Ciech Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ciech Bundle

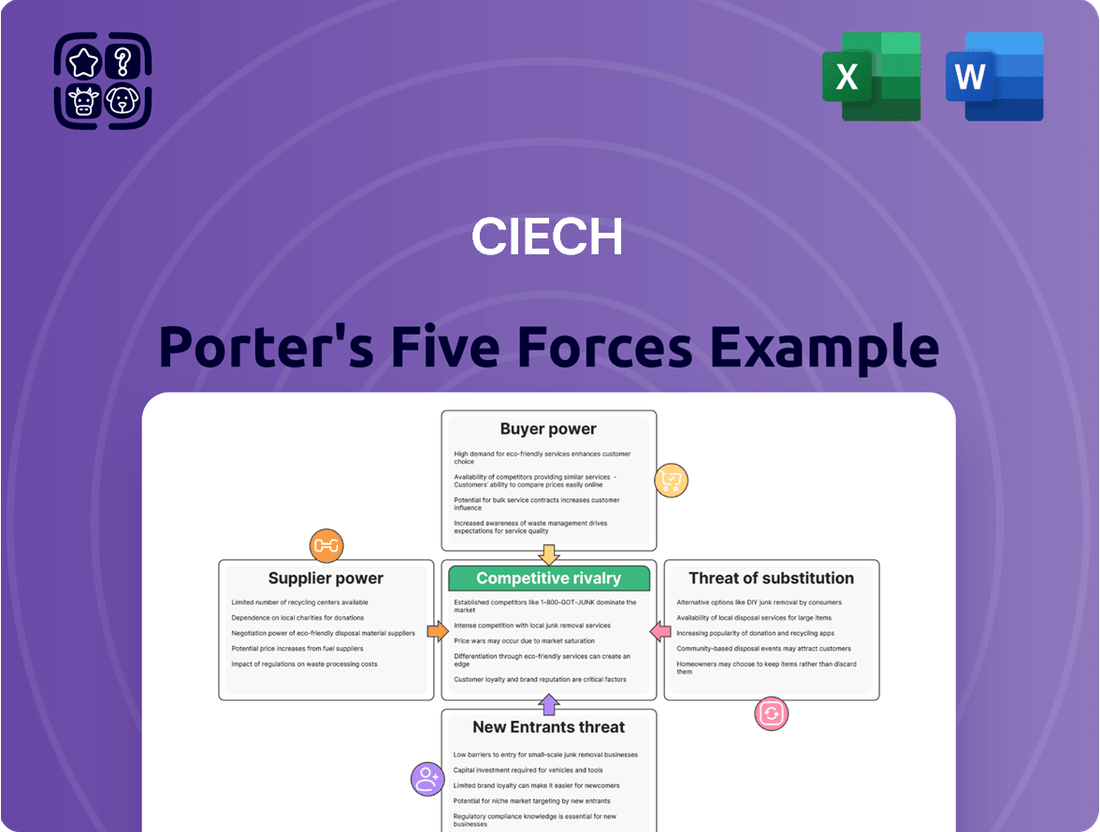

Ciech navigates a competitive landscape shaped by the bargaining power of its buyers and suppliers, while also facing threats from new entrants and substitutes. Understanding these forces is crucial for any stakeholder looking to grasp Ciech's strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ciech’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Ciech, a significant player in the chemical sector, faces considerable risk from the fluctuating costs of its raw materials, which represent a substantial portion of its overall expenses. The chemical industry as a whole saw input costs, particularly for energy and key chemical ingredients, climb in 2024 and continuing into 2025.

This pricing instability poses a direct threat to Ciech's profitability, as it can squeeze profit margins if the company is unable to fully transfer these increased costs to its customers.

European chemical manufacturers like Ciech operate at a significant cost disadvantage due to persistently high energy prices. In 2024, natural gas prices in Europe continued to be substantially higher than in major global competitors such as the United States, China, and the Middle East. This disparity directly inflates production expenses, particularly for energy-intensive operations like soda ash production, where energy constitutes a large portion of the cost structure.

The sustained elevated cost of energy undeniably bolsters the bargaining power of energy suppliers. As European chemical firms grapple with these higher input costs, their ability to negotiate favorable terms with energy providers is diminished, directly impacting profitability and competitive positioning in the global market.

Ciech faces a significant challenge when a limited number of suppliers provide crucial raw materials, especially for specialized chemicals used in products like plant protection or polyurethane foams. This scarcity often translates into less favorable pricing and diminished sourcing flexibility.

When Ciech relies on just a handful of key suppliers for essential inputs, these providers gain considerable leverage. For instance, in 2024, the global soda ash market, a key input for many chemical processes, saw pricing influenced by a concentrated supply base, with major producers in regions like North America and Europe holding substantial market power.

Switching Costs for Alternative Inputs

For Ciech, the difficulty in switching raw material suppliers or adopting alternative inputs is a significant factor. This often involves substantial costs and operational hurdles, such as re-engineering production processes, the rigorous re-qualification of products to meet industry standards, and the potential for costly production downtime during the transition. These complexities effectively act as a barrier, strengthening the bargaining power of current suppliers who understand these switching costs.

The chemical industry, particularly for large-scale operations like those of Ciech, typically features deeply integrated supply chains. This integration means that suppliers are often not just providers of raw materials but are woven into the fabric of the production process itself. This interconnectedness further solidifies the position of existing suppliers, making it more challenging and expensive for Ciech to seek out and implement alternatives.

- High Re-qualification Costs: Introducing a new raw material can necessitate extensive testing and certification, potentially costing millions of euros and taking months, as seen in similar chemical industry transitions.

- Process Re-engineering Expenses: Adapting existing manufacturing lines to accommodate different input specifications can require significant capital investment in new equipment or modifications.

- Supplier Relationship Inertia: Long-standing relationships with established suppliers often come with preferential pricing, guaranteed quality, and reliable delivery schedules that are difficult to replicate quickly with new partners.

- Production Disruption Risk: Any change in raw material sourcing carries an inherent risk of production interruptions, impacting output volume and potentially leading to lost sales and customer dissatisfaction.

Supplier Concentration in Specific Niches

Ciech's reliance on specialized raw materials for certain product lines, like specific minerals for soda ash or unique intermediates for advanced chemicals, can lead to a concentrated supplier base. This concentration means a few suppliers might dominate the market for these critical inputs, giving them significant leverage. For instance, in 2024, the global market for certain rare earth elements, crucial for some specialty chemical applications, saw prices increase by an average of 15% due to limited production capacity from a handful of key mining operations.

This supplier concentration can translate into higher input costs and less favorable supply terms for Ciech. When few companies control the supply of a vital component, they can dictate pricing and availability, directly impacting Ciech's profitability and production schedules. The bargaining power of these niche suppliers is amplified by the difficulty and cost of finding alternative sources or developing in-house production capabilities for these highly specialized materials.

- Dominant Niche Suppliers: A small number of suppliers may hold a near-monopoly on specific chemicals or raw materials essential for Ciech's production processes.

- Price Control: Concentrated suppliers can command premium prices, increasing Ciech's cost of goods sold.

- Supply Chain Vulnerability: Dependence on a few suppliers creates a risk of disruptions, impacting operational continuity.

- Limited Negotiation Power: Ciech's ability to negotiate favorable terms is diminished when alternatives are scarce or non-existent.

Ciech's bargaining power with its suppliers is significantly challenged by the high cost and limited availability of essential raw materials, particularly energy. In 2024, European energy prices remained substantially higher than in competing regions, directly increasing Ciech's production costs and diminishing its negotiating leverage with energy providers. This situation is exacerbated when specialized chemicals or key inputs are sourced from a small number of dominant suppliers, who can then dictate terms and prices. The substantial costs and operational complexities involved in switching suppliers further solidify the power of existing providers, making it difficult for Ciech to secure more favorable terms or alternative sourcing options.

The chemical industry's integrated supply chains mean that suppliers are often deeply embedded in production processes, further increasing their influence. For Ciech, the difficulty in finding alternative sources for specialized inputs, coupled with the high costs of re-qualifying new materials and re-engineering production lines, creates a strong dependency on current suppliers. This dependency directly impacts Ciech's ability to negotiate favorable pricing and secure reliable supply, ultimately affecting its profitability and competitive stance in the market.

The bargaining power of Ciech's suppliers is amplified by the limited number of companies that can provide certain essential raw materials. For example, in 2024, the global market for specific minerals used in soda ash production saw prices rise due to the concentrated supply base. This concentration allows these niche suppliers to exert significant price control and limit sourcing flexibility for companies like Ciech.

| Factor | Impact on Ciech | 2024 Data/Observation |

| Energy Costs | Increases production expenses, reduces negotiation power | European natural gas prices significantly higher than US/Middle East |

| Supplier Concentration | Limits sourcing options, increases input costs | Niche suppliers for specialized chemicals can command premium prices |

| Switching Costs | High costs and complexity reinforce dependence on current suppliers | Re-qualification and process re-engineering can cost millions and take months |

| Supply Chain Integration | Deeply embedded suppliers have greater leverage | Interconnectedness makes finding and implementing alternatives challenging |

What is included in the product

This analysis examines the intensity of competition, buyer and supplier power, threat of new entrants and substitutes, specifically within Ciech's operating industries.

Instantly visualize the intensity of each competitive force, enabling rapid identification of strategic leverage points and potential threats for Ciech.

Customers Bargaining Power

Ciech’s diverse end-use industries, spanning glass, food, agriculture, construction, and detergents, significantly dilute the bargaining power of individual customers. This broad customer base means no single industry segment dictates terms, as reliance is spread. For instance, while the glass sector represents a substantial portion of soda ash demand, estimated at nearly 50% in Europe, Ciech's presence in other sectors mitigates the risk of a concentrated customer's leverage.

In commodity markets such as soda ash and salt, where products are largely undifferentiated, customers exhibit significant price sensitivity. This means they are very focused on the cost of the product, making them powerful negotiators. For instance, if there's an oversupply of soda ash, buyers can leverage this to demand lower prices from producers like Ciech.

The ease with which customers can compare pricing across various suppliers further amplifies their bargaining power. This transparency forces producers to compete aggressively on price, especially when market demand is sluggish. In 2024, global soda ash prices experienced fluctuations due to shifts in energy costs and industrial demand, creating opportunities for large buyers to secure more favorable terms.

Major industrial customers, such as those in the glass and detergent sectors, are key purchasers of Ciech's chemical products. These significant buyers frequently procure substantial quantities, granting them considerable bargaining power.

This leverage allows them to negotiate for reduced prices or more advantageous contractual conditions. For instance, in 2023, soda ash, a core product for Ciech, saw its global price fluctuate, influenced by demand from these large industrial consumers.

The sheer scale of their orders means these customers can effectively exert downward pressure on Ciech's overall profit margins. Their ability to switch suppliers or consolidate purchases makes their demands impactful.

Potential for Backward Integration by Customers

The potential for backward integration by customers, while a theoretical concern, is largely mitigated by the significant capital required and the technical expertise needed for chemical production. For a company like Ciech, this means that most customers are unlikely to undertake such a complex endeavor. Even if a very large buyer were to consider producing some of their chemical inputs, the specialized nature of Ciech's manufacturing processes makes this a less viable option compared to less technical industries.

This latent threat, however, can still be leveraged by powerful customers during negotiations, even if the actualization of backward integration is improbable. For instance, in 2024, the chemical industry saw continued investment in advanced manufacturing technologies, further increasing the barriers to entry for potential integrators. The specialized equipment and proprietary knowledge held by established players like Ciech create a substantial hurdle.

- High Capital Investment: Establishing chemical production facilities requires billions of dollars in investment, making it prohibitive for most customers.

- Technical Expertise: Operating complex chemical processes demands specialized knowledge and skilled personnel, which customers typically lack.

- Scale and Efficiency: Ciech benefits from economies of scale and optimized production processes, which are difficult for individual customers to replicate efficiently.

- Focus on Core Competencies: Most customers are focused on their primary business operations rather than venturing into chemical manufacturing.

Availability of Multiple Suppliers

Customers in the European soda ash and sodium bicarbonate market benefit from a wide array of suppliers. Major global players such as Solvay SA, alongside numerous other regional manufacturers, ensure a competitive landscape.

This abundance of choice significantly empowers customers. They can readily switch between suppliers, which naturally drives down prices and increases their overall bargaining leverage.

- Supplier Diversity: European customers have multiple soda ash and sodium bicarbonate producers to choose from.

- Competitive Pricing: The presence of many suppliers fosters competitive pricing dynamics.

- Ease of Switching: Customers can relatively easily change their suppliers, enhancing their bargaining power.

Ciech's diverse customer base across various industries like glass, food, and agriculture limits the bargaining power of any single customer. This broad reach means that even significant buyers in one sector cannot exert undue influence over pricing or terms due to Ciech's diversified demand. For example, while the glass industry is a major consumer of soda ash, Ciech's engagement in other markets balances this reliance.

In commodity markets, customers are highly price-sensitive, especially when supply exceeds demand. This sensitivity empowers them to negotiate for lower prices. For instance, fluctuations in global soda ash prices in 2024, driven by energy costs and industrial demand, provided opportunities for large buyers to secure more favorable terms.

The transparency of pricing across multiple suppliers in the European soda ash market, with players like Solvay SA and other regional manufacturers, significantly enhances customer bargaining power. This abundance of choice allows customers to switch suppliers easily, driving competitive pricing and increasing their leverage.

Major industrial customers, such as those in the glass and detergent sectors, represent significant purchasers of Ciech's chemical products. Their large order volumes grant them substantial bargaining power, enabling them to negotiate for reduced prices or more advantageous contract terms, which can pressure profit margins.

| Customer Segment | Product Focus | Bargaining Power Factor | Example Impact |

|---|---|---|---|

| Glass Manufacturers | Soda Ash | High Volume Purchases | Negotiate for volume discounts. |

| Detergent Producers | Soda Ash, Sodium Bicarbonate | Price Sensitivity, Supplier Options | Seek competitive pricing due to multiple suppliers. |

| Agriculture Sector | Various Chemicals | Diversified Demand for Ciech | Reduced individual customer leverage. |

Full Version Awaits

Ciech Porter's Five Forces Analysis

This preview showcases the comprehensive Ciech Porter's Five Forces Analysis, detailing the competitive landscape of the chemical industry. The document you see here is the exact, fully formatted report you will receive immediately after purchase, offering actionable insights into the industry's structure and potential profitability. You can be confident that what you preview is precisely the professional analysis you'll be able to download and utilize without delay.

Rivalry Among Competitors

The European chemical sector, especially for products like soda ash and sodium bicarbonate, features a limited number of significant, long-standing companies, including Ciech. This market structure naturally breeds fierce competition as these major entities battle for dominance.

Ciech holds a strong position as the second-largest producer of soda ash and sodium bicarbonate within the European Union, underscoring the concentrated nature of this market.

The European chemical industry experienced a significant downturn in 2023 and 2024, characterized by weak demand and substantial overcapacity. This challenging environment intensified competitive rivalry as companies battled to secure sales volumes amidst declining prices.

This oversupply situation forced many European chemical producers to make difficult decisions, with several plants ceasing operations or temporarily halting production. For instance, reports from early 2024 indicated significant cutbacks across various chemical sectors in Europe, reflecting the severity of the market pressures.

Chemical manufacturing, including operations like those of Ciech, is inherently capital-intensive, demanding significant investment in plants and infrastructure. These substantial fixed costs create a powerful impetus for companies to maximize production output and capacity utilization. In 2024, for instance, companies facing similar cost structures often aim for utilization rates exceeding 80% to achieve economies of scale.

This pressure to maintain high operating levels often translates into aggressive pricing tactics. To secure sales volume and cover fixed expenses, firms may engage in price competition, even when market demand is subdued. This continuous drive to keep production lines running fuels intense rivalry among players in the chemical sector.

Product Homogeneity in Core Segments

In core segments like soda ash and salt, Ciech faces intense competition due to product homogeneity. Customers can easily switch suppliers based on price alone, as these commodity chemicals are largely undifferentiated. This characteristic significantly amplifies the rivalry among market players.

Ciech's strategic focus on innovation and sustainability is a key effort to carve out differentiation, but the fundamental nature of its core products means price sensitivity remains a major driver of customer choice. For instance, in the soda ash market, where global production capacity is substantial, price fluctuations can rapidly shift market share.

- Product Homogeneity: Core products like soda ash and salt are largely identical across competitors.

- Price as a Key Differentiator: This lack of differentiation makes price the primary factor for customer purchasing decisions.

- Intensified Rivalry: Easy switching by customers based on price fuels aggressive competition among producers.

- Ciech's Differentiation Efforts: While innovation and sustainability are pursued, the inherent nature of commodity chemicals limits their impact on price sensitivity.

Global Competition and Imports

European soda ash producers, including Ciech, contend with intense global competition. Significant pressure comes from imports, especially from the United States, a major natural soda ash exporter, and China, a large producer of synthetic soda ash. These international players often benefit from lower production costs, which translates into downward pressure on prices for European manufacturers.

This global rivalry compels European companies like Ciech to prioritize operational efficiency and cost reduction strategies to remain competitive. For instance, in 2023, global soda ash prices saw fluctuations influenced by energy costs and demand, with US producers often having an advantage due to access to cheaper natural gas for their production processes.

- Global Competition: European soda ash producers face strong competition from imports, particularly from the US (natural soda ash) and China (synthetic soda ash).

- Cost Advantages: Overseas producers often have lower production costs, impacting European market prices.

- Price Pressure: This global competition exerts downward pressure on soda ash prices in Europe.

- Focus on Efficiency: European companies must concentrate on efficiency and cost reduction to stay competitive in the global market.

Competitive rivalry in the European chemical sector, particularly for products like soda ash and sodium bicarbonate, is intense. Ciech, as a major player, faces this head-on with a few other significant, established companies. The market's concentrated nature means these entities fiercely compete for market share.

The challenging market conditions of 2023 and 2024, marked by weak demand and overcapacity, exacerbated this rivalry. Companies were forced to fight for sales, often leading to price wars. For example, the European Chemical Industry Council reported declining production volumes across several segments during this period, directly reflecting the competitive pressures.

The capital-intensive nature of chemical manufacturing, with its high fixed costs, compels companies like Ciech to maintain high production levels. This drive for capacity utilization, often aiming for over 80% to achieve economies of scale, fuels aggressive pricing strategies. In 2024, many chemical firms were observed engaging in price competition to secure sales and cover operational expenses.

Product homogeneity in core offerings such as soda ash means customers can easily switch suppliers based on price. This lack of differentiation amplifies competition, as price becomes the primary deciding factor for purchasers. Global competition from producers in the US and China, often with lower production costs, further intensifies this pressure on European manufacturers, forcing a constant focus on efficiency and cost reduction.

| Key Factor | Impact on Ciech | 2023-2024 Data/Observation |

| Market Concentration | Few major players lead to intense competition. | Ciech is the 2nd largest EU producer of soda ash. |

| Market Conditions | Weak demand and overcapacity intensify rivalry. | European chemical output saw declines in 2023-2024. |

| Cost Structure | High fixed costs drive need for high utilization. | Companies aim for >80% capacity utilization to be competitive. |

| Product Homogeneity | Price is the main differentiator for customers. | Easy switching by customers fuels price wars. |

| Global Competition | Imports from US/China exert downward price pressure. | Global soda ash prices influenced by energy costs and US production advantages in 2023. |

SSubstitutes Threaten

The availability of alternative chemicals poses a significant threat to Ciech. For certain applications, other chemical compounds can effectively substitute for Ciech's core products. For example, in industries like pulp and paper, water treatment, and broader chemical manufacturing, caustic soda can often be used in place of soda ash. This substitutability provides customers with choices, potentially limiting Ciech's pricing power and market share if alternatives become more attractive due to cost or performance advantages.

The increasing focus on sustainability presents a significant threat of substitutes for traditional chemicals. Growing environmental awareness and stricter regulations are accelerating the development and adoption of greener alternatives across various industries. For instance, in the textile sector, chemicals like sodium silicate, potassium carbonate, and sodium citrate are being explored as more eco-friendly replacements for soda ash.

If these emerging alternatives become cost-competitive and perform comparably, they could erode the market share of established products. The global market for green chemicals, for example, was valued at approximately $150 billion in 2023 and is projected to grow substantially, indicating a strong shift in consumer and regulatory preferences that directly impacts established players.

Technological advancements pose a significant threat of substitutes for chemical producers like Ciech. New technologies can enable the creation of existing chemicals more efficiently or from entirely different raw materials. This could introduce novel substitute products or processes that bypass traditional manufacturing methods.

For instance, innovations in carbon capture and utilization are showing promise in producing sodium bicarbonate, a key product for Ciech. If these technologies become economically viable and scalable, they could disrupt the established market by offering a competitive alternative to conventional production, thereby increasing the threat of substitution.

Customer Willingness to Switch Based on Price/Performance

Customers are always on the lookout for better value, meaning they'll switch to substitutes if they offer a more attractive price-performance ratio. This could mean a lower price for the same quality or enhanced features without a significant cost increase. For Ciech, this translates to a constant need to innovate and maintain competitive pricing across its product lines.

Ciech's diverse customer base, spanning industries like glass manufacturing, detergents, and agriculture, actively assesses alternatives. These businesses are driven to optimize their own operational expenses and increasingly, to meet evolving environmental standards. For instance, in the soda ash market, where Ciech is a key player, customers might consider alternative alkalis or different production methods if they offer cost savings or a reduced environmental footprint.

- Price Sensitivity: Many of Ciech's products, like soda ash, are commodity chemicals where price is a primary driver for customer purchasing decisions.

- Performance Benchmarking: Customers regularly compare the performance metrics of Ciech's offerings against potential substitutes to ensure optimal production efficiency.

- Sustainability Drivers: Growing demand for eco-friendly solutions means customers may switch to substitutes with better environmental credentials, even at a slightly higher cost.

- Technological Advancements: New technologies can emerge that offer superior performance or cost-effectiveness, creating a threat of substitution.

Indirect Substitutes from Other Industries

While direct chemical alternatives pose a threat, advancements in unrelated sectors can also introduce indirect substitutes, impacting demand for Ciech's core products. For instance, innovations in construction materials could reduce the need for glass, thereby lowering demand for soda ash, a key ingredient. Similarly, shifts in consumer preferences for packaging materials might decrease the requirement for certain plastics that Ciech produces.

These indirect threats are particularly relevant as technological progress accelerates across diverse industries. For example, the development of biodegradable or reusable packaging solutions could significantly curb the market for traditional plastics. In 2023, the global packaging market saw a notable increase in demand for sustainable alternatives, with the bioplastics segment alone projected to grow substantially in the coming years.

Ciech's diversified product portfolio, spanning chemicals, agriculture, and energy, offers a degree of resilience against these indirect substitution risks. By not being solely reliant on one chemical or end-market, the company can better absorb the impact of shifts in demand driven by innovations elsewhere. For example, even if demand for certain plastics softens, growth in their agrochemical segment could offset these pressures.

- Indirect substitution risks can emerge from technological advancements in unrelated industries, impacting demand for core chemical products.

- Innovations in construction materials or packaging preferences can indirectly affect demand for chemicals like soda ash and plastics.

- The global packaging market is increasingly shifting towards sustainable and biodegradable alternatives, posing a potential threat to traditional plastic producers.

- Ciech's diversified business segments, including chemicals, agriculture, and energy, help mitigate the impact of these indirect substitution threats.

The threat of substitutes for Ciech's products is significant, as customers can often find alternative chemicals or entirely different solutions to meet their needs. This is particularly true for commodity chemicals where price and performance are key differentiators. For instance, in the soda ash market, where Ciech is a major producer, customers might explore alternative alkalis or process modifications if they offer cost savings or improved environmental profiles. The global market for green chemicals, valued at approximately $150 billion in 2023, highlights a growing trend towards sustainable alternatives that could impact traditional chemical demand.

| Ciech Product Category | Potential Substitutes | Impact on Ciech | Market Trend Example |

|---|---|---|---|

| Soda Ash | Caustic Soda, Potassium Carbonate, alternative alkalis | Limits pricing power, potential market share loss if substitutes are cheaper or greener | Growing demand for sustainable alternatives in glass and detergent industries |

| Sodium Bicarbonate | Alternative leavening agents, new production technologies (e.g., carbon capture) | Disruption of traditional production methods, price competition | Emerging technologies in food production and industrial applications |

| Plastics | Bioplastics, biodegradable materials, reusable packaging | Reduced demand for conventional plastics, shift in consumer preferences | Global packaging market shift towards sustainable and biodegradable options |

Entrants Threaten

Establishing new chemical production facilities, particularly for large-scale operations like soda ash and sodium bicarbonate, demands colossal capital investments. For instance, constructing a modern chemical plant can easily run into hundreds of millions, if not billions, of dollars.

The sheer cost of building state-of-the-art plants, including advanced machinery, environmental controls, and infrastructure, acts as a formidable barrier to entry for potential new competitors. This substantial financial hurdle effectively deters many aspiring entrants from even considering market entry.

The chemical industry in Europe operates under a demanding and constantly changing landscape of environmental, health, and safety regulations. For any new company looking to enter this market, understanding and complying with this intricate web of rules is a significant hurdle.

New entrants face a substantial challenge in navigating the complex permitting processes, adhering to strict compliance standards, and conducting thorough environmental impact assessments. These requirements add considerable time and financial investment to the market entry process, acting as a powerful deterrent.

This significant regulatory burden disproportionately impacts newcomers compared to established players who already have the infrastructure and expertise to manage compliance. For instance, REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations in the EU require extensive data submission and can cost millions of euros for new substances, making it a significant barrier.

Established players like Ciech leverage substantial economies of scale in production, distribution, and procurement. This allows them to achieve lower per-unit costs, a significant advantage in the chemical industry.

New entrants, typically operating at a much smaller scale, find it challenging to replicate these cost efficiencies. Consequently, they face a considerable hurdle in competing on price against incumbents, making market entry more difficult.

For instance, in 2024, major chemical producers often operate plants with capacities exceeding 100,000 tons per year, enabling significant cost reductions through bulk purchasing of raw materials and optimized logistics.

Access to Raw Materials and Distribution Channels

Securing reliable access to essential raw materials, like the brine and limestone crucial for soda ash production, presents a significant hurdle for newcomers. For instance, in 2024, the global soda ash market, valued at approximately $45 billion, saw established players leveraging their long-term supply contracts, making it difficult for new entrants to secure competitive pricing and consistent volumes.

Establishing extensive distribution networks across Europe and globally is another formidable challenge. Existing companies like Ciech have cultivated deep-rooted relationships and sophisticated logistical infrastructure over decades. This established network provides them with a distinct advantage in reaching customers efficiently and cost-effectively, a capability that new entrants would find extremely difficult and time-consuming to replicate.

The threat of new entrants is thus moderated by the substantial capital investment and time required to build comparable raw material access and distribution capabilities. These barriers create a protective moat for incumbent firms, discouraging new competition.

- Raw Material Access: New entrants face challenges securing consistent and cost-effective supplies of key inputs like brine and limestone.

- Distribution Networks: Building widespread and efficient distribution channels comparable to established players requires significant investment and time.

- Incumbent Advantages: Long-standing relationships and existing infrastructure create substantial barriers to entry in terms of logistics and customer reach.

Brand Loyalty and Customer Relationships

While some chemical products are indeed commodities, the chemical industry, including players like Ciech, often sees customers valuing more than just price. Long-standing relationships, consistent reliability in supply, and robust technical support can cultivate significant customer loyalty, particularly for more specialized chemical offerings. For instance, in 2024, major chemical distributors reported that over 60% of their B2B clients cited supply chain reliability as a primary factor in supplier selection, even above cost savings.

New entrants face a considerable hurdle in overcoming this established trust. They would need to make substantial investments not only in production capabilities but also in building credibility and dislodging deeply entrenched relationships that current suppliers, like Ciech, have cultivated over time. This often translates to lengthy sales cycles and a need for extensive marketing and customer service efforts.

Ciech's established reputation and its long-standing presence in the market serve as a significant competitive advantage. This allows them to leverage existing customer trust, making it more difficult for new, unproven entities to gain market share. In 2023, Ciech reported that its key accounts, representing a substantial portion of its revenue, had been with the company for an average of over ten years, highlighting the strength of these relationships.

- Customer Loyalty Drivers: Reliability of supply, technical support, and established relationships are key differentiators beyond product price in the chemical sector.

- Barriers to Entry: New entrants must invest heavily in building trust and displacing existing customer loyalty, a process that can be time-consuming and costly.

- Ciech's Advantage: The company's established reputation and market presence provide a strong foundation for retaining customers and deterring new competition.

- 2024 Data Point: Over 60% of B2B chemical clients in 2024 prioritized supply chain reliability in supplier choices, underscoring the importance of established operational strengths.

The threat of new entrants into the chemical sector, particularly for established players like Ciech, is significantly mitigated by several high barriers. These include the immense capital required for new plant construction, stringent regulatory compliance, and the difficulty in replicating established economies of scale and raw material access.

Customer loyalty, built on reliability and trust, further solidifies the position of incumbents, demanding substantial investment from newcomers to gain market traction.

These factors collectively create a formidable challenge for potential new competitors, effectively limiting the threat of new market entrants.

Porter's Five Forces Analysis Data Sources

Our Ciech Porter's Five Forces analysis is built upon a foundation of diverse and reliable data sources. We leverage company annual reports, investor presentations, and regulatory filings to understand internal strategies and financial health. Additionally, industry-specific market research reports and trade publications provide crucial insights into market dynamics and competitive landscapes.