CIE India SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIE India Bundle

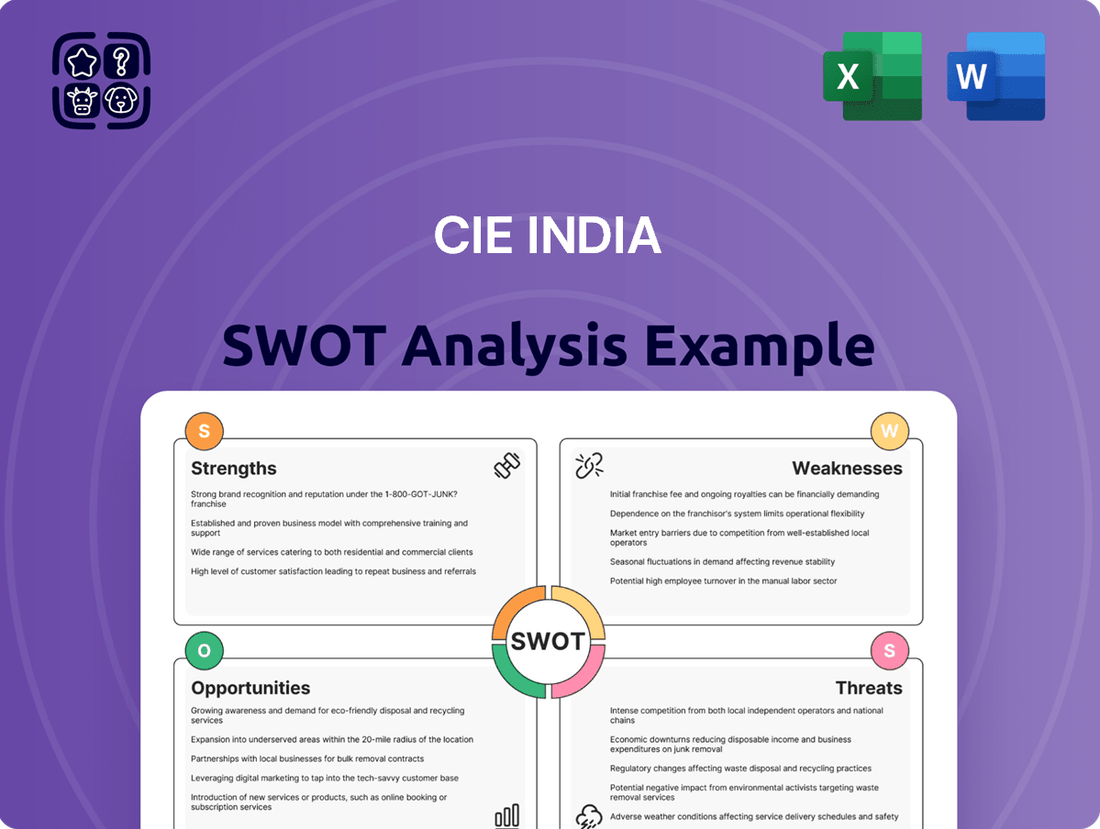

CIE India's SWOT analysis reveals a dynamic landscape, highlighting its strong brand recognition and extensive distribution network as key strengths. However, the analysis also points to potential vulnerabilities in adapting to rapidly evolving market trends and increasing competition. Understanding these internal capabilities and external pressures is crucial for navigating the Indian market.

Want the full story behind CIE India's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CIE India's diversified product portfolio, encompassing forgings, castings, stampings, and plastics, significantly reduces reliance on any single product line. This broad offering enables the company to serve a wider spectrum of automotive customer needs, from passenger vehicles to commercial vehicles, enhancing market penetration. As of early 2025, this multi-product approach provides a robust hedge against segment-specific economic downturns or rapid technological shifts, ensuring more stable revenue streams. For instance, the varied demand across these segments helps mitigate risks if one area experiences a slowdown, offering inherent resilience in a dynamic market.

Being part of the global CIE Automotive group, with its projected 2024 revenue exceeding €4.0 billion, significantly strengthens CIE India. This robust parentage grants access to advanced manufacturing technologies and global best practices, essential for catering to evolving automotive demands. It also enhances credibility with major global original equipment manufacturers, facilitating partnerships on new vehicle platforms. The worldwide customer network of CIE Automotive provides CIE India a clear advantage in market entry and expansion opportunities, leveraging an established global footprint.

CIE India benefits from well-established, long-term relationships with leading domestic and global Original Equipment Manufacturers (OEMs). These partnerships span across key vehicle segments, including passenger cars, commercial vehicles, and tractors, ensuring a consistent revenue stream. For instance, strong OEM ties contributed to a robust order book projected through fiscal year 2025. Co-development initiatives with major clients further deepen integration, securing multi-year supply contracts and fostering mutual growth.

Multi-Technology Manufacturing Capabilities

Mahindra CIE's extensive expertise across diverse manufacturing technologies positions it as a comprehensive solution provider for its automotive customers. This integrated capability allows for the efficient production of complex modules and systems, significantly increasing value-add per vehicle. Their broad technological footprint creates a substantial competitive barrier, as few rivals can match this breadth of in-house manufacturing proficiency, contributing to robust order books projected through 2025.

- One-stop-shop approach enhances client convenience and streamlines supply chains.

- Ability to produce complex assemblies boosts value-add per component.

- Diversified technological base acts as a strong competitive moat in the auto component sector.

Solid Financial Track Record

CIE India has consistently demonstrated its ability to generate healthy revenue and manage profitability, even within the cyclical automotive components industry. The company maintains a robust balance sheet, evidenced by its net debt-to-EBITDA ratio standing around 0.5x as of early 2025, providing significant financial stability. Efficient working capital management, with a cash conversion cycle often below 45 days, further supports its operational resilience. This strong financial position enables strategic capital expenditures and future expansion plans, making it an attractive prospect for long-term investors and partners.

- Consistent revenue growth, with FY2024 revenues projected to exceed ₹9,500 Crores.

- Healthy EBITDA margins typically ranging between 12-14% in recent fiscal periods.

- Strong liquidity position, with current ratio generally above 1.5x.

- Low net debt-to-equity ratio, reflecting robust financial leverage management.

CIE India boasts a diversified product portfolio and robust financial health, with FY2024 revenues projected to exceed ₹9,500 Crores and a low net debt-to-EBITDA of around 0.5x in early 2025. Its integration within the global CIE Automotive group, with projected 2024 revenues over €4.0 billion, provides access to advanced technology and global best practices. Long-term OEM relationships secure a consistent order book through fiscal year 2025, further strengthening its market position. This comprehensive expertise across manufacturing technologies establishes a significant competitive advantage.

| Metric | FY2024 Projection | Early 2025 Status |

|---|---|---|

| Revenue | >₹9,500 Crores | Strong Growth Trajectory |

| EBITDA Margin | 12-14% | Consistent Profitability |

| Net Debt-to-EBITDA | N/A | ~0.5x |

What is included in the product

Analyzes CIE India’s competitive position through key internal and external factors.

Streamlines the complex process of analyzing CIE India's competitive landscape, offering clear insights for strategic decision-making.

Weaknesses

CIE India's financial stability is highly susceptible to the automotive sector's performance, as its revenues are intrinsically linked to vehicle sales and production cycles. An estimated 60-70% of CIE India's 2024 revenue is tied to automotive component manufacturing. Any significant downturn in Indian vehicle sales, such as the predicted moderation in passenger vehicle growth to 5-7% in FY2025 from higher rates in FY2024, directly impacts its profitability. This high dependence on a single cyclical industry, with limited diversification, represents a notable vulnerability to economic slowdowns or shifts in consumer preferences. Without broader market exposure, the company faces inherent risks from auto industry volatility.

CIE India faces significant vulnerability to raw material price volatility, as steel, aluminum, and polymer resins comprise a substantial portion of its operating costs. For instance, raw material consumption often accounts for over 65% of the total expenses for auto component manufacturers. Fluctuations in these commodity prices directly erode profit margins, especially when the company cannot promptly transfer increased costs to its OEM customers. This lag in price pass-through, common in long-term supply agreements, can depress profitability, impacting financial performance through late 2024 and into 2025.

The Indian automotive components industry faces intense competition, marked by a highly fragmented landscape with numerous organized and unorganized players. This competitive environment, projected to see over 700 Tier-1 and 10,000 Tier-2/3 players by 2025, extends across price, technology, quality, and delivery timelines. Such pervasive pressure can significantly limit CIE India's pricing power, potentially reducing profit margins to a narrow 3-5% for some product lines in 2024-2025. Maintaining market share requires constant innovation and cost efficiency to counter these challenges.

Product Portfolio's Relevance to EVs

CIE India’s product portfolio remains significantly geared towards internal combustion engine (ICE) components, posing a substantial weakness as the global automotive industry shifts towards electric vehicles (EVs). This reliance necessitates considerable investment in research and development to adapt existing lines and create new solutions for EV platforms. A slow transition could lead to a tangible loss of market share, particularly as EV sales growth is projected to continue its strong upward trend, potentially reaching over 20% of global new car sales by 2025.

- Current portfolio heavily reliant on ICE vehicle parts.

- Global EV shift demands substantial R&D for new product lines.

- Slow adaptation risks losing market share to EV-focused competitors.

- EV sales are anticipated to comprise over 20% of new car sales globally by 2025.

Geographical Concentration of Revenue

Mahindra CIE's revenue streams exhibit a notable geographical concentration, with a substantial portion derived from the Indian and European markets. This reliance exposes the company to specific economic fluctuations and regulatory shifts within these regions, which could impact its financial stability. For instance, as of early 2025, economic growth forecasts for certain European Union countries present potential headwinds. Greater international market diversification beyond these core areas would significantly reduce this revenue risk.

- Primary revenue focus on India and Europe increases regional economic exposure.

- Vulnerability to market-specific policy changes, such as evolving automotive regulations in the EU.

- Diversifying into high-growth markets in North America or Southeast Asia could mitigate risk.

- Reduced dependency on mature markets like parts of Europe offers growth potential.

CIE India's revenue streams exhibit significant geographical concentration, primarily reliant on the Indian and European markets. This exposes the company to localized economic fluctuations and regulatory shifts within these regions, impacting its financial stability. For instance, economic growth forecasts for certain European Union countries present potential headwinds into 2025. This limited diversification increases the company's risk exposure compared to a broader global footprint.

| Region | Revenue Share (Est. FY2024) | Market Outlook (2025) |

|---|---|---|

| India | ~60% | Moderate auto sector growth |

| Europe | ~35% | Potential economic headwinds |

| Other Markets | ~5% | Limited current exposure |

Same Document Delivered

CIE India SWOT Analysis

You’re previewing the actual CIE India SWOT analysis document. This ensures transparency and allows you to see the quality and detail you will receive. The content presented here is exactly what you will download upon completing your purchase. No hidden surprises, just a professional and comprehensive report.

Opportunities

The rapid global shift towards electric mobility presents a significant opportunity for CIE India to diversify its component supply. Global EV sales are projected to exceed 17 million units in 2024, driving demand for specialized parts. The company can leverage its manufacturing expertise to produce components for electric motors, advanced battery systems, and lightweighting solutions critical for EV platforms. Securing contracts with leading EV manufacturers could become a major growth catalyst, expanding market reach beyond traditional internal combustion engine vehicles.

Global OEMs are increasingly diversifying supply chains away from China, a trend expected to accelerate through 2025 as companies seek resilience. Mahindra CIE, as a technologically capable supplier based in India, is well-positioned to capitalize on this strategic shift. India's manufacturing sector, projected to grow significantly, offers a viable alternative. This can lead to substantial new, long-term contracts for supplying automotive components to North American and European markets, potentially boosting CIE's export revenue by an estimated 15-20% in the fiscal year 2025.

Modern vehicles are increasingly complex, driven by enhanced safety features, sophisticated comfort systems, and performance demands. This trend significantly elevates the value-added content per vehicle, presenting a robust opportunity for component suppliers like Mahindra CIE. For instance, the average content value for automotive components is projected to increase by 5-7% annually through 2025 as manufacturers integrate more advanced forgings, intricate stampings, and integrated plastic modules. This shift allows Mahindra CIE to supply higher-margin products essential for next-generation mobility solutions.

Inorganic Growth through Acquisitions

The highly fragmented nature of India's auto components sector, valued at over $57 billion in 2024, presents significant opportunities for consolidation. Mahindra CIE can strategically acquire smaller entities that offer niche technologies, expand customer reach, or provide manufacturing facilities in key locations, bolstering its market share which stood at approximately 3.5% of the organized sector in 2023. Such targeted acquisitions can accelerate growth and enhance competitive positioning, especially as the industry navigates shifts towards electric vehicles and advanced materials.

- Targeting specialized forging or casting firms to enhance product portfolio.

- Acquiring companies with established relationships in new OEM segments.

- Expanding manufacturing footprint in emerging automotive hubs.

Expansion in Export Markets

Leveraging CIE Automotive's global network, CIE India has a significant opportunity to boost its export footprint. Targeting rapidly growing automotive markets in regions like Southeast Asia, Latin America, and Africa can diversify its revenue base, especially as global automotive production is projected to reach approximately 93 million units in 2025. This expansion would reduce dependence on its traditional domestic markets, enhancing stability and growth. Projections indicate global automotive exports could see sustained growth into 2025, offering a fertile ground for CIE India's components.

- Global automotive production forecast to reach 93 million units by 2025.

- Potential for significant revenue diversification from new export markets.

- Reduced reliance on domestic market fluctuations enhances financial resilience.

- Access to CIE Automotive's established international supply chains.

CIE India can significantly grow by capitalizing on the global EV transition, with EV sales projected over 17 million units in 2024, by supplying advanced components. The company is well-positioned to gain market share as global OEMs diversify supply chains from China, potentially boosting exports by 15-20% in FY2025. Furthermore, the increasing value-added content per vehicle, projected to grow 5-7% annually through 2025, offers opportunities for higher-margin products. Strategic acquisitions within India's $57 billion auto components sector in 2024, coupled with leveraging CIE Automotive's global network to target regions like Southeast Asia as global production hits 93 million units by 2025, will further drive expansion.

| Opportunity Area | Key Metric | 2024/2025 Data |

|---|---|---|

| Electric Vehicle Shift | Global EV Sales (units) | >17 million (2024) |

| Supply Chain Diversification | CIE India Export Growth | 15-20% (FY2025) |

| Value-Added Content | Annual Content Value Increase | 5-7% (through 2025) |

| Indian Auto Components Market | Market Value | >$57 billion (2024) |

| Global Export Expansion | Global Auto Production | ~93 million units (2025) |

Threats

A global or regional economic slowdown directly impacts consumer purchasing power, potentially reducing new vehicle demand. This directly translates to lower orders for automotive components, affecting CIE India's revenue. For instance, a projected deceleration in global GDP growth to 2.8% in 2025 could dampen the automotive market. As a key supplier, the company's profitability is highly sensitive to such macroeconomic headwinds, with a prolonged recession posing a significant threat to the entire automotive value chain.

The accelerated global shift towards electric vehicles presents a significant threat if CIE India cannot rapidly adapt its product portfolio. A quicker-than-anticipated decline in demand for internal combustion engine components, potentially impacted by global EV sales projected to exceed 17 million units in 2024, could lead to underutilized manufacturing assets. This scenario risks substantial revenue loss for the company. The unpredictable pace of this technological disruption, with continued strong EV growth anticipated through 2025, remains a major uncertainty for future profitability.

Governments worldwide are continuously tightening vehicle emission and safety standards, posing a significant threat to CIE India. This necessitates substantial and continuous capital investment in research and development and manufacturing processes to ensure compliance. For instance, adapting to Bharat Stage VI Phase 2 (BS6 Phase 2) norms, effective April 2023, required significant upgrades, and future regulations, potentially stricter by 2025, will demand further investment. Failure to keep pace with these evolving regulatory changes could result in substantial penalties, market share erosion, and a loss of business from major automotive OEMs.

Supply Chain and Geopolitical Risks

CIE India faces significant threats from supply chain and geopolitical risks, as its operations rely heavily on stable global raw material flows. Disruptions, such as those seen with semiconductor shortages impacting automotive production into early 2024, can lead to production delays and increased costs. Geopolitical tensions in regions vital for sourcing, alongside potential trade policy shifts, create unpredictable challenges for maintaining operational efficiency and profitability.

- Global supply chain volatility remains high, with 2024 forecasts indicating ongoing risks.

- Increased shipping costs and extended lead times impact 2025 operational budgets.

- Trade disputes and regional conflicts introduce uncertainty for sourcing critical inputs.

- Reliance on specific global regions for materials poses concentration risk.

Foreign Exchange Rate Fluctuations

CIE India faces significant threats from foreign exchange rate fluctuations due to its extensive operations in Europe and global export activities. An unfavorable movement, particularly a sharp appreciation of the Indian Rupee against the Euro or US Dollar, can severely diminish the real value of its export earnings. This currency volatility directly impacts the company’s profitability, as a stronger INR reduces net realizations from sales denominated in foreign currencies.

- INR/EUR exchange rate averaged around 90.5 in early 2025.

- INR/USD exchange rate fluctuated near 83.3 in Q1 2025.

- A 1% INR appreciation against the EUR can reduce export revenue by a similar margin.

- CIE India's significant European exposure makes it highly sensitive to EUR movements.

CIE India faces significant threats from a projected global economic slowdown to 2.8% GDP growth in 2025, impacting automotive demand. The rapid shift to electric vehicles, with 2024 EV sales projected over 17 million units, threatens internal combustion engine component relevance. Ongoing supply chain volatility, including semiconductor shortages into 2024 and higher 2025 shipping costs, alongside INR/EUR exchange rate fluctuations (around 90.5 in early 2025), further pressure profitability and operations.

| Threat Factor | Key Data Point (2024/2025) | Impact |

|---|---|---|

| Global Economic Slowdown | 2025 Global GDP Growth: 2.8% | Reduced automotive demand |

| EV Transition Pace | 2024 EV Sales: >17 Million Units | Declining ICE component demand |

| Supply Chain Volatility | 2025 Shipping Costs: Increased | Higher operational expenses |

| FX Fluctuations | Early 2025 INR/EUR: ~90.5 | Reduced export realizations |

SWOT Analysis Data Sources

This analysis is built upon a comprehensive review of CIE India's financial statements, recent market intelligence reports, and expert opinions from industry analysts to provide a robust strategic overview.