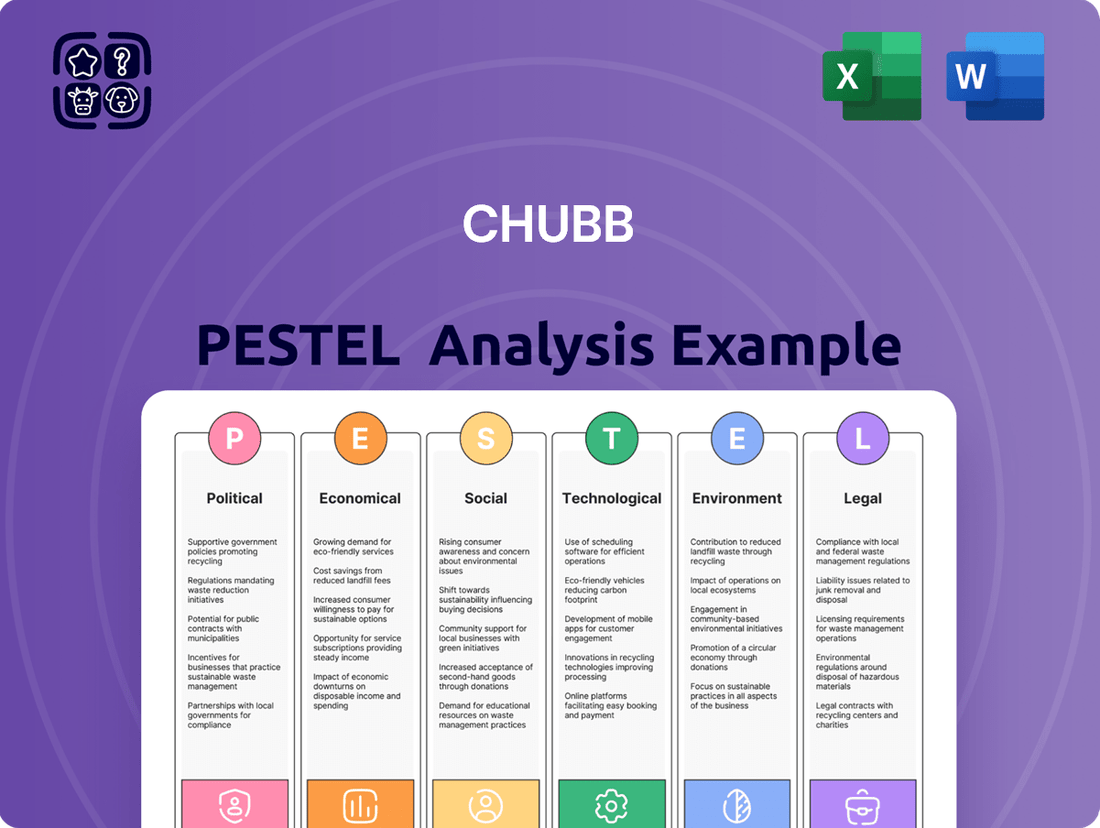

Chubb PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chubb Bundle

Gain a strategic advantage by understanding the external forces shaping Chubb's future. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting the insurance giant. Equip yourself with actionable intelligence to refine your market approach. Download the full PESTLE analysis now for immediate insights.

Political factors

Chubb, like all global insurers, navigates a complex geopolitical environment. The ongoing conflicts and rising tensions worldwide in 2024 and 2025 directly affect regulatory compliance, as Chubb must adhere to varying legal frameworks in each operating region. This necessitates flexible commercial contracts to effectively mitigate the diverse risks arising from this instability.

To thrive amidst this volatility, the insurance sector, including Chubb, must prioritize investments in advanced risk assessment technologies and robust compliance frameworks. Geopolitical risks were indeed a primary concern for risk managers surveyed in 2025, with significant implications for global trade flows and intricate supply chain operations.

The increasing trend of protectionism and nationalism globally, marked by the implementation of tariffs, directly impacts Chubb's international business and its ability to grow premiums. For instance, the U.S. imposed tariffs on goods from various countries in recent years, creating uncertainty in global supply chains and affecting insurance needs.

The results of major elections in 2024, especially in the United States, are anticipated to shape international trade dynamics. A shift in U.S. trade policy could lead to new agreements or increased trade barriers, influencing Chubb's exposure and risk assessment in different markets.

Insurers like Chubb are navigating a rapidly changing regulatory environment. There's heightened scrutiny on Environmental, Social, and Governance (ESG) reporting, with a growing emphasis on climate risk disclosures. For instance, by the end of 2024, many jurisdictions are expected to have finalized or implemented new ESG disclosure frameworks, impacting how Chubb reports its climate-related financial risks.

Government Intervention and Policy Changes

Government policies, encompassing taxation, deregulation, and deficit management, present a multifaceted and occasionally inconsistent policy landscape for international insurers like Chubb. For instance, shifts in tax regulations, such as potential adjustments to corporate tax rates in major markets, directly impact profitability and capital allocation strategies.

Changes in political leadership and national policy directions in key operational regions introduce inherent uncertainty. This can influence regulatory frameworks, economic stability, and market access, thereby shaping the operating environment for Chubb. For example, a change in government in a significant market could lead to revised capital requirements or new consumer protection laws, directly affecting Chubb's business model.

Key considerations for Chubb include:

- Tax Policy Shifts: Monitoring potential changes in corporate tax rates and international tax treaties that could affect Chubb's global tax liabilities and net income.

- Regulatory Environment: Adapting to evolving insurance regulations, solvency requirements, and consumer protection laws in the various jurisdictions where Chubb operates.

- Geopolitical Stability: Assessing the impact of political instability or international trade disputes on global economic conditions and insurance market demand.

- Fiscal Policy: Understanding how government approaches to national debt and deficit reduction might influence economic growth and consumer spending power, which in turn affects insurance sales.

Public-Private Partnerships and Risk Transfer

The insurance industry, including major players like Chubb, is increasingly engaging in public-private partnerships (PPPs) to address complex risks. This trend is amplified by the growing prevalence of systemic threats such as climate change and cyberattacks, which often exceed the capacity of private insurers alone. For instance, in 2024, governments globally continued to explore innovative risk-sharing mechanisms, recognizing the need for collaboration to manage the financial fallout from extreme weather events and sophisticated cyber breaches.

These partnerships allow for the pooling of resources and expertise, enabling the management of risks that were previously uninsurable or prohibitively expensive. Chubb, with its extensive global footprint and expertise in various insurance lines, is well-positioned to participate in these collaborations. This strategic alignment with public sector initiatives can open up new revenue streams and solidify its role in managing societal risks.

- Climate Risk: Governments are increasingly looking to insurers for solutions to climate-related disasters, with insured losses from natural catastrophes reaching an estimated $130 billion globally in 2023, according to Swiss Re.

- Cybersecurity: The escalating cost of cyberattacks, projected to reach $10.5 trillion annually by 2025 according to Cybersecurity Ventures, is prompting discussions about government backstops for major cyber events.

- Infrastructure Investment: PPPs in infrastructure development often include risk transfer components, where insurers like Chubb can provide coverage for construction and operational risks.

Political stability and government policies significantly shape Chubb's operating landscape. Shifts in trade policies, such as tariffs implemented by nations, directly impact international business and premium growth, as seen with U.S. tariff actions. Election outcomes in 2024, particularly in major economies, are expected to influence global trade dynamics and Chubb's market exposure.

Governments are increasingly partnering with insurers like Chubb to manage systemic risks. The growing prevalence of climate change and cyber threats necessitates collaborative risk-sharing mechanisms. For example, insured losses from natural catastrophes were estimated at $130 billion globally in 2023, highlighting the need for such partnerships.

Regulatory environments are also evolving, with heightened scrutiny on ESG reporting and climate risk disclosures. By the close of 2024, many jurisdictions are implementing new ESG frameworks, affecting how companies like Chubb report financial risks.

Tax policy changes, including potential adjustments to corporate tax rates, directly influence Chubb's profitability and capital allocation strategies. Navigating these varied government approaches to taxation, deregulation, and deficit management requires constant adaptation.

| Political Factor | Impact on Chubb | Example/Data Point |

| Trade Policy & Tariffs | Affects international business, premium growth, and supply chain risk | U.S. tariffs on goods create uncertainty in global supply chains. |

| Election Outcomes | Shapes international trade dynamics and market access | 2024 U.S. election results may alter trade agreements. |

| Public-Private Partnerships (PPPs) | Enables management of systemic risks like climate and cyber | Insured losses from natural catastrophes reached $130 billion globally in 2023. |

| ESG & Climate Reporting | Increases regulatory compliance burden and transparency needs | New ESG disclosure frameworks expected by end of 2024. |

| Tax Policy | Impacts profitability and capital allocation | Potential adjustments to corporate tax rates in key markets. |

What is included in the product

This Chubb PESTLE analysis systematically examines how Political, Economic, Social, Technological, Environmental, and Legal forces impact the company's operations and strategic landscape.

The Chubb PESTLE Analysis offers a structured framework to identify and understand external factors impacting the insurance industry, thereby alleviating the pain of navigating complex market dynamics and regulatory shifts.

Economic factors

The global economy is anticipated to see a modest increase in 2025, with real GDP growth estimated at approximately 3.2%. However, this growth isn't uniform across all regions, leading to desynchronized economic performance. Geopolitical tensions are a significant factor that could derail these projections.

This uneven economic landscape, coupled with an unstable geopolitical climate, heightens the possibility of unfavorable macroeconomic outcomes. A global recession remains a tangible risk as these interconnected factors create a more fragile environment for sustained growth.

The prevailing interest rate environment directly influences Chubb's investment income, a critical component of its overall profitability. Higher rates generally translate to better returns on the company's vast portfolio of fixed-income securities and other investments.

In 2024, Chubb experienced a notable uplift in its financial performance, partly driven by this favorable interest rate landscape. The company reported substantial growth in its adjusted net investment income, with figures indicating a significant increase compared to previous periods, underscoring the positive impact of elevated yields on its investment strategy.

Inflation significantly impacts claims severity for property and casualty insurers like Chubb, directly affecting profitability. While inflation is projected to decrease from an estimated 4.5% in 2024 to approximately 3.4% in 2025, the ongoing pressure from wage and services inflation could prompt varied responses from central banks.

These uneven monetary policy adjustments can lead to unpredictable fluctuations in claims costs, making it challenging for insurers to accurately price policies and manage reserves. For instance, rising labor costs for auto repairs or construction materials can substantially increase the payout on a single claim.

Premium Growth and Market Conditions

The global insurance sector, including Chubb, saw robust premium growth throughout 2024. This surge was particularly evident in property and casualty (P&C) and life insurance segments, fueled by a heightened demand for risk protection and generally favorable market dynamics. For instance, industry-wide premium growth in P&C was projected to be around 6-8% for 2024 in many developed markets.

Looking ahead to 2025, while certain insurance lines are expected to maintain their 'hard market' status, a general softening of premium rates is anticipated across various segments. This moderation is a natural progression after periods of significant rate increases, reflecting a rebalancing of supply and demand within the insurance market.

Key factors influencing this premium growth and potential softening include:

- Economic Environment: Inflationary pressures in 2024 contributed to higher claims costs, supporting premium increases. However, as inflation potentially stabilizes in 2025, the upward pressure on premiums may ease.

- Demand for Coverage: Increased awareness of risks, from climate events to cyber threats, has driven sustained demand for insurance products. This demand is expected to remain a supportive factor, even as rates adjust.

- Capacity and Competition: The availability of insurance capacity and the level of competition among insurers play a crucial role. As capacity increases and competition intensifies in certain lines, it typically leads to more moderate pricing.

- Regulatory Landscape: Evolving regulatory requirements can also influence pricing and product availability, impacting premium growth trajectories.

Global Economic Uncertainties and Regional Variations

Global economic uncertainties significantly influence Chubb's commercial insurance premium volume, with notable variations observed across different regions. For instance, while North America and Europe might show moderate growth, emerging markets could present higher volatility due to diverse economic conditions.

Chubb's extensive presence in 54 countries means it navigates a complex landscape of varying economic growth rates and localized challenges. This diversification, while a strength, necessitates tailored strategies to address distinct regional economic headwinds and opportunities.

For example, in 2024, economic growth forecasts for developed markets generally hovered around 1-2%, while some emerging economies projected growth exceeding 4%, creating differing demand patterns for commercial insurance products.

- Regional Premium Growth Disparities: Chubb's premium growth in 2024 varied, with Asian markets potentially showing stronger growth than some European markets facing slower economic recovery.

- Impact of Inflation: Persistent inflation in certain regions in 2024 increased claims costs, impacting profitability and requiring adjustments in pricing strategies.

- Geopolitical Instability: Conflicts and trade tensions in various parts of the world in 2024 introduced significant uncertainty, affecting business investment and insurance demand in those affected regions.

- Interest Rate Environment: Rising interest rates in 2024 in major economies influenced investment income for insurers like Chubb, but also potentially dampened economic activity and demand for certain insurance lines.

The global economic outlook for 2025 suggests a modest GDP growth of around 3.2%, though this expansion is uneven across regions, creating a complex operating environment for Chubb. Persistent geopolitical tensions remain a significant risk, potentially impacting global economic stability and insurance demand. The prevailing interest rate environment directly impacts Chubb's investment income, with higher rates generally boosting returns on its substantial fixed-income portfolio, as evidenced by Chubb's strong adjusted net investment income growth in 2024.

Inflationary pressures, while expected to moderate from an estimated 4.5% in 2024 to 3.4% in 2025, continue to affect claims severity for property and casualty insurers. This necessitates careful reserve management and pricing strategies, especially given the ongoing pressure from wage and services inflation.

The insurance sector, including Chubb, experienced robust premium growth in 2024, with P&C segments projecting 6-8% growth in developed markets, driven by heightened risk awareness. However, a gradual softening of premium rates is anticipated for 2025 as market capacity increases and competition intensifies in certain insurance lines.

| Economic Factor | 2024 Projection/Observation | 2025 Projection | Impact on Chubb |

|---|---|---|---|

| Global GDP Growth | Modest growth, regional variations | ~3.2% | Influences demand for insurance products; regional disparities create varied growth opportunities. |

| Interest Rates | Elevated, boosting investment income | Likely to remain elevated but potentially stabilizing | Positive impact on net investment income; higher yields support profitability. |

| Inflation | Estimated 4.5%, impacting claims severity | Projected 3.4%, but services inflation persists | Increases claims costs, affecting profitability; necessitates adaptive pricing strategies. |

| Premium Growth (P&C) | 6-8% in developed markets | Anticipated moderation/softening | Continued demand but potentially lower rate increases; competitive landscape influences pricing. |

Preview Before You Purchase

Chubb PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive Chubb PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Chubb.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

Modern insurance consumers are no longer content with one-size-fits-all policies and clunky, paper-based interactions. They expect personalized coverage options, readily available through intuitive digital platforms, and the ability to manage their accounts anytime, anywhere. This shift is profoundly reshaping how insurers like Chubb must operate.

The demand for instant gratification and seamless digital experiences is a major force pushing the insurance sector towards digital transformation. For instance, by the end of 2024, it's projected that over 80% of customer interactions in the insurance industry will occur digitally, highlighting the urgency for companies to adapt their service models to meet these evolving expectations.

The world's population is getting older, with projections showing that by 2050, nearly 1 in 6 people globally will be 65 or older, a significant increase from 1 in 11 in 2019. This demographic shift, coupled with evolving social norms like later marriages and a rise in dual-income households, directly impacts the life insurance sector. Insurers like Chubb must adapt to cater to these changing family structures and life stages, offering more personalized and flexible policy options.

The growing public and investor emphasis on Environmental, Social, and Governance (ESG) factors is significantly reshaping corporate strategies, particularly within the insurance sector like Chubb. This heightened awareness translates into new risks and opportunities for insurers as they navigate a landscape where sustainability and social responsibility are increasingly paramount.

Companies demonstrating strong ESG performance are likely to benefit from more favorable insurance terms, potentially securing better coverage and reduced premiums. Conversely, insurers may impose restrictions or higher costs on businesses that fail to address ESG concerns adequately, reflecting the evolving risk landscape.

For instance, in 2024, the global sustainable insurance market was projected to reach over $1.5 trillion in premiums, indicating a substantial shift towards ESG-integrated underwriting and investment strategies. This trend underscores the financial implications of ESG for insurers like Chubb, influencing their product development and risk assessment models.

Societal Concerns Regarding Cybersecurity

Societal concerns around cybersecurity are escalating, with executives identifying it as a paramount risk to business expansion and a significant geopolitical worry. This heightened awareness directly fuels the demand for comprehensive cyber insurance policies and robust security protocols from insurance providers.

The increasing frequency and sophistication of cyberattacks, such as the widespread ransomware attacks impacting global supply chains in 2024, have amplified public and corporate anxiety. This pervasive threat landscape necessitates proactive risk management and insurance solutions.

- Cybersecurity Risk Perception: A 2024 survey indicated that 75% of business leaders consider cybersecurity a top threat to their organization's growth and stability.

- Demand for Cyber Insurance: The global cyber insurance market is projected to reach $20 billion by the end of 2025, reflecting strong societal demand.

- Geopolitical Impact: State-sponsored cyber activities and their potential to disrupt critical infrastructure are a growing societal concern, influencing corporate and governmental security strategies.

- Consumer Trust: Data breaches erode consumer trust, pushing companies to invest heavily in cybersecurity measures and transparent data handling practices.

Demand for Climate Resilience and Mitigation

Societal demand for climate resilience is surging as climate change intensifies, creating a need for robust solutions to protect properties and investments from its impacts. Chubb directly addresses this by providing specialized risk engineering and resilience services.

For instance, Chubb offers critical guidance on wildfire mitigation strategies, a direct response to increasing wildfire frequency and severity observed globally. In 2023 alone, wildfire events caused billions in damages, highlighting the urgent need for such services.

Furthermore, Chubb advises clients on adaptation actions, helping them prepare for and navigate climate-impacted landscapes. This proactive approach aligns with a growing public awareness and expectation for businesses to contribute to climate adaptation efforts.

- Growing Demand: Increased societal awareness of climate risks drives demand for resilience solutions.

- Chubb's Role: Offering risk engineering and resilience services, including wildfire mitigation.

- Adaptation Focus: Providing advice on adaptation actions to help clients manage climate impacts.

- Market Alignment: Services directly meet the evolving needs of individuals and businesses facing climate change.

Societal expectations are shifting towards greater personalization and digital convenience in insurance, pushing Chubb to innovate its service delivery. The growing concern over cybersecurity, highlighted by a 2024 survey where 75% of business leaders cited it as a top threat, directly fuels demand for cyber insurance, a market projected to reach $20 billion by the end of 2025.

Furthermore, heightened awareness of climate change is driving demand for resilience solutions, with Chubb actively providing risk engineering and wildfire mitigation advice. This aligns with the significant $1.5 trillion global sustainable insurance market projected for 2024, demonstrating a clear societal push towards environmentally and socially responsible practices.

Technological factors

The insurance sector is rapidly embracing digital transformation, with a significant 74% of insurers targeting technology adoption and digitalization as a key priority for 2025. This push aims to elevate customer experiences and streamline operations.

This shift involves migrating away from outdated systems towards more agile and intelligent processes. Such advancements are crucial for enabling real-time decision-making and delivering truly customer-centric insurance services.

The integration of Artificial Intelligence (AI) and automation is fundamentally reshaping the insurance landscape, allowing for more efficient data handling and personalized customer experiences. Chubb's significant financial resources empower it to pursue an ambitious, long-term AI strategy, a capability that many rivals find difficult to replicate.

Chubb's commitment to AI is evident in its investment, which aims to leverage these technologies for enhanced data collection, processing, and application. This strategic focus is designed to drive operational efficiencies and enable large-scale personalization, setting Chubb apart in a competitive market.

Chubb actively employs advanced data analytics and visualization tools to process vast amounts of structured and unstructured data. This capability allows for a deeper understanding of complex information across its worldwide operations. For instance, by analyzing customer data, Chubb can identify trends and tailor insurance products, fostering stronger customer relationships and offering more localized solutions.

This data-driven methodology is crucial for enhancing underwriting accuracy and efficiency. In 2024, the insurance industry saw a significant push towards AI-powered underwriting, with Chubb investing heavily in these technologies to improve risk assessment. By leveraging these insights, Chubb can make more informed and agile decisions, leading to better risk management and profitability.

Internet of Things (IoT) for Risk Mitigation

Chubb is leveraging the Internet of Things (IoT) to move beyond traditional claims handling and actively mitigate risks for its policyholders. For instance, the company is exploring and implementing technologies like smart water leak detection sensors. This proactive approach allows Chubb to identify potential issues before they escalate into significant losses, marking a significant shift from a reactive to a preventative insurance model.

By utilizing IoT devices, Chubb can potentially offer new pricing structures and premium credits to policyholders who adopt these risk-reducing technologies. This incentivizes customers to invest in prevention, which in turn can lead to fewer claims and lower overall costs for both the insurer and the insured. The global IoT market is projected to reach over $1.5 trillion by 2025, indicating a substantial opportunity for insurers to integrate these solutions.

The benefits of IoT in risk mitigation for Chubb include:

- Proactive Risk Identification: Early detection of potential hazards like water leaks or unusual temperature fluctuations.

- Reduced Claim Severity: Minimizing damage through timely intervention, leading to lower payout amounts.

- Enhanced Customer Engagement: Offering value-added services that improve policyholder safety and peace of mind.

- Data-Driven Underwriting: Utilizing real-time data from IoT devices to refine risk assessments and pricing accuracy.

Blockchain Technology for Efficiency and Transparency

The insurance industry is actively exploring blockchain technology to improve how policies are issued and claims are settled. This innovation is projected to lead to substantial cost reductions, with estimates suggesting a significant increase in blockchain adoption within the sector by 2025.

Companies are utilizing blockchain to introduce new products, such as parametric insurance, which automatically triggers payouts based on predefined events. This not only boosts operational efficiency but also brings greater transparency to the entire insurance lifecycle, from underwriting to claims resolution.

- Streamlined Operations: Blockchain can automate many manual processes in insurance, reducing errors and speeding up transactions.

- Enhanced Transparency: All parties involved in an insurance contract can have access to a shared, immutable ledger, fostering trust.

- Cost Reduction: By cutting out intermediaries and reducing fraud, blockchain implementation is expected to save insurers considerable amounts.

- Innovative Products: The technology enables the development of smart contracts for parametric insurance, offering faster and more efficient claims processing.

Chubb is heavily investing in AI and advanced analytics to refine underwriting and personalize customer experiences, a trend seen across the insurance sector where 74% of insurers prioritize technology adoption by 2025. The company's substantial financial backing allows for a robust, long-term AI strategy, enhancing data processing and risk assessment capabilities. This technological edge is crucial for navigating the evolving demands of the insurance market.

The integration of the Internet of Things (IoT) is enabling Chubb to shift towards proactive risk mitigation, exemplified by the use of smart sensors for early detection of issues like water leaks. This move from reactive to preventative insurance is supported by the projected growth of the global IoT market, expected to exceed $1.5 trillion by 2025. Such technologies not only reduce claim severity but also offer opportunities for new pricing models based on risk-reducing customer behavior.

Blockchain technology is also being explored by Chubb and the wider insurance industry to streamline policy issuance and claims settlement, with significant cost reductions anticipated. This innovation facilitates the development of products like parametric insurance, which automates payouts based on predefined events, thereby increasing transparency and operational efficiency throughout the insurance lifecycle.

| Technology | Chubb's Application | Industry Trend (2024-2025) |

|---|---|---|

| Artificial Intelligence (AI) | Enhanced underwriting, personalized customer experiences, data processing | 74% of insurers prioritizing tech adoption; AI-powered underwriting increasing |

| Internet of Things (IoT) | Proactive risk mitigation (e.g., leak detection), potential for new pricing models | Global IoT market projected > $1.5 trillion by 2025; focus on preventative insurance |

| Blockchain | Streamlining policy issuance and claims, enabling parametric insurance | Increasing adoption for cost reduction and enhanced transparency in insurance processes |

Legal factors

Global regulatory bodies are significantly increasing their oversight of Environmental, Social, and Governance (ESG) factors. This heightened scrutiny translates into more demanding reporting obligations and a greater potential for litigation for insurance companies like Chubb. For instance, Chubb's 2024 Sustainability Report adheres to the ISSB S-1 and S-2 Standards, alongside meeting Swiss and NAIC climate disclosure mandates, underscoring their proactive approach to compliance.

The escalating cyber threat landscape in 2024 and 2025 demands insurers like Chubb to rigorously comply with data privacy regulations and implement advanced cybersecurity protocols. This directly influences how sensitive customer data is managed and protected, with significant implications for operational costs and risk management strategies.

Regulatory bodies are increasing their oversight on data governance and the potential for bias in AI applications, a trend that has notably intensified in 2025. Chubb, therefore, must proactively invest in and strengthen its data governance frameworks to ensure compliance and mitigate risks associated with AI deployment, reflecting a growing emphasis on ethical data handling.

The increasing focus on climate change and Environmental, Social, and Governance (ESG) factors is creating new legal challenges. Companies are facing lawsuits for environmental damage, human rights violations, and misleading sustainability claims. For instance, in 2024, several major corporations faced shareholder lawsuits alleging insufficient disclosure of climate-related risks, impacting their stock performance.

In response, insurers like Chubb are actively reassessing their insurance policies, particularly Directors and Officers (D&O) liability coverage. They are working to manage the transition risks associated with shifting to a low-carbon economy and the potential liabilities arising from inadequate climate action or ESG practices. This proactive approach aims to mitigate exposure to rapidly evolving legal precedents in these areas.

Compliance Across Diverse Global Jurisdictions

Chubb's extensive global footprint, spanning operations in 54 countries and territories as of late 2024, presents a significant legal challenge due to the fragmentation and divergence of legal systems worldwide. Navigating these varied regulatory landscapes requires constant vigilance and adaptation to ensure compliance.

The increasing trend of geopolitical shifts and isolationist policies complicates risk mitigation for insurers like Chubb. This environment necessitates agile legal strategies to effectively manage cross-border disputes and evolving international legal frameworks.

Key legal considerations for Chubb include:

- Navigating diverse insurance regulations: Adhering to distinct licensing, product approval, and solvency requirements in each operating jurisdiction.

- Cross-border contract enforcement: Ensuring policy terms are legally sound and enforceable across different national legal systems.

- Data privacy and cybersecurity laws: Complying with a patchwork of regulations such as GDPR in Europe and similar frameworks emerging globally, impacting how Chubb handles customer data.

- Anti-corruption and sanctions compliance: Upholding strict adherence to international anti-bribery laws and economic sanctions, particularly critical given Chubb's global reach.

Anti-Money Laundering (AML) and Sanctions Compliance

Heightened global geopolitical tensions and ongoing conflicts, particularly in regions like Eastern Europe and the Middle East, significantly amplify the need for stringent anti-money laundering (AML) and sanctions compliance for international insurers like Chubb. This regulatory landscape requires constant vigilance.

Chubb must meticulously navigate these evolving complexities to ensure unwavering adherence to a growing web of international financial regulations. Failure to do so can result in severe penalties and reputational damage.

- Increased Regulatory Scrutiny: In 2024, financial regulators globally, including OFAC in the US and the FCA in the UK, have intensified their focus on AML and sanctions enforcement, leading to higher compliance costs for insurers.

- Geopolitical Impact on Sanctions Lists: The number of individuals and entities subject to international sanctions has grown substantially, requiring insurers to continuously update their screening processes. For instance, sanctions related to the conflict in Ukraine have impacted numerous financial transactions.

- Cross-Border Transaction Risks: Chubb's international operations mean it handles cross-border transactions, which are inherently more susceptible to being used for illicit purposes, thereby increasing the importance of robust due diligence.

- Technological Investment: To effectively manage these risks, Chubb is likely investing in advanced RegTech solutions for real-time transaction monitoring and enhanced customer due diligence, a trend expected to continue through 2025.

Chubb must navigate an increasingly complex global legal and regulatory environment, with heightened scrutiny on ESG compliance and data privacy. The company's 2024 Sustainability Report, for example, demonstrates adherence to ISSB standards and specific climate disclosure mandates, reflecting a proactive stance on evolving legal obligations.

The surge in cyber threats and the growing emphasis on AI ethics in 2024-2025 necessitate robust data governance and cybersecurity measures. Chubb faces legal risks tied to data breaches and biased AI outcomes, requiring significant investment in compliance and risk mitigation strategies.

Geopolitical shifts and international sanctions, particularly concerning conflicts in 2024-2025, demand stringent AML compliance and agile legal strategies for cross-border operations. Chubb's global presence in 54 countries as of late 2024 amplifies the challenge of adhering to diverse legal systems and sanctions lists.

Environmental factors

Climate change is undeniably escalating the frequency and intensity of natural disasters like wildfires and floods. This directly affects Chubb's property and casualty insurance lines, putting pressure on underwriting outcomes and stretching operational capacity to manage claims and recovery efforts.

Chubb actively integrates the growing impact of weather-related events into its strategic pricing models and comprehensive risk management frameworks. The company acknowledges the significantly altered physical risk landscape that these climate shifts present to its insured assets and liabilities.

For instance, the global insured losses from natural catastrophes reached an estimated $110 billion in 2023, a figure that underscores the increasing financial exposure insurers like Chubb face due to climate-driven events. This necessitates a dynamic approach to risk assessment and capital allocation.

Chubb is actively contributing to the shift towards a low-carbon economy via its Chubb Climate+ initiative. This program offers specialized insurance solutions for companies creating innovative net-zero technologies.

The company’s underwriting efforts extend to renewable energy and climate technology sectors, which have seen substantial premium growth. For instance, Chubb reported a significant increase in premiums for renewable energy projects in 2023, reflecting growing market demand for these insured solutions.

Chubb actively engages with environmental, social, and governance (ESG) principles, evidenced by its yearly Sustainability and Climate-Related Financial Disclosure reports. These publications detail its environmental strategies and ongoing projects, showcasing a dedication to responsible business practices.

The company is focused on enhancing operational efficiency and investing in renewable energy sources. This strategic approach aims to significantly lower its greenhouse gas emissions, aligning with global efforts to combat climate change.

Underwriting Policies for High-Emitting Industries

Chubb has established detailed underwriting policies for industries with significant environmental footprints, including coal-fired power plants and thermal coal mining operations. The company is also actively engaging with oil and gas producers, focusing on methane emissions as a key underwriting consideration. This approach reflects a growing awareness of climate-related risks within the insurance sector.

Despite these measures, the broader insurance industry, including Chubb, faces ongoing scrutiny regarding its role in insuring fossil fuel assets. While insurers aim to support the global energy transition, there's a continuous dialogue about the extent to which they should continue to underwrite high-emitting industries. For instance, global insured losses from natural catastrophes, often linked to climate change, reached an estimated $135 billion in 2023, highlighting the interconnectedness of environmental factors and the insurance business.

- Underwriting Focus: Chubb's policies specifically address high-emitting sectors like coal power and mining.

- Methane Engagement: The company actively discusses methane emission criteria with oil and gas producers.

- Industry Scrutiny: Insurers face ongoing debate about their coverage of fossil fuel assets amidst the energy transition.

- Climate Impact on Insurance: Insured losses from natural catastrophes, exacerbated by climate change, underscore the environmental risks insurers manage.

Resource Scarcity and Environmental Degradation Risks

Beyond the widely discussed impacts of climate change, broader environmental degradation and resource scarcity present significant risks to businesses and their supply chains. These issues can create novel types of insurable losses that insurers like Chubb must consider. For instance, the increasing strain on water resources in many regions could disrupt agricultural output and manufacturing processes, leading to business interruption claims.

Executives increasingly view resource scarcity and environmental degradation as major concerns, alongside geopolitical risks like cybersecurity. A 2024 survey by the World Economic Forum highlighted that water security was among the top global risks, with 70% of respondents expecting it to worsen. This underscores the tangible impact these factors have on business operations and the need for robust risk management strategies.

- Resource Scarcity: Growing demand for critical minerals, water, and arable land can disrupt production and increase costs for industries reliant on these resources.

- Environmental Degradation: Pollution, deforestation, and biodiversity loss can impact ecosystems, affecting industries from agriculture to tourism and potentially creating new liabilities.

- Supply Chain Vulnerability: Environmental stresses can weaken global supply chains, leading to shortages, price volatility, and increased operational risks for companies.

- Insurable Losses: The emergence of new environmental risks, such as those stemming from soil degradation or the collapse of vital ecosystems, may necessitate the development of new insurance products and underwriting approaches.

The escalating frequency and intensity of climate-related natural disasters, such as the estimated $135 billion in global insured losses from natural catastrophes in 2023, directly impact Chubb's property and casualty insurance lines. This necessitates integrating these altered physical risks into strategic pricing and risk management, as seen in Chubb's Chubb Climate+ initiative supporting net-zero technologies.

Chubb's underwriting policies now specifically address high-emitting sectors, including coal power and mining, while engaging oil and gas producers on methane emissions, reflecting a growing awareness of climate-related underwriting considerations.

Beyond climate change, resource scarcity and environmental degradation pose significant risks, with water security identified as a top global concern by a 2024 World Economic Forum survey, potentially creating new insurable losses and supply chain vulnerabilities.

Chubb's commitment to ESG principles is evident in its sustainability reports, detailing strategies to lower greenhouse gas emissions and invest in renewable energy, aligning with global climate action efforts.

| Environmental Factor | Impact on Chubb | Chubb's Response/Data Point |

| Climate Change & Natural Disasters | Increased claims, pressure on underwriting | Global insured losses from natural catastrophes estimated at $135 billion in 2023. |

| Low-Carbon Transition | Opportunity in specialized insurance | Chubb Climate+ initiative supports net-zero technologies; significant premium growth in renewable energy projects in 2023. |

| Resource Scarcity & Degradation | New insurable risks, supply chain disruption | Water security identified as a top global risk in 2024 (World Economic Forum survey). |

| ESG Engagement | Enhanced corporate responsibility, risk mitigation | Regular Sustainability and Climate-Related Financial Disclosure reports published. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Chubb is informed by a robust blend of data, including reports from financial institutions like the IMF and World Bank, government regulatory updates from key operating regions, and leading industry analysis from firms specializing in insurance and risk management. This multifaceted approach ensures a comprehensive understanding of the macro-environmental landscape.