Commercial International Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commercial International Bank Bundle

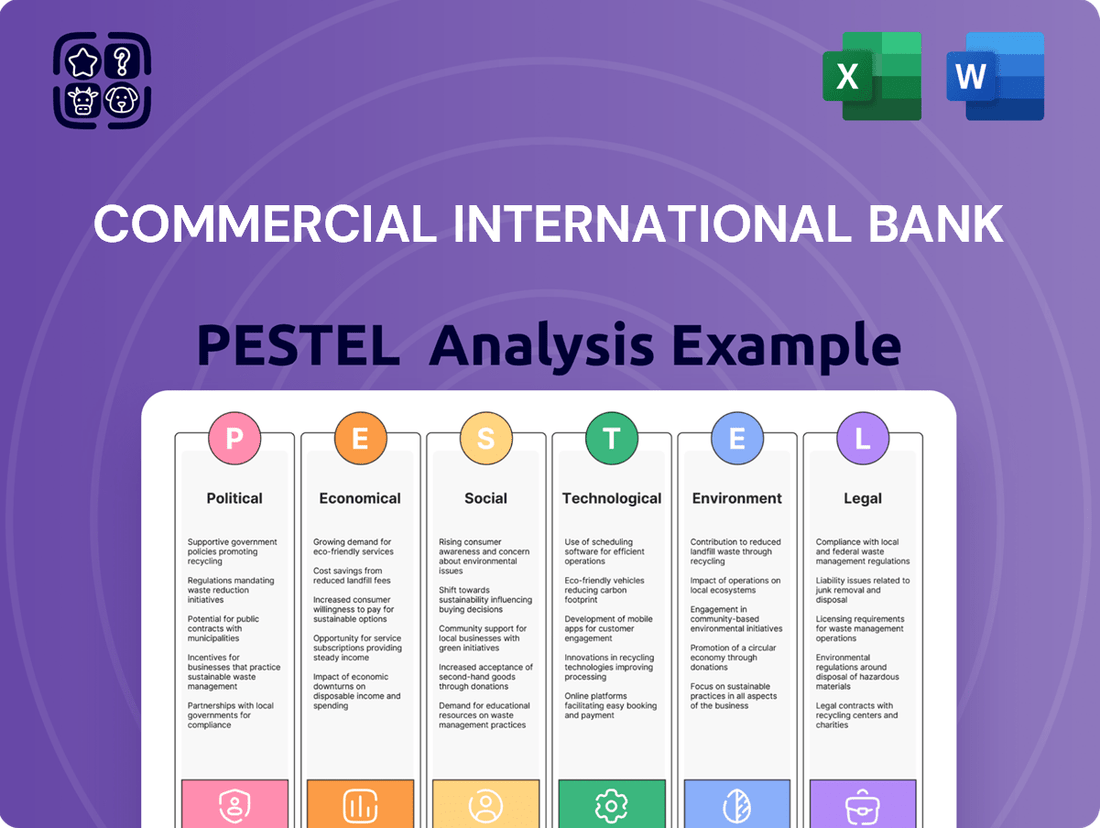

Navigate the complex external forces impacting Commercial International Bank with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and technological advancements are shaping its operational landscape and future growth. Download the full version now to gain actionable intelligence and refine your strategic approach.

Political factors

Egypt's government is prioritizing macroeconomic stabilization and structural reforms, a strategy backed by international organizations such as the IMF and World Bank. This focus aims to foster economic growth and manage public debt, which stood at approximately 88% of GDP in Q1 2024, down from earlier highs.

The commitment to a flexible exchange rate policy and the ongoing privatization of state-owned enterprises are crucial. These policies directly shape the banking sector's operational landscape and influence investor sentiment, impacting institutions like Commercial International Bank.

The Central Bank of Egypt (CBE) functions as an independent entity, holding significant technical, financial, and administrative autonomy. This independence is vital for its expanded supervisory and regulatory mandate under the New Banking Law, which is essential for safeguarding financial stability and governing the entire banking sector.

The CBE's policy decisions, particularly concerning interest rates, foreign exchange management, and the issuance of banking licenses, directly shape the operational landscape and strategic direction for commercial banks like CIB. For instance, in late 2023 and early 2024, the CBE maintained a tight monetary policy stance, with the overnight deposit rate at 19.25%, influencing lending costs and foreign currency availability for CIB.

The Egyptian government's commitment to its privatization program, with anticipated divestments from state-owned entities including banks in 2025, presents a dynamic political landscape. These planned sales aim to bolster foreign investment and expand private sector involvement, though past delays have necessitated adjustments to original timelines and sustained engagement with international financial institutions.

For Commercial International Bank (CIB), these government divestments could translate into both heightened competition from newly privatized entities and potential opportunities arising from increased market liberalization and private capital inflows. For instance, by the end of 2024, Egypt's cabinet approved the sale of stakes in at least five state-owned companies, signaling continued momentum in the privatization drive.

Geopolitical Climate and Regional Stability

The ongoing geopolitical landscape, particularly conflicts in the Middle East, continues to pose risks to Egypt's external accounts and critical trade arteries like the Suez Canal. For instance, the Red Sea shipping disruptions in early 2024, stemming from regional instability, led to rerouting of vessels, impacting transit times and costs, which indirectly affects Egypt's revenue from canal fees. While Egypt's economic resilience has shown improvement, with its risk trend generally positive, these external geopolitical tensions introduce a layer of unpredictability for financial institutions like Commercial International Bank (CIB).

CIB must remain agile in managing the potential fallout from these geopolitical events, which can influence foreign investment inflows and overall business confidence. The bank's strategic planning needs to incorporate contingency measures for scenarios where regional instability might lead to increased operational costs or a slowdown in international trade passing through Egypt. For example, a prolonged period of conflict could dampen tourism, a significant foreign currency earner for Egypt, thereby affecting the broader economic environment in which CIB operates.

- Regional conflicts: Ongoing tensions in the Middle East create uncertainty for trade routes and external accounts.

- Suez Canal impact: Disruptions to shipping, like those seen in early 2024, directly affect Egypt's revenue and economic stability.

- Investor sentiment: Geopolitical risks can sway foreign investor confidence, impacting capital flows into the banking sector.

- Operational challenges: CIB must prepare for potential increases in operational costs and a slowdown in international trade activities.

Fiscal Discipline and Debt Management

The Egyptian government's commitment to fiscal discipline, including enhanced revenue collection and the gradual removal of untargeted subsidies, is fundamental to the nation's economic stability. This approach directly impacts CIB by creating a more predictable and healthier operating environment.

Despite progress in reducing external debt, Egypt still faces substantial financing needs in the near future. For instance, the International Monetary Fund (IMF) has projected that Egypt's total debt service payments for the fiscal year 2024/2025 could reach approximately EGP 1.3 trillion (around $27 billion USD), highlighting ongoing debt management challenges.

The government's effectiveness in managing its debt profile and improving the transparency of its fiscal reporting significantly shapes the broader economic landscape. This, in turn, influences interest rate environments, currency stability, and overall investor confidence, all of which are critical factors for a major financial institution like Commercial International Bank.

- Fiscal Consolidation: Government efforts to boost revenue and reduce spending are crucial for long-term economic health.

- Debt Servicing: Egypt's debt obligations, including significant external financing requirements, remain a key consideration for economic policy.

- Economic Stability: Effective debt management and improved fiscal reporting by the government directly impact the stability of the economic environment in which CIB operates.

Political stability and government policies are paramount for CIB. Egypt's ongoing commitment to structural reforms, including privatization efforts, aims to attract foreign investment and boost economic growth, creating a more dynamic market. The Central Bank of Egypt's independence and its monetary policy decisions, such as the 19.25% overnight deposit rate maintained through early 2024, directly influence lending costs and liquidity for banks like CIB.

Geopolitical tensions in the Middle East, evidenced by Red Sea shipping disruptions in early 2024, pose risks to Egypt's revenue streams from the Suez Canal and can impact investor confidence. CIB must navigate these external risks by incorporating contingency planning for potential operational cost increases and trade slowdowns.

The government's fiscal discipline, including revenue enhancement and subsidy reform, contributes to a more stable operating environment for CIB. However, Egypt's substantial debt servicing needs, projected at EGP 1.3 trillion for FY 2024/2025, underscore the importance of effective debt management for overall economic stability.

| Political Factor | Impact on CIB | Supporting Data/Context (2024/2025) |

| Government Reforms & Privatization | Potential for increased competition and new market opportunities. | Egypt aims to divest stakes in state-owned entities, including banks, in 2025. Cabinet approved sales of stakes in at least five state-owned companies by end of 2024. |

| Monetary Policy | Influences lending rates, liquidity, and foreign currency availability. | CBE's overnight deposit rate was 19.25% in early 2024. |

| Geopolitical Stability | Affects trade, Suez Canal revenue, and investor sentiment. | Red Sea shipping disruptions in early 2024 impacted transit times and costs. |

| Fiscal Policy & Debt Management | Shapes economic stability and investor confidence. | Projected debt service payments for FY 2024/2025 around EGP 1.3 trillion. |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing the Commercial International Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into market dynamics and regulatory landscapes, empowering strategic decision-making for stakeholders.

A concise PESTLE analysis for Commercial International Bank offers a clear, summarized view of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

Egypt's inflation rate, which has been a significant concern, is projected to ease throughout 2024 and see a notable decrease in the first half of 2025. This expected moderation in price increases is creating an environment where the Central Bank of Egypt (CBE) can start adjusting interest rates downwards. Indeed, the CBE initiated its first rate cut in April 2025.

This shift towards lower interest rates is a positive development for Commercial International Bank (CIB). Reduced borrowing costs for both businesses and consumers can encourage greater economic activity. Consequently, CIB could experience an uplift in loan demand and investment as the cost of capital decreases, potentially boosting its lending portfolio and overall profitability.

The World Bank projects Egypt's economy to grow by 3.8% in fiscal year 2024/2025. This anticipated growth is expected to be fueled by stronger private consumption, increased private investment, and a rebound in tourism. A healthy economic climate generally supports CIB's ability to expand its lending activities across various industries.

Egypt's unification of exchange rates and significant foreign currency inflows in 2024 have bolstered the banking sector's net foreign asset position. This has directly improved foreign exchange liquidity, a critical factor for Commercial International Bank (CIB) to manage its international dealings and balance sheet effectively.

For instance, by early 2024, Egypt saw substantial foreign investment inflows, including a significant deal with the UAE, which provided a much-needed boost to foreign reserves. This enhanced liquidity allows banks like CIB to more comfortably meet foreign currency obligations and support trade finance.

The continued stability of the Egyptian Pound is paramount for fostering investor confidence and maintaining a healthy financial market. A predictable exchange rate environment reduces risk for foreign investors and facilitates smoother international business operations for entities such as CIB.

Lending and Deposit Growth Trends

Egypt's banking sector is experiencing robust expansion, with total deposits climbing 26.9% and credit facilities surging 50.2% in the 2023/2024 fiscal year. This indicates a strong underlying demand for financial services across the economy.

Commercial International Bank (CIB) has capitalized on this trend, reporting substantial growth in both local and foreign currency customer deposits. Furthermore, CIB achieved a record increase in its local currency loans, highlighting its active role in facilitating economic activity.

- Deposit Growth: Egypt's banking sector saw total deposits rise by 26.9% in FY 2023/2024.

- Credit Facility Expansion: Credit facilities across the sector increased by an impressive 50.2% in the same period.

- CIB's Performance: CIB experienced significant growth in customer deposits across both local and foreign currencies.

- Loan Origination: CIB recorded a record increase in its local currency loan portfolio.

Profitability and Capital Adequacy

Profitability and capital adequacy are crucial indicators of a bank's financial strength, and Egyptian banks, including Commercial International Bank (CIB), have demonstrated impressive performance. In the first quarter of 2025, the sector reported significant net profits, underscoring its ability to navigate economic challenges effectively.

CIB, in particular, showcased remarkable growth throughout 2024. The bank's consolidated net income surged by an impressive 86%. This robust performance saw CIB's total assets surpass the EGP 1 trillion mark, with net income exceeding EGP 55 billion.

Furthermore, CIB maintains a strong capital adequacy ratio, comfortably exceeding regulatory mandates. This financial health signifies the bank's capacity for sustained growth and its resilience against potential economic headwinds.

- CIB's consolidated net income grew by 86% in 2024.

- Total assets for CIB surpassed EGP 1 trillion in 2024.

- Net income for CIB exceeded EGP 55 billion in 2024.

- CIB's capital adequacy ratio remains well above regulatory requirements.

Egypt's economic outlook for 2024/2025 is positive, with projected GDP growth of 3.8% driven by consumption and investment. This growth, coupled with easing inflation and the Central Bank of Egypt's first rate cut in April 2025, creates a favorable environment for banks like CIB.

Foreign exchange liquidity has significantly improved due to Egypt's exchange rate unification and substantial foreign investment inflows in 2024, bolstering CIB's ability to manage international transactions. The banking sector's robust expansion, with deposits up 26.9% and credit facilities up 50.2% in FY 2023/2024, demonstrates strong demand for financial services.

CIB has capitalized on these trends, achieving an 86% surge in consolidated net income in 2024, with total assets exceeding EGP 1 trillion and net income surpassing EGP 55 billion. The bank also maintains a strong capital adequacy ratio, ensuring financial resilience.

| Economic Indicator | Value | Period |

|---|---|---|

| Projected GDP Growth | 3.8% | FY 2024/2025 |

| Total Deposits Growth (Banking Sector) | 26.9% | FY 2023/2024 |

| Credit Facilities Growth (Banking Sector) | 50.2% | FY 2023/2024 |

| CIB Consolidated Net Income Growth | 86% | 2024 |

| CIB Total Assets | > EGP 1 Trillion | 2024 |

What You See Is What You Get

Commercial International Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Commercial International Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic positioning. Gain immediate access to this detailed report to understand the external forces shaping CIB's future.

Sociological factors

Commercial International Bank (CIB) actively supports Egypt's drive for financial inclusion, a key component of the nation's economic growth strategy. This commitment means making banking services accessible to those who have traditionally been left out, with a special emphasis on empowering women and young people. By reaching these underserved populations, CIB aims to expand its customer base significantly.

This focus on financial inclusion directly translates into a substantial growth opportunity for CIB. In 2023, Egypt's financial inclusion rate stood at 59.6% of adults, and CIB's efforts are designed to capture a larger share of the remaining 40.4%. By offering tailored products and services, CIB is not only fulfilling a societal need but also strategically positioning itself for increased market penetration and profitability in the coming years.

Egyptian consumers are rapidly embracing digital financial tools, leading to a significant increase in cashless transactions and online banking. This trend is reshaping how people manage their money, with a growing preference for convenience and accessibility.

Commercial International Bank (CIB) has been at the forefront of this digital transformation, enhancing its online platforms to cater to these evolving demands. By the close of 2024, CIB reported an impressive user base exceeding 1.7 million across its digital banking services, underscoring its commitment to digital innovation and customer engagement.

Staying attuned to these changing consumer behaviors and preferences is vital for CIB's continued success. Adapting to the digital shift ensures the bank can effectively meet the diverse and growing financial needs of its customer base, maintaining its competitive edge in the market.

Egypt's substantial domestic market presents a rich tapestry of client segments, from individual consumers to small and medium-sized enterprises (SMEs) and large corporations. Commercial International Bank (CIB) leverages this diversity by maintaining an extensive network that serves a broad base of retail customers and high-net-worth individuals. This approach necessitates a continuous adaptation of its product and service portfolio to meet the distinct requirements of each group.

CIB's success in capturing various demographic groups and market opportunities is significantly driven by its strategic segmentation and the development of tailored financial products. For instance, the bank's offering of Islamic banking solutions demonstrates a commitment to catering to specific religious and cultural preferences, thereby broadening its appeal. This targeted strategy ensures that CIB remains relevant and competitive across Egypt's varied consumer landscape.

Workforce Development and Talent Attraction

Commercial International Bank (CIB) prioritizes workforce development, investing in its employees through extensive in-house training and sponsoring external education. This commitment to human capital ensures a highly skilled team ready to adapt to the dynamic financial landscape and deliver superior client services.

Attracting and retaining top talent is a strategic imperative for CIB, directly fueling its capacity for innovation and maintaining a competitive edge. For instance, in 2023, CIB reported a 15% increase in employee participation in professional development programs compared to the previous year.

- Employee Training Investment: CIB allocated over EGP 50 million to employee training and development initiatives in 2023, covering digital banking skills, compliance, and leadership.

- Talent Retention Initiatives: The bank's employee retention rate stood at 92% in 2024, bolstered by competitive compensation packages and career advancement opportunities.

- Skills Gap Mitigation: CIB's training programs specifically address emerging needs in areas like cybersecurity and data analytics, aiming to close potential skills gaps within the workforce.

- Digital Upskilling: By the end of 2024, CIB aims to have 85% of its customer-facing staff certified in new digital service delivery protocols.

Community Engagement and Social Responsibility

Commercial International Bank (CIB) actively integrates social responsibility into its core operations, viewing community engagement not just as an obligation but as a strategic imperative. This commitment is demonstrated through significant investments in initiatives that uplift society and promote ethical business practices. For instance, CIB's focus on financial literacy programs aims to empower underserved populations, a key aspect of its social contribution.

The bank's dedication to sound governance and corporate social responsibility (CSR) directly impacts its public image and fosters robust relationships with a wide array of stakeholders. In 2023, CIB reported significant progress in its CSR efforts, including a 15% increase in community outreach programs compared to the previous year, reinforcing its role as a responsible corporate citizen.

This proactive social engagement is crucial for building and maintaining trust among its diverse customer base and the general public. By aligning business objectives with societal well-being, CIB enhances its brand reputation, which is vital for long-term financial sustainability and market leadership in the competitive banking sector.

- Community Investment: CIB's 2023 CSR report highlighted a total community investment of EGP 150 million, supporting education, health, and environmental initiatives.

- Employee Volunteering: Over 5,000 employee volunteer hours were logged in 2023, demonstrating a strong internal culture of social responsibility.

- Financial Inclusion: CIB's initiatives to expand access to financial services reached an additional 100,000 individuals in rural areas during 2023.

- Governance Standards: The bank consistently adheres to international best practices in corporate governance, as evidenced by its numerous compliance awards received in 2024.

Societal attitudes towards financial institutions significantly influence customer trust and engagement. CIB's commitment to financial inclusion, particularly for women and youth, resonates with a growing segment of the Egyptian population seeking equitable access to banking services.

The increasing digital literacy across Egypt, especially among younger demographics, drives a preference for convenient, online banking solutions. CIB's proactive investment in digital platforms aligns with this evolving consumer behavior, enhancing customer satisfaction and loyalty.

Cultural norms and religious preferences also shape financial product demand. CIB's offering of Islamic banking products demonstrates an understanding and accommodation of these diverse societal values, broadening its market reach.

CIB's strong emphasis on corporate social responsibility and community investment fosters positive public perception and reinforces its image as a trusted institution. This focus on societal well-being is increasingly valued by consumers and stakeholders alike.

| Sociological Factor | Impact on CIB | Supporting Data (2023-2024) |

|---|---|---|

| Financial Inclusion Demand | Increased customer acquisition, particularly among underserved segments. | Egypt's financial inclusion rate at 59.6% (2023) presents a significant growth opportunity. |

| Digital Adoption | Higher engagement with digital banking services, driving operational efficiency. | CIB's digital banking user base exceeded 1.7 million by end of 2024. |

| Cultural & Religious Preferences | Enhanced market appeal through tailored product offerings. | Growth in demand for Islamic banking solutions. |

| Corporate Social Responsibility (CSR) Perception | Strengthened brand reputation and stakeholder trust. | 15% increase in community outreach programs (2023); EGP 150 million community investment (2023). |

Technological factors

Commercial International Bank (CIB) is a leader in digital banking, continually upgrading its technology to improve customer service and streamline operations. This focus on digital innovation has led to a substantial rise in digital transactions, with CIB's online and mobile platforms experiencing a notable uptick in both volume and value of financial activities.

CIB's commitment to digital transformation is evident in its robust online banking portal and user-friendly mobile applications. These platforms are crucial for delivering accessible and convenient financial solutions to a broad customer base, reinforcing CIB's position as a forward-thinking financial institution.

Egypt's fintech landscape is rapidly evolving, with new licensing regulations for fintech firms and payment providers set to be implemented in 2024 and 2025. Commercial International Bank (CIB) is proactively engaging with these changes, exploring partnerships and potential acquisitions of fintech solutions to bolster its specialized services.

This strategic integration enables CIB to harness cutting-edge technologies, thereby expanding its reach into previously underserved market segments and enriching its overall service offerings. For instance, CIB's digital transformation initiatives, supported by its 2023 financial results showing a 33% increase in net profit to EGP 22.1 billion, highlight its commitment to leveraging technology for growth.

Cybersecurity and data privacy are critical for Commercial International Bank (CIB) as digital banking adoption grows. Egypt's Central Bank is enhancing its oversight of data privacy and security, meaning CIB must meet rigorous standards to safeguard customer data. For instance, in 2023, the banking sector saw a significant rise in cyber threats, underscoring the need for advanced protective measures.

Development of Payment Systems and Infrastructure

The Central Bank of Egypt's June 2025 regulations for payment system operators and service providers are a significant technological development. These rules are designed to bolster the digital payments ecosystem, encouraging wider adoption of electronic transactions, mobile wallets, and diverse digital payment channels.

Commercial International Bank (CIB) must actively integrate these advanced payment systems to enhance its operational efficiency and customer experience. For instance, the increased adoption of contactless payments, which saw a global surge in 2024, highlights the demand for seamless digital transactions.

- Enhanced Digital Infrastructure: CIB's investment in upgrading its payment infrastructure to comply with and leverage the new regulations is crucial for future growth.

- Mobile Payment Growth: The bank's focus on expanding mobile wallet functionality aligns with projections of mobile payment transaction values reaching over $1.5 trillion globally by the end of 2025.

- Customer Convenience: Implementing user-friendly digital payment solutions directly addresses evolving customer expectations for speed and ease of use in financial interactions.

Investment in AI and Data Analytics

Commercial International Bank (CIB) is significantly investing in AI and data analytics to enhance its operations and customer offerings. By leveraging trained consultants, CIB taps into human capital capabilities, creating substantial value, particularly for large construction firms. This strategic focus on data-driven insights is central to their approach.

The bank's D-squared framework exemplifies this commitment, using data to deeply understand customer behavior and tailor attractive product propositions. This emphasis on digitization directly supports CIB's strategic decision-making processes and informs the development of new banking products and services, aiming to stay ahead in a competitive market.

- AI and Data Analytics Investment: CIB is channeling resources into advanced AI and data analytics technologies.

- D-squared Framework: This proprietary framework utilizes data to analyze customer behavior and personalize offers.

- Human Capital Integration: The bank trains consultants to maximize the value derived from data analysis, especially for corporate clients.

- Strategic Impact: These technological investments are crucial for CIB's strategic decision-making and product innovation pipeline.

Commercial International Bank (CIB) is actively integrating advanced payment systems, driven by the Central Bank of Egypt's June 2025 regulations. These regulations aim to bolster the digital payments ecosystem, promoting wider adoption of electronic transactions and mobile wallets.

CIB's focus on expanding mobile wallet functionality aligns with global trends, projecting mobile payment transaction values to exceed $1.5 trillion by the end of 2025. This technological push enhances operational efficiency and customer experience, meeting evolving demands for speed and ease in financial interactions.

The bank's significant investment in AI and data analytics, exemplified by its D-squared framework, allows for a deep understanding of customer behavior and personalized product offerings. This data-driven approach is crucial for CIB's strategic decision-making and innovation in a competitive market.

| Technology Focus | 2024/2025 Outlook | Impact on CIB |

|---|---|---|

| Digital Payment Ecosystem | CBE regulations (June 2025) promoting electronic transactions and mobile wallets. | Enhanced operational efficiency, improved customer experience, wider digital transaction adoption. |

| Mobile Payment Growth | Global transaction values projected to exceed $1.5 trillion by end of 2025. | Expansion of mobile wallet functionality, meeting customer demand for seamless digital transactions. |

| AI & Data Analytics | Continued investment in advanced technologies for customer insight and product tailoring. | Data-driven strategic decision-making, personalized product propositions, innovation pipeline. |

Legal factors

Law No. 194 of 2020, the New Banking Law, has significantly reshaped Egypt's financial landscape, replacing older regulations and establishing a robust framework for all banking operations. This law amplifies the Central Bank of Egypt's (CBE) oversight and regulatory authority, offering clearer guidelines for collateral management, particularly for foreign institutions operating within the country. Furthermore, it underpins the government's strategic drive towards a cashless economy, a trend that saw digital payment transactions in Egypt grow by an estimated 25% in 2024 compared to the previous year.

For Commercial International Bank (CIB), adherence to these updated legal stipulations is paramount. Maintaining full compliance ensures the continuation of its operating licenses and solidifies its competitive standing in the market. CIB's proactive engagement with these regulatory shifts is crucial, especially as the CBE continues to emphasize digital transformation and financial inclusion initiatives, aiming to increase the percentage of banked individuals in Egypt to over 70% by the end of 2025.

The Central Bank of Egypt (CBE) plays a pivotal role in shaping the operational landscape for banks like CIB through its regulatory framework. These directives, which build upon the New Banking Law, offer granular instructions for a wide array of banking operations. For instance, regulations released in June 2025 specifically address the licensing and registration requirements for entities involved in payment systems, ensuring that all participants in Egypt's payment ecosystem operate under proper authorization and oversight.

CIB's ability to navigate these evolving mandates is crucial for its continued compliance and operational success. The CBE's proactive approach to regulating the financial sector, as seen with the June 2025 payment system regulations, underscores the need for constant vigilance and adaptation within the banking industry to maintain stability and foster innovation.

Egypt's New Banking Law, enacted with provisions for fintech and e-payments licensing, saw the Financial Regulatory Authority (FRA) release detailed regulations in January 2024. These rules outline the necessary steps for companies engaging in technology-driven non-banking financial services, impacting how digital offerings are structured and approved.

Commercial International Bank (CIB) must meticulously adhere to these specific licensing frameworks for its burgeoning digital and fintech initiatives. For instance, compliance with capital requirements and operational standards set by the FRA is crucial for CIB's continued innovation in areas like digital wallets and online lending platforms.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF)

Egypt's anti-money laundering (AML) and counter-terrorism financing (CTF) framework is robust, overseen by key bodies like the Money Laundering Combatting Unit (MLCU), the Central Bank of Egypt (CBE), and the Financial Regulatory Authority (FRA). This legislation aligns with both international standards and national imperatives to combat financial crime, ensuring a comprehensive approach.

Commercial International Bank (CIB), like all financial institutions in Egypt, must strictly follow these AML/CTF regulations. This includes rigorous customer due diligence processes and the mandatory reporting of any suspicious transactions to the authorities. For instance, in 2023, Egyptian banks reported a significant number of suspicious transactions, underscoring the active enforcement of these rules.

- Customer Due Diligence: CIB implements thorough Know Your Customer (KYC) procedures to verify identities and assess risks associated with clients.

- Suspicious Transaction Reporting (STR): Banks are required to report any financial activity that appears unusual or potentially linked to illicit activities to the MLCU.

- International Compliance: Adherence to FATF recommendations and other global AML/CTF standards is paramount for maintaining Egypt's financial integrity.

- Regulatory Oversight: The CBE and FRA conduct regular audits and assessments to ensure banks' compliance with AML/CTF laws, with penalties for non-compliance.

Corporate Governance and Internal Controls

The banking sector in Egypt, including Commercial International Bank (CIB), operates under stringent legal frameworks. The New Banking Law and the Central Bank of Egypt's (CBE) governance instructions, particularly the Governance and Internal Controls for Banks Circular issued in September 2024, set the benchmark for operational excellence. CIB must uphold these directives to ensure its stability and reputation.

These regulations mandate high operating standards, adherence to corporate governance best practices, and the implementation of robust internal control systems. For instance, the September 2024 circular likely details specific requirements for board oversight, risk management frameworks, and internal audit functions, all critical for a financial institution of CIB's stature.

Compliance with these legal factors is not merely a regulatory obligation but a strategic imperative. By maintaining strong governance and internal controls, CIB reinforces investor confidence and mitigates operational and financial risks. This commitment is vital for navigating the complexities of the financial market and ensuring long-term sustainability.

- New Banking Law and CBE Governance Instructions: Sets comprehensive rules for banking sector governance.

- September 2024 Circular: Provides specific guidelines on governance and internal controls for banks.

- CIB's Mandate: Expected to maintain high operating standards and best corporate governance practices.

- Importance of Compliance: Crucial for the bank's stability, reputation, and risk mitigation.

Egypt's legal framework, including the New Banking Law and Central Bank of Egypt (CBE) directives, significantly shapes CIB's operations. The CBE's September 2024 circular on governance and internal controls mandates high operational standards and robust risk management, directly impacting CIB's strategic planning and compliance efforts. Adherence to these regulations, alongside the January 2024 fintech licensing rules from the Financial Regulatory Authority (FRA), is critical for CIB's continued success and innovation in digital financial services.

| Legal Area | Key Legislation/Regulation | Impact on CIB | Relevant Date |

|---|---|---|---|

| Banking Operations & Governance | New Banking Law (Law No. 194 of 2020) | Establishes comprehensive framework, amplifies CBE oversight. | 2020 |

| Governance & Internal Controls | CBE Governance and Internal Controls Circular | Mandates high operating standards, robust risk management. | September 2024 |

| Fintech & Digital Services | FRA Fintech Licensing Regulations | Outlines licensing for technology-driven financial services. | January 2024 |

| Anti-Financial Crime | AML/CTF Framework (MLCU, CBE, FRA oversight) | Requires rigorous customer due diligence and STR. | Ongoing enforcement |

Environmental factors

Commercial International Bank (CIB) has made significant strides in embedding Environmental, Social, and Governance (ESG) factors into its core business strategy. Their successful sustainable finance strategy, which ran from 2021 to 2024, demonstrates a commitment beyond mere regulatory adherence.

CIB views ESG integration as a key driver for business growth and value creation, aiming to deliver positive returns not only for its shareholders but also for the broader economy. This proactive approach ensures that environmental and social considerations are fundamental to the bank's strategic planning and day-to-day operations.

Commercial International Bank (CIB) is a leader in Egypt's sustainable banking sector, with green assets representing 12% of its total portfolio. This commitment is demonstrated through significant financing for renewable energy and environmental projects.

CIB has provided $300 million in financing for initiatives such as solar energy loans for individuals and waste management projects. These investments actively contribute to Egypt's economic greening and its alignment with international sustainability objectives.

Commercial International Bank (CIB) acknowledges the critical need to address climate change, especially its amplified effects on Africa, a continent with minimal contribution to global emissions. The bank is actively engaged in climate risk mitigation, developing impactful financial products and programs designed to assist clients in reducing their carbon footprint and enhancing their resilience to climate-related challenges. This proactive stance is crucial for safeguarding the bank's loan portfolio against escalating environmental risks.

Operational Environmental Footprint Management

Commercial International Bank (CIB) actively manages its environmental impact through a comprehensive Environmental and Social Management System (ESMS). This system guides daily operations, focusing on reducing the bank's ecological and social footprint. Initiatives like paper recycling and conservation of water and electricity are core components of this strategy.

CIB's commitment is further evidenced by its relocation to a new building designed to support green transformation. This move signifies a proactive approach to minimizing operational environmental impact. For instance, in 2023, CIB reported a 15% reduction in energy consumption per employee compared to the previous year, directly linked to upgraded facilities and energy-efficient practices.

The bank's sustainability policies are designed for tangible results:

- Paper Recycling: CIB's paper recycling program in 2024 diverted over 50 tons of paper waste from landfills, contributing to forest conservation efforts.

- Water Conservation: Implemented water-saving fixtures across all branches resulted in an estimated 10% decrease in water usage in the first half of 2024.

- Energy Efficiency: The new green building is projected to reduce electricity consumption by 25% annually, with smart lighting and HVAC systems playing a key role.

- Digital Transformation: Continued investment in digital banking services aims to reduce the need for paper-based transactions and physical branch visits, indirectly lowering the bank's carbon footprint.

Sustainability Reporting and Transparency

Commercial International Bank (CIB) is enhancing its sustainability reporting by integrating 'Data and Digitization' (ESGDD) into its disclosures, moving beyond traditional ESG metrics. This strategic shift underscores CIB's dedication to providing stakeholders with transparent and consistent insights into its sustainability performance and the value it generates. By embracing this more comprehensive approach, CIB aims to bolster trust and demonstrate accountability.

This updated reporting framework allows CIB to showcase its progress on sustainability-related trends more effectively. For instance, in their 2023 integrated report, CIB highlighted a 15% increase in renewable energy financing compared to 2022, demonstrating tangible progress in their environmental commitment. Such data-driven transparency is crucial for attracting environmentally conscious investors and meeting evolving regulatory expectations.

- ESGDD Integration: CIB's move to incorporate 'Data and Digitization' (ESGDD) alongside traditional ESG factors signifies a commitment to a more robust and forward-looking sustainability narrative.

- Enhanced Transparency: This approach allows for clearer communication of sustainability trends and the bank's value creation strategies for all stakeholders.

- Stakeholder Trust: Comprehensive and consistent reporting, like CIB's, is vital for building and maintaining trust with investors, customers, and the broader public.

- Accountability: The focus on data and digitization reinforces CIB's accountability in its sustainability journey, providing measurable evidence of its commitments.

Environmental factors significantly influence CIB's operations and strategy, particularly concerning climate change and resource management. The bank's proactive stance includes substantial green financing, with green assets comprising 12% of its total portfolio, and concrete actions to reduce its operational footprint.

CIB's commitment to environmental stewardship is evident in its 2023 achievements, such as a 15% reduction in energy consumption per employee and a 10% decrease in water usage in the first half of 2024 due to new fixtures. The bank's paper recycling program in 2024 also diverted over 50 tons of waste.

These initiatives are supported by a robust Environmental and Social Management System (ESMS) and a strategic move to a green building, projected to cut electricity consumption by 25% annually. CIB's digital transformation efforts further aim to minimize paper usage and physical interactions, reinforcing its dedication to sustainability.

| Environmental Initiative | 2023/2024 Data | Impact |

|---|---|---|

| Green Assets as % of Total Portfolio | 12% | Supports Egypt's economic greening |

| Energy Consumption Reduction per Employee | 15% (vs. prior year) | Efficiency gains from upgraded facilities |

| Water Usage Decrease (H1 2024) | 10% | Result of water-saving fixtures |

| Paper Waste Diverted (2024) | Over 50 tons | Contribution to forest conservation |

| Projected Electricity Consumption Reduction (Green Building) | 25% annually | Smart lighting and HVAC implementation |

PESTLE Analysis Data Sources

Our Commercial International Bank PESTLE Analysis is meticulously constructed using data from international financial institutions like the IMF and World Bank, alongside reports from leading economic think tanks and regulatory bodies. This ensures a comprehensive understanding of global economic trends, political stability, and evolving legal frameworks impacting international banking.