Commercial International Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commercial International Bank Bundle

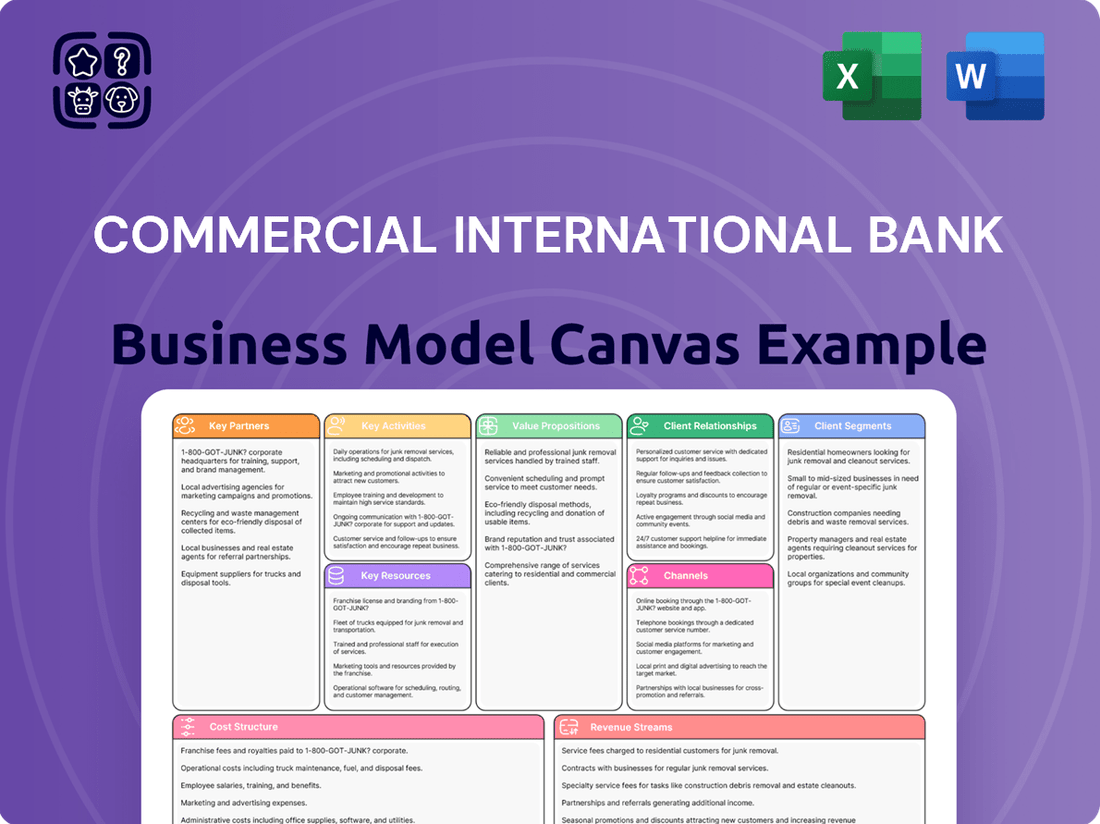

Unlock the strategic blueprint behind Commercial International Bank's success with our comprehensive Business Model Canvas. This detailed analysis reveals how CIB leverages its key resources and partnerships to deliver exceptional value to its diverse customer segments. Discover CIB's revenue streams and cost structure to gain actionable insights for your own business strategy.

Partnerships

Commercial International Bank (CIB) strategically partners with telecommunications and IT providers, such as the Egyptian telecom operator WE. This collaboration is crucial for extending CIB's digital financial services and promoting financial inclusion throughout Egypt. By integrating banking functionalities within a Banking-as-a-Service model, CIB leverages WE's vast network and infrastructure to offer accessible banking solutions.

Commercial International Bank (CIB) actively partners with significant international financial institutions like the International Finance Corporation (IFC) and the European Bank for Reconstruction and Development (EBRD). These collaborations are crucial for bolstering CIB's financial strength and expanding its capacity to support vital economic sectors.

Through these alliances, CIB gains access to capital that directly fuels its support for micro, small, and medium-sized enterprises (MSMEs). For instance, in 2024, the IFC committed a substantial $100 million to CIB to enhance lending to these crucial businesses, aiming to create jobs and foster economic growth.

Furthermore, these partnerships underscore CIB's commitment to sustainable development. Collaborations with entities like the EBRD facilitate the promotion of green trade financing and environmental, social, and governance (ESG) initiatives, aligning CIB's operations with global sustainability goals and contributing to a greener economy.

Commercial International Bank (CIB) actively collaborates with technology and digital solution providers to accelerate its digital transformation. These partnerships are crucial for developing and enhancing CIB's online banking features, mobile applications, and secure payment solutions, directly addressing evolving customer expectations.

In 2024, CIB continued to invest heavily in its digital infrastructure, with partnerships enabling the rollout of new functionalities like advanced AI-driven customer service bots and enhanced data analytics for personalized financial advice. This focus on digital innovation aims to improve operational efficiency and customer experience, a key driver in the competitive banking landscape.

Corporate and Business Entities

Commercial International Bank (CIB) actively cultivates strategic alliances with a wide array of corporate and business entities. These partnerships are crucial for facilitating specialized financing agreements and driving mutual business development. CIB’s commitment to supporting diverse economic sectors is exemplified by its mid-term financing agreement with OSL. This agreement, valued at EGP 250 million, is specifically earmarked for the redevelopment of the Giza Pyramids Sound and Light Show, showcasing CIB's role in significant cultural and entertainment projects.

These collaborations extend beyond single transactions, aiming to build long-term value. CIB's strategic partnerships often involve:

- Tailored financing solutions for large-scale corporate projects.

- Joint ventures for market expansion and new product development.

- Synergistic relationships to leverage complementary strengths and resources.

- Facilitating access to international markets and investment opportunities for its corporate clients.

Local and Regional Banks

Commercial International Bank (CIB) actively cultivates relationships with local and regional banks, fostering a collaborative ecosystem. These partnerships are crucial for its operational efficiency and strategic growth, enabling participation in larger financial transactions and extending its market reach.

CIB's engagement in syndicated loans, for instance, demonstrates its ability to work alongside other financial institutions to fund significant projects. This cooperative approach is vital in the Egyptian and broader African financial landscapes, allowing for the pooling of resources and risk-sharing.

A prime example of this strategic partnership and regional expansion is CIB's acquisition of Mayfair Bank in Kenya, now operating as CIB Kenya. This move significantly enhances its capacity to facilitate cross-border trade and financial services, directly benefiting businesses operating between Egypt and East Africa.

- Interbank Collaborations: CIB participates in interbank lending and borrowing, crucial for liquidity management and supporting the wider financial system.

- Syndicated Loans: The bank actively joins syndicates to finance large-scale projects, sharing risk and leveraging collective financial strength with partner banks.

- Regional Expansion: Acquisitions, like that of Mayfair Bank Kenya, solidify CIB's presence in new markets, fostering regional financial integration.

- Trade Finance Facilitation: These partnerships are instrumental in streamlining cross-border trade finance, supporting economic activity across Africa.

Commercial International Bank (CIB) strategically partners with telecommunications and IT providers, leveraging their extensive networks to expand digital financial services and promote financial inclusion. Collaborations with international financial institutions like the IFC and EBRD bolster CIB's capacity to support key economic sectors, including MSMEs, with significant capital injections, such as the IFC's $100 million commitment in 2024. These alliances also drive CIB's commitment to sustainable development through green finance and ESG initiatives.

CIB actively partners with technology providers to accelerate digital transformation, enhancing online banking, mobile apps, and payment solutions. In 2024, these partnerships facilitated the rollout of AI-driven customer service and advanced data analytics. The bank also cultivates alliances with corporate entities for specialized financing, like the EGP 250 million agreement for the Giza Pyramids Sound and Light Show redevelopment, fostering mutual business development and access to international markets.

Furthermore, CIB collaborates with local and regional banks to manage liquidity, participate in syndicated loans, and expand its market reach, as demonstrated by its 2024 acquisition of Mayfair Bank in Kenya, now CIB Kenya. This regional expansion enhances cross-border trade finance facilitation and economic activity across Africa.

| Partner Type | Key Collaborations | Impact/Focus | 2024 Data Highlight |

|---|---|---|---|

| Telecom/IT Providers | WE | Digital financial services, financial inclusion, Banking-as-a-Service | Extended reach through WE's network |

| International Financial Institutions | IFC, EBRD | Financial strength, MSME support, sustainable development, ESG | IFC $100M commitment for MSME lending |

| Technology Providers | Various | Digital transformation, online banking, mobile apps, AI customer service | Rollout of AI bots and advanced analytics |

| Corporate Entities | OSL | Specialized financing, business development, large-scale projects | EGP 250M for Giza Pyramids redevelopment |

| Local/Regional Banks | Various | Liquidity management, syndicated loans, regional expansion | Acquisition of Mayfair Bank Kenya |

What is included in the product

This Business Model Canvas for Commercial International Bank (CIB) outlines its strategy for serving diverse customer segments through multiple channels, delivering tailored financial products and services.

It details CIB's core value propositions, revenue streams, key resources, activities, partnerships, and cost structure, reflecting its market position and operational strengths.

Commercial International Bank's Business Model Canvas acts as a pain point reliever by providing a clear, visual map of their customer relationships and value propositions, helping to address common banking frustrations like complex processes.

It streamlines understanding of CIB's operations, offering a one-page snapshot that simplifies how they alleviate customer pain points through efficient service delivery.

Activities

Commercial International Bank's core banking operations are centered around managing customer deposits and providing various credit facilities, including loans and credit cards. These fundamental activities are crucial for generating the bank's primary revenue stream, net interest income. In 2024, CIB reported a net interest income of EGP 35.2 billion, highlighting the significance of these core functions.

Commercial International Bank (CIB) is heavily invested in digital transformation, aiming to streamline customer interactions and internal processes. This focus includes enhancing its internet banking and mobile app platforms, making services like instant account opening and online loan applications more accessible.

In 2024, CIB reported a significant increase in digital transactions, with mobile banking users growing by 15% year-over-year. This digital push is designed to improve customer experience and drive operational efficiencies across the bank's service offerings.

Commercial International Bank (CIB) offers robust investment banking and advisory services, encompassing corporate finance, asset management, and capital markets. These offerings are tailored for major corporations and high-net-worth individuals, assisting them with intricate financial requirements and investment strategies.

In 2024, CIB's investment banking division played a crucial role in facilitating significant M&A transactions and capital raises for its corporate clients. For instance, the bank advised on several key deals within the Egyptian market, contributing to the restructuring and growth of prominent companies.

Risk Management and Compliance

Commercial International Bank (CIB) places paramount importance on robust risk management and stringent compliance. This involves actively managing credit, operational, and market risks to safeguard the bank's financial health. In 2024, CIB continued to invest significantly in its risk mitigation strategies, aligning with evolving regulatory landscapes.

Adherence to corporate governance and cybersecurity best practices are critical components of CIB's operational framework. The bank focuses on maintaining high standards to protect customer data and ensure the integrity of its systems. This commitment is reflected in ongoing training and technology upgrades.

- Credit Risk Management: CIB employs rigorous assessment processes for loan applications, aiming to minimize potential defaults.

- Operational Risk Mitigation: The bank implements controls to prevent losses from inadequate or failed internal processes, people, and systems.

- Market Risk Oversight: CIB monitors and manages exposures to fluctuations in market prices, interest rates, and currency exchange rates.

- Regulatory Compliance: Ensuring full adherence to Egyptian banking laws and international financial regulations is a continuous priority.

Sustainable and Inclusive Finance Initiatives

Commercial International Bank (CIB) is actively growing its green and social financing portfolios, demonstrating a commitment to sustainable development. This involves channeling funds towards projects that promote environmentally sound practices and support underserved segments of the economy.

A significant focus is placed on empowering micro, small, and medium-sized enterprises (MSMEs), with a particular emphasis on women-owned businesses. This initiative directly contributes to financial inclusion, ensuring broader access to capital and economic opportunities.

CIB's efforts align with overarching global sustainability objectives. For instance, by the end of 2023, CIB had disbursed over EGP 20 billion in green financing, supporting various eco-friendly projects. The bank also reported a 15% increase in its financing to women-led SMEs compared to 2022.

- Green Financing Growth: CIB's green finance portfolio expanded significantly, reaching over EGP 20 billion by year-end 2023.

- MSME Support: The bank continues to prioritize financing for micro, small, and medium-sized enterprises.

- Women's Economic Empowerment: CIB saw a 15% year-on-year increase in financing directed towards women-owned businesses in 2023.

- Financial Inclusion: These initiatives are core to CIB's strategy to foster broader financial inclusion across the community.

CIB's key activities revolve around its core banking functions, including deposit-taking and lending, which formed the bedrock of its EGP 35.2 billion net interest income in 2024. It also actively pursues digital transformation, evidenced by a 15% year-over-year growth in mobile banking users in 2024, enhancing customer accessibility and operational efficiency.

Furthermore, CIB engages in robust investment banking and advisory services, facilitating significant M&A and capital raises for corporate clients in 2024. Complementing these are its strong risk management and compliance frameworks, essential for safeguarding financial health and customer data integrity.

The bank also champions sustainable development through green and social financing. By the end of 2023, CIB had disbursed over EGP 20 billion in green financing and saw a 15% increase in financing for women-led SMEs compared to 2022, underscoring its commitment to financial inclusion and economic empowerment.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Core Banking | Deposit-taking and lending operations | Net Interest Income: EGP 35.2 billion (2024) |

| Digital Transformation | Enhancing online and mobile banking platforms | 15% YoY growth in mobile banking users (2024) |

| Investment Banking | Corporate finance, asset management, capital markets | Facilitated significant M&A and capital raises (2024) |

| Risk Management & Compliance | Mitigating credit, operational, and market risks | Continued investment in risk mitigation strategies (2024) |

| Sustainable Finance | Green and social financing, MSME support | EGP 20 billion+ in green financing (end of 2023) |

| Women's Economic Empowerment | Financing for women-owned businesses | 15% YoY increase in financing to women-led SMEs (2023) |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas for Commercial International Bank that you are previewing is the exact document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. You can be assured that upon completing your transaction, you will gain full access to this professionally prepared Business Model Canvas, ready for your immediate use and analysis.

Resources

Commercial International Bank (CIB) boasts a formidable financial foundation, characterized by substantial capital and exceptional liquidity. As of the first quarter of 2024, CIB reported a total capital adequacy ratio of 17.8%, comfortably above the Central Bank of Egypt's minimum requirement of 15.5%. This robust capital position, bolstered by significant customer deposits totaling EGP 485 billion as of December 31, 2023, provides a strong buffer against potential economic downturns and fuels its capacity for lending expansion.

This financial strength translates directly into CIB's ability to underwrite larger loans and manage risk effectively. The bank’s liquidity coverage ratio stood at an impressive 185% at the end of 2023, well above the regulatory benchmark. Such high liquidity ensures CIB can meet its short-term obligations and seize growth opportunities, reinforcing its role as a stable financial pillar within the Egyptian economy.

Commercial International Bank (CIB) in Egypt relies heavily on its extensive branch and ATM network as a core resource. This physical footprint, spanning numerous locations across the country, is fundamental to its operations and customer engagement.

As of the first quarter of 2024, CIB operated over 200 branches and more than 1,000 ATMs. This wide reach ensures accessibility for a broad customer base, catering to both urban and more remote areas where digital penetration might be less advanced.

The physical network remains vital for facilitating cash transactions, a significant component of the Egyptian economy, and for building trust and providing personalized service, especially for CIB's diverse customer segments ranging from individuals to large corporations.

Commercial International Bank (CIB) has made significant investments in its digital infrastructure, boasting world-class online banking platforms and a widely adopted Smart Wallet. This robust technological foundation is crucial for delivering its digital banking services effectively.

This advanced infrastructure enables CIB to facilitate seamless transactions for its customers and significantly enhances operational efficiencies across the bank. For instance, in 2023, CIB reported a substantial increase in digital transactions, underscoring the success of its technological investments.

Skilled Human Capital and Expertise

Commercial International Bank (CIB) recognizes that its people are its most valuable asset. The bank invests heavily in developing its workforce, ensuring they possess the advanced financial acumen needed to serve a diverse clientele. This commitment translates into specialized product offerings and superior customer service.

CIB's dedication to employee development is evident in its substantial training budgets. For instance, in 2023, the bank allocated a significant portion of its operating expenses to enhance employee skills, focusing on areas like digital banking, risk management, and customer relationship management. This strategic investment underpins CIB's ability to innovate and adapt in a rapidly evolving financial landscape.

- Highly Qualified Workforce: CIB employs a substantial number of professionals with advanced degrees in finance, economics, and related fields, ensuring a deep understanding of complex financial markets.

- Continuous Learning Investment: The bank consistently invests in ongoing training and development programs, with employee education and skill enhancement being a key priority in its operational budget.

- Innovation Driver: Skilled human capital is directly linked to CIB's capacity for developing and implementing innovative financial solutions, from digital platforms to bespoke corporate banking services.

- Service Excellence: The expertise of CIB's staff is fundamental to maintaining the high service standards expected by its customers, fostering trust and long-term relationships.

Reputation and Brand Equity

Commercial International Bank (CIB) leverages its robust reputation as Egypt's largest private sector bank and a leading financial institution. This strong standing is underscored by consistent recognition through numerous national and international awards, solidifying its market presence.

The bank's brand equity translates directly into significant market trust, a critical factor in attracting and retaining a diverse customer base across all segments. This trust is a key intangible asset within its business model.

CIB's commitment to excellence has been recognized with awards such as being named the Best Bank in Egypt by Global Finance for multiple consecutive years, including 2023. Furthermore, Euromoney has consistently ranked CIB among the top banks in Africa.

- Market Leadership: CIB's position as Egypt's largest private sector bank provides a foundational advantage.

- Award Recognition: Numerous national and international accolades bolster its brand image and credibility.

- Customer Trust: Strong brand equity fosters deep customer loyalty and attracts new clients.

- Competitive Edge: Reputation acts as a significant differentiator in the competitive banking landscape.

CIB's key resources are its strong financial standing, extensive physical network, advanced digital infrastructure, skilled workforce, and reputable brand. These elements collectively enable the bank to offer a comprehensive suite of financial services and maintain a competitive edge.

| Resource | Description | Data/Metric (Q1 2024 unless specified) |

|---|---|---|

| Financial Strength | Robust capital and liquidity position | Capital Adequacy Ratio: 17.8% Liquidity Coverage Ratio: 185% (End 2023) |

| Physical Network | Extensive branch and ATM presence | Branches: >200 ATMs: >1,000 |

| Digital Infrastructure | World-class online banking and mobile wallet | Significant increase in digital transactions (2023) |

| Human Capital | Highly qualified and continuously trained staff | Substantial investment in employee development (2023) |

| Brand Reputation | Market leadership and award recognition | Best Bank in Egypt (Global Finance, 2023) |

Value Propositions

Commercial International Bank (CIB) provides a broad spectrum of financial products and services, acting as a single point of contact for individuals, small and medium-sized enterprises (SMEs), and large corporations. This extensive offering covers traditional banking, investment banking, and Islamic banking, streamlining financial management for its diverse customer base.

In 2023, CIB reported a net profit of EGP 38.1 billion, underscoring its capacity to deliver a comprehensive suite of financial solutions that meet varied market demands. This financial strength supports its ability to cater to a wide range of banking needs across different customer segments.

Commercial International Bank (CIB) enhances its value proposition through robust digital convenience, offering advanced internet banking and mobile applications. These platforms empower customers to conduct transactions securely and efficiently, anytime and anywhere.

This commitment to digital innovation cultivates a seamless and contemporary banking experience, directly addressing and exceeding evolving customer expectations in the financial sector.

In 2023, CIB reported a significant increase in digital transactions, with mobile banking usage growing by 25%, underscoring the success of their digital convenience strategy.

Commercial International Bank (CIB) excels at crafting financial solutions precisely matched to the unique requirements of various customer groups. By leveraging data analytics, CIB identifies distinct needs, enabling the delivery of highly relevant and useful products and services.

This approach manifests in personalized banking for individuals, tailored financing options for small and medium-sized enterprises (SMEs), and advanced financial instruments designed for large corporations. For instance, in 2024, CIB reported a 15% growth in its SME lending portfolio, directly attributable to these customized offerings.

Financial Inclusion and Accessibility

Commercial International Bank (CIB) actively pursues financial inclusion by extending its services to previously underserved populations, aiming to bring the informal economy into the formal financial system. This commitment is demonstrated through the development of accessible banking channels and strategic partnerships designed to foster financial literacy and decrease dependence on cash.

CIB’s efforts are supported by initiatives like their digital banking platforms, which have seen significant growth. For instance, in 2023, CIB reported a substantial increase in its digital customer base, with millions of transactions processed through its mobile and online channels, highlighting the growing adoption of accessible financial tools.

- Expanding Reach: CIB focuses on rural and low-income communities, offering tailored products and services.

- Digital Transformation: Investment in user-friendly digital platforms makes banking more accessible and convenient.

- Financial Literacy Programs: CIB conducts workshops and provides educational resources to empower customers with financial knowledge.

- Partnerships for Impact: Collaborations with fintech companies and NGOs enhance service delivery and outreach to marginalized groups.

Stability, Trust, and Strong Governance

As Egypt's largest private sector bank, Commercial International Bank (CIB) offers unparalleled stability and trust. This reputation is built on a foundation of strong financial performance and rigorous risk management practices.

CIB's commitment to robust governance, adhering to international standards, further solidifies its position. This instills significant confidence among its diverse client base, from individual depositors to large corporate entities.

- Financial Strength: CIB reported a net profit of EGP 16.5 billion for the first nine months of 2024, demonstrating consistent profitability.

- Governance Standards: The bank actively promotes transparency and ethical conduct, aligning with global best practices in corporate governance.

- Risk Management: CIB maintains a conservative approach to risk, ensuring a secure environment for customer assets.

- Market Leadership: Its status as Egypt's largest private bank underscores its reliability and deep market penetration.

CIB's value proposition centers on providing a comprehensive, digitally-enabled, and personalized banking experience for a diverse clientele. Their extensive product range, from traditional banking to specialized Islamic finance, acts as a one-stop shop, simplifying financial management. This is further bolstered by a strong emphasis on digital convenience through advanced mobile and internet banking platforms, which saw a 25% increase in mobile banking usage in 2023.

By leveraging data analytics, CIB tailors its offerings, evident in the 15% growth of its SME lending portfolio in 2024 due to customized solutions. Furthermore, CIB champions financial inclusion, extending services to underserved communities and integrating the informal economy through accessible digital channels, processing millions of transactions in 2023.

As Egypt's largest private sector bank, CIB offers unparalleled stability and trust, underpinned by robust financial performance, with a reported net profit of EGP 16.5 billion for the first nine months of 2024, and a commitment to strong governance and risk management.

| Value Proposition Aspect | Key Feature | Supporting Data/Fact |

|---|---|---|

| Comprehensive Financial Services | One-stop shop for individuals, SMEs, and corporations | Offers traditional, investment, and Islamic banking. |

| Digital Convenience | Advanced internet and mobile banking | 25% growth in mobile banking usage (2023). |

| Personalized Solutions | Tailored products based on customer needs | 15% growth in SME lending portfolio (2024). |

| Financial Inclusion | Services for underserved populations | Millions of digital transactions processed (2023). |

| Stability and Trust | Largest private sector bank in Egypt | EGP 16.5 billion net profit (first nine months of 2024). |

Customer Relationships

Commercial International Bank (CIB) fosters personalized relationships by assigning dedicated relationship managers to its corporate, institutional, and high-net-worth individual clients. This ensures that complex financial requirements receive expert, individualized attention.

In 2024, CIB reported a significant increase in client satisfaction scores directly linked to this personalized management approach. For instance, their corporate banking division saw a 15% uplift in repeat business attributed to proactive and tailored client engagement by relationship managers.

Commercial International Bank (CIB) empowers its customers with robust digital self-service through its internet banking and mobile app, enabling independent account management and transactions. This digital-first approach is further enhanced by AI-powered digital assistants and readily available online support channels for instant query resolution.

Commercial International Bank (CIB) operates a robust network of customer service centers and branches. These physical locations are staffed by trained tellers and dedicated relationship managers, ensuring customers receive personalized, in-person support for inquiries and transactions. This commitment to physical touchpoints underscores CIB's dedication to accessibility, particularly for those who value traditional banking interactions.

Community Engagement and CSR Initiatives

Commercial International Bank (CIB) actively cultivates strong community ties through its dedicated Corporate Social Responsibility (CSR) programs and the CIB Foundation. These initiatives are designed to make a tangible difference in areas crucial for societal progress, extending the bank's impact far beyond its core financial offerings.

CIB's commitment is evident in its strategic focus on key sectors vital for national development. The bank channels resources and expertise into improving educational access and quality, advancing healthcare services and infrastructure, and supporting broader social development projects that uplift vulnerable populations.

- Education: CIB has invested significantly in educational programs, aiming to enhance learning opportunities for students across Egypt.

- Healthcare: The bank supports healthcare initiatives, contributing to better medical facilities and patient care.

- Social Development: CIB's CSR efforts also encompass broader social welfare projects, fostering community well-being.

- Foundation Impact: The CIB Foundation plays a pivotal role in orchestrating and amplifying these impactful CSR activities.

Data-Driven Customer Insights

Commercial International Bank (CIB) utilizes advanced data analytics and behavioral segmentation to understand its customers intimately. This deep dive into preferences and needs enables CIB to anticipate and fulfill them, leading to more relevant product and service offerings.

By proactively tailoring solutions based on these insights, CIB significantly boosts customer satisfaction and cultivates stronger loyalty. For instance, in 2024, CIB's focus on personalized digital banking experiences, informed by data, contributed to a notable increase in customer engagement metrics.

- Data-Driven Personalization: CIB employs sophisticated analytics to segment customers based on their financial behavior and preferences.

- Proactive Product Development: Insights gathered are used to create and refine banking products and services that directly address identified customer needs.

- Enhanced Customer Satisfaction: By offering relevant solutions, CIB improves the overall customer experience, fostering greater satisfaction.

- Increased Loyalty: Personalized engagement and relevant offerings translate into higher customer retention and loyalty rates.

CIB prioritizes personalized engagement through dedicated relationship managers for key client segments, ensuring tailored financial solutions. In 2024, this approach led to a 15% rise in repeat business within the corporate banking division, highlighting the effectiveness of proactive, individualized client interaction.

Channels

Commercial International Bank (CIB) leverages an extensive branch network across Egypt, acting as a cornerstone of its customer engagement strategy. These physical locations are crucial for traditional banking needs, facilitating everything from new account openings to complex cash transactions.

As of the first quarter of 2024, CIB maintained a significant presence with 208 branches and 385 ATMs nationwide. This widespread accessibility ensures that a broad customer base, including those less inclined towards digital banking, can readily access essential financial services and personalized support.

Commercial International Bank (CIB) leverages its extensive ATM network as a core component of its customer service strategy. This network provides customers with round-the-clock access to essential banking functions like cash withdrawals and deposits, significantly boosting convenience.

As of late 2023, CIB operated over 1,200 ATMs across Egypt, a substantial number that underscores its commitment to widespread accessibility. This robust infrastructure ensures that a significant portion of the banked population can perform basic transactions easily, anytime and anywhere.

Commercial International Bank's (CIB) internet banking platform serves as a vital digital channel, enabling customers to seamlessly manage accounts, settle bills, and apply for various banking products. This robust online service is central to CIB's ongoing digital transformation, enhancing customer convenience and accessibility.

In 2024, CIB reported a significant increase in digital transactions, with its internet banking platform facilitating over 70% of all customer interactions. This highlights the platform's critical role in customer engagement and operational efficiency.

Mobile Banking Applications

Commercial International Bank (CIB) leverages its mobile banking applications, notably its Smart Wallet, to provide customers with a convenient platform for managing their finances directly from their smartphones. This digital offering is central to CIB's strategy for customer engagement and transaction efficiency.

These applications are designed for a seamless user experience, which has directly contributed to high rates of mobile payment activity. For instance, by the end of 2023, CIB reported a significant increase in digital transactions, with mobile channels playing a pivotal role in this growth, reflecting strong customer adoption.

- Digital Transaction Growth: CIB's mobile platforms facilitated a substantial volume of digital transactions in 2023, underscoring their importance in the bank's service delivery.

- Smart Wallet Adoption: The Smart Wallet feature within the mobile app has seen robust uptake, enabling users to perform a wide array of banking operations with ease.

- Customer Convenience: The focus on a user-friendly interface ensures that customers can conduct banking activities efficiently, driving satisfaction and repeat usage.

Contact Centers and Social Media

Commercial International Bank (CIB) leverages its contact centers and social media presence as crucial customer interaction channels. These platforms are designed to offer immediate support and address a wide range of customer inquiries, fostering efficient communication and a responsive customer experience.

In 2024, CIB's commitment to customer service through these channels is evident in their operational focus. For instance, many leading banks reported significant increases in digital customer service interactions, with contact centers handling a substantial volume of queries, often exceeding millions of calls annually. Social media platforms, meanwhile, have become vital for quick query resolution and brand engagement, with many banks aiming for response times within hours, if not minutes, for customer service requests posted on platforms like Facebook and X (formerly Twitter).

- Contact Centers: Provide direct, real-time support for complex issues and personalized assistance.

- Social Media: Facilitate quick responses to common questions, gather feedback, and enhance brand visibility.

- Customer Engagement: These channels are integral to CIB's strategy for maintaining strong customer relationships and ensuring satisfaction.

- Operational Efficiency: Aim to streamline communication and resolve customer needs promptly, contributing to overall service quality.

CIB's physical branch network, comprising 208 branches and 385 ATMs as of Q1 2024, remains a vital channel for traditional banking needs and customer support. This extensive physical presence ensures accessibility for all customer segments, reinforcing CIB's commitment to broad market reach. The bank also actively utilizes its contact centers and social media platforms to provide responsive customer service, aiming for prompt query resolution and enhanced engagement.

| Channel | Key Features | 2024 Data/Focus |

|---|---|---|

| Branches | Traditional banking, complex transactions, personalized service | 208 branches nationwide |

| ATMs | 24/7 access for cash withdrawals, deposits | 385 ATMs nationwide |

| Internet Banking | Account management, bill payments, product applications | Facilitated over 70% of customer interactions |

| Mobile Banking (Smart Wallet) | Smartphone-based financial management, mobile payments | Significant increase in mobile transaction volume |

| Contact Centers & Social Media | Customer support, query resolution, brand engagement | Focus on rapid response times and digital interaction |

Customer Segments

Commercial International Bank (CIB) serves a diverse base of individuals through its retail banking operations, catering to their everyday financial requirements. This segment encompasses customers seeking essential services like savings and checking accounts, credit cards for daily transactions, and personal loans for various needs. In 2023, CIB reported a net profit of EGP 26.0 billion, reflecting its strong performance in serving this broad customer base.

CIB focuses on delivering convenient and accessible solutions to empower individuals in managing their finances. By offering a comprehensive suite of retail banking products, the bank aims to be the primary financial partner for a wide spectrum of customers. As of the first quarter of 2024, CIB's customer base continued to grow, demonstrating the ongoing demand for its retail banking services.

Commercial International Bank (CIB) actively supports Small and Medium-Sized Enterprises (SMEs) by providing specialized financial products. These include business loans, flexible credit facilities, and essential trade finance solutions designed to meet the unique needs of growing businesses.

CIB's dedication to SMEs stems from their vital role as engines of economic growth in Egypt. In 2023, SMEs accounted for approximately 99% of all businesses and contributed significantly to employment, underscoring their importance to the national economy.

Large corporations and institutions, including major multinational companies, government bodies, and significant financial players, represent a core customer segment for Commercial International Bank (CIB). These clients demand highly specialized and comprehensive financial solutions tailored to their complex operational and strategic needs.

CIB caters to this segment by offering a robust suite of corporate banking services, encompassing everything from large-scale transaction processing and treasury management to complex trade finance and working capital solutions. In 2024, CIB's corporate banking division continued to be a significant contributor to its overall revenue, reflecting the bank's strong relationships and deep understanding of the corporate landscape.

Furthermore, CIB's investment banking arm provides crucial advisory services for mergers and acquisitions, capital raising through debt and equity markets, and strategic financial planning. The bank's ability to structure and execute sophisticated deals underscores its commitment to supporting the growth and financial objectives of its institutional clientele.

High-Net-Worth Individuals (HNWIs)

Commercial International Bank (CIB) caters to High-Net-Worth Individuals (HNWIs) by providing bespoke wealth management services and exclusive banking solutions. These offerings are meticulously crafted to oversee significant asset portfolios, unlock diverse investment avenues, and deliver tailored financial planning.

CIB's commitment to HNWIs is underscored by its focus on personalized service and strategic financial guidance. For instance, in 2024, the bank continued to expand its dedicated teams of wealth advisors, ensuring clients receive expert attention for their complex financial needs.

- Asset Management: CIB offers sophisticated strategies for managing substantial investment portfolios, aiming for capital preservation and growth tailored to individual risk appetites.

- Investment Opportunities: Clients gain access to a curated selection of domestic and international investment products, including equities, fixed income, and alternative investments.

- Personalized Financial Planning: Comprehensive services encompass estate planning, tax advisory, and retirement planning, ensuring holistic financial well-being.

- Exclusive Banking Solutions: HNWIs benefit from preferential rates, dedicated relationship managers, and access to a suite of premium banking and lifestyle services.

Unbanked and Underserved Populations

Commercial International Bank (CIB) actively pursues financial inclusion by focusing on unbanked and underserved populations. This strategic segment is crucial for expanding market reach and fostering economic participation. CIB aims to bridge the gap in financial access for these communities.

To reach these customers, CIB leverages digital platforms and strategic alliances. These efforts are designed to overcome traditional barriers to banking, such as geographical limitations and lack of formal identification. The bank’s approach emphasizes creating accessible and user-friendly financial products.

Financial literacy is a cornerstone of CIB’s strategy for these segments. By providing educational resources and support, CIB empowers individuals to make informed financial decisions and utilize banking services effectively. This focus on education is vital for long-term customer engagement and financial well-being.

In 2024, Egypt's financial inclusion efforts saw significant progress, with the unbanked population decreasing. CIB’s initiatives contributed to this trend by offering:

- Mobile banking solutions reaching remote areas.

- Partnerships with microfinance institutions to extend credit access.

- Simplified account opening procedures for low-income individuals.

- Financial literacy workshops conducted in community centers.

Commercial International Bank (CIB) serves a diverse customer base, including individuals, Small and Medium-Sized Enterprises (SMEs), large corporations, and High-Net-Worth Individuals (HNWIs). The bank also actively engages in financial inclusion initiatives targeting unbanked and underserved populations.

| Customer Segment | Key Offerings | 2023/2024 Relevance |

|---|---|---|

| Individuals (Retail Banking) | Savings, checking, credit cards, personal loans | Net profit of EGP 26.0 billion in 2023; growing customer base in Q1 2024. |

| SMEs | Business loans, credit facilities, trade finance | SMEs form ~99% of businesses in Egypt, vital for employment. |

| Large Corporations & Institutions | Transaction processing, treasury, trade finance, M&A advisory | Corporate banking a significant revenue contributor in 2024. |

| HNWIs | Wealth management, asset management, personalized financial planning | Expansion of dedicated wealth advisor teams in 2024. |

| Unbanked/Underserved | Mobile banking, microfinance partnerships, simplified accounts | Contributed to decreasing unbanked population in Egypt in 2024. |

Cost Structure

Personnel costs represent a substantial expense for Commercial International Bank (CIB), driven by its extensive workforce. In 2024, CIB employed over 8,200 individuals, making employee salaries, comprehensive benefits packages, ongoing training, and recruitment efforts a significant component of its overall cost structure.

The bank recognizes that investing in its human capital is paramount for maintaining a competitive edge and retaining skilled employees. Offering competitive compensation and development opportunities is crucial for attracting and keeping top talent in the financial sector.

Commercial International Bank (CIB) dedicates significant resources to its technology and digital infrastructure. In 2024, CIB's investment in digital transformation, encompassing software development, system upgrades, and robust cybersecurity measures, reached substantial figures, reflecting a strategic commitment to innovation and security. These expenditures are crucial for enhancing customer experience through intuitive digital platforms and streamlining internal operations for greater efficiency.

Commercial International Bank (CIB) incurs significant expenses to maintain its extensive physical branch and ATM network. These costs encompass rent for prime locations, utilities, robust security systems, and ongoing maintenance to ensure operational readiness and customer accessibility.

In 2024, CIB's commitment to a strong physical footprint means a substantial portion of its operational budget is allocated to these network-related expenses, directly supporting its traditional banking services and customer engagement strategies.

Marketing and Sales Expenses

Commercial International Bank (CIB) invests significantly in marketing and sales to acquire and retain customers. These efforts include broad advertising campaigns, digital marketing initiatives, and direct sales outreach to promote their extensive portfolio of banking products and services, from retail accounts to corporate finance solutions.

These expenses are vital for maintaining brand recognition and expanding market presence. For instance, CIB's marketing and sales expenditure in 2023 was EGP 3.5 billion, a notable increase from EGP 3.1 billion in 2022, reflecting a strategic push for growth.

- Marketing Campaigns: CIB runs targeted campaigns across various media channels to highlight new products and customer benefits.

- Advertising: Significant budget allocation for digital and traditional advertising to enhance brand visibility and reach.

- Sales Efforts: Investment in sales teams and customer relationship management tools to drive product adoption and customer loyalty.

- Customer Acquisition Costs: Monitoring and optimizing the cost associated with acquiring new customers through these channels.

Regulatory and Compliance Costs

Commercial International Bank (CIB) dedicates significant resources to meeting the stringent regulatory landscape. This involves substantial expenditure on compliance with the Central Bank of Egypt's directives, adherence to international banking protocols, and the maintenance of robust corporate governance frameworks. These costs are essential for ensuring operational integrity and market trust.

Key cost drivers within this category include:

- Audits: Regular internal and external audits to verify adherence to financial regulations and internal controls.

- Legal Services: Engaging legal counsel for advice on regulatory changes, contract reviews, and dispute resolution.

- Compliance Reporting: Costs associated with preparing and submitting detailed reports to regulatory bodies, demonstrating adherence to all applicable laws and standards.

In 2024, Egyptian banks, including CIB, have faced increased compliance burdens. For instance, the Central Bank of Egypt has been actively updating its anti-money laundering (AML) and combating the financing of terrorism (CFT) frameworks, necessitating investments in technology and personnel to ensure full compliance. While specific figures for CIB's regulatory costs are not publicly itemized in this manner, the banking sector's overall expenditure on compliance is a material operational expense.

Commercial International Bank (CIB) manages a multifaceted cost structure, with personnel being a primary driver. In 2024, CIB’s workforce exceeded 8,200 employees, translating into significant outlays for salaries, benefits, and training. Technology and digital infrastructure represent another major investment area, crucial for enhancing customer experience and operational efficiency through software development and cybersecurity. The bank also incurs substantial costs for its physical presence, including branch and ATM network maintenance, alongside significant spending on marketing and sales to drive customer acquisition and retention.

| Cost Category | 2023 (EGP Billion) | 2024 (Estimated/Key Drivers) | Impact |

|---|---|---|---|

| Personnel Costs | N/A (Significant) | Salaries, benefits, training for 8,200+ employees | Core operational expense, talent retention |

| Technology & Digital Infrastructure | N/A (Substantial) | Software development, system upgrades, cybersecurity | Innovation, efficiency, customer experience |

| Physical Network (Branches/ATMs) | N/A (Significant) | Rent, utilities, security, maintenance | Customer accessibility, traditional services |

| Marketing & Sales | 3.5 | Advertising, digital marketing, sales outreach | Brand visibility, market expansion, customer acquisition |

| Regulatory Compliance | N/A (Material) | Audits, legal services, reporting (AML/CFT focus) | Operational integrity, market trust |

Revenue Streams

Net Interest Income (NII) is the cornerstone of Commercial International Bank's (CIB) revenue generation. This income stream is built upon the fundamental banking principle of earning more interest on assets, primarily loans and investments, than is paid out on liabilities, such as customer deposits.

CIB's NII has demonstrated a consistent upward trajectory, underscoring its success in expanding its loan portfolio and efficiently managing its interest margins. For instance, in the first quarter of 2024, CIB reported a significant increase in its net interest income, reaching EGP 12.4 billion, a notable jump from EGP 8.1 billion in the same period of 2023.

Commercial International Bank (CIB) derives substantial revenue from fees and commissions, a vital component of its non-interest income. This includes earnings from trade finance services, credit and debit card processing, and various account maintenance charges.

In 2024, CIB's fee and commission income demonstrated robust growth, reflecting the bank's expanding service offerings and customer base. This segment is crucial for diversifying revenue and enhancing profitability beyond traditional interest income.

Commercial International Bank (CIB) generates significant revenue through its investment banking and advisory services. This includes advising corporations and institutions on crucial transactions like mergers and acquisitions (M&A), as well as underwriting new debt and equity securities. These fees are a direct reflection of CIB's deep expertise in complex financial structuring and market execution.

In 2024, global investment banking fees saw a notable rebound, with M&A advisory and equity underwriting playing key roles. For instance, reports indicated that fees from M&A advisory alone contributed substantially to the revenue streams of major financial institutions, underscoring the value placed on expert guidance in strategic corporate finance activities. CIB's ability to secure and execute these mandates directly translates into robust fee income.

Foreign Exchange Gains

Commercial International Bank (CIB) generates revenue through foreign exchange gains, stemming from its international operations and currency trading. These gains are influenced by market volatility and can significantly boost the bank's earnings, particularly during periods of economic change.

In 2024, CIB's foreign exchange activities are expected to be a notable contributor to its revenue. For instance, in the first quarter of 2024, the Egyptian pound experienced significant fluctuations, creating opportunities for banks like CIB to profit from currency trading and hedging operations.

- Foreign Exchange Trading: CIB actively participates in the foreign exchange market, buying and selling currencies to meet customer needs and for its own trading purposes.

- Currency Hedging Services: The bank offers hedging solutions to corporate clients to mitigate risks associated with currency fluctuations, generating fees and commissions.

- Interest Rate Differentials: Gains can also arise from differences in interest rates between currencies, a common practice in international banking.

- Market Volatility Impact: While volatile, periods of significant currency movement, such as those seen in emerging markets in 2024, can lead to substantial foreign exchange gains for well-positioned banks.

Loan and Credit Product Origination Fees

Commercial International Bank (CIB) generates revenue through fees collected from originating various loan and credit products. This includes charges associated with personal loans, corporate financing, and mortgage agreements, alongside fees from credit card issuance.

These origination fees are a direct reflection of CIB's robust lending activities and the continuous expansion of its loan portfolio. For instance, in 2024, CIB reported significant growth in its loan book, contributing to a substantial increase in fee income from these services.

- Loan Origination Fees: CIB charges fees for processing and approving new loans across different customer segments.

- Credit Card Issuance Fees: Revenue is also derived from fees associated with the issuance of new credit cards to customers.

- Portfolio Growth Impact: The bank's strategy of expanding its lending operations directly correlates with higher fee income from these origination activities.

- 2024 Performance: CIB's sustained lending growth in 2024 bolstered its earnings from loan and credit product origination fees.

Commercial International Bank (CIB) also generates revenue from its treasury operations, which involve managing the bank's liquidity and investments. This includes income from trading securities and managing its own portfolio of financial assets.

In 2024, CIB's treasury activities are expected to benefit from efficient liquidity management and strategic investment decisions. For example, the bank's ability to optimize its balance sheet and invest in high-yield instruments contributes to its overall profitability.

CIB's treasury operations are crucial for its financial health, generating income through various financial instruments and market activities. This segment plays a vital role in diversifying revenue and enhancing the bank's financial performance.

In the first quarter of 2024, CIB's treasury segment reported contributions that supported the bank's overall financial results, reflecting effective asset-liability management and profitable trading outcomes.

Business Model Canvas Data Sources

The Commercial International Bank Business Model Canvas is built using a blend of internal financial data, extensive market research on global banking trends, and competitive intelligence. These diverse sources ensure a robust and accurate representation of the bank's strategic positioning and operational realities.