Commercial International Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commercial International Bank Bundle

Commercial International Bank operates in a dynamic financial landscape, facing pressures from intense rivalry and the constant threat of new entrants. Understanding the bargaining power of both buyers and suppliers is crucial for navigating this competitive environment.

The complete report reveals the real forces shaping Commercial International Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Depositors, especially major institutional and corporate clients, hold considerable sway over Commercial International Bank's (CIB) funding expenses. These entities can shift vast sums between financial institutions, directly impacting CIB's profitability and how it manages its available cash based on interest rate differentials or service quality. For instance, in early 2024, a slight uptick in interbank lending rates in Egypt, where CIB operates, could prompt large depositors to seek higher yields elsewhere, forcing CIB to adjust its deposit rates upwards.

Specialized technology and infrastructure providers, particularly those offering core banking systems, advanced cybersecurity, and digital transformation platforms, wield significant bargaining power. Their leverage stems from the high switching costs associated with replacing these critical systems and the proprietary nature of their intellectual property. For instance, the global market for core banking solutions is dominated by a few key players, meaning banks like Commercial International Bank (CIB) often face limited alternatives when seeking to upgrade or maintain their foundational technology.

CIB's deep reliance on these vendors for maintaining operational efficiency, enabling innovation, and ensuring robust digital services makes it vulnerable to their pricing strategies and contractual terms. A failure to secure favorable renegotiations on service agreements or software licenses could lead to increased operational expenses and potentially hinder CIB's ability to adapt to evolving market demands. This dependence can restrict the bank's strategic flexibility, as the cost and complexity of migrating to alternative providers can be prohibitive.

The bargaining power of suppliers, particularly in the form of skilled human capital, is a significant consideration for Commercial International Bank (CIB). The availability of professionals adept in digital banking, data analytics, risk management, and investment banking is paramount for CIB to achieve its strategic goals. A scarcity of these specialized skills within the Egyptian labor market directly translates to increased competition for talent among financial institutions.

This heightened competition for top-tier personnel empowers these skilled professionals, enabling them to negotiate for higher salaries, more attractive benefits packages, and improved working conditions. For instance, in 2023, the average salary for a data scientist in Egypt saw an upward trend, reflecting the high demand for such expertise across various sectors, including banking.

Interbank Market and Central Bank Policies

The bargaining power of suppliers, in this case, refers to entities that provide crucial funding to Commercial International Bank (CIB). These include other commercial banks participating in the interbank market and the Central Bank of Egypt (CBE). CIB's ability to access liquidity and the cost associated with borrowing are directly shaped by the conditions and policies set by these suppliers of capital.

When the interbank market experiences tight liquidity or the CBE adjusts its monetary policy by increasing benchmark interest rates, CIB's funding expenses naturally rise. This escalation in borrowing costs signifies an increased bargaining power wielded by these systemic capital providers. For instance, in early 2024, the CBE raised its deposit and lending rates, impacting the cost of funds for Egyptian banks like CIB.

- Interbank Market Dynamics: CIB relies on the interbank market for short-term liquidity management. The availability and cost of these funds fluctuate based on overall market sentiment and the liquidity positions of other banks.

- Central Bank Influence: The CBE's monetary policy, including its benchmark interest rates and reserve requirements, directly influences the cost of funds for all Egyptian banks, including CIB.

- Impact on Profitability: Higher borrowing costs from suppliers translate into increased operational expenses for CIB, which can put pressure on its net interest margins and overall profitability.

Credit Rating Agencies and External Auditors

Credit rating agencies wield considerable influence over Commercial International Bank (CIB) by shaping its cost of capital and international funding accessibility. For instance, a downgrade by Moody's or Standard & Poor's can immediately increase borrowing costs for CIB, making it more expensive to raise funds. In 2023, global financial markets saw increased volatility, making robust credit ratings even more critical for banks like CIB seeking foreign investment.

External auditors also possess significant bargaining power, as their role is indispensable for CIB's financial transparency and adherence to regulatory standards. Their opinions directly affect investor confidence and market perception. A qualified audit opinion or significant findings could lead to a sharp decline in CIB's stock price and hinder its ability to secure new financing.

- Credit Rating Agencies: Their assessments directly impact CIB's borrowing costs and international investment appeal.

- External Auditors: Their assurance of financial integrity is crucial for maintaining investor trust and regulatory compliance.

- Impact of Negative Assessments: Findings from these entities can severely damage CIB's reputation and access to capital markets.

- Market Sensitivity: In 2023, heightened market volatility underscored the importance of reliable ratings and audits for financial institutions like CIB.

Suppliers of critical technology and specialized talent possess significant leverage over Commercial International Bank (CIB). The limited availability of advanced banking software providers and highly skilled professionals in areas like data analytics and cybersecurity means CIB faces intense competition for these resources. This dependence can drive up costs for CIB, impacting its operational efficiency and strategic agility.

For instance, the global market for core banking systems is concentrated, giving dominant players substantial pricing power. Similarly, in 2023, the demand for experienced cybersecurity experts in Egypt outstripped supply, leading to increased salary expectations for these professionals, a cost CIB must absorb.

| Supplier Type | Leverage Factor | Impact on CIB | 2023/2024 Trend Example |

|---|---|---|---|

| Core Banking System Providers | Limited market players, high switching costs | Increased software licensing and maintenance fees | Global vendors maintaining premium pricing for system upgrades. |

| Cybersecurity Specialists | High demand, scarce talent pool | Higher recruitment and retention costs for talent | Upward pressure on salaries for cybersecurity professionals in Egypt. |

| Data Analytics Experts | Critical for innovation, specialized skills | Competitive salary packages and benefits | Increased compensation demands from data scientists in the financial sector. |

What is included in the product

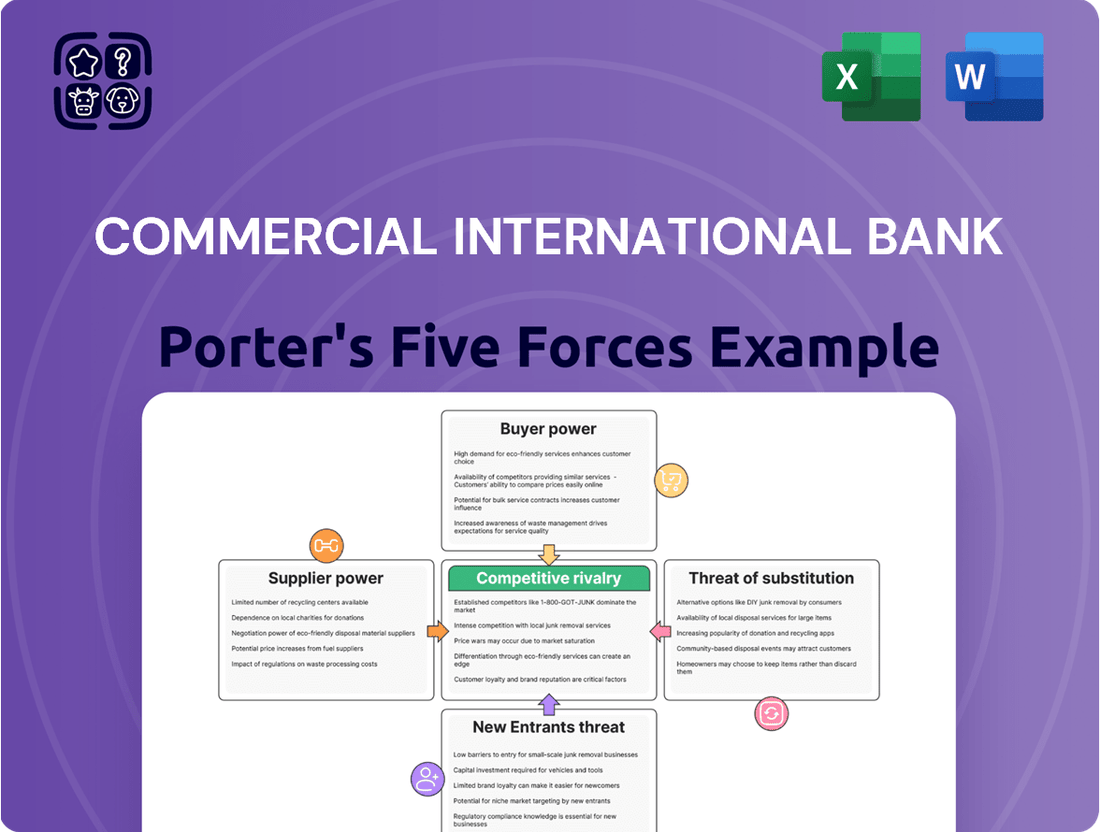

Tailored exclusively for Commercial International Bank, this analysis dissects the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitutes, providing a strategic view of its competitive environment.

Instantly understand competitive pressures on CIB with a clear, visual representation of Porter's Five Forces, allowing for swift strategic adjustments.

Customers Bargaining Power

Large corporate and institutional clients wield considerable bargaining power over Commercial International Bank (CIB). Their ability to shift substantial volumes of business, often involving complex financial needs, means CIB must actively compete for their loyalty. For instance, in 2024, major financial institutions like CIB often find themselves negotiating terms for multi-million dollar loan facilities or large deposit accounts, where even minor rate differences can represent significant cost savings for the client.

These sophisticated clients frequently demand customized financial solutions, including bespoke lending rates, attractive deposit yields, and specialized treasury or investment banking services. CIB's need to meet these demands to secure and retain such high-value relationships can directly influence its profitability. The bank must balance offering competitive pricing and premium services against maintaining healthy profit margins, especially when dealing with clients who have the financial acumen and market access to easily explore alternatives.

High Net Worth Individuals (HNWIs) wield significant bargaining power due to their substantial financial assets. They demand highly personalized services, exclusive investment opportunities, and competitive wealth management solutions. For instance, the global HNWI population grew by 4.7% in 2023, reaching 22.8 million individuals, with their total wealth increasing by 5.1% to $86.8 trillion, according to Knight Frank's Wealth Report 2024. This financial muscle allows them to negotiate favorable terms and fees, putting pressure on institutions like Commercial International Bank (CIB) to offer superior value.

While individual small and medium-sized enterprises (SMEs) might not wield significant individual power, their collective economic impact and growth potential make them a formidable force in the banking sector. In 2024, SMEs continued to be a vital engine for economic growth, representing a substantial portion of job creation and GDP in many regions. This makes them a highly sought-after customer base for banks like Commercial International Bank (CIB).

Banks actively compete for SME business by developing tailored financial products, offering valuable business advisory services, and investing in advanced digital banking platforms designed to meet the unique needs of these businesses. This competition directly translates into increased bargaining power for SMEs, as they can readily compare and switch between various banking institutions based on the most attractive terms, rates, and service levels.

Consequently, CIB faces considerable pressure to offer competitive pricing, efficient service delivery, and innovative solutions to attract and retain its SME clientele. The ability of SMEs to easily access and compare offerings across the market means that CIB must continuously adapt its strategies to remain a preferred banking partner for this crucial segment.

Retail Customers and Digital Banking

Retail customers typically wield limited individual bargaining power with banks like CIB because banking products are often standardized, and switching institutions can seem like a hassle. However, the rise of digital banking has dramatically lowered these barriers. Customers can now effortlessly compare interest rates, fees, and service offerings across various banks, increasing price transparency.

This shift empowers retail customers by making it easier to find better deals. For instance, in 2024, the ease of opening new accounts online has made it simpler for consumers to move funds. CIB, like other major banks, must therefore focus on providing compelling digital experiences and competitive retail products to retain and attract these more informed and mobile customers.

- Reduced Switching Costs: Digital platforms allow for account opening and management from anywhere, significantly decreasing the effort required to change banks.

- Increased Price Transparency: Online comparison tools and readily available rate information mean customers can easily identify the most cost-effective banking options.

- Digital Engagement: Banks are investing heavily in user-friendly apps and online services to meet customer expectations and maintain competitiveness in the retail sector.

Customers Leveraging Multiple Banking Relationships

Many customers, especially businesses and high-net-worth individuals, now maintain relationships with several banks. This diversification strategy allows them to mitigate risk, tap into specialized financial products, and negotiate more favorable terms. For instance, in 2024, a significant portion of corporate clients reported using at least two different banking institutions for their primary operational needs.

This multi-banking trend directly amplifies customer bargaining power. They can effectively leverage competitive offers from one bank against another, forcing institutions like Commercial International Bank (CIB) to compete more aggressively on pricing and service. CIB’s challenge is to consistently prove its added value to secure a dominant position in its clients’ financial ecosystems.

- Diversified Banking Relationships: Customers spread their business across multiple banks to reduce reliance on a single institution.

- Negotiating Leverage: The ability to switch or threaten to switch business to a competitor empowers customers to demand better rates and services.

- CIB's Value Proposition: To counter this, CIB must excel in offering superior service, innovative products, and competitive pricing to retain and attract clients.

Customers, particularly large corporations and high-net-worth individuals, possess significant bargaining power with Commercial International Bank (CIB). Their ability to move substantial financial volumes and demand tailored services necessitates competitive offerings from CIB. In 2024, the banking landscape saw increased competition, forcing banks like CIB to focus on retaining these high-value clients through favorable terms and specialized services.

The proliferation of digital banking has also empowered retail customers by reducing switching costs and increasing price transparency. This allows them to easily compare rates and services, compelling CIB to enhance its digital platforms and product competitiveness. Furthermore, the trend of customers maintaining relationships with multiple banks amplifies their negotiating leverage, requiring CIB to consistently demonstrate superior value.

| Customer Segment | Bargaining Power Drivers | Impact on CIB |

|---|---|---|

| Large Corporates/Institutions | High volume business, complex needs, ability to shift funds | Pressure on pricing, demand for customized solutions |

| High Net Worth Individuals (HNWIs) | Substantial assets, demand for personalized service | Need for premium wealth management, competitive fees |

| Small & Medium Enterprises (SMEs) | Collective economic impact, growth potential | Requirement for tailored products, competitive digital platforms |

| Retail Customers | Reduced switching costs, increased price transparency (digital) | Focus on competitive rates, user-friendly digital experience |

Same Document Delivered

Commercial International Bank Porter's Five Forces Analysis

This preview showcases the precise Porter's Five Forces analysis for Commercial International Bank, offering a comprehensive examination of competitive forces. The document you see here is the exact, fully formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information. You'll gain immediate access to this in-depth strategic assessment, ready for immediate application and understanding of CIB's competitive landscape.

Rivalry Among Competitors

Commercial International Bank (CIB) navigates a competitive landscape in Egypt, significantly shaped by the presence of large public sector banks. These state-backed institutions often leverage their extensive branch networks, which in 2023 continued to cover a substantial portion of the Egyptian market, and a perception of inherent stability to attract customers.

Public sector banks can sometimes offer more aggressive pricing, potentially including lower interest rates on loans or higher rates on deposits, particularly for initiatives aligned with government priorities. This competitive pressure necessitates that CIB continuously focuses on delivering exceptional customer service, driving technological innovation, and maintaining operational efficiency to stand out.

Commercial International Bank (CIB) faces intense competition from other prominent private banks operating in Egypt. Key rivals include QNB Alahli, AlexBank, and HSBC Egypt, all of which are well-established players with significant market presence.

These competitors actively contest market share across the entire banking spectrum, encompassing retail, corporate, and investment banking services. This vigorous competition translates into aggressive marketing efforts, a continuous drive for product innovation, and competitive pricing strategies.

For instance, in 2023, the Egyptian banking sector saw strong performance from private banks, with QNB Alahli reporting a net profit of EGP 12.2 billion. This intense rivalry directly impacts CIB by putting pressure on its profit margins and its overall market positioning.

Competitive rivalry in the banking sector is fierce, extending far beyond simple interest rates. Commercial International Bank (CIB) faces intense pressure from competitors who are constantly innovating across a wide spectrum of products and services. This includes advancements in digital platforms, the sophistication of investment products, and the development of specialized lending solutions tailored to specific market needs.

Banks are increasingly differentiating themselves through the quality of customer experience and the seamless integration of digital capabilities. For instance, in 2024, many banks are investing heavily in AI-driven customer service and personalized financial advice delivered through mobile apps. CIB's ability to maintain its market leadership hinges on its continuous efforts to enhance its existing offerings and strategically invest in cutting-edge technology to deliver a demonstrably superior and differentiated value proposition to its customers.

Market Share and Growth Strategies

As Egypt's largest private sector bank, Commercial International Bank (CIB) faces intense competition. Rivals are actively employing aggressive strategies to chip away at CIB's market share, especially by targeting lucrative segments like Small and Medium Enterprises (SMEs) and the rapidly expanding digital banking sector. For instance, in 2023, the Egyptian banking sector saw significant growth in digital transactions, a trend CIB is keen to maintain its lead in.

To counter this, CIB must continuously innovate and execute its own robust growth strategies. This involves a multi-pronged approach, potentially including expanding its branch network organically, forging strategic alliances with fintech companies, or pursuing targeted acquisitions to bolster its service offerings and client base. CIB's ability to adapt and grow will be crucial in defending its leading position against these competitive pressures.

- Market Share Defense: CIB's status as Egypt's largest private bank makes it a primary target for competitors seeking to increase their own market share.

- Aggressive Rival Strategies: Competitors are employing aggressive tactics, particularly in high-growth areas like SME financing and digital banking services, to attract CIB's customers.

- CIB's Growth Imperative: CIB needs to proactively implement its own growth strategies, which could include organic expansion, strategic partnerships, or acquisitions, to safeguard its market position.

- Digital Banking Focus: The Egyptian digital banking landscape is dynamic, with significant transaction growth observed in 2023, highlighting the importance of CIB's digital offerings.

Fintech Companies and Niche Players

Fintech companies and niche players are increasingly challenging traditional banks like Commercial International Bank (CIB) in Egypt. These agile firms focus on specific services, often offering more convenient and cost-effective digital solutions. For instance, by mid-2024, Egypt's digital payments sector saw significant growth, with transaction volumes on mobile wallets and online platforms expanding rapidly, directly impacting traditional banking service usage.

These specialized fintechs, while not full-service banks, are carving out market share in areas like consumer lending and wealth management. Their ability to innovate quickly and cater to specific customer needs means CIB must adapt. This could involve strategic partnerships with these fintechs or developing its own competitive digital offerings to retain customers and market position.

- Fintech Disruption: Fintechs are challenging CIB by offering specialized, often lower-cost, digital alternatives for payments, lending, and wealth management.

- Market Share Erosion: As fintech adoption grows, CIB faces potential erosion of its market share in key banking services.

- Strategic Imperative: CIB must either collaborate with or develop its own innovative digital services to counter the competitive threat from these niche players.

- 2024 Growth: The Egyptian fintech sector experienced substantial growth in 2024, with digital payment transactions showing a notable upward trend, underscoring the competitive pressure.

Commercial International Bank (CIB) faces intense rivalry from both large public sector banks and other established private institutions in Egypt. Competitors like QNB Alahli and AlexBank are actively vying for market share across all banking segments, employing aggressive marketing and product innovation. This pressure from rivals, who are also investing heavily in digital advancements and customer experience, necessitates CIB's continuous focus on differentiation and efficiency to maintain its leading position.

| Competitor | Market Focus | Key Strategies | 2023 Profit (EGP billions) |

|---|---|---|---|

| Public Sector Banks | Broad market, government initiatives | Extensive branch networks, perceived stability, competitive pricing | N/A (aggregate data not readily available) |

| QNB Alahli | Retail, Corporate, Investment | Aggressive expansion, digital services, competitive rates | 12.2 |

| AlexBank | Retail, SME | Customer service, digital transformation, tailored products | N/A (specific profit not publicly detailed for 2023) |

| HSBC Egypt | Corporate, Premier Banking | Global network, specialized services, wealth management | N/A (specific profit not publicly detailed for 2023) |

SSubstitutes Threaten

Mobile payment solutions and digital wallets, often backed by major tech players or telecom companies, are increasingly viable alternatives to traditional banking services. These platforms, like Fawry in Egypt which saw a significant surge in users and transaction volumes in 2023, allow for peer-to-peer transfers, bill payments, and even online purchases, bypassing conventional bank channels. This growing adoption directly challenges the transaction-based revenue streams of established banks such as Commercial International Bank (CIB).

Peer-to-peer (P2P) lending platforms, while still developing in Egypt, present a growing alternative for individuals and small businesses seeking funding. These platforms connect borrowers directly with investors, circumventing traditional banking channels. As of early 2024, the digital lending landscape in Egypt is expanding, with fintech solutions gaining traction, indicating a potential shift in financing preferences.

The increasing adoption of such platforms poses a direct threat to Commercial International Bank's (CIB) core lending business. If P2P platforms gain significant market share, especially in consumer and small and medium-sized enterprise (SME) lending, they could siphon off a portion of CIB's customer base and revenue streams. This disruption highlights the need for CIB to innovate its digital offerings to remain competitive.

For large corporations, accessing capital markets directly through bond issuances or equity offerings presents a significant substitute for traditional bank financing. This direct route allows companies to bypass intermediaries like Commercial International Bank (CIB) and potentially secure more favorable terms or larger funding amounts. In 2024, global bond issuance by corporations remained robust, indicating continued reliance on capital markets as an alternative to bank loans.

CIB's investment banking division faces direct competition from these capital markets, as companies can raise funds directly from investors. This means CIB must actively compete to offer attractive services and competitive terms to retain its corporate clients seeking financing. The ability of companies to tap into public markets for billions in funding underscores the persistent threat of substitution.

Informal Financial Channels

Informal financial channels remain a significant threat in markets like Egypt, offering alternatives to traditional banking. These channels, including money lenders and community savings groups, cater to a considerable segment of the population, especially in less urbanized areas. For instance, in 2024, it's estimated that a substantial portion of Egyptians, particularly those in rural settings, still rely on these informal methods for credit and savings, bypassing formal banking institutions.

These informal avenues provide a level of convenience and accessibility that formal banks sometimes struggle to match, especially for individuals lacking formal identification or consistent transaction history. This makes them a direct substitute for basic banking services offered by institutions like Commercial International Bank (CIB). The ease of obtaining small loans or participating in savings schemes through community networks can be more appealing than navigating formal banking procedures.

- Accessibility: Informal channels often require less documentation than formal banks, making them easier for unbanked populations to access.

- Convenience: Transactions can be faster and more personal, especially in local communities where trust is established.

- Cost: While interest rates can be higher, the overall transaction costs and perceived effort might be lower for some users compared to formal banking.

Alternative Investment Vehicles

Customers looking to grow their savings have a growing array of options beyond traditional bank accounts. These include mutual funds, real estate investments, and precious metals. For instance, in 2024, the Egyptian Exchange saw continued interest in various asset classes, with some mutual funds reporting positive returns despite market volatility.

The rise of digital assets, while still navigating regulatory frameworks in Egypt, also presents a substitute. These alternatives can divert funds that might otherwise be deposited with Commercial International Bank (CIB) or managed through its wealth management services. This directly impacts CIB's deposit base and potential fee-generating activities.

- Mutual Funds: Offer diversification and professional management, attracting investors seeking growth beyond fixed deposits.

- Real Estate: Remains a tangible asset class, appealing to those prioritizing physical asset ownership and potential rental income.

- Digital Assets: Emerging as a high-risk, high-reward alternative, drawing interest from a segment of the investment community.

The threat of substitutes for Commercial International Bank (CIB) is significant, driven by evolving financial technologies and market dynamics. Mobile payment solutions and digital wallets, exemplified by Fawry's user surge in 2023, offer convenient alternatives for everyday transactions, directly impacting CIB's fee-based revenue. Furthermore, the growth of peer-to-peer lending platforms in Egypt as of early 2024 presents a direct challenge to CIB's core lending business, particularly for consumers and SMEs.

Corporations increasingly bypass traditional banking by accessing capital markets directly, as evidenced by robust global bond issuance in 2024, posing a threat to CIB's investment banking division. Informal financial channels persist in Egypt, serving a segment of the population with accessible credit and savings options, thereby substituting basic banking services.

Beyond traditional banking, customers are diversifying savings through mutual funds, real estate, and emerging digital assets, as seen with continued interest in the Egyptian Exchange in 2024. These alternatives divert funds from CIB's deposit base and wealth management services.

| Substitute Category | Examples | Impact on CIB | 2023/2024 Data/Trend |

|---|---|---|---|

| Digital Payments | Fawry, Mobile Wallets | Reduced transaction fees, competition for customer loyalty | Fawry saw significant user and transaction volume growth in 2023. |

| Alternative Lending | P2P Lending Platforms | Loss of market share in consumer and SME lending | Digital lending landscape expanding in Egypt as of early 2024. |

| Capital Markets | Bond Issuances, Equity Offerings | Reduced demand for corporate loans, competition for investment banking services | Robust global corporate bond issuance in 2024. |

| Informal Finance | Money Lenders, Savings Groups | Loss of customer base for basic banking services, particularly in rural areas | Substantial portion of Egyptians, especially in rural settings, still rely on these methods in 2024. |

| Investment Alternatives | Mutual Funds, Real Estate, Digital Assets | Reduced deposit base, competition for wealth management services | Continued interest in various asset classes on the Egyptian Exchange in 2024. |

Entrants Threaten

The banking sector in Egypt, overseen by the Central Bank of Egypt (CBE), presents substantial hurdles for new entrants. Stringent licensing, rigorous capital adequacy ratios, and extensive compliance mandates significantly elevate the cost and complexity of establishing a new banking operation.

These formidable regulatory and capital barriers effectively deter potential competitors, making it exceedingly challenging and expensive for newcomers to launch a banking service on par with established institutions like Commercial International Bank (CIB).

Commercial International Bank (CIB), as Egypt's largest private sector bank, has built a formidable brand over decades. This strong recognition and deep-seated customer trust present a significant hurdle for any new entrant aiming to penetrate the Egyptian banking market. For instance, CIB's market share in personal loans was approximately 25% as of early 2024, indicating a substantial customer base built on reliability.

New players would need to invest heavily in marketing and dedicate considerable time to replicate CIB's established credibility and customer loyalty. The inherent reluctance of customers to switch financial institutions, especially for core services like banking, means that building comparable brand equity is a lengthy and costly endeavor. This established trust acts as a powerful deterrent, effectively raising the barrier to entry.

Commercial International Bank (CIB) benefits from substantial economies of scale, meaning its large operational size translates to lower per-unit costs for services like IT infrastructure and branch management. For instance, in 2024, CIB's investment in digital transformation significantly reduced transaction processing costs per customer. New entrants would face a considerable challenge replicating this cost efficiency without a similarly massive initial investment.

Furthermore, CIB leverages economies of scope by offering a wide array of financial products, from retail banking to corporate finance. This diversification creates synergies and reduces the cost of offering multiple services. A new competitor would need significant capital and time to build a comparable product breadth, making it difficult to compete on both cost and comprehensive offerings.

Access to Distribution Channels and Talent

New banks face significant hurdles in building out their distribution networks, encompassing physical branches, ATM accessibility, and robust digital platforms. This infrastructure development demands considerable capital outlay and a lengthy implementation period, often proving prohibitive for startups. For instance, in 2024, the cost of establishing and maintaining a single bank branch can range from hundreds of thousands to over a million dollars annually, depending on location and services offered.

Securing and retaining top-tier banking talent, particularly those with expertise in areas like cybersecurity, digital transformation, and risk management, presents another formidable barrier. The competition for these skilled professionals is intense, driving up salary expectations and requiring attractive benefits packages. As of early 2024, the average salary for a senior cybersecurity analyst in the financial sector in Egypt, a key market for CIB, was approximately EGP 500,000 to EGP 800,000 per year.

- High Capital Requirements: Establishing a widespread and efficient distribution network, including digital channels, requires substantial upfront investment, making it difficult for new entrants to compete with incumbents like CIB.

- Talent Acquisition Challenges: Attracting and retaining experienced banking professionals, especially in specialized and in-demand fields, is a significant hurdle due to the competitive nature of the talent market.

- Incumbent Advantage: Commercial International Bank's established network of branches and ATMs, coupled with its deep pool of experienced personnel, provides a strong competitive moat against potential new entrants.

Technological Infrastructure and Cybersecurity

For new entrants aiming to compete with established players like Commercial International Bank (CIB), the technological infrastructure and cybersecurity demands present a substantial hurdle. Building a robust, secure, and scalable IT backbone capable of processing millions of transactions daily and safeguarding sensitive customer information requires immense capital investment. For instance, global spending on financial IT infrastructure and cybersecurity is projected to reach hundreds of billions of dollars annually, with significant portions dedicated to upgrading legacy systems and implementing advanced threat detection.

New entrants must allocate considerable resources to acquire and maintain cutting-edge IT systems and sophisticated cybersecurity measures to meet stringent regulatory standards and gain customer trust. This high upfront investment, coupled with continuous operational and maintenance costs, creates a significant barrier to entry, making it challenging for newcomers to establish a competitive technological footing.

- Significant Capital Outlay: New banks or fintechs need to invest billions in secure, scalable IT infrastructure.

- Cybersecurity Imperative: Protecting customer data against increasingly sophisticated threats is paramount and costly.

- Regulatory Compliance: Meeting rigorous financial regulations regarding data security and system resilience adds to the expense.

- Ongoing Maintenance: Continuous updates, patches, and system upgrades are essential, representing a perpetual cost.

The threat of new entrants in the Egyptian banking sector, particularly concerning Commercial International Bank (CIB), is considerably low due to substantial barriers. These include high capital requirements, stringent regulatory licensing, and the significant investment needed to build a competitive technological and distribution infrastructure.

New players must overcome CIB's established brand loyalty and extensive customer base, a feat requiring immense marketing spend and time. For example, CIB's market share in personal loans around 25% in early 2024 highlights its entrenched position.

Economies of scale and scope further fortify CIB's competitive advantage, making it difficult for newcomers to match its cost efficiency and comprehensive product offerings. Attracting skilled talent also poses a significant challenge, with senior cybersecurity analysts in Egypt earning between EGP 500,000 to EGP 800,000 annually as of early 2024.

| Barrier | Impact on New Entrants | Example for CIB (2024 Data) |

|---|---|---|

| Capital Requirements | High upfront investment needed for licensing, infrastructure, and operations. | Establishing a new bank branch can cost hundreds of thousands to over a million dollars annually. |

| Brand Reputation & Customer Loyalty | Difficult and costly to build trust and replicate established relationships. | CIB's ~25% personal loan market share indicates deep customer penetration. |

| Economies of Scale & Scope | New entrants struggle to match cost efficiencies and product breadth. | CIB's digital transformation reduced per-customer transaction costs. |

| Talent Acquisition | Intense competition for skilled professionals drives up costs. | Senior cybersecurity analysts earn EGP 500,000-800,000 annually. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for commercial international banks is built upon a robust foundation of data from financial statements, regulatory filings (e.g., SEC, central bank reports), and reputable industry publications like The Banker and Euromoney. We also leverage macroeconomic data from organizations such as the World Bank and IMF to capture global economic influences.