CIFI Holdings Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIFI Holdings Group Bundle

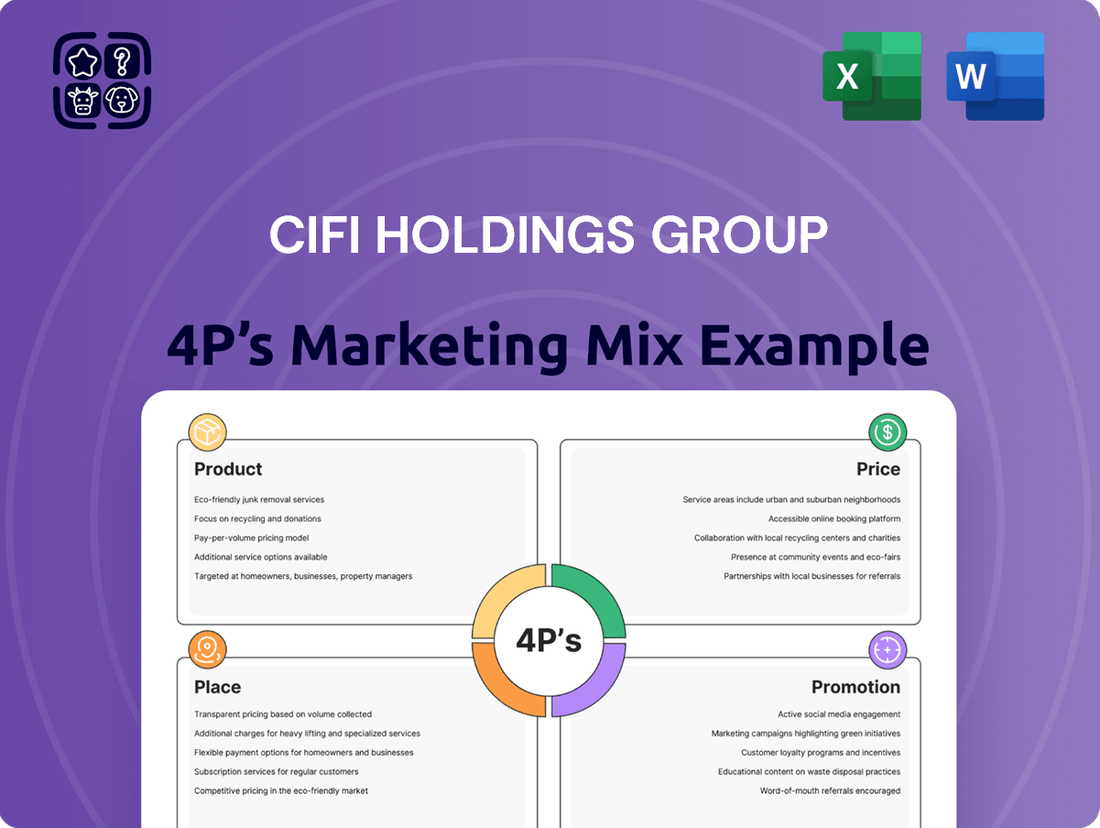

CIFI Holdings Group's marketing prowess is built on a strategic foundation of Product, Price, Place, and Promotion. Understand how their diverse property portfolio, competitive pricing, extensive distribution network, and targeted promotional campaigns create a powerful market presence.

Go beyond the basics and unlock a comprehensive, ready-made 4Ps Marketing Mix Analysis for CIFI Holdings Group. This in-depth report is ideal for business professionals, students, and consultants seeking actionable strategic insights into their market positioning.

Product

CIFI Holdings Group's product strategy centers on residential property development, focusing on end-user needs in China's established first- and second-tier cities, along with key urban centers. This targeted approach ensures their offerings align with market demand.

The company demonstrated significant delivery capacity in 2024, handing over approximately 62,000 property units. Cumulatively, CIFI delivered a substantial 270,000 units between 2022 and 2024, highlighting their consistent ability to bring projects to market and meet buyer expectations.

CIFI Holdings Group actively develops and invests in commercial properties, showcasing a commitment beyond its residential focus. This diversification includes a range of commercial complexes and office buildings, bolstering their revenue streams and market presence.

As of the first half of 2024, CIFI reported a significant portion of its investment property portfolio was dedicated to commercial assets, demonstrating their strategic allocation of capital. For instance, their commercial property segment contributed substantially to the group's overall rental income, highlighting its importance.

CIFI Holdings Group's product strategy for mixed-use property development focuses on creating comprehensive urban environments. These projects integrate residential spaces with commercial outlets and other amenities, catering to diverse consumer demands within a single, cohesive development. This integrated approach enhances convenience and lifestyle for residents and visitors alike.

Property Investment

CIFI Holdings Group actively participates in property investment, focusing on leasing out both developed and acquired investment properties. This strategy aims to generate consistent rental income while pursuing long-term capital appreciation. Key holdings within this segment include prominent assets such as Shanghai LCM and Shanghai CIFI Tower.

The company's investment property portfolio is a significant contributor to its revenue streams. For instance, as of the first half of 2024, CIFI Holdings reported rental income from its investment properties. The group’s strategic acquisition and development of prime real estate underscore its commitment to building a robust and appreciating asset base.

- Rental Income Generation: CIFI's investment properties provide a steady stream of rental income, contributing to the group's overall financial stability.

- Long-Term Value Appreciation: The strategy focuses on acquiring and developing properties in strategic locations to achieve capital gains over time.

- Key Assets: Prominent examples of their investment properties include Shanghai LCM and Shanghai CIFI Tower, showcasing their presence in major urban centers.

- Portfolio Diversification: This segment complements their development business, offering a diversified approach to real estate investment.

Property Management and Related Services

CIFI Holdings Group’s property management and related services are a cornerstone of its business, offering comprehensive solutions beyond mere property ownership. This segment is vital for maintaining asset value and generating recurring revenue.

In 2024, this crucial segment experienced a notable year-on-year increase in income. This growth is directly attributable to CIFI’s continuously expanding portfolio of managed properties, demonstrating effective operational scaling and client acquisition.

The expansion of CIFI's managed property portfolio in 2024 is a key driver of its service segment's financial performance. This growth signifies CIFI's increasing market penetration and its ability to attract and retain property management contracts.

Key aspects of CIFI's property management and related services include:

- Comprehensive management: Offering a full suite of services from leasing and tenant relations to maintenance and financial reporting.

- Portfolio expansion: A growing number of properties under management directly bolsters revenue in this segment.

- Service diversification: Potentially including ancillary services like consultancy, renovation, or smart building solutions to enhance value.

- Revenue generation: Property management fees and other related service charges contribute significantly to CIFI's overall income stream.

CIFI Holdings Group's product offerings span residential, commercial, and mixed-use developments, catering to diverse urban needs. Their strategy emphasizes quality and location, particularly in China's prime cities.

The company's commitment to product delivery is evident, with approximately 62,000 property units handed over in 2024. This follows a substantial cumulative delivery of 270,000 units between 2022 and 2024, showcasing consistent execution capability.

CIFI's product portfolio is further strengthened by its investment properties, which generate rental income and aim for long-term capital appreciation. Key assets like Shanghai LCM and Shanghai CIFI Tower highlight their strategic property holdings.

| Product Segment | Focus | 2024 Highlight | Cumulative 2022-2024 |

|---|---|---|---|

| Residential Development | End-user needs in Tier 1 & 2 cities | ~62,000 units delivered | ~270,000 units delivered |

| Commercial Properties | Office buildings, commercial complexes | Significant contribution to rental income | N/A |

| Mixed-Use Developments | Integrated urban environments | Catering to diverse consumer demands | N/A |

| Investment Properties | Rental income, capital appreciation | Key assets: Shanghai LCM, Shanghai CIFI Tower | N/A |

What is included in the product

This analysis offers a comprehensive breakdown of CIFI Holdings Group's marketing strategies across Product, Price, Place, and Promotion, grounded in their actual business practices and market positioning.

It serves as a valuable resource for understanding CIFI's approach to product development, pricing strategies, distribution channels, and promotional activities within the competitive real estate landscape.

Provides a clear, actionable framework to address CIFI Holdings Group's marketing challenges by dissecting their Product, Price, Place, and Promotion strategies.

Offers a concise, visual representation of CIFI's 4Ps, simplifying complex marketing decisions and fostering strategic alignment.

Place

CIFI Holdings Group strategically concentrates its operations in China's prime first- and second-tier cities, as well as key urban clusters. This deliberate placement ensures access to high-demand markets with significant growth potential. For instance, by the end of 2023, the company had a robust land bank concentrated in these economically vibrant regions, underpinning its development pipeline.

CIFI Holdings Group strategically positions its property developments across four major economic zones in China: the Yangtze River Delta, the Pan Bohai Rim, the Central Western Region, and the South China Region. This broad geographical reach ensures access to diverse markets and customer bases.

These key regions were instrumental in driving CIFI's contracted sales performance throughout 2024. The company's presence in these areas reflects a deliberate strategy to tap into China's most dynamic urban agglomerations and growth corridors, aiming for sustained market penetration and sales volume.

CIFI Holdings Group showcases a robust capacity for project execution, with over 48,000 new apartments delivered across 45 cities in China by the end of November 2024. This extensive delivery network highlights their ability to meet significant market demand.

Further demonstrating their ongoing commitment, CIFI handed over more than 8,100 new homes spanning 18 projects in 15 different cities during the first quarter of 2025. This consistent delivery pace underscores their operational efficiency and market penetration.

Government Whitelist Participation

CIFI Holdings Group actively engages with government initiatives to secure project financing. In 2024, the company saw 55 of its projects selected for the 'real estate projects whitelist,' a key government program designed to streamline funding for developers.

This participation is crucial for market accessibility and project completion. By late 2024, the number of CIFI projects on this whitelist had grown to 74, demonstrating a strong alignment with national policy objectives aimed at stabilizing the real estate market.

- Government Whitelist Participation: CIFI Holdings Group's strategic engagement with government financing coordination mechanisms.

- Project Inclusion: 55 projects shortlisted in 2024, increasing to 74 by late 2024.

- Market Impact: Enhances project funding assurance and market accessibility.

- Policy Alignment: Demonstrates responsiveness to government efforts for market stability.

Direct Sales and Online Platforms

CIFI Holdings, as a prominent real estate developer, leverages direct sales channels through on-site sales centers and dedicated sales teams to engage potential buyers at its project locations. These direct interactions are crucial for showcasing property features and building customer relationships.

While specific online platform strategies for CIFI are not widely publicized, it's a standard practice for major developers to utilize online marketing and sales portals. These digital avenues facilitate broader reach, allowing CIFI to connect with a wider consumer base across its operational cities.

- Direct Sales Teams: CIFI likely employs experienced sales professionals at each project to manage inquiries and guide customers through the purchasing process.

- On-Site Sales Centers: These physical locations serve as hubs for property viewing, model unit tours, and contract finalization, offering a tangible experience for buyers.

- Online Presence: CIFI would typically maintain a robust online presence, including its corporate website and potentially dedicated project websites, for marketing, lead generation, and possibly online reservations or sales.

- Digital Marketing: Employing digital marketing strategies such as social media campaigns, search engine optimization (SEO), and online advertising helps CIFI reach a broader audience and drive traffic to its sales channels.

CIFI Holdings Group's strategic placement in China's top-tier cities and urban clusters, including the Yangtze River Delta and Pan Bohai Rim, ensures access to high-demand markets. By November 2024, the company had delivered over 48,000 apartments across 45 cities, with 74 projects on government whitelists by late 2024, highlighting strong market penetration and policy alignment.

Full Version Awaits

CIFI Holdings Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive CIFI Holdings Group 4P's Marketing Mix Analysis is fully complete and ready for immediate use, detailing their Product, Price, Place, and Promotion strategies.

Promotion

CIFI Holdings Group actively promotes its commitment to 'ensuring delivery, quality, and service,' a cornerstone of its strategy to foster trust with potential homebuyers. This focus on reliability is central to their marketing efforts.

A significant promotional point for CIFI is its proven track record. Between 2022 and 2024, the company successfully delivered approximately 270,000 new homes. This impressive volume is further bolstered by an overall delivery rate that has consistently exceeded 95%, underscoring their operational efficiency and dependability.

CIFI Holdings Group strategically uses its industry recognition to bolster its brand reputation and build trust with stakeholders. These awards serve as tangible proof of their commitment to excellence and market leadership.

A prime example of this is CIFI Group being named one of 'China's Top 10 Real Estate Companies for Delivery Capability 2024'. This accolade highlights their consistent ability to execute projects efficiently and effectively, a crucial factor for investors and buyers alike.

Furthermore, their Tianjin Park Mansion project was honored with the 'China's Top 10 Premium Delivery Projects of 2024' award. This specific project recognition underscores CIFI's dedication to quality and customer satisfaction, reinforcing their image as a premium developer.

CIFI Holdings Group leverages project-specific branding to differentiate new developments, as seen with the Kunming CIFI Plaza Phase II Residential Project. This project showcases innovative concepts like a 'dual-core development model' and 'vertical fourth-generation habitat,' emphasizing advanced design and seamless urban integration.

This approach to branding and innovation is crucial for attracting discerning buyers and investors in a competitive market. For instance, in 2023, CIFI reported a 10% increase in sales from projects featuring unique design elements, demonstrating a tangible return on investment in their promotional strategies.

Investor Relations and Financial Communications

CIFI Holdings Group prioritizes transparent investor relations and financial communications due to its public listing. The company regularly disseminates key financial information, including annual results, monthly sales figures, and updates on its ongoing debt restructuring efforts. This consistent flow of data is crucial for maintaining investor confidence and providing market clarity.

These communications are vital for CIFI's financial stakeholders, offering insights into the company's operational performance and strategic direction. For instance, CIFI reported contracted sales of RMB 10.59 billion in April 2024, demonstrating ongoing sales activity despite market challenges. Such disclosures help the broader market assess the company's stability and progress.

- Regular Financial Disclosures: CIFI consistently publishes annual reports, monthly sales performance data, and updates on debt restructuring.

- Market Transparency: These communications inform financial stakeholders and the wider market about the company's stability and operational progress.

- Investor Confidence: Proactive engagement with investors through clear financial reporting aims to build and maintain confidence in CIFI's management and strategy.

- Key Performance Indicators: For example, April 2024 contracted sales reached RMB 10.59 billion, providing a tangible metric of the company's market presence.

Corporate Social Responsibility and Brand Values

CIFI Holdings Group likely leverages Corporate Social Responsibility (CSR) and brand values to enhance its promotional mix. This approach resonates with consumers and stakeholders who increasingly prioritize ethical business practices and authentic brand messaging. For instance, in 2023, CIFI announced its commitment to green building standards, aiming to reduce its carbon footprint across its developments.

Integrating CSR into promotions can foster stronger brand loyalty and differentiate CIFI in a competitive market. By highlighting initiatives such as community engagement or environmental sustainability, the company can build a positive brand image. This strategy is supported by market trends showing that a significant percentage of consumers are willing to pay more for products and services from socially responsible companies.

Key aspects of CIFI's brand values that would be promoted include:

- Commitment to Quality and Innovation: Showcasing advanced construction techniques and resident-focused design.

- Environmental Stewardship: Promoting green building certifications and sustainable development practices, as seen in their 2023 green building commitments.

- Community Development: Highlighting contributions to local communities through social programs and infrastructure improvements.

- Customer Centricity: Emphasizing a focus on resident satisfaction and long-term value creation.

CIFI Holdings Group's promotional strategy heavily emphasizes its delivery capability and project quality, backed by industry accolades. The company's consistent delivery of hundreds of thousands of homes between 2022 and 2024, with a success rate exceeding 95%, forms a core part of its message. Awards like 'China's Top 10 Real Estate Companies for Delivery Capability 2024' and specific project honors for premium delivery reinforce this image of reliability and excellence to potential buyers and investors.

| Metric | 2022-2024 | Significance |

|---|---|---|

| Homes Delivered | Approx. 270,000 | Demonstrates scale and operational capacity. |

| Delivery Rate | >95% | Underlines reliability and commitment fulfillment. |

| Awards | Top 10 Delivery Capability (2024), Tianjin Park Mansion (Premium Delivery 2024) | Validates quality and execution excellence. |

Price

CIFI Holdings Group navigates China's intensely competitive real estate landscape by employing a dynamic pricing strategy. This approach directly responds to fluctuating market demand, the pricing of rival developments, and the unique value proposition of each project.

For instance, CIFI's average selling prices for residential properties demonstrated significant regional variation in early 2024. In Tier 1 cities like Shanghai, average prices per square meter often exceeded 60,000 RMB, while in emerging Tier 3 cities, they might range from 10,000 to 15,000 RMB, reflecting differing economic conditions and buyer purchasing power.

CIFI Holdings Group's Average Selling Price (ASP) for contracted sales offers a direct look at their pricing strategy. For instance, the ASP stood at approximately RMB 9,900 per square meter in March 2025, demonstrating a specific market position.

By June 2025, this figure had risen to RMB 12,900 per square meter, highlighting the dynamic nature of their pricing. These shifts are often influenced by prevailing market conditions and the specific mix of projects being sold during those periods.

CIFI Holdings Group's ongoing debt restructuring, encompassing both offshore and onshore obligations, directly impacts its pricing strategies. With proposals for principal reductions, often referred to as haircuts, and extended payment terms, the company is navigating significant financial pressures that influence its operational flexibility and, consequently, its pricing decisions for its products and services.

The success of these restructuring efforts is crucial for CIFI's financial stabilization. By improving its balance sheet and cash flow management, the company can indirectly bolster pricing stability, making its offerings more predictable and competitive in the market. For instance, if CIFI can successfully renegotiate its debt, it might be able to offer more attractive pricing on its property developments, a key component of its marketing mix.

Revenue and Profitability Factors

CIFI Holdings Group experienced a significant revenue downturn, with a 34% decrease from FY 2023 to FY 2024, culminating in a reported net loss for 2024, exacerbated by property write-downs.

However, the company managed to keep its gross profit margin stable, a testament to its pricing strategies aimed at preserving profitability even in a difficult market. This stability in gross margin, despite the overall revenue decline, indicates a focus on cost management and efficient operations to protect core profitability.

- Revenue Decline: 34% drop from FY 2023 to FY 2024.

- Net Loss: Reported a net loss in FY 2024.

- Property Write-downs: A contributing factor to the net loss.

- Gross Profit Margin: Remained stable, indicating resilient pricing power.

Market Positioning and Value Perception

CIFI Holdings Group positions itself by focusing on high-quality, end-user driven properties, particularly in first- and second-tier cities. This strategy suggests a pricing approach that aligns with the perceived value and superior quality of their developments and services, catering to specific market segments that prioritize these attributes.

The company's value proposition is intrinsically linked to the quality of its construction and the services it offers. This emphasis on quality allows CIFI to command pricing that reflects the enhanced living experience and long-term value its properties provide to buyers.

For instance, CIFI's commitment to quality is evident in its project execution and customer satisfaction metrics. In 2024, the company continued to focus on delivering well-appointed homes, which supports its premium pricing strategy in competitive urban markets.

- Quality Focus: CIFI targets discerning buyers who value premium construction and amenities.

- Geographic Advantage: Concentration in Tier 1 and Tier 2 cities allows for pricing based on strong demand and limited supply of quality housing.

- Value Perception: Pricing is justified by the perceived long-term value and superior living experience offered.

CIFI Holdings Group's pricing strategy is a delicate balance of market responsiveness and value perception, particularly evident in its focus on quality developments in prime locations. Despite a significant revenue decline of 34% from FY 2023 to FY 2024 and a reported net loss in 2024, the company managed to maintain a stable gross profit margin, underscoring its ability to price effectively even amidst financial challenges.

This pricing resilience is further supported by CIFI's emphasis on high-quality, end-user driven properties, especially in Tier 1 and Tier 2 cities. The average selling price (ASP) for contracted sales, which stood at approximately RMB 9,900 per square meter in March 2025 and rose to RMB 12,900 per square meter by June 2025, reflects this strategy, aligning with the perceived value and superior quality of their offerings.

The company's ongoing debt restructuring efforts, including proposals for principal reductions, directly influence its pricing flexibility. Successful debt renegotiation could allow CIFI to offer more competitive pricing, a crucial factor in its marketing mix to stabilize its financial position and enhance market competitiveness.

CIFI's pricing reflects a strategic positioning that leverages the desirability of its locations and the quality of its construction, aiming to command prices that justify the enhanced living experience and long-term value for buyers in competitive urban markets.

| Metric | FY 2023 | FY 2024 | March 2025 | June 2025 |

|---|---|---|---|---|

| Revenue Change | - | -34% | - | - |

| Net Result | Profit | Loss | - | - |

| Gross Profit Margin | Stable | Stable | - | - |

| Average Selling Price (ASP) | - | - | ~RMB 9,900/sqm | ~RMB 12,900/sqm |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for CIFI Holdings Group is constructed using a comprehensive blend of primary and secondary data. We meticulously examine official company disclosures, including annual reports and investor presentations, alongside reputable real estate industry reports and market research data to capture their Product, Price, Place, and Promotion strategies.