CIFI Holdings Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIFI Holdings Group Bundle

Navigate the complex external environment impacting CIFI Holdings Group with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping the real estate sector. Gain a strategic advantage by identifying potential risks and opportunities. Download the full PESTLE analysis now for actionable intelligence to inform your investment decisions.

Political factors

The Chinese government's commitment to stabilizing the real estate sector significantly influences CIFI Holdings. Recent policy shifts, such as a 25 basis point cut in the five-year loan prime rate in February 2024, aimed at boosting market confidence and easing buyer financing.

Further measures, including reduced down payment ratios for first-time homebuyers to 15% and for second homes to 25% in many cities, are designed to stimulate demand. These adjustments, coupled with the removal of purchase restrictions in several major cities, are crucial for CIFI's sales performance and overall market recovery.

A key political factor influencing real estate developers like CIFI Holdings is the 'white list' mechanism, introduced in January 2024. This initiative by local authorities aims to identify and recommend eligible real estate projects for financial backing, thereby stabilizing the sector.

CIFI Holdings has strategically leveraged this policy, with 55 of its projects being included in these recommended lists during 2024. This has been instrumental in securing vital financing and easing liquidity challenges for the company.

The primary objective of the 'white list' is to ensure the completion of ongoing housing projects and channel financial support directly to developers facing difficulties, thereby bolstering market confidence.

The Chinese government is significantly increasing its backing for urban renewal, targeting the renovation of 1 million more housing units, often through monetary compensation. This policy shift directly impacts the real estate sector, creating new avenues for developers like CIFI Holdings.

Furthermore, there's a pronounced emphasis on boosting the availability of affordable housing, specifically catering to new urban dwellers, young individuals, and migrant populations. This strategic focus indicates a growing segment of the market prioritizing cost-effective living solutions.

These government-led initiatives present a dual opportunity for CIFI Holdings: the chance to engage in new urban renovation projects and a potential pivot in market demand towards more affordable housing segments, aligning with evolving societal needs.

Regulatory Environment and De-leveraging Efforts

China's regulatory push to de-lever the property sector, notably through policies like the 'three red lines,' has directly influenced developers' debt management. CIFI Holdings Group, like its peers, has navigated these regulations, focusing on reducing its overall indebtedness. The government's ongoing commitment to financial stability and risk mitigation remains a central political consideration for the real estate market.

CIFI Holdings' efforts to deleverage are evident in its financial disclosures. For instance, as of the first half of 2024, the company reported a continued focus on optimizing its capital structure to meet evolving regulatory benchmarks. The 'three red lines' policy, introduced in August 2020, set specific debt ratios for developers, aiming to curb excessive borrowing and promote sustainable growth. While CIFI has shown progress in adhering to these, the broader political landscape continues to prioritize prudent financial practices within the industry.

- Regulatory Focus: The Chinese government's emphasis on de-leveraging the property sector remains a primary political driver.

- 'Three Red Lines' Impact: These policies have significantly reshaped how developers manage their debt levels.

- CIFI's Progress: CIFI Holdings has actively worked to reduce its total indebtedness in response to the regulatory environment.

- Risk Prevention: The ongoing political stance favors risk prevention and the healthy, stable development of the real estate market.

Long-term Housing Development Model Shift

China's real estate sector is undergoing significant policy shifts, moving away from the long-standing pre-sale model towards selling completed new homes. This reform aims to stabilize the market and enhance buyer protection. For CIFI Holdings, this means a strategic pivot is essential to navigate the evolving landscape of property development and sales.

The government's push for a higher supply of quality housing underscores a commitment to improving living standards and fostering sustainable urban development. This policy direction directly impacts how developers like CIFI must plan and execute their projects, focusing on value and long-term resident satisfaction rather than rapid construction cycles.

- Shift from Pre-sales to Completed Homes: This change requires developers to manage cash flow differently, as revenue realization will be delayed until property completion.

- Focus on High-Quality Housing: Increased emphasis on improved housing stock means investing more in construction quality, design, and amenities.

- Government Objectives Alignment: CIFI must align its business strategies with national goals for housing market stability and consumer confidence.

- Market Structure Evolution: The transition necessitates adapting to new market dynamics and potentially different financing structures.

Government policies aimed at stabilizing the real estate market, such as the introduction of a 'white list' mechanism in January 2024, have directly benefited CIFI Holdings. By February 2024, 55 of CIFI's projects were included in these lists, securing crucial financing and alleviating liquidity pressures.

The shift from pre-sale models to selling completed homes, a policy change designed to enhance buyer protection and market stability, necessitates a strategic adaptation for developers like CIFI. Concurrently, increased government support for urban renewal and affordable housing presents new development opportunities.

CIFI Holdings continues to navigate the 'three red lines' policy, a key regulatory measure focused on de-leveraging the property sector. As of the first half of 2024, the company actively worked on optimizing its capital structure, demonstrating a commitment to financial prudence in line with national objectives for market stability.

What is included in the product

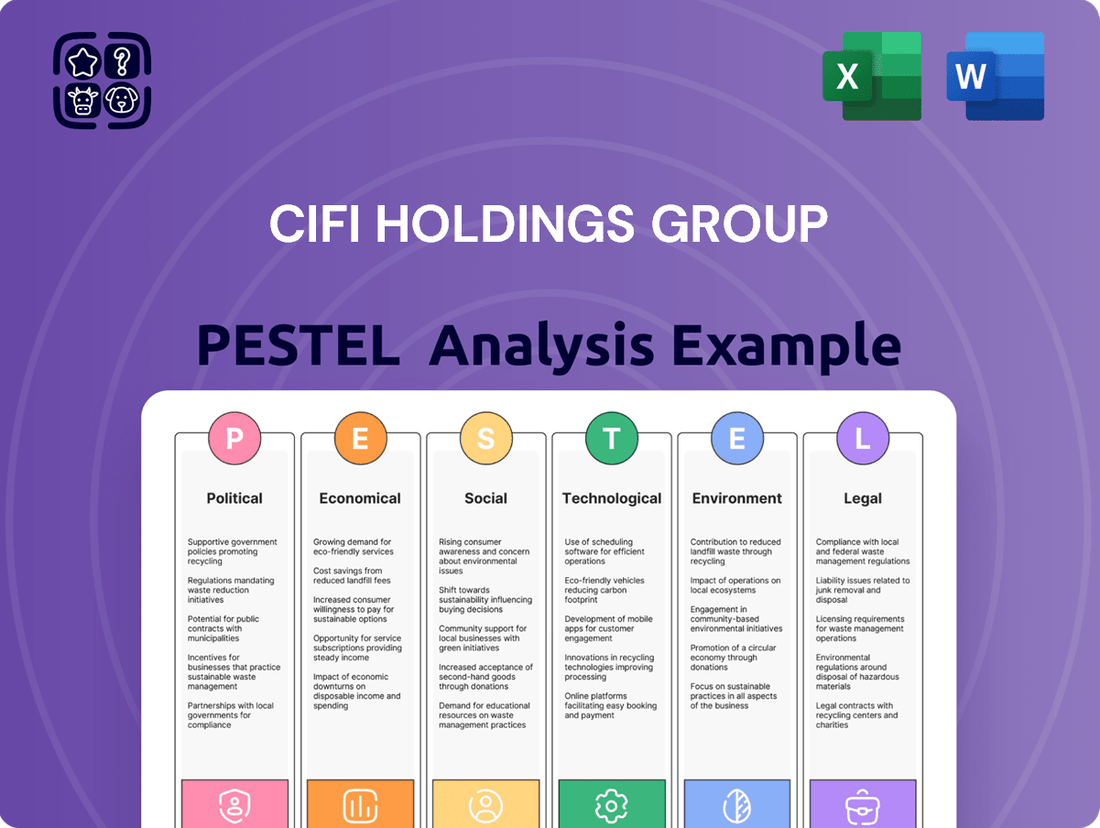

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting CIFI Holdings Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into market dynamics and regulatory landscapes, enabling strategic decision-making and proactive opportunity identification for stakeholders.

A CIFI Holdings Group PESTLE analysis provides a clear, summarized version of external factors for easy referencing during meetings or presentations, alleviating the pain of sifting through raw data.

Visually segmented by PESTEL categories, the analysis allows for quick interpretation at a glance, simplifying complex market dynamics and easing decision-making.

Economic factors

China's property sector has been navigating a challenging period since late 2020, marked by declining property values and subdued transaction volumes. This downturn has impacted developers and related industries significantly.

However, recent data suggests a potential shift. In the first quarter of 2024, new home sales in major cities like Beijing and Shanghai saw year-on-year growth, with some reports indicating a 15% increase in transactions in key urban areas compared to the previous year. This stabilization is largely attributed to government support, including relaxed purchase restrictions and targeted stimulus packages.

While the broader market recovery remains uneven, with smaller cities still facing headwinds, the renewed activity in tier-one and select tier-two cities offers a glimmer of hope. This renewed confidence, if sustained, could provide a more stable operating environment for companies like CIFI Holdings.

CIFI Holdings faced significant headwinds in 2024, reporting a net loss primarily due to property write-downs stemming from the broader real estate market downturn. This financial strain underscored the urgent need for strategic financial maneuvers to ensure operational continuity.

A pivotal development occurred in June 2025 with the court approval of CIFI Holdings' offshore debt restructuring. This landmark achievement is anticipated to substantially ease the company's liquidity pressures.

The successful restructuring is projected to establish a more sustainable capital structure, a critical step for CIFI Holdings' survival and its ability to navigate future operations and market challenges.

Consumer confidence has been a significant headwind for CIFI Holdings Group's real estate business, exacerbated by rising household debt. For instance, in late 2023 and early 2024, many Chinese households faced increased financial pressure, impacting their willingness to make large purchases like homes.

Government initiatives to stimulate the property market, such as easing mortgage requirements and lowering transaction costs, are in place. However, the effectiveness of these measures hinges on broader economic indicators like sustained job creation and real wage growth, which are crucial for restoring robust demand for housing.

Investment and Financing Landscape

The real estate investment sector experienced a significant downturn, leading to a contraction in overall investment. This contraction has also resulted in local governments facing fiscal challenges, largely due to a decline in revenue from land sales. For instance, China's property investment fell by 9.5% in the first four months of 2024 compared to the same period in 2023.

Despite these headwinds, the government is implementing measures to support real estate financing. Initiatives like the 'white list' system, which identifies projects eligible for funding, and new regulations for commercial property loans aim to address the reasonable financing requirements of developers. This strategic support is crucial for companies like CIFI Holdings Group as they navigate the evolving capital markets.

- Shrinking Investment: China's property investment decline of 9.5% in Jan-Apr 2024 highlights the challenging investment environment.

- Fiscal Strain on Local Governments: Falling land sale revenues are creating fiscal gaps for local authorities.

- Government Support Mechanisms: The 'white list' and new commercial property loan regulations are designed to facilitate developer financing.

- Impact on CIFI Holdings: The effectiveness of these financing measures directly influences CIFI's ability to secure capital for its operations.

Shift Towards Property Management and Services

The real estate sector is seeing a notable pivot from pure construction to property management and related services. This shift is driven by evolving market demands and the need for more stable, recurring revenue streams. CIFI Holdings Group, with its existing footprint in property management, is well-positioned to capitalize on this trend.

This evolution presents a strategic opportunity for CIFI to diversify its revenue base beyond traditional development. By focusing on property management, rentals, and renovation, the company can build a more resilient business model. For instance, the Chinese property management sector's market size was projected to reach approximately RMB 2.5 trillion by the end of 2024, indicating significant growth potential.

- Industry Transition: A move from construction-centric revenue to service-based income is a defining characteristic of the current real estate market.

- CIFI's Position: CIFI's established property management division offers a platform for growth in this evolving landscape.

- Revenue Diversification: Expanding services like rentals and renovations can create more predictable and recurring income for CIFI.

- Market Growth: The increasing demand for professional property management services in China, with market size projections showing substantial growth, highlights a favorable environment.

Economic factors continue to shape CIFI Holdings Group's performance, with the property sector's recovery remaining a key concern. While some urban markets showed signs of stabilization in early 2024, with transaction volumes increasing, the overall economic climate and consumer confidence are critical determinants of future demand. The government's fiscal policies and efforts to manage inflation will also play a significant role in creating a more predictable operating environment.

The real estate investment landscape in China saw a notable contraction, with property investment declining by 9.5% in the first four months of 2024 compared to the previous year. This downturn has also led to fiscal challenges for local governments, as revenues from land sales have diminished. However, the government is actively supporting developer financing through mechanisms like the 'white list' system, which aims to identify eligible projects for funding, and new regulations for commercial property loans, offering a lifeline to companies like CIFI Holdings.

| Economic Factor | Impact on CIFI Holdings | Relevant Data (2024/2025) |

|---|---|---|

| Property Market Recovery | Stabilization in key cities supports renewed transaction activity. | New home sales in major cities grew year-on-year in Q1 2024; some areas saw a 15% increase in transactions. |

| Consumer Confidence & Household Debt | Lower confidence and higher debt limit housing demand. | Household financial pressure was a concern in late 2023 and early 2024, impacting large purchases. |

| Real Estate Investment | Contraction in investment creates broader market headwinds. | China's property investment fell 9.5% in Jan-Apr 2024 year-on-year. |

| Government Support & Financing | Targeted measures aim to ease developer liquidity issues. | 'White list' system and new commercial property loan regulations are in place to facilitate financing. |

Preview the Actual Deliverable

CIFI Holdings Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CIFI Holdings Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Gain valuable insights into the strategic landscape and potential challenges and opportunities facing the company.

Sociological factors

China's demographic landscape is shifting dramatically, with the population declining for the third year in a row as of 2024. This trend, marked by falling birth rates and an aging population, is projected to significantly reduce urban housing demand in the coming years. Fewer households being formed directly impacts the long-term need for new residential properties, a crucial consideration for developers like CIFI Holdings.

Despite a national population decline, China's ongoing urbanization and rural-to-urban migration continue to fuel housing demand in its major cities. CIFI Holdings, by concentrating its development efforts on first and second-tier urban centers, is well-placed to capitalize on this trend, although the rate of this migration is anticipated to slow.

Even with a general cooling in the property market, the desire for better homes is growing. By 2024, it's projected that demand for housing upgrades will represent a larger slice of China's overall property needs. This trend is a direct result of rising incomes and a general push for improved living standards, pushing consumers towards higher-quality, more contemporary residences.

CIFI Holdings Group is well-positioned to capitalize on this shift. Their strategy of developing properties focused on end-user needs and emphasizing quality directly addresses this burgeoning demand for upgraded living spaces. For instance, in 2023, CIFI's sales performance indicated a resilience in its core markets, suggesting that buyers are prioritizing quality and location, aligning with the upgrade trend.

Consumer Sentiment and Confidence

Consumer sentiment and confidence significantly shape the real estate market, and for CIFI Holdings, this is a critical sociological consideration. Years of market downturns and persistent concerns regarding project completion have eroded buyer trust in the sector. For instance, in early 2024, surveys indicated a cautious approach from potential homebuyers, with many prioritizing developers with a proven track record of timely delivery. CIFI's capacity to consistently meet its project timelines and uphold its brand reputation is paramount to regaining and retaining buyer confidence.

The lingering effects of past market volatility and the visibility of unfinished developments continue to cast a shadow over buyer sentiment. This sociological backdrop directly impacts CIFI Holdings' sales performance and its ability to attract new customers. As of Q1 2024, data from property analytics firms showed a notable preference for developers with strong balance sheets and a history of completed projects, suggesting that trust is a key differentiator in the current environment. Therefore, CIFI's strategic focus on project execution and transparent communication is vital for rebuilding its standing and fostering a more positive consumer outlook towards its developments.

Rebuilding trust is an ongoing process for CIFI Holdings, directly tied to its operational success and public perception. The company's commitment to delivering on its promises is not just a business imperative but a sociological necessity in an environment where buyer confidence is fragile. Market reports from late 2023 highlighted that developers who successfully navigated the downturn by completing projects saw a gradual improvement in their brand image and sales conversion rates.

Lifestyle Changes and Property Preferences

Shifting lifestyle trends are significantly reshaping how people view and select property. There's a growing demand for residences equipped with smart home technology, offering convenience and efficiency. For instance, a 2024 survey indicated that over 60% of potential homebuyers in major Chinese cities consider smart home features a key purchasing factor. CIFI Holdings must integrate these innovations to meet evolving urban expectations.

Furthermore, sustainability is no longer a niche concern but a mainstream preference. Buyers are increasingly prioritizing properties with green building certifications and energy-efficient designs, reflecting a broader societal move towards environmental consciousness. CIFI's commitment to incorporating features like solar panels and advanced insulation in its 2024 projects directly addresses this growing demand, aiming to attract environmentally aware buyers.

Community amenities are also playing a more crucial role in property decisions. Residents are seeking developments that offer more than just housing, desiring integrated spaces for recreation, social interaction, and work. CIFI's focus on mixed-use developments that include retail, dining, and green spaces, as seen in its recent projects in Shanghai, aligns with this trend, enhancing the overall living experience and property appeal.

- Smart Home Integration: Over 60% of homebuyers in major Chinese cities in 2024 prioritized smart home features.

- Green Building Demand: Growing preference for energy-efficient designs and eco-friendly materials in new constructions.

- Community Amenities: Increased value placed on developments offering integrated lifestyle facilities, including recreational and social spaces.

- CIFI's Response: Development of mixed-use properties and incorporation of sustainable technologies in 2024 projects to meet these lifestyle shifts.

Consumer confidence remains a critical factor, with data from early 2024 indicating a preference for developers with strong track records and timely project completion. CIFI's focus on execution and transparency is therefore vital for rebuilding trust. This sentiment is further shaped by lingering concerns over market volatility and visible unfinished projects, making reliability a key differentiator.

Lifestyle shifts are increasingly influencing housing choices, with smart home technology and sustainability becoming major priorities. A 2024 survey revealed that over 60% of potential homebuyers in major Chinese cities consider smart home features essential. CIFI's integration of these features and eco-friendly designs in its 2024 projects directly addresses these evolving urban expectations and growing environmental consciousness.

Demand for enhanced living experiences is driving a preference for developments offering integrated community amenities. Buyers are seeking more than just housing, valuing spaces for recreation and social interaction. CIFI's strategy of developing mixed-use properties, incorporating retail and green spaces, aligns with this trend by improving overall lifestyle appeal.

| Sociological Factor | Impact on CIFI Holdings | 2024/2025 Data/Trend |

|---|---|---|

| Consumer Confidence | Drives purchasing decisions; reliance on developer reliability. | Surveys in early 2024 show cautious buyers prioritizing developers with proven delivery records. |

| Lifestyle Preferences | Influences demand for modern features and amenities. | Over 60% of 2024 homebuyers in major cities prioritize smart home tech; growing demand for green features. |

| Urbanization & Migration | Fuels demand in tier 1 & 2 cities, though migration rate is slowing. | Continued, albeit decelerating, rural-to-urban migration supports demand in key CIFI markets. |

Technological factors

CIFI Holdings Group is navigating a real estate landscape increasingly shaped by property technology, or proptech, and broader digitalization. This trend spans everything from managing properties more smoothly to how they market and sell units.

By embracing digital platforms, CIFI can significantly boost the efficiency of its property management services. For instance, implementing smart building technologies and online tenant portals can streamline maintenance requests and rent collection, improving operational flow.

Furthermore, digitalization offers powerful avenues to enhance customer experience. CIFI can utilize virtual tours, online sales platforms, and personalized digital communication to engage potential buyers and residents, making the property acquisition and living experience more convenient and attractive.

The increasing adoption of smart home and building technologies presents a significant opportunity for CIFI Holdings. By integrating features like automated climate control, smart security systems, and energy-efficient lighting, CIFI can enhance the appeal of its residential and commercial properties. For instance, a study by Statista in late 2023 projected the global smart home market to reach over $150 billion by 2027, indicating strong consumer demand for connected living solutions.

These advanced systems not only cater to the growing segment of tech-savvy consumers but also contribute to improved operational efficiency and reduced utility costs for building owners and residents. CIFI's strategic implementation of these technologies can therefore serve as a key differentiator in a competitive property market, potentially boosting sales and tenant satisfaction.

Technological advancements are revolutionizing building materials and construction. Innovations like recycled steel, low-carbon concrete, and modular construction are making projects more eco-friendly and potentially cheaper. For instance, the global green building materials market is projected to reach $456.7 billion by 2027, indicating a significant shift towards sustainability.

CIFI Holdings can leverage these technologies to improve its brand as an environmentally conscious developer. Adopting green building certifications and efficient construction methods, such as prefabrication, can lead to reduced waste and faster project completion times, ultimately lowering operational expenses and enhancing long-term profitability.

Data Analytics for Market Insights

CIFI Holdings Group can leverage big data analytics to gain a more profound understanding of market dynamics, including emerging trends and shifts in consumer preferences. This analytical capability is crucial for identifying lucrative investment opportunities and anticipating future demand in the real estate sector.

A data-driven strategy allows CIFI to make more informed decisions across its operations. For example, insights derived from analytics can guide land acquisition strategies, optimize property design to meet specific buyer needs, and refine pricing models for maximum market penetration and profitability. This approach was evident in CIFI's 2023 performance, where strategic land banking in tier-1 and tier-2 cities contributed to a stable revenue base.

- Market Trend Analysis: Utilizing data to predict property market shifts and identify growth corridors.

- Consumer Behavior Profiling: Understanding buyer demographics, preferences, and purchasing power to tailor offerings.

- Investment Opportunity Identification: Pinpointing undervalued land parcels or high-demand development areas.

- Operational Efficiency: Optimizing project planning, construction timelines, and sales strategies based on data insights.

Building Information Modeling (BIM) and Automation

CIFI Holdings Group's integration of Building Information Modeling (BIM) and construction automation is a key technological driver. BIM adoption, seen across the industry, allows for more precise project design and management, leading to fewer errors and faster project timelines. For instance, by 2024, it's estimated that over 70% of major construction projects globally will utilize BIM to some extent, a significant increase from previous years.

Automation in construction, from robotic bricklaying to drone-based site surveys, further enhances CIFI's operational efficiency. These advancements can reduce labor costs and improve safety. CIFI can leverage these technologies to streamline its entire development lifecycle, from initial concept to final delivery, ultimately boosting project quality and reducing waste. In 2024, the global construction automation market was valued at approximately $2.5 billion and is projected to grow substantially.

- BIM Adoption: Enhances design accuracy and project management, reducing errors by an estimated 15-20%.

- Automation in Construction: Improves efficiency and safety, potentially cutting project completion times by up to 10%.

- Market Growth: The construction automation market is experiencing rapid expansion, signaling a strong industry-wide shift towards technological integration.

CIFI Holdings Group is actively integrating property technology (proptech) and digitalization to enhance its operations. The company leverages digital platforms for streamlined property management and improved customer engagement through virtual tours and online sales.

The adoption of smart home and building technologies presents a significant opportunity, with the global smart home market projected to exceed $150 billion by 2027. CIFI can utilize these innovations to boost property appeal and operational efficiency.

Advancements in construction technology, including green building materials and modular construction, are making projects more eco-friendly and cost-effective. The green building materials market is expected to reach $456.7 billion by 2027, supporting CIFI's efforts towards sustainability.

CIFI utilizes big data analytics to understand market trends and consumer behavior, informing strategic decisions in land acquisition and property development. This data-driven approach was reflected in CIFI's 2023 strategy of land banking in key cities.

The integration of Building Information Modeling (BIM) and construction automation is crucial for CIFI. BIM adoption is expected to be utilized in over 70% of major global construction projects by 2024, enhancing design accuracy and project management.

Automation in construction, including robotics and drones, is improving efficiency and safety, with the global construction automation market valued at approximately $2.5 billion in 2024.

| Technological Factor | Impact on CIFI Holdings Group | Supporting Data/Trend |

| Proptech & Digitalization | Enhanced property management, improved customer experience, efficient marketing and sales. | Growing adoption of digital platforms in real estate operations. |

| Smart Home/Building Tech | Increased property appeal, better operational efficiency, reduced utility costs. | Global smart home market projected to exceed $150 billion by 2027. |

| Green Building Materials & Modular Construction | Environmental consciousness, reduced waste, faster project completion, lower operational expenses. | Green building materials market to reach $456.7 billion by 2027. |

| Big Data Analytics | Informed decision-making, identification of market trends and investment opportunities, optimized operations. | CIFI's 2023 strategic land banking based on market insights. |

| BIM & Construction Automation | Improved design accuracy, reduced errors, faster project timelines, cost savings, enhanced safety. | BIM utilization in over 70% of major global projects by 2024; construction automation market ~$2.5 billion in 2024. |

Legal factors

CIFI Holdings Group navigates a complex web of real estate development and land use laws within China, which are among the most dynamic globally. These regulations dictate everything from how land can be acquired and zoned to the intricate approval processes for new projects and the standards that must be met during construction. For instance, in 2024, the central government continued to emphasize policies aimed at stabilizing the property market, which includes stricter oversight on developer financing and sales practices.

These legal frameworks directly shape CIFI's operational capacity and strategic planning. The company must adhere to evolving land use policies, which can influence project feasibility and profitability. Furthermore, regulations surrounding property sales, including pricing controls and buyer eligibility, significantly impact revenue streams and market penetration. In 2023, China's Ministry of Housing and Urban-Rural Development reiterated its commitment to ensuring the delivery of pre-sold housing projects, a key area of focus for developers like CIFI.

The legal framework for property financing in China, including mortgage regulations and developer financing rules, directly impacts CIFI Holdings Group's operations. Recent policy shifts in 2024 have focused on stabilizing the property market by easing financing constraints for developers and potential homebuyers. For instance, the People's Bank of China and the National Financial Regulatory Administration have encouraged financial institutions to support developers with project financing and to relax down payment requirements for certain residential purchases.

CIFI Holdings Group operates under China's robust contract law framework, which mandates clear terms and conditions for all property transactions, including pre-sales. Compliance with consumer protection laws is paramount, requiring transparency in advertising, accurate disclosure of property details, and adherence to delivery timelines. Failure to meet these legal obligations can result in significant penalties and reputational damage.

In 2024, the Chinese government continued to emphasize consumer rights in the real estate sector, introducing stricter regulations on pre-sale fund management and project completion. CIFI's commitment to timely project delivery and effective grievance resolution is essential to navigate this evolving legal landscape and maintain consumer confidence.

Corporate Governance and Listing Rules

As a company listed on the Hong Kong Stock Exchange, CIFI Holdings Group must adhere to stringent listing rules and corporate governance standards. These regulations cover crucial areas such as financial disclosure, safeguarding shareholder interests, and ensuring effective board supervision. For instance, the company's 2025 Annual General Meeting (AGM) saw deliberations on its financial statements and the re-election of directors, underscoring these compliance obligations.

These legal frameworks are designed to promote transparency and accountability within listed entities. CIFI's compliance with these rules directly impacts investor confidence and its ability to access capital markets. The company's adherence to these requirements, including timely and accurate financial reporting, is a key factor in its operational legitimacy and market standing.

Key aspects of these legal factors for CIFI Holdings include:

- Compliance with Hong Kong Stock Exchange Listing Rules: Adherence to regulations concerning financial reporting, disclosure, and market conduct.

- Corporate Governance Standards: Implementation of best practices in board structure, shareholder rights, and ethical business operations.

- Shareholder Oversight: Ensuring mechanisms are in place for shareholders to exercise their rights, as demonstrated in the 2025 AGM resolutions.

- Regulatory Reporting: Meeting all mandatory reporting requirements to maintain its listed status and public trust.

Debt Restructuring Legal Framework

CIFI Holdings Group's efforts to manage its substantial debt are significantly shaped by the legal environments in both China and Hong Kong, particularly concerning corporate insolvency and restructuring. The successful court sanctioning of its offshore debt restructuring plan in early 2024 underscores the critical need to expertly navigate these complex legal pathways to establish a stable financial footing. This legal framework dictates the procedures, timelines, and creditor rights involved, making compliance and strategic legal engagement paramount for CIFI.

The approval process for such restructuring schemes involves meeting specific legal thresholds and demonstrating the viability of the proposed plan to courts and creditors. For instance, the offshore restructuring scheme required widespread creditor support, a common feature in many jurisdictions' insolvency laws designed to ensure fairness and facilitate a resolution. This legal precedent is crucial for CIFI as it continues to address its financial obligations and rebuild investor confidence.

- Legal Framework Influence: CIFI's debt restructuring is directly impacted by China's and Hong Kong's corporate insolvency and restructuring laws, which govern procedures and creditor protections.

- Offshore Restructuring Approval: The court approval of CIFI's offshore debt restructuring scheme in early 2024 demonstrates the effectiveness of navigating these legal processes.

- Creditor Rights and Compliance: Adherence to legal requirements, including securing creditor consent, is vital for the successful implementation of restructuring plans and maintaining market trust.

CIFI Holdings Group's operations are intrinsically tied to China's evolving real estate regulations, which govern land acquisition, project approvals, and sales practices. In 2024, policies aimed at market stabilization continued, including stricter oversight on developer financing, impacting CIFI's access to capital and operational flexibility.

The company must also navigate consumer protection laws, ensuring transparency in sales and timely project delivery, a focus reiterated by the Ministry of Housing and Urban-Rural Development in 2023. Furthermore, as a Hong Kong-listed entity, CIFI adheres to stringent listing and corporate governance rules, vital for maintaining investor confidence and market access, as evidenced by its 2025 AGM discussions on financial reporting.

CIFI's significant debt restructuring efforts in 2024 were heavily influenced by Chinese and Hong Kong insolvency laws, with the successful court sanctioning of its offshore debt plan highlighting the critical role of legal compliance and strategic engagement with creditor rights.

Environmental factors

China's construction industry is increasingly prioritizing environmental sustainability, leading to a greater focus on green building standards. This trend means CIFI Holdings Group must align its projects with these evolving regulations to maintain compliance and market relevance.

To gain a competitive edge and improve property appeal, CIFI should actively pursue green building certifications. For instance, the Ministry of Housing and Urban-Rural Development reported that by the end of 2023, over 2.7 billion square meters of green buildings had been constructed nationwide, highlighting the growing market acceptance of such standards.

Climate change presents significant physical risks to CIFI Holdings Group's real estate portfolio, with an increasing likelihood of extreme weather events like typhoons and heavy rainfall. These events can lead to direct property damage, increased insurance costs, and potential disruptions to operations. For instance, China experienced over 100 extreme weather events in 2023, impacting various regions where CIFI operates.

To address these challenges, CIFI should prioritize climate resilience in its property development and design strategies. This includes incorporating features that can withstand severe weather, such as enhanced structural integrity, improved drainage systems, and flood-resistant materials. Such measures are crucial for ensuring the long-term viability and value of their assets in a changing climate.

The global push for energy efficiency in buildings is intensifying, directly impacting carbon emission reduction efforts. CIFI Holdings Group has a significant opportunity to integrate advanced energy-saving technologies and sustainable design principles into its developments. This strategic alignment with national environmental targets, such as China's goal to peak carbon emissions before 2030, positions CIFI to potentially capitalize on government incentives and subsidies designed to promote green building practices.

Land Use and Environmental Protection Regulations

China's stringent environmental protection regulations significantly impact land use for developers like CIFI Holdings. These rules cover areas such as pollution control, waste disposal, and the preservation of natural habitats. Failure to adhere can result in substantial fines and reputational damage, jeopardizing future projects.

For CIFI Holdings, navigating these complex regulations is crucial. For instance, in 2024, China continued to emphasize green development, with new guidelines potentially increasing compliance costs for construction projects. Ensuring adherence to these evolving standards is essential for maintaining operational continuity and social acceptance.

- Pollution Control: CIFI must manage emissions and wastewater from construction sites, aligning with national standards that were further refined in 2024.

- Waste Management: Regulations mandate proper disposal and recycling of construction waste, a key operational consideration for CIFI's numerous projects.

- Ecological Preservation: Projects in sensitive areas require CIFI to implement measures to protect biodiversity and minimize environmental impact, a growing focus for Chinese authorities.

- Compliance Costs: Increased environmental scrutiny in 2024 and 2025 is likely to add to CIFI's operational expenses related to environmental impact assessments and mitigation efforts.

Resource Scarcity and Sustainable Materials Sourcing

Growing concerns over the scarcity of raw materials are significantly influencing the real estate development sector, prompting a shift towards more sustainable sourcing of construction materials and greater efficiency in resource utilization. This trend is particularly relevant for companies like CIFI Holdings Group.

CIFI Holdings can proactively address these environmental pressures by integrating practices that prioritize recycled materials, minimize construction waste, and optimize water consumption across its diverse projects. For instance, by adopting circular economy principles, the company can reduce its environmental footprint and potentially lower material costs. In 2023, the global construction industry generated an estimated 1.3 billion tons of municipal solid waste, with construction and demolition waste accounting for a substantial portion of this figure, highlighting the critical need for waste reduction strategies.

To foster sustainability, CIFI Holdings could focus on several key areas:

- Increased use of recycled content: Incorporating materials like recycled steel, concrete, and plastics in new constructions.

- Waste reduction initiatives: Implementing on-site sorting and recycling programs to divert waste from landfills.

- Water efficiency measures: Utilizing low-flow fixtures and water-saving landscaping in residential and commercial developments.

- Sustainable material certification: Sourcing materials with recognized environmental certifications, such as LEED or BREEAM compliant products.

China's intensified focus on environmental protection, particularly concerning pollution and ecological preservation, directly impacts CIFI Holdings Group's development practices. Stricter regulations in 2024 and anticipated further refinements in 2025 necessitate robust compliance measures, potentially increasing operational costs for environmental impact assessments and mitigation efforts.

The growing emphasis on green building standards and energy efficiency presents both challenges and opportunities for CIFI. By integrating sustainable design and advanced energy-saving technologies, CIFI can align with China's 2030 carbon peak target and potentially benefit from government incentives, enhancing property appeal and market competitiveness.

Climate change poses physical risks to CIFI's real estate portfolio, with an increasing frequency of extreme weather events. Proactive strategies for climate resilience, such as enhanced structural integrity and improved drainage, are crucial for safeguarding asset value and operational continuity, especially considering China's over 100 extreme weather events recorded in 2023.

Resource scarcity is driving a shift towards sustainable material sourcing and waste reduction in the construction sector. CIFI Holdings can leverage circular economy principles, increase the use of recycled content, and implement waste management initiatives to mitigate environmental impact and potentially reduce material costs, addressing the significant construction waste generated globally.

| Environmental Factor | Impact on CIFI Holdings Group | Key Considerations/Actions | Relevant Data/Trends (2023-2025) |

|---|---|---|---|

| Green Building Standards | Increased demand for sustainable construction; need for compliance. | Pursue green building certifications (e.g., LEED, BREEAM). | Over 2.7 billion sq meters of green buildings by end of 2023 in China. |

| Climate Change & Extreme Weather | Physical risks to properties (damage, increased insurance). | Integrate climate resilience in design and development. | Over 100 extreme weather events in China in 2023. |

| Energy Efficiency & Carbon Emissions | Regulatory pressure to reduce carbon footprint; potential incentives. | Adopt energy-saving technologies and sustainable design. | China's goal to peak carbon emissions before 2030. |

| Pollution Control & Waste Management | Stricter regulations on emissions, wastewater, and construction waste. | Ensure compliance with national standards; implement waste reduction. | Continued emphasis on green development in 2024; refined pollution standards. |

| Resource Scarcity & Sustainable Sourcing | Need for efficient resource utilization and recycled materials. | Focus on recycled content, waste minimization, and water efficiency. | Global construction waste estimated at 1.3 billion tons in 2023. |

PESTLE Analysis Data Sources

Our CIFI Holdings Group PESTLE Analysis draws on a comprehensive blend of data from official government publications, international financial institutions like the IMF and World Bank, and reputable industry-specific market research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.