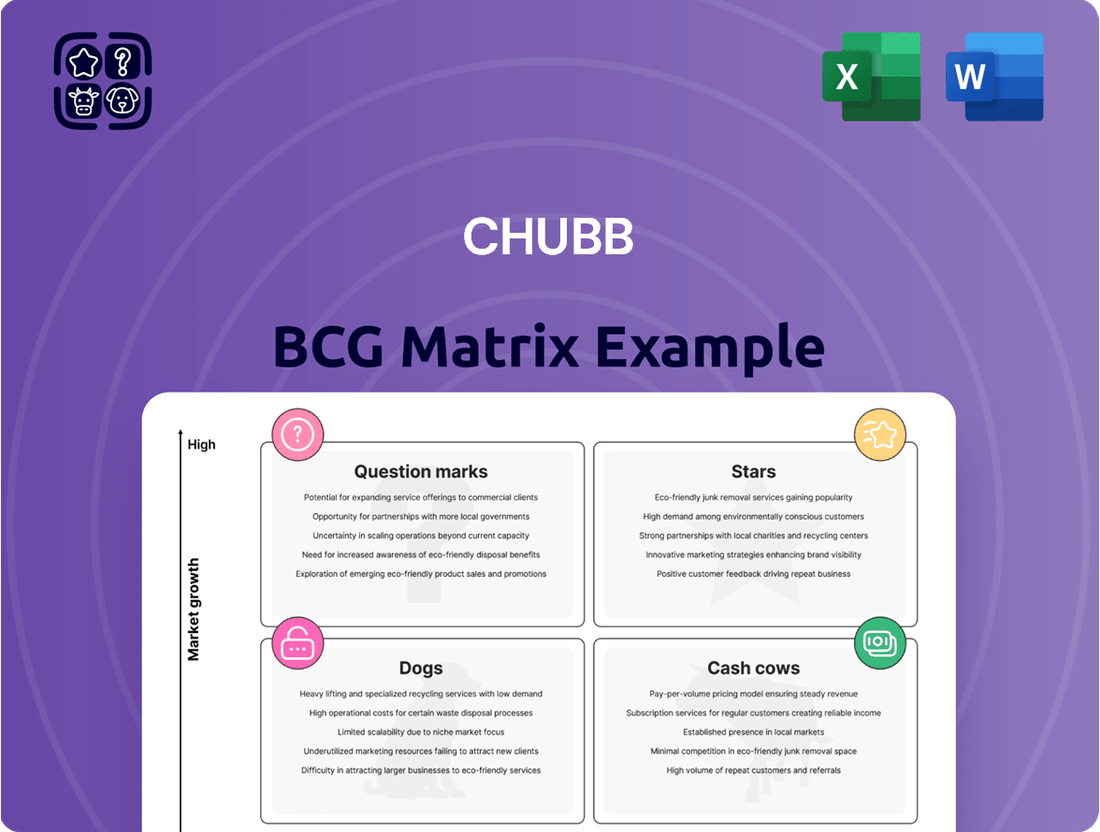

Chubb Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chubb Bundle

Curious about where Chubb's products fit in the market? Our preview offers a glimpse into the BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock strategic advantages and make informed decisions about resource allocation and future investments, you need the full picture.

Purchase the complete Chubb BCG Matrix report for a comprehensive breakdown of each product's position. Gain data-driven insights and actionable recommendations to optimize your portfolio and drive growth.

Stars

Chubb's global Property & Casualty (P&C) underwriting segment is a powerhouse, consistently achieving record underwriting income. In 2024, this segment demonstrated exceptional profitability, driven by disciplined underwriting and favorable market dynamics across many regions. The company's ability to maintain an industry-leading combined ratio underscores its operational excellence and strategic market positioning.

Chubb's life insurance segment in Asia is a prime example of a Star within the BCG matrix. The company is aggressively expanding its footprint in the Asia-Pacific region, recognizing its significant growth potential. For instance, Chubb increased its stake in China's Huatai Insurance Group, signaling a strong commitment to this dynamic market.

This strategic focus on Asia is driven by rising incomes and an increasing awareness of the need for financial protection, making life insurance a high-demand product. By pursuing acquisitions and partnerships, Chubb is solidifying its position in a market poised for substantial expansion. This strategic move aligns with the characteristics of a Star, indicating strong market share in a rapidly growing sector.

Chubb's North America Personal Insurance segment is a significant contributor to its overall performance. In 2024, this segment demonstrated robust growth, with net premiums written experiencing a notable increase, underscoring its strong market position. This expansion points to its role as a key growth driver for the company within an expanding consumer base.

The profitability of this segment is further bolstered by improvements in its combined ratio, a key metric indicating underwriting profitability. A lower combined ratio suggests that Chubb is effectively managing its claims and expenses relative to the premiums it collects, making this segment a valuable asset.

Overseas General Consumer Insurance

Chubb's Overseas General consumer insurance lines are showing robust growth, particularly in constant dollars, reflecting successful expansion in key international markets. This segment benefits from a strong market presence in rapidly developing geographic areas such as Latin America, Asia, and Europe. The strategic emphasis on catering to consumer needs within these growing regions is a significant driver of Chubb's overall financial performance.

The company's commitment to understanding and serving diverse consumer bases internationally is yielding tangible results. For instance, in 2024, Chubb reported significant premium growth in its overseas general insurance operations, with consumer lines being a standout performer. This growth is underpinned by strategic product development and distribution enhancements tailored to local market demands.

- Strong Growth: Chubb's Overseas General consumer insurance lines are expanding rapidly in constant dollar terms.

- Geographic Strength: High market share is evident in growing international segments like Latin America, Asia, and Europe.

- Consumer Focus: Addressing specific consumer needs in these regions is a key contributor to overall performance.

- 2024 Performance: The segment demonstrated notable premium increases, highlighting its importance to Chubb's global strategy.

Specialty and Middle Market Commercial P&C

Chubb's Specialty and Middle Market Commercial Property & Casualty (P&C) business stands out as a key strength within its portfolio. While larger accounts might see more intense competition, Chubb benefits from disciplined market conditions and increasing rates in its middle market and small commercial segments. This positions these areas as high-growth, high-market-share opportunities for the company.

The company's leadership in these segments is underpinned by its deep underwriting expertise. This allows Chubb to effectively navigate market dynamics and capitalize on the favorable conditions present in the middle market and specialty lines. For instance, in 2024, the commercial P&C market, particularly for small and middle-market businesses, continued to show resilience with rate increases averaging in the mid-single digits for many lines, reflecting ongoing profitability focus.

- Market Leadership: Chubb holds a strong position in the middle market and specialty P&C segments.

- Disciplined Conditions: These segments benefit from disciplined market behavior and rising premium rates.

- Growth Potential: The combination of market share and favorable conditions presents a significant growth avenue.

- Underwriting Expertise: Chubb's ability to underwrite effectively allows it to leverage these market opportunities.

Chubb's life insurance operations in Asia, particularly its increased stake in Huatai Insurance Group, exemplify a Star. This segment benefits from a rapidly growing market driven by rising incomes and increased demand for financial protection. Chubb's strategic investments and focus on this region position it for substantial expansion in a high-growth sector.

The North America Personal Insurance segment also demonstrates Star characteristics, showing robust growth in net premiums written in 2024. Its strong market position and improving combined ratio highlight its role as a key growth driver, capitalizing on an expanding consumer base.

Chubb's Overseas General consumer insurance lines are performing exceptionally well, exhibiting strong growth in constant dollars across regions like Latin America, Asia, and Europe. The company's strategic focus on these developing markets and tailored product offerings contributed to significant premium increases in 2024, solidifying its Star status.

Similarly, Chubb's Specialty and Middle Market Commercial P&C business is a significant Star. Benefiting from disciplined market conditions and rising rates in 2024, averaging mid-single digits for many lines, these segments offer high growth potential due to Chubb's strong market share and underwriting expertise.

| Segment | BCG Classification | Key Growth Drivers | 2024 Data Highlight |

| Asia Life Insurance | Star | Rising incomes, increased demand for protection, strategic investments | Increased stake in Huatai Insurance Group |

| North America Personal Insurance | Star | Expanding consumer base, strong market position | Notable increase in net premiums written |

| Overseas General (Consumer) | Star | Growth in developing regions, tailored products | Significant premium growth in constant dollars |

| Specialty & Middle Market P&C | Star | Disciplined market, rising rates, underwriting expertise | Mid-single digit average rate increases for many lines |

What is included in the product

The Chubb BCG Matrix analyzes Chubb's business units by market share and growth rate.

It guides strategic decisions on investment, divestment, or maintenance for each unit.

Visualizes business unit performance, easing the pain of resource allocation decisions.

Cash Cows

Chubb's North America Commercial Property & Casualty (P&C) business, when excluding the highly competitive large account property segment, stands as a robust cash cow. This focus on the middle and small commercial sectors allows Chubb to leverage disciplined pricing strategies and benefit from more orderly market conditions. These factors contribute to consistent and reliable profitability, making it a significant contributor to the company's overall financial strength.

Chubb's investment portfolio is a significant driver of its financial performance, consistently delivering robust pre-tax net investment income. This income stream is a reliable cash cow, bolstering the company's profitability and providing essential capital for strategic growth and other business ventures.

The rising new money rate in 2024 further enhances the attractiveness of Chubb's investment portfolio. This trend suggests that newly invested capital is yielding higher returns, reinforcing the portfolio's role as a stable and growing source of income for the company.

Chubb's established global reinsurance business, a classic Cash Cow, continues to be a bedrock of its financial strength. While net premiums written experienced a modest dip in Q2 2025, the segment's operational efficiency shines through with a robust combined ratio, underscoring its profitability.

This mature sector, characterized by its deep market penetration and stringent underwriting practices, reliably generates substantial cash flow. Despite facing slower growth prospects compared to emerging markets, its consistent performance provides the financial fuel for Chubb's other strategic ventures.

Global Accident and Health Insurance

Chubb's Global Accident and Health insurance segment is a prime example of a Cash Cow within its BCG Matrix. This business line benefits from a well-established presence and consistent demand across its worldwide operations. The mature nature of this market segment suggests a high market share for Chubb, leading to predictable and robust cash generation.

These mature offerings require minimal incremental investment for growth or promotion, allowing them to contribute significantly to Chubb's overall profitability. For instance, in 2023, Chubb reported a substantial portion of its overall revenue stemming from its Global A&H segment, underscoring its role as a consistent cash generator.

Key characteristics of Chubb's Global Accident and Health insurance as a Cash Cow include:

- High Market Share: Chubb holds a leading position in many geographies for accident and health products.

- Stable Demand: The need for accident and health coverage is consistently present, providing a reliable revenue stream.

- Low Investment Needs: Mature products require less capital for marketing and expansion compared to growth-oriented segments.

- Significant Cash Flow: The segment generates substantial, consistent profits that can be reinvested in other areas of the business.

Traditional Commercial Property Lines (Stable Markets)

In stable commercial property markets, Chubb's established position and robust underwriting expertise enable it to capture a significant market share, translating into consistent cash generation. These segments, characterized by less aggressive competition compared to larger account segments, demand minimal incremental investment to preserve their standing. For instance, in 2024, the U.S. commercial property insurance market, while facing some rate adjustments, remained a bedrock for established insurers, with Chubb demonstrating resilience in maintaining its premium volume in these less volatile sectors.

- Stable Market Share: Chubb leverages its long-standing presence to maintain a high market share in traditional commercial property lines.

- Consistent Cash Flow: Strong underwriting capabilities in these mature markets lead to predictable and steady revenue streams.

- Low Investment Needs: Maintaining leadership in stable markets requires less aggressive capital allocation compared to growth-oriented segments.

- 2024 Market Context: Despite some market fluctuations, Chubb's performance in these segments in 2024 underscored their role as reliable cash generators.

Chubb's investment portfolio continues to be a significant cash cow, consistently generating robust pre-tax net investment income. This reliable income stream bolstered Chubb's profitability, providing essential capital for growth. The rising new money rate in 2024 further enhanced the portfolio's yield, reinforcing its role as a stable and growing income source.

Chubb's established global reinsurance business, a classic Cash Cow, remains a bedrock of its financial strength. Despite a modest dip in net premiums written in Q2 2025, the segment's operational efficiency, evidenced by a strong combined ratio, underscores its profitability. This mature sector reliably generates substantial cash flow, providing financial fuel for other strategic ventures.

The Global Accident and Health insurance segment is a prime example of a Cash Cow. Benefiting from a well-established presence and consistent demand, this mature market segment yields predictable and robust cash generation. These offerings require minimal incremental investment, allowing them to contribute significantly to Chubb's overall profitability, with substantial revenue contribution noted in 2023.

In stable commercial property markets, Chubb's established position and underwriting expertise translate into consistent cash generation. These segments, characterized by less aggressive competition, demand minimal incremental investment. Chubb demonstrated resilience in maintaining premium volume in these less volatile sectors in 2024, underscoring their role as reliable cash generators.

| Segment | BCG Category | Key Characteristics | 2024/2025 Data Point |

|---|---|---|---|

| North America Commercial P&C (excl. large accounts) | Cash Cow | Disciplined pricing, orderly markets, consistent profitability | Robust contributor to financial strength |

| Investment Portfolio | Cash Cow | Strong pre-tax net investment income, rising new money rates | Enhanced yield in 2024 |

| Global Reinsurance | Cash Cow | Operational efficiency, strong combined ratio, reliable cash flow | Modest premium dip in Q2 2025, but profitable |

| Global Accident & Health | Cash Cow | High market share, stable demand, low investment needs | Substantial revenue contributor in 2023 |

| Stable Commercial Property Markets | Cash Cow | Significant market share, strong underwriting, minimal investment needs | Resilient premium volume in 2024 |

What You See Is What You Get

Chubb BCG Matrix

The Chubb BCG Matrix preview you see is the identical, fully polished document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted strategic tool ready for your immediate use. You can confidently evaluate its comprehensive analysis and clear presentation, knowing this is precisely what you'll download to inform your business decisions. This is your direct gateway to actionable strategic insights, delivered in its final, uncompromised form.

Dogs

The U.S. commercial property and casualty insurance market, particularly for large account retail and excess and surplus (E&S) property, has intensified its competition, leading to declining rates. This challenging environment suggests that Chubb may be experiencing low growth and a reduced market share within this specific segment.

In 2024, industry data indicates a softening market for commercial property insurance, with average rate decreases observed across various segments. For instance, reports from insurance analytics firms showed average property rate renewals in the low single digits for many insureds, a stark contrast to the hardening market conditions seen in prior years.

This trend points to a potential "Dog" classification for Chubb in this particular niche. A "Dog" in the BCG matrix represents a business with low market share in a slow-growing industry. The combination of intense competition and falling rates in large account retail and E&S property insurance likely places Chubb in such a position, requiring careful strategic consideration.

Chubb's North America Agricultural Insurance segment can be viewed as a Dog in the BCG Matrix. In 2023, this segment saw a decrease in net premiums written, a trend largely attributed to the prevailing lower commodity prices. This situation points to a market characterized by low growth prospects.

The reduced premium income indicates that the segment is operating in a mature or declining market. This environment often leads to increased competition for a shrinking pool of business, potentially resulting in a loss of market share for Chubb if strategic adjustments are not made. The data suggests a challenging landscape for agricultural insurance in North America.

Within Chubb's extensive insurance offerings, certain legacy or niche products, perhaps catering to specialized industries or historical risks, may be showing signs of declining demand. These offerings, characterized by low market growth and a correspondingly low market share, are likely to contribute minimal returns to the company's overall performance.

Underperforming Geographies or Segments (if not strategic for future growth)

Even with Chubb's robust global presence, certain smaller geographic markets or niche insurance segments might be experiencing persistent underperformance. These areas, if they do not align with the company's long-term strategic objectives for expansion or innovation, could represent an inefficient allocation of capital and management attention. For instance, if a particular country's regulatory environment or market maturity significantly hinders growth in a core insurance line, it might be a candidate for divestment or reduced investment.

Evaluating these underperforming areas involves a close look at their contribution to overall profitability and their potential future relevance. For example, in 2024, while Chubb reported strong overall revenue growth, specific emerging markets might have shown flat or declining premium volumes in certain lines of business, particularly if competitive pressures intensified without a clear path to market leadership. The decision to divest or restructure such segments hinges on whether the resources consumed outweigh their strategic value or potential for future turnaround.

- Underperforming Segments: Identify specific lines of business or geographic regions with consistently low profitability and minimal strategic alignment.

- Resource Allocation: Assess if these underperforming areas consume significant capital, operational resources, or management bandwidth that could be better deployed elsewhere.

- Strategic Fit: Determine if these segments contribute to Chubb's long-term growth strategy, innovation pipeline, or overall market positioning.

- Divestment/Restructuring: Consider options like divestiture, sale, or significant restructuring for segments that drain resources without offering future strategic benefits.

Outdated Digital Platforms or Infrastructure

Outdated digital platforms and legacy IT systems represent significant internal resource drains for companies. These systems, often costly to maintain, fail to provide competitive advantages in efficiency or customer experience, effectively becoming Question Marks within the internal resource assessment of a BCG Matrix. For instance, in 2024, many financial institutions continued to grapple with the high operational costs of maintaining mainframe systems, which can consume substantial IT budgets without yielding modern capabilities.

These aging infrastructures can hinder innovation and agility. Companies investing heavily in keeping these systems operational are diverting funds that could be used for developing new digital products or improving customer interfaces. A report from Gartner in 2024 indicated that a significant portion of IT spending in large enterprises is still allocated to maintaining legacy applications, often exceeding 50% of the total IT budget.

- High Maintenance Costs: Legacy systems can incur substantial operational expenses, including specialized staffing and frequent hardware upgrades.

- Lack of Competitive Edge: Outdated platforms often lack the features and scalability needed to compete effectively in today's digital landscape.

- Resource Misallocation: Funds and skilled personnel are tied up in maintaining these systems, detracting from investments in growth-oriented initiatives.

Chubb's North America Agricultural Insurance segment is a prime example of a "Dog" in the BCG matrix. This is due to a combination of low market growth, evidenced by declining net premiums written in 2023, and potentially a low market share within this specific, challenged sector. The prevailing lower commodity prices directly impacted this segment, signaling a mature or even declining market environment.

The U.S. commercial property and casualty insurance market, particularly for large account retail and excess and surplus (E&S) property, also presents a "Dog" scenario for Chubb. Intense competition and declining rates, with average property rate renewals in the low single digits observed in 2024, indicate a low-growth industry where Chubb may struggle to gain significant market share.

Certain niche or legacy products within Chubb's portfolio might also be classified as Dogs. These are offerings facing declining demand and low market growth, contributing minimally to overall company performance and potentially representing an inefficient use of resources.

Specific smaller geographic markets or insurance segments that exhibit persistent underperformance and do not align with Chubb's strategic growth objectives could also be considered Dogs. These areas might consume capital and management attention without offering substantial returns or future strategic value.

Question Marks

The cyber insurance market is booming, with many business leaders intending to increase their coverage as digital threats escalate. Chubb's strategic investments in technology and AI signal a push into this high-growth sector, likely with innovative or expanding cyber insurance products designed to meet evolving client needs.

Embedded insurance, seamlessly integrating coverage into non-insurance purchases, is a burgeoning sector poised for substantial expansion. Chubb's strategic focus on this area highlights its recognition of a high-potential market where competitive advantages are still being forged.

Chubb's initiatives in embedded insurance align with a market forecast to reach $3 trillion globally by 2030, according to McKinsey. This growth trajectory positions embedded insurance as a key driver for insurers looking to tap into new customer segments and distribution channels.

As artificial intelligence (AI) rapidly integrates into business operations, new liability exposures are emerging. Chubb, a global insurer, is strategically positioning itself to address these evolving risks through specialized insurance products. This move signifies their entry into a burgeoning market with significant growth potential, though their current market share in this niche is likely minimal.

Chubb's proactive approach to AI-related liabilities reflects a broader trend of insurers adapting to technological advancements. For instance, the global AI market was projected to reach over $136 billion in 2022 and is expected to grow substantially. This expansion creates a fertile ground for insurance products designed to cover potential damages stemming from AI system failures, data breaches, or biased algorithmic outcomes.

New Digital Life Insurance Products (e.g., in Brazil)

Chubb is strategically introducing new digital life insurance products, notably in emerging markets like Brazil. These innovations aim to capture a share of the expanding digital insurance landscape, a sector that saw significant growth in Latin America. For instance, Brazil's digital insurance market was projected to reach over $10 billion in premiums by 2024, highlighting the potential for these new offerings.

These digital-first products are positioned to attract a younger, tech-savvy demographic. As relatively new entrants, they are in the crucial phase of establishing brand recognition and customer acquisition. This aligns with the characteristics of a question mark in the BCG matrix, representing high market growth potential but currently low market share.

- Market Potential: Brazil's digital insurance sector is experiencing rapid expansion, driven by increased internet penetration and a growing preference for online services.

- Current Position: As new product lines, Chubb's digital life insurance offerings are in the early stages of market penetration, aiming to build a solid customer base.

- Strategic Focus: The company is investing in digital transformation to enhance accessibility and customer experience, a key strategy for succeeding in this competitive segment.

- Investment Needs: Significant investment in marketing, technology, and customer support will be required to move these products from the question mark category towards becoming stars.

Chubb Climate+ Initiatives

Chubb Climate+ represents a strategic investment in a high-growth sector, focusing on insurance solutions for renewable energy and climate technology. This initiative positions Chubb to capitalize on the global shift towards a low-carbon economy, a market experiencing significant expansion.

The company's market share within these specialized climate-tech insurance offerings is still in its formative stages, reflecting the nascent yet rapidly developing nature of this segment.

Chubb's commitment to this area is evident in its ongoing investments, aiming to build a strong presence as the market matures.

- Market Focus: Renewable energy and climate technology insurance.

- Growth Trajectory: Operating in a high-growth, evolving market.

- Strategic Position: Investing to support the transition to a low-carbon economy.

- Market Share: Developing market share in new climate-tech insurance solutions.

Chubb's digital life insurance products in emerging markets, such as Brazil, represent a classic question mark. These offerings target a rapidly expanding digital insurance landscape, with Brazil's market projected to exceed $10 billion in premiums by 2024. While the growth potential is significant, Chubb is still in the early stages of building market share and brand recognition in this segment.

The company's strategic investments in technology and marketing are crucial for nurturing these nascent products. Success hinges on effectively acquiring customers and establishing a strong foothold before competitors solidify their positions. This phase requires substantial investment to transform these question marks into future stars.

Chubb's climate-tech insurance solutions also fall into the question mark category. This sector, focused on renewable energy and climate technology, is experiencing considerable expansion driven by the global transition to a low-carbon economy. Chubb is actively investing to build its presence, but its market share in these specialized offerings is still developing.

The strategic importance lies in capturing a share of this high-growth market as it matures. The company's commitment to these areas underscores a forward-looking approach, aiming to capitalize on emerging trends and create future revenue streams from these developing business lines.

| Product Area | Market Growth | Current Market Share | Strategic Focus | Investment Needs |

|---|---|---|---|---|

| Digital Life Insurance (Emerging Markets) | High (Brazil market > $10B by 2024) | Low | Customer acquisition, brand building | Marketing, technology, support |

| Climate-Tech Insurance | High (Global low-carbon transition) | Developing | Establishing presence, building expertise | Product development, risk assessment |

BCG Matrix Data Sources

Our Chubb BCG Matrix leverages comprehensive data from Chubb's financial statements, global insurance market research, and industry growth projections to accurately position business units.