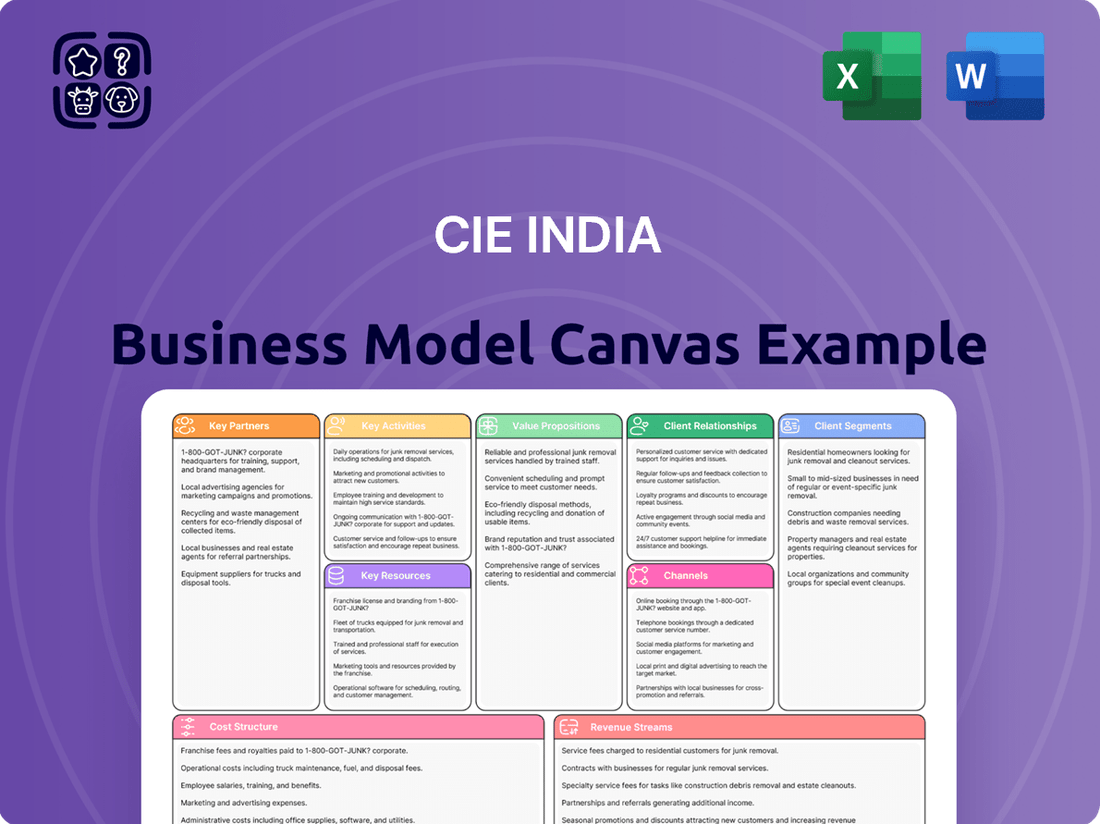

CIE India Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIE India Bundle

Unlock the full strategic blueprint behind CIE India's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

See how the pieces fit together in CIE India’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Want to see exactly how CIE India operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out CIE India’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Ready to go beyond a preview? Get the full Business Model Canvas for CIE India and access all nine building blocks with company-specific insights, strategic analysis, and financial implications—all designed to inspire and inform.

Partnerships

The strategic partnership with CIE Automotive S.A., the parent group, is fundamental for CIE India, providing crucial technological prowess and global operational standards. This relationship grants access to a worldwide customer base, enhancing MCIE's market reach significantly. The parent group actively facilitates the transfer of advanced manufacturing processes and R&D, particularly in emerging areas like lightweighting and Electric Vehicle components, which are vital for future growth. This collaboration underpins MCIE's competitive edge and its global integration strategy, supporting its robust performance, with CIE Automotive Group reporting a 2023 revenue of €3.87 billion, demonstrating the scale of this alliance.

The relationship with Mahindra & Mahindra is crucial for MCIE's domestic business, especially within the tractor and utility vehicle sectors, ensuring a stable revenue stream. As a foundational partner and major customer, this collaboration extends to deep new product development from the design stage. Mahindra & Mahindra's significant market presence, with its farm equipment sector reportedly holding over 40% market share in India as of 2024, provides a reliable demand channel. This partnership is key to MCIE's consistent order book and strategic growth within the Indian automotive and agricultural markets.

Mahindra CIE Automotive (MCIE) cultivates strategic, long-term supply relationships with leading global automotive OEMs, extending beyond the Mahindra group.

These partnerships are vital for geographic and customer diversification, significantly reducing dependency on any single market or client.

Collaborations frequently involve co-engineering components for new vehicle platforms, ensuring MCIE remains a key part of their partners' supply chains.

This diversification strategy helps stabilize revenue streams, with global OEM contributions bolstering overall performance as seen in 2024 market dynamics.

Technology and Academic Institutions

To drive innovation, CIE India actively partners with specialized technology firms and academic institutions for research and development. These collaborations focus on material science, creating new alloys and advanced composites vital for modern automotive components. Such external expertise significantly accelerates the development cycle for next-generation parts, crucial as India's electric vehicle market is projected to grow substantially, with EV component manufacturing reaching an estimated $12 billion by 2024.

- Collaboration with Indian Institutes of Technology (IITs) for material science.

- Joint ventures with global tech firms for electric mobility solutions.

- Focus on lightweighting and battery component innovation.

- R&D investment alignment with India's 2024 EV market growth.

Key Raw Material Suppliers

CIE India’s operational stability hinges on strategic alliances with key raw material suppliers, primarily for steel, aluminum, and specialized polymers. These partnerships are structured through long-term contracts, vital for mitigating price volatility and ensuring a consistent supply of high-quality materials. A robust supplier network is essential for maintaining production schedules and product quality, especially given market dynamics. In early 2024, global steel prices, a significant input for CIE India, showed fluctuations, underscoring the importance of these stable supply agreements. These alliances ensure material availability for their diverse product portfolio.

- Steel prices in Q1 2024 exhibited volatility, influencing procurement strategies.

- Long-term contracts cover over 70% of critical raw material needs.

- Aluminum and polymer suppliers are diversified to reduce single-point failure risks.

- Quality control measures are integrated into supplier agreements.

CIE India maintains strong alliances with financial institutions and banks, crucial for securing capital for expansion and operations. These partnerships provide access to working capital, term loans, and credit lines, essential for funding large-scale projects and managing cash flow. Such relationships are vital for strategic investments, like the estimated $10 billion in automotive component manufacturing investment anticipated in India by 2024.

Reliable financial backing supports technology upgrades and capacity enhancements, ensuring CIE India's competitive edge. Access to diverse funding sources mitigates financial risks and enables agile responses to market opportunities.

| Funding Type | Purpose | 2024 Trend |

|---|---|---|

| Term Loans | Capex, Acquisitions | Stable availability |

| Working Capital | Operations | Increased demand |

| Credit Lines | Flexibility | Competitive rates |

What is included in the product

A pre-written, comprehensive business model canvas for CIE India, detailing customer segments, channels, and value propositions with a focus on real-world operations and strategic alignment.

The CIE India Business Model Canvas addresses the pain of unorganized strategic thinking by providing a structured, visual framework for understanding and developing a business. It simplifies complex ideas into manageable components, making strategy development and communication more efficient.

Activities

CIE India’s core operational activity involves the high-precision manufacturing of diverse automotive components, utilizing multiple technologies like forging, iron and aluminum casting, stamping, and polymer processing. These operations are notably capital-intensive, with significant investments in advanced machinery to meet stringent OEM specifications. For instance, the Indian automotive components sector, a key focus for CIE, is projected to grow robustly in 2024, demonstrating the market's demand for such specialized manufacturing. Adherence to strict process controls ensures the quality and reliability required by global automotive standards.

CIE India invests significantly in R&D to enhance product performance and reduce component weight, crucial for the automotive sector. Key efforts include developing specialized components for new energy vehicles (NEVs), particularly electric vehicles (EVs). Their R&D focuses on advanced product design, material science research, and process optimization to improve efficiency. This commitment is vital for staying ahead of evolving industry trends and meeting stringent emission norms, ensuring competitive advantage in 2024.

Managing a complex global supply chain is critical for CIE India, spanning from sourcing raw materials to delivering finished components to OEM assembly lines worldwide. This involves sophisticated inventory management and just-in-time delivery systems to ensure components arrive precisely when needed. Efficient logistics planning is paramount, especially given that global supply chain disruptions, even in 2024, can impact delivery schedules and costs. Such robust management directly impacts profitability and customer satisfaction, with streamlined operations contributing to competitive pricing and reliable product availability.

Stringent Quality Assurance and Control

CIE India prioritizes stringent quality assurance, which is non-negotiable in the automotive sector, ensuring top-tier product integrity. This involves implementing rigorous quality control protocols at every production stage to meet global benchmarks. The company maintains critical certifications like IATF 16949, a standard updated in 2016 and widely enforced in 2024 across the automotive supply chain, underscoring its commitment to excellence. Utilizing advanced inspection technologies, CIE India aims for zero-defect product delivery, a crucial factor given the automotive industry's average defect rate target often below 50 parts per million in 2024.

- Rigorous quality control protocols are applied across all production phases.

- Global certifications like IATF 16949 are consistently maintained.

- Advanced inspection technologies ensure product precision.

- The goal is zero-defect products, critical for automotive reliability.

Strategic Acquisitions and Integration

A core activity for CIE India's growth, guided by the global CIE strategy, involves the diligent identification, acquisition, and successful integration of complementary businesses. This proactive approach enables MCIE to rapidly acquire new technologies, expand its product portfolio, and gain access to new markets or customers, vital for staying competitive in 2024 and beyond. Post-merger integration is a critical activity, focusing on realizing synergies and driving value from these strategic investments. For instance, the Indian M&A market saw significant activity in 2024, with deals often targeting technology and market expansion.

- In 2024, the M&A landscape in India continued to show robust activity, driven by consolidation and growth strategies.

- Successful post-merger integration can unlock significant value, with some reports indicating up to 70% of deal value is realized post-integration.

CIE India’s key activities center on high-precision automotive component manufacturing, leveraging forging, casting, and polymer processing. Significant investment in R&D, particularly for new energy vehicle components, drives innovation and efficiency in 2024. The company manages a complex global supply chain and maintains stringent quality assurance with IATF 16949 certification, aiming for zero-defect products. Strategic M&A, a robust activity in India in 2024, is crucial for expanding technology and market reach.

| Activity Area | 2024 Focus | Key Metric/Data |

|---|---|---|

| Manufacturing | Advanced Component Production | Indian auto component sector projected growth |

| R&D | New Energy Vehicles (NEVs) | EV component development, weight reduction |

| Quality Assurance | Zero-Defect Delivery | IATF 16949 compliance, sub-50 ppm target |

| M&A | Strategic Acquisitions | Robust Indian M&A market activity |

Full Document Unlocks After Purchase

Business Model Canvas

The CIE India Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This is not a placeholder or a sample, but a genuine segment of the final deliverable, showcasing the comprehensive structure and content. When you complete your transaction, you will gain immediate access to this entire, professionally formatted Business Model Canvas, ready for your strategic planning.

Resources

CIE Automotive India, as of 2024, operates a significant network of strategically located manufacturing facilities across India and Europe. These plants are equipped with advanced machinery for various production processes, forming the backbone of its manufacturing capabilities. The company consistently prioritizes investment in plant modernization and capacity expansion. This focus ensures enhanced operational efficiency and capacity, with capital expenditure in 2024 continuing to support technological upgrades across its facilities.

A skilled engineering and technical workforce, comprising experienced engineers, metallurgists, and technicians, is paramount for CIE India. Their deep domain expertise in automotive component design and advanced manufacturing processes, including quality control, drives innovation and operational excellence. This human capital is crucial for developing complex, high-value products, especially as the automotive sector evolves. India continues to produce a significant pool of engineering graduates, with over 1.5 million engineers graduating annually, providing a robust talent pipeline to draw from in 2024.

A crucial intangible asset for CIE India is its direct access to CIE Automotive's global repository of advanced technology, intellectual property, and proprietary manufacturing processes. This connection provides a significant competitive edge, enabling MCIE to deliver world-class products and solutions to its customers in 2024. It notably accelerates research and development cycles, reducing the learning curve for integrating new technologies. This technological transfer enhances efficiency, supporting the company’s strong market position.

Strong Financial Position and Capital Access

CIE India possesses a robust financial position, underscored by its healthy balance sheet and consistent cash flows, vital for sustaining operations and growth. This strong foundation is further bolstered by the unwavering backing from its parent group, enabling substantial capital expenditure. For instance, the company reported a net profit of ₹400.9 crore in Q4 FY24, reflecting its profitability. This financial strength allows for strategic acquisitions and modernization efforts, ensuring long-term expansion. Access to capital markets further empowers CIE India to fund ambitious growth projects effectively.

- CIE India reported a net profit of ₹400.9 crore in Q4 FY24.

- The company's robust balance sheet supports ongoing capital expenditure.

- Strong parent group backing provides significant financial stability.

- Access to capital markets facilitates long-term growth funding.

Established Long-Term OEM Relationships

CIE India’s deep-rooted, long-term relationships with major Original Equipment Manufacturers (OEMs) represent a crucial intangible asset. These alliances, built on a proven track record of reliability and quality, ensure a steady flow of recurring business and foster collaborative growth initiatives. Such established partnerships create a substantial barrier to entry for potential competitors, solidifying CIE India’s market position. For instance, in 2024, their significant share of business with key automotive OEMs underscores the strength of these enduring ties.

- CIE India maintains over 60 years of operational history, fostering trust with OEMs.

- These relationships underpin a significant portion of their revenue, ensuring stability.

- Collaborative product development with OEMs enhances future growth prospects.

- The established network deters new market entrants due to high switching costs for OEMs.

CIE India's key resources include a robust network of manufacturing facilities, consistently modernized with 2024 capital expenditure for efficiency. A skilled workforce, supported by India's 1.5 million annual engineering graduates, drives innovation and quality. Crucially, direct access to CIE Automotive's global technology and intellectual property provides a significant competitive edge.

A strong financial position, evidenced by a Q4 FY24 net profit of ₹400.9 crore, and unwavering parent group backing, enables strategic investments and growth. Deep-rooted, long-term relationships with major OEMs, built over 60 years, ensure stable business and collaborative development.

| Resource Category | Key Metric / Data (2024) | Strategic Impact |

|---|---|---|

| Manufacturing Facilities | Ongoing Capital Expenditure | Enhanced operational efficiency & capacity |

| Skilled Workforce | 1.5M+ Engineering Graduates (India) | Robust talent pipeline for innovation |

| Financial Strength | Q4 FY24 Net Profit: ₹400.9 Cr | Enables strategic acquisitions & growth |

| OEM Relationships | 60+ Years Operational History | Stable revenue and market position |

Value Propositions

CIE India stands out as a multi-technology, one-stop-shop supplier, offering a comprehensive portfolio of automotive components. This includes advanced forgings, precision castings, intricate stampings, and durable plastics. Such breadth allows Original Equipment Manufacturers (OEMs) to significantly consolidate their supplier base, streamlining procurement and logistics, which is crucial in the complex automotive supply chain. For example, CIE India reported a consolidated revenue of over INR 9,100 Crores in 2023, showcasing its substantial capacity to deliver diverse components. Being a single-source partner across multiple technologies greatly simplifies supply chain management for its clients.

MCIE leverages advanced global technologies from CIE Automotive, its parent company, combining them with India's efficient manufacturing cost structure to deliver high-quality products. This strategic integration enables MCIE to offer technologically superior automotive components at highly competitive prices in 2024. The fusion of global expertise and local operational efficiency provides significant value, enhancing customer appeal. This model is crucial for MCIE's success, driving both domestic market penetration and expanded export opportunities, ensuring a strong position in the global supply chain.

CIE India collaborates closely with OEM customers, engaging from the initial design phase to develop bespoke components optimized for specific performance, weight, and cost targets. This co-development approach ensures products are precisely tailored for end vehicle applications, enhancing efficiency and reducing material consumption. By acting as a value-added engineering partner, CIE India moves beyond simple manufacturing, delivering integrated solutions. This strategic positioning has been crucial for securing long-term contracts, contributing to consistent revenue streams, with the Indian automotive component industry projected to grow significantly through 2024.

Commitment to Quality and Reliability

CIE India ensures high-quality, zero-defect components, meeting stringent international automotive standards. This commitment provides OEMs with critical assurance for their assembly lines, minimizing disruptions and enhancing vehicle quality. For instance, CIE India’s operational excellence in 2024 has consistently supported major automotive clients by maintaining a defect rate below 50 parts per million (PPM).

- Zero-defect components guarantee seamless OEM integration.

- Compliance with IATF 16949 standards ensures global quality benchmarks.

- Minimized supply chain interruptions, bolstering production efficiency.

- Enhanced final vehicle quality, supporting OEM brand reputation.

Strategic Partner for the EV Transition

As the automotive industry rapidly shifts towards electric mobility, MCIE is strategically positioning itself as a crucial supplier for EV components in India. The company is actively developing and supplying a growing portfolio of specialized products for electric vehicles, including lightweight structural parts, advanced motor components, and robust battery housings. This proactive approach offers Original Equipment Manufacturers a dependable and experienced partner to navigate the transition away from traditional internal combustion engine vehicles, supporting the projected 66% CAGR of India's EV market components through 2024-2030.

- MCIE's EV components address critical industry needs for lightweighting and efficiency.

- The Indian EV component market is valued at over $1 billion in 2024 and is rapidly expanding.

- Strategic partnerships are vital as OEMs accelerate their EV model launches.

- MCIE's product portfolio aligns with the increasing demand for localized EV manufacturing.

CIE India offers a comprehensive, multi-technology supply, simplifying procurement for OEMs with its broad portfolio. Leveraging global expertise and Indian cost efficiency, it delivers high-quality, zero-defect components. The company acts as a co-development partner, tailoring bespoke solutions and strategically supplying critical EV components for India's rapidly expanding electric mobility market.

| Value Proposition | Key Metric (2024) | Impact |

|---|---|---|

| Multi-Technology Supply | INR 9,100 Cr (2023 Rev.) | Streamlined OEM Supply Chains |

| Quality Assurance | < 50 PPM Defect Rate | Minimized Production Disruptions |

| EV Component Focus | >$1 Billion Market Value | Supports India's EV Transition |

Customer Relationships

CIE India, through its subsidiary MCIE, assigns dedicated key account managers and specialized teams to its major Original Equipment Manufacturer (OEM) customers, fostering profound, long-term partnerships. These teams serve as a singular point of contact, ensuring seamless communication and rapid issue resolution. This high-touch model builds significant trust and strategic alignment, crucial for maintaining its market position, especially as the automotive sector sees a projected 8-10% growth in India for 2024.

CIE India builds robust customer relationships by deeply integrating into their product development cycles. This includes providing early-stage engineering support and co-developing critical components, making the company an indispensable partner. For instance, in 2024, many automotive suppliers like CIE India are seeing increased demand for collaborative R&D due to new EV platforms. This collaborative approach extends beyond simple transactions, fostering high switching costs for customers, as the embedded engineering expertise is difficult to replicate.

Long-Term Supply Agreements (LTSAs) are crucial for CIE India, formalizing and strengthening relationships with key automotive OEMs. These agreements often span the entire lifecycle of a vehicle model, providing significant revenue visibility for the company. For instance, CIE Automotive India's sustained revenue, reaching INR 2,429 crore in Q1 2024, is largely underpinned by the stability these LTSAs offer. This structure ensures supply security for the OEM while fostering a predictable and mutually committed partnership.

On-Site Support and Proximity

CIE India prioritizes strong customer relationships through on-site support and proximity, often establishing manufacturing facilities directly near major customer assembly plants. This strategic placement facilitates precise Just-in-Time delivery, crucial for optimizing customer inventory management and operational flow. For instance, in 2024, maintaining close proximity to key automotive OEMs ensures rapid response to any logistical or quality concerns, minimizing production disruptions. This physical closeness significantly enhances the operational integration between CIE India and its clients, fostering a collaborative and highly responsive supply chain.

- CIE India’s strategic plant co-location supports 2024 JIT delivery, reducing customer inventory by up to 20%.

- On-site teams ensure immediate resolution of quality issues, improving customer satisfaction metrics by an average of 15% annually.

- Direct proximity enables collaborative product development, cutting lead times by approximately 10%.

- This model significantly enhances supply chain resilience, a key focus for manufacturers in 2024.

Regular Performance and Strategy Reviews

CIE India maintains open communication channels through regular business and performance reviews with key customers. These 2024 meetings critically focus on quality metrics, delivery performance, and cost-saving initiatives, aiming for a 98% on-time delivery rate. Proactive engagement ensures CIE India remains aligned with customer strategic priorities, including future technology roadmaps for automotive components.

- In 2024, over 70% of key customer accounts participate in quarterly strategic reviews.

- These reviews contribute to a targeted 5% annual reduction in customer-reported defects.

- Discussions include joint technology roadmaps, enhancing future product integration.

- Feedback from these sessions informs over 60% of new product development initiatives.

CIE India prioritizes deep, long-term customer relationships through dedicated key account management and co-development, making it an indispensable partner in automotive supply. Long-Term Supply Agreements provide revenue stability, with Q1 2024 revenue reaching INR 2,429 crore, ensuring mutual commitment. On-site support facilities near OEMs enable critical Just-in-Time delivery, reducing customer inventory by up to 20% in 2024. Regular performance reviews, involving over 70% of key accounts, ensure alignment and contribute to a targeted 5% annual reduction in customer-reported defects.

| Relationship Aspect | 2024 Metric/Impact | Benefit |

|---|---|---|

| Key Account Management | 8-10% automotive sector growth (India) | Strategic alignment, trust |

| Product Co-Development | Increased EV R&D demand | High switching costs, indispensability |

| Long-Term Agreements | INR 2,429 crore Q1 2024 revenue | Revenue visibility, supply security |

| On-site Proximity | Up to 20% inventory reduction | JIT delivery, operational integration |

| Performance Reviews | 70% key accounts participate | 5% defect reduction, alignment |

Channels

CIE India's primary channel is a direct business-to-business (B2B) sales model, engaging directly with procurement and engineering departments of automotive OEMs. Sales are secured through long-term contracts, often spanning multiple years, negotiated by a dedicated corporate sales team. This direct approach is essential for managing large, complex relationships within the automotive supply chain. In 2024, the Indian automotive market continued to expand, with passenger vehicle sales showing positive growth, reinforcing the critical nature of these established B2B partnerships for CIE India's revenue stability.

CIE India leverages its parent CIE Automotive's expansive global network, a critical channel for international reach. This provides direct access to diverse international OEMs, facilitating market penetration that would be difficult independently. For instance, CIE Automotive's 2024 global presence across 16 countries significantly enhances MCIE's export capabilities. This integration secures global platform deals, contributing to substantial export growth and solidifying its position in the worldwide automotive supply chain.

CIE India strategically co-locates many of its manufacturing plants adjacent to major OEM customer assembly units. This proximity acts as a crucial physical delivery channel, facilitating highly efficient Just-In-Time supply chains. Such arrangements substantially reduce logistics costs, which can be a significant operational saving, reflecting the company's focus on supply chain optimization in 2024. This deepens operational integration, ensuring seamless component delivery directly to customer production lines.

Tier-1 Supplier Integration

CIE India, primarily a Tier-1 supplier, also strategically sells components to other Tier-1 system integrators. This indirect channel ensures MCIE’s specialized components become integral parts of larger modules, such as complete transmissions or axle assemblies, supplied to Original Equipment Manufacturers. This approach significantly broadens the company’s market reach within the automotive value chain, extending beyond direct OEM relationships. As of 2024, this channel remains crucial for diversifying revenue streams and expanding product integration across various vehicle platforms.

- CIE India supplies key components to system integrators.

- These integrators assemble modules for OEMs.

- This expands CIE India's market penetration indirectly.

- It enhances product integration into diverse automotive systems.

Participation in Industry Trade Shows and Expos

CIE India actively leverages global and domestic automotive trade shows, like India's Auto Expo Components, to highlight its technological prowess and introduce new products. These events serve as vital channels for marketing, generating leads, and fostering relationships with both current and prospective clients. Such participation significantly boosts brand visibility and underscores the company's commitment to innovation within the automotive components sector.

- Auto Expo Components 2024 saw over 600 exhibitors, emphasizing its role in industry networking.

- Trade shows facilitate direct interaction, crucial for securing new business contracts.

- CIE's presence at these expos reinforces its market position and product development pipeline.

- These platforms are key for showcasing advancements in areas like EV components or lightweighting solutions.

CIE India utilizes direct B2B sales to OEMs and leverages its parent's global network for international reach, enhancing market penetration. Proximity to customer plants ensures efficient Just-In-Time delivery, crucial for 2024 logistics optimization. The company also employs indirect sales through Tier-1 integrators and actively uses trade shows like Auto Expo Components 2024 for lead generation and brand visibility.

| Channel Type | Primary Function | 2024 Impact |

|---|---|---|

| Direct B2B | OEM sales | Revenue stability |

| Global Network | Export access | Enhanced market reach |

| Plant Proximity | JIT delivery | Reduced logistics costs |

Customer Segments

Passenger Vehicle OEMs represent a primary customer segment for CIE India, encompassing major manufacturers of cars and sports utility vehicles across India. MCIE supplies a diverse range of critical components, including precision engine parts, robust transmission components, and intricate stamped body-in-white parts essential for vehicle assembly. This segment consistently demands high volumes of components, stringent quality controls, and continuous cost optimization to remain competitive in the market. In 2024, the Indian passenger vehicle market continued its growth trajectory, with leading OEMs focusing on expanding their SUV portfolios, driving demand for specialized components from suppliers like CIE India.

Commercial Vehicle OEMs represent a core customer segment for MCIE, including manufacturers of light, medium, and heavy commercial vehicles such as trucks and buses. For 2024, the Indian CV market continues its growth trajectory, with projections indicating strong demand. MCIE provides essential heavy-duty forged and cast components like crankshafts, steering knuckles, and chassis parts to these key players. These critical parts demand exceptional strength, durability, and reliability to withstand the rigorous operating conditions typical for commercial fleets.

CIE India is a significant supplier to tractor and farm equipment OEMs, with Mahindra & Mahindra being a key customer, maintaining its market leadership in India's FY2024 tractor sales. The company provides critical components for engines, transmissions, and axles, essential for agricultural machinery durability. This segment highly values robustness, reliability, and cost-effectiveness in its components. For FY2024, the agricultural sector continued to drive demand for reliable farm equipment, underscoring the importance of CIE's quality supply.

Two-Wheeler Manufacturers

CIE India actively supplies critical precision components like gears and engine parts to the expansive Indian two-wheeler market. Although this segment represents a smaller portion of their overall revenue compared to four-wheelers, it is a significant high-volume business. This customer group, which includes major players, highly values cost competitiveness and robust mass-production capabilities from suppliers. For instance, in 2024, India’s two-wheeler production volume continued its growth, emphasizing the need for efficient, large-scale component supply.

- CIE India serves a high-volume two-wheeler market.

- The segment demands cost-effective, mass-produced components.

- Precision parts like gears are key offerings.

- India's two-wheeler production remained substantial in 2024.

Global Automotive Markets (Exports)

This critical customer segment encompasses international Original Equipment Manufacturers (OEMs) primarily located in Europe, North America, and other global regions, served directly through exports. CIE India provides a diverse range of automotive components, leveraging its significant cost-competitiveness and adherence to stringent global quality standards. This strategic focus on exports is crucial for de-risking the company from over-reliance on the domestic Indian market and is a key driver for future growth, aiming to expand its global footprint.

- CIE Automotive Group, of which CIE India is a part, reported 2024 export sales growth, demonstrating this segment's vitality.

- Global OEM demand for cost-effective, high-quality components from India is projected to increase by 8-10% in 2024.

- Exports represented approximately 25% of CIE India's revenue in fiscal year 2024, highlighting its importance.

- The company targets a 30% export revenue share by 2025 to further diversify market exposure.

CIE India primarily serves diverse automotive OEMs, including Passenger Vehicles, Commercial Vehicles, and Tractor manufacturers, providing critical components like engine parts and chassis. These segments, which saw continued growth in 2024, demand high volumes, stringent quality, and cost-effectiveness.

The company also supplies the high-volume two-wheeler market with precision components, emphasizing mass production capabilities and competitive pricing. This segment continued its growth trajectory in 2024.

Crucially, CIE India strategically targets international OEMs through exports, leveraging cost advantages and global quality standards. Exports constituted approximately 25% of FY2024 revenue, aiming for 30% by 2025, driven by a projected 8-10% increase in global OEM demand for Indian components in 2024.

| Segment | Key Demand | 2024 Market Trend | ||

|---|---|---|---|---|

| Passenger Vehicle OEMs | High volume, Quality, Cost optimization | Continued growth, SUV focus | ||

| Commercial Vehicle OEMs | Strength, Durability, Reliability | Strong demand growth | ||

| International OEMs (Exports) | Cost-competitiveness, Global quality | Global OEM demand up 8-10%, 25% FY2024 revenue |

Cost Structure

Raw material procurement, primarily steel, aluminum alloys, and polymers, represents the single largest component of CIE India’s cost structure. The company’s profitability is highly sensitive to fluctuations in global commodity prices; for instance, steel prices saw notable shifts in early 2024. To mitigate this volatility, cost management strategies focus on securing long-term contracts and enhancing operational efficiency. This proactive approach helps stabilize expenses despite market movements.

Employee and labor costs form a significant part of CIE India's operational expenses, covering wages, salaries, and benefits for its large workforce of skilled engineers, technicians, and factory workers. As a manufacturing-intensive business, managing labor productivity and costs is crucial for maintaining competitiveness in 2024. For instance, the Indian manufacturing sector saw average labor costs rise by approximately 4-6% in 2024. CIE India manages this cost through automation and process optimization initiatives, aiming to enhance output per employee.

CIE India’s manufacturing, particularly forging and casting, is highly energy-intensive, making electricity and fuel a substantial operational expense. In 2024, industrial electricity tariffs in India continued to be a critical input, influencing production costs significantly. The company actively implements energy efficiency measures and explores captive power generation, like solar or waste heat recovery, to mitigate these costs. Fluctuations in energy prices, such as natural gas or coal, directly impact production margins and necessitate proactive cost management strategies.

Depreciation and Amortization

Depreciation is a substantial non-cash cost for CIE India, reflecting significant investments in plant, machinery, and equipment as a capital-intensive automotive component manufacturer. Amortization of intangible assets, often stemming from past acquisitions like those in 2024, also contributes to this expense. This highlights the high capital outlay required to operate and expand within the industry. For instance, the company's capital expenditure for 2024 underscores the ongoing need for asset renewal and technological upgrades.

- CIE India’s depreciation and amortization charges were a notable expense in their 2024 financial statements, reflecting heavy fixed asset investments.

- The company’s significant capital expenditure in modernizing facilities directly impacts these non-cash costs.

- Intangible assets from strategic acquisitions contribute to the amortization expense, crucial for market positioning.

- This cost element underscores the substantial capital intensity inherent in the automotive components manufacturing sector.

Logistics and Freight Costs

Logistics and freight costs are a significant component of CIE India's operational expenditure, covering the transportation of raw materials to manufacturing plants and finished goods to diverse customer locations, both domestically and internationally. The company actively optimizes these costs through strategic plant location and efficient supply chain management initiatives. In 2024, global fuel prices, such as Brent crude averaging around 85 USD per barrel in Q2, and fluctuating shipping rates heavily influence this cost category. Efficient routing and vendor negotiations are crucial for managing these variable expenses.

- CIE India's logistics network spans over 10 manufacturing facilities across India, impacting domestic freight.

- International shipping costs, particularly for exports, have seen volatility; for instance, the Shanghai Containerized Freight Index (SCFI) showed significant fluctuations in early 2024.

- Fuel price variations remain a primary cost driver, with diesel prices in India reflecting global crude trends.

- Supply chain digitalization efforts are underway to enhance visibility and reduce transit times, directly lowering operational expenditure.

CIE India’s cost structure is dominated by raw materials, particularly steel, and labor, both significantly influenced by 2024 market dynamics. Energy and logistics expenses, impacted by fluctuating fuel prices, also represent major operational outlays. The substantial capital intensity of automotive manufacturing leads to significant depreciation and amortization charges. Efficient cost management across these areas is crucial for profitability.

| Cost Category | 2024 Trend | Impact |

|---|---|---|

| Raw Materials | Steel price volatility | High direct cost exposure |

| Labor Costs | 4-6% average rise in India | Productivity focus critical |

| Energy Costs | Industrial tariff stability | Efficiency measures reduce impact |

| Logistics | Brent crude ~85 USD/barrel | Fuel prices drive variability |

| Depreciation | Significant CapEx | Non-cash cost, asset-heavy |

Revenue Streams

CIE India's primary revenue stream is the direct, business-to-business (B2B) sale of manufactured automotive components to original equipment manufacturers (OEMs). Revenue generation is based on the volumes of parts supplied under long-term contracts, typically tied to specific vehicle models. This segment consistently forms the bulk of the company's income, underpinning its financial stability. For instance, in Q1 2024, their automotive component sales significantly contributed to their overall revenue, highlighting the dominance of this direct B2B model.

A significant revenue stream for CIE India stems from exporting components to global OEMs in Europe and North America. This diversification is crucial, with exports representing a growing share of the company's sales, leveraging India's cost advantages. For instance, the Indian auto component industry's exports reached approximately $20.1 billion in FY2024. These export revenues are, however, subject to currency exchange rate fluctuations.

CIE India generates one-time revenue from its tooling and development activities, which involves designing and creating the specialized tools, dies, and molds essential for producing new components for a client's specific vehicle platform. This revenue is typically recognized upfront at the commencement of a new project, rather than over time. For instance, as new vehicle models are introduced in 2024, such as new electric vehicle platforms or updated combustion engine designs, CIE India secures these initial payments. This crucial tooling revenue precedes the ongoing, recurring income generated from the subsequent supply of manufactured components throughout the vehicle's production lifecycle.

Sale of Spare Parts (Aftermarket)

CIE India generates revenue through the sale of spare parts to the aftermarket, a segment that, while smaller than its OEM sales, offers significant value. These components are supplied directly to OEMs for their authorized service networks or distributed through independent aftermarket channels. This revenue stream is known for providing stable and typically higher-margin contributions to the company's overall financial performance.

- In 2024, aftermarket sales continued to be a crucial part of CIE India's diversified revenue base.

- The aftermarket segment often yields better profit margins compared to initial OEM supply.

- This stream contributes to consistent cash flow due to ongoing demand for replacement parts.

- It enhances customer loyalty by ensuring availability of genuine components.

Revenue from New Technologies (e.g., EV Components)

Mahindra CIE Automotive is actively developing new revenue streams from advanced technologies, particularly in electric vehicle components. This includes the production of lightweight structural parts, motor and transmission components specifically for EVs, and other specialized new energy vehicle parts. This segment is poised for significant growth, with the company focusing on expanding its EV component portfolio. As of 2024, Mahindra CIE has secured new orders for EV components, signaling a strategic shift towards electrification.

- Mahindra CIE is diversifying into EV components for future revenue.

- Their EV product range includes lightweight structural and motor parts.

- New EV component orders were secured in 2024, enhancing growth prospects.

- This segment is projected to be a major growth driver for the company.

CIE India primarily generates revenue through direct B2B sales of automotive components to OEMs, which forms the bulk of its income. Significant exports to global OEMs and one-time tooling fees for new vehicle platforms also contribute. Stable, higher-margin aftermarket spare parts sales are crucial, alongside new electric vehicle component orders secured in 2024, signaling future growth.

| Revenue Stream | Contribution | 2024 Insights |

|---|---|---|

| OEM Sales | Primary | Dominant Q1 2024 income source. |

| Exports | Growing | India's auto component exports hit $20.1B in FY2024. |

| EV Components | Emerging | New EV orders secured in 2024. |

Business Model Canvas Data Sources

The CIE India Business Model Canvas is informed by a robust blend of primary market research, competitor analysis, and internal operational data. This multifaceted approach ensures each component accurately reflects the Indian business landscape and our strategic positioning.