CIFI Holdings Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIFI Holdings Group Bundle

Discover the core elements of CIFI Holdings Group's success with our Business Model Canvas. This visual tool breaks down their customer relationships, revenue streams, and key resources, offering a clear understanding of their operational strategy. Dive into the full canvas to uncover how they achieve sustainable growth and market dominance.

Partnerships

CIFI Holdings Group maintains vital relationships with a broad network of financial institutions and lenders, including major banks and other creditors, to fuel its expansive real estate development pipeline.

These partnerships are indispensable for securing the substantial project financing and ongoing liquidity necessary to navigate the capital-intensive Chinese property market. For instance, in 2023, CIFI actively managed its debt profile, engaging in various restructuring initiatives with its financial partners to ensure financial stability and operational continuity.

Collaborations with government agencies and local authorities are crucial for CIFI Holdings Group, enabling streamlined land acquisition and project development processes in China. These partnerships are vital for navigating complex approval procedures, zoning regulations, and urban planning mandates, ensuring projects align with national development goals.

CIFI actively engages in financing coordination mechanisms with governmental bodies, a strategy that proved particularly beneficial in 2024. The company's projects being shortlisted on 'real estate project whitelists' throughout 2024 highlights their strong relationships and the government's confidence in CIFI's development capabilities and financial stability.

CIFI Holdings Group relies heavily on a network of construction companies and contractors to bring its diverse property developments to life. These collaborations are fundamental to CIFI's operational efficiency and its commitment to delivering high-quality residential, commercial, and mixed-use projects across China.

The scale of CIFI's operations, evidenced by its delivery of approximately 62,000 property units in 2024, underscores the critical nature of these construction partnerships. Effectively managing these relationships ensures that CIFI can meet its ambitious development timelines and maintain the standards expected by its customers.

Joint Venture Partners and Associates

CIFI Holdings Group actively pursues joint ventures and strategic alliances with other prominent real estate developers. These collaborations are crucial for diversifying risk, pooling specialized knowledge, and accessing broader market opportunities. For instance, in 2024, CIFI continued to leverage these partnerships to undertake large-scale urban development projects.

A significant portion of CIFI's contracted sales and actual property deliveries are facilitated through its network of joint ventures and associated entities. This model allows CIFI to maintain a leaner balance sheet while still participating in a substantial volume of development. In the first half of 2024, approximately 60% of CIFI's total contracted sales were generated from projects involving joint venture partners.

- Risk Sharing: Joint ventures allow CIFI to share the financial burdens and market uncertainties associated with large development projects, particularly in evolving economic conditions seen in 2024.

- Expertise Augmentation: Partnering with firms possessing complementary skills, such as specialized construction techniques or local market insights, enhances project execution and quality.

- Market Expansion: These alliances enable CIFI to enter new geographical regions or property segments more effectively than it might be able to on its own.

- Sales and Delivery Volume: In 2024, joint ventures contributed significantly to CIFI's overall sales performance, with over 150 billion RMB in contracted sales attributed to these collaborations during the first three quarters.

Property Management Service Providers

CIFI Holdings Group leverages partnerships with specialized property management service providers to ensure the efficient operation and upkeep of its completed properties. These collaborations are vital for maintaining high customer satisfaction and generating consistent recurring service income.

- Specialized Expertise: Partnering with external firms brings specialized knowledge in areas like building maintenance, tenant relations, and facility management, enhancing the overall quality of service.

- Operational Efficiency: Outsourcing allows CIFI to focus on its core development activities while ensuring that its properties are managed effectively and cost-efficiently.

- Revenue Diversification: The income generated from property management services, including those facilitated by partners, contributes to CIFI's diversified revenue streams.

- Financial Performance: In 2024, CIFI Holdings reported an increase in its property management and other services income, underscoring the value of these operational partnerships.

CIFI Holdings Group's success is deeply intertwined with its robust network of key partners, spanning financial institutions, government bodies, construction firms, and fellow developers. These collaborations are not merely transactional but strategic, enabling CIFI to navigate the complexities of the real estate market, secure funding, and execute large-scale projects efficiently.

The company's strong relationships with financial institutions are critical for its capital-intensive operations. In 2024, CIFI's ability to secure project financing and manage its debt was significantly bolstered by its ongoing dialogue and restructuring efforts with various lenders, demonstrating the essential nature of these partnerships for financial stability.

Collaborations with government agencies are paramount for CIFI, facilitating land acquisition and project approvals. The company's presence on national real estate project whitelists throughout 2024 is a testament to these strong governmental ties, ensuring smoother development processes and alignment with national objectives.

Joint ventures with other developers are a cornerstone of CIFI's strategy, allowing for risk sharing and market expansion. In the first three quarters of 2024, these ventures contributed over 150 billion RMB to CIFI's contracted sales, highlighting their substantial impact on the company's performance and market reach.

| Partnership Type | Role and Importance | 2024 Impact/Data |

|---|---|---|

| Financial Institutions | Securing project financing, liquidity, debt management | Active debt restructuring and financing coordination throughout 2024. |

| Government Agencies | Streamlining land acquisition, project approvals, regulatory navigation | Projects consistently featured on 'real estate project whitelists' in 2024. |

| Construction Companies | Project execution, quality assurance, timely delivery | Essential for delivering approximately 62,000 property units in 2024. |

| Other Real Estate Developers (Joint Ventures) | Risk sharing, market access, expertise pooling, sales generation | Contributed over 150 billion RMB in contracted sales in the first three quarters of 2024. |

What is included in the product

This Business Model Canvas provides a strategic overview of CIFI Holdings Group's operations, focusing on its core business of property development and sales, and its expansion into related services.

It details CIFI's customer segments, value propositions, and channels, offering a comprehensive framework for understanding its market position and growth strategy.

CIFI Holdings Group's Business Model Canvas acts as a pain point reliever by streamlining complex real estate development processes, offering a clear roadmap to address challenges in land acquisition and project execution.

It provides a structured approach to identify and mitigate risks in the property market, simplifying strategic planning and operational efficiency for stakeholders.

Activities

CIFI Holdings Group's core operation revolves around the comprehensive development and construction of a diverse range of properties, including residential, commercial, and mixed-use projects throughout China. This encompasses the entire property lifecycle, from initial land acquisition and meticulous planning to detailed design, efficient construction, and the ultimate delivery of completed units to buyers.

In 2024, CIFI demonstrated its substantial development capacity by successfully delivering approximately 62,000 property units. This figure underscores the company's active role in the market and its ability to execute large-scale construction projects, contributing significantly to the urban landscape and housing supply in numerous Chinese cities.

CIFI Holdings actively participates in property investment, acquiring and holding various assets like commercial properties. The primary goal is to generate consistent rental income and achieve long-term capital appreciation from these holdings.

This segment of their business model focuses on generating lease and service income. These revenues stem from the rental agreements and associated services provided to tenants across their investment property portfolio.

In 2024, CIFI Holdings reported a positive trend in this area, with their lease and service income experiencing a year-on-year increase, demonstrating the ongoing success of their property investment strategy.

CIFI Holdings actively manages its developed properties, a crucial activity that ensures asset quality and tenant satisfaction. This hands-on approach not only generates stable, recurring revenue streams but also elevates the overall customer experience for residents and commercial tenants alike.

The company's commitment to property management is reflected in its financial performance, with property management and other services income experiencing a notable 9.4% increase in 2024. This growth underscores the segment's importance in contributing to CIFI's overall profitability and operational efficiency.

Sales and Marketing of Properties

CIFI Holdings Group actively engages in robust sales and marketing to move its developed properties. This includes direct outreach to potential buyers, organizing promotional events, and leveraging various sales channels to maximize reach and conversion.

The company's commitment to effective property sales is evident in its regular reporting of contracted sales figures, which serve as a key performance indicator for its ongoing market activities. For instance, CIFI Holdings reported contracted sales of RMB 134.5 billion in 2023, demonstrating significant sales volume.

- Property Promotion: Organizing sales events, online campaigns, and showroom experiences to attract buyers.

- Channel Management: Utilizing a mix of direct sales teams, real estate agents, and online platforms.

- Sales Performance Tracking: Regularly reporting contracted sales figures to monitor market reception and sales effectiveness.

Financing and Debt Management

Given CIFI Holdings Group's capital-intensive real estate operations, financing and debt management are critical key activities. The company actively secures various forms of financing, including bank loans and bond issuances, to fund its development projects and manage its ongoing financial obligations. This proactive approach ensures the group maintains financial flexibility and operational continuity in a dynamic market.

CIFI Holdings has demonstrated a strong focus on optimizing its debt structure. This involves strategic negotiations with creditors and the implementation of debt restructuring plans to enhance financial stability. The company has made notable strides in its offshore debt restructuring efforts, with significant progress reported through 2024 and continuing into 2025, aiming to improve its financial health and investor confidence.

- Securing Diverse Financing: CIFI actively pursues bank loans, corporate bonds, and other credit facilities to fuel its property development pipeline.

- Debt Restructuring: The company has undertaken significant offshore debt restructuring initiatives, particularly in 2024 and 2025, to manage its liabilities effectively.

- Financial Stability: These activities are geared towards ensuring robust financial health, maintaining operational continuity, and supporting sustainable growth.

- Creditor Negotiations: CIFI engages in ongoing dialogue and negotiation with its creditors to manage its debt portfolio and secure favorable terms.

CIFI Holdings Group's business model centers on property development, encompassing residential, commercial, and mixed-use projects. They manage the entire development lifecycle, from land acquisition to project completion and sales. In 2024, CIFI successfully delivered around 62,000 property units, showcasing their significant execution capabilities.

Beyond development, CIFI actively invests in and manages properties, generating rental and service income. This segment saw a positive trend in 2024, with lease and service income increasing year-on-year, highlighting the stability and growth potential of their investment portfolio. The property management services also grew, with a 9.4% increase in income in 2024, demonstrating effective asset oversight and tenant relations.

Financing and debt management are crucial activities for CIFI, given the capital-intensive nature of real estate. The company actively secures various funding sources and has been engaged in significant offshore debt restructuring efforts through 2024 and into 2025 to ensure financial stability and operational continuity.

| Key Activity | Description | 2024/2023 Data Point |

|---|---|---|

| Property Development & Delivery | End-to-end management of property projects from acquisition to completion. | Delivered ~62,000 property units in 2024. |

| Property Investment & Management | Acquiring, holding, and managing properties for rental income and capital appreciation. | Lease and service income increased year-on-year in 2024. Property management income grew by 9.4% in 2024. |

| Sales & Marketing | Promoting and selling developed properties through various channels. | Reported contracted sales of RMB 134.5 billion in 2023. |

| Financing & Debt Management | Securing funds for development and managing financial obligations, including debt restructuring. | Significant offshore debt restructuring efforts ongoing through 2024-2025. |

Preview Before You Purchase

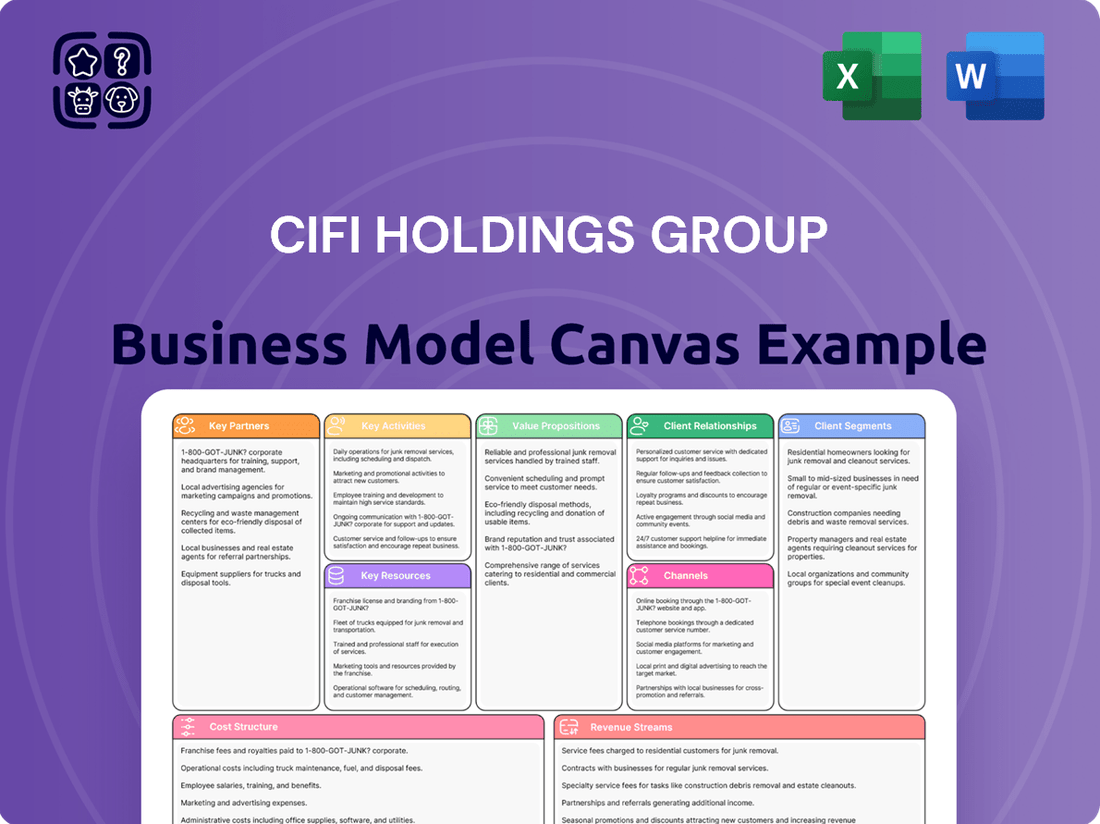

Business Model Canvas

The Business Model Canvas for CIFI Holdings Group that you are previewing is the actual, complete document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the detailed analysis you'll gain access to, providing a clear understanding of CIFI's strategic framework.

Resources

CIFI Holdings’ most vital physical asset is its substantial land bank and diverse property portfolio. This encompasses residential, commercial, and mixed-use developments spread across numerous Chinese urban centers.

By the close of 2024, CIFI Holdings managed an impressive portfolio exceeding 180 completed property projects. Additionally, the company maintained a robust pipeline with 120 projects either actively under development or held for future growth.

CIFI Holdings Group's access to substantial financial capital is a cornerstone of its business model, fueling land acquisition, construction, and ongoing operations. This financial muscle is derived from a diverse mix of sources, including robust internal cash flow, strategic bank borrowings, and the issuance of senior notes, alongside various other financing instruments.

In 2024, CIFI Holdings has demonstrated a proactive approach to managing its financial obligations and securing the necessary capital for its extensive development pipeline. The company has been actively working to optimize its debt structure and has successfully obtained project development loans, ensuring continued momentum in its growth initiatives.

CIFI Holdings Group's skilled human capital is a bedrock of its operations. This includes seasoned management, adept project managers, innovative architects, proficient engineers, and effective sales teams. Their collective knowledge is vital for navigating the complexities of property development and investment.

The group's capacity to execute a substantial volume of projects and manage intricate developments is directly attributable to the expertise of its human resources. For instance, in 2024, CIFI's ability to maintain a robust development pipeline, even amidst market fluctuations, underscores the critical role of its experienced teams in project execution and risk management.

Brand Reputation and Market Presence

CIFI Holdings Group's brand reputation and established market presence in China are critical, albeit intangible, assets. This strong brand equity is instrumental in drawing in customers, fostering crucial partnerships, and instilling confidence among investors. The company's extensive nationwide operating coverage, particularly its robust presence in key first- and second-tier cities, underpins this valuable market position.

As of the first half of 2024, CIFI Holdings Group reported a significant market presence, having secured land reserves in numerous cities across China. For instance, the company's strategic development efforts in 2023 and early 2024 continued to solidify its footprint in economically vibrant regions. This widespread operational coverage is a direct reflection of its accumulated brand strength and market penetration.

- Brand Recognition: CIFI is recognized for its quality development and customer service, enhancing its appeal to homebuyers.

- Market Penetration: The company operates in over 80 cities across China, demonstrating a broad and deep market reach.

- Investor Confidence: A strong brand and market presence contribute to CIFI's ability to attract capital and maintain investor trust.

- Partnership Opportunities: Its established reputation facilitates collaborations with suppliers, financial institutions, and government entities.

Operational Systems and Technology

CIFI Holdings Group relies on robust operational systems and technology to manage its extensive property development and management activities. Efficient project management software is crucial for overseeing construction timelines and budgets, while customer relationship management (CRM) systems help track sales pipelines and enhance buyer engagement. Financial management tools are indispensable for accurate accounting, cash flow analysis, and strategic financial planning.

Technology underpins CIFI's ability to streamline operations, from land acquisition and development to sales and post-sale property management. Advanced data analytics capabilities allow for informed decision-making, identifying market trends and optimizing resource allocation. This technological infrastructure is key to maintaining competitive advantage and operational excellence.

- Project Management Software: Facilitates real-time tracking of construction progress and resource deployment, aiming to reduce project delays and cost overruns.

- Customer Relationship Management (CRM): Supports personalized customer interactions and efficient sales process management, crucial for the group's extensive sales volume.

- Financial Management Tools: Ensure accurate financial reporting, budgeting, and cash flow management, vital for the group's financial health and investment capacity.

- Data Analytics Platforms: Enable data-driven insights into market performance, customer behavior, and operational efficiency, informing strategic business decisions.

CIFI Holdings Group's key resources are its extensive land bank and diverse property portfolio, its substantial financial capital, and its skilled human capital. These are complemented by a strong brand reputation and efficient operational systems powered by technology.

In 2024, CIFI's operations were supported by a land reserve spanning numerous Chinese cities, with over 180 completed projects and 120 in development. The company's financial strategy involved optimizing debt and securing project loans, demonstrating its capacity to fund its growth initiatives.

The group's human resources, encompassing experienced management and technical teams, are crucial for navigating market complexities and executing projects efficiently. This expertise was evident in 2024 through the successful management of its development pipeline amidst market shifts.

CIFI's brand strength, established through market penetration in over 80 cities by mid-2024, underpins investor confidence and partnership opportunities. This brand equity is a significant intangible asset, facilitating access to capital and market opportunities.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Physical Assets | Land bank and property portfolio | Over 180 completed projects, 120 in development pipeline. |

| Financial Capital | Internal cash flow, borrowings, senior notes | Active debt structure optimization and project development loans secured. |

| Human Capital | Management, project managers, engineers, sales teams | Expertise vital for project execution and risk management in a fluctuating market. |

| Brand & Market Presence | Nationwide coverage, reputation for quality | Operates in over 80 cities; strong presence in tier 1 & 2 cities. |

| Operational Systems & Technology | Project management, CRM, financial tools, data analytics | Streamlines operations from land acquisition to post-sale management. |

Value Propositions

CIFI Holdings Group delivers value through its commitment to developing and providing high-quality residential and commercial properties. These developments are thoughtfully designed to meet the evolving needs and preferences of urban dwellers and businesses alike.

The company strategically focuses on end-user driven properties, concentrating its efforts within the mature segments of first- and second-tier cities across China. This approach ensures that CIFI's projects are situated in prime locations with strong demand.

In 2023, CIFI Holdings reported a contracted sales value of RMB 160.2 billion, underscoring its significant market presence and the demand for its well-positioned properties. This sales performance reflects the appeal of their focus on desirable living and working environments.

CIFI Holdings Group offers a full spectrum of real estate services, encompassing development, investment, and management. This integrated approach streamlines the customer journey, providing a seamless experience from acquisition to long-term property care.

In 2024, CIFI's commitment to integrated services was evident in its continued expansion. The company reported significant progress in its property development pipeline, alongside a steady growth in its rental income from investment properties, showcasing the synergy between these core offerings.

CIFI Holdings Group places a strong emphasis on dependable property delivery and exceptional customer service, even amidst a demanding market. This commitment underpins their value proposition, ensuring buyers receive their homes as promised.

The company demonstrated this reliability by successfully delivering more than 8,100 new homes across 15 cities during the first quarter of 2025. This impressive figure, spanning 18 distinct projects, highlights CIFI’s operational efficiency and dedication to its customers.

Furthermore, CIFI has consistently maintained an overall delivery rate above 95% from 2022 through 2024. This sustained high performance reinforces CIFI's reputation for trustworthiness and its ability to meet contractual obligations, a critical factor for customer confidence.

Strategic Urban Development and Investment

CIFI Holdings Group actively shapes urban environments by investing in and developing mixed-use properties, transforming cityscapes and offering multifaceted functionality. This strategy directly benefits urban planners and communities by fostering dynamic, sustainable living and working spaces.

The company’s commitment to strategic urban development provides significant value through:

- Enhancing City Infrastructure: CIFI’s projects often include integrated public spaces, transportation links, and community facilities, improving the overall urban fabric. For instance, in 2024, CIFI continued its focus on urban regeneration projects, particularly in tier-1 and tier-2 cities across China.

- Creating Vibrant Communities: By developing mixed-use projects, CIFI fosters lively neighborhoods that combine residential, commercial, and recreational elements, boosting local economies and social interaction.

- Promoting Sustainability: The group prioritizes green building practices and sustainable design in its developments, contributing to more environmentally friendly urban growth. In 2023, CIFI reported a significant portion of its new projects were designed with enhanced energy efficiency standards.

Financial Stability and Long-Term Value

CIFI Holdings Group is committed to delivering financial stability and long-term value, even amidst fluctuating market conditions. This dedication is evident in their strategic approach to debt management and building operational resilience, aiming to reassure investors and creditors.

The company's focus on financial health is underscored by its consistent performance. For the three years leading up to 2024, CIFI Holdings has successfully maintained positive net operating cash flow, a key indicator of its ability to generate cash from its core operations.

Furthermore, CIFI Holdings is actively transitioning towards an asset-light business model. This strategic shift is designed to enhance flexibility and potentially improve returns on capital over the long term.

- Financial Stability: CIFI Holdings prioritizes a robust financial structure to weather market volatility.

- Long-Term Value Creation: The group aims to generate sustainable value for all stakeholders.

- Operational Resilience: Strategies are in place to ensure consistent performance despite external challenges.

- Positive Net Operating Cash Flow: The company has demonstrated this for three consecutive years, indicating strong operational cash generation.

- Asset-Light Model Transition: CIFI is moving towards a more agile business structure.

CIFI Holdings Group provides high-quality, thoughtfully designed residential and commercial properties in mature urban segments, focusing on end-user needs. They offer integrated real estate services, ensuring dependability in property delivery and customer care, as demonstrated by a consistent overall delivery rate above 95% from 2022 through 2024.

The company actively shapes urban environments through mixed-use developments, enhancing city infrastructure and creating vibrant, sustainable communities. CIFI Holdings also prioritizes financial stability and long-term value creation, evidenced by positive net operating cash flow for three consecutive years up to 2024, while transitioning to an asset-light model.

| Value Proposition | Description | Key Metrics/Facts |

| High-Quality Property Development | Developing and providing well-designed residential and commercial properties meeting evolving urban needs. | Focus on first- and second-tier cities; Contracted sales value of RMB 160.2 billion in 2023. |

| Integrated Real Estate Services | Offering a full spectrum of services including development, investment, and management for a seamless customer experience. | Synergy between development and rental income growth in 2024. |

| Dependable Delivery & Customer Service | Commitment to timely property delivery and exceptional customer support. | Overall delivery rate above 95% (2022-2024); Delivered over 8,100 homes in Q1 2025. |

| Urban Environment Shaping | Investing in and developing mixed-use properties to transform cityscapes and foster dynamic living/working spaces. | Continued focus on urban regeneration projects in 2024; Emphasis on energy efficiency in new projects (2023). |

| Financial Stability & Value Creation | Maintaining financial health and generating sustainable value for stakeholders through strategic financial management. | Positive net operating cash flow for three consecutive years (up to 2024); Transitioning to an asset-light business model. |

Customer Relationships

CIFI Holdings Group leverages dedicated sales and customer service teams to foster direct relationships with property buyers. These teams are crucial for providing detailed project information, navigating clients through the acquisition journey, and promptly resolving any questions or issues that arise. This hands-on approach is designed to cultivate strong customer trust and ensure a high level of satisfaction throughout the entire buying experience.

CIFI Holdings cultivates lasting connections with residents and tenants through dedicated property management and after-sales support. These services, encompassing maintenance, security, and cleaning, are crucial for resident satisfaction and building a strong sense of community.

In 2024, CIFI Holdings saw a notable increase in its property management services income. This financial performance directly reflects the company's active engagement and success in maintaining and enhancing the living experience for its residents, thereby strengthening customer relationships.

CIFI Holdings Group likely leverages digital platforms, including their official website and social media channels, to foster robust customer relationships. These online touchpoints serve as crucial avenues for disseminating company updates, project information, and engaging directly with their customer base. In 2023, CIFI reported significant digital engagement, with their online customer service portal handling over 1 million inquiries, demonstrating a commitment to accessibility.

Community Building Initiatives

CIFI Holdings Group actively cultivates community within its developments through targeted initiatives. These efforts aim to create a stronger sense of belonging and improve the overall living and working experience for residents and tenants. By fostering interaction and providing shared spaces, CIFI enhances the value proposition of its properties.

- Community Events: Organizing regular events like seasonal festivals or local markets within residential compounds encourages resident engagement and interaction.

- Shared Facilities: Investing in and maintaining communal amenities such as clubhouses, parks, and children's play areas provides spaces for residents to connect.

- Resident Engagement Platforms: Establishing digital or physical platforms for residents to communicate, share information, and organize activities can strengthen community bonds.

- Local Partnerships: Collaborating with local businesses or organizations for events and services can further integrate projects into the wider community fabric.

Investor Relations and Transparency

CIFI Holdings Group prioritizes clear and consistent communication with its investors. This commitment is vital for building trust and maintaining confidence, particularly as the company navigates its debt restructuring efforts. Regular updates on financial performance and strategic initiatives are key to keeping its diverse investor base informed.

- Financial Reporting: CIFI Holdings adheres to strict financial reporting standards, providing timely and accurate quarterly and annual results. For instance, in its 2023 annual report, the company detailed its revenue and profit figures, alongside key operational metrics.

- Investor Briefings: The company conducts regular investor briefings and conference calls to discuss its performance, market outlook, and the progress of its restructuring plan. These sessions offer direct engagement opportunities for analysts and shareholders.

- Transparency in Strategy: CIFI Holdings communicates its strategic direction openly, outlining its plans for deleveraging and future growth. This transparency is crucial for managing expectations and demonstrating a clear path forward to stakeholders.

- Stakeholder Engagement: Proactive engagement with all stakeholders, including bondholders and equity investors, is a cornerstone of CIFI's approach. This ensures that all parties are kept abreast of developments and have avenues for feedback.

CIFI Holdings Group focuses on building strong relationships with property buyers through dedicated sales and customer service teams, ensuring a smooth acquisition process and high satisfaction. The company also cultivates lasting connections with residents and tenants via proactive property management and after-sales support, enhancing community living. In 2024, CIFI's property management income growth underscored the success of these resident-focused efforts.

Digital platforms, including their website and social media, are key for CIFI to disseminate updates and engage with customers, with their online service portal handling over 1 million inquiries in 2023. Furthermore, CIFI actively fosters community within its developments through events and shared facilities, enhancing the overall living experience and property value.

| Customer Relationship Aspect | Key Activities | 2023/2024 Data Point |

|---|---|---|

| Direct Buyer Engagement | Dedicated Sales & Service Teams | N/A (Ongoing focus) |

| Resident/Tenant Support | Property Management, After-Sales Service | Increased Property Management Income (2024) |

| Digital Engagement | Website, Social Media, Online Portals | Over 1 million inquiries via online portal (2023) |

| Community Building | Events, Shared Facilities, Engagement Platforms | N/A (Ongoing focus) |

Channels

CIFI Holdings Group leverages direct sales offices and showrooms, often situated at project sites or in high-traffic urban locations. These physical touchpoints are crucial for allowing prospective buyers to experience model units firsthand, access detailed project information, and engage directly with the sales team.

In 2024, CIFI's commitment to these channels was evident in its ongoing sales efforts, reflecting a strategy to provide tangible interaction with their property developments. This direct engagement is designed to build trust and facilitate informed purchasing decisions, a key component of their customer-centric approach.

CIFI Holdings Group collaborates with a broad network of external real estate agencies and brokers. This strategy significantly expands their market reach, tapping into established client bases and local market knowledge. These partnerships are crucial for effectively marketing and selling their diverse property portfolio across various regions.

In 2024, the real estate sector saw continued reliance on brokerage networks for sales volume. While specific figures for CIFI’s agency partnerships are proprietary, the broader industry trend indicates that leveraging these external channels remains a cost-effective way to access a wider pool of potential buyers compared to solely relying on in-house sales teams.

Online property portals and CIFI Holdings' own website serve as vital digital storefronts. These platforms are essential for reaching a wide audience, offering comprehensive details on CIFI's diverse property portfolio and acting as key lead generation channels. In 2024, CIFI continued to leverage these digital avenues to connect with potential buyers, highlighting their commitment to digital accessibility and customer engagement in the property market.

Marketing and Advertising Campaigns

CIFI Holdings Group leverages extensive marketing and advertising campaigns across diverse channels to showcase its properties and cultivate strong brand recognition. These initiatives, encompassing digital ads, print, billboards, and social media, are designed to reach and engage a broad consumer base.

In 2024, CIFI continued its multi-channel approach. For instance, their digital marketing efforts likely saw significant investment, targeting potential buyers through platforms like WeChat and other popular Chinese social media channels. This digital focus is crucial for reaching younger demographics and providing interactive property information.

- Digital Marketing: Increased investment in online advertisements and social media engagement to reach a wider audience, particularly younger demographics.

- Brand Building: Campaigns focused on reinforcing CIFI's reputation for quality and customer service across all property developments.

- Targeted Promotions: Utilizing data analytics to tailor advertising messages to specific customer segments, enhancing campaign effectiveness.

- Offline Presence: Maintaining visibility through traditional channels like print media and strategically placed billboards in key urban areas.

Public Relations and Media Engagement

CIFI Holdings Group utilizes public relations and media engagement as a vital channel to communicate its corporate narrative and development milestones. This proactive approach ensures that key stakeholders, including investors and potential buyers, are kept informed about the company's progress and strategic direction. For instance, in 2024, CIFI actively managed its media presence to highlight its ongoing projects and financial performance, aiming to foster trust and transparency.

These engagements are crucial for shaping public perception and reinforcing CIFI's brand as a reliable developer. By strategically disseminating company news and project updates, CIFI can effectively reach a wide audience, thereby enhancing its market visibility and attractiveness to both customers and the investment community.

Key aspects of CIFI's Public Relations and Media Engagement include:

- Dissemination of Company News: Sharing updates on financial results, strategic partnerships, and corporate governance initiatives to maintain transparency and investor confidence.

- Project Updates and Milestones: Communicating progress on ongoing property developments, new project launches, and successful completions to attract buyers and showcase operational capabilities.

- Brand Image Building: Engaging in CSR activities and highlighting community contributions to cultivate a positive and responsible corporate image.

- Investor Relations Communications: Providing clear and consistent information to the financial community through press releases, investor calls, and annual reports to support market valuation.

CIFI Holdings Group's channels are multifaceted, encompassing direct sales, agency partnerships, and robust digital platforms. These avenues are critical for reaching diverse customer segments and driving sales volume. In 2024, the company continued to emphasize both physical showrooms for tangible customer experiences and online portals for broad accessibility and lead generation, underscoring a balanced approach to market engagement.

Customer Segments

CIFI Holdings Group's core customer base consists of urban middle to high-income households primarily located in China's first and second-tier cities. These individuals and families are actively seeking well-designed residential properties that offer modern amenities and convenient access to urban infrastructure. In 2024, this segment continued to represent a significant portion of CIFI's sales, driven by ongoing urbanization and a desire for improved living standards.

Commercial enterprises and businesses are a crucial customer segment for CIFI Holdings Group, acquiring or leasing a variety of commercial properties. These include office spaces and retail units integrated into CIFI's mixed-use projects. For example, in 2023, CIFI's commercial property segment contributed significantly to its overall revenue, demonstrating strong demand from businesses seeking prime locations.

Property investors, both individuals and institutions, represent a key customer segment for CIFI Holdings Group. These investors are actively seeking opportunities in the real estate market, aiming to generate income through rental yields or profit from property value increases.

This segment includes those looking to acquire residential units for leasing, commercial spaces for business tenants, or even entire portfolios of investment properties. Their decisions are driven by market trends, economic outlook, and the potential for a strong return on investment.

In 2024, the real estate investment landscape continued to be shaped by evolving economic conditions. For instance, the demand for well-located and well-managed rental properties remained robust, offering a stable income stream for investors. CIFI's focus on developing quality residential and commercial projects directly caters to this demand.

Government and Public Sector Entities

Government and public sector entities can be significant customers for CIFI Holdings Group, especially in large urban regeneration or public infrastructure projects. These collaborations often focus on developing affordable housing or essential public amenities as part of broader mixed-use developments. CIFI's inclusion on various government 'real estate project whitelists' underscores its active engagement with this crucial customer segment.

For instance, in 2024, CIFI actively participated in discussions and project proposals related to urban renewal initiatives in major Chinese cities. These projects often involve significant public investment and aim to improve urban living standards. The company's ability to secure approvals and partnerships within these government-led frameworks is a testament to its strategic alignment with public sector objectives.

- Urban Development Partnerships: Collaborating with governments on large-scale urban renewal and infrastructure projects.

- Affordable Housing Initiatives: Contributing to the development of residential projects aimed at increasing housing affordability.

- Public-Private Collaborations: Engaging in projects that require joint efforts between CIFI and public sector bodies for community benefit.

Existing Property Owners and Tenants

Existing property owners and tenants represent a core customer segment for CIFI Holdings Group. These individuals and entities already reside in or own properties managed by CIFI, creating a foundation for sustained engagement and revenue generation through property management, maintenance, and potential upgrades or additional services. In 2023, CIFI’s property management segment demonstrated its importance, contributing significantly to the group's overall financial performance.

- Recurring Revenue Stream: This segment provides a stable base for recurring revenue through rental income and property management fees, essential for CIFI's ongoing operations and growth.

- Tenant Retention and Loyalty: Focusing on positive relationships with current tenants fosters loyalty, reduces turnover, and enhances the group's reputation, which is vital for attracting new residents and investors.

- Upselling Opportunities: Existing residents are prime candidates for value-added services such as smart home technology integration, enhanced community amenities, or renovation services, driving additional revenue.

- Feedback and Improvement: Engaging with this segment provides valuable insights into property performance and resident satisfaction, enabling CIFI to refine its offerings and operational strategies.

CIFI Holdings Group primarily serves urban middle to high-income households in China's major cities, seeking quality residential properties. Commercial entities also form a key segment, leasing office and retail spaces within CIFI's mixed-use developments. Property investors, both individual and institutional, are crucial, attracted by rental yields and capital appreciation potential.

The company also engages with government and public sector entities for urban regeneration and affordable housing projects. Existing property owners and tenants are vital for recurring revenue through management services and offer opportunities for upselling. In 2023, CIFI's property management segment showed significant contribution to overall performance.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

| Urban Households | Middle to high-income, first/second-tier cities, seeking modern amenities. | Continued demand driven by urbanization. |

| Commercial Enterprises | Businesses seeking office/retail spaces in mixed-use projects. | Significant revenue contribution in 2023 from this segment. |

| Property Investors | Individuals/institutions seeking rental income or capital gains. | Demand for well-located rental properties remained robust in 2024. |

| Government/Public Sector | Partnerships for urban renewal, affordable housing, infrastructure. | Active engagement in urban renewal initiatives in 2024. |

| Existing Owners/Tenants | Recurrent revenue through management, upselling opportunities. | Provided stable base for recurring revenue in 2023. |

Cost Structure

Land acquisition represents a substantial portion of CIFI Holdings Group's cost structure. In 2024, the company continued to invest heavily in securing land, particularly in tier-one and desirable tier-two cities across China, which are crucial for the success and profitability of its development projects.

The cost of these prime land parcels is a direct determinant of project feasibility, influencing everything from initial investment requirements to the final sale price and overall profit margins. CIFI's strategic land banking efforts are therefore a critical factor in managing its overall expenses and ensuring future revenue streams.

Construction and development costs are a major expense for CIFI Holdings Group, encompassing everything from raw materials and skilled labor to fees paid to subcontractors. These costs are directly influenced by the size and intricacy of the real estate projects undertaken. For instance, in 2023, CIFI reported that its cost of sales, which largely comprises these construction expenses, stood at RMB 71.1 billion.

Financing and interest expenses represent a substantial cost for CIFI Holdings Group due to its significant reliance on external capital. In 2023, the company reported finance costs of RMB 8,281 million, reflecting the ongoing expense of servicing its considerable debt obligations.

Managing these interest expenses is paramount for CIFI's profitability and financial stability, given its substantial interest-bearing liabilities. These costs directly impact the bottom line, making efficient debt management a key strategic imperative.

Sales, Marketing, and Administrative Expenses

CIFI Holdings Group's cost structure is significantly influenced by its sales, marketing, and administrative expenses. These costs are crucial for generating revenue and maintaining efficient operations.

Costs associated with selling and marketing properties form a substantial portion of expenditures. This includes outlays for advertising campaigns, sales commissions paid to agents, and various promotional activities designed to attract buyers. For instance, in 2024, CIFI's sales and marketing expenses are expected to reflect the dynamic nature of the real estate market, with a focus on digital marketing and targeted promotions.

Administrative expenses also represent a notable part of the company's cost base. These cover general overheads such as salaries for corporate staff, office rent, utilities, and other corporate functions necessary for the smooth running of the business. These expenses are essential for supporting the overall strategic direction and operational management of CIFI Holdings.

- Sales and Marketing Expenses: Costs incurred to promote and sell properties, including advertising and commissions.

- Administrative Expenses: General overheads and corporate functions essential for business operations.

- 2024 Focus: Investments in digital marketing and targeted sales strategies are key components of the sales and marketing budget.

- Operational Efficiency: Managing administrative costs is vital for maintaining profitability and supporting growth initiatives.

Property Management and Maintenance Costs

CIFI Holdings Group allocates significant resources to property management and maintenance for its extensive portfolio. These essential operational expenses cover routine upkeep, security personnel, cleaning services, and other necessary expenditures to ensure properties remain functional and attractive to tenants and buyers. For instance, in 2023, the company's property management segment, which includes these costs, generated revenue of RMB 2,037 million, indicating the scale of operations and associated expenditures.

These costs are fundamental to preserving the value of CIFI's investment properties and delivering high-quality property management services. The ongoing investment in maintenance and operational efficiency directly impacts tenant satisfaction and the long-term financial health of the managed assets. The company's commitment to maintaining its properties is a key component of its business model, ensuring a stable revenue stream and asset appreciation.

- Property Maintenance: Ongoing repairs, renovations, and preventative maintenance to preserve asset quality.

- Security Services: Costs associated with ensuring the safety and security of residents and property.

- Cleaning and Landscaping: Expenses for maintaining the aesthetic appeal and hygiene of common areas and grounds.

- Operational Utilities: Costs for electricity, water, and other utilities necessary for property operations.

CIFI Holdings Group's cost structure is heavily weighted towards land acquisition and construction. In 2023, the cost of sales, largely representing development and construction expenses, was RMB 71.1 billion. Financing costs are also significant, with RMB 8,281 million reported in finance costs for 2023, underscoring the impact of debt servicing on profitability.

| Cost Category | 2023 (RMB Million) | Key Drivers |

| Cost of Sales (Construction) | 71,100 | Raw materials, labor, subcontractor fees |

| Finance Costs | 8,281 | Interest on debt, financing activities |

| Sales and Marketing | Significant portion of operating expenses | Advertising, commissions, promotions |

| Administrative Expenses | General overheads, corporate functions | Salaries, rent, utilities |

| Property Management & Maintenance | Operational expenditures for property upkeep | Repairs, security, cleaning, utilities |

Revenue Streams

CIFI Holdings Group's main income comes from selling the properties they build, both homes and businesses. This includes apartments, houses, office buildings, and shops that they have already sold to customers. For example, in the first half of 2025, CIFI reported contracted sales totaling RMB10.16 billion.

CIFI Holdings Group generates revenue from its portfolio of investment properties, which includes commercial complexes and office buildings. This segment offers a predictable and consistent income source, contributing to the company's overall financial stability.

In 2024, the company saw a notable increase in its rental income, with lease and service income related to investment properties growing by 10.4% compared to the previous year. This growth highlights the effectiveness of their property management and leasing strategies.

CIFI Holdings Group generates revenue through property management fees, which are collected for services provided to both residents and property owners. These fees cover essential property upkeep and can also include charges for additional, value-added services. In 2024, the company saw a healthy increase in this income stream, with property management and other services income rising by 9.4%.

Project Management and Consultancy Fees

CIFI Holdings Group can generate income by offering its project management and consultancy expertise. This service is likely provided for real estate developments, including those undertaken in joint ventures or for external clients.

This revenue stream capitalizes on CIFI's established proficiency in navigating the complexities of real estate development. For instance, in 2023, CIFI's revenue from property development and sales was RMB 100.5 billion, indicating a substantial operational base from which to offer such specialized services.

The consultancy aspect allows CIFI to leverage its deep understanding of market trends, regulatory environments, and construction best practices. This can translate into fees earned from advising other developers or partners throughout the project lifecycle.

- Project Management Fees: Charging for overseeing the planning, execution, and completion of real estate projects.

- Consultancy Services: Earning revenue from providing expert advice on development strategy, market analysis, and operational efficiency.

- Joint Venture Support: Offering project management and consultancy to partners within CIFI's joint venture structures.

- Third-Party Developer Services: Extending expertise to external real estate companies for a fee.

Other Real Estate-Related Services

CIFI Holdings Group diversifies its income beyond property development and sales through a range of other real estate-related services. These can include offering preliminary planning and design consultancy to third parties, leveraging their expertise in urban development and architectural planning.

Furthermore, CIFI generates revenue from specific value-added services provided within its managed properties. This might encompass property management fees, leasing services, or even offering curated lifestyle amenities and services to residents and commercial tenants, thereby enhancing property value and occupancy rates.

- Property Management: CIFI's property management segment likely contributes a steady stream of recurring revenue, with fees typically calculated as a percentage of rental income or a fixed amount per property.

- Consultancy Services: Revenue from planning and design consultancy can be project-based, reflecting the scale and complexity of the projects undertaken.

- Ancillary Services: Value-added services within properties, such as retail leasing or operational management of amenities, contribute to overall profitability.

- Investment Income: While not explicitly a service, income from investments in joint ventures or associated companies related to real estate projects also bolsters the group's financial performance.

CIFI Holdings Group's revenue streams are multifaceted, extending beyond direct property sales. A significant portion comes from property development and sales, as evidenced by their RMB 100.5 billion in revenue from this segment in 2023. Additionally, rental income from investment properties, such as commercial complexes, provides a stable income, with lease and service income growing by 10.4% in 2024. Property management fees also contribute, with this income stream seeing a 9.4% rise in 2024. The company also leverages its expertise through project management and consultancy services for both internal and external projects.

| Revenue Stream | Description | 2023 Data (if available) | 2024 Data (if available) | H1 2025 Data (if available) |

|---|---|---|---|---|

| Property Development & Sales | Income from selling residential and commercial properties. | RMB 100.5 billion | N/A | RMB 10.16 billion (contracted sales) |

| Investment Property Rental Income | Revenue from leasing commercial complexes, office buildings, etc. | N/A | 10.4% growth in lease and service income | N/A |

| Property Management & Other Services | Fees for managing properties and providing additional services. | N/A | 9.4% growth in property management and other services income | N/A |

| Project Management & Consultancy | Fees for overseeing real estate projects and providing expert advice. | N/A | N/A | N/A |

Business Model Canvas Data Sources

The CIFI Holdings Group Business Model Canvas is built using a combination of internal financial disclosures, extensive market research on the Chinese real estate sector, and strategic analysis of industry trends. These data sources ensure a robust and accurate representation of the company's operations and strategic direction.