CI Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CI Financial Bundle

CI Financial navigates a complex landscape shaped by intense rivalry and significant buyer power within the wealth management sector. Understanding the nuances of supplier relationships and the threat of substitutes is crucial for forecasting its future performance.

The ease of switching providers and the concentration of buyers exert considerable pressure on CI Financial's pricing and service offerings, demanding constant innovation and value enhancement.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CI Financial’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The primary suppliers for CI Financial in wealth and asset management are highly skilled portfolio managers, financial advisors, and investment analysts. Their specialized expertise forms the core input for CI Financial's services. A tight labor market for top-tier financial talent, as observed in 2024, significantly drives up compensation costs. This gives these professionals substantial leverage, with their departure potentially impacting investment performance and client relationships. For instance, attracting and retaining top wealth advisors can cost firms millions in upfront bonuses and ongoing incentives.

CI Financial relies heavily on technology and data providers for essential infrastructure, including trading platforms and portfolio management software. Key suppliers like Bloomberg and Refinitiv offer market data feeds critical for daily operations. These providers hold significant bargaining power as their platforms are often industry standards, making switching both costly and complex for CI Financial. Their ability to dictate pricing directly impacts CI Financial's operating margins, reflecting the high value and limited alternatives for these crucial services in 2024.

Third-party custodians and clearing houses are indispensable for CI Financial, as they securely hold client assets and facilitate trade settlements, a core function of wealth management. The market for these critical services is highly concentrated among a few dominant players, such as BNY Mellon, State Street, and JPMorgan, due to significant regulatory hurdles and the immense scale required for operation. This concentration empowers these suppliers with moderate to high bargaining power over financial firms like CI Financial. For instance, in 2024, the global custodian banking market continued its consolidation trend, with the top few firms managing trillions in assets, reflecting their crucial leverage.

Specialized Research and Analytics Firms

Independent research and analytics firms provide crucial data and insights that inform CI Financial’s investment decisions and strategies. The uniqueness and quality of proprietary research can give these suppliers significant leverage, especially if their analysis consistently leads to superior investment performance, as seen with some firms commanding premium fees for specialized market intelligence in 2024. However, the increasing availability of diverse research sources and internal analytical capabilities within large financial institutions like CI Financial, which managed approximately $475 billion in assets as of early 2024, can mitigate this bargaining power to some extent. The competitive landscape among data providers means CI Financial can often choose from multiple vendors, limiting any single supplier's undue influence.

- Proprietary research insights are critical for CI Financial's investment strategy.

- Unique data offerings enhance supplier leverage, especially in niche markets.

- The proliferation of data sources and internal analytics moderates supplier power.

- CI Financial's scale allows for diversified research procurement and negotiation.

Marketing and Distribution Partners

Marketing and distribution partners, including digital agencies and third-party platforms, serve as key suppliers for CI Financial, aiding its client outreach and market penetration. While crucial for expanding reach, their bargaining power remains relatively low. This is primarily due to the vast array of alternative marketing channels available in the digital era, offering diverse options for client acquisition. CI Financial's robust internal distribution network and strong brand recognition, evidenced by its significant assets under management (AUM) which stood at approximately C$474.9 billion as of March 31, 2024, further diminish its reliance on any single external partner.

- Digital marketing channels offer numerous alternatives for CI Financial.

- CI Financial's established brand reduces dependency on external partners.

- Their substantial AUM strengthens their negotiating position.

- The wide availability of third-party distributors limits supplier power.

CI Financial faces varied supplier power; highly skilled financial talent and critical technology providers like Bloomberg exhibit strong leverage due to specialized demand and high switching costs impacting operating margins in 2024. Custodians also wield significant power given market concentration. However, the firm's substantial assets, approximately C$474.9 billion as of March 2024, and diversified procurement strategies temper the influence of research and marketing partners.

| Supplier Type | Bargaining Power | 2024 Impact Factor |

|---|---|---|

| Skilled Talent | High | Tight labor market, compensation costs |

| Tech/Data Providers | High | Industry standards, switching costs |

| Custodians | Moderate-High | Market consolidation, regulatory hurdles |

| Marketing/Distribution | Low | Diverse alternatives, CI's AUM |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to CI Financial's asset and wealth management operations.

Quickly assess competitive intensity and identify vulnerabilities with a visually intuitive five forces framework, enabling proactive strategy adjustments.

Customers Bargaining Power

High-net-worth (HNW) and ultra-high-net-worth (UHNW) clients form a critical segment for CI Financial, wielding significant bargaining power.

These sophisticated investors, managing complex portfolios, are adept at negotiating fees and demanding bespoke service levels.

The potential departure of even a single large client can noticeably impact the firm's assets under management, which stood at $475.2 billion as of April 30, 2024.

Their leverage stems from the sheer volume of assets they entrust, making client retention a strategic imperative.

For CI Financial, the low actual and perceived costs of switching wealth management providers significantly empower clients. The process of transferring assets has become more streamlined, with digital platforms facilitating moves to competitors offering better returns or lower fees. This dynamic forces firms like CI Financial to remain highly competitive on service and pricing, as evidenced by ongoing fee compression trends in the broader wealth management sector through 2024. For instance, industry reports indicate that clients often consider switching if fee structures are not transparent or if perceived value diminishes.

The widespread availability of financial information online, coupled with the growth of robo-advisors and low-cost ETFs, significantly empowers CI Financial's customers. For example, Canadian ETF assets reached CAD $408 billion in 2024, demonstrating robust alternatives. This transparency enables clients to easily compare CI Financial's offerings, putting downward pressure on fees and demanding higher service quality. Clients are more knowledgeable about competitive options, such as robo-advisor platforms offering management fees often below 0.50% compared to traditional advisory fees. This shifts bargaining power towards the informed consumer.

Power of Institutional Clients

Institutional clients, including pension funds and corporations, hold immense bargaining power over asset managers like CI Financial due to their substantial assets under management. These sophisticated entities conduct rigorous due diligence, demanding highly customized services and negotiating very competitive fee structures. Gaining or losing a single institutional mandate can significantly impact a firm's revenue and AUM, especially as CI Financial manages hundreds of billions in assets. Their ability to switch providers for even a slight fee advantage or better service amplifies their influence.

- Institutional clients demand bespoke solutions and rigorous reporting.

- Their large asset bases allow for aggressive fee negotiations.

- A single mandate loss can substantially decrease a firm's AUM and revenue.

- CI Financial's focus on retaining these clients is crucial for stability.

Importance of Advisor-Client Trust

While CI Financial's services involve complex financial metrics, the client-advisor relationship is fundamentally built on deep trust and personal connection. This strong bond can significantly reduce client bargaining power, as clients often hesitate to leave a long-standing, trusted advisor. However, this loyalty is not absolute; it must be continuously reinforced through consistent strong performance and excellent service, especially given competitive pressures in the wealth management sector in 2024. For instance, CI Financial reported approximately $474.9 billion in total assets under management and advisement as of March 31, 2024, emphasizing the scale of relationships managed.

- Client retention is crucial; advisor-client trust significantly influences it.

- Long-term relationships can mitigate price sensitivity among clients.

- Performance and service are key to maintaining loyalty against competition.

- CI Financial's Q1 2024 AUM figures highlight the importance of client base stability.

CI Financial's clients, especially HNW, UHNW, and institutional investors, wield significant bargaining power due to their large asset bases and low switching costs. The widespread availability of information and competitive alternatives like low-cost ETFs (CAD $408 billion in 2024) further empowers them to demand lower fees and enhanced services. While client trust mitigates some pressure, continuous performance and value delivery are crucial for retention. This dynamic necessitates CI Financial to remain highly competitive in pricing and service quality.

| Client Segment | Bargaining Lever | Impact on CI Financial |

|---|---|---|

| HNW/UHNW | Negotiate fees, bespoke service | AUM volatility, fee pressure |

| Institutional | Large mandates, due diligence | Significant revenue impact per mandate |

| All Clients | Low switching costs, info access | Increased competition, service demand |

Preview the Actual Deliverable

CI Financial Porter's Five Forces Analysis

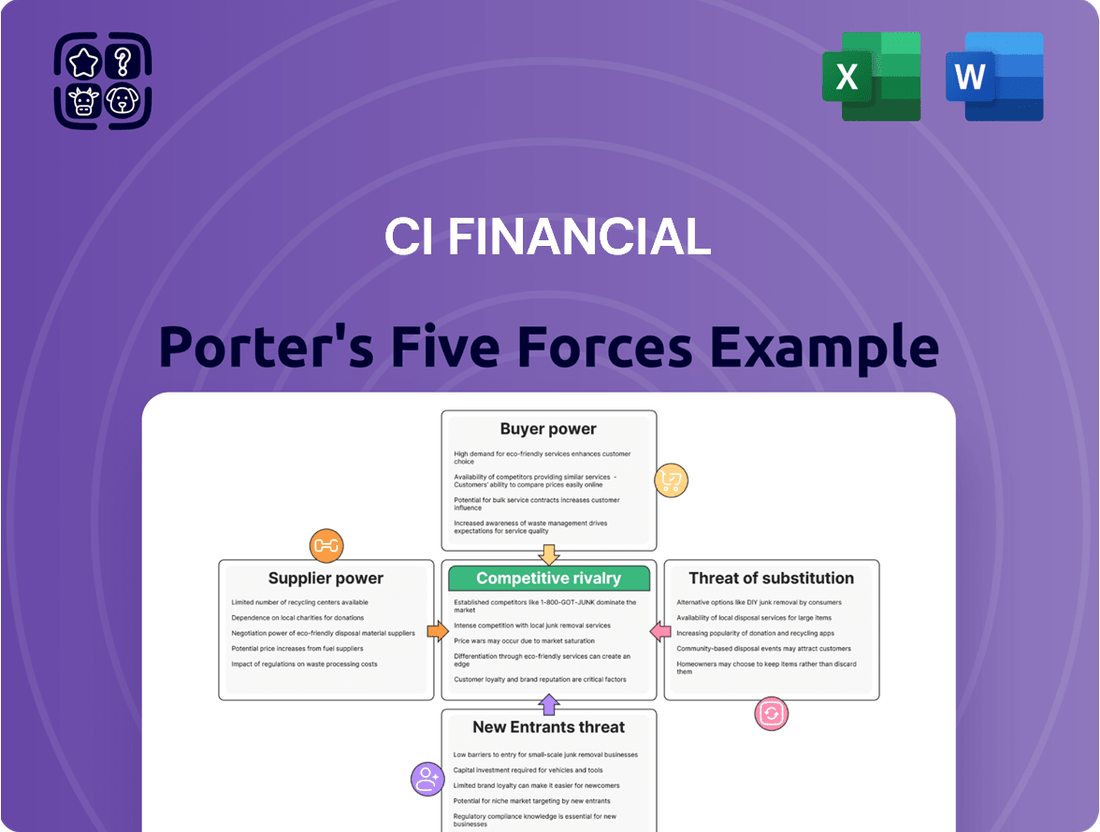

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The CI Financial Porter's Five Forces Analysis you see here details the competitive landscape, including the bargaining power of buyers, the threat of new entrants, and the bargaining power of suppliers. It thoroughly examines the intensity of rivalry among existing competitors and the threat of substitute products or services, offering a comprehensive view of the industry's structure and CI Financial's strategic position within it.

Rivalry Among Competitors

The North American wealth and asset management industry is exceptionally fragmented, hosting a vast array of competitors. Large multinational banks and insurance companies contend with numerous independent asset managers and smaller boutique advisory firms. This saturation creates intense and persistent competition for client assets, with over 15,000 registered investment advisors in the US alone as of early 2024. This crowded landscape necessitates aggressive strategies for client acquisition and retention, directly impacting profitability across the sector.

CI Financial faces formidable competition from the wealth management divisions of major Canadian and U.S. banks. Institutions like RBC Wealth Management and TD Wealth, with their vast resources and extensive branch networks across North America, exert significant pressure. For instance, RBC's wealth management segment reported over C$1.5 trillion in assets under administration in fiscal 2023, showcasing their scale. Their established brands and integrated financial services provide a strong competitive advantage, directly impacting CI Financial's market share in 2024.

CI Financial faces intense competition from numerous independent asset managers, both public and private, across Canada and the U.S. This rivalry for client segments, particularly in wealth management, is driven by factors like investment performance and the strength of advisor relationships. As of early 2024, the Canadian asset management market alone saw significant AUM growth, intensifying the fight for market share. Competitors continuously innovate, enhancing product offerings and leveraging technology to attract and retain clients.

Intense Fee Compression

Intense fee compression defines the competitive landscape for CI Financial, driven by the proliferation of low-cost passive investment products and increasing client demand for value. This ongoing pressure significantly erodes margins for traditional active management and advisory services. Firms like CI Financial must increasingly differentiate their offerings beyond price, focusing on holistic financial planning, exclusive product access, and premium client service to retain and attract assets. The industry saw average advisory fees decline further into 2024, pushing firms to innovate.

- Fee compression impacts AUM revenue, with average advisory fees for managing client assets seeing continued pressure in 2024.

- Growth of low-cost ETFs and index funds intensifies the competitive pressure on actively managed funds.

- Clients increasingly demand transparent fee structures and demonstrable value for financial advice.

- Differentiation through value-added services like wealth planning or tax optimization becomes crucial for profitability.

Aggressive M&A Landscape

The financial advisory sector is marked by aggressive merger and acquisition activity, intensifying competitive rivalry. Firms, including CI Financial, actively pursue growth-through-acquisition strategies, particularly within the fragmented U.S. registered investment advisor (RIA) market. This M&A rush, with over 300 RIA deals projected for 2024, heightens competition as companies vie for premier advisory practices, top talent, and expanded market share. The ongoing consolidation race fundamentally shapes the current competitive landscape, demanding strategic agility from all players.

- CI Financial completed significant RIA divestitures in 2024 to reduce debt.

- RIA M&A deal volume remained robust, with over 300 transactions anticipated in 2024.

- Firms compete intensely for accretive acquisitions and skilled financial advisors.

- Consolidation is a primary driver of market share shifts and competitive pressure.

Competitive rivalry for CI Financial is intense due to a highly fragmented North American wealth management industry, hosting over 15,000 US RIAs by early 2024. Major banks like RBC, with over C$1.5 trillion in AUA, provide formidable competition, while fee compression from low-cost products erodes margins. Aggressive M&A, with 300+ RIA deals projected for 2024, further heightens the fight for market share and talent.

| Competitive Factor | Impact on CI Financial | 2024 Data Point |

|---|---|---|

| Industry Fragmentation | Increased client acquisition costs | Over 15,000 US RIAs |

| Major Bank Scale | Market share pressure | RBC Wealth AUA > C$1.5T (2023) |

| Fee Compression | Margin erosion | Average advisory fees declining |

| M&A Activity | Heightened competition for talent/firms | Over 300 RIA deals projected |

SSubstitutes Threaten

The most significant substitute threat to CI Financial stems from the rapid growth of fintech innovations, particularly robo-advisors and automated online investment platforms. These digital services provide algorithm-driven portfolio management at a significantly lower cost than traditional human advisors, often charging advisory fees as low as 0.25% annually compared to 1% or more for human advisors. This affordability and accessibility strongly appeal to younger, tech-savvy investors and those with simpler financial planning needs, posing a direct competitive challenge. In 2024, the global robo-advisor market continues its expansion, with projections estimating assets under management (AUM) reaching over $3.2 trillion globally.

The secular shift from active to passive management presents a significant substitute threat to CI Financial. Low-cost exchange-traded funds (ETFs) and index funds tracking market benchmarks have surged in popularity. As of early 2024, global passive assets under management (AUM) exceeded $18 trillion, enabling investors to easily build diversified portfolios themselves. This trend bypasses the need for a traditional asset manager's stock-picking expertise, directly impacting firms relying on active strategies.

The rise of accessible, low-cost self-directed investing platforms like Fidelity and Charles Schwab poses a significant threat to traditional wealth management firms such as CI Financial. Many individuals are increasingly choosing this do-it-yourself approach, directly substituting the comprehensive services of financial advisors. The primary draw for these investors is the appeal of lower fees and greater personal control over their investment decisions. In 2024, the trend continues, with retail investor participation remaining robust as digital platforms simplify market access and portfolio management.

Direct Investment in Alternatives

Investors are increasingly bypassing traditional wealth managers to directly allocate capital into alternative asset classes like private equity, real estate, and private credit, often through specialized digital platforms. This direct access serves as a significant substitute for the diversified public market portfolios typically managed by firms such as CI Financial. Even though wealth managers are incorporating these alternatives into their offerings, the ease of direct investment poses a competitive threat by allowing clients to manage these allocations themselves. This trend is amplified by the growth of accessible private market funds.

- Global alternative assets under management are projected to reach $18.3 trillion by 2027, highlighting sustained investor interest.

- Platforms like iCapital Network and CAIS enable individual investors to access private market funds directly.

- High-net-worth investors often seek direct alternative exposure for enhanced diversification and potential alpha.

- The ability to invest directly reduces reliance on traditional advisory fees for these specific asset classes.

Financial Planning Software

Sophisticated financial planning software directly empowers consumers, enabling them to model their financial future, plan for retirement, and manage budgets without traditional advisement. These powerful tools, often integrated with investment platforms, directly substitute the financial planning component of a wealth manager's value proposition. This threat is particularly salient for CI Financial's clients in the accumulation phase with less complex needs, as digital solutions offer a cost-effective alternative. The global financial planning software market is projected to reach significant valuations, reflecting this growing consumer preference for self-directed tools.

- The global financial planning software market was valued at over $4 billion in 2023, with continued growth expected in 2024.

- Many software platforms offer comprehensive budgeting, goal-setting, and scenario analysis features.

- Clients with simpler financial situations increasingly opt for these digital alternatives over traditional advisors.

- The rise of hybrid models integrating software with limited human interaction further intensifies competitive pressure.

The threat of substitutes for CI Financial is strong, driven by the widespread adoption of cost-effective digital alternatives. Robo-advisors, projected to manage over $3.2 trillion globally in 2024, offer significantly lower fees. The ongoing shift to passive investing, with global passive AUM exceeding $18 trillion in early 2024, combined with robust self-directed platforms, allows investors to bypass traditional advice. Additionally, direct access to alternative assets and advanced financial planning software provides powerful self-management tools.

| Substitute Category | 2024 Data Point | Impact on CI Financial |

|---|---|---|

| Robo-Advisors | Global AUM > $3.2 Trillion | Lower fees, digital appeal |

| Passive Investing | Global Passive AUM > $18 Trillion | Bypasses active management |

| Financial Planning Software | Market > $4 Billion (2023, growing) | Empowers self-management |

Entrants Threaten

The financial services industry, particularly in Canada and the United States, faces extensive regulatory oversight. Regulatory bodies like OSFI in Canada and the SEC in the U.S. impose stringent licensing, capital adequacy, and compliance requirements on all participants. These complex hurdles, including significant legal and operational costs for compliance, act as a formidable barrier to entry for new players. Such high regulatory burdens effectively protect established firms like CI Financial, limiting the threat from new entrants in 2024 due to the immense investment and time required to meet these standards.

Establishing a trusted brand is paramount in wealth management, where clients entrust firms with their financial security and life savings. New entrants face the immense challenge of building a reputation for reliability and integrity from the ground up. This takes considerable time and marketing investment, often requiring millions in annual spending, which acts as a major deterrent. For instance, in 2024, top wealth management firms continue to allocate substantial budgets to brand reinforcement, making it harder for newcomers to gain a foothold. Clients prioritize established track records, making trust a significant barrier to entry.

Large, established firms like CI Financial benefit significantly from economies of scale in investment research, technology, and compliance. With CI Financial reporting assets under management (AUM) of approximately C$147.8 billion as of March 31, 2024, they can spread fixed costs over a vast asset base. A new entrant would struggle immensely to compete on cost, lacking the necessary AUM to achieve comparable operational efficiency. Reaching the scale required for profitability poses a formidable barrier to entry.

Access to Distribution Channels

New entrants face a significant hurdle in accessing distribution channels within the financial services industry. Incumbent firms like CI Financial have well-established networks, including a vast proprietary advisor force and strong relationships with third-party brokers and dealers. Building these channels from scratch is a costly and time-consuming endeavor for new players, often requiring substantial upfront investment. For instance, gaining market share against firms managing hundreds of billions in client assets, as CI Financial does with approximately C$470 billion in wealth management assets as of Q1 2024, highlights the deep client penetration of existing players.

- CI Financial's extensive advisor network and long-standing partnerships create high barriers to entry.

- New entrants must invest heavily to replicate established distribution reach, often taking years.

- Gaining trust and access for new financial products is challenging without existing client bases.

- The cost of customer acquisition for new firms remains a significant deterrent in 2024.

Niche Fintech Entrants

While a full-scale direct competitor to CI Financial is unlikely to emerge easily, the most potent threat of new entry comes from technology-focused firms, often called Fintechs. These entrants typically target specific, underserved niches within the financial value chain, offering specialized digital solutions. They can chip away at the market share of traditional firms by providing superior, focused services.

For instance, automated tax-loss harvesting platforms or specialized ESG investing tools represent areas where agile Fintechs can gain traction. In 2024, the Canadian fintech sector continued to see growth, with many startups focusing on niche wealth management and advisory tech solutions. These firms leverage lower operational costs and advanced algorithms to offer competitive services, potentially impacting CI Financial's client base in specific segments.

- Fintechs target specific, underserved niches within the financial value chain.

- They offer superior, specialized digital solutions, such as automated tax-loss harvesting.

- Specialized ESG investing platforms are another area where these entrants pose a threat.

- Canadian fintech investment in 2024 shows continued growth in niche wealth tech.

The financial industry's extensive regulatory hurdles, significant brand building costs, and economies of scale create formidable barriers for new entrants. Established firms like CI Financial also benefit from extensive distribution networks, making direct competition difficult. The primary threat comes from agile Fintechs, which target niche financial services with specialized digital solutions, potentially impacting specific segments of CI Financial's business in 2024.

| Barrier Type | CI Financial Advantage (2024) | Impact on New Entrants | ||

|---|---|---|---|---|

| Regulatory Compliance | C$147.8B AUM (March 2024) | High legal and operational costs | ||

| Brand & Trust | Established track record | Years to build reputation | ||

| Economies of Scale | C$470B Wealth AUM (Q1 2024) | Struggle to compete on cost |

Porter's Five Forces Analysis Data Sources

Our CI Financial Porter's Five Forces analysis leverages data from annual reports, investor presentations, and industry-specific market research to understand competitive dynamics.

We also incorporate insights from financial news outlets and regulatory filings to provide a comprehensive view of the forces shaping the financial services industry.