Ciech Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ciech Bundle

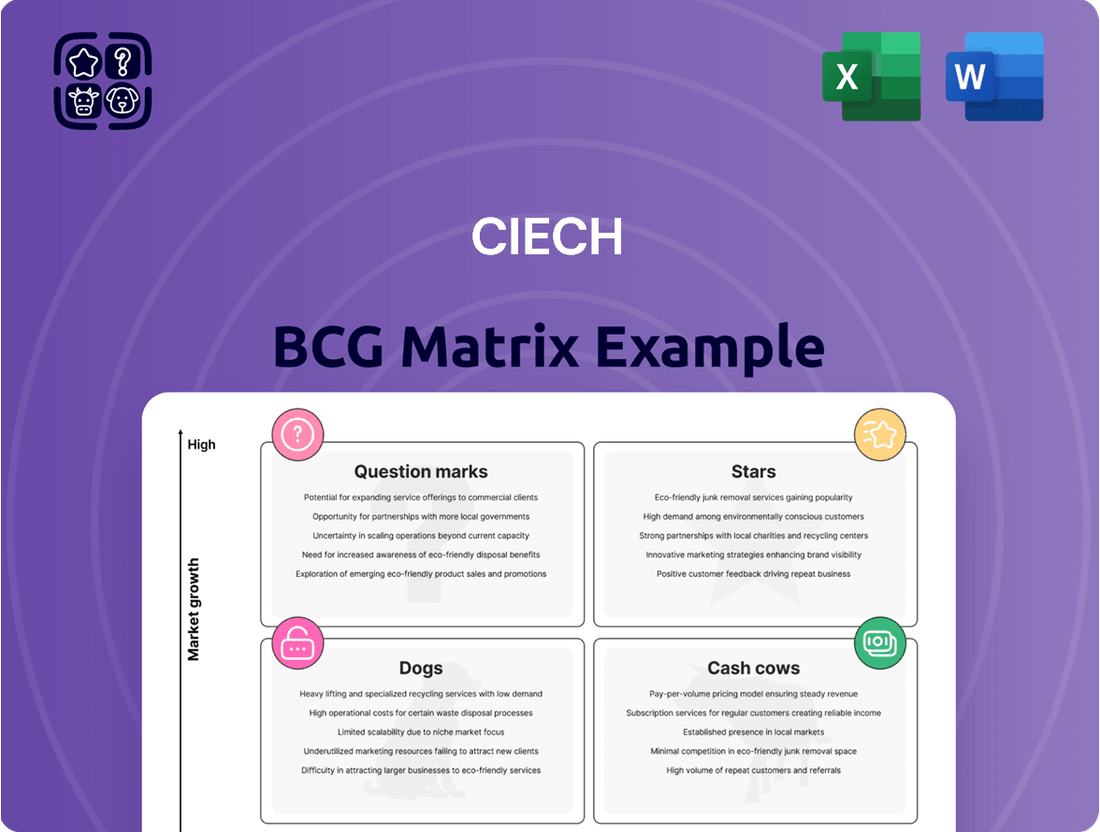

Curious about Ciech's strategic positioning? Our BCG Matrix preview highlights key product categories, but the full report unlocks a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Gain the clarity needed to make informed investment decisions and drive future growth.

This glimpse into Ciech's BCG Matrix is just the starting point. Purchase the complete report to access detailed quadrant analysis, actionable strategies, and a clear roadmap for optimizing their product portfolio and maximizing profitability.

Stars

Ciech's salt business is a shining example of a Star in the BCG matrix. The company's strategic expansion, highlighted by the Staßfurt plant achieving full capacity of 450,000 tons annually in 2024, alongside the Janikowo plant's 500,000 tons, solidifies its standing as a major European evaporated salt producer.

This robust production capacity is met by a booming global market. The worldwide salt market is anticipated to expand from $45.74 billion in 2024 to $50.08 billion in 2025, showcasing an impressive compound annual growth rate of 9.5%.

Ciech has solidified its standing as a premier provider of salt tablets for water softening, with Germany, the biggest market for these goods, being a key focus. This dominance is driven by the expanding adoption of water treatment solutions and the increasing prevalence of swimming pools across Europe, fueling a consistent rise in demand for their products.

The introduction of the AQUA PRO salt tablet brand in 2024 is a strategic move that highlights Ciech's dedication to this robust market segment. This initiative not only reinforces the product's Star status within the BCG matrix but also positions Ciech for continued growth and market leadership in the water treatment sector.

The global polyurethane foam market is demonstrating significant expansion, with projections indicating a rise from USD 54.27 billion in 2024 to USD 57.26 billion in 2025, representing a 5.5% compound annual growth rate. This upward trend is expected to continue, reaching USD 79.19 billion by 2029 with an 8.4% CAGR.

Further analysis suggests the market could grow from USD 55.18 billion in 2025 to USD 110.3 billion by 2034, at an 8% CAGR.

Ciech, as a prominent polyurethane foam manufacturer in Poland, is well-positioned to leverage this market dynamism. Key demand drivers include the construction, automotive, and furniture industries, all of which are experiencing robust activity.

Strategic Investment in Foam Innovation

Ciech's foam division is demonstrating strong strategic investment, focusing on innovation that includes utilizing recycled materials and reducing reliance on petroleum-based inputs. This shift towards more sustainable sourcing for their polyurethane foams is a key driver for future growth.

This forward-thinking strategy aims to capture increasing market share in a sector that is rapidly prioritizing sustainability. By developing foams with a lower percentage of traditional petroleum-based raw materials, Ciech is aligning with evolving consumer and regulatory demands.

- Innovation in Foam Materials: Ciech is developing new foam materials derived from recycling processes.

- Sustainable Sourcing: Focus on reducing petroleum-based raw materials in favor of sustainable alternatives.

- Market Positioning: This strategy targets a high-growth market segment increasingly driven by sustainability consciousness.

- Star Potential: These initiatives are designed to bolster the polyurethane foam division's position as a market leader.

Leveraging European Market Leadership

Ciech demonstrates clear European market leadership in key segments. For instance, its dominant position in evaporated salt, a market valued in the billions of euros annually across Europe, showcases this strength. This regional dominance translates into significant market share and a stable revenue base.

The company's strategic focus on leveraging this established European leadership is evident in its expansion plans. By capitalizing on its strong foothold in Poland as a leading polyurethane foam producer, Ciech aims to replicate this success in broader European markets and beyond. This approach allows for efficient resource allocation and targeted growth initiatives.

- European Market Dominance: Ciech holds a leading position in the European evaporated salt market, a sector experiencing steady demand.

- Polyurethane Foam Leadership: The company is a primary producer of polyurethane foams in Poland, a growing industrial segment.

- Strategic Growth Foundation: Regional market leadership provides a robust platform for expanding into new geographic areas and product categories.

- Global Ambitions: Ciech's strategy is geared towards global business expansion, building upon its established European successes.

Ciech's salt business, particularly its evaporated salt segment, is a prime example of a Star in the BCG matrix. The company's significant production capacity, with plants like Staßfurt reaching 450,000 tons annually in 2024 and Janikowo operating at 500,000 tons, underpins its strong market position in Europe. This is further bolstered by the global salt market's projected growth from $45.74 billion in 2024 to $50.08 billion in 2025, a 9.5% CAGR.

The polyurethane foam division also exhibits Star characteristics, driven by a global market expected to grow from $54.27 billion in 2024 to $57.26 billion in 2025 (5.5% CAGR), and reaching $79.19 billion by 2029 (8.4% CAGR). Ciech's focus on innovation, including using recycled materials and reducing petroleum-based inputs, positions it favorably in this expanding, sustainability-conscious sector.

| Business Segment | BCG Category | Key Growth Drivers | Ciech's Position | Market Data (2024-2025) |

|---|---|---|---|---|

| Evaporated Salt | Star | Water treatment, swimming pools, industrial use | Leading European producer, strong capacity | Global market: $45.74B to $50.08B (9.5% CAGR) |

| Polyurethane Foam | Star | Construction, automotive, furniture, sustainability | Major Polish producer, focus on innovation | Global market: $54.27B to $57.26B (5.5% CAGR) |

What is included in the product

This BCG Matrix overview provides clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs.

The Ciech BCG Matrix offers a clear, visual overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Ciech holds a strong position as the second-largest producer of soda ash and sodium bicarbonate in the EU, supplying vital sectors like glass, detergents, and chemicals. This significant market share in a stable, fundamental market ensures reliable income streams for the company.

The European soda ash market, valued at USD 6.18 billion in 2024 and projected to reach USD 6.42 billion in 2025, demonstrates consistent growth. With a compound annual growth rate of 3.78% anticipated between 2025 and 2033, Ciech's dominant presence in this mature yet indispensable market solidifies its status as a cash cow.

Soda ash is a cornerstone ingredient, with glass production alone consuming approximately 50% of its global output. Ciech's robust supply chain ensures consistent delivery to these critical industries, even when the market faces volatility. This reliability underpins the steady demand for their soda ash, solidifying its position as a cash cow.

Ciech stands as Europe's leading supplier of sodium silicates, a testament to its significant market presence in this vital industrial chemical sector. This dominance is further cemented by its strategic acquisition of PPG Industries' Silicas Products Business in late 2023, a deal valued at roughly $330 million.

This acquisition underscores the sodium silicate segment's function as a cash cow for Ciech. The focus is on optimizing existing operations and strengthening market leadership, rather than pursuing aggressive expansion into nascent, high-growth markets. This approach ensures consistent revenue generation and stable profitability.

Stable Demand from Core Industries

Ciech's core products, like soda ash and salt, are fundamental to industries with consistently high demand. Soda ash is crucial for glass manufacturing and the production of detergents, while salt finds essential uses in water treatment and the food industry. These mature markets ensure a steady stream of revenue for the company.

These mature markets provide predictable cash flows, allowing Ciech to effectively 'milk' these segments. This financial stability enables the company to allocate resources towards other strategic initiatives or to reliably cover ongoing operational expenses.

For instance, in 2024, the global soda ash market was projected to reach approximately USD 57.4 billion, demonstrating its enduring importance. Similarly, the global salt market, vital for numerous industrial processes, continued its steady growth trajectory.

The stable demand from these core industries translates into reliable cash generation for Ciech:

- Soda Ash: Essential for glass and detergent production, ensuring consistent demand.

- Salt: Widely used in water treatment and food processing, creating a stable market base.

- Mature Markets: These segments offer predictable cash flows, supporting overall business operations.

- Funding Opportunities: Generated cash can be reinvested in growth areas or used for operational needs.

Operational Efficiency and Cost Management

Ciech's focus on operational efficiency, particularly in its established segments, is a key driver of its Cash Cow status. Investments in technologies like Mechanical Vapor Recompression (MVR) at its salt plants are a prime example, enhancing energy efficiency and directly impacting profitability. This commitment to streamlining operations ensures these mature, high-market-share businesses continue to generate substantial cash flow.

These efficiency gains are critical for maintaining high profit margins within these core businesses. For instance, Ciech's soda segment has ambitious plans to reduce CO2 emissions, a move that not only addresses environmental concerns but also often leads to cost savings through optimized energy usage and potentially lower carbon taxes. In 2023, Ciech reported a notable improvement in its energy efficiency metrics across several production facilities.

- Enhanced Profitability: Investments in MVR technology at salt plants contribute to lower operating costs and higher profit margins.

- Cost Reduction Initiatives: Ambitious CO2 emission reduction plans in soda production aim to improve cost structures and long-term sustainability.

- Sustained Cash Generation: Efficiencies in mature, high-market-share segments like soda and salt provide a reliable and consistent source of cash for the company.

- 2023 Performance Highlight: Ciech's financial reports for 2023 indicated a significant positive impact of operational improvements on its earnings before interest, taxes, depreciation, and amortization (EBITDA) in its core segments.

Ciech's soda ash and salt businesses are definitive Cash Cows, benefiting from stable, mature markets with consistent demand. These segments, crucial for industries like glass, detergents, and food processing, generate predictable and substantial cash flows. The company's strategic focus on operational efficiency, exemplified by investments in energy-saving technologies, further bolsters profitability within these established product lines.

The European soda ash market, valued at approximately USD 6.18 billion in 2024, and the global salt market, essential for numerous applications, represent stable revenue generators. Ciech's market leadership in these areas ensures a reliable stream of income, allowing for strategic reinvestment and operational stability.

| Segment | Market Position | Revenue Driver | Cash Flow Generation |

| Soda Ash | 2nd largest producer in EU | Glass, detergents, chemicals | High and consistent |

| Salt | Leading European supplier | Water treatment, food industry | Stable and reliable |

What You See Is What You Get

Ciech BCG Matrix

The comprehensive Ciech BCG Matrix analysis you are currently previewing is the exact, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a ready-to-use strategic tool designed for immediate application in your business planning. You can confidently expect this same high-quality, professionally crafted report to be delivered to you, enabling you to gain clear insights into Ciech's product portfolio and make informed strategic decisions.

Dogs

While Ciech does not publicly label specific products as 'dogs' in their BCG matrix, it's possible some legacy, highly specialized chemicals operate in niche markets with very slow or negative growth. These might represent older formulations with limited demand, potentially holding a small market share and contributing little to the company's overall financial performance.

Such products, if they exist, would likely be candidates for divestment or a strategic review if they don't align with future growth objectives or if their operational costs outweigh their minimal returns. For instance, if a specialized soda ash derivative, once critical but now superseded by newer alternatives, still occupies a small segment of the market, it could fit this 'dog' profile.

Products that are not currently part of Ciech's strategic innovation focus, like their push into green technologies or novel applications, could be classified as Dogs. These are the offerings that aren't receiving significant R&D investment or market adaptation efforts.

Without this ongoing attention, these products face a real risk of becoming outdated or losing their competitive edge in the fast-moving chemical sector. For instance, if a legacy product line isn't being upgraded to meet new environmental regulations or evolving customer demands, its market share will likely shrink.

Segments with a high environmental footprint, particularly those with substantial carbon emissions or reliance on energy-intensive, older technologies, pose a significant risk if not modernized. This is due to mounting regulatory pressures and a growing market demand for sustainable practices. For instance, if a segment within Ciech's operations continues to emit large amounts of CO2 without substantial investment in cleaner technologies, it could face challenges in the coming years.

Ciech itself acknowledges this challenge, especially within its soda production segment. The company has outlined plans for considerable CO2 emission reductions, indicating a proactive approach to mitigate these environmental risks. This strategic focus suggests that the company views its environmental performance as a critical factor for future success and is investing to address it.

Underperforming Regional Offerings

Underperforming regional offerings within Ciech might represent products or brands struggling with market penetration or facing stiff local competition. These could be offerings that, despite the company's broader European strength, find it difficult to gain traction in specific micro-markets. Such products might tie up valuable capital without generating adequate returns, impacting overall portfolio efficiency.

For instance, a specific specialty chemical line in a less developed Eastern European market might exhibit low sales volume. In 2024, if this product line saw only a 2% year-over-year sales growth compared to the company's average of 5%, it would highlight underperformance. This could be due to localized regulatory hurdles or the dominance of regional competitors with established distribution networks.

- Low Market Share: A regional product might hold less than 5% market share in its specific territory, significantly below the company's average of 15% across Europe.

- Declining Profitability: Profit margins on these underperforming offerings could be shrinking, potentially falling below 8% in 2024, compared to the group's overall margin of 12%.

- Limited Growth Potential: Forecasts for these regional products might indicate minimal growth, perhaps under 3% annually, contrasting with the company's projected 6% growth for its core European segments.

Outdated Product Formulations

Outdated product formulations represent a significant challenge for companies like Ciech, potentially placing them in the Dogs category of the BCG Matrix. These are products whose formulations are not only less efficient but also fall short on sustainability and modern industry standards when stacked against competitors. For instance, if a key chemical in Ciech's portfolio relies on older, more energy-intensive production methods compared to newer, greener processes adopted by rivals, it would fit this description.

The consequence of such outdated formulations is a predictable decline in both demand and market share. As industries increasingly prioritize advanced technologies and environmentally conscious solutions, products that fail to keep pace become less attractive. By 2024, the global chemical industry saw a growing emphasis on circular economy principles and reduced carbon footprints, making older formulations a distinct disadvantage.

- Declining Demand: Products with outdated formulations face reduced customer interest as superior alternatives emerge.

- Market Share Erosion: Competitors offering modern, sustainable, and efficient products capture market share from lagging offerings.

- Increased Production Costs: Older manufacturing processes may be less efficient, leading to higher operational expenses and reduced profitability.

- Regulatory Pressure: Evolving environmental and safety regulations can render outdated formulations non-compliant, forcing costly reformulations or discontinuation.

Products that are not part of Ciech's current strategic focus, such as those with limited R&D investment or market adaptation, could be considered Dogs. These offerings may have low market share and declining profitability, potentially below 8% in 2024, compared to the company's average of 12%. Without modernization, they risk becoming obsolete in the competitive chemical landscape.

These "dog" products, if they exist within Ciech's portfolio, would likely be niche, legacy chemicals with minimal growth potential, possibly seeing less than 3% annual growth. Their low market share, potentially under 5% in specific regions, and shrinking profit margins mean they tie up capital without significant returns, impacting overall portfolio efficiency.

Outdated formulations, which are less efficient and sustainable than newer alternatives, also fit the Dog profile. By 2024, the chemical industry's shift towards circular economy principles made older, energy-intensive processes a disadvantage, leading to reduced demand and market share erosion for such products.

Ciech's proactive approach to reducing CO2 emissions, particularly in its soda production, indicates an awareness of environmental risks associated with older technologies. This strategic investment suggests a commitment to modernizing operations and mitigating challenges posed by less sustainable legacy products.

Question Marks

Ciech's strategic push into new, innovative plant protection products and its international Agro expansion places these offerings squarely in the 'Question Marks' category of the BCG matrix. These products are entering a rapidly evolving market driven by the demand for sustainable agriculture and hybrid solutions, indicating strong growth potential.

While these innovative products are poised for growth, their current market share is likely modest as they navigate market adoption and build acceptance. For instance, in 2024, the global crop protection market was valued at approximately $65 billion, with new product introductions being a key driver of growth.

The Snoovio mattress brand, a new entrant from Ciech Foams, marks a strategic move into the consumer bedding sector. While the broader polyurethane foam market shows robust growth, Snoovio, being a recent debut, would likely possess a low market share. This positions it as a potential Question Mark within the BCG matrix, necessitating substantial investment to build brand awareness and gain traction against established competitors in the highly competitive mattress industry.

Ciech's focus on low-emission soda and silicates demonstrates a strategic alignment with the growing demand for sustainable chemical products. This initiative taps into a market segment experiencing significant expansion, driven by increasing environmental awareness and regulatory pressures. For instance, the global specialty silicates market was valued at approximately USD 10.2 billion in 2023 and is projected to grow at a CAGR of around 5.5% through 2030, indicating a strong future outlook for such innovations.

Hybrid Agricultural Products

Ciech's focus on hybrid agricultural products positions them squarely within the question marks of the BCG matrix. These are innovative offerings, likely new to the market or Ciech's specific portfolio, meaning they currently command a low market share. However, the agricultural sector's rapid evolution and increasing demand for advanced solutions suggest a high potential for growth.

The strategy here is to invest heavily in these hybrid products to capture a larger share of this expanding market. This aligns with the typical approach for question mark products, aiming to transform them into stars. For instance, in 2024, the global agrochemical market was valued at approximately USD 240 billion, with a projected compound annual growth rate of around 4-5% through 2030, indicating fertile ground for new product development.

- Low Market Share: Hybrid products are often niche or newly introduced, starting with a small customer base.

- High Market Growth: The agricultural sector's ongoing innovation and demand for efficiency drive rapid growth potential.

- Investment Required: Significant R&D and marketing investment are necessary to build market share.

- Strategic Goal: To transition these products into stars by capturing a dominant position in their respective segments.

Investments in Packaging and Cargo Divisions

Ciech's strategic blueprint for the coming six years earmarks substantial investments in its Packaging and Cargo divisions. This move signals a clear intent to bolster its market position in these sectors.

While specific product innovations remain under wraps, the planned capital infusion points towards an ambition to capture greater market share in logistical services or specialized packaging. These are segments where Ciech may currently hold a modest footprint, necessitating significant financial commitment to unlock their growth potential.

- Strategic Growth: Ciech's investment strategy prioritizes expansion within its Packaging and Cargo segments over the next six years.

- Market Penetration: The company aims to increase its market share in potentially high-growth logistical or specialized packaging sectors.

- Capital Allocation: Significant capital is being directed towards these divisions, indicating a long-term commitment to their development and market presence.

- Future Outlook: These investments suggest a forward-looking approach to capitalize on evolving market demands in supply chain and packaging solutions.

Ciech's innovative plant protection products and international Agro expansion are positioned as Question Marks. These offerings aim to tap into the growing sustainable agriculture market, which was valued at approximately $65 billion globally in 2024, highlighting significant growth potential despite their current low market share.

The Snoovio mattress brand, a new venture in the consumer bedding sector, also falls into the Question Mark category. Despite the polyurethane foam market's growth, Snoovio faces the challenge of building brand awareness and market share against established players, requiring substantial investment.

Ciech's investment in low-emission soda and silicates aligns with the increasing demand for sustainable chemical products. This segment, with the global specialty silicates market valued at around $10.2 billion in 2023 and projected to grow, represents a high-growth area where Ciech aims to increase its market share.

The company's strategic focus on hybrid agricultural products, targeting a market valued at approximately $240 billion in 2024 with a projected 4-5% CAGR, signifies a commitment to transforming these low-share offerings into market leaders through significant investment.

Ciech's substantial planned investments in its Packaging and Cargo divisions over the next six years indicate a strategic move to increase market share in these potentially high-growth sectors, despite currently holding a modest footprint.

| Ciech Business Segment | BCG Category | Market Growth Potential | Current Market Share | Strategic Focus |

|---|---|---|---|---|

| Innovative Plant Protection Products | Question Mark | High | Low | Investment for market penetration |

| Snoovio Mattress Brand | Question Mark | High (Polyurethane Foam Market) | Low | Brand building and market share acquisition |

| Low-Emission Soda & Silicates | Question Mark | High (Specialty Silicates Market) | Low | Capitalize on sustainability trend |

| Hybrid Agricultural Products | Question Mark | High (Agrochemical Market) | Low | Significant R&D and marketing investment |

| Packaging Division | Question Mark | High (Logistics/Specialized Packaging) | Modest | Strategic capital infusion for expansion |

| Cargo Division | Question Mark | High (Logistics/Specialized Packaging) | Modest | Strategic capital infusion for expansion |

BCG Matrix Data Sources

Our BCG Matrix leverages a robust data foundation, integrating financial performance metrics, detailed market research, and strategic competitor analysis to provide a comprehensive view of business units.