CIFI Holdings Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIFI Holdings Group Bundle

Curious about CIFI Holdings Group's strategic positioning? Our BCG Matrix preview highlights key product areas, but the full report unlocks a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks.

Don't miss out on the detailed quadrant placements and actionable insights that will empower your investment and product development decisions.

Purchase the full BCG Matrix report today for a complete breakdown and a clear roadmap to outmaneuver the competition.

Stars

CIFI's property management and other services segment demonstrated robust growth in 2024, with income climbing 9.4% year-on-year to approximately RMB 6,639.5 million. This expansion was fueled by an increasing portfolio of managed properties, underscoring the company's solid market standing and its capacity for further development within this service area.

CIFI Holdings Group demonstrated robust execution in property deliveries throughout 2024, handing over approximately 62,000 units. This significant volume underscores their operational capacity and commitment to fulfilling sales agreements.

Over the three-year period from 2022 to 2024, CIFI successfully delivered a cumulative total of 270,000 property units. This consistent output, achieved with an impressive delivery rate exceeding 95%, highlights the company's reliability and efficiency in project completion.

Inclusion in the 'real estate projects whitelist' is a significant indicator for CIFI Holdings Group, particularly in the context of its Business Growth Matrix. This designation signifies government endorsement, which directly translates into improved access to crucial financing. For 2024, a substantial 55 of CIFI's projects secured a spot on these whitelists across different regions, with an impressive 53 already receiving funding.

This strong governmental backing for CIFI's projects in 2024 provides a clear advantage. It not only eases the financial burden by facilitating funding but also acts as a powerful confidence booster for potential buyers. Consequently, these recognized projects are well-positioned for robust sales performance and are likely to capture a larger share of the market.

Positive Net Cash from Operating Activities

CIFI Holdings Group has demonstrated consistent financial health by maintaining positive net cash from operating activities for three consecutive years, a trend that extended through 2024. This sustained positive cash flow is a strong indicator of the company's operational efficiency and its ability to generate sufficient funds internally to support its business operations and strategic initiatives.

This operational strength allows CIFI to self-fund ongoing development projects and explore new investment opportunities. It reduces the reliance on external debt or equity financing, contributing to a more stable financial structure and potentially lower borrowing costs.

- Positive Net Cash from Operations: CIFI maintained this positive trend through 2024.

- Operational Efficiency: Indicates strong core business performance.

- Funding Capacity: Enables self-funding of projects and growth initiatives.

- Financial Stability: Reduces dependence on external financing.

Strategic Focus on Core Cities and Regions

CIFI Holdings Group's strategic focus on core cities and regions is a cornerstone of its business model, targeting mature segments within first- and second-tier Chinese cities. This approach allows for concentrated development efforts in areas with established demand and robust economic activity.

This geographical concentration spans four key regions: the Yangtze River Delta, Pan Bohai Rim, Central Western Region, and South China Region. By concentrating resources in these high-growth urban centers, CIFI aims for deeper market penetration and potentially higher returns.

- Geographic Concentration: Focus on Yangtze River Delta, Pan Bohai Rim, Central Western Region, and South China Region.

- Target Market: High-quality, end-user driven properties in mature segments.

- City Tiers: Primarily first- and second-tier cities.

- Strategic Advantage: Deeper market penetration and potential for higher returns in high-demand urban centers.

CIFI's property management segment, a burgeoning Star in its BCG matrix, saw significant revenue growth in 2024, reaching approximately RMB 6,639.5 million, a 9.4% increase year-on-year. This expansion is driven by a growing portfolio of managed properties, indicating strong market positioning and future potential. The company's ability to consistently deliver projects, with over 62,000 units handed over in 2024 and a cumulative 270,000 units from 2022-2024 at a >95% delivery rate, further solidifies its operational strength.

| Segment | 2024 Revenue (RMB million) | YoY Growth | Units Delivered (2024) | Key Strengths |

|---|---|---|---|---|

| Property Management & Services | 6,639.5 | 9.4% | N/A | Growing portfolio, strong market position |

| Property Development | N/A | N/A | ~62,000 | Consistent delivery, operational efficiency |

What is included in the product

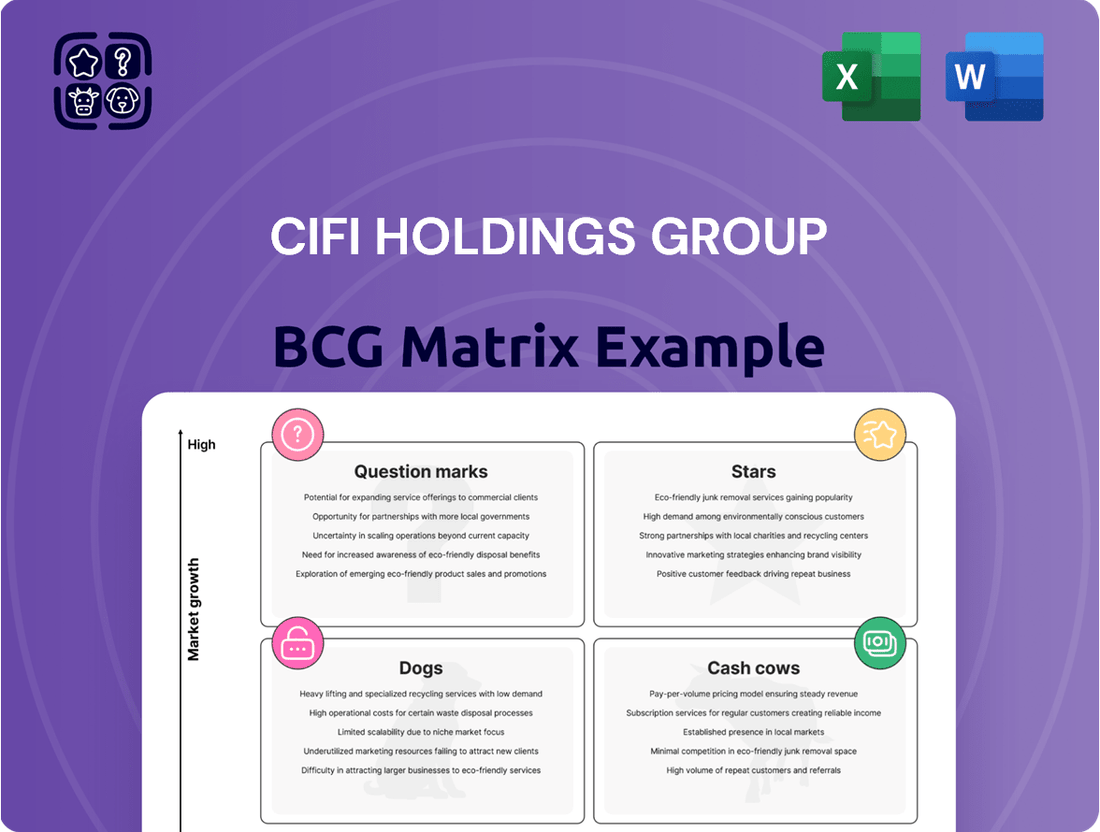

The CIFI Holdings Group BCG Matrix provides a strategic overview of its diverse business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis highlights which business units to invest in, hold, or divest to optimize CIFI's portfolio and competitive positioning.

A clear BCG Matrix visualizes CIFI's portfolio, easing strategic decision-making and resource allocation.

This BCG Matrix offers a simplified view of CIFI's businesses, alleviating complexity for executives.

Cash Cows

CIFI Holdings Group's investment properties and lease income are firmly positioned as Cash Cows. In 2024, this segment saw a robust 10.4% year-on-year increase, bringing in approximately RMB 1,758.0 million.

This consistent revenue generation stems from a well-established portfolio, including prominent assets like Shanghai LCM and Beijing Wukesong Arena. These properties contribute a stable, high-margin income stream, indicative of their mature and profitable status within CIFI's operations.

CIFI Holdings Group's established residential property portfolio represents a classic Cash Cow. Despite broader market headwinds in China's real estate sector, these completed and occupied developments consistently deliver stable rental income and maintain their value, providing a dependable cash flow stream.

CIFI Holdings Group's commercial and mixed-use properties function as significant cash cows. These assets, once fully developed and occupied, generate steady rental income, bolstering the group's financial stability. For instance, by the end of 2023, CIFI reported a substantial portfolio of investment properties, contributing reliably to its overall revenue streams.

Reduced Total Indebtedness

CIFI Holdings Group has demonstrated a strong commitment to financial health by reducing its total indebtedness for three consecutive years. This strategic move is a positive indicator for its position within the BCG Matrix, suggesting a move towards greater financial stability.

Specifically, in 2024, CIFI achieved a notable year-on-year decrease in total indebtedness of approximately RMB 5,627.3 million. This brought the company's total debt down to RMB 86,653.8 million.

This reduction in debt is significant because it directly impacts the company's ability to generate net cash. With less capital allocated to servicing debt, CIFI has more resources available for its core operations and can explore opportunities for reinvestment, thereby enhancing its overall financial resilience.

- Reduced Total Indebtedness: CIFI's debt reduction trend indicates improved financial management.

- 2024 Debt Reduction: A decrease of roughly RMB 5,627.3 million was recorded in 2024.

- Current Total Indebtedness: CIFI's total debt stood at RMB 86,653.8 million in 2024.

- Financial Stability: Lower debt levels free up cash, bolstering operational capacity and reinvestment potential.

Strong Project Delivery Capability

CIFI Holdings Group's strong project delivery capability positions it as a Cash Cow within the BCG Matrix. The company consistently handed over a substantial volume of property units, with approximately 270,000 units delivered between 2022 and 2024. This track record highlights an efficient and reliable construction and handover process, crucial for converting pre-sold inventory into realized revenue.

This consistent delivery is vital for maintaining buyer confidence and ensuring a steady inflow of cash from property sales. The ability to execute projects on time and to a high standard directly fuels CIFI's cash generation, supporting its operations and investments in other business areas.

- Consistent High Volume Delivery: CIFI delivered around 270,000 property units from 2022 to 2024, showcasing its operational strength.

- Revenue Realization: Efficient project completion ensures timely revenue recognition from pre-sold properties, a key driver of cash flow.

- Buyer Confidence: A proven delivery record builds trust with customers, supporting sustained sales momentum.

- Cash Cow Status: This reliable cash generation from its core property development business solidifies its position as a Cash Cow.

CIFI Holdings Group's lease income from investment properties, such as Shanghai LCM and Beijing Wukesong Arena, significantly contributes to its Cash Cow status. In 2024, this segment generated approximately RMB 1,758.0 million, marking a 10.4% year-on-year increase. This stable, high-margin income stream underscores the mature and profitable nature of these assets.

The group's established residential property portfolio, comprising completed and occupied developments, also functions as a strong Cash Cow. These properties consistently provide dependable rental income and retain their value, even amidst broader market challenges in China's real estate sector. This reliability ensures a steady cash flow for CIFI.

CIFI's strategic reduction of total indebtedness further solidifies its Cash Cow position. By decreasing total debt by approximately RMB 5,627.3 million in 2024, bringing it down to RMB 86,653.8 million, the company enhances its financial resilience and frees up capital for core operations and reinvestment.

| Segment | 2024 Revenue (RMB million) | YoY Growth | Key Assets |

|---|---|---|---|

| Investment Properties & Lease Income | 1,758.0 | 10.4% | Shanghai LCM, Beijing Wukesong Arena |

| Residential Property Portfolio | Stable Rental Income | Consistent | Completed & Occupied Developments |

What You’re Viewing Is Included

CIFI Holdings Group BCG Matrix

The CIFI Holdings Group BCG Matrix preview you are viewing is the identical, fully polished document you will receive upon purchase. This means you get the complete strategic analysis, ready for immediate application without any alterations or watermarks. The report is meticulously prepared to offer actionable insights into CIFI's portfolio, allowing for informed decision-making. You can confidently use this preview as a direct representation of the high-quality, professional BCG Matrix you'll be acquiring.

Dogs

CIFI Holdings Group's property development segment faced a substantial downturn. Overall revenue for the group plummeted by 34% from FY 2023 to FY 2024, settling at CN¥ 47.8 billion. This sharp decline suggests a weakening position in the property market, potentially indicating a low-growth environment coupled with a diminishing market share for their core offerings.

CIFI Holdings Group's net loss attributable to equity owners for the year ending December 31, 2024, was approximately RMB 7,075,859,000. This significant loss indicates that the company's core operations are not currently profitable enough to cover expenses and generate positive earnings for its shareholders.

CIFI Holdings Group experienced a notable write-down of properties held for sale, a key factor contributing to its net loss in 2024. This situation indicates that certain developed properties are not achieving their expected sale prices, or the market for these assets is experiencing extended stagnation.

The write-down effectively ties up capital in assets that are underperforming, impacting the company's financial health. For instance, in 2024, CIFI reported a significant impairment loss related to these properties, highlighting the challenges in the real estate market.

Contracted Sales Decline

CIFI Holdings Group is experiencing a significant downturn in its contracted sales, a key indicator of its market performance. In April 2024 alone, the company saw a sharp 52% year-on-year decline in contracted sales. This trend continued into the first five months of 2025, with aggregated contracted sales reaching approximately RMB 8.85 billion, and sales attributable to equity owners falling to RMB 4.57 billion.

These figures highlight a challenging market environment for CIFI. The persistent decline points to several underlying issues:

- Weak Market Demand: The overall property market is facing subdued demand, impacting sales across the sector.

- Shrinking Market Share: CIFI's share of the property sales market appears to be contracting, suggesting increased competition or a loss of competitive edge.

- Financial Strain: The reduction in sales directly affects revenue generation and cash flow, potentially putting financial pressure on the company.

- Strategic Re-evaluation Needed: Such a steep decline necessitates a thorough review of CIFI's product offerings, pricing strategies, and market positioning.

Outstanding Defaults on Debt Obligations

CIFI Holdings Group's financial situation as of December 31, 2024, reveals significant distress in its debt obligations. The company faced an inability to meet its repayment commitments on various financial instruments.

Specifically, CIFI defaulted on approximately RMB 18,331,289,000 in bank borrowings, RMB 29,104,995,000 in offshore senior notes, and RMB 1,310,772,000 in convertible bonds. These defaults, along with triggered cross-defaults, highlight critical weaknesses within specific segments of its capital structure.

- Bank Borrowings Default: RMB 18,331,289,000

- Offshore Senior Notes Default: RMB 29,104,995,000

- Convertible Bonds Default: RMB 1,310,772,000

- Overall Impact: These defaults signal that certain financial components are not self-sustaining and are under extreme pressure.

CIFI Holdings Group's property development segment, characterized by declining sales and significant financial distress, aligns with the characteristics of a "Dog" in the BCG Matrix. The company's contracted sales saw a substantial year-on-year drop of 52% in April 2024, and aggregated sales for the first five months of 2025 were approximately RMB 8.85 billion, indicating low market share and low growth prospects.

The group's overall revenue decline of 34% to CN¥ 47.8 billion in FY 2024, coupled with a net loss of RMB 7,075,859,000 for the same period, further solidifies this classification. These financial results, including defaults on significant debt obligations totaling over RMB 48 billion, underscore a business unit with poor performance and limited future potential.

The write-down of properties held for sale in 2024, resulting in impairment losses, signifies an asset that is not generating adequate returns and is likely consuming resources without contributing positively to the company's overall growth or profitability.

| BCG Category | CIFI Holdings Group Segment | Market Growth | Relative Market Share | Financial Health Indicator |

|---|---|---|---|---|

| Dog | Property Development | Low (indicated by declining sales and market stagnation) | Low (indicated by sales decline and shrinking market share) | Negative (significant net loss, debt defaults) |

Question Marks

CIFI Holdings Group, despite a challenging market, is pushing forward with new residential developments. For instance, the Kunming CIFI Plaza Phase II Residential Project, launched in March 2025, introduces innovative 'vertical fourth-generation habitat' concepts. This strategic move positions these projects as potential high-growth stars within CIFI's portfolio.

However, these ambitious launches are occurring within a Chinese property market still facing considerable headwinds and subdued homebuyer sentiment. The success of these pioneering projects, therefore, hinges on their ability to resonate with consumers amidst this uncertain economic landscape, making their market penetration a key variable.

CIFI Holdings Group's offshore debt restructuring achieved a significant milestone with court approval in June 2025, following substantial creditor support. This development is a critical step in establishing a more stable financial foundation for the company.

However, the ultimate success of this comprehensive restructuring and its long-term effects on CIFI's financial well-being and its capacity to secure future investments are still uncertain. The intricate nature of the process, coupled with persistent market volatility, means the full impact is yet to be determined.

CIFI Holdings Group is actively exploring the restructuring of its onshore corporate bonds, a significant undertaking with a current valuation of CNY 10.06 billion. This move is crucial for bolstering the company's financial health and reassuring investors about its long-term viability.

The success of this onshore bond restructuring is paramount, representing a high-stakes maneuver for CIFI. It's a complex process, currently under internal review, that could significantly impact the company's market standing and its ability to navigate future financial challenges.

Asset-Light Business Model Transition

CIFI Holdings Group is strategically shifting towards an asset-light model to navigate the property development industry's current recalibration. This move is designed to foster long-term sustainability and resilience.

This transition, if successful, could unlock significant growth potential for CIFI. However, its effectiveness hinges on widespread market acceptance and substantial internal operational adjustments within a dynamic economic landscape.

- Strategic Pivot: CIFI's stated aim is a gradual move to an asset-light business model.

- Growth Potential: This shift is viewed as a high-growth opportunity.

- Market Adoption: Success depends on significant market adoption and operational changes.

- Industry Context: The strategy addresses the property development industry's adjustment cycle.

Disposal of Non-Core Assets

CIFI Holdings Group's strategy includes actively seeking opportunities to divest non-core assets. This initiative is designed to bolster the company's cash reserves and enhance its liquidity.

However, the effectiveness and the timeline for these asset disposals remain subject to market conditions, particularly in a potentially challenging economic environment. The successful execution of this strategy is crucial for maintaining a healthy asset base and ensuring future revenue generation.

- Asset Divestment Strategy: CIFI aims to improve its cash position by selling off assets that are not central to its core business operations.

- Liquidity Enhancement: The primary goal of disposing of non-core assets is to increase the company's available cash and financial flexibility.

- Market Uncertainty: The success and timing of these sales are contingent on market demand and prevailing economic conditions, which can introduce an element of unpredictability.

- Impact on Asset Base: While intended to strengthen finances, the disposal of assets could also affect the company's overall asset valuation and its capacity for future growth.

CIFI Holdings Group's development of innovative projects like the Kunming CIFI Plaza Phase II Residential Project, launched in March 2025, positions them as potential Stars in the BCG Matrix. These ventures aim to capture market share in a recovering, albeit still sensitive, property market, highlighting a strategic push into higher-growth segments.

The company's ongoing offshore debt restructuring, approved by the court in June 2025 with significant creditor backing, and the active exploration of onshore bond restructuring (valued at CNY 10.06 billion) are critical moves to stabilize its financial position. These actions are essential for managing its Dogs and potentially freeing up resources for Stars.

CIFI's strategic pivot towards an asset-light model and the divestment of non-core assets are designed to enhance liquidity and foster long-term sustainability. This recalibration aims to improve the performance of existing assets and manage its Question Marks effectively.

| BCG Category | CIFI Holdings Group Examples | Market Share | Market Growth | Strategic Implication |

|---|---|---|---|---|

| Stars | Kunming CIFI Plaza Phase II Residential Project | Rising (Targeted) | High (Innovative Concepts) | Invest for growth, maintain market leadership. |

| Question Marks | Onshore Bond Restructuring (CNY 10.06 billion) | Uncertain | Variable (Market Dependent) | Analyze and potentially invest or divest. |

| Cash Cows | Existing stabilized rental income properties (Hypothetical) | Stable | Low | Generate cash to fund Stars and Question Marks. |

| Dogs | Underperforming or non-core assets targeted for divestment | Low | Low | Divest or reposition to free up resources. |

BCG Matrix Data Sources

Our CIFI Holdings Group BCG Matrix is constructed using comprehensive financial disclosures, industry growth forecasts, and competitive landscape analysis to provide an accurate strategic overview.