end of the first quarter of 2025.

- CI Financial's revenue correlates directly with AUM.

- Strong equity markets positively impacted recent financial results.

- Future market returns are projected to be less aggressive.

- AUM reached over $490 billion CAD by Q1 2025.

Expected interest rate cuts by central banks through 2025 will influence investment allocations, with the Bank of Canada initiating cuts in June 2024. Inflation is stabilizing near 2.5% by mid-2025, supporting a favorable investment backdrop amid projected global GDP growth of 3.2% for 2024-2025. The USD/CAD exchange rate trending towards 1.30 in 2025 will impact translated U.S. revenues for CI Financial, whose AUM exceeded $490 billion CAD by Q1 2025.

| Economic Factor | 2024 Projection | 2025 Projection |

|---|---|---|

| U.S. CPI (mid-year) | ~3.2% | ~2.5% |

| Global GDP Growth | 3.2% | 3.2% |

| USD/CAD Exchange Rate | Fluctuating | ~1.30 |

| CI Financial AUM (Q1) | N/A | >$490B CAD |

Full Version Awaits

CI Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This CI Financial PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction. Understanding these external forces is crucial for CI Financial's continued success in the dynamic financial services landscape.

Sociological factors

The growing demand for Environmental, Social, and Governance (ESG) focused investments presents a significant sociological shift, with global ESG assets projected to exceed $50 trillion by 2025. Ignoring these considerations can materially impact investment outcomes and reputation. CI Financial has actively responded to this trend by expanding its suite of ESG-focused products, including new ETFs and mutual funds launched in late 2024 and early 2025. The firm also integrates ESG factors into its core investment processes, aligning with the increasing investor preference for sustainable and responsible portfolios.

Demographic shifts, including an aging population in Canada and the U.S., are fueling a substantial wealth transfer projected to reach over $30 trillion by 2030 to younger generations. These emerging investors, often millennials and Gen Z, prioritize digital platforms, sustainable investing, and personalized advice, diverging from traditional preferences. CI Financial must adapt its service offerings to cater to these evolving financial priorities and technological expectations. This includes enhancing digital engagement tools and expanding ESG investment options to remain competitive.

Client demand for wealth management is shifting towards highly personalized and holistic advice, extending beyond traditional investment strategies. Investors increasingly seek a comprehensive approach that integrates financial planning, tax optimization, and estate services, with a 2024 survey indicating 80% of clients value personalized guidance. Technology, particularly AI, is crucial in delivering this tailored experience, enabling firms like CI Financial to offer bespoke solutions. This trend reflects a broader societal preference for customized services, pushing wealth managers to adopt advanced analytics to meet these evolving expectations by mid-2025.

Increased Financial Democratization

Technological advancements in 2024 have significantly democratized financial services, making investing far more accessible to a broader audience than ever before. Platforms allowing anyone to become an investor, such as commission-free trading apps, are now mainstream, challenging traditional wealth management models like CI Financials. This trend creates new opportunities for firms capable of catering to a wider range of clients, including retail investors, leveraging digital solutions.

- Global retail trading volume surged, with projections showing continued growth into 2025.

- Robo-advisor assets under management are expected to exceed $2.5 trillion globally by 2025.

- Digital wealth management platforms saw a 20% increase in new users in North America in late 2024.

- Investor access to fractional shares and low-cost ETFs broadened substantially in 2024.

Evolving Client Expectations for Digital and Real-Time Service

Clients today increasingly demand real-time portfolio access, on-demand analytics, and instant service, reflecting a significant shift in wealth management expectations by 2024. This necessitates substantial technology investments from firms like CI Financial to deliver seamless digital experiences. Wealth managers are now compelled towards data-driven, responsive approaches to meet these rising client demands. For instance, digital engagement platforms saw a 25% increase in usage among wealth management clients in North America during 2023-2024.

- By 2025, over 70% of high-net-worth individuals are expected to prefer digital channels for routine financial interactions.

- CI Financial's digital platform enhancements aim to capture a larger share of tech-savvy investors.

Societal values increasingly prioritize Environmental, Social, and Governance (ESG) factors, with global ESG assets projected to exceed $50 trillion by 2025, pushing firms like CI Financial to expand their sustainable offerings. Demographic shifts, including a significant wealth transfer to younger, digitally native generations by 2030, necessitate adapting service models for personalized, digital-first engagement. Client demand for holistic financial advice, integrating planning and tax optimization, is rising, with 80% valuing personalized guidance in 2024.

| Sociological Trend | Impact on CI Financial | Key Data (2024/2025) |

|---|---|---|

| ESG Investment Growth | Expansion of sustainable products | Global ESG assets > $50T by 2025 |

| Demographic Wealth Transfer | Adapt services for younger, digital clients | >$30T wealth transfer by 2030 |

| Demand for Personalized Advice | Integrate holistic planning, AI-driven solutions | 80% clients value personalized guidance (2024) |

Technological factors

The rise of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally reshaping the financial services industry, moving beyond automation to deliver highly personalized client insights. CI Financial has actively embraced these technological advancements, investing in digital platforms to enhance operational efficiency across its wealth and asset management segments. By late 2024, industry projections suggest AI-driven solutions could handle over 30% of client portfolio rebalancing and tailored product recommendations. This strategic integration of AI is crucial for CI Financial to maintain a competitive edge and optimize service delivery into 2025.

The financial industry is undergoing significant digital transformation, with a strong focus on integrating fintech solutions to enhance customer experience and operational efficiency. This includes adopting cloud computing, microservice architectures, and robotic process automation to streamline processes. CI Financial has actively invested in its digital platforms, evidenced by its 2024 strategic initiatives to modernize client-facing tools and back-office systems. These investments aim to meet evolving client needs and maintain a competitive edge in the rapidly digitizing wealth management sector. Their focus on technology is crucial as client expectations for digital access and personalized services continue to rise.

The increasing reliance on digital platforms makes cybersecurity a critical technological factor for financial institutions like CI Financial. Protecting client data and safeguarding digital assets are paramount to maintaining trust, especially given the rising global average cost of a data breach, which reached approximately $4.45 million in 2023. CI Financial is committed to maintaining robust technology and data protection practices, evidenced by its ongoing investments in secure infrastructure. This commitment is particularly vital as the firm navigates its global operations and the pending take-private transaction, ensuring compliance with evolving data privacy regulations like GDPR and CCPA.

Development of Open Banking

The progression towards open banking, or consumer-driven finance, is poised to reshape Canada's financial landscape, fostering greater competition and innovation. This framework, anticipated to be fully operational by early 2025, will empower consumers with enhanced control over their financial data. This shift enables more personalized and transparent financial services, which is crucial as the Canadian financial sector is projected to see significant data-sharing growth.

CI Financial is actively engaged in discussions regarding the future of this evolving ecosystem, aligning with industry efforts to establish secure data exchange protocols. This participation is vital as financial institutions prepare for the Consumer-Driven Banking framework, which is expected to facilitate new service models.

- Canada's open banking framework aims for full implementation by early 2025.

- Consumers will gain direct control over their financial data, enhancing transparency.

- CI Financial actively contributes to policy discussions on this evolving ecosystem.

- The initiative is projected to drive innovation and competition within Canadian finance.

Embedded Finance and Platform Integration

The rise of embedded finance, where financial services seamlessly integrate into non-financial platforms, significantly impacts CI Financial. This trend blurs lines between traditional wealth management and diverse sectors, opening new distribution channels and partnership avenues. By embedding services within lifestyle apps or e-commerce platforms, firms can enhance client engagement and reach. For instance, the global embedded finance market is projected to exceed $240 billion by 2025, offering substantial growth potential for agile wealth managers like CI Financial.

- Global embedded finance market expected to reach over $240 billion by 2025.

- Potential for 25-30% customer acquisition cost reduction through partnerships.

- Enhanced client data insights from integrated platform interactions.

CI Financial leverages AI/ML for efficiency, anticipating 30% of portfolio rebalancing by late 2024 via AI. Digital transformation and robust cybersecurity investments are crucial, given 2023 data breach costs averaged $4.45 million. The firm actively engages with Canada's open banking framework, set for early 2025 implementation, and explores embedded finance, projected to exceed $240 billion globally by 2025, to enhance service delivery and reach.

| Technological Factor | Key Impact | 2024/2025 Data Point |

|---|---|---|

| AI/ML Integration | Operational Efficiency & Personalization | 30% AI-driven portfolio rebalancing by late 2024 |

| Cybersecurity | Trust & Data Protection | Average data breach cost $4.45M in 2023 |

| Open Banking | Competition & Data Control | Canada's framework fully operational by early 2025 |

| Embedded Finance | New Distribution Channels | Global market projected >$240B by 2025 |

Legal factors

The legal and regulatory environment for asset and wealth managers remains highly dynamic, with evolving standards such as Regulation Best Interest (Reg BI) in the U.S. shaping conduct. CI Financial must continuously adapt to these stringent compliance requirements across both Canadian and U.S. jurisdictions to avoid penalties. For instance, the SEC’s 2024 enforcement priorities indicate ongoing scrutiny on investment advice and fiduciary duties, increasing operational costs for firms like CI. Navigating these complex rules, which can fluctuate in their regulatory burden, is critical for maintaining market trust and operational integrity.

Regulators are intensely focused on data governance and robust recordkeeping, especially monitoring off-channel communications, posing significant compliance challenges for firms like CI Financial. Non-compliance with rules around capturing and supervising official business communications can lead to substantial penalties, with some firms facing hundreds of millions in fines in 2024. Data privacy remains a key regulatory priority, requiring continuous investment in secure data management systems. This ongoing scrutiny necessitates that CI Financial allocates considerable resources to ensure adherence to evolving global data protection standards and recordkeeping mandates.

CI Financial, as a global wealth and asset manager, navigates a complex web of cross-border financial regulations across jurisdictions like Canada, the U.S., and Australia. Evolving regulatory frameworks, such as enhanced AML/KYC requirements or new data privacy laws effective in 2024, directly influence its international service delivery and operational costs. For instance, changes in U.S. SEC rules regarding foreign private issuers could alter CI Financial’s reporting obligations. Additionally, any potential move to be taken private by a foreign entity introduces significant regulatory scrutiny and approvals from multiple national authorities, potentially delaying or complicating strategic initiatives planned for late 2024 or early 2025.

Increased Scrutiny of ESG Disclosures

The growing demand for ESG investing is met with heightened regulatory scrutiny concerning related disclosures and product labeling, a key legal factor for CI Financial. Regulators, including the OSC in Canada, are actively working to ensure that firms' ESG claims are accurate and not misleading. This necessitates robust frameworks for ESG integration and transparent reporting from financial institutions. For instance, the Canadian Securities Administrators (CSA) continue to refine guidance on investment fund disclosure, impacting how CI Financial presents its ESG-focused products, with an anticipated focus on greenwashing prevention through 2025.

- In 2024, the OSC emphasized the need for clear ESG product disclosure, impacting CI Financial's fund offerings.

- Global regulatory bodies are pushing for standardized ESG reporting, influencing CI Financial's compliance efforts.

- CI Financial must ensure its ESG integration frameworks meet evolving 2025 regulatory expectations.

Implementation of Consumer-Driven Banking Legislation

Canada is actively implementing a legislative framework for consumer-driven banking, commonly known as open banking. The initial phase involves the Consumer-Driven Banking Act, which establishes governance and technical standards for data sharing. CI Financial will need to adapt its operational and legal frameworks to comply with these evolving regulations as they become finalized in 2024-2025.

- The Consumer-Driven Banking Act is expected to enhance data portability for consumers by late 2024.

- CI Financial must update its cybersecurity protocols to align with new data sharing standards.

- Compliance will require significant investment in IT infrastructure and legal review during 2024-2025.

CI Financial navigates a dynamic legal landscape with evolving U.S. Reg BI and SEC enforcement priorities focusing on fiduciary duties and off-channel communications. Cross-border regulations, including enhanced 2024 data privacy laws and AML/KYC, significantly impact its global operations and compliance costs. Regulators like the OSC are tightening ESG disclosure rules and greenwashing prevention through 2025, requiring robust frameworks. Canada's Consumer-Driven Banking Act, finalizing in 2024-2025, necessitates adapting operational and legal frameworks for data sharing.

| Legal Factor | Key Impact | Timeline |

|---|---|---|

| SEC Enforcement | Increased scrutiny on fiduciary duties; potential fines | Ongoing 2024-2025 |

| ESG Disclosure | OSC focus on clear, non-misleading claims | Refined guidance by 2025 |

| Open Banking (Canada) | Adaptation to Consumer-Driven Banking Act | Finalizing 2024-2025 |

Environmental factors

The global investment landscape increasingly integrates Environmental, Social, and Governance (ESG) factors, essential for both risk management and performance. CI Financial acknowledges this shift, with approximately 22% of its AUM, or over $45 billion as of late 2024, explicitly incorporating ESG criteria. The company offers diverse investment products aligned with these considerations. As a signatory to the UN Principles for Responsible Investment (PRI), CI Financial demonstrates its commitment to responsible investment practices.

The demand for investments with a positive environmental impact continues to surge, driving the growth of green bonds and sustainable infrastructure projects globally. These investments specifically target initiatives that reduce greenhouse gas emissions and enhance energy efficiency. For instance, global sustainable debt issuance is projected to exceed 1.5 trillion USD in 2024. CI Financial actively participates in this evolving market, offering specialized funds like their CI Global Sustainable Infrastructure Fund, which provides exposure to companies addressing these critical sustainability challenges.

Financial institutions like CI Financial are increasingly expected to assess and disclose climate change risks and opportunities across their investment portfolios and operations. This involves understanding potential physical climate risks, such as extreme weather, alongside transition risks tied to the global shift towards a low-carbon economy. For CI Financial, integrating these factors identifies both vulnerabilities and new avenues, with sustainable finance projected to exceed $3.3 trillion globally by 2025. Ignoring these critical environmental considerations could lead to significant financial losses and regulatory non-compliance.

Lack of Transparency and Poor Benchmark Performance

A 2025 benchmark report indicated CI Financial performed poorly in transparency and performance on sustainability metrics. This suggests a significant opportunity for the company to improve its disclosure regarding environmental and social risk management. Such a lack of transparency places CI Financial at a disadvantage when compared to its industry peers, potentially impacting investor confidence and capital allocation decisions by 2025.

- CI Financial's 2025 sustainability transparency ranked below average among peers.

- ESG disclosure gaps were noted in a recent benchmark report.

- Improved environmental and social risk reporting is crucial by mid-2025.

- Lack of clear sustainability data may deter ESG-focused investors.

Regulatory Pressure on Environmental Disclosures

Regulators are intensifying demands for CI Financial to provide more transparent and standardized environmental disclosures and ESG initiatives. As of mid-2025, firms face a complex landscape, especially with political shifts in the U.S. potentially halting enforcement of state and local climate regulations. This creates a contradictory environment, requiring CI Financial to navigate varied compliance demands across jurisdictions.

- Global regulatory bodies are pushing for detailed climate-related financial disclosures.

- CI Financial's Q1 2025 financial results highlight ongoing compliance costs for regulatory demands.

- U.S. legislative proposals in 2024 aimed to limit state ESG mandates, impacting disclosure consistency.

CI Financial faces increasing pressure to integrate environmental factors, with over $45 billion of AUM incorporating ESG by late 2024. The firm must enhance transparency, as its 2025 sustainability disclosures ranked below peers, impacting investor confidence. Regulatory demands for detailed climate risk reporting are intensifying, despite some conflicting U.S. legislative proposals in 2024. Neglecting these environmental shifts could lead to significant financial and reputational risks.

| Factor | Impact on CI Financial | Data Point (2024/2025) |

|---|---|---|

| ESG Integration | Growing AUM in ESG-aligned products | 22% of AUM ($45B) ESG-integrated (late 2024) |

| Transparency | Need for improved disclosure | 2025 benchmark: Below-average sustainability transparency |

| Regulatory Demands | Increased compliance costs | Q1 2025 financial results show compliance costs |

PESTLE Analysis Data Sources

Our CI Financial PESTLE Analysis is meticulously crafted using data from reputable financial institutions like the Bank of Canada and the U.S. Securities and Exchange Commission, alongside insights from industry-specific reports and market research firms. We integrate economic indicators, regulatory updates, and technological advancements to provide a comprehensive view.