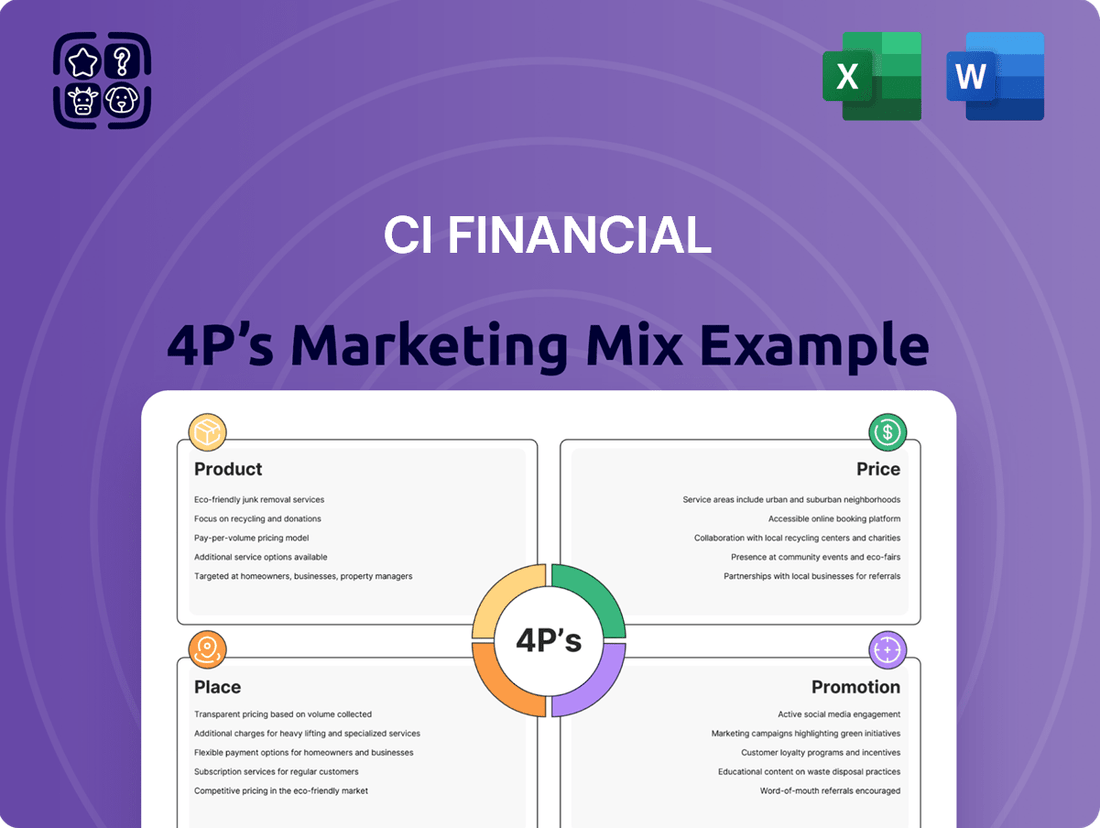

CI Financial Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CI Financial Bundle

CI Financial's marketing success hinges on a well-coordinated Product, Price, Place, and Promotion strategy. Their diverse product suite, from wealth management to asset management, caters to a broad spectrum of clients.

Discover how CI Financial strategically prices its services to remain competitive while delivering value. This analysis delves into their pricing architecture and its impact on market share.

Explore CI Financial's extensive distribution network and how they leverage various channels to reach their target audience effectively. Understanding their Place strategy is key to grasping their market penetration.

Uncover the intricacies of CI Financial's promotional efforts, from digital marketing to traditional advertising, and how they build brand awareness and customer loyalty.

Ready to gain a complete understanding of CI Financial's marketing brilliance? Access the full, editable 4Ps Marketing Mix Analysis to unlock actionable insights and strategic frameworks.

Save valuable time and elevate your own marketing acumen. This comprehensive report provides a detailed breakdown of CI Financial's 4Ps, perfect for strategic planning or academic research.

Go beyond the surface and get instant access to a professionally written, presentation-ready 4Ps Marketing Mix Analysis for CI Financial.

Product

CI Financial delivers comprehensive wealth management through key brands like CI Assante Wealth Management, CI Private Wealth, and Corient Private Wealth in the U.S. These integrated services target high-net-worth and ultra-high-net-worth individuals, providing holistic financial planning, investment advisory, and sophisticated tax, estate, and succession strategies. As of Q1 2024, Corient Private Wealth alone managed approximately US$170 billion in assets, illustrating the scale of their affluent client focus. The goal is to offer customized solutions addressing the complex financial needs of this segment.

CI Global Asset Management (CI GAM) provides a comprehensive product suite, featuring over 270 mutual funds and 120 exchange-traded funds (ETFs) as of mid-2024. This extensive offering also includes various private pools and alternative investments. The products are designed to meet diverse risk appetites, incorporating innovative solutions like Bitcoin and Ethereum ETFs. Additionally, CI GAM offers robust ESG mandates and private equity options, ensuring a broad market appeal.

CI Financial leverages its CI Direct Investing brand to offer comprehensive digital investment platforms, targeting a broad investor base seeking modern solutions. These platforms provide both robo-advisory services for automated portfolio management and self-directed trading through CI Direct Trading, addressing diverse client needs. This dual approach capitalizes on the growing demand for accessible, lower-cost digital wealth management, with industry projections indicating continued strong growth in robo-advisors through 2025. Empowering clients with choice, CI Financial integrates these digital offerings to complement its traditional wealth services, contributing significantly to its overall wealth management assets which exceeded C$80 billion as of early 2024.

Alternative and Private Market Investments

CI Financial has strategically expanded its product offerings into alternative investments, providing clients with crucial diversification beyond traditional stocks and bonds. This includes robust private equity funds and private credit strategies, notably through firms like Marret Asset Management, which manages approximately C$14.8 billion in assets as of Q1 2025. These sophisticated products aim for higher returns and lower correlation to public markets, catering specifically to institutional and high-net-worth investors seeking enhanced portfolio resilience.

- Alternative AUM reached C$14.8 billion by Q1 2025.

- Offers private equity and private credit solutions.

- Targets institutional and high-net-worth clients.

- Aims for uncorrelated returns and diversification.

Brokerage and Custodial Services

CI Investment Services (CIIS) operates as a crucial broker-dealer, delivering comprehensive brokerage, trading, and custodial services primarily to other portfolio managers, introducing brokers, and institutional investors. This B2B offering significantly diversifies CI Financial's revenue streams, contributing to its financial stability. By integrating these services, CI strengthens its position within the broader Canadian financial services ecosystem. In 2024, CIIS continued to serve a substantial client base, underpinning CI Financial's strategic growth initiatives.

- CIIS provides core B2B brokerage and custodial solutions.

- Key clients include portfolio managers and institutional investors.

- Diversifies CI Financial's revenue, enhancing market integration.

- Supports CI Financial's overall strategic growth into 2025.

CI Financial offers a diverse product suite, spanning comprehensive wealth management for affluent clients, including Corient Private Wealth with US$170 billion AUM by Q1 2024. Their asset management arm provides over 270 mutual funds and 120 ETFs as of mid-2024, alongside digital investment solutions through CI Direct Investing. Strategic expansion into alternative investments reached C$14.8 billion in AUM by Q1 2025, complemented by B2B brokerage services via CI Investment Services.

| Product Category | Key Offerings | 2024/2025 Data Points |

|---|---|---|

| Wealth Management | Holistic financial planning, advisory | Corient AUM: US$170B (Q1 2024) |

| Asset Management | Mutual funds, ETFs, alternatives | 270+ Mutual Funds, 120+ ETFs (mid-2024) |

| Alternative Investments | Private equity, private credit | Alternative AUM: C$14.8B (Q1 2025) |

What is included in the product

This analysis provides a comprehensive examination of CI Financial's marketing mix, detailing their Product, Price, Place, and Promotion strategies with real-world examples.

It’s designed for professionals seeking to understand CI Financial's market positioning and benchmark their own strategies.

Simplifies complex marketing strategies by clearly outlining CI Financial's Product, Price, Place, and Promotion, alleviating the pain of unclear strategic direction.

Place

CI Financial's distribution strategy heavily relies on its extensive network of financial advisors across Canada, a core component of its Place in the marketing mix. Services are primarily delivered through advisors under CI Assante Wealth Management and Aligned Capital Partners, offering personalized financial advice and direct access to CI's diverse product suite. This model emphasizes the crucial advisor-client relationship, which facilitates tailored wealth management solutions for a broad client base. As of early 2025, CI Assante and Aligned Capital collectively oversee a significant portion of CI's wealth management assets, underscoring the network's importance.

CI Financial maintains a significant physical footprint, with its headquarters in Toronto and a key U.S. headquarters established in Miami. The firm operates through numerous subsidiary offices and over 60 acquired registered investment advisor (RIA) firms across Canada and the United States, as of early 2025. This extensive localized presence enables direct client engagement and fosters a deeper understanding of diverse regional market dynamics. Such widespread physical access supports tailored financial advice and strengthens client relationships.

CI Financial leverages digital channels like CI Direct Investing and CI Direct Trading to make its investment products and services directly accessible. These online platforms enable clients to seamlessly open accounts, manage their portfolios, and utilize integrated financial planning tools. This digital-first approach caters significantly to a growing segment of tech-savvy investors seeking convenience and self-service, as evidenced by the continued growth in online brokerage assets, which reached over $1.7 trillion in Canada by early 2024, reflecting strong demand for digital solutions.

U.S. Expansion through RIA Acquisitions

CI Financial's distribution strategy heavily leverages rapid U.S. expansion, acquiring numerous high-quality Registered Investment Advisor firms. These acquisitions, now unified under the Corient brand, form a national platform serving high-net-worth clients across the United States. This approach has significantly broadened CI's geographic footprint and client base south of the border, with Corient managing approximately $140 billion in assets as of early 2025.

- Corient manages over $140 billion in client assets.

- Strategic RIA acquisitions expanded CI's U.S. presence to over 20 states.

Multi-Channel Institutional Distribution

CI Global Asset Management leverages a robust multi-channel institutional distribution network to offer its diverse investment products, including mutual funds and ETFs, across Canada. This strategy involves extensive partnerships with over 20,000 independent financial advisors affiliated with third-party investment dealers, mutual fund dealers, and insurance advisors. This broad outreach ensures CI GAM's funds are widely accessible to investors, enhancing market penetration and client reach.

- CI Global Asset Management manages approximately C$150 billion in assets as of early 2025, with a significant portion distributed through institutional channels.

- The firm's partnerships extend to major dealer networks, providing access to a substantial segment of the Canadian retail investment market.

- ETFs, a key product, saw over C$1.5 billion in net inflows for CI GAM in 2024, largely driven by institutional adoption.

- This multi-channel model is critical for maintaining CI Financial's competitive position in the evolving Canadian wealth management landscape.

CI Financial's Place strategy combines extensive physical presence with robust digital channels and strategic partnerships to reach diverse client segments. Its advisor networks and U.S. RIA acquisitions, including Corient, provide localized service and access to a broad client base. Digital platforms like CI Direct Investing cater to tech-savvy investors, while CI Global Asset Management leverages institutional distribution. This multi-faceted approach ensures wide accessibility and strong market penetration.

| Distribution Channel | Key Metric (Early 2025) | Impact |

|---|---|---|

| Corient (U.S. RIAs) | ~$140B AUM | Expands U.S. high-net-worth market reach. |

| CI GAM Institutional | ~C$150B AUM | Broadens reach via 20,000+ advisors. |

| CI Direct Investing | Significant online growth | Addresses demand for digital self-service. |

What You Preview Is What You Download

CI Financial 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of CI Financial's 4P's Marketing Mix is fully prepared for your immediate use. You can confidently assess the product, price, place, and promotion strategies without any hidden elements. This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing a complete and actionable understanding of CI Financial's market approach.

Promotion

CI Financial has significantly rebranded, consolidating its U.S. wealth management firms under the Corient brand by early 2024, and its asset manager as CI Global Asset Management. This strategy aims to create a unified, stronger North American brand, enhancing its market presence and clearly communicating integrated service offerings. The company emphasizes being a forward-thinking employer to attract top talent, aligning with its growth objectives. These branding efforts are crucial for CI Financial’s competitive positioning and client acquisition in the evolving financial landscape.

CI Financial leverages its robust digital footprint, including its primary website and active social media channels, to showcase its diverse financial services and thought leadership. The investor relations section on CIFinancial.com provides comprehensive 2024 financial reports and detailed presentations, attracting a significant volume of institutional investors and analysts. Their online platforms also effectively promote client-focused events and webinars, with recent Q1 2025 virtual sessions drawing over 1,500 participants, enhancing engagement and brand visibility. This integrated digital strategy supports a broad market reach.

CI Financial prioritizes its network of independent financial advisors, recognizing them as a key promotional channel for its wealth management services.

The company significantly supports these advisors by integrating advanced technological tools, notably the AI-powered financial planning software from Conquest. This strategic partnership, solidified in 2024, empowers advisors to deliver highly sophisticated and dynamic financial plans to their clients.

Such support enhances the advisors' value proposition, allowing them to attract and retain high-net-worth clients by offering cutting-edge solutions in a competitive market.

Public Relations and Media Engagement

CI Financial actively engages with media through press releases, announcing key financial milestones like its Q1 2024 adjusted earnings per share of C$0.86 and assets under management (AUM) reaching C$474.9 billion as of April 2024. The company regularly hosts conference calls and webcasts for analysts and investors to discuss performance and strategic initiatives, ensuring transparency. This consistent communication helps maintain a high profile within the competitive financial industry, attracting new clients and reinforcing investor confidence.

- Q1 2024 Adjusted EPS: C$0.86

- AUM (April 2024): C$474.9 billion

- Regular analyst and investor webcasts

- Consistent press release schedule

Industry Events and Thought Leadership

CI Financial and its executives actively engage in industry events and webinars, solidifying their position as key thought leaders in wealth and asset management. CI Global Asset Management frequently hosts specialized events for financial advisors throughout 2024, featuring expert portfolio managers and strategists discussing market outlooks and investment solutions. These gatherings are crucial for educating partners on the latest offerings and strengthening professional relationships, which is vital as the firm continues to expand its advisor network and AUM, projected to exceed CAD 450 billion in 2025. Such targeted outreach supports client acquisition and retention by fostering deep trust and expertise.

- CI GAM hosted over 50 advisor-focused educational events across Canada in 2024, enhancing partner knowledge.

- Executive participation in major financial conferences in 2024-2025 emphasizes CI Financial's strategic vision.

- These promotional efforts directly contribute to advisor engagement, a key driver for CI Financial's projected AUM growth.

CI Financial's promotion strategy focuses on a unified brand identity under Corient and CI Global Asset Management, effectively using its robust digital presence and media engagement. The firm significantly supports its independent financial advisors with advanced tools like Conquest AI, enhancing their client offerings. Through consistent press releases, such as Q1 2024 adjusted EPS of C$0.86, and active participation in industry events, CI Financial maintains high visibility and strengthens client and investor relationships, driving projected AUM growth beyond C$450 billion in 2025.

| Promotional Channel | Key Initiative/Metric (2024/2025) | Impact |

|---|---|---|

| Branding | Corient U.S. wealth management rebranding (early 2024) | Unified North American brand, enhanced market presence |

| Digital Engagement | Q1 2025 virtual sessions (1,500+ participants) | Increased client engagement and brand visibility |

| Advisor Support | Conquest AI integration (2024 partnership) | Empowered advisors, attracted high-net-worth clients |

| Media Relations | Q1 2024 Adjusted EPS: C$0.86; AUM (April 2024): C$474.9B | Maintained high profile, reinforced investor confidence |

| Industry Events | CI GAM hosted 50+ advisor events (2024); Projected AUM >C$450B (2025) | Educated partners, fostered trust, supported AUM growth |

Price

CI Global Asset Management primarily uses an asset-based fee model, charging a percentage of client assets under management (AUM). Their Management Expense Ratios (MERs) vary across funds, generally ranging from 0.50% to over 2.00%, comparable to industry standards for similar investment products. This pricing structure directly aligns CI Financial's revenue with the growth and value of the client assets it manages. For instance, as of Q1 2025, CI Financial reported approximately $145 billion in total AUM, with these fees forming a significant portion of their recurring income. This model incentivizes strong performance to retain and attract higher asset bases.

CI Financial employs a tiered advisory fee structure for its wealth management services, particularly through platforms like CI Direct Investing. As of 2024, clients typically see management fees start at 0.60% for assets up to $150,000. This rate then decreases significantly, dropping to 0.35% for portfolio values exceeding $500,000. Such a progressive pricing model effectively incentivizes clients to consolidate and expand their financial assets under the firm's management.

CI Global Asset Management (CI GAM) has introduced innovative pricing models, such as the CI Performance Series, which features a 0% fixed management fee. Instead, a performance fee is charged only when the investment pool outperforms its benchmark index. This pay-for-outperformance model, actively utilized in 2024, directly ties CI GAM's compensation to its investment performance. This strategy is designed to strongly align the firm's financial interests with those of its clients, fostering a collaborative approach to achieving superior returns.

Fee-Based Financial Planning

CI Financial's wealth management subsidiaries, like CI Assante Wealth Management, largely employ a fee-based planning model. This structure moves away from traditional product commissions, compensating advisors for ongoing comprehensive financial advice and holistic client well-being management. This aligns with industry trends towards fiduciary responsibility and transparency, enhancing client trust. As of Q1 2024, CI Financial's wealth management assets under advisement reached approximately C$150 billion, primarily under this fee-based model.

- Revenue generation shifts from transactional sales to recurring advisory fees.

- Clients pay for continuous financial planning and portfolio oversight.

- This model supports long-term client relationships and holistic advice delivery.

- It reflects a focus on client outcomes over product pushing.

Transactional and Custodial Fees

CI Financial generates significant revenue through transactional and custodial fees via CI Investment Services, providing essential functions like trade execution and asset custody for other financial institutions and portfolio managers.

These charges represent a critical revenue stream, directly tied to the volume and specific types of services rendered to its institutional client base.

- CI Financial's Wealth Management assets, which benefit from these services, stood at approximately C$151 billion as of March 31, 2024.

- Fees are often structured as a percentage of assets under custody or per-transaction charges.

CI Financial uses an asset-based fee model, charging 0.50% to over 2.00% on its Q1 2025 AUM of $145 billion. Tiered advisory fees for wealth management begin at 0.60% for assets up to $150,000, dropping to 0.35% for portfolios over $500,000 as of 2024. Innovative performance-based fees, like the CI Performance Series in 2024, charge only for outperformance. Additionally, the firm generates revenue from transactional and custodial fees for its C$151 billion wealth management assets as of March 31, 2024.

| Pricing Model | Description | Typical Range/Rate |

|---|---|---|

| Asset-Based Fees | Percentage of Assets Under Management (AUM) | 0.50% - 2.00%+ MERs |

| Tiered Advisory Fees | Decreasing percentage based on AUM tiers | 0.60% (up to $150k) to 0.35% (over $500k) |

| Performance Fees | Fee charged only for outperformance against benchmark | 0% fixed, performance-based fee |

4P's Marketing Mix Analysis Data Sources

Our CI Financial 4P's Marketing Mix Analysis is built upon a robust foundation of publicly available information, including official financial disclosures, investor relations materials, and company website data. We also incorporate insights from reputable industry reports and competitive intelligence to provide a comprehensive understanding of their strategies.