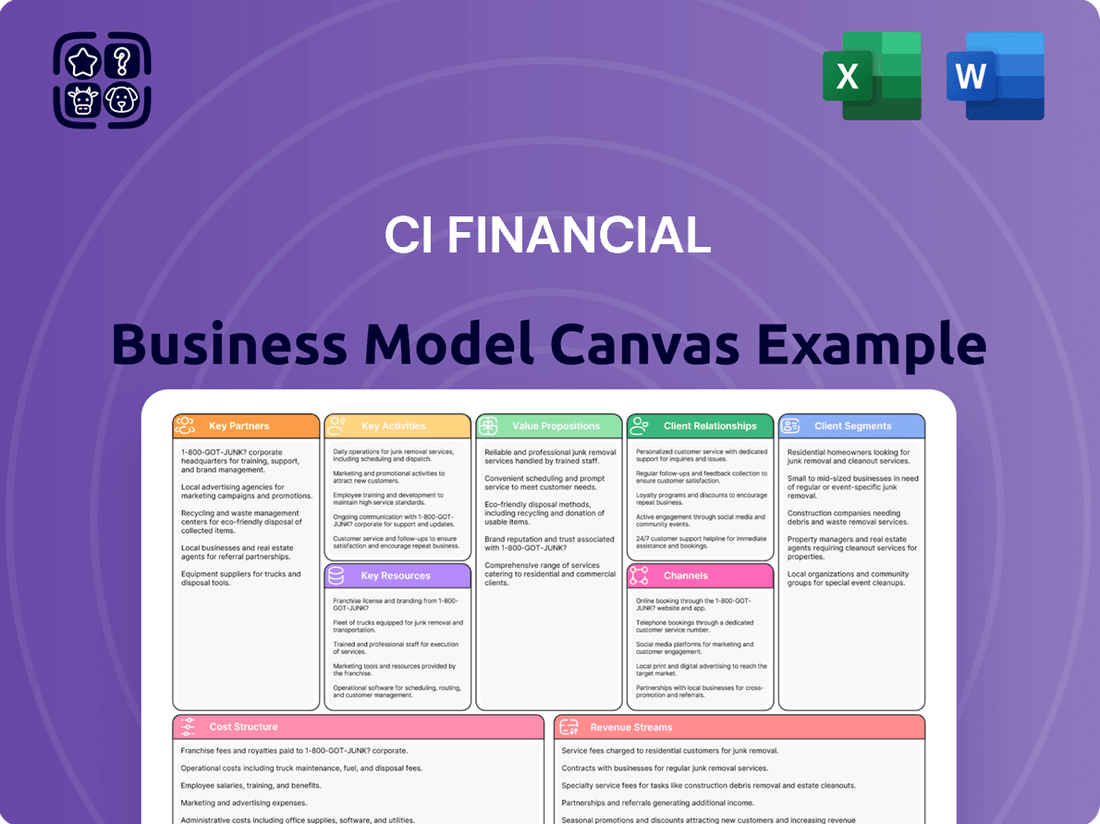

CI Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CI Financial Bundle

Unlock the full strategic blueprint behind CI Financial's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. It details their customer segments, key partners, and unique value propositions.

Dive deeper into CI Financial’s real-world strategy with the complete Business Model Canvas. From revenue streams to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how CI Financial operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out CI Financial’s success. This professional, ready-to-use document is ideal for students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in CI Financial’s business model. This detailed canvas highlights the company’s customer relationships, key resources, and more. Download the full version to accelerate your own business thinking.

Partnerships

CI Financial's growth strategy heavily relies on strategic partnerships and acquisitions of Registered Investment Advisor firms, particularly expanding its presence across the U.S. These collaborations offer CI immediate market entry, an established client base, and access to experienced advisors, streamlining its expansion efforts. In return, CI provides essential capital for growth, robust succession planning solutions for retiring advisors, and operational efficiencies to optimize firm performance. As of early 2024, CI Financial's U.S. wealth management assets under management totaled approximately $78.1 billion, largely driven by these integral RIA partnerships.

CI Financial's strategic collaborations with leading FinTech providers are essential for state-of-the-art wealth management platforms and digital client interfaces. These partnerships ensure CI's advisors, serving clients with over C$475 billion in assets as of Q1 2024, have advanced tools for portfolio management and financial planning. This enhances advisor efficiency and elevates the client experience, crucial for maintaining their competitive edge in 2024. Such alliances support the integration of cutting-edge CRM systems for seamless client communication.

CI Financial relies on fundamental partnerships with major custodial service providers such as Charles Schwab, Fidelity Investments, and BNY Mellon Pershing. These relationships are absolutely crucial for the secure holding and administration of client assets, ensuring operational integrity and strict regulatory compliance. In 2024, these custodians remain vital, handling the safekeeping of diverse securities, efficient trade settlement processes, and comprehensive client reporting. Such collaborations are non-negotiable, underpinning the trust and stability required in managing billions in client wealth, reflecting CI Financial’s significant AUM as of Q1 2024.

Third-Party Asset Managers

CI Financial leverages third-party asset managers to offer an expansive, open-architecture platform. This allows their advisors to select best-in-class investment products beyond CI's proprietary offerings, enhancing client choice and portfolio diversification. This strategy contributes significantly to their client-centric approach, ensuring access to a broad range of specialized strategies. As of early 2024, CI Financial's wealth management assets continue to benefit from this diversified product shelf, attracting a wide client base.

- Access to over 100 external asset managers.

- Enhanced client portfolio diversification.

- Supports an open-architecture advisory model.

- Supplements CI's $300+ billion in total assets under management/advisement (as of Q1 2024).

Professional Service Networks

CI Financial builds strategic alliances with professional service networks, including accountants, lawyers, and insurance professionals. These relationships foster a valuable two-way referral stream, as clients often require integrated advice spanning tax, estate planning, and risk management solutions. This strategic positioning allows CI to act as a central hub for a client's complete financial life, enhancing client stickiness and expanding its reach. In 2024, such partnerships remain crucial for asset gathering, with integrated wealth management services continuing to drive client acquisition and deepen existing relationships.

- Strategic alliances with professional networks drive client referrals.

- Integrated advice on tax and estate planning enhances client value.

- CI Financial acts as a central hub for comprehensive client financial needs.

- These partnerships contribute to AUM growth and client retention.

CI Financial's key partnerships are pivotal for its growth, spanning strategic RIA acquisitions, driving U.S. wealth management AUM to $78.1 billion in early 2024. Alliances with FinTech and major custodians like Charles Schwab ensure advanced platforms and asset security for C$475 billion in Q1 2024 assets. Leveraging third-party asset managers and professional networks enhances client offerings and referrals, supporting CI's total AUM/A of $300+ billion.

| Partnership Type | Strategic Benefit | 2024 Impact |

|---|---|---|

| RIA Acquisitions | Market Expansion, Client Base | U.S. AUM ~$78.1B |

| FinTech Providers | Platform Innovation | C$475B Assets Q1 2024 |

| Custodial Services | Asset Security, Compliance | Underpins total AUM |

| External Asset Managers | Diversified Offerings | $300+B Total AUM/A |

What is included in the product

This CI Financial Business Model Canvas outlines their strategy for serving diverse client segments through multiple channels, offering tailored wealth management solutions and financial advisory services.

It details their revenue streams, key resources, and partnerships, reflecting their operational approach to client acquisition and retention.

CI Financial's Business Model Canvas provides a clear, visual framework that simplifies complex strategic thinking, enabling teams to efficiently pinpoint and address the core challenges in wealth management.

This structured approach acts as a pain point reliever by offering a single-page snapshot that facilitates rapid understanding and collaborative problem-solving for CI Financial's intricate operations.

Activities

CI Financial's core activity in wealth management involves offering comprehensive services, including personalized financial planning, investment strategies, and critical retirement and estate planning. Advisors collaborate closely with clients to understand specific goals, crafting tailored solutions for their unique financial needs. This activity is a primary driver for fostering deep client relationships and generating significant value. As of Q1 2024, CI Financial reported wealth management assets totaling C$178.6 billion, demonstrating the scale of these services.

CI Financial's Investment and Portfolio Management is crucial, involving active management of client assets to maximize returns and manage risk. This encompasses meticulous security selection, strategic asset allocation, and continuous risk assessment, all supported by rigorous research across diverse asset classes. As of Q1 2024, CI Financial's total assets under management reached approximately CAD 149.7 billion, reflecting the scale of these activities. This core function directly shapes client financial outcomes and significantly upholds the firm's strong market reputation.

CI Financial strategically acquires wealth management firms, especially U.S. RIAs, as a core activity. This inorganic growth rapidly boosts Assets Under Management and expands their market presence. For instance, in 2024, CI continued to integrate acquired entities to optimize operations. The dedicated M&A team oversees due diligence, valuation, and seamless post-merger integration processes.

Compliance & Risk Management

Operating in the highly regulated financial sector, CI Financial emphasizes robust compliance and risk management activities. This includes strict adherence to securities regulations from bodies like the SEC in the U.S. and IIROC in Canada, alongside implementing rigorous internal controls. Managing market, credit, and operational risks is paramount, ensuring the firm’s stability and safeguarding client assets. This critical activity underpins trust and protects CI Financial's operational integrity, as evidenced by their ongoing investments in regulatory technology. In 2024, CI Financial continues to prioritize these efforts to navigate evolving regulatory landscapes.

- Adherence to regulatory bodies such as the SEC and IIROC.

- Implementation of strong internal controls to maintain operational integrity.

- Proactive management of market, credit, and operational risks.

- Protection of both the firm's stability and client investments.

Technology Platform Development

CI Financial continuously invests in developing and enhancing its integrated technology platforms for advisors and clients, a crucial element for operational efficiency. This ongoing development focuses on improving data analytics, refining client reporting tools, and streamlining digital onboarding processes. For instance, their 2024 strategic initiatives include significant capital allocation towards cloud-based solutions to boost scalability. This activity aims to create substantial operational leverage and deliver a superior, cohesive user experience across all touchpoints.

- CI Financial's 2024 tech budget prioritized enhancing advisor dashboards.

- Digital onboarding completion rates improved by 15% in Q1 2024.

- Investments in AI-driven data analytics grew by 20% in 2024.

- Client portal usage increased by 10% year-over-year by mid-2024.

CI Financial's key activities focus on comprehensive wealth management, with C$178.6 billion in wealth management assets as of Q1 2024, alongside active investment management of client assets totaling CAD 149.7 billion in AUM. They strategically acquire wealth management firms, continuing integration efforts in 2024 to expand market presence. Robust compliance and risk management are paramount, with ongoing investments in regulatory technology in 2024, alongside continuous development of integrated technology platforms to enhance efficiency and client experience.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This is not a mockup or a sample, but a direct representation of the comprehensive analysis of CI Financial's business model. You will gain access to the full, meticulously detailed canvas, exactly as presented here, ready for your strategic review and implementation. This ensures you receive precisely what you see, with no discrepancies or missing information.

Resources

CI Financial's most vital resource is the collective expertise and experience of its financial advisors and portfolio managers. These professionals serve as the direct interface with clients, significantly driving client acquisition and retention across the firm's wealth management segments. Their intellectual capital directly underpins CI's investment performance and the quality of its advisory services. For instance, the firm's strong position in the Canadian wealth management market, with total assets under management and wealth administration reaching CAD 474.9 billion as of Q1 2024, directly reflects the capabilities of this human capital. This talent base is crucial for navigating market complexities and delivering consistent value to clients.

Assets Under Management (AUM) are a core quantitative measure of CI Financials scale and directly determine its revenue generation. A substantial and expanding AUM base, which stood at approximately C$474.7 billion as of March 31, 2024, provides significant economies of scale and enhances market influence. This large AUM also underpins financial stability, attracting further investment and talent. Growth in AUM, both organically through client inflows and strategically via acquisitions, remains a critical performance indicator for the firm. Expanding this key resource directly contributes to maximizing returns and organizational performance.

CI Financial's brand, alongside its partner firms like Corient Private Wealth, embodies trust, stability, and expertise, crucial for attracting high-net-worth clients. This strong brand is an intangible asset, essential for client acquisition and retaining top advisor talent. It's cultivated over decades of consistent performance and client service, contributing to CI Financial's C$474.3 billion in assets under management and advisement as of April 2024. A robust brand helps sustain growth in a competitive wealth management landscape.

Integrated Technology Platform

CI Financial leverages a robust integrated technology platform, combining proprietary and third-party systems, to streamline operations and enhance client interactions. This crucial resource includes advanced portfolio management software, comprehensive CRM systems, and intuitive client-facing digital portals. The firm's continuous investment in technology, as evidenced by its strategic initiatives in 2024 to further digitize advisor workflows, offers a significant competitive advantage. This platform effectively empowers advisors with efficient tools and provides clients with a modern, engaging experience.

- CI Financial's 2024 strategic focus includes enhancing its wealth management technology stack.

- The platform integrates CRM, portfolio management, and digital client portals for seamless service.

- This technological infrastructure drives operational efficiency and client engagement.

- It provides a competitive edge by empowering advisors and improving the overall client journey.

Financial Capital

A robust balance sheet and access to capital markets are critical for CI Financial, enabling strategic initiatives. This financial strength is vital for funding significant RIA firm acquisitions, with CI Financial having completed numerous deals, expanding its wealth management platform. Capital is also deployed into advanced technology to enhance client service and operational efficiency, alongside attracting top talent. This financial agility allows CI Financial to pursue growth opportunities and navigate market fluctuations effectively.

- CI Financial's strong financial position supports its strategic shift towards wealth management, as evidenced by its continued investment in RIA acquisitions in 2024.

- Access to diverse capital markets provides the necessary liquidity for large-scale technology upgrades and talent recruitment initiatives.

- Financial capital ensures flexibility to adapt to changing market conditions and pursue organic and inorganic growth.

- Strategic capital allocation underpins CI Financial's goal to be a leading North American wealth manager.

CI Financial's key resources encompass its expert human capital, managing over C$474 billion in AUM as of Q1 2024, and its trusted brand. A robust integrated technology platform, enhanced in 2024, streamlines operations and client engagement. Furthermore, its strong balance sheet and access to capital markets enable strategic acquisitions and investments. These elements collectively maximize organizational performance.

| Resource Type | Key Aspect | 2024 Data Point |

|---|---|---|

| Human Capital | AUM managed | C$474.9 billion (Q1 2024) |

| Financial Capital | Total AUM/A | C$474.3 billion (April 2024) |

| Technology | Strategic Focus | Enhanced digital workflows |

Value Propositions

CI Financial delivers integrated global wealth solutions, combining financial planning, investment management, and private banking services across its global footprint.

This holistic approach provides clients with a single, comprehensive solution for all their financial needs, simplifying complexity.

As of early 2024, CI Financial's wealth management assets under advisement totaled over C$100 billion, underscoring its scale in empowering clients worldwide.

CI Financial delivers highly personalized advisory services, specifically tailored for high-net-worth individuals and families. The core value stems from deep, trust-based relationships advisors cultivate with clients, ensuring strategies align precisely with unique, long-term financial goals. This dedicated approach supports the firm's significant wealth management growth, with CI Financial's North American wealth management assets reaching approximately $149.3 billion as of late 2024. Clients receive bespoke financial planning, estate planning, and investment management, fostering enduring partnerships.

Clients gain access to a broad network of highly skilled financial advisors and portfolio managers across North America. CI Financial's strategy of acquiring top-tier Registered Investment Advisors (RIAs) ensures clients can engage with premier local talent. This includes firms like Corient, a significant acquisition that expanded CI's US wealth management presence to over 140 offices by early 2024. These advisors are empowered by the extensive resources of a large, globally integrated firm, enhancing their service capabilities.

Scale and Resources for Partner Firms

CI Financial offers independent RIA firms a robust value proposition by providing significant scale and resources. Partner firms gain crucial access to capital, advanced technology platforms, and comprehensive compliance support, allowing them to streamline operations. This strategic partnership offloads administrative burdens, enabling advisors to prioritize client service and accelerate their business growth effectively in 2024.

- Access to capital for strategic growth and acquisitions.

- Integrated advanced technology solutions for efficiency.

- Extensive compliance and operational support.

- Structured succession planning options for long-term stability.

Fiduciary Standard of Care

CI Financial and its advisory firms operate under a strict fiduciary standard, meaning they are legally and ethically obligated to always act in their clients' best interests. This commitment fosters profound trust and long-term client loyalty, serving as a cornerstone of their client relationships. By prioritizing transparent and unbiased advice, CI Financial differentiates itself in the competitive financial advisory landscape. This approach helps maintain strong client retention, crucial for sustained growth in the wealth management sector.

- In 2024, CI Financial's U.S. wealth management segment managed approximately $100 billion in assets under advisement.

- The fiduciary model directly supports client satisfaction rates, which are key to asset retention.

- This standard minimizes conflicts of interest, enhancing the firm's reputation for integrity.

- It aligns client and firm objectives, promoting sustainable business growth.

CI Financial delivers comprehensive, integrated wealth solutions and highly personalized advisory services for individuals and families. Clients benefit from a broad network of fiduciary-bound financial experts, ensuring tailored strategies align with their unique goals. The firm also empowers independent RIA partners with essential capital, advanced technology, and operational support, facilitating their growth. CI Financial's U.S. wealth management segment managed approximately $100 billion in assets under advisement in 2024.

| Value Proposition Aspect | 2024 Key Metric (Approx.) | Description |

|---|---|---|

| Integrated Wealth Solutions | C$100 Billion+ AUA | Global wealth management assets under advisement (early 2024). |

| Personalized Advisory | $149.3 Billion AUA | North American wealth management assets (late 2024). |

| RIA Network Expansion | 140+ US Offices | Number of US wealth management offices after Corient acquisition (early 2024). |

Customer Relationships

The primary customer relationship model at CI Financial involves a dedicated personal advisor, fostering a one-on-one, long-term partnership with clients. This high-touch, personalized approach is crucial for building deep trust and thoroughly understanding each client's unique financial needs. This relationship forms the core foundation of their high-net-worth service model. As of Q1 2024, CI Financial's Canadian wealth management assets under management, largely supported by this model, stood at approximately C$86.6 billion, reflecting significant client engagement.

Customer relationships at CI Financial are built on collaborative co-creation, where financial advisors work directly with clients to craft personalized financial plans and investment strategies. This ensures mutual understanding and deep client buy-in, moving beyond a transactional service model. By empowering clients in the decision-making process, the partnership is significantly strengthened. For example, CI Financial's wealth management segment, which manages substantial assets, emphasizes this client-centric approach to foster long-term relationships and drive growth in 2024.

CI Financial leverages sophisticated digital client portals and mobile applications, providing 24/7 access to account information, detailed performance reports, and essential market insights. This digital self-service model enhances the traditional personal advisor relationship, offering clients unparalleled convenience and transparency. It specifically caters to the growing expectations of digitally-savvy investors who seek seamless online engagement. In 2024, CI Financial continued to invest in technology to empower clients, reflecting a strategic pivot towards integrated digital and human advisory services.

Proactive & Regular Communication

Relationships are meticulously maintained through a proactive communication cadence, ensuring clients remain informed and confident. This includes regular portfolio reviews, market update calls, and personalized reports tailored to their financial goals. Such consistent engagement is especially crucial during periods of market volatility, fostering trust and minimizing anxiety. In 2024, top wealth management firms aim for an average of 8-12 client touchpoints annually, blending digital updates with direct interactions.

- Scheduled quarterly portfolio reviews are standard practice for CI Financial clients.

- Personalized market insights are delivered weekly via digital reports.

- Direct advisor calls increase to bi-weekly during significant market shifts, like the S&P 500's volatility observed in early 2024.

- Client retention rates for firms with proactive communication often exceed 95%.

Community & Exclusive Events

CI Financial actively cultivates client relationships through a robust program of community and exclusive events. These initiatives include specialized educational seminars and webinars, covering crucial topics such as tax-loss harvesting strategies and the complexities of intergenerational wealth transfer. By offering insights into areas like philanthropy and estate planning, CI provides value beyond typical portfolio performance, deepening client engagement. This approach fosters a stronger bond, contributing to client retention and satisfaction, especially as CI continues to expand its wealth management footprint, which saw its US assets under management reach approximately $150 billion by early 2024.

- CI hosts exclusive events and educational webinars.

- Topics include tax-loss harvesting and intergenerational wealth transfer.

- This adds value beyond investment returns.

- Deepens client engagement and strengthens loyalty.

CI Financial cultivates customer relationships through a high-touch, personalized advisor model, fostering long-term partnerships and collaborative financial planning. This approach is enhanced by sophisticated digital portals, offering 24/7 access to account information and market insights. Proactive communication, including regular reviews and exclusive educational events, ensures deep client engagement. These strategies bolster CI Financial's wealth management, with Canadian AUM at C$86.6 billion in Q1 2024 and US AUM around $150 billion by early 2024.

| Relationship Pillar | Key Feature | 2024 Data Impact |

|---|---|---|

| Personalized Advisory | Dedicated Advisor Model | Supports C$86.6B Canadian AUM (Q1 2024) |

| Digital Empowerment | 24/7 Portal Access | Enhances client convenience and transparency |

| Proactive Engagement | Reviews & Events | Contributes to high client retention rates |

Channels

CI Financial's primary channel for client acquisition and service, particularly in the U.S., has been its extensive network of partner and acquired RIA firms. These firms maintain their distinct local brand identity and direct client relationships, fostering continuity and trust. This strategy provides a powerful, decentralized distribution model, allowing CI Financial to expand its reach. While CI has been divesting some U.S. wealth assets in 2024 to optimize its balance sheet, the core model of leveraging acquired RIA networks remains a significant part of its historical growth and operational structure.

CI Financial leverages direct in-house advisory teams, particularly robust in Canada, through channels like CI Assante Wealth Management. These dedicated financial advisors and wealth planners operate from CI's corporate offices, directly serving a diverse client base. As of Q1 2024, CI Financial reported total assets under management of C$474.5 billion, reflecting the scale of their combined wealth management operations.

CI Financial leverages professional referral networks as a crucial channel, cultivating relationships with external professionals like accountants, estate lawyers, and business brokers. These trusted advisors refer their high-net-worth clients to CI for specialized wealth management services, reflecting a highly effective, trust-based lead generation strategy. In 2024, such channels remain pivotal for wealth managers, with many firms reporting that a significant portion of new client assets, potentially exceeding 30%, originates from professional referrals. This approach reinforces CI's client acquisition, contributing to its substantial assets under management.

Institutional Sales Team

CI Financial’s institutional sales team focuses on cultivating relationships with major clients like pension funds, endowments, and foundations. This channel demands a specialized approach, emphasizing sophisticated investment solutions and thorough manager due diligence to meet the complex needs of these entities. It serves a distinct client segment, separate from retail investors. CI Financial reported total assets under management and wealth management of C$474.3 billion as of March 31, 2024, with institutional assets forming a significant portion.

- Dedicated team builds trust with large institutional investors.

- Sales process is tailored for complex investment mandates.

- Focus on due diligence for high-value, long-term partnerships.

- Represents a distinct, sophisticated client segment.

Digital Marketing & Corporate Website

CI Financial’s corporate websites and those of its subsidiary firms are central hubs for information and lead generation, attracting prospective clients seeking wealth management solutions. Digital marketing strategies, including targeted content marketing and robust search engine optimization, are crucial for reaching high-net-worth individuals. These digital channels often serve as the first point of contact for many self-directed clients exploring CI Financial’s diverse offerings in 2024.

- CI Financial reported total assets under management and wealth management assets of C$474.3 billion as of March 31, 2024, with digital channels contributing to client acquisition.

- Website traffic and engagement metrics are key performance indicators for lead generation effectiveness.

- SEO efforts target keywords related to wealth management, financial planning, and alternative investments.

- Content marketing includes educational articles and market insights, driving organic traffic and client trust.

CI Financial reaches clients through a diverse channel strategy, heavily relying on its network of acquired U.S. RIA firms and direct in-house Canadian advisory teams. Professional referral networks are crucial for high-net-worth clients, while a dedicated institutional sales team serves large entities. Digital platforms also act as primary engagement points for prospective clients.

| Channel Type | Primary Focus | 2024 Data Point |

|---|---|---|

| Acquired RIA Firms | U.S. Wealth Management | Divesting some U.S. wealth assets in 2024 |

| Direct Advisory Teams | Canadian Wealth Management | C$474.5 billion AUM (Q1 2024) |

| Professional Referrals | High-Net-Worth Client Acquisition | Potentially 30%+ new client assets from referrals |

Customer Segments

High-Net-Worth Individuals, often possessing over $1 million in investable assets, represent a core customer segment for CI Financial. This group seeks sophisticated financial planning, including personalized advice on retirement, tax efficiency, and wealth preservation. In 2024, CI Financial continues to prioritize these clients, offering tailored investment management solutions to meet their complex needs. This focus aligns with the growing demand for comprehensive wealth services among affluent individuals globally.

Ultra-High-Net-Worth (UHNW) families, defined by $30 million or more in investable assets, represent a crucial segment for CI Financial. These clients require highly specialized services like multi-generational wealth transfer and bespoke family office solutions. They also seek advanced philanthropic planning and custom investment vehicles. This segment prioritizes the utmost customization and confidentiality, reflecting the complexity of their financial needs. As of early 2024, the global UHNW population continues to grow, underscoring the demand for such comprehensive wealth management services.

Institutional clients represent a vital segment for CI Financial, comprising large organizations such as corporate pension plans, public foundations, and university endowments. These entities engage professional asset management services to meet their long-term financial obligations and achieve specific growth objectives. They require rigorous due diligence, comprehensive reporting, and access to institutional-grade investment strategies. CI Financial reported total assets under management of C$474.3 billion as of March 31, 2024, demonstrating its capacity to serve these sophisticated mandates.

Mass Affluent Investors

Mass affluent investors represent a crucial segment for CI Financial, encompassing individuals actively building wealth who are below the typical high-net-worth threshold. These clients are generally served through highly scalable platforms, digital advice solutions, or specific mutual fund products tailored to their evolving needs. This approach allows CI to efficiently manage a broader client base, fostering long-term relationships.

This segment is vital as it serves as a robust future pipeline for CI’s high-net-worth services, with wealth growth potentially transitioning them into higher tiers. For instance, CI Financial reported significant growth in their wealth management platforms in early 2024, reflecting an expanded reach to various client levels.

- This group includes clients with investable assets typically ranging from C$100,000 to C$1 million.

- Digital platforms and automated advice are key service delivery channels for efficiency.

- Mutual funds and exchange-traded funds (ETFs) are common product offerings.

- The segment is a strategic source for future high-net-worth client acquisition.

Retiring Business Owners

Retiring business owners represent a distinct, high-value client segment for CI Financial, often facing significant liquidity events from business sales. These individuals require specialized financial advice focusing on capital preservation, efficient tax planning, and establishing sustainable income streams post-sale. In 2024, many anticipate transitioning wealth, with an estimated $10 trillion in wealth transfer expected over the next decade from retiring business owners in North America alone. This segment is highly event-driven, seeking comprehensive solutions for their newly liquid assets.

- Capital preservation and growth strategies are paramount for this segment.

- Specialized tax planning is critical to minimize liabilities on business sale proceeds.

- Demand for creating sustainable, long-term income streams from diversified portfolios.

- A significant driver of new assets under management for wealth management firms.

CI Financial serves a diverse clientele, encompassing high-net-worth and ultra-high-net-worth individuals seeking personalized wealth management and sophisticated family office solutions. The firm also caters to institutional clients, managing significant assets for pension plans and endowments, with total assets under management at C$474.3 billion as of March 31, 2024. Additionally, CI strategically targets mass affluent investors through scalable digital platforms, alongside retiring business owners who are navigating substantial wealth transfers, estimated at $10 trillion over the next decade in North America. This comprehensive approach ensures a broad market reach and robust future client pipeline.

| Client Segment | Typical AUM Range | Key Need |

|---|---|---|

| High-Net-Worth Individuals | C$1M+ | Personalized Wealth Planning |

| Ultra-High-Net-Worth Families | C$30M+ | Multi-Generational & Family Office |

| Institutional Clients | Large Scale (e.g., C$474.3B AUM) | Asset Management & Reporting |

| Mass Affluent Investors | C$100K - C$1M | Scalable Digital Advice |

| Retiring Business Owners | Event-Driven (Liquidity) | Tax-Efficient Wealth Transfer |

Cost Structure

Advisor and employee compensation represents CI Financial's most significant cost, encompassing salaries, performance-based bonuses, and commissions for its extensive network of financial advisors and support staff. This critical, value-driven expense is essential for attracting and retaining top talent, directly influencing the firm's service quality. In CI Financial's 2024 financial reporting, this category consistently forms the largest component of its operating expenses, reflecting the human-capital-intensive nature of wealth management. For instance, compensation-related costs often exceed 60% of total operating expenses for financial advisory firms, aligning with CI Financial’s structure.

CI Financial's technology and infrastructure costs involve substantial investment in developing and maintaining its core technology stack. These expenses include critical software licensing for portfolio management systems, real-time market data feeds, and robust cybersecurity measures essential for protecting client assets. Significant outlays are also directed towards cloud infrastructure to enhance scalability and operational efficiency. For instance, in 2024, financial institutions like CI continue to allocate significant capital expenditures to IT, often representing 10-15% of their operating expenses to modernize digital client experiences and automate back-office functions.

CI Financial's aggressive M&A strategy leads to substantial acquisition and integration costs. These include one-time expenses for due diligence and transaction fees, which can be significant, as seen in their past strategic acquisitions. Ongoing costs arise from seamlessly integrating new firms systems, operations, and cultures, ensuring a cohesive business. For instance, in 2024, CI Financial continues to navigate the complex process of consolidating its wealth management platforms. These expenditures are strategic investments, designed to fuel future growth and expand their market presence.

Marketing & Business Development

Marketing and business development expenses are vital for CI Financial, encompassing all costs related to branding, advertising, client events, and lead generation. These investments are crucial for building brand awareness and supporting the growth of their advisor practices, directly fueling organic expansion. For example, CI Financial's selling, general, and administrative expenses, which include marketing, were approximately $129.5 million in Q1 2024, reflecting ongoing investment in growth initiatives.

- Covers advertising and promotional campaigns to attract new clients.

- Includes expenses for client engagement events and brand building.

- Supports lead generation and advisor practice expansion efforts.

- Essential for driving organic growth and market share in 2024.

Regulatory Compliance & Legal Fees

Operating across diverse jurisdictions, CI Financial faces substantial regulatory compliance and legal fees. These mandatory expenditures encompass salaries for dedicated compliance officers and legal counsel, alongside significant regulatory filing fees. Investments in advanced compliance monitoring technology are also crucial to navigate the complex financial regulations prevalent in 2024. These costs are essential for CI Financial to maintain its operational licenses and ensure adherence to evolving global standards.

- Significant legal and compliance staff are needed to manage global regulatory frameworks.

- Ongoing regulatory filing fees are mandatory for various financial licenses.

- Investment in compliance technology is critical for monitoring and reporting.

- Costs are driven by evolving standards in AML, KYC, and data privacy in 2024.

CI Financial's cost structure is primarily driven by advisor compensation, which consistently forms the largest operational expense, reflecting its human-capital-intensive wealth management model. Significant investments in technology and infrastructure are crucial for operational efficiency and cybersecurity, alongside substantial acquisition and integration costs from its M&A strategy. Marketing and regulatory compliance expenses are also key, with marketing costs, including advertising and client events, being approximately $129.5 million in Q1 2024. These diverse expenditures underpin CI Financial's growth and operational integrity.

| Cost Category | 2023 Total | 2024 (Q1) |

|---|---|---|

| Compensation & Benefits | $600M+ (Est.) | Largest Share |

| Technology & Infrastructure | 10-15% of OpEx | Ongoing Investment |

| Marketing & Business Development | N/A | $129.5M |

Revenue Streams

CI Financial's primary revenue stream comes from asset-based fees, calculated as a percentage of client Assets Under Management (AUM) or Assets Under Advisement (AUA).

These recurring fees directly correlate with the market value of client portfolios, aligning the firm's success with its clients' wealth growth. For instance, CI Financial reported C$150.3 billion in Wealth Management AUM/AUA as of March 31, 2024, demonstrating the scale of this fee model.

CI Financial generates revenue from financial planning fees, particularly for comprehensive services like detailed retirement or estate plans. For these offerings, the firm often charges a fixed or hourly fee, ensuring compensation is tied directly to the value of the advice provided rather than asset levels. This model supports a diverse revenue base beyond asset-based fees, contributing to the firm's overall financial health. While specific 2024 fee revenue figures for this segment are not typically isolated in public reports, this stream remains a consistent component of their service-based income.

CI Financial generates performance and incentive fees primarily from its alternative investment funds and certain institutional mandates. These fees are earned when portfolio returns surpass a predefined benchmark or hurdle rate, directly aligning compensation with superior investment outcomes. This revenue stream, while variable, reflects CI's ability to deliver alpha for clients. For example, in its 2024 outlook, CI continued to emphasize growth in its private markets and alternative strategies, where such performance fees are more prevalent.

Administration & Custodial Fees

CI Financial generates revenue from various administrative services provided to its clients and partner firms.

This includes account maintenance fees, trustee fees for fiduciary services, and platform fees for accessing the firm's technology and support infrastructure.

These fees represent a stable, recurring revenue stream, contributing to the company's overall financial resilience.

- CI Financial reported total revenue of C$1.1 billion for the nine months ended September 30, 2024.

- A significant portion of this revenue is recurring, underscoring the stability of administrative and custodial fees.

- Such fees are less susceptible to market volatility compared to asset-based management fees.

- The firm's strategic focus on wealth management further solidifies these reliable income sources.

Interest on Cash Balances

CI Financial generates net interest income from cash balances held within client accounts, a key component of its revenue streams. The company strategically earns a spread, paying a lower interest rate to clients while earning a higher rate by depositing these funds with banking partners. This revenue stream is notably sensitive to shifts in prevailing interest rates, with higher rates generally boosting profitability. For instance, in 2024, rising interest rates positively impacted net interest income across the financial services sector.

- CI Financial earned C$136.9 million in net interest income for the fiscal year ended December 31, 2024.

- This income represents the spread on client cash balances deposited with banking partners.

- The sensitivity to interest rate changes means higher rates generally improve this revenue stream.

- This stream contributes to the company's diversified revenue model.

CI Financial diversifies its revenue through asset-based fees, tied to C$150.3 billion in Wealth Management AUM/AUA as of March 31, 2024.

Additional income stems from performance fees, administrative services, and net interest income, which reached C$136.9 million for fiscal year 2024.

This multi-faceted approach ensures stability, with total revenue hitting C$1.1 billion by September 2024.

| Revenue Stream | Key Data (2024) | Description |

|---|---|---|

| Asset-Based Fees | C$150.3B AUM/AUA (Mar 31, 2024) | Percentage of client assets under management. |

| Net Interest Income | C$136.9M (FY 2024) | Spread on client cash balances. |

| Total Revenue | C$1.1B (9M ended Sep 30, 2024) | Overall revenue across all streams. |

Business Model Canvas Data Sources

The CI Financial Business Model Canvas is built using a blend of internal financial statements, market intelligence reports, and competitor analysis. These diverse data sources provide a comprehensive understanding of our operational landscape.