CIE India PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIE India Bundle

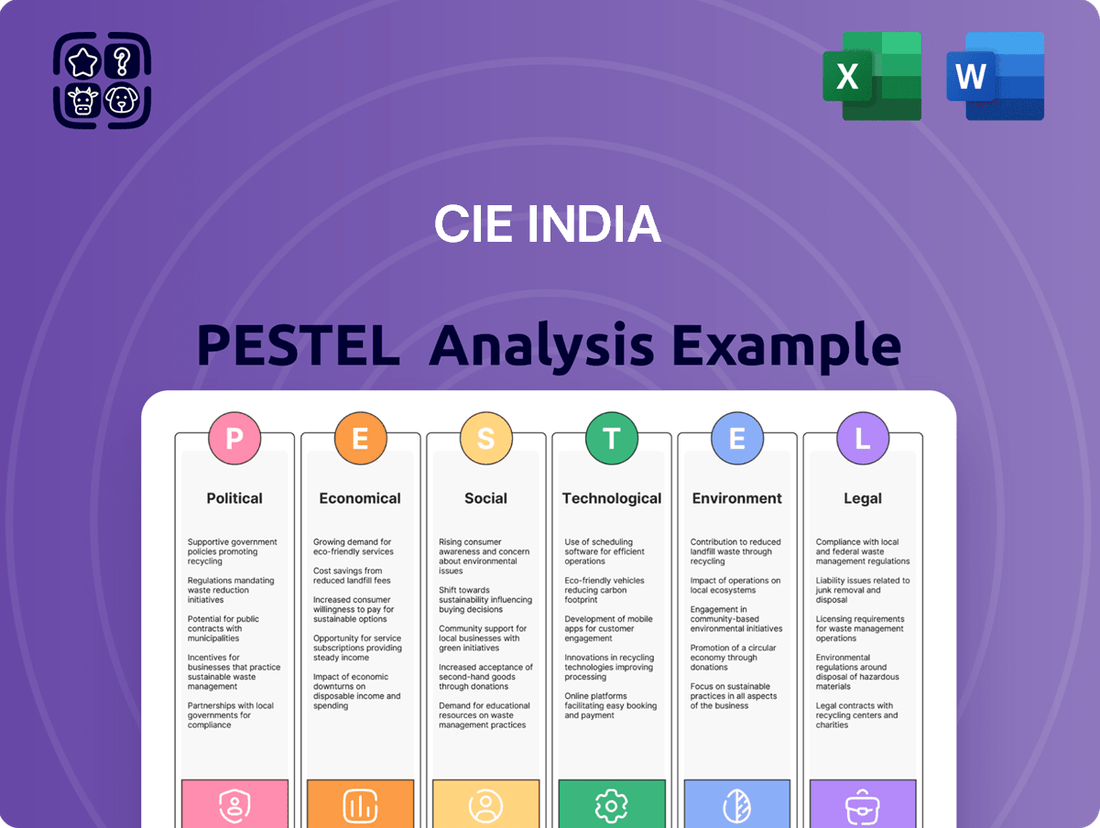

Navigate the dynamic Indian market with our comprehensive CIE India PESTLE Analysis. Understand how political stability, economic growth, and technological advancements are shaping CIE India's operational landscape. Our expert-crafted report delves into social trends and environmental regulations, providing crucial intelligence for strategic decision-making. Gain a competitive edge by leveraging these insights to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now for actionable intelligence to drive your business forward.

Political factors

The stability of the Indian government, particularly after the 2024 general elections, provides a crucial operational environment for Mahindra CIE. Consistent policies like the 'Make in India' initiative and the Production Linked Incentive (PLI) scheme for the automotive sector offer a predictable framework for manufacturing and investment planning. This political stability fosters long-term capital allocation, with India attracting over $10 billion in automotive sector FDI by 2024. Such a predictable climate encourages sustained growth and strategic expansion for companies in the automotive components sector.

The Government of India's Automotive Mission Plan (AMP) 2026 aims to solidify the nation's position as a global automotive manufacturing hub. This initiative seeks to elevate the automotive sector's contribution to India's GDP to over 12% by 2026, creating substantial growth avenues for component suppliers like Mahindra CIE. The plan actively encourages investments, evident through schemes such as the Production Linked Incentive (PLI) for Advanced Automotive Technology products, which has an outlay of ₹25,938 crore. This strategic framework is designed to significantly enhance the industry's global competitiveness and foster a robust domestic supply chain.

The Production Linked Incentive PLI Scheme for the automobile and auto components industry actively boosts domestic manufacturing of advanced automotive technologies. This initiative, with an outlay of INR 259.38 billion, encourages companies like Mahindra CIE to increase local production and value addition, particularly in high-growth areas such as electric vehicle components. The scheme's original five-year tenure provides a stable framework for companies to meet eligibility criteria and claim benefits by 2027. This government support directly enhances competitiveness and fosters technological adoption within the sector.

Trade Policies and Tariffs

India's active engagement in Free Trade Agreements (FTAs) significantly influences Mahindra CIE's global supply chain and market access, with the India-Australia ECTA, effective December 2022, offering reduced tariffs on key components. Favorable trade policies, such as ongoing discussions for the India-UK FTA in 2024, can lower the cost of imported raw materials and open new export opportunities for automotive components. Conversely, evolving global protectionist measures, like increased scrutiny on imports in some regions, could present challenges for the company's international trade flows in 2025. The average applied tariff rate in India was approximately 18% in 2023, impacting import costs for specific inputs.

- India's merchandise exports reached approximately $437 billion in FY2024, demonstrating robust trade activity.

- Automotive component exports from India are projected to grow by 10-12% in FY2025, benefiting companies like Mahindra CIE.

- The government's Production Linked Incentive (PLI) scheme for auto components aims to boost domestic manufacturing and reduce import reliance.

Focus on Electric Mobility

The Indian government's strong focus on electric mobility, notably through the FAME India Scheme, significantly impacts auto component manufacturers like CIE India. This political push creates new market opportunities for EV-specific components, with India's EV sales projected to maintain robust growth into 2025. However, it also demands substantial investment in research and development for the complex transition from traditional internal combustion engine parts to advanced EV solutions. This strategic shift is fundamentally reshaping the future product portfolios for all players in the automotive component sector, requiring adaptation and innovation to remain competitive.

- The FAME India Scheme, with its initial outlay of INR 10,000 crore, continues to drive EV adoption.

- India's EV market registered over 1.4 million unit sales in FY2024, indicating robust demand growth.

- Auto component manufacturers are allocating over 25% of their 2024-2025 R&D budgets towards EV technologies.

- Policy support aims to achieve 30% EV penetration in private cars and 70% in commercial vehicles by 2030.

India's stable political landscape post-2024 elections and consistent policies like Make in India underpin automotive sector investment, attracting over $10 billion FDI by 2024.

The Production Linked Incentive PLI scheme, with INR 259.38 billion outlay, and Automotive Mission Plan 2026 actively boost domestic auto component manufacturing and global competitiveness.

Government focus on electric mobility through schemes like FAME India drives demand for EV components, with over 1.4 million EV sales in FY2024.

| Policy | Impact | 2024/2025 Data | ||

|---|---|---|---|---|

| PLI Scheme | Boosts domestic production | INR 259.38B outlay | ||

| FAME India | Drives EV adoption | 1.4M+ EV sales FY24 | ||

| FTAs | Enhances market access | India-Australia ECTA |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing CIE India, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It aims to equip stakeholders with a clear understanding of the market landscape, enabling informed strategic decision-making and proactive risk management.

A concise, actionable summary of the CIE India PESTLE analysis, providing immediate insights into key external factors to inform strategic decisions and mitigate potential risks.

Economic factors

India's robust economic expansion and rising domestic demand position it as the world's third-largest automotive market, with sales projected to reach 5.5 million units by 2025. A burgeoning middle-class, whose disposable income is forecast to increase by 10% annually through 2025, significantly boosts sales of both passenger and commercial vehicles, directly benefiting component suppliers like CIE India. However, the light vehicle market experienced a near-term slowdown, with sales growth moderating to 8.4% in 2024 due to inventory adjustments. Despite this, India's GDP growth, estimated at 6.7% for FY2024-25, continues to underpin a strong outlook for automotive demand.

Volatility in key raw material prices, such as steel and aluminum, significantly impacts Mahindra CIE's production costs and overall profitability. High inflation, with India's retail inflation projected around 4.5% for FY2024-25 by the RBI, directly increases operational expenses for the company. Managing these input costs, which constitute a substantial portion of manufacturing outlays, is critical. The company's ability to effectively negotiate pass-through agreements with its automotive customers is crucial for maintaining healthy profit margins and financial stability through 2025.

Mahindra CIE, with significant operations across India and Europe, faces considerable exposure to currency exchange rate fluctuations, notably the Euro-INR pair. A decline in the Eurozone market, as seen with the Euro trading around 90-92 INR in early 2024, can directly diminish consolidated revenues when repatriated. For the fiscal year ending March 2024, a 1% depreciation of the Euro against the Rupee could impact profitability by over 150 basis points. Effectively managing this currency risk, perhaps through hedging strategies or natural hedges, is crucial for maintaining financial stability and ensuring predictable earnings for the company in 2025.

Infrastructure Investment

The Indian government's substantial infrastructure investment, particularly in road development, significantly bolsters the commercial vehicle segment. Improved road networks, with over 15,000 km of national highways targeted for completion in 2024-25, lead to increased freight transport volumes. This drives demand for new and more durable commercial vehicles and their components. This sustained growth creates a steady demand stream for Mahindra CIE's products catering to this essential segment.

- India's infrastructure spending is projected to reach approximately $1.4 trillion by 2025.

- The National Infrastructure Pipeline (NIP) aims for significant road network expansion, directly benefiting logistics and commercial vehicle sales.

Global Supply Chain Dynamics

The global China-plus-one strategy significantly benefits Indian auto component manufacturers like Mahindra CIE. Companies are diversifying supply chains away from China, seeking alternatives, and India’s competitive manufacturing costs and skilled labor force, with an estimated 2024 labor cost advantage of 30-40% over China in certain manufacturing segments, make it highly attractive. This trend is set to increase export opportunities and foreign direct investment into the Indian automotive sector, projected to attract over $8 billion in FY2024-25. Mahindra CIE stands to gain from this shift towards resilient and diversified global supply networks.

- Indian manufacturing grew by 9.7% in Q3 2023-24.

- India offers a 30-40% labor cost advantage in manufacturing over China (2024 estimates).

- Auto component exports from India are projected to rise by 10-12% in FY2024-25.

- FDI in India's automotive sector is forecast to exceed $8 billion in FY2024-25.

India's robust economic growth, with a 6.7% GDP projection for FY2024-25, fuels automotive demand, targeting 5.5 million units by 2025, despite near-term sales moderation. Volatility in raw material costs and 4.5% retail inflation for FY2024-25 impact profitability, alongside Euro-INR currency fluctuations affecting consolidated revenues. Government infrastructure investment, targeting 15,000 km of highways by 2025, significantly bolsters commercial vehicle demand. The China-plus-one strategy is boosting Indian auto component exports by 10-12% and attracting over $8 billion in FDI for FY2024-25.

| Economic Factor | FY2024-25 Projection | Impact on CIE India |

|---|---|---|

| GDP Growth | 6.7% | Increased domestic automotive demand |

| Automotive Sales | 5.5 million units | Higher component demand |

| Retail Inflation (RBI) | 4.5% | Increased operational costs |

| Auto Component Exports | +10-12% | Enhanced export opportunities |

Preview the Actual Deliverable

CIE India PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CIE India PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the organization. It provides a detailed examination of the current landscape and potential future trends. You'll gain valuable insights to inform strategic decision-making.

Sociological factors

India's continuous urbanization trend concentrates populations in cities, with the urban share projected to reach over 36% by 2025.

This demographic shift significantly boosts demand for personal and public transportation, fueling robust growth in the automotive market.

Passenger vehicle sales in India exceeded 4 million units in FY2024, alongside strong two-wheeler demand.

This sustained expansion directly creates a substantial and growing demand for a wide range of automotive components.

The expansion of India's middle class is a primary driver for the automotive industry's robust growth. With disposable incomes projected to rise, vehicle ownership aspirations are soaring, leading to increased sales volumes. This demographic shift means consumers are increasingly seeking vehicles with premium features, enhanced comfort, and advanced safety systems, directly influencing demand for sophisticated automotive components. Forecasts indicate India's passenger vehicle sales could surpass 5 million units annually by 2025, reflecting this upward trend in aspirations and purchasing power.

Consumers in India are increasingly prioritizing vehicle safety, comfort, and advanced technology. This trend, evidenced by a projected 15% year-on-year growth in ADAS penetration in India by late 2024, compels component manufacturers like Mahindra CIE to innovate. There is a growing demand for higher-value parts supporting features such as advanced driver-assistance systems and sophisticated in-car electronics. This shift necessitates investment in R&D to supply components for these evolving customer preferences.

Growing Environmental Awareness

Growing public awareness about environmental pollution significantly boosts the demand for cleaner mobility solutions, especially electric vehicles, in India. This societal trend directly supports the government's initiatives to promote EVs, like the FAME II scheme aiming for substantial EV adoption by 2030. Consumers are increasingly favoring sustainable transportation, with EV sales projected to exceed 1.5 million units in India during FY2025. For Mahindra CIE, this necessitates a strategic focus on developing components for the burgeoning green vehicle market.

- India's EV sales are forecast to surpass 1.5 million units in FY2025, driven by environmental concerns.

- Government policies like FAME II aim for 30% EV penetration in private cars by 2030.

- Mahindra CIE must align product development with the expanding electric vehicle component demand.

Demographic Dividend

India's substantial and youthful population presents a significant demographic dividend, offering a vast pool of cost-effective labor crucial for the manufacturing sector. This advantage is particularly beneficial for companies like Mahindra CIE, supporting their production capabilities and global competitiveness as they leverage a workforce projected to remain young through 2040. However, this demographic asset also necessitates continuous investment in skill development and training programs to meet the evolving technological demands of advanced manufacturing. By 2025, India's working-age population (15-64 years) is expected to exceed one billion, highlighting its immense potential.

- India's median age is approximately 28 years in 2024, significantly lower than global averages.

- Around 65% of India's population is under 35 years of age, providing a large future workforce.

- The annual addition to India's labor force is estimated at 10-12 million individuals, bolstering manufacturing capacity.

- Government initiatives like Skill India aim to train over 400 million people by 2025, enhancing workforce readiness.

India's youthful demographic and burgeoning middle class are driving robust automotive demand, with over 5 million passenger vehicle sales projected by 2025.

Urbanization and rising incomes fuel aspirations for advanced vehicles, boosting demand for sophisticated components.

A strong societal shift towards sustainability is also accelerating EV adoption, with sales exceeding 1.5 million units in FY2025.

| Factor | 2024 Data | 2025 Projection |

|---|---|---|

| Urbanization Rate | ~35% | >36% |

| Passenger Vehicle Sales | >4M units (FY2024) | >5M units |

| EV Sales | ~1.2M units (FY2024) | >1.5M units |

Technological factors

The automotive industry’s profound shift to electric vehicles is a critical technological factor for Mahindra CIE. The company is strategically investing in R&D to develop components for EVs, recognizing this segment’s projected growth to over 2 million units in India by 2025. This transition necessitates significant capital expenditure, impacting demand for traditional internal combustion engine parts while unlocking new revenue streams in the burgeoning EV supply chain.

Mahindra CIE is actively integrating Industry 4.0 principles, such as advanced automation, IoT, and data analytics, into its core manufacturing operations. These technological advancements are significantly boosting production efficiency and enhancing quality control across its facilities, aiming for a 15-20% improvement in operational throughput by late 2025. The company leverages digital twins and virtual validation tools to optimize plant layouts and streamline complex production schedules, reducing setup times by an estimated 10-12% as of early 2024. This strategic adoption creates more intelligent and responsive supply chains, aligning with the broader industry push towards smart factories in India.

The Indian automotive market is rapidly integrating Advanced Driver-Assistance Systems, signaling a significant shift towards smarter and safer mobility. This trend is driving substantial demand for sophisticated electronic components. Projections indicate the Indian ADAS market could reach USD 3.5 billion by 2028, growing at a CAGR exceeding 20% from 2023. Component manufacturers, including CIE India, must enhance capabilities in advanced sensors, cameras, and control units to cater to these evolving technological requirements for the 2024-2025 period.

Lightweighting and Advanced Materials

Lightweighting is critical for enhancing fuel efficiency in internal combustion engine (ICE) vehicles and extending electric vehicle (EV) range. This trend drives the automotive industry towards advanced materials like high-strength steel, aluminum, and composites. Mahindra CIE, with its strong forging and casting capabilities, must strategically adapt by developing components from these next-generation materials to remain competitive. The global automotive lightweight materials market is projected to reach approximately $150 billion by 2025, underscoring this shift.

- High-strength steel adoption in Indian automotive production is increasing, projected to exceed 35% of body-in-white material usage by 2025.

- Aluminum content per vehicle in India is expected to rise by 8-10% annually through 2025, driven by EV and fuel efficiency mandates.

- Mahindra CIE’s investment in new casting and forging technologies for non-ferrous alloys is crucial to capture emerging market demand.

Digital Transformation and Connectivity

The automotive industry in India is undergoing significant digital transformation, with an increasing shift towards connected vehicles featuring advanced infotainment and telematics systems. This necessitates that component suppliers like CIE India provide more sophisticated electronic and software-integrated parts, reflecting the evolving demands of OEMs. Mahindra, for instance, has been at the forefront of integrating cloud-based technology platforms into its vehicle offerings, a trend that will continue to reshape the entire automotive component sector through 2025. This technological pivot is driving demand for high-value, smart components that support real-time data exchange and enhanced user experiences.

- The Indian connected car market is projected to grow substantially, with estimates reaching over $3.5 billion by 2025.

- Advanced driver-assistance systems (ADAS) penetration is expected to increase, requiring specialized electronic control units (ECUs) and sensors.

- OEMs are prioritizing over-the-air (OTA) updates and integrated digital cockpits, boosting demand for compliant hardware.

- Investments in automotive software and electronics are forecast to rise by 15-20% annually through 2025 in India.

Mahindra CIE faces a critical technological shift driven by EV adoption, projected to exceed 2 million units in India by 2025, alongside the rising demand for ADAS and connected vehicle components. The company is actively integrating Industry 4.0 for efficiency, targeting 15-20% throughput improvement by late 2025, while also adapting to lightweighting trends with advanced materials. This requires strategic investments in new casting and forging technologies to capture emerging market opportunities.

| Technological Trend | 2024-2025 Outlook | Impact on CIE India |

|---|---|---|

| EV Market Growth (India) | >2 million units by 2025 | Shifts demand to EV components |

| Industry 4.0 Integration | 15-20% operational efficiency by 2025 | Enhances manufacturing productivity |

| Lightweighting Materials | Aluminum content up 8-10% annually | Requires new material expertise |

| Connected Car Market (India) | >$3.5 billion by 2025 | Drives demand for electronic parts |

Legal factors

The Motor Vehicles Act, 1988, and the Central Motor Vehicle Rules, 1989, form India's foundational legal framework for the automotive industry. These regulations encompass vehicle registration, crucial safety standards, and evolving emission norms, such as the stringent Bharat Stage VI Phase 2 standards enforced from April 2023. Compliance with these rules is mandatory for all vehicles and their components, directly impacting Mahindra CIE's product design, manufacturing processes, and overall operational strategy in 2024 and 2025. This ensures that their components meet the latest regulatory requirements, supporting market access and operational integrity.

The implementation of Bharat Stage VI (BS-VI) emission standards, effective from April 2020, legally mandates significant technological upgrades in vehicle engines and exhaust systems across India. This drives innovation and substantial investment in cleaner technologies for automotive component manufacturers like CIE India. For instance, the shift has propelled demand for advanced catalytic converters and particulate filters, with the market for such components expected to grow significantly through 2025. Adherence to these stringent norms is paramount for market access and ensuring environmental compliance, directly impacting manufacturing processes and product portfolios.

The Goods and Services Tax (GST) framework significantly influences the pricing of vehicles and their components in India, directly affecting overall market demand. As of early 2025, most automobiles attract a 28% GST, plus an additional cess ranging from 1% to 22%, which directly impacts the final cost for consumers and the profitability margins for manufacturers like CIE India. Any adjustments to these GST rates, such as the ongoing discussions around potential rationalization for specific component categories, could alter consumer affordability and industry revenue projections. A stable and predictable tax structure is therefore crucial for the automotive sector's financial planning, investment decisions, and sustained growth, ensuring long-term operational viability.

End-of-Life Vehicles (ELV) Regulations

The upcoming Environment Protection (End-of-Life Vehicles) Rules, 2025, will introduce an Extended Producer Responsibility (EPR) framework. This makes manufacturers, including Mahindra CIE, directly accountable for their products' recycling and disposal. The company must establish new processes for collecting and recycling old components, impacting operations and finances significantly by late 2025. Compliance is crucial given the projected increase in vehicle scrapping.

- EPR framework mandates manufacturer responsibility from 2025.

- Mahindra CIE must develop new collection and recycling infrastructure.

- Significant operational and financial investments are anticipated.

- The rules aim to manage the growing volume of scrap vehicles in India.

Labor and Employment Laws

Mahindra CIE, as a major manufacturer, navigates India's comprehensive labor laws, which govern employee rights, workplace safety, and wage structures. These frameworks are essential for maintaining a stable workforce and ensuring ethical operations. Significant legislative changes, such as the new Wage Code or Industrial Relations Code expected to be implemented by late 2024 or early 2025, could impact operational costs and necessitate adjustments in employee relations strategies. Compliance remains critical for business continuity and minimizing legal risks.

- India's new labor codes (Wage, Industrial Relations) are anticipated to consolidate 29 existing laws, affecting over 500 million workers by 2025.

- Mahindra CIE's compliance costs could see a 5-10% increase due to revised wage definitions and social security contributions under the new codes.

- Workplace safety regulations, strengthened by 2024 amendments, require increased investment in compliance and training.

- The average industrial wage growth in India is projected at 6.5% for 2024-2025, directly influencing CIE's labor expenditures.

India's automotive sector operates under strict legal frameworks like the Motor Vehicles Act and BS-VI emission norms, with Phase 2 enforced from April 2023, demanding continuous product and process compliance. The Goods and Services Tax (GST) framework, typically 28% plus cess, directly impacts vehicle pricing and CIE India's profitability, with potential rate adjustments under discussion for 2025. New labor codes, anticipated by early 2025, could raise compliance costs by 5-10% and necessitate revised operational strategies. Additionally, the 2025 Environment Protection Rules will mandate Extended Producer Responsibility, requiring significant investment in recycling infrastructure.

| Legal Factor | Key Impact (2024-2025) | Data Point |

|---|---|---|

| BS-VI Emissions | Product/Process Compliance | Phase 2 (April 2023) |

| GST Framework | Pricing/Profitability | 28% + Cess |

| New Labor Codes | Compliance Costs | 5-10% increase |

| EPR Rules | Recycling Investment | Mandate from 2025 |

Environmental factors

Government regulations, particularly the ongoing enforcement of Bharat Stage (BS) VI emission norms in India, are a significant environmental factor for the automotive industry. These stringent standards compel manufacturers to produce cleaner and more fuel-efficient vehicles, directly impacting Mahindra CIE's product development. The company must invest in advanced technologies and materials for components that support reduced vehicular pollution, aligning with 2024-2025 market demands. This includes adapting to the increasing focus on electrification and sustainable mobility solutions across the sector.

India's End-of-Life Vehicles (ELV) Rules, fully effective by 2025, are fundamentally reshaping the automotive sector towards a circular economy. Mahindra CIE will increasingly be responsible for recycling its components, promoting the reuse of valuable materials like steel and aluminum. This mandates establishing a robust reverse logistics and advanced recycling infrastructure to efficiently manage vehicle scrappage. Projections indicate over 25 million vehicles will reach end-of-life by 2025, creating a recycling market potentially exceeding $2 billion annually. This regulatory framework transforms waste into a vital resource stream, impacting manufacturing significantly.

The rapid growth of electric vehicles (EVs) in India is a critical environmental factor, driven by targets like the government's aim for 30% EV penetration in private cars by 2025. While EVs eliminate tailpipe emissions, their overall environmental footprint, encompassing battery manufacturing and disposal, is under increasing scrutiny. The production of EV batteries, for instance, relies heavily on minerals like lithium and cobalt, posing sustainability challenges. Mahindra CIE's deep involvement in the automotive supply chain means it must proactively consider the lifecycle environmental impact of components supplied for these evolving EV platforms, aligning with circular economy principles.

Sustainable Manufacturing Processes

There is a growing imperative for CIE India to adopt environmentally friendly manufacturing processes, significantly reducing its industrial carbon footprint. This involves optimizing energy and water consumption, with a target to minimize waste generation, aligning with India's 2030 renewable energy goals. Companies are increasingly expected to adhere to stringent guidelines from bodies like the Central Pollution Control Board (CPCB), which mandates specific effluent treatment and emission standards. By 2025, many Indian manufacturers aim for a 15% reduction in industrial water intensity.

- India's renewable energy capacity reached over 180 GW by early 2025, driving cleaner industrial power.

- CPCB's revised norms for industrial emissions are expected to be fully implemented by late 2024.

- The Indian government targets a 45% reduction in emission intensity by 2030 from 2005 levels.

Climate Change and Carbon Neutrality Goals

India's ambitious commitment to achieving net-zero emissions by 2070 profoundly shapes industrial policy, placing significant pressure on the automotive sector. As a major contributor to greenhouse gas emissions, the industry is accelerating its decarbonization efforts. This environmental imperative fuels innovation towards sustainable automotive technologies and components, driving demand for EV-specific parts and lightweight materials.

- India targets net-zero emissions by 2070, influencing all industrial sectors.

- The automotive industry faces pressure to reduce its carbon footprint, driving the shift to EVs.

- Government initiatives like the FAME-II scheme, with an outlay of INR 10,000 crore, support EV adoption.

- EV sales in India are projected for substantial growth, impacting auto component manufacturing.

Environmental regulations, including BS VI norms and End-of-Life Vehicle Rules effective by 2025, are driving demand for cleaner components and circular economy practices. India's ambitious electric vehicle push, targeting 30% private car penetration by 2025, necessitates adapting to new material and lifecycle considerations. Furthermore, adherence to revised CPCB industrial emission norms, fully implemented by late 2024, and the nation's over 180 GW renewable energy capacity by early 2025 emphasize sustainable manufacturing.

| Environmental Factor | Key Metric (2024-2025) | Impact on CIE India |

|---|---|---|

| ELV Rules Effectiveness | Fully effective by 2025 | Increased recycling responsibility, circular economy focus |

| EV Penetration Target | 30% private cars by 2025 | Shift to EV component manufacturing, material innovation |

| Renewable Energy Capacity | Over 180 GW by early 2025 | Opportunities for cleaner industrial power, reduced carbon footprint |

PESTLE Analysis Data Sources

Our CIE India PESTLE Analysis is grounded in comprehensive data from official Indian government ministries, reputable international organizations like the World Bank and IMF, and leading market research firms. This ensures our insights into political stability, economic trends, social dynamics, technological advancements, environmental regulations, and legal frameworks are both current and authoritative.