Ciech Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ciech Bundle

Curious about how Ciech masterfully navigates the chemical industry? This Business Model Canvas breaks down their core strategies, from customer relationships to revenue streams, offering a clear view of their competitive advantage. Ready to unlock the full picture and apply these insights to your own ventures?

Partnerships

Kulczyk Investments, Ciech's strategic investor, is pivotal in providing essential financial backing and strategic guidance. Following their full acquisition and the delisting from the Warsaw Stock Exchange in March 2024, this partnership is geared towards fostering long-term development and exploring potential acquisitions.

Ciech actively collaborates with startups and technology firms to drive innovation. A prime example is their investment in DePoly, a company focused on advanced plastic recycling, through Ciech Ventures. This partnership directly supports Ciech's commitment to developing sustainable solutions and advancing its environmental, social, and governance (ESG) objectives.

Ciech’s partnerships with energy and infrastructure providers are crucial for its operations and future sustainability. A key example is the agreement with ORLEN Synthos Green Energy to explore the feasibility of constructing small modular reactors (SMRs). This collaboration aims to secure a stable and potentially greener energy supply, addressing the significant energy demands of chemical manufacturing.

This focus on energy supply is particularly important given the chemical industry's energy intensity. By investigating advanced energy solutions like SMRs, Ciech is proactively working towards decarbonization goals and ensuring long-term energy resource security. This strategic approach helps mitigate risks associated with volatile energy markets and supports the company's transition to more sustainable production methods.

Research and Development Institutions

Ciech actively collaborates with research and development institutions to drive innovation and refine its chemical production. This partnership is crucial for developing novel products and making existing processes more efficient, ultimately strengthening its market position.

These collaborations are instrumental in Ciech's strategy to expand its patent portfolio and introduce more sustainable offerings. A key focus area is the development of low-carbon soda and bio-based foams, aligning with global trends towards greener chemistry.

- Innovation Hubs: Partnering with universities and specialized research centers fuels the discovery of new chemical applications and advanced manufacturing techniques.

- Sustainability Focus: R&D efforts are directed towards creating environmentally friendly products, such as bio-based materials and chemicals with reduced carbon footprints.

- Process Optimization: Collaboration aims to enhance production efficiency, reduce waste, and lower energy consumption across Ciech's manufacturing operations.

- Intellectual Property: These partnerships are vital for generating patents, securing Ciech's technological advancements and competitive edge in the chemical industry.

Distribution and Logistics Partners

Ciech relies on a robust network of distribution and logistics partners to manage its extensive global operations, serving over 100 countries. These collaborations are essential for the efficient movement of a wide array of chemical products, ensuring timely delivery to diverse industries worldwide. For instance, in 2024, Ciech continued to leverage specialized logistics providers to navigate complex international shipping regulations and maintain product integrity across continents.

These partnerships are fundamental to Ciech's ability to reach its international customer base effectively. They enable the company to manage the complexities of transporting chemicals, which often require specific handling and storage conditions.

- Global Reach: Facilitating product delivery to over 100 countries across nearly every continent.

- Supply Chain Efficiency: Ensuring timely and secure transportation of diverse chemical products.

- Market Access: Enabling access to various industries and markets through specialized logistics solutions.

- Regulatory Compliance: Navigating complex international shipping and chemical handling regulations.

Ciech's key partnerships are crucial for innovation, sustainability, and market reach. Strategic investor Kulczyk Investments provides vital financial backing and guidance, especially after its full acquisition in March 2024. Collaborations with startups like DePoly, through Ciech Ventures, drive advancements in areas such as plastic recycling, supporting ESG goals.

Energy and infrastructure partnerships, like the one with ORLEN Synthos Green Energy to explore small modular reactors (SMRs), are vital for securing stable and potentially greener energy supplies for its energy-intensive operations. These alliances are key to achieving decarbonization targets and ensuring long-term energy resource security.

Furthermore, partnerships with R&D institutions are instrumental in developing new products and improving production efficiency, leading to a stronger patent portfolio and the introduction of sustainable offerings like bio-based foams. These collaborations bolster Ciech's competitive edge through technological advancement and process optimization.

Ciech's extensive global operations, serving over 100 countries, depend on strong distribution and logistics partnerships. These collaborations ensure the efficient and compliant movement of chemicals worldwide, maintaining product integrity and market access. In 2024, these logistics networks were critical for navigating international shipping complexities.

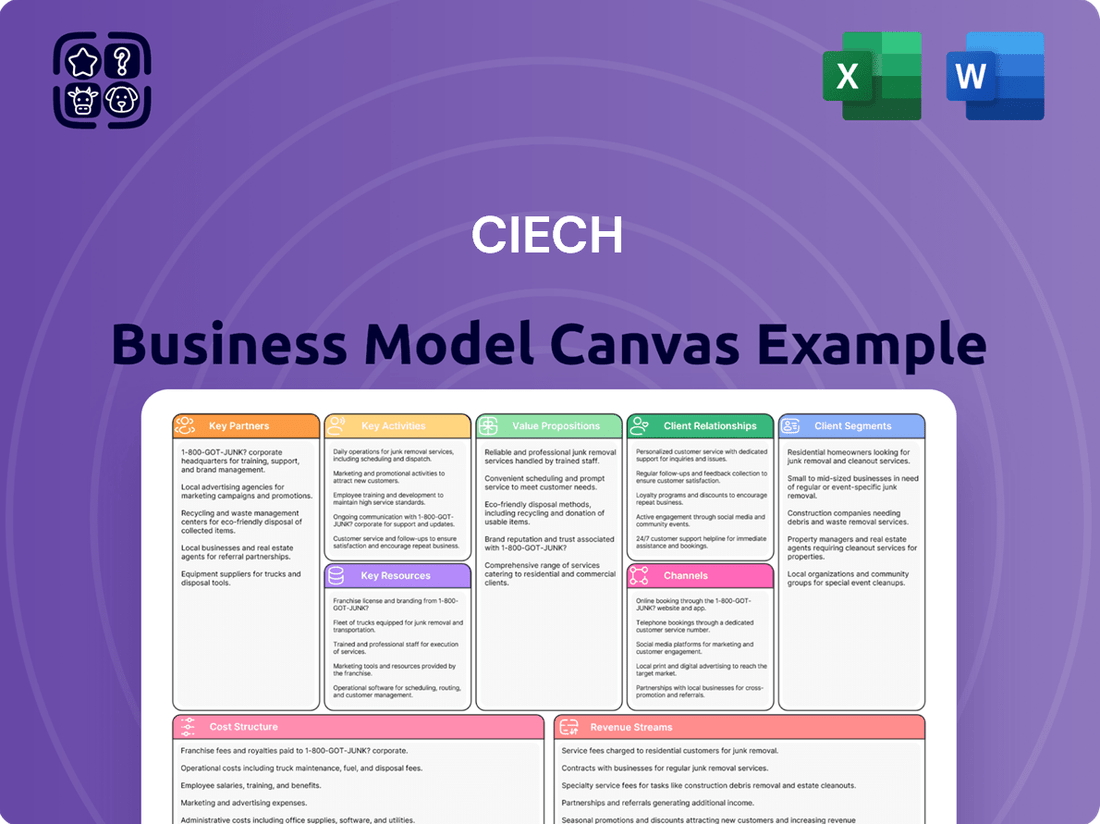

What is included in the product

A structured overview of Ciech's operations, detailing its key customer segments, value propositions, and revenue streams across its diverse chemical and soda production segments.

The Ciech Business Model Canvas offers a structured approach to pinpoint and alleviate operational inefficiencies.

It provides a clear, visual representation of how Ciech creates, delivers, and captures value, acting as a diagnostic tool for identifying and resolving pain points.

Activities

Ciech's core activity is the large-scale manufacturing of essential chemicals. This includes producing soda ash, a key ingredient in glass and detergents, and sodium bicarbonate, used in food and pharmaceuticals. They also produce salt, vital for various industries, as well as plant protection products for agriculture and polyurethane foams for insulation and furniture.

Managing a network of production facilities across Poland, Germany, and Romania is central to their operations. In 2023, Ciech's Soda business segment, a significant contributor, generated revenues of approximately PLN 2.4 billion. This extensive production capacity allows them to serve a broad range of industrial clients.

Ciech's Research and Development is a cornerstone, driving innovation and efficiency. Their focus is on creating new products and enhancing existing ones, with a keen eye on sustainability and reducing their environmental footprint. This commitment is evident in their exploration of clean technologies and their goal to secure ten new patents by 2026.

A significant aspect of their R&D involves developing chemicals that are not only low-carbon but also sourced sustainably. This forward-thinking approach aligns with global trends towards greener chemistry and positions Ciech for future market demands. In 2023, Ciech invested approximately PLN 30 million in R&D activities, underscoring their dedication to this vital area.

Ciech manages a vast global sales and distribution network, ensuring its products reach customers in over 100 countries. This expansive reach is critical for its diverse product portfolio, which includes essential chemicals and specialized agricultural solutions.

Strategic market expansion is a key activity, exemplified by the introduction of products like Halvetic, a plant protection product, into new geographical territories. This growth strategy is supported by maintaining robust relationships with a wide array of customer segments, from industrial clients to agricultural producers.

In 2024, Ciech continued to focus on optimizing its distribution channels and strengthening its market presence. For instance, the company reported significant progress in its agro segment, with sales of plant protection products showing strong performance in key European markets, underscoring the effectiveness of its distribution efforts.

Supply Chain Management

Ciech's key activities in supply chain management revolve around the efficient procurement of essential raw materials, particularly coal for its soda production. This involves strategic renegotiations to secure favorable pricing, a critical factor given the volatility in energy markets. For instance, in 2023, the company actively managed its procurement strategies to mitigate the impact of fluctuating global commodity prices.

Production planning and logistics are also central to Ciech's operations. The company focuses on optimizing its manufacturing schedules and distribution networks to ensure a consistent flow of products to market. This adaptability is vital for responding to shifting market demands and navigating economic uncertainties, allowing for efficient inventory management.

- Raw Material Procurement: Securing reliable and cost-effective coal supplies is paramount for soda ash production, with ongoing efforts to renegotiate pricing structures.

- Production Planning: Optimizing manufacturing processes and output levels to align with market demand and manage operational efficiency.

- Logistics and Distribution: Ensuring timely and cost-effective delivery of finished goods to customers across various markets.

- Inventory Management: Maintaining appropriate stock levels to meet demand while minimizing holding costs and adapting to economic conditions.

Sustainability and ESG Initiatives

Ciech's key activities heavily involve the implementation and ongoing monitoring of its Environmental, Social, and Governance (ESG) strategies. This commitment is concretely demonstrated through ambitious targets, such as a planned 45% reduction in CO2 emissions by 2029 and achieving climate neutrality by 2040.

Further, a significant focus is placed on cultivating and promoting an environmentally sustainable product portfolio. This proactive approach not only addresses regulatory pressures but also aligns with growing consumer and investor demand for responsible business practices, reinforcing the company's dedication to long-term value creation.

- Implementing ESG Strategies: Actively putting into practice environmental, social, and governance policies.

- Monitoring ESG Performance: Continuously tracking progress against ESG goals and making necessary adjustments.

- Reducing CO2 Emissions: Working towards a 45% reduction by 2029 and climate neutrality by 2040.

- Promoting Sustainable Products: Developing and marketing products that minimize environmental impact.

Ciech's key activities also encompass robust financial management and strategic investment. This involves careful capital allocation, debt management, and ensuring profitability across its diverse business segments. For instance, in 2023, the company reported strong financial results, with its Soda segment alone achieving revenues of approximately PLN 2.4 billion, demonstrating effective financial stewardship.

Continuous operational improvement and efficiency gains are critical. This includes optimizing energy consumption, enhancing production yields, and implementing lean manufacturing principles. Such focus on efficiency is vital for maintaining competitiveness in the chemical industry, especially in light of fluctuating energy costs.

Ciech actively engages in mergers and acquisitions to expand its market reach and product portfolio. These strategic moves are aimed at strengthening its competitive position and driving long-term growth. The company also prioritizes digital transformation, integrating advanced technologies to streamline operations and improve customer engagement.

In 2024, Ciech continued its focus on optimizing its production processes and supply chain. The company invested in modernizing its facilities to enhance efficiency and reduce its environmental impact. This commitment to operational excellence is a core driver of its business strategy.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Financial Management | Capital allocation, debt management, profitability focus | Soda segment revenue ~PLN 2.4 billion (2023) |

| Operational Improvement | Energy efficiency, production yield optimization, lean manufacturing | Ongoing facility modernization for efficiency and environmental impact reduction (2024 focus) |

| Strategic Investments | Mergers, acquisitions, digital transformation | Expansion of market reach and product portfolio through strategic moves |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you are seeing the complete, unedited version of the strategic tool, ensuring full transparency and no hidden surprises. Once your order is confirmed, you will gain immediate access to this exact file, ready for immediate use and customization.

Resources

Ciech's production facilities are its backbone, featuring advanced saltworks and soda plants strategically located across Poland, Germany, and Romania. These extensive physical assets are crucial for its large-scale chemical manufacturing, underpinning significant production capacities for its diverse product portfolio.

Ciech's innovation engine is fueled by its proprietary technologies and a dedicated strategy to secure new patents, targeting an impressive milestone of 10 new patents by 2026.

These valuable intellectual properties are the bedrock of Ciech's competitive edge, allowing the company to pioneer advanced chemical solutions and optimize its manufacturing operations for greater efficiency.

Ciech's highly skilled workforce, encompassing R&D specialists, engineers, and operational personnel, forms a cornerstone of its business model. Their deep knowledge in chemical manufacturing, process enhancement, and market expansion is vital for ensuring superior product quality and fostering innovation.

This expertise directly translates into Ciech's ability to maintain a competitive edge. For instance, in 2024, the company continued to invest in its talent pool, recognizing that specialized skills are indispensable for navigating complex chemical processes and developing new, advanced materials.

Raw Materials and Energy Supply

Access to key raw materials, like coal for soda ash production, and a reliable energy supply are fundamental to Ciech's ongoing operations. In 2023, the company continued to focus on securing these essential inputs to maintain consistent production output.

Ciech actively manages its resource procurement, with strategic initiatives aimed at diversifying energy sources and improving energy efficiency. These efforts are crucial for controlling production expenses and achieving the company's environmental sustainability goals.

- Coal Procurement: Ciech's soda plants, particularly in Poland, rely on coal as a primary energy source. The company works to ensure stable and cost-effective coal supply contracts.

- Energy Diversification: Efforts are underway to reduce reliance on single energy sources, exploring options like natural gas and renewable energy where feasible to mitigate price volatility and environmental impact.

- Energy Efficiency: Investments in modernizing production processes aim to lower overall energy consumption per unit of output, contributing to both cost savings and reduced carbon footprint.

- Logistics and Supply Chain: Efficient transportation and storage of raw materials are critical to preventing operational disruptions and managing inventory costs effectively.

Strong Brand Reputation and Market Position

Ciech boasts a strong brand reputation, recognized as a major player in the European chemical industry. This established presence underpins its value proposition, fostering trust with customers and partners worldwide.

Their leading market positions are a critical component of this reputation. For instance, Ciech stands as the second-largest producer of soda ash within the European Union. Furthermore, they are the largest producer of evaporated salt in Poland, highlighting their dominance in key product categories.

- Market Leadership: Second largest soda ash producer in the EU.

- Dominant Producer: Largest evaporated salt producer in Poland.

- Brand Equity: Strong reputation enhances global business relationships.

- Intangible Asset: Market position significantly contributes to overall company value.

Ciech's key resources are its advanced production facilities, proprietary intellectual property, a skilled workforce, and access to essential raw materials and energy. These elements are fundamental to its operational capabilities and competitive advantage in the chemical sector.

The company's strategic focus on innovation, evidenced by its patent acquisition goals, and its commitment to efficient resource management, including energy diversification and efficiency improvements, further solidify its resource base. Ciech's strong brand reputation and market leadership in key products, such as soda ash and evaporated salt, are also invaluable intangible assets.

| Resource Category | Specific Resources | Key Facts/Data |

|---|---|---|

| Physical Assets | Production Facilities (Saltworks, Soda Plants) | Located in Poland, Germany, Romania; significant production capacities. |

| Intellectual Property | Proprietary Technologies, Patents | Targeting 10 new patents by 2026; enables advanced chemical solutions and operational optimization. |

| Human Capital | Skilled Workforce (R&D, Engineers, Operations) | Deep knowledge in chemical manufacturing, process enhancement; investment in talent in 2024. |

| Natural Resources & Energy | Coal, Energy Supply | Coal is a primary energy source for soda plants; focus on diversification and efficiency. |

| Intangible Assets | Brand Reputation, Market Leadership | 2nd largest soda ash producer in EU; largest evaporated salt producer in Poland. |

Value Propositions

Ciech's diversified product portfolio is a cornerstone of its business model, offering essential chemicals like soda ash, sodium bicarbonate, and salt. This wide array of products serves critical industries such as glass manufacturing, food processing, and agriculture, making Ciech a vital supplier across multiple sectors.

The company's commitment to a broad product range extends to plant protection products and polyurethane foams, further solidifying its position as a comprehensive chemical solutions provider. This strategic diversification allows Ciech to cater to a vast customer base with varied industrial needs, acting as a one-stop shop for many of its clients.

For instance, in 2023, Ciech's Soda segment, which includes soda ash and sodium bicarbonate, was a significant contributor to its revenue. The company's ability to supply these fundamental chemicals to industries ranging from detergents to food underscores the value proposition of its extensive product offering.

Ciech's substantial production capacity, exemplified by its 450,000 tonnes per year salt output in Germany by 2024 and 550,000 tonnes in Poland, guarantees a consistent and dependable supply of essential chemicals to its industrial clientele.

This robust manufacturing infrastructure is crucial for meeting the ongoing demand from diverse sectors and enabling clients to maintain their own large-scale operational continuity.

The reliability stemming from these high production volumes directly translates into a secure and stable sourcing advantage for businesses relying on Ciech's chemical products.

Ciech is deeply invested in innovation and sustainability, actively pursuing strategies to reduce its carbon footprint. This includes a strong focus on developing eco-friendly products and exploring cutting-edge clean technologies.

In 2024, Ciech continued its efforts to lower CO2 emissions, a key performance indicator for its sustainability drive. The company's commitment to environmental responsibility resonates with a growing market segment that prioritizes sustainable sourcing and production methods.

This dedication to innovation and sustainability not only enhances Ciech's brand reputation but also attracts customers and partners who are increasingly aligning their own business objectives with environmental stewardship, reflecting a broader global trend.

Tailored Solutions for Industrial Clients

Ciech offers highly specialized chemicals designed to meet the precise demands of diverse industrial sectors. This includes everything from food-grade salt and water purification tablets to essential components for consumer goods and agricultural applications, demonstrating a deep understanding of varied industry needs.

The company's strength lies in its capacity to develop and deliver customized chemical solutions. This adaptability is crucial for clients in sectors like construction, automotive, and pharmaceuticals, where specific performance characteristics are paramount. For instance, in 2024, Ciech's Soda business segment continued to be a key supplier to industries requiring high-purity soda ash, a critical ingredient in glass manufacturing and chemical production.

- Customized chemical formulations to meet specific industrial performance requirements.

- Diverse industry applications including food, water treatment, household products, and agriculture.

- Adaptability to address unique client needs in sectors like construction and automotive.

Global Reach and Export Capabilities

Ciech leverages its extensive export network, reaching nearly every continent, to ensure its chemical products are accessible to a diverse global customer base. This broad geographical presence enhances reliability for international clients, solidifying its standing as a significant global chemical supplier.

In 2024, Ciech's commitment to global reach was evident in its sales distribution, with a substantial portion of revenue generated from international markets. This expansive export capability allows the company to tap into varied economic cycles and demand patterns across different regions, mitigating risks associated with over-reliance on any single market.

- Global Market Penetration: Ciech's products are distributed across Europe, North and South America, Asia, and Africa.

- Supply Chain Resilience: The wide export network supports a robust supply chain, ensuring consistent product availability for international customers.

- Market Diversification: Export activities contribute to revenue diversification, reducing dependence on domestic market performance.

- Competitive Advantage: A strong export capability positions Ciech favorably against competitors with more limited international reach.

Ciech's value proposition is built on providing essential chemicals that are fundamental to various industries, ensuring reliability and consistent supply. Its diversified product range, encompassing soda ash, sodium bicarbonate, and salt, serves critical sectors like glass manufacturing, food processing, and agriculture, making it an indispensable partner for many businesses.

The company's commitment to innovation and sustainability further enhances its appeal, with a focus on eco-friendly products and clean technologies. This dedication, evident in its 2024 efforts to reduce CO2 emissions, aligns with growing market demand for environmentally responsible sourcing and production.

Ciech also excels in offering customized chemical solutions tailored to specific industrial needs, from food-grade salt to specialized components for construction and automotive sectors. This adaptability, coupled with substantial production capacities, such as its 2024 salt output of 450,000 tonnes in Germany, guarantees dependable supply and operational continuity for its clients.

Furthermore, Ciech's extensive global export network, reaching nearly every continent, ensures accessibility and supply chain resilience for its international customer base. This broad market penetration in 2024 contributed significantly to its revenue, demonstrating a strong competitive advantage and market diversification.

| Value Proposition | Description | Key Facts/Data (as of 2024) |

|---|---|---|

| Diversified Product Portfolio | Essential chemicals for key industries | Soda ash, sodium bicarbonate, salt; serves glass, food, agriculture |

| Innovation & Sustainability | Eco-friendly products and clean technologies | Focus on CO2 emission reduction; commitment to environmental stewardship |

| Customized Solutions & Reliability | Tailored chemicals and dependable supply | Specialized formulations for construction, automotive; 450,000 tonnes/year salt capacity in Germany |

| Global Market Access | Wide export network and supply chain resilience | Presence across continents; significant international revenue contribution |

Customer Relationships

Ciech cultivates robust customer connections via specialized sales personnel and technical assistance. This team offers expert guidance, aiding clients in effectively utilizing and enhancing product performance.

This commitment ensures industrial customers receive thorough service and customized solutions, addressing their unique operational requirements and fostering long-term partnerships.

Ciech's strategy of forming long-term supply agreements with major industrial clients is a cornerstone of its customer relationship management. These agreements are crucial for securing stable demand for its core products, like soda ash and agrochemicals, thereby providing a predictable revenue stream.

For instance, in 2024, Ciech continued to leverage these partnerships to ensure consistent off-take, which is vital for managing production capacity and inventory levels effectively. This approach not only guarantees business for Ciech but also offers its customers, who often rely on these chemicals for their own manufacturing processes, a reliable source of supply.

These enduring relationships are built on trust and mutual benefit, creating a stable foundation for future growth and innovation. By solidifying these long-term commitments, Ciech strengthens its market position and fosters deeper, more resilient partnerships within the industrial sector.

For its significant industrial clients and crucial strategic partners, Ciech utilizes a dedicated key account management strategy. This approach is designed to cultivate robust, close-knit relationships, ensuring a deep understanding of their constantly changing requirements and market dynamics.

This personalized engagement model allows for more profound collaboration, leading to the development of tailored solutions and proactive identification and resolution of potential issues. For instance, in 2024, Ciech's soda ash segment reported strong demand from key industrial sectors, underscoring the success of these direct engagement strategies in securing and expanding business with major clients.

Digital Communication and Information Platforms

Ciech leverages digital communication platforms extensively to connect with its stakeholders. Its official website serves as a primary hub for disseminating crucial information, including financial reports, sustainability initiatives, and product details.

Social media channels like LinkedIn and Twitter are actively used to share company news and engage with a wider audience. This digital presence ensures transparency and builds trust with investors, customers, and the general public.

- Website Accessibility: Ciech's website provides easy access to annual reports and press releases, fostering an informed investor community.

- Social Media Engagement: In 2023, Ciech reported a significant increase in social media engagement, indicating successful outreach efforts.

- Information Dissemination: Digital platforms enable rapid distribution of product updates and market insights to customers.

Participation in Industry Conferences and Events

Ciech actively participates in major global industry events, such as the World Soda Ash Conference. This engagement is crucial for fostering strong customer relationships, allowing for direct interaction and feedback. In 2024, attending these events provided a platform to present innovative solutions and gain insights into evolving market dynamics.

These conferences are more than just networking opportunities; they are vital for showcasing Ciech's latest product developments and technological advancements. By demonstrating their commitment to innovation, Ciech reinforces its position as a leader in the chemical industry and strengthens its appeal to existing and potential clients.

- Networking: Direct engagement with clients and partners to build and maintain relationships.

- Product Showcase: Presenting new and improved chemical products and solutions.

- Market Intelligence: Gathering insights on industry trends, competitor activities, and customer needs.

- Opportunity Identification: Discovering new business avenues and potential collaborations.

Ciech prioritizes strong customer relationships through dedicated sales teams and technical support, ensuring clients effectively utilize products and receive tailored solutions. This focus on personalized service and long-term supply agreements, particularly for key industrial clients, guarantees stable demand and fosters resilient partnerships crucial for business continuity.

In 2024, Ciech's strategic approach to customer relationships was evident in its continued success with major industrial clients, securing consistent off-take for core products like soda ash. This strategy is reinforced by active participation in industry events, enabling direct client engagement, showcasing innovation, and gathering vital market intelligence.

Digital platforms, including an informative website and active social media presence, further enhance transparency and engagement with a broad audience. This multi-faceted approach, combining personal interaction with digital outreach, underpins Ciech's commitment to building trust and delivering value to its diverse customer base.

Channels

Ciech leverages its dedicated direct sales force to cultivate deep relationships with significant industrial clients, especially for its foundational chemical offerings such as soda ash and salt. This direct engagement facilitates personalized negotiations and the development of bespoke solutions, fostering robust partnerships with key accounts.

Ciech's global reach is powered by an extensive export and distribution network, serving customers in over 100 countries worldwide. This vast network ensures their diverse product portfolio, from soda ash to agrochemicals, reaches markets across nearly every continent.

A key element of this network is its robust logistics infrastructure. Ciech has historically operated its own transport segment, such as Ciech Cargo (now Qemetica Cargo), which plays a crucial role in managing the efficient movement of goods. This internal capability, combined with strategic partnerships with external logistics providers, underpins their ability to deliver reliably on a global scale.

For instance, in 2023, the company continued to optimize its supply chain, a critical factor in maintaining competitiveness in international markets. The efficient management of this network directly impacts their ability to meet diverse customer needs and capitalize on global demand for their chemical products.

Ciech leverages specialized distributors and agents to tap into niche markets and specific geographic regions. These partners possess invaluable local market knowledge and existing customer relationships, facilitating effective market penetration for Ciech's varied product lines.

In 2023, Ciech S.A. reported revenue of PLN 4.2 billion, with its Soda business segment, a key area served by such distribution networks, contributing significantly. This strategy allows Ciech to efficiently reach customers requiring specialized chemical products, enhancing its overall market presence.

Online Presence and Corporate Website

Ciech's corporate website, rebranded as Qemetica.com, acts as a central hub for all company information. It details their diverse product portfolio, from soda ash to agrochemicals, and outlines their commitment to sustainability. The site is a vital tool for investor relations, offering up-to-date financial reports and news.

This digital presence is key for engaging with various stakeholders, including potential investors, customers, and the media. In 2024, Qemetica.com continued to be updated with information on the company's strategic direction and operational performance.

- Qemetica.com as the primary information source

- Crucial for investor relations and media communication

- Showcases products, services, and sustainability efforts

- Facilitates general public engagement

Industry Trade Fairs and Exhibitions

Ciech actively participates in key international trade fairs and industry-specific exhibitions. This strategy is crucial for showcasing its diverse product portfolio, fostering relationships with both new and existing clients, and highlighting its commitment to innovation and sustainable practices. For instance, in 2024, Ciech Soda Polska participated in the International Trade Fair of Plastics Processing PLASTPOL, demonstrating its latest offerings in the plastics sector.

These events serve as vital platforms for lead generation, significantly boosting market visibility and brand recognition. They provide direct interaction opportunities, allowing Ciech to gauge market trends and gather valuable customer feedback. In 2023, the company reported a strong presence at various European chemical industry events, contributing to its robust sales pipeline.

- Showcasing Innovation: Industry trade fairs allow Ciech to present its latest product developments and technological advancements to a targeted audience.

- Customer Engagement: Direct interaction at exhibitions facilitates stronger relationships with existing customers and opens doors to new business opportunities.

- Market Intelligence: Participation provides insights into competitor activities and emerging market demands, informing future business strategies.

- Brand Visibility: These events enhance Ciech's brand presence and reputation within the global chemical industry.

Ciech utilizes a multi-channel approach, combining direct sales for key industrial accounts with an extensive global export and distribution network. This dual strategy ensures broad market coverage and tailored client engagement.

Specialized distributors and agents are employed to penetrate niche markets, leveraging local expertise. Furthermore, Qemetica.com serves as a vital digital hub for information and stakeholder engagement, while participation in trade fairs amplifies market visibility and client interaction.

The company's robust logistics, including its own transport capabilities, are fundamental to reliable global delivery, supporting its diverse product range across numerous countries. This integrated channel strategy is critical to its market presence and revenue generation.

| Channel | Key Function | 2023 Revenue Contribution (Estimated) | Key Products Served |

|---|---|---|---|

| Direct Sales Force | Key account management, bespoke solutions | Significant (Soda, Chemicals) | Soda Ash, Caustic Soda, Salt |

| Global Export & Distribution Network | Broad market reach, logistics | Majority of international sales | All product segments |

| Specialized Distributors/Agents | Niche market penetration, local expertise | Growing (Agrochemicals, Specialty Chemicals) | Agrochemicals, Silicates, Foams |

| Qemetica.com (Digital) | Information hub, investor relations, lead generation | Indirect (Brand building, engagement) | All product segments |

| Trade Fairs & Exhibitions | Market visibility, lead generation, relationship building | Indirect (Sales pipeline support) | All product segments |

Customer Segments

The glass industry represents a significant customer segment for Ciech, primarily relying on its soda ash products. Soda ash is a fundamental raw material in glass production. In 2023, Ciech's soda ash segment was a cornerstone of its operations, contributing substantially to its overall revenue.

This segment encompasses manufacturers of flat glass, used in construction and automotive applications, as well as producers of glass packaging like bottles and jars. Ciech's reliable supply of high-quality soda ash is crucial for these diverse glass manufacturing processes.

The food and pharmaceutical industries represent a crucial customer segment for Ciech, primarily utilizing its high-purity sodium bicarbonate and evaporated salt. These products are essential components in a wide array of applications, from enhancing food products and fortifying animal feed to serving as critical ingredients in pharmaceutical preparations.

Ciech's commitment to quality is evident in its production of high-purity soda bicarbonate that adheres to stringent European and US Pharmacopoeia standards. This dedication ensures the product's suitability for even the most sensitive pharmaceutical uses, such as in hemodialysis treatments, underscoring the segment's reliance on Ciech's specialized offerings.

Farmers and agricultural businesses are a core customer segment for Ciech, particularly for its plant protection products like the herbicide Halvetic. These solutions are designed to boost crop yields and effectively control pests, which is crucial for modern farming operations.

Ciech's commitment to this sector is underscored by its international expansion in agro-solutions. In 2023, the company reported significant growth in its agro segment, with sales reaching approximately PLN 1.1 billion, demonstrating its increasing reach and impact within the global agricultural market.

Construction and Automotive Industries

Ciech is a significant supplier to the construction and automotive sectors, providing essential chemicals that form the backbone of many products. Their offerings include polyurethane foams, silicates, and resins, all vital components for manufacturing in these industries. For instance, polyurethane foams are integral to creating comfortable and durable furniture, as well as cushioning and structural elements in vehicles.

Silicates, another key product, find their way into a wide array of construction applications, enhancing the performance of building materials. Furthermore, these silicates are increasingly important in the automotive industry for the production of 'green' tires, contributing to improved fuel efficiency and reduced environmental impact. In 2023, the global construction chemicals market was valued at approximately $115 billion, with projections indicating continued growth, underscoring the demand for Ciech's silicate-based products.

- Construction Industry Applications: Silicates for concrete admixtures, sealants, and coatings.

- Automotive Industry Applications: Polyurethane foams for seating, insulation, and interior components.

- Environmental Benefits: Silicates contributing to the development of eco-friendly tires, a growing market segment.

- Market Relevance: The automotive sector is a major consumer of chemical products, with global automotive production reaching over 85 million vehicles in 2023.

Detergent and Chemical Industries

Manufacturers of detergents, soaps, and other chemical products represent a core customer segment for Ciech. These businesses depend on Ciech for fundamental raw materials like soda ash and sodium silicates, which are vital components in their extensive product formulations.

The demand from this sector is substantial, as these chemicals are foundational for creating a wide array of consumer and industrial cleaning agents. In 2024, the global detergent market was valued at approximately $200 billion, highlighting the significant volume of raw materials required.

- Detergent Manufacturers: Rely on soda ash for its alkalinity, crucial in washing powders and liquids.

- Soap Producers: Utilize soda ash in the saponification process for creating bar soaps.

- Chemical Product Companies: Incorporate sodium silicates as binders, corrosion inhibitors, and builders in various chemical formulations.

- Market Dependence: Ciech's basic chemicals are indispensable inputs for the consistent production of these everyday and specialized chemical goods.

Ciech serves diverse customer segments, with a strong focus on industries requiring its core chemical products. The glass manufacturing sector relies heavily on Ciech's soda ash, a fundamental ingredient for flat glass, packaging, and specialty glass production. In 2023, the global glass industry continued to be a significant consumer of soda ash, driven by construction and automotive demand.

The food and pharmaceutical industries are key clients, utilizing Ciech's high-purity sodium bicarbonate and evaporated salt for applications ranging from food fortification to pharmaceutical formulations. Ciech's adherence to stringent quality standards, including European and US Pharmacopoeia, makes its products essential for these sensitive sectors. By 2024, the demand for high-quality ingredients in these industries remained robust.

Agricultural businesses depend on Ciech for plant protection products, such as herbicides, to enhance crop yields and manage pests. The company's expansion in agro-solutions, with sales reaching approximately PLN 1.1 billion in 2023, highlights its growing influence in this segment. Farmers increasingly seek effective and sustainable solutions for crop management.

Furthermore, the construction and automotive industries are significant consumers of Ciech's chemicals, including silicates and polyurethane foams. These materials are vital for producing building materials, insulation, and automotive components. The global construction chemicals market, valued at around $115 billion in 2023, demonstrates the substantial demand for such inputs, including those contributing to eco-friendly products like 'green' tires.

| Customer Segment | Key Ciech Products Used | Primary Applications | 2023/2024 Market Context |

|---|---|---|---|

| Glass Manufacturing | Soda Ash | Flat glass, glass packaging, specialty glass | Continued demand driven by construction and automotive sectors. |

| Food & Pharmaceutical | Sodium Bicarbonate, Evaporated Salt | Food fortification, animal feed, pharmaceutical formulations | Robust demand for high-purity, compliant ingredients. |

| Agriculture | Herbicides (e.g., Halvetic) | Crop yield enhancement, pest control | Growing market for sustainable agro-solutions; Ciech agro sales ~PLN 1.1 billion in 2023. |

| Construction & Automotive | Silicates, Polyurethane Foams | Building materials, insulation, automotive components, eco-tires | Global construction chemicals market ~ $115 billion in 2023; automotive production > 85 million vehicles in 2023. |

| Detergents & Chemicals | Soda Ash, Sodium Silicates | Washing powders, soaps, chemical formulations | Global detergent market ~ $200 billion in 2024; essential raw materials for consumer and industrial goods. |

Cost Structure

Raw material costs represent a substantial portion of Ciech's expenses. For instance, coal is a primary input for their soda production, and the company also relies on various other chemical inputs for its diverse product portfolio.

In 2024, global commodity markets experienced volatility. Ciech's profitability is directly tied to the price swings of these raw materials, underscoring the critical need for robust procurement strategies and effective hedging to mitigate financial risks.

For Ciech, a chemical group heavily reliant on energy-intensive production, particularly for soda ash, energy consumption constitutes a significant portion of its cost structure. In 2023, the company continued its strategic push towards energy transformation.

To mitigate these substantial energy costs and align with climate objectives, Ciech is actively investing in renewable energy sources and more efficient technologies. A key initiative includes the deployment of biomass-fired boilers, which are designed to lower energy expenditure and reduce their carbon footprint.

Ciech's production and operational expenses are significant, encompassing the upkeep of its manufacturing sites and machinery in Poland, Germany, and Romania. These costs are directly tied to maintaining a workforce of over 3,000 individuals across these locations.

In 2023, Ciech reported total operating expenses of approximately PLN 3.7 billion. A substantial portion of this is allocated to production and personnel, highlighting the importance of efficiency. For instance, optimizing production processes and ensuring high capacity utilization are critical levers for managing these substantial operational outlays and maintaining profitability.

Research and Development (R&D) Investments

Ciech's cost structure is significantly influenced by its substantial Research and Development (R&D) investments. These expenditures are crucial for exploring emerging technologies and creating innovative, sustainable products, which are vital for long-term growth and maintaining a competitive edge. While these are strategic, forward-looking investments, they represent a continuous drain on resources.

For instance, in 2024, Ciech continued to prioritize innovation, with R&D expenses forming a key component of its operational costs. These investments are not merely about creating new products but also about enhancing existing processes and ensuring environmental responsibility, aligning with global trends towards greener chemistry.

- Significant R&D Expenditure: Ciech allocates considerable financial resources to R&D activities.

- Focus on Innovation: Investments are directed towards exploring new technologies and developing novel, sustainable products.

- Long-Term Strategic Investment: R&D costs are viewed as essential for future competitiveness and market leadership.

- Ongoing Operational Expense: Despite their strategic nature, R&D outlays are a consistent part of the company's cost base.

Logistics and Distribution Costs

Ciech faces significant logistics and distribution costs due to its broad international presence. These expenses cover the movement and storage of goods, as well as the operational management of its supply chain. In 2024, the company continued to leverage its internal transport capabilities through Qemetica Cargo, alongside partnerships with external logistics providers to ensure efficient delivery across its markets.

These costs are a crucial component of the business model, directly impacting profitability and customer satisfaction. Managing this complex network requires substantial investment in infrastructure, technology, and personnel. The efficiency of these operations is paramount for maintaining competitive pricing and timely product availability.

- Transportation: Costs incurred for moving raw materials and finished goods via various modes, including road, rail, and sea.

- Warehousing: Expenses related to storing inventory in strategically located facilities to meet market demand.

- Distribution Network Management: Costs associated with managing relationships with logistics partners and optimizing delivery routes.

- Internal Logistics (Qemetica Cargo): Operational expenses for Ciech's own transport services, contributing to cost control and flexibility.

Ciech's cost structure is heavily influenced by its raw material and energy expenses, which are subject to global market fluctuations. The company's reliance on coal for soda production and its energy-intensive operations mean that price volatility in these commodities directly impacts profitability.

Operational and personnel costs are also significant, reflecting the maintenance of manufacturing sites and a workforce of over 3,000 employees across Poland, Germany, and Romania. In 2023, total operating expenses were approximately PLN 3.7 billion, with production and labor being key drivers.

Furthermore, Ciech invests substantially in Research and Development (R&D) to foster innovation and sustainability, viewing these as critical for long-term competitiveness. Logistics and distribution costs, managed partly through its internal Qemetica Cargo and external partners, are also essential for efficient market reach.

| Cost Category | Key Components | 2023 Impact (Approximate) |

| Raw Materials | Coal, chemical inputs | Substantial portion of COGS |

| Energy | Electricity, natural gas, biomass | Significant for energy-intensive production |

| Operations & Personnel | Manufacturing upkeep, salaries, benefits | ~PLN 3.7 billion total operating expenses |

| R&D | New technologies, sustainable products | Ongoing strategic investment |

| Logistics & Distribution | Transportation, warehousing, supply chain | Essential for market access and customer service |

Revenue Streams

Ciech's primary revenue streams stem from the sale of soda ash, both light and dense, and sodium bicarbonate. These essential chemicals are vital inputs for a wide array of industries, including glass manufacturing, food production, detergents, and pharmaceuticals.

As the second-largest producer of soda ash and sodium bicarbonate within the European Union, Ciech leverages its significant market position to generate substantial revenue. In 2023, Ciech Group's Soda segment, which includes these products, reported revenue of PLN 3.5 billion, underscoring the critical role these sales play in the company's overall financial performance.

Ciech generates revenue by selling a diverse range of evaporated salt products. This includes high-quality food-grade salt for consumers, specialized salt tablets crucial for water softening systems, and industrial-grade salt granules used in various manufacturing processes. This multi-faceted approach ensures a broad customer base and consistent income.

The company's salt business is experiencing significant growth, bolstered by strategic investments in expanding production capabilities. Notably, Ciech has increased its salt production capacity in Germany, a move expected to enhance market reach and efficiency. This expansion is a key driver for projected revenue increases in the coming fiscal periods.

Ciech generates significant revenue from its agricultural segment by selling plant protection products. This includes key herbicides such as Halvetic. The company is actively pursuing growth in this area, with Halvetic, for instance, seeing expansion into new international markets, contributing to the overall sales figures.

Sales of Polyurethane Foams and Resins

Ciech generates revenue from selling polyurethane foams and a range of resins, including epoxy and polyester. These materials are essential components for various manufacturing sectors.

Key industries relying on these products include furniture manufacturing, the automotive sector for interior and exterior components, and the production of paints and coatings. Electronics manufacturing also utilizes these resins for insulation and protection.

In 2024, the demand for construction materials, which often incorporate polyurethane foams for insulation, remained robust, contributing to sales growth. The automotive industry's recovery also boosted demand for resins used in vehicle production.

- Polyurethane Foams: Used in furniture cushioning, insulation, and packaging.

- Epoxy Resins: Applied in coatings, adhesives, and composite materials, particularly in aerospace and automotive.

- Polyester Resins: Common in fiberglass reinforced plastics, paints, and coatings.

Sales of Silicates and Glass Products

Ciech generates significant revenue through the sale of silicates and glass products. This includes a wide array of sodium silicates, essential for industries like detergents and construction, as well as various types of glass and glass packaging. Their products serve diverse sectors, from food and beverage to building materials.

As a leading supplier of sodium silicates in Europe, Ciech benefits from consistent demand. In 2024, the company continued to leverage its strong market position in this segment. The glass segment, encompassing packaging for food and beverages, also represents a crucial revenue stream, supported by ongoing consumer demand.

- Sodium Silicates: Key revenue driver for construction, detergents, and other industrial applications.

- Glass Products: Includes various types of glass and glass packaging for the food and beverage industry.

- European Market Leadership: Ciech is a major European supplier of sodium silicates, ensuring a stable customer base.

- Diversified Applications: Products cater to a broad range of industries, mitigating sector-specific risks.

Ciech's revenue streams are diversified across several key chemical and material segments. The company's core business revolves around the production and sale of soda ash and sodium bicarbonate, essential for industries like glass and food. Additionally, Ciech generates income from its extensive salt business, supplying food-grade, water-softening, and industrial salts. The agricultural segment contributes through the sale of plant protection products, notably herbicides. Furthermore, revenue is derived from polyurethane foams and various resins, serving the furniture, automotive, and coatings sectors, as well as from silicates and glass products used in detergents, construction, and packaging.

| Segment | Key Products | 2023 Revenue (PLN billion) | Key Applications |

|---|---|---|---|

| Soda | Light and Dense Soda Ash, Sodium Bicarbonate | 3.5 | Glass manufacturing, food production, detergents, pharmaceuticals |

| Salt | Food-grade salt, Water softening salt, Industrial salt | N/A (included in other segments historically) | Food industry, water treatment, industrial processes |

| Agro | Plant Protection Products (e.g., Halvetic) | N/A | Agriculture, crop protection |

| Polymers | Polyurethane Foams, Epoxy Resins, Polyester Resins | N/A | Furniture, automotive, coatings, electronics |

| Silicates & Glass | Sodium Silicates, Glass Products | N/A | Detergents, construction, food and beverage packaging |

Business Model Canvas Data Sources

The Ciech Business Model Canvas is meticulously constructed using a blend of internal financial reports, extensive market research, and competitive analysis. This multi-faceted approach ensures each component of the canvas is informed by accurate and actionable data.