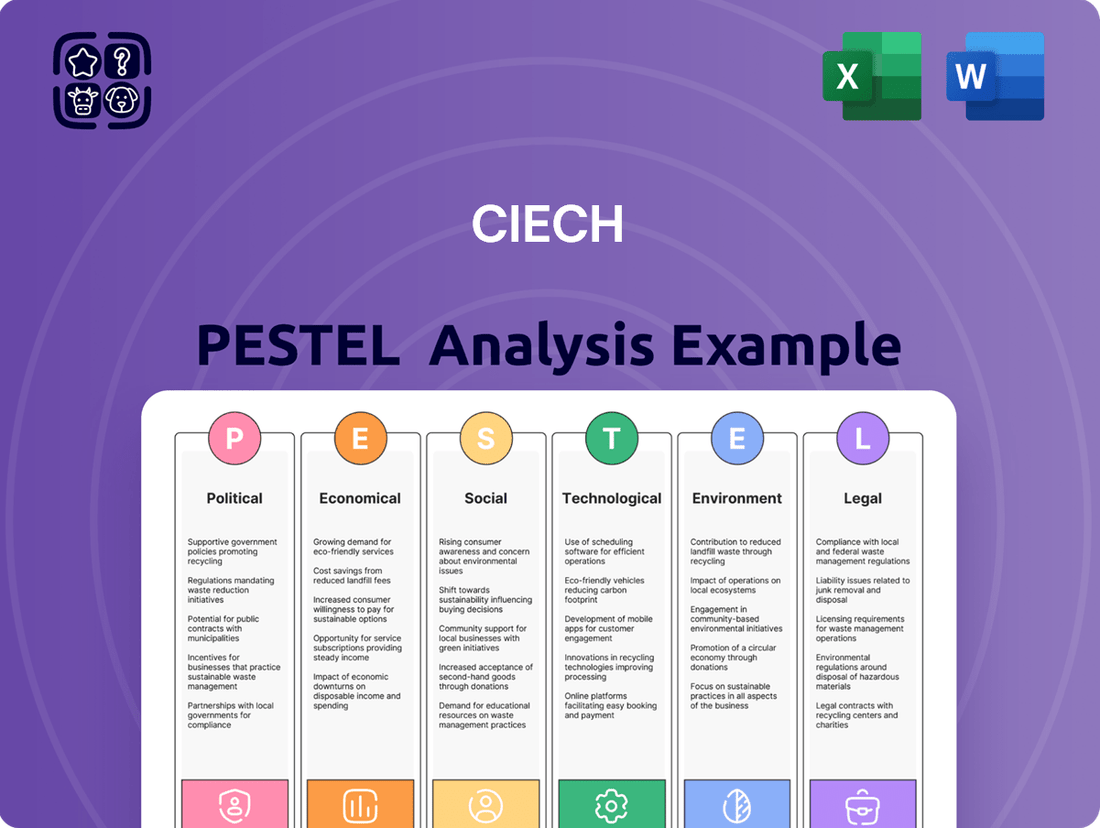

Ciech PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ciech Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Ciech's trajectory. Our comprehensive PESTLE analysis provides the strategic foresight you need to navigate market complexities and identify emerging opportunities. Download the full version now to gain actionable intelligence and secure your competitive advantage.

Political factors

The stability of government policies and regulations within Poland and the broader European Union is a critical factor for Ciech. Predictable industrial policies, especially concerning environmental standards and energy, directly influence operational costs and investment horizons. For instance, the EU's Green Deal initiatives, while driving innovation, also necessitate significant capital expenditure for compliance, impacting long-term financial planning.

Changes in international trade policies, including tariffs and non-tariff barriers, directly influence Ciech's ability to import essential raw materials and export its finished products, such as soda ash and specialized chemicals. For instance, the European Union's carbon border adjustment mechanism (CBAM), which began its transitional phase in October 2023, could impact the cost of imported inputs and the competitiveness of EU-produced goods like those from Ciech in international markets. This evolving trade landscape necessitates careful monitoring and strategic adaptation to maintain profitability.

Ongoing geopolitical tensions, particularly the conflict in Eastern Europe, pose significant risks to Ciech's operations. Disruptions to critical supply chains for raw materials and energy price volatility, directly impacting production costs, are a primary concern. For instance, the European chemical industry experienced significant energy cost increases in 2022 and 2023, with natural gas prices fluctuating wildly, affecting profitability.

Such instability can also dampen demand for industrial chemicals as downstream industries face economic uncertainty. Investor confidence in European markets, including the chemical sector, can erode during periods of heightened geopolitical risk, potentially impacting Ciech's access to capital and overall valuation. The lingering effects of sanctions and trade reconfigurations continue to shape the operational landscape.

Industrial and Environmental Policy Direction

The European Green Deal significantly shapes the chemical industry, pushing for sustainability and reduced environmental impact. This policy direction directly influences companies like Ciech, which already emphasizes sustainable chemical production. Stricter emissions standards and the promotion of circular economy principles are key components that will require ongoing adaptation and investment in greener technologies.

Ciech's strategic focus aligns with these policy shifts, particularly in areas like reducing greenhouse gas emissions and developing eco-friendly products. For instance, the EU aims to cut emissions by at least 55% by 2030 compared to 1990 levels, a target that necessitates innovation across the chemical sector. The drive towards a circular economy encourages the reuse and recycling of materials, impacting feedstock sourcing and product lifecycle management for chemical producers.

- European Green Deal targets a 55% net greenhouse gas emission reduction by 2030.

- Circular economy initiatives aim to increase resource efficiency and reduce waste in industrial processes.

- Stricter environmental regulations, such as those on chemical safety and emissions, are becoming more prevalent.

- Support for sustainable chemical production is increasing through various EU funding and research programs.

Political Support for Key Industries

Governments often prioritize key industries to foster economic growth and technological advancement. Poland, for instance, has recognized the chemical sector's significance, with initiatives aimed at bolstering its competitiveness. This support can manifest through various channels, directly impacting major chemical producers like Ciech.

These political factors can include direct financial aid, tax incentives, and substantial investments in research and development. For example, Poland's National Recovery and Resilience Plan (KPO), approved in 2022, allocates significant funds towards green transformation and digitalization, areas where the chemical industry plays a crucial role. Ciech, as a leading chemical group in Poland and Central Europe, stands to benefit from such strategic governmental focus.

The level of government backing for the chemical industry can be seen in:

- Direct subsidies and grants for innovation and sustainable practices.

- Tax relief measures designed to encourage investment and R&D.

- Public funding for infrastructure projects that support industrial operations.

- Favorable regulatory environments that promote growth in strategic chemical sub-sectors.

Governmental support for the chemical sector in Poland and the EU is a significant political factor for Ciech. Initiatives like Poland's National Recovery and Resilience Plan (KPO), approved in 2022, earmark funds for green transformation and digitalization, directly benefiting chemical companies. This focus translates into potential advantages through subsidies, tax incentives, and R&D funding, bolstering Ciech's competitive edge.

The EU's commitment to the Green Deal, targeting a 55% net greenhouse gas emission reduction by 2030, mandates stricter environmental regulations and promotes circular economy principles. Ciech's alignment with these policies, particularly in reducing emissions and developing eco-friendly products, positions it to leverage increasing support for sustainable chemical production. This policy direction encourages innovation and investment in greener technologies.

Geopolitical stability, especially in Eastern Europe, remains crucial for Ciech's operations and supply chains. Disruptions and energy price volatility, as seen with natural gas price surges in 2022-2023, directly impact production costs. The EU's Carbon Border Adjustment Mechanism (CBAM), effective from October 2023, also introduces complexities for imported inputs and export competitiveness, requiring constant strategic adaptation.

| Policy Area | Key Initiative/Regulation | Impact on Ciech | 2024/2025 Relevance |

|---|---|---|---|

| Environmental Policy | EU Green Deal | Drives investment in sustainable production, compliance costs | Continued focus on emission reduction targets (55% by 2030), circular economy adoption |

| Trade Policy | CBAM (Transitional Phase Oct 2023) | Affects cost of imported raw materials and export competitiveness | Ongoing monitoring of trade flows and potential cost impacts on key products like soda ash |

| National Economic Policy | Poland's National Recovery and Resilience Plan (KPO) | Provides funding for green transformation and digitalization | Opportunities for R&D grants and investment in sustainable technologies |

| Geopolitical Stability | Eastern European Conflict | Supply chain disruptions, energy price volatility | Continued risk management for raw material sourcing and energy cost fluctuations |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting Ciech, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for strategic decision-making.

Economic factors

The health of the global economy significantly impacts Ciech's demand. For instance, a slowdown in major economies like the EU, a key market for Ciech, can directly reduce industrial output. This translates to lower demand for chemicals used in construction and manufacturing.

In 2024, forecasts suggest a moderate global economic expansion, but regional variations exist. Emerging markets might show stronger growth, potentially offsetting slower demand in developed nations. However, persistent inflation and interest rate hikes in 2024 continue to pose risks to industrial investment and consumer spending, impacting sectors Ciech serves.

The industrial sectors Ciech supplies, such as glass, construction, and automotive, are sensitive to economic cycles. A downturn in these areas, perhaps due to reduced consumer confidence or supply chain disruptions, would naturally lead to decreased orders for Ciech's basic and specialized chemical products throughout 2024 and into 2025.

Ciech, as a major chemical producer, faces significant challenges from volatile energy and raw material prices. Fluctuations in natural gas and electricity costs directly impact its production expenses, which are a substantial part of its overall operational budget. For instance, in 2023, the energy sector experienced considerable price swings, and this trend is expected to continue into 2024 and 2025, directly affecting Ciech's cost structure.

The cost of key raw materials like salt and limestone also plays a critical role in Ciech's profitability. Any upward movement in these input prices can squeeze profit margins, especially if these costs cannot be fully passed on to customers. The global supply chain disruptions and geopolitical factors observed in recent years continue to influence the availability and pricing of these essential materials, making strategic procurement and cost management paramount for Ciech.

Ciech's profitability is significantly influenced by exchange rate fluctuations, especially concerning the Euro and Polish Zloty. For instance, in 2023, a stronger Euro against the Zloty would generally benefit Ciech's export revenues, as sales denominated in Euros would translate into more Zlotys. Conversely, a weaker Euro could negatively impact these revenues.

The cost of imported raw materials and energy is also sensitive to currency movements. If Ciech sources inputs priced in USD or other foreign currencies, a depreciating Zloty would increase these input costs, potentially squeezing profit margins if these increases cannot be passed on to customers. This volatility requires careful financial hedging strategies.

Inflation and Interest Rates

Inflation significantly impacts Ciech's operational costs, including raw materials and energy, potentially squeezing profit margins. For instance, in early 2024, global energy prices saw fluctuations, directly affecting chemical production expenses. Furthermore, rising inflation can erode consumer purchasing power, leading to reduced demand in key end-user sectors like construction and agriculture, which are crucial for Ciech's product sales.

Rising interest rates, as seen with central bank policy adjustments throughout 2023 and into 2024, increase borrowing costs for Ciech. This directly affects the expense of financing new investments and managing working capital. Higher interest payments can reduce net income and make expansion plans, such as new plant construction or acquisitions, more financially challenging, impacting the company's overall financial leverage.

- Impact on Operational Costs: Inflation directly increases expenses for raw materials and energy, crucial for chemical production.

- Consumer Demand Sensitivity: Higher inflation can reduce consumer spending, negatively impacting demand for Ciech's products in sectors like construction and agriculture.

- Increased Borrowing Costs: Rising interest rates, a trend observed in 2023-2024, make debt financing more expensive for Ciech's investments and working capital.

- Financial Leverage and Expansion: Higher interest expenses can limit Ciech's ability to take on new debt for strategic growth initiatives.

Competition and Market Dynamics

The chemical industry in Europe and globally is characterized by intense competition, with established players and new entrants constantly vying for market share. Ciech faces significant pricing pressures from competitors, particularly those in regions with lower production costs. The emergence of innovative alternative products also poses a challenge, potentially disrupting traditional markets and impacting Ciech's pricing power.

Maintaining market share and pricing power is fundamental to Ciech's economic health. For instance, in the soda ash market, a key segment for Ciech, global production capacity has been increasing, leading to more competitive pricing. In 2024, several new soda ash production facilities, particularly in North America and Asia, came online, adding to global supply and intensifying price competition in export markets that Ciech serves.

- Intense competition in European and global chemical markets.

- Pricing pressures from established competitors and new entrants.

- Emergence of alternative products impacting market share and pricing power.

- Increased global soda ash production capacity in 2024 adding to supply and price competition.

Global economic conditions directly influence demand for Ciech's chemical products. A slowdown in key markets, such as the EU, can reduce industrial activity, leading to lower consumption of chemicals used in construction and manufacturing. While global growth is projected for 2024, persistent inflation and interest rate hikes in major economies continue to pose risks to industrial investment and consumer spending, impacting sectors Ciech serves.

Ciech's profitability is significantly impacted by volatile energy and raw material prices, with natural gas and electricity costs being substantial operational expenses. For example, in 2023, energy prices saw considerable swings, a trend anticipated to continue into 2024 and 2025, directly affecting Ciech's cost structure. Similarly, the prices of essential raw materials like salt and limestone are critical; any upward movement can squeeze profit margins if not fully passed on to customers.

Exchange rate fluctuations, particularly involving the Euro and Polish Zloty, directly affect Ciech's financial performance. A stronger Euro in 2023, for instance, generally benefited Ciech's export revenues. Conversely, a weaker Zloty increases the cost of imported raw materials and energy, potentially impacting profit margins if these increased costs cannot be effectively transferred to consumers.

Full Version Awaits

Ciech PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ciech PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a thorough understanding of the external forces shaping Ciech's strategic landscape.

Sociological factors

Consumer preferences are increasingly shifting towards sustainable and environmentally friendly products. This trend directly impacts Ciech, pushing the company to adapt its product development and marketing to meet this growing demand. For instance, the European Union's Green Deal initiatives are driving significant changes in industrial practices, making eco-conscious production a necessity rather than an option.

Companies like Ciech face heightened scrutiny regarding their environmental footprint and ethical production standards. Consumers and investors alike are demanding transparency and accountability for a company's impact on the planet. This societal pressure means that robust sustainability reporting and demonstrable progress in reducing environmental impact are becoming crucial for maintaining brand reputation and market access.

Demographic shifts, including an aging workforce in many developed European markets where Ciech operates, present a dual challenge: a potential shortage of experienced personnel and the need to attract younger talent. For instance, in Poland, the proportion of the population aged 65 and over is projected to increase significantly in the coming years, impacting the pool of available workers. Ciech must focus on knowledge transfer and upskilling to maintain operational efficiency.

The availability of skilled labor, particularly in specialized chemical engineering and production roles, is critical for Ciech's innovation capacity. A report from the European Chemical Industry Council (CEFIC) highlighted a growing demand for digitally skilled workers within the sector. Attracting and retaining this talent requires competitive compensation, robust training programs, and a forward-looking company culture that embraces new technologies.

Societal expectations for robust health and safety in chemical production are paramount, directly impacting Ciech's operational license and public trust. In 2023, the European Chemical Industry Council (Cefic) reported a 2% decrease in workplace accidents across the sector, highlighting a continued focus on safety improvements, a trend Ciech must align with to maintain its reputation and avoid costly incidents.

Public perception of chemical companies is heavily influenced by their safety records and environmental stewardship. A strong commitment to health and safety not only ensures regulatory compliance but also fosters a positive corporate image, which is vital for attracting talent and maintaining community relations. For instance, incidents like the 2024 chemical spill in Germany, which led to significant environmental damage and public outcry, underscore the severe reputational and financial consequences of safety failures.

Corporate Social Responsibility (CSR) Expectations

Ciech faces growing expectations regarding its Corporate Social Responsibility (CSR) efforts. Stakeholders, including customers, employees, and investors, increasingly value ethical sourcing, meaningful community engagement, and clear, transparent reporting on environmental and social impacts. For instance, in 2023, the chemical industry globally saw a significant uptick in consumer demand for sustainably produced goods, with reports indicating over 60% of consumers are willing to pay more for products from environmentally responsible companies.

Strong CSR performance can directly bolster Ciech's reputation and strengthen relationships with all its stakeholders. Companies demonstrating robust social and environmental commitments often experience enhanced brand loyalty. Furthermore, this focus attracts a growing segment of socially conscious investors who prioritize Environmental, Social, and Governance (ESG) criteria in their investment decisions. For example, the European Union's Sustainable Finance Disclosure Regulation (SFDR) has amplified the need for clear ESG reporting, influencing investment flows towards companies with strong CSR profiles.

- Ethical Sourcing: Ensuring raw materials are obtained responsibly and without exploitation.

- Community Engagement: Investing in and supporting the local communities where Ciech operates.

- Transparent Reporting: Openly communicating CSR performance and progress to the public.

- Attracting ESG Investors: Appealing to investment funds that prioritize sustainability and ethical practices.

Urbanization and Infrastructure Development

Global urbanization continues to fuel demand for chemicals essential in construction and infrastructure projects. As cities expand, the need for materials like soda ash, used in glass for windows and concrete additives, increases. For instance, the global construction market was valued at approximately $10.7 trillion in 2023 and is projected to reach $17.5 trillion by 2030, presenting a significant opportunity for chemical suppliers like Ciech.

The ongoing development of water treatment facilities worldwide also directly benefits chemical manufacturers. Chemicals are vital for purifying water for both industrial and residential use, a growing concern with increasing population density. By 2050, it's estimated that 68% of the world's population will live in urban areas, underscoring the long-term demand for these essential chemical applications.

- Growing urban populations necessitate increased construction, driving demand for soda ash in glass and building materials.

- Infrastructure development, including water treatment, relies heavily on chemicals, creating a steady market for producers.

- The projected growth of the global construction market to $17.5 trillion by 2030 highlights the economic significance of urbanization for the chemical sector.

- By 2050, with 68% of the global population expected to reside in urban centers, the demand for chemicals supporting urban living will intensify.

Societal expectations for chemical companies are evolving, with a strong emphasis on sustainability and ethical practices, influencing consumer choices and investor decisions. For example, in 2023, over 60% of consumers expressed willingness to pay more for environmentally responsible products, a trend that directly impacts Ciech's market positioning and product development strategies.

The demand for transparency in Corporate Social Responsibility (CSR) is growing, pushing companies like Ciech to clearly communicate their environmental and social impacts. This aligns with regulations like the EU's Sustainable Finance Disclosure Regulation (SFDR), which guides investment towards firms with strong ESG profiles, impacting capital access and company valuation.

Demographic shifts, particularly an aging workforce in Europe, present challenges for Ciech in securing skilled labor, necessitating robust knowledge transfer and talent attraction strategies. Poland's projected increase in its elderly population by 2030 highlights the need for proactive human resource planning to maintain operational continuity and innovation.

Public perception of chemical firms is increasingly tied to their safety records and environmental stewardship, making a strong commitment to health and safety crucial for maintaining public trust and operational licenses. The European Chemical Industry Council reported a 2% decrease in sector accidents in 2023, underscoring the industry's focus on safety improvements that Ciech must mirror.

Technological factors

Ciech continually faces the imperative to innovate its chemical production processes. This drive is essential for boosting efficiency, cutting operational costs, and elevating product quality, crucial for maintaining competitiveness in the global chemical market. For instance, the chemical industry saw a significant uptick in investment in advanced manufacturing technologies in 2024, with automation and AI integration becoming key priorities for efficiency gains.

Embracing advancements in automation and digitalization offers Ciech substantial opportunities. These technologies can streamline complex chemical reactions, improve process control, and reduce the likelihood of human error. Furthermore, the adoption of energy-efficient manufacturing techniques, such as those utilizing renewable energy sources or optimizing heat recovery, is becoming increasingly vital, especially with rising energy prices and environmental regulations.

Ciech is actively investing in research and development to create innovative chemical products, with a focus on specialized chemicals and sustainable solutions. This strategic approach aims to meet the dynamic demands of the market and stringent regulatory landscapes.

In 2023, Ciech Group's R&D expenditures reached PLN 47.9 million, a significant increase from PLN 34.4 million in 2022, highlighting their commitment to technological advancement. This investment is crucial for developing new materials and applications, such as advanced soda ash or innovative agrochemical formulations, which are key to their long-term growth strategy.

Ciech is increasingly integrating digital transformation and Industry 4.0 principles into its operations. The company is exploring the adoption of technologies like artificial intelligence for process optimization, big data analytics to understand market trends, and the Internet of Things (IoT) for enhanced monitoring of its production facilities.

These advancements are crucial for improving efficiency. For instance, implementing AI in production planning can lead to better resource allocation, while IoT sensors can enable predictive maintenance, reducing downtime and associated costs. In 2024, many chemical industry players reported significant efficiency gains from such digital initiatives, with some seeing operational cost reductions of up to 15%.

Emergence of Green Chemistry Technologies

The chemical industry is increasingly embracing green chemistry, focusing on reducing environmental impact through innovative technologies. This shift is driven by regulatory pressures and growing consumer demand for sustainable products. For instance, the global green chemistry market was valued at approximately $10.5 billion in 2023 and is projected to grow significantly, reaching an estimated $27.3 billion by 2030, with a compound annual growth rate of around 14.6%.

These advancements include:

- Renewable Feedstocks: Utilizing biomass and agricultural waste as alternatives to fossil fuels in chemical production.

- Waste Minimization: Implementing processes that generate less hazardous waste, such as catalytic converters and efficient reaction pathways.

- Biodegradable Products: Developing chemicals and materials that naturally decompose, reducing long-term environmental persistence.

- Energy Efficiency: Optimizing chemical processes to consume less energy, often through lower-temperature reactions or improved process design.

Ciech, as a major chemical producer, is strategically positioned to leverage these green chemistry advancements to meet its sustainability targets and enhance its competitive edge in a market increasingly prioritizing eco-friendly solutions.

Automation and Advanced Manufacturing

Ciech is increasingly leveraging automation and advanced manufacturing to boost efficiency. These technologies enhance productivity and precision, which is vital for a chemical producer like Ciech. By reducing manual labor and minimizing errors, the company can achieve better capacity utilization and potentially lower operational costs.

The adoption of Industry 4.0 principles, including robotics and AI-driven process optimization, is a key focus. For instance, by 2024, many industrial sectors reported significant gains in output per worker due to automation. Ciech's investment in modernizing its production lines aims to mirror these industry-wide improvements, ensuring competitiveness in a global market.

- Enhanced Productivity: Automation allows for continuous operation and faster processing times, directly impacting output volume.

- Improved Precision and Quality: Automated systems reduce human variability, leading to more consistent product quality and fewer defects.

- Safety Gains: Automating hazardous tasks protects employees and reduces workplace accidents.

- Cost Efficiencies: Lower labor costs and reduced waste contribute to a healthier bottom line.

Technological advancements are reshaping the chemical industry, pushing companies like Ciech towards greater efficiency and sustainability. Investments in automation, AI, and digital transformation are becoming standard practice, with the sector seeing significant gains in productivity and cost reduction. For example, the chemical industry's adoption of advanced manufacturing technologies in 2024 focused heavily on AI and automation for these very reasons.

Ciech's commitment to innovation is evident in its R&D spending, which rose to PLN 47.9 million in 2023, up from PLN 34.4 million in 2022. This investment fuels the development of new products and processes, including a growing emphasis on green chemistry. The global green chemistry market's projected growth to $27.3 billion by 2030, with a 14.6% CAGR, underscores the market's shift towards eco-friendly solutions.

The integration of Industry 4.0 principles, such as robotics and AI for process optimization, is crucial for Ciech to maintain its competitive edge. By embracing these technologies, the company aims to enhance productivity, improve product quality, and ensure greater operational safety. Many industrial sectors in 2024 reported efficiency improvements of up to 15% from similar digital initiatives.

Ciech is actively exploring technologies like AI for process optimization and IoT for enhanced production monitoring, aligning with industry trends. These digital initiatives are vital for achieving better resource allocation and enabling predictive maintenance, ultimately reducing downtime and operational costs.

Legal factors

Ciech operates within a stringent environmental regulatory landscape, particularly concerning emissions and waste management. For instance, the EU’s Emissions Trading System (ETS) sets caps on greenhouse gas emissions, impacting energy-intensive industries like chemical manufacturing. Compliance with these evolving standards, including chemical registration under REACH, necessitates substantial investment in cleaner technologies and operational adjustments.

Chemical manufacturing, like Ciech's operations, is subject to rigorous occupational health and safety legislation. These laws are designed to prevent workplace accidents and protect employees, a critical aspect for any company in this sector. Failure to comply can lead to severe consequences, including significant financial penalties and even temporary or permanent closure of facilities, directly affecting a company's ability to conduct business.

In 2024, for instance, the European Agency for Safety and Health at Work (EU-OSHA) reported that despite progress, the chemical industry still faces challenges in maintaining zero-accident rates. Regulations often mandate specific safety protocols, personal protective equipment (PPE) standards, and regular safety training, all of which represent ongoing operational costs and require diligent management by companies like Ciech to ensure continued operation and avoid costly disruptions.

Product liability and consumer protection laws significantly shape Ciech's operations. In 2024, the European Union continued to strengthen its consumer protection framework, with directives focusing on product safety and transparency in chemical labeling. Failure to adhere to these regulations, such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), can result in substantial fines and reputational damage. Ensuring all chemical products meet rigorous quality standards and clear labeling requirements is paramount to avoiding costly litigation and preserving customer confidence.

Competition Law and Anti-Trust Regulations

Competition laws and anti-trust regulations significantly shape Ciech's operational landscape, particularly concerning pricing, M&A, and strategic alliances. These regulations aim to foster a fair market by prohibiting monopolistic practices and ensuring a level playing field for all participants. For instance, the European Commission's scrutiny of the chemicals sector, including potential cartel investigations, underscores the importance of strict adherence. Failure to comply can result in substantial fines, impacting profitability and market reputation.

Key implications for Ciech include:

- Pricing Strategies: Adherence to anti-trust laws prevents price-fixing and predatory pricing, ensuring competitive and fair market pricing for Ciech's products like soda ash and agrochemicals.

- Mergers and Acquisitions: Any proposed mergers or acquisitions by Ciech must undergo rigorous review by competition authorities to prevent undue market concentration. For example, in 2023, the European Union reviewed several large chemical industry mergers, setting precedents for future transactions.

- Collaborations and Joint Ventures: Ciech's participation in industry collaborations or joint ventures is subject to anti-trust oversight to ensure they do not stifle competition or lead to market manipulation.

- Market Dominance: Regulations are in place to prevent any single entity, including Ciech if it were to gain significant market share, from abusing a dominant position to the detriment of consumers and smaller competitors.

International Trade Laws and Sanctions

Ciech's global operations are significantly shaped by international trade laws, including tariffs and import/export regulations. For instance, in 2023, the European Union, a key market for Ciech, continued to adjust trade policies, impacting the cost of raw materials and finished goods. Navigating these evolving legal landscapes is crucial for maintaining market access and ensuring smooth supply chain operations.

Sanctions and export controls, particularly those imposed by major economic blocs like the US and EU, present substantial legal challenges. These restrictions can directly affect Ciech's ability to trade with certain countries or source specific technologies. For example, ongoing geopolitical tensions in 2024 continue to necessitate careful monitoring of sanctions lists to avoid non-compliance, which could lead to severe penalties and operational disruptions.

The company must stay abreast of changes in customs duties and trade agreements, as these directly influence its competitive pricing and profitability in international markets. As of early 2024, discussions around potential new trade barriers or preferential agreements continue to create an environment of legal uncertainty for businesses like Ciech.

Key legal considerations for Ciech include:

- Compliance with EU and international sanctions regimes.

- Adherence to import/export controls for chemical products.

- Understanding and adapting to evolving trade tariffs and agreements.

- Managing legal risks associated with cross-border supply chains.

Ciech must navigate a complex web of environmental regulations, from the EU’s Emissions Trading System impacting its carbon footprint to stringent chemical registration requirements like REACH. These legal frameworks demand continuous investment in sustainable technologies and operational adjustments to maintain compliance and avoid penalties.

Occupational health and safety laws are paramount, dictating safety protocols and employee protection measures within Ciech's facilities. Adherence is critical to prevent accidents, which could lead to severe financial penalties and operational shutdowns, as highlighted by ongoing safety challenges in the chemical sector reported by EU-OSHA in 2024.

Product liability and consumer protection laws, including those related to chemical labeling and safety under REACH, significantly influence Ciech's market practices. Non-compliance can result in substantial fines and reputational damage, underscoring the need for rigorous quality control and transparent product information.

Competition and anti-trust regulations are vital for Ciech's pricing, M&A, and collaboration strategies, preventing market manipulation and ensuring fair competition. The European Commission's active scrutiny of the chemical industry in 2023 and 2024 serves as a reminder of the importance of adhering to these rules.

Environmental factors

Ciech faces increasing pressure to curb its greenhouse gas emissions and shrink its carbon footprint. This is largely due to stringent regulatory targets, such as those within the EU Emissions Trading System (ETS), and growing demands from stakeholders who prioritize sustainability. For instance, in 2023, the EU ETS saw carbon prices averaging around €90 per tonne, directly impacting companies like Ciech that operate within its scope.

To meet these environmental challenges, Ciech is actively investing in several key areas. These include enhancing energy efficiency across its operations, transitioning towards renewable energy sources to power its facilities, and exploring the implementation of carbon capture technologies. Such strategic investments are crucial for navigating the evolving regulatory landscape and meeting stakeholder expectations for a reduced environmental impact.

Resource scarcity, especially concerning water, presents a significant environmental challenge for chemical manufacturers like Ciech. Water is fundamental to many chemical processes, from cooling to ingredient sourcing.

In 2023, the chemical industry globally faced increasing scrutiny over its water footprint, with many regions experiencing heightened water stress. Ciech's commitment to sustainable water management, including advanced recycling technologies and optimizing water usage in its production facilities, is therefore paramount for ensuring operational resilience and minimizing environmental impact.

The global push to reduce waste and embrace circular economy models is a significant environmental factor. Companies like Ciech are increasingly expected to minimize landfill reliance by recycling by-products and developing closed-loop systems. This not only addresses environmental concerns but also unlocks new revenue streams from previously discarded materials.

Biodiversity Loss and Ecosystem Protection

Ciech, as a major player in the chemical industry, faces significant environmental scrutiny regarding its impact on biodiversity and local ecosystems. Industrial operations, particularly those involving chemical production, carry inherent risks of pollution and land use changes that can disrupt natural habitats. For instance, the chemical sector globally contributes to water and air pollution, which directly affects plant and animal life. In 2023, the European Environment Agency reported that a significant percentage of European rivers were still not in good ecological status, partly due to industrial discharges.

The company's commitment to mitigating these impacts is crucial for its long-term sustainability and social license to operate. Responsible land management practices, such as habitat restoration and minimizing land footprint, are key. Furthermore, robust pollution control measures, including advanced wastewater treatment and emission reduction technologies, are essential to protect surrounding biodiversity. Ciech's sustainability reports often highlight investments in environmental protection technologies, aiming to reduce their ecological footprint.

- Industrial operations inherently pose risks to biodiversity through potential pollution and land use.

- Ciech's proactive approach to responsible land management and pollution control is vital for ecosystem protection.

- The chemical industry's environmental performance is under increasing pressure, with regulatory bodies and stakeholders demanding greater accountability.

- Global initiatives focused on biodiversity conservation are likely to influence operational standards and reporting requirements for companies like Ciech.

Pollution Control and Emission Standards

Ciech faces significant environmental pressures related to pollution control and emission standards. Chemical production inherently generates byproducts that require careful management to prevent harm to air and water quality. The company must continually invest in advanced technologies to meet increasingly stringent regulations, a process that represents both a substantial operational cost and a critical factor in maintaining its license to operate.

Meeting evolving emission standards is a significant environmental and operational challenge for Ciech. For instance, the European Union's Industrial Emissions Directive (IED) sets benchmarks for pollution from large industrial installations, including chemical plants. Companies like Ciech must adhere to these regulations, which often necessitate upgrades to production processes and abatement equipment. In 2023, the chemical industry in Poland, where Ciech operates extensively, continued to focus on reducing its environmental footprint, with investments in cleaner technologies being a key priority for many players.

- Stringent EU and national regulations mandate strict limits on air and water pollutants from chemical manufacturing.

- Continuous investment in advanced pollution abatement technologies is essential for compliance and operational sustainability. For example, upgrades to flue gas desulfurization or wastewater treatment facilities are common requirements.

- Evolving emission standards pose an ongoing challenge, requiring proactive adaptation and significant capital expenditure to maintain compliance and minimize environmental impact.

- The chemical sector's commitment to sustainability, as highlighted in industry reports from 2024, emphasizes the growing importance of environmental performance as a competitive differentiator.

Environmental factors significantly shape Ciech's operational landscape, demanding a proactive approach to sustainability. The company faces mounting pressure to reduce greenhouse gas emissions, with EU ETS carbon prices averaging around €90 per tonne in 2023, directly impacting its operational costs. Water scarcity is another critical concern, as the chemical industry globally grapples with its water footprint, underscoring the need for efficient water management and recycling technologies.

Circular economy principles are increasingly influencing the chemical sector, pushing companies like Ciech to minimize waste and explore by-product recycling. Furthermore, the impact on biodiversity and ecosystems is under scrutiny, with European rivers in 2023 still showing significant percentages not in good ecological status due to industrial discharges, necessitating robust pollution control and responsible land management.

| Environmental Factor | Impact on Ciech | 2023/2024 Data/Trend |

|---|---|---|

| Greenhouse Gas Emissions | Increased operational costs due to carbon pricing; need for emission reduction strategies. | EU ETS carbon prices ~€90/tonne in 2023. |

| Water Scarcity | Operational risks; need for efficient water usage and recycling. | Heightened water stress in many regions impacting chemical industry operations. |

| Circular Economy | Opportunity to reduce waste, create new revenue streams from by-products. | Growing industry focus on waste minimization and closed-loop systems. |

| Biodiversity & Ecosystems | Reputational risk; need for pollution control and responsible land management. | Concerns over industrial discharges affecting water quality; ~X% of European rivers not in good ecological status (2023 data). |

PESTLE Analysis Data Sources

Our PESTLE analysis for Ciech is built upon a robust foundation of data from official government publications, leading economic institutions like the IMF and World Bank, and reputable industry-specific market research reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.