Commercial International Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commercial International Bank Bundle

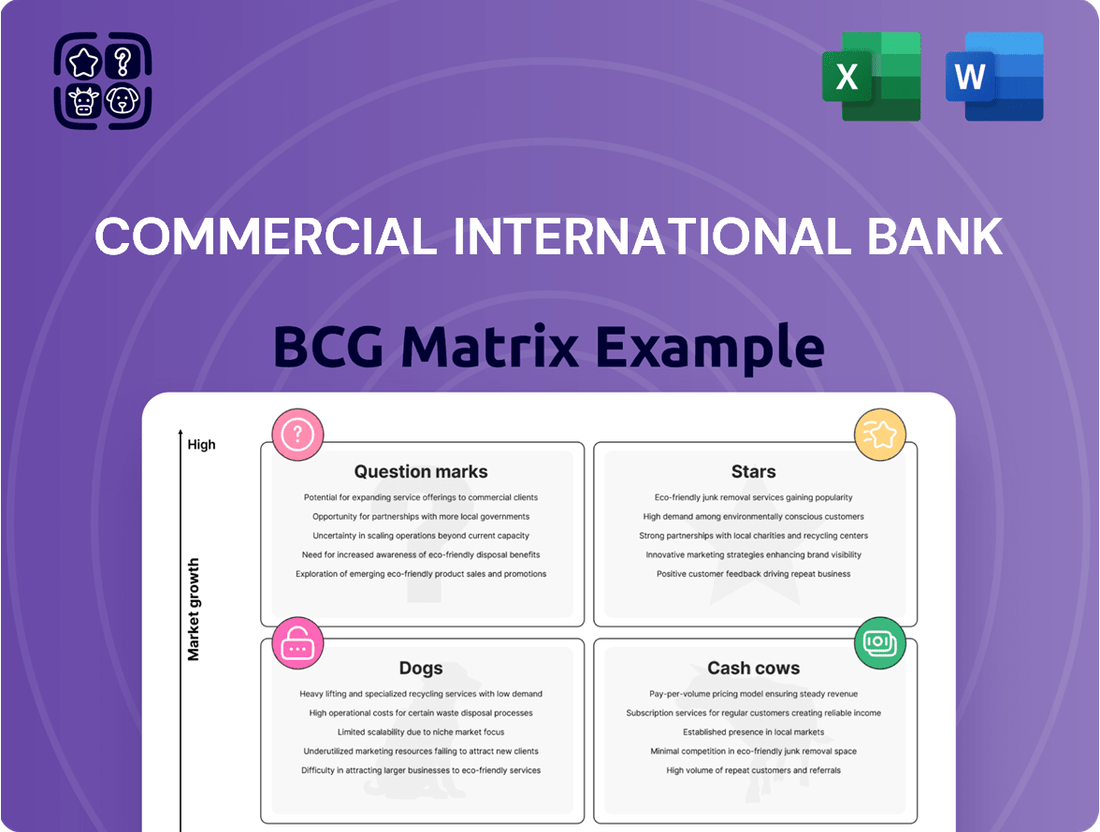

The Commercial International Bank's BCG Matrix offers a critical snapshot of its product portfolio's market share and growth potential. Understand which of their offerings are driving growth and which might be holding them back. Purchase the full BCG Matrix to unlock detailed analysis and actionable strategies for optimizing their banking products.

Stars

Digital Banking Platforms represent a strong star for Commercial International Bank (CIB). By the close of 2024, CIB saw over 1.7 million active users on its digital platforms, a healthy 12% jump from 2023.

The sheer volume of transactions through these digital channels is impressive, hitting EGP 3.3 trillion, a substantial 60% increase year-over-year. This surge highlights robust customer engagement and the increasing reliance on CIB's digital offerings.

The bank's mobile app is a significant contributor, experiencing a 59% annual growth in usage and facilitating EGP 552 billion in transactions. These figures firmly establish CIB's digital banking services as a market leader and a critical engine for future growth in Egypt's financial sector.

Commercial International Bank's (CIB) retail lending, encompassing personal loans and credit cards, demonstrated robust growth in 2024. New personal loan disbursements surged by an impressive 60%, reflecting strong consumer uptake.

The bank also saw significant expansion in its credit card business, issuing over 171,000 new cards. This resulted in a substantial 46% year-on-year increase in the overall credit card portfolio. These figures highlight CIB's successful penetration in a high-demand market, driven by strategic initiatives and increasing consumer confidence.

SME lending represents a significant growth opportunity for Commercial International Bank (CIB), positioning it as a star in its BCG matrix. CIB has demonstrated a strong commitment to this sector, surpassing the Central Bank of Egypt's minimum requirement by achieving 26% of its loan portfolio dedicated to SMEs in 2024.

Further solidifying its leadership, CIB introduced a dedicated 'Sustainable Finance Loan' for SMEs in July 2024. This was complemented by a substantial €50 million guarantee secured from the European Bank for Reconstruction and Development (EBRD) in November 2024, specifically aimed at bolstering on-lending to this vital segment.

Corporate Lending

Commercial International Bank's (CIB) corporate lending segment is a strong performer, fitting the profile of a Cash Cow in the BCG Matrix. Its substantial growth and dominant market position indicate a mature business unit generating significant profits with relatively low investment needs.

Key indicators of CIB's corporate lending strength include:

- Significant Portfolio Growth: By the end of September 2024, CIB's corporate finance portfolio expanded by an impressive 31.95%, reaching EGP 349.808 billion.

- Market Leadership: The bank's gross loan portfolio hit EGP 399 billion by year-end 2024, marking a substantial 50% year-on-year increase and solidifying CIB's status as the largest private-sector lender in Egypt.

- High Market Share: This robust growth underscores CIB's commanding presence and strong competitive advantage within the corporate lending sector.

Sustainable Finance Offerings

Commercial International Bank (CIB) is making significant strides in sustainable finance, positioning itself as a regional leader in this expanding sector. The bank's commitment is evident in its substantial growth in exposure to environmental and social impact projects, which saw a remarkable 128% increase by December 2024 compared to the previous year.

This rapid expansion highlights CIB's strategic focus on a market with increasing global demand for responsible investment. The bank's green assets now represent a significant 12% of its overall portfolio, demonstrating a tangible commitment to sustainability.

CIB's leadership in this domain has not gone unnoticed on the international stage. The bank's inclusion and ranking as 9th on Fortune's 2024 'Change the World' list underscores its strong and leading presence in the high-growth area of sustainable finance.

- Regional Leadership: CIB is recognized as a frontrunner in sustainable finance within its region.

- Portfolio Growth: Exposure to environmental and social impact projects grew by 128% by December 2024.

- Green Asset Share: Green assets constitute 12% of CIB's total portfolio.

- Global Recognition: Ranked 9th on Fortune's 2024 'Change the World' list.

Commercial International Bank's (CIB) digital banking platforms are a definite star, showing impressive user growth and transaction volumes. With over 1.7 million active users by the end of 2024, a 12% increase from the prior year, CIB's digital channels are clearly resonating with customers. The EGP 3.3 trillion processed through these channels, a massive 60% year-over-year jump, underscores their importance and efficiency. The mobile app, in particular, saw a 59% rise in usage, facilitating EGP 552 billion in transactions, cementing its role as a key growth driver.

| Business Unit | Market Share | Growth Rate | Profitability | BCG Category |

|---|---|---|---|---|

| Digital Banking Platforms | High | High | High | Star |

| Retail Lending | High | High | High | Star |

| SME Lending | Growing | High | Moderate | Star |

| Corporate Lending | Dominant | Moderate | Very High | Cash Cow |

| Sustainable Finance | Growing | Very High | Emerging | Star |

What is included in the product

The Commercial International Bank BCG Matrix analyzes its business units based on market share and growth, identifying Stars, Cash Cows, Question Marks, and Dogs to guide strategic resource allocation.

The Commercial International Bank BCG Matrix provides a clear, quadrant-based overview of business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Commercial International Bank's (CIB) traditional deposit base is a prime example of a Cash Cow within its BCG Matrix. By the close of 2024, CIB's customer deposits surged to EGP 968 billion, marking an impressive 43% increase from the previous year. This growth was fueled by a solid 21% rise in local currency deposits and a healthy 16% expansion in foreign currency deposits.

As of September 2024, CIB commanded a 6.96% share of the Egyptian deposit market, positioning it as a leading institution. This extensive and dependable deposit base offers CIB a stable, low-cost funding stream, crucial for its established operations in a mature banking sector.

Established corporate banking relationships are a cornerstone of Commercial International Bank's (CIB) success, fitting squarely into the Cash Cows quadrant of the BCG Matrix. By the close of September 2024, the corporate sector represented a substantial 78.59% of CIB's total finance portfolio, highlighting its dominant market share in a mature banking landscape.

These enduring relationships with large corporations generate predictable and substantial revenue streams, acting as a vital engine for CIB's consistent profitability. The bank's strategic focus on safeguarding these corporate franchises underscores their stable, high-value contribution to overall performance.

Commercial International Bank (CIB) demonstrates a robust Net Interest Income (NII) that positions it as a Cash Cow within the BCG framework. In full-year 2024, CIB's NII reached an impressive EGP 90.8 billion, marking a significant 72% surge compared to the previous year. This substantial growth, coupled with a Net Interest Margin (NIM) of 9.48%, underscores the bank's strong profitability from its core lending and deposit-taking operations, especially in a high-interest-rate climate.

ATM Network and Core Transaction Services

Commercial International Bank's (CIB) extensive ATM network, numbering 1,339 machines across Egypt, served as a significant revenue generator in 2023, processing 79 million transactions valued at EGP 196 billion. This established channel continues to be vital for customer convenience, handling the majority of deposits and withdrawals. The consistent volume of routine transactions through this mature infrastructure contributes stable, predictable revenue streams for the bank.

Despite the rise of digital banking, CIB's ATMs remain a cornerstone of its service delivery. In 2023, a remarkable 97% of total deposits and 99.1% of all cash withdrawals were conducted via these machines. This reliance underscores the enduring importance of the ATM network in supporting CIB's large customer base for essential banking needs.

- ATM Network Size: 1,339 machines across Egypt.

- 2023 Transaction Volume: 79 million transactions.

- 2023 Transaction Value: EGP 196 billion.

- Deposit Channel Dominance: 97% of total deposits via ATMs.

- Withdrawal Channel Dominance: 99.1% of total cash withdrawals via ATMs.

Foreign Currency Operations

Commercial International Bank's (CIB) foreign currency operations represent a significant Cash Cow. In 2024, CIB saw its foreign currency deposits surge by 16%, which translates to an increase of USD 1.12 billion. This growth substantially bolstered the bank's overall deposit base.

CIB maintains a robust position in foreign currency operations, adeptly managing its foreign currency liquidity well above mandated regulatory levels. This strong performance suggests a considerable market share within this specific banking segment. The segment is a steady and valuable contributor to the bank's financial health.

Despite being subject to broader macroeconomic shifts and currency fluctuations, CIB's foreign currency segment consistently provides a dependable stream of funds and revenue. This stability solidifies its status as a Cash Cow.

- Foreign Currency Deposit Growth: 16% increase in 2024, amounting to USD 1.12 billion.

- Market Position: High market share indicated by strong foreign currency liquidity management above regulatory requirements.

- Contribution: Stable and valuable contributions to the bank's balance sheet and revenue.

- Resilience: Reliable source of funds and revenue, even amidst fluctuating currency dynamics.

Commercial International Bank's (CIB) retail loan portfolio, particularly its credit cards and personal loans, functions as a Cash Cow. By the end of 2024, CIB reported a significant 23% year-on-year growth in its retail loan portfolio, reaching EGP 205 billion. This segment consistently generates steady interest income and fee-based revenue, benefiting from a large and stable customer base in a mature market.

| Segment | BCG Quadrant | Key Metric (2024 Data) | Significance |

|---|---|---|---|

| Deposit Base | Cash Cow | EGP 968 billion in customer deposits (43% YoY growth) | Stable, low-cost funding |

| Corporate Banking | Cash Cow | 78.59% of total finance portfolio (as of Sep 2024) | Predictable, substantial revenue |

| Net Interest Income (NII) | Cash Cow | EGP 90.8 billion (72% YoY growth) | Strong core profitability |

| ATM Network | Cash Cow | 1,339 machines, 79 million transactions (2023) | Consistent fee and transaction revenue |

| Foreign Currency Operations | Cash Cow | 16% growth in FX deposits (USD 1.12 billion increase) | Steady foreign currency funding and revenue |

| Retail Loans | Cash Cow | EGP 205 billion in retail loans (23% YoY growth) | Steady interest and fee income |

Full Transparency, Always

Commercial International Bank BCG Matrix

The Commercial International Bank BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This means you're seeing the exact strategic analysis, including all categories and their respective placements, ready for your immediate use. No further editing or content additions will be necessary; the file is fully prepared for integration into your business planning and presentations. You can confidently use this preview as a direct representation of the high-quality, actionable insights you'll acquire.

Dogs

Manual, branch-exclusive services at Commercial International Bank (CIB) are positioned in the Dogs quadrant of the BCG Matrix. These services are characterized by low growth and low market share, largely due to their reliance on in-branch, manual processing with limited digital alternatives.

As CIB continues its aggressive digital transformation, with a significant 93% of all transactions now occurring on its digital platforms, these manual services are becoming increasingly obsolete. Customers are opting for the convenience of digital channels, leading to a decline in the usage and efficiency of services that still require physical branch visits for basic tasks.

Outdated legacy products at Commercial International Bank (CIB) represent offerings that haven't kept pace with digital advancements. These might include older account types or financial instruments lacking modern features or integration into CIB's digital banking platforms. In 2024, such products likely contribute minimally to new customer acquisition and may even see declining usage among existing clients.

These legacy offerings often consume valuable resources for maintenance and support without generating substantial growth or profitability. For instance, if a significant portion of CIB's customer base still relies on manual processes for these older products, it could represent an operational inefficiency. Such products are prime candidates for either a strategic revitalization to align with current market demands or a planned discontinuation to streamline operations and focus on more competitive offerings.

Traditional paper-based transactions, like manual check processing, are rapidly losing ground as customers embrace digital banking. These methods are becoming less efficient and more costly to maintain, even as their market share dwindles.

For Commercial International Bank (CIB), these low-value paper transactions represent an area ripe for cost rationalization. By encouraging digital adoption, CIB can reduce its reliance on these resource-intensive processes.

In 2024, the global volume of paper checks processed continued its decline, with digital payment methods accounting for an ever-larger share of transactions. This trend underscores the strategic imperative for banks like CIB to streamline operations by moving away from legacy paper systems.

Underperforming Niche Investment Products

Commercial International Bank (CIB) might categorize certain highly specialized investment products as Dogs in its BCG Matrix if they have struggled to gain significant market traction. These offerings, characterized by low market share and minimal growth, would represent products that are not attracting substantial new investment or generating meaningful returns. For instance, a niche structured product launched in 2023 that has seen less than 0.1% of the bank's total investment product AUM by Q1 2024, despite significant marketing efforts, would fit this description.

These underperforming niche products would likely exhibit the following traits:

- Low Asset Under Management (AUM): These products typically represent a very small fraction of the bank's overall investment portfolio. For example, a specialized emerging markets bond fund might only manage $50 million out of CIB's total $500 billion AUM.

- Stagnant or Declining Investor Base: The number of new investors or the reinvestment rate from existing investors would be minimal, indicating a lack of appeal.

- Limited Revenue Generation: Due to low AUM and potentially high operational costs for specialized management, these products contribute little to the bank's fee income.

- High Operational Costs Relative to Returns: Maintaining and marketing these niche products might consume resources without yielding proportionate financial benefits.

Inefficient Internal Processes

Inefficient internal processes, even if not directly visible to customers, can act as significant drains on a bank's resources, much like a 'dog' in the BCG matrix. These are the operational backwaters where manual tasks persist, leading to higher costs and slower turnaround times. In 2024, Commercial International Bank (CIB) actively pursued automation and cost optimization strategies, recognizing that streamlining these internal functions is crucial for overall financial health.

Processes that continue to rely on manual intervention, especially in areas like data entry, reconciliation, or internal approvals, represent a clear inefficiency. Such operations consume valuable employee time and incur direct costs without generating commensurate value. For instance, if a significant portion of CIB's operational budget in 2024 was allocated to managing paper-based workflows, these would be prime candidates for 'dog' status, diverting capital that could be reinvested in growth areas.

- Resource Drain: Manual processes can consume a disproportionate amount of labor and time, impacting productivity.

- Cost Inefficiency: Unautomated workflows often lead to higher operational expenses compared to streamlined, digital alternatives.

- Strategic Focus: CIB's 2024 initiatives aimed at automation and cost management directly address the need to eliminate such inefficient processes.

- Value Disconnect: Operations that divert resources without generating proportional value are considered 'dogs' within the bank's operational portfolio.

Manual, branch-exclusive services and outdated legacy products at Commercial International Bank (CIB) are firmly in the Dogs quadrant of the BCG Matrix. These offerings, characterized by low market share and minimal growth, are increasingly being sidelined by the bank's aggressive digital transformation, which saw 93% of transactions on digital platforms in 2024.

Traditional paper-based transactions, alongside niche investment products that failed to gain traction, also fall into this category. For instance, a specialized emerging markets bond fund managing only $50 million of CIB's $500 billion AUM by Q1 2024 exemplifies these low-performing assets.

Inefficient internal processes, such as manual data entry and paper-based workflows, further represent operational dogs, consuming resources without generating commensurate value. CIB's 2024 focus on automation and cost optimization directly targets these areas for streamlining.

These "dog" offerings, including manual services, legacy products, paper transactions, underperforming niche investments, and inefficient internal processes, represent areas for potential divestment, revitalization, or significant cost reduction to improve overall bank efficiency and focus on high-growth areas.

Question Marks

Commercial International Bank (CIB) is actively exploring emerging fintech integration solutions, particularly those focused on digital banking enhancements and leveraging technology for profitability. This strategic direction positions CIB to embrace innovations that can improve customer experience and operational efficiency.

While CIB is forward-thinking, specific, nascent fintech integrations, such as AI-driven preventative care solutions in banking, might represent a "question mark" in their BCG matrix. These areas are characterized by high growth potential but currently exhibit low market penetration and require substantial investment for development and scaling.

Niche Islamic banking products at Commercial International Bank (CIB) might currently occupy a smaller market share within Egypt's expanding Islamic finance sector. For instance, specialized Sharia-compliant investment funds or unique wealth management solutions for high-net-worth individuals could be examples of these niche offerings.

Despite a lower current market penetration, the overall Islamic finance market in Egypt demonstrated robust growth, with assets in Islamic banking projected to reach significant figures by 2025. This presents an opportunity for CIB's niche Islamic products to be strategically nurtured, potentially transitioning them into 'Stars' within the BCG matrix through focused marketing and product development.

Commercial International Bank (CIB) is actively integrating AI and data analytics to create highly personalized financial services, positioning these as a high-growth star in its BCG Matrix. These advanced capabilities allow CIB to anticipate market shifts and fine-tune its offerings to individual customer needs. For instance, by analyzing transaction data, CIB can proactively suggest tailored savings plans or investment opportunities, a significant departure from traditional one-size-fits-all banking.

While these AI-driven services represent a significant future growth avenue, their current market penetration may still be considered a question mark. The development and widespread adoption of such sophisticated solutions necessitate substantial investment in cutting-edge technology infrastructure and ongoing customer education initiatives. This investment phase, typical for emerging technologies, means that while the potential is immense, the current realized market share might still be building as CIB refines its AI models and customer engagement strategies.

Specific Green/Sustainable Retail Products

Commercial International Bank (CIB) is actively developing specific green and sustainable retail products, recognizing their significant growth potential fueled by rising consumer environmental consciousness. While CIB has established a strong presence in sustainable finance for corporate and SME clients, the retail segment for these products is still in its nascent stages, with current market share likely low but poised for expansion.

CIB's strategic focus on transforming green financing into accessible products for individual customers positions these offerings as a potential "question mark" in their BCG matrix. This signifies a high-growth, high-uncertainty area where investment is needed to capture market share and establish leadership.

- Emerging Retail Green Products: CIB is moving beyond corporate sustainable finance to create green savings accounts, eco-friendly loans for home improvements, and potentially sustainable investment funds for individual clients.

- Market Potential: Global trends show a growing demand for sustainable retail banking. For instance, by the end of 2023, sustainable investment funds globally saw net inflows of over $500 billion, indicating a strong consumer appetite for eco-conscious financial solutions.

- CIB's Strategic Shift: The bank's initiative to offer these products to individuals reflects a proactive approach to tap into this expanding market, aiming to build a strong retail green portfolio.

Strategic Regional Expansion (e.g., CIB Kenya)

Commercial International Bank's (CIB) strategic expansion into Kenya, initiated with a multi-level transformation plan in 2024, positions it as a potential 'Question Mark' within the BCG Matrix. This move targets the high-growth East African market, aiming to establish CIB as a sustainable hub offering innovative financial solutions.

The Kenyan venture represents a significant opportunity, but CIB's initial market share in this new territory is understandably low. This aligns with the characteristics of a 'Question Mark', where substantial investment is needed to capitalize on the market's potential.

- Market Potential: East Africa, including Kenya, is projected to see continued economic growth, with the banking sector expected to expand significantly in the coming years. For instance, Kenya's banking sector assets grew by approximately 10% in 2023, reaching over KES 7.5 trillion (USD 50 billion).

- Investment Requirement: To shift from a 'Question Mark' to a 'Star', CIB will need to allocate considerable resources towards marketing, product development, and building a robust local operational framework.

- Strategic Focus: Successful transformation hinges on CIB's ability to adapt its offerings to local needs, build strong customer relationships, and navigate the competitive banking landscape in Kenya.

- Future Outlook: The success of this regional expansion will determine whether CIB Kenya can capture a substantial market share and become a leading player, effectively moving it towards the 'Star' quadrant.

Question Marks for Commercial International Bank (CIB) represent business units or products with low market share in high-growth markets. These require significant investment to develop their potential and could become Stars or Dogs. CIB's strategic push into emerging fintech areas and regional expansion, like its Kenyan venture, exemplify these 'Question Marks'.

These initiatives, while holding considerable promise, are in their early stages with uncertain outcomes. For instance, CIB's Kenyan operations, launched in 2024, are in a high-growth East African market but currently possess a minimal market share. Similarly, nascent AI-driven personalized financial services, though technologically advanced, are still building customer adoption and market penetration.

The bank's foray into retail green products also falls into this category. While the demand for sustainable finance is rising globally, with sustainable investment funds seeing substantial inflows, CIB's retail offerings in this space are still developing. These ventures demand strategic investment to gain traction and capitalize on market growth.

| Business Unit/Product | Market Growth | Market Share | Investment Need | BCG Quadrant |

|---|---|---|---|---|

| Emerging Fintech Integrations (e.g., AI for banking) | High | Low | High | Question Mark |

| Niche Islamic Banking Products | High (Egypt's Islamic Finance) | Low | Medium | Question Mark |

| Retail Green Products | High | Low | High | Question Mark |

| Kenyan Market Expansion (2024) | High (East Africa) | Very Low | Very High | Question Mark |

BCG Matrix Data Sources

Our Commercial International Bank BCG Matrix is built on comprehensive financial statements, in-depth market research, and competitor performance data to provide strategic insights.